Escolar Documentos

Profissional Documentos

Cultura Documentos

Economic Essays

Enviado por

maheshgullankiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Economic Essays

Enviado por

maheshgullankiDireitos autorais:

Formatos disponíveis

FDI

What

is

FDI?

Foreign Direct Investment is the investment which is done in productive assets and participation in the

management of the company as the stake holders by a company which is based in one country, into a

company based in another country. Recently the cabinet said OK for 51% FDI in multi-brand retail

sector & 100% FDI in single brand. Foreign Investment in India is governed by the FDI policy

announced by the Government of India and the provision of the Foreign Exchange Management Act

(FEMA) 1999. RBI also issues notifications which contains the Foreign Exchange Management

(Transfer or issue of security by a person resident outside India) Regulations, 2000 and had been

amended many times. The Ministry of Commerce and Industry, Government of India is the nodal

agency

for

motoring

and

reviewing

Ways

the

FDI

policy

on

continued

of

basis.

investment?

The investing company may make its overseas investment in a number of ways - Joint Ventures,

merger, Franchising, Sourcing of Supplies from small-scale sector, Cash and Carry whole sale

trading, Non-Store Formats, Strategic Licensing Agreements, either by setting up a subsidiary or

associate company in the foreign country, by acquiring shares of an overseas company.

The foreign retail chains will need to make very expensive real estate investments which may or may

not

Who

be

feasible

are

the

in

target

the

long

run.

group

for

FDI?

The people who prefer going to shopping malls instead of kirana shops constitute not a sizable

percentage and who belong to affluent, upper middle and middle class. As such there is no immediate

threat to the kirana shops or small venders, as they have their own share of customers with whom

they

share

Why

special

only

relationship.

India?

India has a population of nearly 1.2 billion, and many countries feel it as most alluring and thriving

retail destination. Liberalization of trade policy and loosening of barriers and restrictions to the foreign

investment in the retail sector of India, have made the FDI in retail sector quite easy and smooth.

India being a signatory to World Trade Organisations General Agreement on Trade in Services, which

include wholesale and retailing services, had to open up the retail trade sector to foreign investment.

In 1997, FDI in cash and carry (wholesale) with 100 percent ownership was allowed under the

Government approval route. It was brought under the automatic route in 2006. 51 percent investment

in a single brand retail outlet was also permitted in 2006. India being an open economy with skilled

workforces and good growth prospects tend to attract larger amounts of foreign direct investment

among

other

Advantages of FDI:

growing

and

emerging

markets.

FDI in Retail Sector

What

is

Retail

sector?

In 2004, The High Court of Delhi defined the term retail as a sale for final consumption in contrast to

a sale for further sale or processing (i.e. wholesale). The Retail Industry is the sector of economy

which is consisted of individuals, stores, commercial complexes, agencies, companies, and

organizations, etc., involved in the business of selling or merchandizing diverse finished products or

goods to the end-user consumers directly and indirectly. A retailer is involved in the act of selling

goods to the individual consumer at a margin of profit. Thus, retailing can be said to be the interface

between

the

producer

and

the

individual

consumer

buying

for

personal

consumption.

According to the Investment Commission of India, the retail sector is expected to grow almost three

times its current levels of $250 billion to $660 billion by 2015. The Indian Retail Industry is the 5th

largest retail destination and the second most attractive market for investment in the globe after

Vietnam as reported by AT Kearneys seventh annual Globe Retail Development Index (GRDI), in

2008 Retail sector contributes to maximum percentage of employment after agriculture. In spite of the

recent developments retail sector is assumed to possess huge growth potential. The retail industry is

mainly

1)

2)

divided

into:-

Organised

and

Unorganised

Retailing

Organised retailing- refers to trading activities undertaken by licensed retailers, that is, those who are

registered for sales tax, income tax, etc. These include the corporate-backed hypermarkets and retail

chains, and also the privately owned large retail businesses. In India 97% of the business is done by

organized

sector.

Unorganised retailing - refers to the traditional formats of low-cost retailing, for example, the local

kirana shops, owner manned general stores, paan/beedi shops, convenience stores, hand cart and

pavement

What

vendors,

is

FDI

in

etc.

Multiple

brand

retail?

Multiple brand retail means selling the same product under different brand names. FDI in multi-brand

retailing should be carefully monitored as there are chances that if left alone it can directly impact a

large percentage of population and would ultimately deepen the gap between the rich and the poor.

So in order to ensure development, it can be stipulated that a percentage of FDI should be spent

towards building up of back end infrastructure, logistics or agro processing units, and reconstituting

the poverty stricken and stagnating rural structure with at least 50% of the jobs in the retail outlet

should

be

reserved

for

rural

youth.

India and the Global Financial Crisis What Have We Learnt?

K.R. Narayanan Oration by Dr. Duvvuri Subbarao, Governor, Reserve Bank of

India at the South Asia Research Centre of the Australian National University,

Canberra on June 23, 2011

By all accounts the 2008/09 crisis has been the deepest financial crisis of our times. It has taken a

devastating toll on global output and welfare. Arguably, the fundamental causes of all financial crises

are the same - global imbalances, loose monetary policy and high levels of leverage driven by

irrational

exuberance.

In

that

respect,

this

crisis

has

been

no

different.

5. Where this crisis has been different, however, is in its manifestation. Most recent crises had

occurred in individual emerging economies or regions, and they were, at their core, traditional retail

banking or currency crises. The countries in trouble could be rescued by multilateral interventions;

besides, the advanced countries provided a buffer for trade and financial support. In contrast, this

crisis originated in the most advanced economy, the United States, and hit at the very core of the

global financial system. With virtually no buffers to fall back on, the crisis rapidly engulfed the whole

world. Much to their dismay, emerging market economies too were soon pulled into the whirlpool.

How

was

India

hit

by

the

Crisis?

India was no exception. We too were affected by the crisis. Output growth that averaged 9.5 per cent

per annum during the three year period 2005/08 dropped to 6.8 per cent in the crisis year of 2008/09.

Exports that grew at 25 per cent during 2005/08 decelerated to 12.2 per cent in the crisis year

(2008/09) and declined by 2.2 per cent in 2009/10. In the pre-crisis years, we had capital flows far in

excess of our current account deficit. In contrast, during the crisis year, net capital flows were

significantly short of the current account deficit and this put downward pressure on the rupee. The

exchange rate depreciated from ` 39.37 per dollar in January 2008 to ` 51.23 per dollar in March

2009.

Notwithstanding our sound banking system and relatively robust financial markets, India felt the

tremors of the tectonic shocks in the global financial system. The first round effects came through the

finance channel by way of sudden stop and then reversal of capital flows consequent upon the global

deleveraging process. This jolted our foreign exchange markets as well as our equity markets. Almost

simultaneously, our credit markets came under pressure as corporates, finding that their external

sources of funding had dried up, turned to domestic bank and non-bank sources for credit.

By far the most contagious route for crisis transmission was the confidence channel. For weeks after

the Lehman collapse in mid-September 2008, everyday there was news of yet another storied

institution crashing. In this global scenario of uncertainty, the lack of confidence in advanced country

markets transmitted as hiccups to our markets too. The net result was that all our financial markets equity, debt, money and foreign exchange markets - came under varying degrees of pressure. Finally,

the transmission of the crisis through the real channel was quite straightforward as the global

Changing Inflation Dynamics in India

Speech by Deepak Mohanty, Executive Director, Reserve Bank of India, delivered

at the Motilal Nehru National Institute of Technology (MNNIT), Allahabad on 13th

August 2011

The headline wholesale price index (WPI) inflation averaged 9.6 per cent in 2010-11 as compared

with 5.3 per cent per annum in the previous decade. Similarly, the average consumer price inflation,

measured by the consumer price index for industrial workers (CPI-IW), was even higher at 10.5 per

cent in 2010-11 as compared with 5.9 per cent per annum in the previous decade. Moreover, this

elevated level of inflation also persisted through the first quarter of 2011-12. In response to inflationary

pressures, the Reserve Bank has raised the policy repo rate 11 times bringing it up from a low of 4.75

per cent in March 2010 to 8.00 per cent by July 2011. It is expected that inflation should come down

towards

the

later

part

of

this

year.

Why has inflation been so high and persisted for so long? This is the theme of my talk today. In my

presentation, I propose to address the following questions: Is India an outlier among major countries

in terms of recent inflation performance? Has the inflation process changed? What are the causal

factors global and domestic as well as supply and demand? I will conclude with some thoughts on

managing

Is

India

the

an

inflation

outlier

in

dynamics

the

inflation

on

the

performance

among

way

forward.

major

countries?

It is important to appreciate the global backdrop in which we are experiencing a resurgence of inflation

now. In the last decade, inflation was low, both in advanced countries as well as in emerging and

developing economies till the global financial crisis unfolded. Consequently, global economy got into a

recession and global output declined by 0.5 per cent in 2009. However, global output growth

rebounded

to

5.0

per

cent

in

2010.

As the global economy recovered from the worst effect of the global financial crisis, inflation picked up

in emerging and developing economies. This was because the global recovery was largely driven by

emerging market economies (EMEs) what was termed as a two-speed recovery a faster growth in

EMEs accompanied by a slower growth in advanced economies. As output gaps closed, there was

increasing inflationary pressure in EMEs, particularly in Asia. According to the International Monetary

Fund (IMF), consumer price inflation in developing Asia almost doubled from 3.1 per cent in 2009 to

6.0 per cent in 2010 and is projected to be around the same level in 2011. Latest data suggest that

inflation

in

rapidly

growing

BRICS

remains

elevated.

Transnational Gas Pipelines

1.

Natural

Gas

the

Clean

Fuel

of

21st

Century:

Natural gas is a clean fuel and would be increasingly used in the 21st century. Gas is a mainly used in

the

power

2.

sector

but

Natural

is

also

Gas

used

in

Key

refining,

to

industry

and

India|s

domestic

consumption.

Economic

Growth:

India does not have the gas reserves to match its growing needs. India imports 67 million cubic

metres of gas per day as part of its requirement of 150 million cubic metres (mcm) of gas per day. By

2020 India|s demand for gas could go up to 400 mcm per day. Thus, an assured supply of gas will be

the

key

India|s

3.

economic

growth

of

Transnational

8-9

per

Gas

cent.

Pipelines:

The Soviet Union constructed the first transnational gas pipelines in the 1970s to supply natural gas to

West Germany and other parts of Western Europe. Currently Russia meets 30 per cent of Europe|s

gas requirements. Currently over 100 gas pipeline projects valued at $100 billion are being

implemented

4.

across

Main

Sources

of

the

Natural

Gas

globe.

are

in

Asia:

Analysts point out that the main sources of natural gas are in Asia. Russia|s Asian area has 27 per

cent of the world|s proven reserves, with Iran (15 per cent) and Qatar (14 per cent) following. Over 70

per cent of the world|s reserves of natural gas are found in northern Central Asia and the Gulf.

5. Transnational Gas Pipelines to Increase in Asia with Increase in Demand for Gas:

The transnational gas pipelines across Asia are set to multiply with an increase in gas demand over

the next few years. Thus, as the energy requirements of Asia increase, the transnational gas pipelines

will

6.

A.Gas

play

an

increasingly

Advantages

Pipeline

important

role

in

of

the

meeting

Gas

Cheapest

Mode

these

demands.

Pipelines:

of

Transportation:

There are three ways of transporting gas - by ships as Liquefied Natural Gas (LNG); through deepsea pipeline; or by gas pipelines on land. Analysts point out that world over, gas pipeline

transportation is the preferred mode for gas conveyance as it is the cheapest and does not entail any

loss

B.India

of

Should

energy

Make

Gas

in

Strategic

conversion.

Determinant:

Analysts point out that of the total global energy consumption in world, gas accounts for 30%. Gas will

be a key commodity in the overall context of India|s national security calculus. Gas is an eco-friendly

Você também pode gostar

- Facebook ChecklistDocumento3 páginasFacebook ChecklistBuddha BlessedAinda não há avaliações

- Aggregate Expenditure and Equilibrium Output - BAGUSDocumento31 páginasAggregate Expenditure and Equilibrium Output - BAGUSSupriYono100% (1)

- Recent Development in Global Financial MarketDocumento8 páginasRecent Development in Global Financial MarketBini MathewAinda não há avaliações

- Marketing Plan For Organic SoapDocumento19 páginasMarketing Plan For Organic Soapkatakhijau270% (10)

- Metabical Case Study-Group 4Documento7 páginasMetabical Case Study-Group 4s panda100% (1)

- MensurationDocumento20 páginasMensurationmaheshgullanki100% (1)

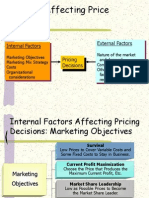

- Internal Factors External Factors Pricing DecisionsDocumento17 páginasInternal Factors External Factors Pricing DecisionssaurabhsaggiAinda não há avaliações

- Management in Daraz - PKDocumento40 páginasManagement in Daraz - PKMumtaz Yaseen33% (3)

- Consumer's EquilibriumDocumento37 páginasConsumer's EquilibriumSoumendra Roy67% (3)

- The Indian Kaleidoscope: Emerging Trends in RetailDocumento52 páginasThe Indian Kaleidoscope: Emerging Trends in RetailSwati Agarwal100% (1)

- Case 1 We've Got Rhythm!Documento25 páginasCase 1 We've Got Rhythm!Sujith Johnson67% (3)

- Make Sure To Personalize The Letter by Addressing The Recipient by Name and Not Writing "Dear Customer"Documento2 páginasMake Sure To Personalize The Letter by Addressing The Recipient by Name and Not Writing "Dear Customer"magur-aAinda não há avaliações

- Campus Cafe LpuDocumento16 páginasCampus Cafe Lpugyanprakashdeb302Ainda não há avaliações

- Chapter 1 Introduction of FdiDocumento47 páginasChapter 1 Introduction of FdiSunny KumarAinda não há avaliações

- All ChaptersDocumento8 páginasAll ChaptersDrShailly SinghAinda não há avaliações

- Foreign Direct Investment in Retail Market in India: Some Issues and ChallengesDocumento10 páginasForeign Direct Investment in Retail Market in India: Some Issues and ChallengesNeeraj LingwalAinda não há avaliações

- Introduction To FDIDocumento22 páginasIntroduction To FDIPRATIKAinda não há avaliações

- Impact of The Global Financial Crisis by D SubburaoDocumento6 páginasImpact of The Global Financial Crisis by D SubburaoDhruv VatsAinda não há avaliações

- Observation of Fiis Trends in IndiaDocumento25 páginasObservation of Fiis Trends in IndiaManju MessiAinda não há avaliações

- FDI in IndiaDocumento15 páginasFDI in IndiaArjunSharmaAinda não há avaliações

- Fdi in Multi - Brand Retail: Is It The Need of The HOUR??: ZenithDocumento39 páginasFdi in Multi - Brand Retail: Is It The Need of The HOUR??: ZenithKapil DharmaniAinda não há avaliações

- Budget 2011 Is An Item Number. by Sheila, For Munni!Documento6 páginasBudget 2011 Is An Item Number. by Sheila, For Munni!pranabanandarathAinda não há avaliações

- Foreign Direct Investment in The Retail Sector in IndiaDocumento5 páginasForeign Direct Investment in The Retail Sector in IndiaKashaf ShaikhAinda não há avaliações

- Fdi DataaDocumento3 páginasFdi DataaSagar SatujaAinda não há avaliações

- Masharu-Nasir2018 Article PolicyOfForeignDirectInvestmenDocumento23 páginasMasharu-Nasir2018 Article PolicyOfForeignDirectInvestmenKaushal NahataAinda não há avaliações

- FDI in Retail in India ME and BEDocumento5 páginasFDI in Retail in India ME and BERam PandeyAinda não há avaliações

- Impact of Foreign Direct Investment On Retail Shops: Dr. Prasanna KumarDocumento7 páginasImpact of Foreign Direct Investment On Retail Shops: Dr. Prasanna KumarShyamSunderAinda não há avaliações

- FDI in Multi Brand Retailing in India Research PaperDocumento17 páginasFDI in Multi Brand Retailing in India Research PaperBiswadeep ChakravartyAinda não há avaliações

- Assignment On Fundamental Analysis of IdbiDocumento11 páginasAssignment On Fundamental Analysis of IdbifiiimpactAinda não há avaliações

- Foreign Direct Investment in Banking Sector by Shubham ShuklaDocumento12 páginasForeign Direct Investment in Banking Sector by Shubham ShuklaShubham ShuklaAinda não há avaliações

- Concept Note:: Resentation TranscriptDocumento4 páginasConcept Note:: Resentation TranscriptR.S.TiwariAinda não há avaliações

- HEMADocumento65 páginasHEMANeena AshokAinda não há avaliações

- FDI in RetailDocumento31 páginasFDI in Retailsusmile7Ainda não há avaliações

- Grant Thornton FICCI MSMEDocumento76 páginasGrant Thornton FICCI MSMEIshan GuptaAinda não há avaliações

- What Is Foreign Direct InvestmentDocumento2 páginasWhat Is Foreign Direct InvestmentpplahaneAinda não há avaliações

- The Impact of FDI On BankingDocumento6 páginasThe Impact of FDI On BankingNavdeep Singh SohalAinda não há avaliações

- Helping You Spot Opportunities: Investment Update - August, 2013Documento55 páginasHelping You Spot Opportunities: Investment Update - August, 2013akcool91Ainda não há avaliações

- Multi Brand Retailing in IndiaDocumento30 páginasMulti Brand Retailing in IndiasupriyaAinda não há avaliações

- FDI in Indian Retail Sector-Pros & Cons: Presented By: 1) K.Veena MadhuriDocumento10 páginasFDI in Indian Retail Sector-Pros & Cons: Presented By: 1) K.Veena MadhuriebabjiAinda não há avaliações

- Write Up 2Documento3 páginasWrite Up 2Raviraj PrajapatAinda não há avaliações

- Foreign Direct Investment in Indian Retail Sector Pros and ConsDocumento8 páginasForeign Direct Investment in Indian Retail Sector Pros and ConsSunilChaudharyAinda não há avaliações

- What Does High Net Worth Individual - HNWI Mean?: 51% GowthDocumento4 páginasWhat Does High Net Worth Individual - HNWI Mean?: 51% GowthyayhdapuAinda não há avaliações

- Portfolio Development: Live Project - BANKING SectorDocumento61 páginasPortfolio Development: Live Project - BANKING SectorRicha AgarwalAinda não há avaliações

- Retail Sector in India PDFDocumento12 páginasRetail Sector in India PDFjayAinda não há avaliações

- The Impact of FDIDocumento7 páginasThe Impact of FDIArham KothariAinda não há avaliações

- Foreign Direct Investment in IndiaDocumento5 páginasForeign Direct Investment in IndiaDisha JaniAinda não há avaliações

- Project Report On Risk Premium Analysis of BRIC Nations As Compared To IndiaDocumento33 páginasProject Report On Risk Premium Analysis of BRIC Nations As Compared To Indiashivanipanda1234Ainda não há avaliações

- Indian Capital Market ReviewDocumento6 páginasIndian Capital Market ReviewArindam BanerjeeAinda não há avaliações

- SS4 ART KK RetailSectorinIndiaDocumento6 páginasSS4 ART KK RetailSectorinIndiaKrish KumarAinda não há avaliações

- Fundamental Analysis of Airtel ReportDocumento29 páginasFundamental Analysis of Airtel ReportKoushik G SaiAinda não há avaliações

- Ijrfm Volume 2, Issue 2 (February 2012) ISSN: 2231-5985 Fiis: Fuel of India'S Growth EngineDocumento17 páginasIjrfm Volume 2, Issue 2 (February 2012) ISSN: 2231-5985 Fiis: Fuel of India'S Growth Enginehimanshu_jhanjhariAinda não há avaliações

- Hot ItDocumento26 páginasHot ItTanoj PandeyAinda não há avaliações

- Fdi in Multi-Brand Retailing: Opportunities and Threats For Rural IndiaDocumento6 páginasFdi in Multi-Brand Retailing: Opportunities and Threats For Rural IndiaArvind NayakaAinda não há avaliações

- Supriya - Proj - Report 1st TimeDocumento34 páginasSupriya - Proj - Report 1st TimeSupriya BaghAinda não há avaliações

- Fundamental Analysis of Icici Bank: School of Management Studies Punjabi University PatialaDocumento21 páginasFundamental Analysis of Icici Bank: School of Management Studies Punjabi University Patialapuneet_kissAinda não há avaliações

- IFM SyllabusDocumento17 páginasIFM Syllabussagarzawar1Ainda não há avaliações

- FDI in Retail Sector in India: Challenges and OpportunitiesDocumento5 páginasFDI in Retail Sector in India: Challenges and OpportunitiesGlobal Journal of Engineering and Scientific ResearchAinda não há avaliações

- 11.SWOT Analysis For Opening of FDI in IDocumento12 páginas11.SWOT Analysis For Opening of FDI in IsakinaAinda não há avaliações

- Globalisation and Its Impact On Financial ServicesDocumento30 páginasGlobalisation and Its Impact On Financial ServicesLairenlakpam Mangal100% (3)

- Methods of Foreign Direct InvestmentDocumento4 páginasMethods of Foreign Direct InvestmentchhaviAinda não há avaliações

- Keshava FinalDocumento82 páginasKeshava FinalRavi KumarAinda não há avaliações

- NL NL Indian Retail MarketDocumento21 páginasNL NL Indian Retail MarketmmmkiAinda não há avaliações

- Union Cabinet Approves 51% FDI in Multi-Brand RetailDocumento17 páginasUnion Cabinet Approves 51% FDI in Multi-Brand RetailDeepak NairAinda não há avaliações

- In Retail Sector in India-Conceptual, Descriptive and Analytical StudyDocumento7 páginasIn Retail Sector in India-Conceptual, Descriptive and Analytical StudyTaveleAinda não há avaliações

- International Factor Movements: Foreign CapitalDocumento26 páginasInternational Factor Movements: Foreign CapitalRitika PrasadAinda não há avaliações

- 11 Chapter 3Documento57 páginas11 Chapter 3Add KAinda não há avaliações

- Critical Appraisal of FDI On Retail MarketDocumento11 páginasCritical Appraisal of FDI On Retail MarketJayesh MahajanAinda não há avaliações

- Unlocking the Potential of Islamic Finance for SME`sNo EverandUnlocking the Potential of Islamic Finance for SME`sAinda não há avaliações

- GeographyDocumento22 páginasGeographymaheshgullankiAinda não há avaliações

- History: Section - D: General AwarenessDocumento24 páginasHistory: Section - D: General AwarenessLeslie MorganAinda não há avaliações

- History: Section - D: General AwarenessDocumento24 páginasHistory: Section - D: General AwarenessLeslie MorganAinda não há avaliações

- Video Case #1 Goodwill: IndustriesDocumento2 páginasVideo Case #1 Goodwill: IndustriesMhaegia Nalla EscobalAinda não há avaliações

- PCC Module 3Documento3 páginasPCC Module 3Aries MatibagAinda não há avaliações

- Research Design: Ibrahim MatwawalaDocumento4 páginasResearch Design: Ibrahim MatwawalaibrahimAinda não há avaliações

- Independent University, BangladeshDocumento93 páginasIndependent University, BangladeshShahriar HaqueAinda não há avaliações

- Product Marketing Mix PDFDocumento17 páginasProduct Marketing Mix PDFDharani C KAinda não há avaliações

- Liril Case - 1Documento13 páginasLiril Case - 1Vishal Jagetia100% (3)

- Impact of Covid-19 On FMCG IndustryDocumento7 páginasImpact of Covid-19 On FMCG IndustryBhumika JainAinda não há avaliações

- PDF ImpDocumento10 páginasPDF ImpstudiessAinda não há avaliações

- Fairness CreamDocumento15 páginasFairness CreamcoolmayurmestryAinda não há avaliações

- Downloadable Solution Manual For Essentials of Marketing Research A Hands On Orientation 1st Edition Malhotra Case 1.1 Dell 1Documento21 páginasDownloadable Solution Manual For Essentials of Marketing Research A Hands On Orientation 1st Edition Malhotra Case 1.1 Dell 1dolly-sharmaAinda não há avaliações

- Customer Satisfaction With Customer Service and Service Quality in SupermarketsDocumento9 páginasCustomer Satisfaction With Customer Service and Service Quality in SupermarketsThiều Quang100% (1)

- Case AnalysisDocumento6 páginasCase AnalysisLenard BelanoAinda não há avaliações

- MedimixDocumento2 páginasMedimixKomal MishraAinda não há avaliações

- Task 3: Applications of Customer DataDocumento1 páginaTask 3: Applications of Customer DatasivaniAinda não há avaliações

- Dabur Project - 11111Documento32 páginasDabur Project - 11111King Nitin Agnihotri0% (1)

- Cema Release 0Documento2 páginasCema Release 0rajayu20002724Ainda não há avaliações

- Principles of Economics - UpdatedDocumento72 páginasPrinciples of Economics - UpdatedHabibullah Sarker0% (1)

- Primer Routledge, 2004Documento6 páginasPrimer Routledge, 2004ravi1bhairavAinda não há avaliações

- 06 Theory of Consumer Behaviour Notes FinalDocumento79 páginas06 Theory of Consumer Behaviour Notes FinalAnaida A Sangma 21A-18Ainda não há avaliações

- Supply Chain ManagementDocumento21 páginasSupply Chain ManagementMTZAAinda não há avaliações