Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 4

Enviado por

Crystal BrownTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 4

Enviado por

Crystal BrownDireitos autorais:

Formatos disponíveis

CHAPTER 4

Income Measurement and

Accrual Accounting

OVERVIEW OF EXERCISES, PROBLEMS, AND CASES

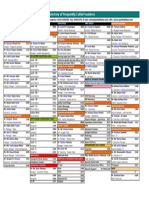

Exercises

Estimated

Time in

Minutes

Level

1. Explain the significance of recognition and measurement

in the preparation and use of financial statements.

18*

20

Diff

2. Explain the differences between the cash and accrual

bases of accounting.

18*

20

Diff

3. Describe the revenue recognition principle and explain its

application in various situations.

1

18*

10

20

Easy

Diff

4. Describe the matching principle and the various methods

for recognizing expenses.

2

19*

20*

10

15

15

Mod

Mod

Mod

5. Identify the four major types of adjustments and determine

their effect on the accounting equation.

3

4

5

6

7

8

9

10

11

12

13

14

15

16

19*

20*

10

10

20

20

15

15

15

15

15

15

15

15

10

15

15

15

Easy

Easy

Easy

Easy

Easy

Easy

Easy

Mod

Easy

Easy

Easy

Easy

Mod

Mod

Mod

Mod

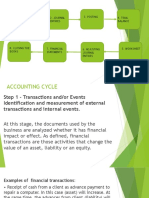

6. Explain the steps in the accounting cycle and the significance

of each step.

17

Easy

Learning Objective

*Exercise, problem, or case covers two or more learning objectives

Level = Difficulty levels: Easy; Moderate (Mod); Difficult (Diff)

4-1

4-2

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

Estimated

Time in

Minutes

Level

8*

25

Mod

8*

9*

25

25

Mod

Diff

8*

9*

25

25

Mod

Diff

5. Identify the four major types of adjustments and determine

their effect on the accounting equation.

1

2

3

4

5

6

7

10*

20

20

20

15

20

25

15

60

Mod

Mod

Mod

Mod

Mod

Mod

Mod

Mod

6. Explain the steps in the accounting cycle and the significance

of each step.

10*

90

Mod

Learning Objective

Problems

and

Alternates

1. Explain the significance of recognition and measurement

in the preparation and use of financial statements.

2. Explain the differences between the cash and accrual

bases of accounting.

3. Describe the revenue recognition principle and explain its

application in various situations.

4. Describe the matching principle and the various methods

for recognizing expenses.

*Exercise, problem, or case covers two or more learning objectives

# Original problem only

**Alternate problem only

Level = Difficulty levels: Easy; Moderate (Mod); Difficult (Diff)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

Learning Objective

Cases

1. Explain the significance of recognition and measurement

in the preparation and use of financial statements.

Estimated

Time in

Minutes

Level

1*

30

Mod

2. Explain the differences between the cash and accrual

bases of accounting.

1*

3*

5*

30

30

60

Mod

Mod

Diff

3. Describe the revenue recognition principle and explain its

application in various situations.

1*

2

3*

5*

30

30

30

60

Mod

Mod

Mod

Diff

3*

4

5*

6

30

25

60

45

Mod

Mod

Diff

Mod

5*

60

Diff

4. Describe the matching principle and the various methods

for recognizing expenses.

5. Identify the four major types of adjustments and determine

their effect on the accounting equation.

6. Explain the steps in the accounting cycle and the significance

of each step.

*Exercise, problem, or case covers two or more learning objectives

Level = Difficulty levels: Easy; Moderate (Mod); Difficult (Diff)

4-3

4-4

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

QUESTIONS

1.

The accountant cannot show a stockholder or other user the companys assets,

such as cash and buildings. Instead, what the user sees is a representation or

depiction of the real thing. The accountant describes with words and numbers the

various items in the financial statements.

2.

Accountants strive to present financial statements that are both relevant to the

decisions made by users of the statements and also reliable or verifiable.

Sometimes, however, there are trade-offs. For example, in deciding whether an

asset that a company pledges as collateral for a loan is sufficient, a banker may

be most interested in the current value of the asset. That is, this amount may be

the most relevant attribute or characteristic of the asset for the bankers needs.

The accountant, however, may be reluctant to present the current value of the

asset on the balance sheet because of the difficulty in measuring the value of the

asset with any degree of reliability. The amount paid for the assetthat is, its

historical costmay be more reliable, although not as relevant to the bankers

decision.

3.

The realtor will recognize revenue from the sale of the home on July 8 if the cash

basis is used because this is the date cash is received. Revenue will be

recognized on June 12 if the accrual basis is used because this is the date the

sale takes place and thus is the date on which the revenue is earned.

4.

This statement is not entirely accurate. Because it is based on historical cash

flows, a statement of cash flows is not necessarily the most accurate source of

information on the future cash flow prospects for a company. An income

statement may in fact provide more important information about future cash flows.

For example, an income statement includes not only sales on a cash basis this

period but also sales on credit that will generate cash flows in future periods.

Similarly, a statement of cash flows reports only expenses that required a cash

outlay in the current period. An accrual-based income statement provides

information on accrued expenses that will result in a cash outlay in future periods.

5.

The time period assumption is important in accounting because financial

statement users want information about a company as of a particular point in time

and for distinct periods of time. For example, a potential stockholder wants to

know the financial position at the end of the most recent year and the profit of a

business for the most recent year. Under an accrual accounting system, revenues

are recognized when they are earned regardless of when cash is received, and

expenses are recognized when they are incurred regardless of when cash is

paid. The accountant does not wait until all of the cash from a sale has been

collected to report the sale on the income statement. In this way, the user of the

statement receives information on a timely basis.

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-5

6.

No, the recognition of revenue is not always the result of the acquisition of an

asset. Assume that a publisher sells a magazine subscription and collects cash

from the customer in advance. At the time cash is collected, the publisher incurs a

liability. As each months magazine is mailed to the customer, a portion of the

liability is satisfied and revenue is recognized. Thus, in some instances, revenue

results from the settlement of a liability.

7.

A company incurs a cost when it acquires an asset. For example, assume that a

retailer buys a product for $100 on October 21. On this date, it has incurred a

cost of $100 to acquire an asset, namely merchandise inventory. The asset will

be removed from the records and an expense recognized, namely cost of goods

sold, when the product is sold. In place of the inventory, the company will acquire

another asset, either cash or an account receivable. In summary, assets are

unexpired costs and expenses are expired costs.

8.

Depreciation is the process of allocating the cost of a tangible long-term asset to

its useful life. For example, the accountant attempts to recognize or match the

cost of a machine as an expense over the period of time that the machine is used

to manufacture products.

9.

The four basic types of adjustments are:

a. To recognize the expired portion of a prepaid expense. For example, an

adjustment is needed at the end of each month to recognize insurance

expense for the portion of an insurance policy that has expired during the

period.

b. To recognize the earned portion of a deferred revenue or liability. For

example, a publisher has to make an adjustment at the end of each period to

recognize the earned portion of a subscription.

c. To recognize expense at the end of the period before cash is paid. For

example, an adjustment is made at the end of the year to recognize income

tax expense, even though the taxes will not be paid until early in the following

year.

d. To recognize revenue at the end of the period before cash is received. For

example, a landlord will need to make an adjustment at the end of the month

for the rent owed by a tenant but not payable until some time during the

following month.

4-6

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

10.

Balance sheet accounts are called real accounts because they are permanent

and are not closed at the end of a period. Conversely, income statement accounts

are called nominal accounts because they are temporary and are closed at the

end of the period. For example, it would not make sense to close the Equipment

account at the end of the period. The account should stay on the books as long

as the company keeps the asset. On the other hand, Depreciation Expense on

the equipment is a temporary account that indicates the expense associated with

using the asset during the period and is therefore closed along with all other

income statement accounts at the end of the period.

11.

Closing entries serve two important purposes. First, the balances in all temporary

or nominal accounts are returned to zero to start the next accounting period.

Second, the net income and the dividends of the period are transferred to the

Retained Earnings account.

EXERCISES

LO 3

EXERCISE 4-1 REVENUE RECOGNITION

Cash collected at toll booth

Passes redeemed

Revenue recognized

$ 3,000,000

1,700,000

$ 4,700,000

Only the amount of passes that have been used should be recognized as revenue. The

difference between the $2,000,000 of passes issued and the $1,700,000 of passes

used is unearned revenue at this point.

LO 4

EXERCISE 4-2 THE MATCHING PRINCIPLE

1. b

2. c

3. b or c (would recognize immediately if supplies are normally used up within the

period)

4. c

5. a

6. c

7. a

8. c

9. b

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

EXERCISE 4-3 ACCRUALS AND DEFERRALS

LO 5

1.

2.

3.

4.

AL

DR

AA

DE

LO 5

4-7

5.

6.

7.

8.

DE

DR

AL

AA

EXERCISE 4-4 OFFICE SUPPLIES

To record office supplies used.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

5/31 Office Supplies

on Hand (1,630)

(1,450 + 1,100

920)

Office Supplies

Expense

(1,630)

Net income for the month of May would be overstated by $1,630 if this adjustment were

not recognized, because expenses would be understated.

LO 5

EXERCISE 4-5 PREPAID RENTQUARTERLY

ADJUSTMENTS

1. $12,000/6 months = $2,000 per month.

2. To record prepayment of six months rent on September 1.

BALANCE SHEET

Assets

9/1 Prepaid

Rent

Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

12,000

(12,000)

3. To record one month of rent expense on September 30.

BALANCE SHEET

Assets

9/30 Prepaid

Rent

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Rent Expense

(2,000)

(2,000)

4. If the accountant forgot to record an adjustment on December 31, net income for

the year would be overstated by $6,000 ($2,000 per month 3 months).

4-8

LO 5

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

EXERCISE 4-6 DEPRECIATION

1. To record purchase of combine on July 1.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

7/1 Equipment 100,000

Cash

(100,000)

2. Purchase price

Less: Estimated salvage value

Depreciable cost

$ 100,000

(16,000)

$ 84,000

3. Monthly depreciation = depreciable cost/estimated life = $84,000/84 months =

$1,000/month.

4. To record one months depreciation expense on July 31.

BALANCE SHEET

Assets

Liabilities

INCOME

7/31 Accumulated

Depreciation (1,000)

Depreciation

Expense

5. Equipment

Less: Accumulated depreciation (6 months

$1,000/month)

Carrying value

LO 5

STATEMENT

Stockholders Equity + Revenues Expenses

(1,000)

$ 100,000

(6,000)

$ 94,000

EXERCISE 4-7 PREPAID INSURANCEANNUAL

ADJUSTMENTS

1. Monthly cost: $72,000/24 months = $3,000.

2. To record purchase of 24-month policy on April 1.

BALANCE SHEET

Assets

4/1 Prepaid

Insurance 72,000

Cash

(72,000)

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-9

EXERCISE 4-7 (Concluded)

3. To record expiration of nine months of insurance on December 31.

BALANCE SHEET

Assets

INCOME

Liabilities

STATEMENT

Stockholders Equity + Revenues Expenses

12/31 Prepaid

Insurance (27,000)

(27,000)

Insurance

Expense

4. Net income will be overstated by $27,000 if the accountant forgets to record an

adjustment to recognize an expense.

EXERCISE 4-8 SUBSCRIPTIONS

LO 5

1. To record collection of 900 subscriptions of $30 each in August.

BALANCE SHEET

Assets

Aug. Cash

=

27,000

Liabilities

Subscriptions

Received in

Advance

(900 30)

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

27,000

2. To record subscriptions earned during August and recorded on August 31.

BALANCE SHEET

Assets

8/31

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Subscriptions

Received in

Advance

(7,500)

(40,500 + 27,000 60,000)

Revenue

Subscriptions

7,500

3. Net income for the month would be understated by $7,500 if the accountant forgot

to make the adjustment to recognize revenue earned.

4-10

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

EXERCISE 4-9 CUSTOMER DEPOSITS

LO 5

1. To record on April 1 receipt of customer deposit for three months of legal service.

BALANCE SHEET

Assets

4/1

Cash

=

9,000

INCOME

Liabilities

Customer

Deposits

STATEMENT

Stockholders Equity + Revenues Expenses

9,000

2. To record on April 30 one month of legal fees earned.

BALANCE SHEET

Assets

4/30

INCOME

Liabilities

Customer

Deposits

(9,000/3)

STATEMENT

Stockholders Equity + Revenues Expenses

Legal Fees

Earned

(3,000)

3,000

3. If the April 30 adjustment is not recorded, net income will be understated by $3,000.

EXERCISE 4-10 WAGES PAYABLE

LO 5

1. Weekly payroll:

$17,500

$10 per hour 7 hours per day 5 days 50 employees =

2. To record payment of weekly payroll on October 27.

BALANCE SHEET

Assets

10/27 Cash

INCOME

Liabilities

STATEMENT

Stockholders Equity + Revenues Expenses

(17,500)

Wages Expense (17,500)

3. To record accrual for two days wages on October 31.

BALANCE SHEET

Assets

10/31

INCOME

Liabilities

Wages Payable

(17,500/5 days

STATEMENT

Stockholders Equity + Revenues Expenses

7,000

2 days)

Wages Expense

(7,000)

4. To record payment of weekly payroll on November 3.

BALANCE SHEET

Assets

11/3 Cash

Liabilities

(17,500) Wages Payable

INCOME

+

(7,000)

STATEMENT

Stockholders Equity + Revenues Expenses

Wages Expense

(10,500)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-11

5. Net income for October would be overstated by $7,000 if the company failed to

record accrued wages on October 31.

EXERCISE 4-11 INTEREST PAYABLE

LO 5

1. To record 12%, 90-day loan from First National Bank on March 1.

BALANCE SHEET

Assets

3/1 Cash

Liabilities

100,000 Note Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

100,000

2. To accrue interest due on note for one month on March 31.

BALANCE SHEET

Assets

3/31

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Payable

1,000

(100,000 .12 30/360)

Interest Expense (1,000)

To accrue interest due on note for one month on April 30.

BALANCE SHEET

Assets

4/30

Liabilities

Interest Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

1,000

Interest Expense

(1,000)

3. To record payment of note and interest at maturity date on May 30.

BALANCE SHEET

Assets

5/30 Cash

LO 5

(103,000)

Liabilities

Note Payable

Interest

Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

(100,000)

Interest Expense

(1,000)

(2,000)

EXERCISE 4-12 PROPERTY TAXES PAYABLE

ANNUAL ADJUSTMENTS

1. To accrue 2007 property taxes on December 31.

BALANCE SHEET

Assets

2007

12/31

Liabilities

Property Taxes

Payable

(50,000 1.05)

INCOME

52,500

STATEMENT

Stockholders Equity + Revenues Expenses

Property Tax

Expense

(52,500)

4-12

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

EXERCISE 4-12 (Concluded)

2. To record payment of 2007 property taxes on June 1.

BALANCE SHEET

Assets

2008

6/1 Cash

LO 5

1.

Liabilities

(52,500) Property Taxes

Payable

INCOME

(52,500)

EXERCISE 4-13 INTEREST RECEIVABLE

To record 10%, 60-day loan to MaxiDriver Inc. on June 1.

BALANCE SHEET

Assets

6/1

2.

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Cash

(60,000)

Note

Receivable 60,000

To accrue interest due on note for one month on June 30.

BALANCE SHEET

Assets

Liabilities

INCOME

6/30 Interest

Receivable 500

(60,000 .10 30/360)

3.

STATEMENT

Stockholders Equity + Revenues Expenses

STATEMENT

Stockholders Equity + Revenues Expenses

Interest

Income

500

To record collection of note and interest at maturity date on July 31.

BALANCE SHEET

Assets

7/31 Cash

61,000

Note

Receivable (60,000)

Interest

Receivable

(500)

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Income

500

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-13

EXERCISE 4-14 UNBILLED ACCOUNTS RECEIVABLE

LO 5

1. Under the revenue recognition principle, revenue should be recorded when

services are performed, because this is the point at which revenue is earned.

2. To record on June 30 unbilled service fees earned during June.

BALANCE SHEET

Assets

6/30

Liabilities

Service Fees

Earned

LO 6

40,000

EXERCISE 4-15 THE EFFECT OF IGNORING ADJUSTMENTS

ON NET INCOME

1. O

2. U

3. O

1.

2.

3.

4.

5.

6.

STATEMENT

Stockholders Equity + Revenues Expenses

Accounts

Receivable 40,000

LO 5

LO 5

INCOME

4. O

5. O

6. U

EXERCISE 4-16 THE EFFECT OF ADJUSTMENTS ON THE

ACCOUNTING EQUATION

Assets

D

NE

D

NE

I

NE

Liabilities

NE

I

NE

D

NE

I

EXERCISE 4-17 THE ACCOUNTING CYCLE

Order in the accounting cycle: 4, 7, 1, 5, 3, 6, 2

Stockholders Equity

D

D

D

I

I

D

4-14

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

MULTI-CONCEPT EXERCISES

LO 1,2,3

EXERCISE 4-18 REVENUE RECOGNITION, CASH AND

ACCRUAL BASIS

1. Accrual-basis income statements:

HATHAWAY HEALTH CLUB

INCOME STATEMENTS

FOR THE YEARS ENDED DECEMBER 31

Sales*$

Expenses:

Depreciation**

Salaries and wages

Advertising

Rent and utilities

Total expenses

Net income (loss)

Year 1

122,000

Year 2

$152,000

Year 3

$ 182,000

$ 33,000

50,000

5,000

36,000

$124,000

$ (2,000)

$ 33,000

50,000

5,000

36,000

$124,000

$ 28,000

$ 33,000

50,000

5,000

36,000

$ 124,000

$ 58,000

*Year 1: $366,000/3 = $122,000 with a three-year membership; only one-third of

the total recognized.

Year 2: $122,000 + [(100)($900)/3] (additional three-year memberships sold in

second year, but only one-third recognized as revenue) = $152,000.

Year 3: $122,000 + $30,000 (additional year of revenue recognized on

memberships sold in year 2) + $30,000 (additional three-year memberships sold

in third year, but only one-third recognized as revenue) = $182,000.

**($100,000 $1,000)/3 years = $33,000 per year.

2. Under the revenue recognition principle, revenue is recognized not when cash is

received but rather when revenue is earned. It is earned with the passage of time

as members use the facilities over their respective three-year membership periods.

Accrual-basis income statements allow the reader to focus on the long-term

profitability of the business rather than simply on the amount of cash received in

any given year.

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

LO 4,5

4-15

EXERCISE 4-19 DEPRECIATION EXPENSE

1. Depreciation

Truck

Computer

Building

expense for 2007:

[($18,000 $3,000)/5] 9/12

[($55,000 $5,000)/10] 6/12

[($250,000 $10,000)/30] 3/12

=

=

=

$2,250

$2,500

$2,000

2. Certainly, it would be less costly in terms of the time spent by the accountant to

expense all costs rather than treat certain ones as assets to be written off over their

useful lives. However, this is a violation of the matching principle which requires

that costs be allocated to the periods during which they provide benefits, i.e., aid

the generation of revenue. Estimates such as those required to depreciate assets

are a normal and necessary part of an accrual accounting system.

LO 4,5

EXERCISE 4-20 ACCRUAL OF INTEREST ON A LOAN

1. To record two-month, 12% bank loan on July 1.

BALANCE SHEET

Assets

a. 7/1 Cash

Liabilities

50,000 Notes Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

50,000

To accrue one-month interest on bank loan on July 31.

BALANCE SHEET

Assets

b. 7/31

Liabilities

INCOME

Interest Payable

500

(50,000 .12 1/12)

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Expense

(500)

To record repayment of principal and interest on bank loan on August 31.

BALANCE SHEET

Assets

c. 8/31 Cash

2.

Liabilities

(51,000) Interest Payable

Notes Payable

INCOME

+

(500)

(50,000)

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Expense

(500)

It would save the time and cost in making a journal entry to skip an adjustment on

July 31 and simply record interest when the loan is repaid on August 31. However,

to do so would violate the matching principle. One of the necessary costs in July

was interest, and it should be matched with the revenues of that period. If interest

were not accrued at the end of July, the expense for that month would be

understated and the expense for August would be overstated.

4-16

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEMS

PROBLEM 4-1 ADJUSTMENTS

LO 5

1. Adjustments on March 31, 2007:

To accrue interest.

BALANCE SHEET

Assets

a. 3/31

Liabilities

INCOME

Interest Payable

100

(15,000 .08 30/360)

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Expense

(100)

To record supplies used.

BALANCE SHEET

Assets

Liabilities

INCOME

b. 3/31 Office Supplies

on Hand

(660)

(1,280 + 750 1,370)

STATEMENT

Stockholders Equity + Revenues Expenses

Supplies Expense

(660)

To record depreciation.

BALANCE SHEET

Assets

c. 3/31

Liabilities

INCOME

Accumulated

Depreciation

Office

Equipment (800)

(62,600 5,000) 1/72

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

(800)

To accrue wages.

BALANCE SHEET

Assets

d. 3/31

Liabilities

Wages Payable

(950 6)

INCOME

+

5,700

STATEMENT

Stockholders Equity + Revenues Expenses

Wages Expense

(5,700)

To recognize rent earned.

BALANCE SHEET

Assets

e. 3/31

Liabilities

Rent Collected

in Advance

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Rent Revenue

(2,500)

2,500

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-1 (Concluded)

To record customer deposits earned.

BALANCE SHEET

Assets

f. 3/31

Liabilities

Customer

Deposits

(4,800/4)

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Service Revenue

1,200

(1,200)

To record estimated income taxes.

BALANCE SHEET

Assets

g. 3/31

Liabilities

Income Tax

Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Income Tax

Expense

3,900

2. Income before adjustments

Rent revenue

Service revenue

Interest expense

Supplies expense

Depreciation expense

Wages expense

Income tax expense

Adjusted net income

LO 5

(3,900)

$ 23,000

+ 2,500

+ 1,200

(100)

(660)

(800)

(5,700)

(3,900)

$ 15,540

PROBLEM 4-2 ANNUAL ADJUSTMENTS

1. Adjustments on December 31, 2007:

To record annual depreciation expense.

BALANCE SHEET

Assets

a. 12/31

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Accumulated

Depreciation (2,950)

(15,000 250)/5 years

Depreciation

Expense

(2,950)

To record supplies used during the year.

BALANCE SHEET

Assets

Liabilities

b. 12/31 Supplies

on Hand (19,350)

(3,600 + 17,600 1,850)

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Supplies

Expense

(19,350)

4-17

4-18

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-2 (Concluded)

To record customer deposits earned between August and December.

BALANCE SHEET

Assets

c. 12/31

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Customer

Deposits

(20,000)

(24,000/6 months) 5 months

Fees Earned

20,000

To record rent expense for November through December.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

d. 12/31 Prepaid Rent (5,400)

(2,700 2)

Rent Expense

(5,400)

To accrue interest payable on note.

BALANCE SHEET

Assets

e. 12/31

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Payable

3,000

(200,000 .09 60/360)

Interest Expense

(3,000)

To accrue wages payable at year-end.

BALANCE SHEET

Assets

f. 12/31

Liabilities

Wages Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

500

2. Net increase (decrease) in net income from adjustments:

a. Depreciation expense

b. Supplies expense

c. Fees earned

d. Rent expense

e. Interest expense

f. Wage expense

Overstatement of 2007 net income

Wage Expense

(500)

$ (2,950)

(19,350)

20,000

(5,400)

(3,000)

(500)

$ (11,200)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-3 RECURRING TRANSACTIONS AND

ADJUSTMENTS

LO 5

a.

b.

c.

d.

e.

f.

g.

h.

4-19

1, 12, 13

5, 1

7, 1, 11

3, 1

4, 8

1, 14

1, 2

2, 14

i.

j.

k.

l.

m.

n.

o.

8, 1

17, 9

15, 4

16, 3

11, 19, 1

18, 6

20, 10

PROBLEM 4-4 USE OF ACCOUNT BALANCES AS A

BASIS FOR ANNUAL ADJUSTMENTS

LO 5

1. Adjustments on December 31, 2007:

To recognize expired insurance.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

a. 12/31 Prepaid

Insurance (1,000)

(7,200 5/36)

Insurance

Expense

(1,000)

To recognize rent earned.

BALANCE SHEET

Assets

b. 12/31

Liabilities

INCOME

Rent Collected in

Advance

(6,000 7/12)

STATEMENT

Stockholders Equity + Revenues Expenses

Rent Revenue

3,500

(3,500)

To recognize interest earned.

BALANCE SHEET

Assets

Liabilities

c. 12/31 Interest

Receivable 1,500

(50,000 .09 4/12)

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Revenue

1,500

2. If adjustments were made at the end of each month, the Prepaid Insurance account

would have been reduced by the monthly expense of $200 ($7,200/36) on four

occasions: August 31, September 30, October 31, and November 30. Thus, the

balance in the account before the December adjustment would be $7,200 [(4)

($200)] = $6,400.

4-20

LO 5

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-5 USE OF ACCOUNT BALANCES AS A BASIS

FOR ADJUSTMENTS

1. Adjustments on April 30, 2007:

To recognize one months insurance expense.

BALANCE SHEET

Assets

Liabilities

INCOME

a. Prepaid Insurance (50)

STATEMENT

Stockholders Equity + Revenues Expenses

Insurance Expense

(50)

To record supplies used.

BALANCE SHEET

Assets

b. Office Supplies

(250 180)

Liabilities

INCOME

(70)

STATEMENT

Stockholders Equity + Revenues Expenses

Office Supplies

Expense

(70)

To record depreciation.

BALANCE SHEET

Assets

Liabilities

INCOME

c. Accumulated

Depreciation

Office Equipment

(417)

(50,000 1/120)

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

(417)

To record depreciation.

BALANCE SHEET

Assets

d. Accumulated

Depreciation

Automobile

(200)

(12,000 1/60)

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

(200)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-21

PROBLEM 4-5 (Concluded)

To record commissions earned.

BALANCE SHEET

Assets

e.

Liabilities

Unearned

Commissions

(9,500 5,000)

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Commissions

Earned

(4,500)

4,500

To record revenue earned, not yet collected.

BALANCE SHEET

Assets

f. Accounts

Receivable

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Commissions

Earned

1,500

1,500

To record interest on note payable.

BALANCE SHEET

Assets

g.

Liabilities

INCOME

Interest Payable

STATEMENT

Stockholders Equity + Revenues Expenses

20

Interest Expense

(20)

To record salaries not yet paid.

BALANCE SHEET

Assets

h.

Liabilities

Salaries Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

2,500

2. Net increase (decrease) in net income from adjustments:

Insurance expense

Office supplies expense

Depreciation expense

Depreciation expense

Commissions earned

Commissions earned

Interest expense

Salaries expense

Net increase in net income

Salaries Expense

(2,500)

(50)

(70)

(417)

(200)

4,500

1,500

(20)

(2,500)

$ 2,743

3. The office equipment was purchased on April 1, 2006, and has been depreciated

for one year before depreciation is recorded for the month of April 2007. Thus, if

the equipment has a 10-year life, the balance in Accumulated Depreciation will be

$50,000/10 years, or $5,000.

4-22

LO 5

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-6 RECONSTRUCTION OF ADJUSTMENTS FROM

ACCOUNT BALANCES

1. To record insurance expense on June 30.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Prepaid Insurance (150)

(3,600 3,450)

Insurance Expense

(150)

2. Cost of policy was $150 36 months = $5,400.

3. To record depreciation expense on June 30.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Accumulated

(Depreciation (80)

(1,360 1,280)

Depreciation

Expense

(80)

4. Estimated useful life in months: $9,600/$80 month = 120 months.

5. To record interest expense on June 30.

BALANCE SHEET

Assets

6/30

Liabilities

Interest Payable

(2,448 2,304)

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

144

Interest Expense

(144)

6. Interest rate: ($144 per month 12 months)/$9,600 = 18%.

The monthly rate is 18%/12 months = 1.5%.

LO 5

PROBLEM 4-7 USE OF ACCOUNT BALANCES AS A

BASIS FOR ADJUSTMENTS

1. Recording adjustments:

To record rent expense.

BALANCE SHEET

Assets

a. Prepaid Rent

=

(600)

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Rent Expense

(600)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-7 (Continued)

To record expense of worn-out videos.

BALANCE SHEET

Assets

INCOME

Liabilities

STATEMENT

Stockholders Equity + Revenues Expenses

b. Video Inventory (2,460)

Video Expense

(2,460)

To record depreciation expense on display stands.

BALANCE SHEET

Assets

c. Accumulated

Depreciation

INCOME

Liabilities

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

(140)

(140)

To record unpaid wages and salaries.

BALANCE SHEET

Assets

d.

INCOME

Liabilities

Wages and

Salaries

Payable

STATEMENT

Stockholders Equity + Revenues Expenses

Wages and

Salary

Expense

1,450

(1,450)

To record subscription revenue earned.

BALANCE SHEET

Assets

e.

INCOME

Liabilities

Customer

Subscriptions

STATEMENT

Stockholders Equity + Revenues Expenses

(2,440)

Subscription

Revenue

2,440

To record accrued income taxes.

BALANCE SHEET

Assets

f.

Liabilities

Income Taxes

Payable

Explanations:

(a) $7,200/12 months

(b) $25,600 $23,140

(c) ($8,900 $500)/60 months

INCOME

+

849

STATEMENT

Stockholders Equity + Revenues Expenses

Income Tax

Expense

(849)

4-23

4-24

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-7 (Concluded)

(f) Calculation of taxes due:

Subscription revenue

Rental revenue

Wage and salary expense ($2,320 + $1,450)

Utility expense

Advertising expense

Rent expense

Video expense

Depreciation expense

Income before tax

tax rate

Income tax expense

$ 2,440

9,200

(3,770)

(1,240)

(600)

(600)

(2,460)

(140)

$ 2,830

0.30

$

849

2. On the basis of the information available, Four Star appears to be a profitable

business. Subscription revenue and rental revenue together total $11,640 for the

month. Net income for the month is $2,830 $849 (taxes), or $1,981. This results

in a profit margin of $1,981/$11,640, or 17%.

MULTI-CONCEPT PROBLEMS

LO 2,3,4

PROBLEM 4-8 CASH AND ACCRUAL INCOME

STATEMENTS FOR A MANUFACTURER

1. Cash revenue: 500,000 components $2

Less: Amounts not yet received

Cash revenue

Accrual revenue: 500,000 components $2

$ 1,000,000

150,000

$ 850,000

$ 1,000,000

2. Under the matching principle, Drysdale should match all expenses to revenues

generated. Thus, all expenses should be recognized during the year, except for the

cost of the truck. The cost of $10,000 should be spread over the estimated useful

life of five years.

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-25

PROBLEM 4-8 (Concluded)

3. Income statement under the accrual basis:

DRYSDALE COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED XX/XX/XX

Sales revenue

Cost of goods sold

Gross profit

Operating expenses:

Sales and administrative salaries

Truck depreciation

Total operating expenses

Net income

$ 1,000,000

602,000*

$ 398,000

$

$

$

*Rent: $1,000 12

Raw materials

Salaries and wages

Cost of goods sold

$

$

100,000

2,000**

102,000

296,000

12,000

400,000

190,000

602,000

**$10,000/5 years

LO 3,4

PROBLEM 4-9 REVENUE AND EXPENSE

RECOGNITION

Income statements for Years 1 and 2:

DARBY DELIVERY SERVICE

INCOME STATEMENTS

Sales revenue (a)

Expenses:

Advertising (b)

Salaries (c)

Rent (d)

Total expenses

Net income

Year 1

$ 23,000

Year 2

$ 46,000

$ 2,000

15,000

5,000

$ 22,000

$ 1,000

$ 1,500

24,000

5,000

$ 30,500

$ 15,500

4-26

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-9 (Concluded)

Explanations:

a. Let X = Year 1 sales

Year 1 sales + 2(Year 1 sales) = $69,000

3X = $69,000;

X = $23,000 = Year 1 sales

2X = $46,000 = Year 2 sales

b. Total advertising expense

$3,500

Less promotional portion

500

Total weekly expense

$3,000 or $1,500/year

Year 1 advertising = $500 + $1,500 = $2,000

Year 2 advertising = $1,500

c. Let X = one employee's annual salary

1st year = X + 0.25X

2nd year = 2X

X + 0.25X + 2X = $39,000

3.25X = $39,000; X = $12,000

1st year = $12,000 + 0.25($12,000) = $15,000

2nd year = 2($12,000) = $24,000

d. Same rent for two years: $10,000/2 = $5,000

LO 5,6

PROBLEM 4-10 MONTHLY TRANSACTIONS,

ADJUSTMENTS, AND FINANCIAL STATEMENTS

1. Effects on the accounting equation:

To record issuance of stock to owners on January 2.

BALANCE SHEET

Assets

1/2 Cash

60,000

(3 20,000)

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Capital

Stock

60,000

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-10 (Continued)

To record purchase of a Victorian inn on January 2.

BALANCE SHEET

Assets

1/2 Land

House

Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

15,000

35,000

(50,000)

To record issuance of two-year, 12% promissory note on January 3.

BALANCE SHEET

Assets

1/3 Cash

=

30,000

Liabilities

Notes Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

30,000

To record purchase of furniture for cash on January 4.

BALANCE SHEET

Assets

1/4 Furniture

Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

15,000

(15,000)

To record purchase of 24-month insurance policy on January 5.

BALANCE SHEET

Assets

1/5 Prepaid

Insurance

Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6,000

(6,000)

To record payment for advertising on January 6.

BALANCE SHEET

Assets

1/6 Cash

Liabilities

INCOME

(450)

STATEMENT

Stockholders Equity + Revenues Expenses

Advertising

Expense

(450)

To record purchase of cleaning supplies on account on January 7.

BALANCE SHEET

Assets

1/7 Cleaning

Supplies

Liabilities

Accounts Payable

950

INCOME

+

950

STATEMENT

Stockholders Equity + Revenues Expenses

4-27

4-28

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-10 (Continued)

To record payment of wages for first half of month on January 15.

BALANCE SHEET

Assets

1/15 Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

(4,230)

Wages Expense

(4,230)

To record guest's prepayment for two-week stay on January 16.

BALANCE SHEET

Assets

1/16 Cash

Liabilities

980 Rent Received

in Advance

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

980

To record cash receipts from rentals for January on January 31.

BALANCE SHEET

Assets

1/31 Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

8,300

Revenue from

Rental of Rooms 8,300

To record cash receipts from restaurant for January on January 31.

BALANCE SHEET

Assets

1/31 Cash

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6,600

Restaurant

Revenue

6,600

To record payment of dividends for January on January 31.

BALANCE SHEET

Assets

1/31 Cash

(3 200)

=

(600)

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Dividends

(600)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-10 (Continued)

2. List of accounts and account balances:

Assets

Cash

Land

House

Furniture

Prepaid Insurance

Cleaning Supplies

$ 29,600

15,000

35,000

15,000

6,000

950

Liabilities

Accounts Payable

Notes Payable

Rent Received in Advance

Owners Equity

Capital Stock

Advertising Expense

Wages Expense

Revenue from Rental of Rooms

Restaurant Revenue

Dividends

950

30,000

980

$ 60,000

450

4,230

8,300

6,600

600

3. Adjustments:

To record depreciation expense on the house.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

a. Accumulated

Depreciation

House

(100)

Depreciation

Expense

(100)

To record depreciation expense on the furniture.

BALANCE SHEET

Assets

Liabilities

INCOME

b. Accumulated

Depreciation

Furniture

(125)

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

Furniture

(125)

To record interest on the note.

BALANCE SHEET

Assets

c.

Liabilities

Interest Payable

INCOME

+

300

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Expense

(300)

4-29

4-30

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-10 (Continued)

To record expired insurance.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

d. Prepaid Insurance (250)

Insurance Expense

(250)

To record earned portion of guests deposit.

BALANCE SHEET

Assets

e.

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Rent Received

in Advance (490)

Revenue from

Rental of Rooms

490

To record wages earned by employees.

BALANCE SHEET

Assets

f.

Liabilities

Wages Payable

INCOME

+

5,120

STATEMENT

Stockholders Equity + Revenues Expenses

Wages Expense

(5,120)

To record use of cleaning supplies.

BALANCE SHEET

Assets

Liabilities

INCOME

g. Cleaning Supplies (720)

STATEMENT

Stockholders Equity + Revenues Expenses

Supplies Expense

(720)

To record utility expense.

BALANCE SHEET

Assets

h.

Liabilities

Utilities Payable

INCOME

+

740

STATEMENT

Stockholders Equity + Revenues Expenses

Utilities Expense

(740)

To record income tax expense.

BALANCE SHEET

Assets

i.

Liabilities

Income Tax

Payable

INCOME

+

1,007

STATEMENT

Stockholders Equity + Revenues Expenses

Income Tax

Expense

(1,007)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-10 (Continued)

Explanations for adjusting entry amounts:

(a) ($35,000 $5,000)/300 months = $100/month

(b) $15,000/120 months = $125/month

(c) $30,000 12% 1/12 = $300/month

(d) $6,000/24 months = $250/month

(e) $980/2 weeks = $490/week

(f)

$5,120 for second half of month

(g) $950 $230 = $720 used

(h) $740 due at end of month

(i) Calculation of tax expense:

Revenue from rental of rooms

Restaurant revenue

Wages expense

Advertising expense

Depreciation on house

Depreciation on furniture

Interest expense

Insurance expense

Supplies expense

Utilities expense

Income before tax

Tax rate

Income tax expense

$ 8,790

6,600

(9,350)

(450)

(100)

(125)

(300)

(250)

(720)

(740)

$ 3,355

0.30

$ 1,007

4-31

4-32

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-10 (Continued)

4. Financial statements:

(a)

MOONLIGHT BAY INN

INCOME STATEMENT

FOR THE MONTH ENDED JANUARY 31, 2007

Revenues:

From rental of rooms

From restaurant

Total revenues

Expenses:

Advertising

Wages

Depreciationhouse

Depreciationfurniture

Interest

Insurance

Supplies

Utilities

Income taxes

Total expenses

Net income

(b)

$ 8,790

6,600

$ 15,390

$

450

9,350

100

125

300

250

720

740

1,007

13,042

$ 2,348

MOONLIGHT BAY INN

STATEMENT OF RETAINED EARNINGS

FOR THE MONTH ENDED JANUARY 31, 2007

Beginning balance, January 1, 2007

Add: Net income

Deduct: Cash dividends

Ending balance, January 31, 2007

0

2,348

600

$ 1,748

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-33

PROBLEM 4-10 (Concluded)

(c)

MOONLIGHT BAY INN

BALANCE SHEET

JANUARY 31, 2007

Assets

Current assets:

Cash

Cleaning supplies

Prepaid insurance

Total current assets

Property, plant, and equipment:

Land

House

Less: Accumulated

depreciation

Furniture

Less: Accumulated

depreciation

Total property, plant, and

equipment

Total assets

Liabilities

Current liabilities:

Accounts payable

Interest payable

Wages payable

Income tax payable

Rent received in advance

Utilities payable

Total current liabilities

Long-term debt:

Notes payable

Total liabilities

Stockholders Equity

Capital stock

Retained earnings

Total stockholders equity

Total liabilities and stockholders

equity

$ 29,600

230

5,750

$ 35,580

$ 15,000

$ 35,000

100

$ 15,000

34,900

125

14,875

64,775

$ 100,355

$

950

300

5,120

1,007

490

740

$

8,607

30,000

$ 38,607

$ 60,000

1,748

$ 61,748

$ 100,355

5. The inn has shown the ability to make a profit. The profit margin is

$2,348/$15,390, or approximately 15%. This is an indication that the inn has

been able to generate revenues and control the necessary costs in the process.

The balance sheet shows a very strong current position for the inn. The current

ratio is $35,580/$8,607, or over 4 to 1. The inn has almost enough cash on

hand at the present time to repay the loan. On the basis of the financial

statements alone, it appears that the banker should be comfortable with the

loan made.

4-34

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

ALTE R N ATE P R O B L E M S

LO 5

PROBLEM 4-1A ADJUSTMENTS

1. Adjustments on June 30, 2007:

a. To accrue interest: $10,000 4% 1/12.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Interest Receivable 33

Interest Revenue

33

b. To record supplies used: $475 + $5,600 $507.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Office Supplies

on Hand

(5,568)

Supplies Expense

(5,568)

c. To record depreciation: ($170,000 $2,000) 1/48.

BALANCE SHEET

Assets

Liabilities

INCOME

6/30 Accumulated

Depreciation

Machinery (3,500)

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

(3,500)

d. To record rent expense: $4,650/3.

BALANCE SHEET

Assets

Liabilities

INCOME

6/30 Prepaid Rent (1,550)

STATEMENT

Stockholders Equity + Revenues Expenses

Rent Expense

(1,550)

e. To accrue wages: $7,000.

BALANCE SHEET

Assets

6/30

Liabilities

Wages Payable

INCOME

+

6,000

STATEMENT

Stockholders Equity + Revenues Expenses

Wages Expense

(6,000)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-35

PROBLEM 4-1A (Concluded)

f.

To record estimated income taxes.

BALANCE SHEET

Assets

6/30

2.

Liabilities

Income Taxes

Payable

INCOME

Stockholders Equity + Revenues Expenses

Income Tax

Expense

2,900

Income before adjustments

Interest revenue

Supplies expense

Depreciation expense

Rent expense

Wages expense

Income tax expense

Adjusted net income

LO 5

STATEMENT

(2,900)

$ 35,000

33

(5,568)

(3,500)

(1,550)

(6,000)

(2,900)

$ 15,515

PROBLEM 4-2A ANNUAL ADJUSTMENTS

1. Adjustments:

a. To record annual depreciation expense: ($25,000 $4,000)/7 years.

BALANCE SHEET

Assets

12/31 Accumulated

Depreciation

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Depreciation

Expense

(3,000)

(3,000)

b. To record supplies used during year: $1,200 + $12,900 $900.

BALANCE SHEET

Assets

12/31 Supplies

on Hand

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Supplies

Expense

(13,200)

(13,200)

c. To record customer deposits earned between July and December: ($8,800/8

months) 6 months.

BALANCE SHEET

Assets

12/31

Liabilities

Customer

Deposits

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Fees Earned

(6,600)

6,600

4-36

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-2A (Concluded)

d. To record rent expense for September through December: $4,000 4.

BALANCE SHEET

Assets

12/31 Prepaid Rent

INCOME

Liabilities

STATEMENT

Stockholders Equity + Revenues Expenses

(16,000)

Rent Expense

(16,000)

e. To accrue interest payable on note: $30,000 6% 60/360.

BALANCE SHEET

Assets

12/31

INCOME

Liabilities

Interest Payable

f.

Stockholders Equity + Revenues Expenses

300

Interest Expense

BALANCE SHEET

12/31

INCOME

Liabilities

Wages Payable

830

PROBLEM 4-3A RECURRING TRANSACTIONS AND

ADJUSTMENTS

1, 11, 12

5, 1

2, 1

4, 7

1, 3

1,18

16,1

5, 1,10

i.

j.

k.

l.

m.

STATEMENT

Stockholders Equity + Revenues Expenses

2. Net increase (decrease) in net income from adjustments:

a. Depreciation expense

b. Supplies expense

c. Fees earned

d. Rent expense

e. Interest expense

f. Wage expense

Overstatement of 2007 net income

a.

b.

c.

d.

e.

f.

g.

h.

(300)

To accrue wages payable at year-end: $4,150/5.

Assets

LO 5

STATEMENT

2, 13

17, 6

19, 9

14, 4

15, 3

Wage Expense

(830)

(3,000)

(13,200)

6,600

(16,000)

(300)

(830)

$ (26,730)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

LO 5

4-37

PROBLEM 4-4A USE OF ACCOUNT BALANCES AS A

BASIS FOR ANNUAL ADJUSTMENTS

1. Adjustments on December 31, 2007:

a. To record supplies used: $5,790 $1,520.

BALANCE SHEET

Assets

12/31 Supplies

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

(4,270)

Supplies

Expense

(4,270)

b. To recognize revenue earned: $1,800 8/12.

BALANCE SHEET

Assets

12/31

Liabilities

Unearned

Revenue

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Service Revenue

1,200

(1,200)

c. To record interest on note: $60,000 10% 4/12.

BALANCE SHEET

Assets

12/31

Liabilities

Interest

Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

Interest Expense

(2,000)

2,000

2. If adjustments were made at the end of each month, the Unearned Revenue

account would have been reduced by the monthly revenue of $150 ($1,800/12) at

the end of each of seven months, beginning on May 31 and ending on November

30. Thus, the balance in the account before the December adjustment would be

$1,800 [(7)($150)] = $750.

4-38

LO 5

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-5A USE OF ACCOUNT BALANCES AS A

BASIS FOR ADJUSTMENTS

1. Adjustments on June 30, 2007:

a. To recognize one month's rent expense.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Prepaid Rent (600)

Rent Expense

(600)

b. To record supplies used: $15,210 $1,290.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Office

Supplies (13,920)

Supplies

Expense

(13,920)

c. To record depreciation: ($46,120 $6,120) 1/120.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Accumulated

Depreciation

Equipment

(333)

Depreciation

Expense

(333)

d. To record interest on note payable.

BALANCE SHEET

Assets

6/30

Liabilities

INCOME

Interest Payable

e.

Stockholders Equity + Revenues Expenses

50

Interest Expense

(50)

To record salaries not yet paid.

BALANCE SHEET

Assets

6/30

STATEMENT

Liabilities

Salaries Payable

INCOME

+

620

STATEMENT

Stockholders Equity + Revenues Expenses

Salaries Expense

(620)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-39

PROBLEM 4-5A (Concluded)

2. Net increase (decrease) in net income from adjustments:

a.

b.

c.

d.

e.

Net decrease in net income from adjustments

(600)

(13,920)

(333)

(50)

(620)

$ (15,523)

3. The office equipment was purchased on June 1, 2006, and has been depreciated

for one year before depreciation is recorded for the month of June 2007. Thus, if

the equipment has a 10-year life, the balance in Accumulated Depreciation will be

($46,120 $6,120/10 years), or $4,000.

LO 5

PROBLEM 4-6A RECONSTRUCTION OF ADJUSTMENTS

FROM ACCOUNT BALANCES

1. To record rent expense on June 30: $4,000 $3,000.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Prepaid Rent (1,000)

Rent Expense

(1,000)

2. At $1,000 per month, the original six-month payment and balance of Prepaid Rent

on April 1, 2007, was $6,000.

3. To record depreciation expense on June 30: $900 $800.

BALANCE SHEET

Assets

Liabilities

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

6/30 Accumulated

Depreciation (100)

Depreciation

Expense

(100)

4. Estimated useful life in months: $9,600/$100 month = 96 months.

5. To record interest expense on June 30: $864 $768.

BALANCE SHEET

Assets

6/30

Liabilities

Interest Payable

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

96

Interest Expense

(96)

6. Interest rate: ($96 per month 12 months)/$9,600 = 12% (annual rate). The

monthly rate is 12%/12 months = 1%.

4-40

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-7A USE OF ACCOUNT BALANCES AS A

BASIS FOR ADJUSTMENTS

LO 5

1. Adjustments:

BALANCE SHEET

Assets

a. Prepaid Rent

INCOME

Liabilities

(400)

Rent Expense

BALANCE SHEET

Assets

b. Accumulated

Depreciation

INCOME

Liabilities

c. Chemical

Inventory

INCOME

Liabilities

d.

INCOME

Liabilities

Wages and

Salaries

Payable

e.

Income Taxes

Payable

INCOME

+

1,881

(a) $4,800/12 months = $400/month

(b) ($18,200 $200)/120 months = $150/month

($9,400 $1,300) = $8,100

STATEMENT

Stockholders Equity + Revenues Expenses

Explanations:

(c)

STATEMENT

Wages and

Salary

Expense

(1,080)

1,080

Liabilities

(8,100)

Stockholders Equity + Revenues Expenses

BALANCE SHEET

Assets

STATEMENT

Chemical

Expense

(8,100)

(150)

Stockholders Equity + Revenues Expenses

BALANCE SHEET

Assets

STATEMENT

Depreciation

Expense

(150)

(400)

Stockholders Equity + Revenues Expenses

BALANCE SHEET

Assets

STATEMENT

Stockholders Equity + Revenues Expenses

Income Tax

Expense

(1,881)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-41

PROBLEM 4-7A (Concluded)

(e) Calculation of taxes due:

Treatment revenue

Wages and salary expense

Utility expense

Advertising expense

Rent expense

Depreciation expense

Chemical expense

Income before tax

Tax rate

Income tax expense

$ 40,600

(23,580)

(1,240)

(860)

(400)

(150)

(8,100)

$ 6,270

0.30

$ 1,881

2. On the basis of the information available, Lewis appears to be a profitable

business. Net income for the month was $6,270 $1,881 (taxes), or $4,389. With

treatment revenue of $40,600, this results in a profit margin of $4,389/$40,600, or

approximately 11%.

ALTE R N ATE M U LTI - C O N C E P T P R O B L E M S

LO

2,3,4

PROBLEM 4-8A CASH AND ACCRUAL INCOME

STATEMENTS FOR A MANUFACTURER

1. Cash revenue: 50,000 sandwiches $2

Less: Amounts not yet received

Cash revenue

Accrual revenue: 50,000 sandwiches $2

$ 100,000

25,000

$ 75,000

$ 100,000

2. Accountants recognize revenue under an accrual accounting system when it is

earned. In the catering business, revenue is earned as the sandwiches are

delivered to the vendors. Maries might consider using the cash method to account

for sales of sandwiches if there is a significant amount of uncertainty about the

collectibility of accounts receivable.

4-42

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-8A (Concluded)

3.

Income statement under the accrual basis:

MARIES CATERING

INCOME STATEMENT

FOR THE YEAR ENDED XX/XX/XX

Sales revenue

Cost of goods sold

Gross profit

Operating expenses:

Office salaries

Equipment depreciation

Truck depreciation

Total operating expenses

Net income

*Rent: $800 12

Raw materials

Salaries and wages

Cost of goods sold

**$10,000/10 years

***$14,000/5 years

$100,000

69,600*

$ 30,400

$ 12,000

1,000**

2,800***

$ 15,800

$ 14,600

$ 9,600

25,000

35,000

$69,600

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

LO 3,4

PROBLEM 4-9A REVENUE AND EXPENSE

RECOGNITION

Income statements for the first two years:

Sales revenue (a)

Expenses:

Advertising (b)

Salaries

Depreciation (c)

Rent (d)

Total expenses

Net income

SUES AUDIO BOOK RENTALS

INCOME STATEMENTS

Year 1

$ 21,000

Year 2

$ 63,000

$ 6,000

0

2,500

9,000

$ 17,500

$ 3,500

$ 4,500

12,000

2,500

9,000

$ 28,000

$ 35,000

Explanations:

a. Let X = Year 1 sales:

Year 1 sales + 3(Year 1 sales) = $84,000

4X = $84,000

X = $21,000 = Year 1 sales

3X = $63,000 = Year 2 sales

b. Total advertising expense

Less promotional portion

Total ad expense

$ 10,500

1,500

$ 9,000 or $4,500/year

Year 1 advertising = $4,500 + $1,500 = $6,000

Year 2 advertising = $4,500

c. Depreciation per year = $5,000/2 = $2,500/year

d. Rent per year = $18,000/2 = $9,000/year

4-43

4-44

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

LO 5,6

PROBLEM 4-10A ADJUSTMENTS AND

FINANCIAL STATEMENTS

1. Adjustments:

BALANCE SHEET

Assets

a. Prepaid

Insurance

Liabilities

INCOME

Insurance Expense

Liabilities

INCOME

Depreciation

Expense

Warehouse

BALANCE SHEET

=

Liabilities

INCOME

d.

Liabilities

Interest Payable

INCOME

e.

Liabilities

375

Customer

Deposits

f.

Liabilities

Wages and

Salaries

Payable

g.

Liabilities

Income Taxes

Payable

STATEMENT

Freight Revenue

4,500

(4,500)

INCOME

Wages and

Salary

Expense

8,200

INCOME

STATEMENT

Stockholders Equity + Revenues Expenses

BALANCE SHEET

Assets

(375)

Stockholders Equity + Revenues Expenses

BALANCE SHEET

Assets

STATEMENT

Interest Expense

INCOME

(3,125)

Stockholders Equity + Revenues Expenses

BALANCE SHEET

Assets

STATEMENT

Depreciation

Expense

Truck Fleet

BALANCE SHEET

=

(150)

Stockholders Equity + Revenues Expenses

c. Accumulated

Depreciation

Truck Fleet (3,125)

Assets

STATEMENT

Stockholders Equity + Revenues Expenses

b. Accumulated

Depreciation

Warehouse

(150)

Assets

(750)

(750)

BALANCE SHEET

Assets

STATEMENT

Stockholders Equity + Revenues Expenses

(8,200)

STATEMENT

Stockholders Equity + Revenues Expenses

9,237

Income Tax

Expense

(9,237)

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

PROBLEM 4-10A (Continued)

Explanations for adjusting entry amounts:

(a) $18,000/24 months = $750/month

(b) ($40,000 $4,000)/240 months = $150/month

(c) ($240,000 $15,000)/72 months = $3,125/month

(d) ($50,000 9%) 1/12 = $375

(g) Calculation of income tax expense:

Freight revenue

Gas and oil expense

Maintenance expense

Wage and salary expense

Insurance expense

Depreciation on warehouse

Depreciation on truck fleet

Interest expense

Income before tax

Tax rate

Income tax expense

2.

$ 170,170

(57,330)

(26,400)

(51,250)

(750)

(150)

(3,125)

(375)

$ 30,790

0.30

$

9,237

Financial statements:

(a)

TENFOUR TRUCKING COMPANY

INCOME STATEMENT

FOR THE MONTH ENDED JANUARY 31, 2007

Freight revenue

Expenses:

Gas and oil

$ 57,330

Maintenance

26,400

Wages and salaries

51,250

Insurance

750

Depreciationwarehouse

150

Depreciationtruck fleet

3,125

Interest

375

Income taxes

9,237

Net income

TENFOUR TRUCKING COMPANY

STATEMENT OF RETAINED EARNINGS

FOR THE MONTH ENDED JANUARY 31, 2007

Beginning balance, January 1, 2007

Add: Net income

$ 170,170

148,617

$ 21,553

(b)

Deduct: Cash dividends

Ending balance, January 31, 2007

$ 40,470

21,553

$ 62,023

20,000

$ 42,023

4-45

4-46

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

PROBLEM 4-10A (Continued)

(c)

TENFOUR TRUCKING COMPANY

BALANCE SHEET

JANUARY 31, 2007

Assets

Current assets:

Cash

Accounts receivable

Prepaid insurance

Total current assets

Property, plant, and equipment:

Land

Warehouse

Less: Accumulated

depreciation

Truck fleet

Less: Accumulated

depreciation

Total property, plant, and

equipment

Total assets

Liabilities

Current liabilities:

Accounts payable

Notes payable

Interest payable

Customer deposits

Wages and salaries payable

Income tax payable

Total current liabilities

Total liabilities

Stockholders Equity

Capital stock

Retained earnings

Total stockholders equity

Total liabilities and stockholders

equity

$ 27,340

41,500

17,250

$ 86,090

$ 20,000

$ 40,000

21,750

18,250

$ 240,000

115,625

124,375

162,625

$ 248,715

$ 32,880

50,000

4,875

1,500

8,200

9,237

$ 106,692

$ 106,692

$ 100,000

42,023

142,023

$ 248,715

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-47

PROBLEM 4-10A (Concluded)

3. Current ratio = Current assets/Current liabilities

$86,090/$106,692 = 0.81 to 1

Tenfour may have difficulties in meeting all of its current obligations. Especially

noteworthy is the significantly higher amount of accounts receivable at year-end

compared with cash (cash and accounts receivable constitute 32% and 48% of the

current assets, respectively). It is also worth noting that the other 20% of the

current assets consists of prepaid insurance, an asset that will not be converted

into cash and thus will not help in any way to pay the current liabilities.

4. Tenfour cannot compute a gross profit ratio because it does not report cost of

sales. It is a service business rather than a product company. One possible

measure of profitability for any company is the profit margin, which is net income

divided by sales. For Tenfour, this ratio is $21,553/$170,170 or 12.7%. Many

service businesses calculate ratios that are specific to their type of business. For

example, a trucking firm might compute the ratio of revenues to miles driven.

DECISION CASES

READING AND INTERPRETING FINANCIAL STATEMENTS

LO 1,2,3

DECISION CASE 4-1 COMPARING TWO COMPANIES IN THE SAME INDUSTRY:

FINISH LINE AND FOOT LOCKER

1. According to Note 1 in its annual report, Finish Line recognizes revenue when the

customer receives the merchandise. Foot Locker indicates in its Note 1 that revenue

from stores is recognized when the product is delivered to customers. The

companies have essentially the same policy for the recognition of revenue.

2. On its February 25, 2006, balance sheet, Finish Line reports Accounts receivable,

net of $11,999,000. This comprises only $11,999,000/$627,816,000, or 1.9% of the

companys total assets. The reason that this percentage is so small is because

customers in a store such as Finish Line usually pay with either cash or a credit

card.

3. In Foot Lockers annual report, Note 8, titled Other Current Assets includes Net

receivables of $49,000,000 at January 28, 2006 (the note also reports the Current

portion of Northern Group note receivable of $1,000,000). These receivables

together represent only $50,000,000/$3,312,000,000, or 1.5% of total assets on this

date.

4-48

FINANCIAL ACCOUNTING SOLUTIONS MANUAL

DECISION CASE 4-1 (Concluded)

4. The two approaches differ in that Foot Locker chooses to report a single Property

and Equipment account on its balance sheet with Note 9 showing the individual

amounts for the items, such as furniture, fixtures, and equipment, which make up

this asset. Companies have flexibility as to whether they report this information

directly on the balance sheet or instead in one of the notes to the statements.

LO 3

1.

DECISION CASE 4-2 READING AND INTERPRETING SEARS,

ROEBUCKS NOTESREVENUE RECOGNITION

Under the accrual basis, revenue should be recognized when it is earned rather

than when cash is received. Over the life of a service contract, the retailer will incur

costs to repair damaged merchandise. The retailer earns revenue over the life of

the service contract.

2. Revenue to be recognized each year:

Sales revenue

Service contract revenue

Total revenue

Year 1

$2,320*

60**

$2,380

Year 2

$

0

60

$ 60

Year 3

$ 0

60

$ 60

Total

$ 2,320

180

$ 2,500

*$2,500 $180

**$180/3 years

When a retailer sells a service contract, it receives cash and at the same time

incurs a liability to provide service in the future. Thus, on its balance sheet, it will

report a liability account for work to be performed under service contractsa form

of unearned revenue. This account tells the reader the amount of revenue to be

recognized in the future under service contracts.

In this particular example, the liability account would contain $120 and $60 at

the end of Years 1 and 2, respectively, to report the amount of unearned revenue.

CHAPTER 4 INCOME MEASUREMENT AND ACCRUAL ACCOUNTING

4-49

MAKING FINANCIAL DECISIONS

LO 2,3,4

1.

DECISION CASE 4-3 THE USE OF NET INCOME

AND CASH FLOW TO EVALUATE A COMPANY

DUKE INC.

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED DECEMBER 31, 2007

Operating Activities:

Cash received from services

provided to clients

Cash paid for:

Salaries and wages

Supplies

Utilities

Rent

Net increase in cash

$ 1,020,000*

$ 440,000**

100,000

30,000

180,000***

$

750,000

270,000

*$1,250,000 $230,000

**$480,000 $40,000

***$10,000 18 months

Note to Instructor: You may want to point out to students that the net increase in cash

is also the net cash provided by operating activities for the year. That is, there are no