Escolar Documentos

Profissional Documentos

Cultura Documentos

Case8 Enhancing Supply Velocity at DaimlerCrysler PDF

Enviado por

Racing SangersDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Case8 Enhancing Supply Velocity at DaimlerCrysler PDF

Enviado por

Racing SangersDireitos autorais:

Formatos disponíveis

GLOBAL SUPPLY CHAIN MANAGEMENT

CASE: GS-25

SGSCMF: 001-2001

DATE: 07/17/01 (REVISED 03/23/05)

SEECOMMERCE:

ENHANCING SUPPLY CHAIN VELOCITY AT

DAIMLERCHRYSLER

SEECOMMERCE ENCOUNTER: MARCH 2000

Jerry Quell was in a quandary. His company had begun to take a strategic look at its supply

chain two years before and had reinvented most of its major supply chain systemsdemand

collection and forecasting, order processing, inventory control, and warehouse

managementover the previous five years. Because the companys supply chain was mature

and had been the focus of numerous improvement initiatives, Quell was in a dilemma as to how

he might further improve demand forecasting and minimize inventory for the service parts group

while ensuring that customers were not left waiting for replacement parts at a dealer.

Quell was the senior manager of Materials Operations Planning for the Mopar Parts group at

DaimlerChrysler. He had been with the company for over 15 years, and was involved in most of

the supply chain initiatives previously undertaken by the division. Recently, in 2000, Quell

became aware that one of DaimlerChryslers weak areas was supply chain collaboration, and that

there was a pressing need for better visibility in order to shrink Mopars decision-cycle times and

react to unplanned changes promptly. As he was exploring alternatives for addressing this

challenge, he came across a company called SeeCommerce, which had recently received

recognition from AMR Research. SeeCommerce provided performance management solutions,

a topic in which Quell was interested. Accordingly, out of curiosity, he picked up the phone to

learn more about SeeCommerces offering.

SEECOMMERCE: HISTORY

Founded in 1996, SeeCommerce was a Palo Alto-based company with over 120 employees.

Since its inception, SeeCommerce had received infusions of over $66 million in venture capital

from A-list investors such as Amerindo Investment Advisors, Integral Capital Partners, Insight

This case was prepared by Paresh Rajwat under the supervision of Professor Hau Lee at Stanford University. The case was

prepared as a basis for class discussion and not to illustrate either effective or ineffective management practices.

Copyright 2002 by the Board of Trustees of the Leland Stanford Junior University. All rights reserved. To order copies or

request permission to reproduce materials, e-mail the Case Writing Office at: cwo@gsb.stanford.edu or write: Case Writing

Office, Stanford Graduate School of Business, 518 Memorial Way, Stanford University, Stanford, CA 94305-5015. No part of

this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any

means electronic, mechanical, photocopying, recording, or otherwise without the permission of the Stanford Graduate

School of Business.

ecch the case for learning

Distributed by ecch, UK and USA

www.ecch.com

All rights reserved

North America

t +1 781 239 5884

e ecchusa@ecch.com

Rest of the world

t +44 (0)1234 750903

e ecch@ecch.com

<Case Title> <Case Number>

p. 2

Capital Partners, Sierra Ventures, Voyager Capital, and others. The company had also been

awarded the APICS Certificate of Excellence in Innovation, Arthur Andersen Best Practices

Award, AMR Researchs 12 Hot New Applications Market Leader, Red Herring 100, Upside

Hot 100 and the Enterprise Outlook Investors Choice Top 10. As a result, it was clear that

SeeCommerce was the leading provider of supply chain performance management and

improvement applications, designed to enable business managers and trading partners to

continuously manage and improve business performance across complex supply chains.

SeeCommerce's products had been adopted in a wide variety of industries, including high-tech,

automotive and packaged-goods manufacturing, retail and financial services. In addition,

industry-leading companies such as Ariba, Siebel Systems, Deloitte Consulting, KPMG, and

IBM Global Services had endorsed SeeCommerce's products through strategic partnerships.

Furthermore, SeeCommerce had referenced more than 30 customers across the United States and

Europe, including Nestl Germany, Pfizer, Philips, Polaroid, PNC, FIAT, Qwest,

DaimlerChrysler, Applied Materials, Charles Schwab, and SCI.

COMPLETING THE SUPPLY CHAIN MANAGEMENT CYCLE

Quell was interesting in understanding what had made SeeCommerce so successful, and why it

outstripped its competitors in so many performance areas. To learn more, he began to

investigate the product.

SeeCommerce was intended to be an improvement on a basic business process that was

commonly used to operate a supply chain: the PlanExecutePlan Cycle (Exhibit 1). Planning

solutions provided by i2, Manugistics, Adexa, and others gave what-if capabilities to their users

to help to improve a companys performance. Similarly, order processing and management

solutions provided by Oracle, Commerce One, SAP, Ariba, and their competitors enabled the

execution of transactions. However, without a transparent and real-time view of the supply

chain, managers confidence could ebb and, as a result, the entire supply chain would slow to a

crawl. Most managers still relied on manual reports for performance data on each connection

(manufacturing, warehousing, transportation, etc.) of the supply chain. If managers could not

look across the enterprise at the various links to access information and tune performance, it was

difficult to act fast and address problems before they occurred. SeeCommerce provided the

required transparency by adding a Measure dimension to the traditional supply chain cycle,

thus completing the management cycle to PlanExecuteMeasurePlan. This new dimension

enabled better performance management, provided easy access to all data in the supply chain and

offered a what-is capability to business users. By adding this crucial step, SeeCommerce had

integrated all the components (event management, visibility and business processes) of supply

chain performance management and improvement, to provide a complete solution.

Increasing Visibility through SeeCommerce

Prior to 2000, supply chains consisting of suppliers and customers were usually connected

through various channel masters that provided the service of purchasing, transportation,

planning, and sales, etc. (Exhibit 2). Each channel master acted independently. Because of this

independence, they did not have the visibility of other channel partners, and collaboration among

them was infrequent. SeeCommerce envisioned the post-2000 supply chain with suppliers and

<Case Title> <Case Number>

p. 3

customers connected through a common business-to-business (B-to-B) home page and a single

channel master center which would enable all supply chain processes (such as supply, demand,

material, production, inventory, and fulfillment) to share a common data pool (Exhibit 2). The

key to the post-2000 model was transparency, making collaboration the big differentiator.

The suite of SeeChainTM applications (Exhibit 3) provided by SeeCommerce allowed companies

to measure the accuracy of forecasted demand, raw material availability, production performance

against plan, finished goods availability, customer service fulfillment etc. at various stages and

collaborate on their performance over the Web. Data in different information systems at

different locations could be assessed, aggregated, compared, and shared. This dramatically

reduced the time it took to make decisions and adapt to market trends. (Exhibit 4 depicts the

measured impacts through SeeChainTM on decision-cycle time and other performance

parameters.) The solutions increased supply chain velocity by replacing manual performance

systems, or systems that did not exist, with automated measurements and alert systems.

SeeCommerce empowered business managers to see problems and effects over time, to take

corrective actions and gain measurable supply chain improvements.

The solution also helped business users benchmark company performance against industry

standards, reduce operational costs by automating information distribution, generate fewer

printed reports by making information available anytime, from anywhere, using a Web browser;

and also provide Web-based access to critical information across the total supply chain. As a

result, executives did not need to be at their desks at all times but could receive e-mail alerts and

simply log onto the network and access the required information. They could immediately see

performance measurements from demand to supplyacross product lines, distribution centers,

and their entire organizationfrom a single screen view and could have all of the relevant

information at their fingertips, with explanations for changes in performance. (Exhibit 5 gives a

sample of potential competitors of SeeCommerce.)

Impact of Timely Performance Measurements Through SeeChainTM

In an age of hyper-competition, continuous innovation and new product development is a key to

success. Companies need to manage the time to new product introductions, and alert suppliers

about product changes during and between product life cycles. In the front part of the product

life cycle (Exhibit 6), the contribution of the new product to a company increases with time,

while in the back part of the life cycle, the contribution decreases with the passage of time.

Ultimately, the product is replaced by another new product.

Managing successful product rollover requires close tracking of operational data and demand

trends of a product. SeeCommerce provided this tracking and performance measurement

functionality. It supplied product performance snapshots and helped managers identify the

turning points when the contribution of the product began to diminish. If production plans were

to be changed, suppliers could be immediately notified. This way, the product can be

transitioned smoothly from one generation to the next. Improved product demand visibility

helped companies to better plan the timing of the ramp-up phase of the new product cycle

relative to the previous product, enabling a quick product transition and avoiding costly product

<Case Title> <Case Number>

p. 4

rollovers. Reduction in the decision-cycle time could result in huge savings in inventories, and

finished goods carrying costs (as shown in Exhibit 6).

Similarly, SeeChainTM applications could quickly diagnose other problems (such as supply

shortfalls, backlog accumulation, delinquent deliveries, and other supply chain operational

problems), as well as pinpoint opportunities across the global supply chain. When performance

went outside acceptable levels, SeeChainTM automatically alerted business managers so that they

could quickly investigate, collaborate and take corrective action, all via the Internet.

THE MOPAR PARTS GROUP OF DAIMLERCHRYSLER

At the beginning of the twenty-first century, DaimlerChrysler was the world's leading

manufacturer of commercial vehicles with brands like Mercedes-Benz, Chrysler, Jeep, Dodge,

smart, Freightliner, Sterling, Western Star, Thomas Built Buses, Setra, Orion, American

LaFrance, MTU, TEMIC, and others. With global alliances with Mitsubishi Motors Corporation

and Hyundai Motor Corporation, the company recorded automotive sales of 4.2 million

passenger cars in more than 200 countries, and revenue of over $144 billion in 2000. The

company had 400,000 employees and manufacturing sites in 37 countries.

The Mopar group was the spare parts division for the Chrysler Group of DaimlerChrysler and a

primary distributor of parts and accessories for all Chrysler, Dodge and Jeep dealerships in the

United States. The group managed more than 280,000 original equipment parts procured from

about 3,000 different suppliers, and processed over 220,000 dealer order lines per day. Mopars

distribution supply chain consisted of four national distribution centers or central warehouses

(CW) and 15 domestic field parts distribution centers or regional warehouses (RW). Mopars

automotive parts and distribution business relied on how effectively the company could forecast

demand, manage parts inventory and fill customer orders.

Mopar had maintained a five-year demand history for every dealer, and forecasted demand for

about 1.8 million different SKUs (stock keeping units) at the RW level on a

daily/weekly/monthly basis. These were then rolled up to part level, and a Distribution

Requirement Planning (DRP) system was used to determine the required stocking level and the

associated material acquisition with suppliers. Mopar released about 65,000 orders every week

to its suppliers.

Distribution and fulfillment of dealer orders were achieved through the use of dedicated delivery

service (DSS). Referral dealer orders were handled by the UPS Logistics Group. It operated two

Order Consolidation Centers. The UPS Logistics Group provided DaimlerChrysler with a

multimodal transportation system into and out of those centers. More critical orders were

consolidated and shipped via UPS, using one-day ground or air delivery service.

Before SeeCommerce became involved, a daily cycle of order fulfillment at Mopar worked as

follows (Exhibit 7): During the day, the global order processing system would try to fill part

orders from dealers using inventory at the respective regional warehouse. Traditionally, Mopar

had been able to achieve a fill rate of 89.5 percent from the stock at the regional warehouses.

The unfilled orders were routed to the central warehouses and, by the end of the second day,

these parts arrived at the dealers (if the central warehouses had the stock on hand). The average

<Case Title> <Case Number>

p. 5

fill rate at the end of the second day was usually 92 percent. If the central warehouses did not

have stock on hand, the orders were referred to other regional warehouses based on stock

position. By the third day, Mopar could usually achieve a fill rate of 95.5 percent as a result of

such inventory pooling. In the next two days, a resourceful inventory planner might start looking

for parts that were in transit or available at suppliers, and use expedited shipments to get the parts

to the dealers. Although expeditions could be very costly to Mopar, the average fill rate at the

end of five days was 97.5 percent. Finally, the remaining 2.5 percent of unfilled orders were

backordered and released when material was received anywhere in the distribution system.

Quell, as senior manager of materials planning at Mopar, had been looking for ways to improve

customer service levels and reduce the expenses associated with frequent expedited shipments.

He recognized that the key was to have a continuous and tight process of performance

measurements that would identify problem areas and opportunities in the service parts supply

chain on a timely basis. In 1998, Mopar initiated a project to create tools that would allow the

company to measure customer service levels. The project therefore required the development of

a system of tools for the extraction of data from operational databases into datamarts using

OLAP (online analytical processing) tools. After 18 months, a prototype system was created.

Teaching all users proficiency with the new system was quite a challenge, as it was not userfriendly. The associated data files were also enormous. There were 220,000 dealer order lines

per day from over 4,000 dealers. To monitor order shipment versus allocation was the goal. The

complexity of the system was such that it was difficult to monitor performance on a weekly

basis.

SEECOMMERCE AT DAIMLERCHRYSLER: APRIL 2000

At Quells request, the SeeCommerce team took a strategic look into the Mopar Parts Groups

supply chain. It revealed tremendous opportunity of cost savings by improving performance in

terms of lower inventory costs and better order flow. The key was to enhance supply chain

visibility and shorten the reaction times to problems. The solution proposed by SeeCommerce

showed a lot of promise, and since the previous internally developed system was going nowhere,

Quell decided to give it a try. In fact, the Mopar Parts Group conducted an internal

benchmarking study to evaluate what it would take to develop a similar solution in-house. They

realized that their IT (Information Technology) group would require 9 to18 months to develop an

internal solution. Also, since most of Mopars IT systems were mainframe based, the solution

would not have utilized the latest peer-to-peer technology on which SeeCommerce was based.

Peer-to-peer technology could provide the ability to dynamically unify diverse and widely

distributed elements of contents, systems and services, without removing control from the peers

on the network. By enabling peers to find and collaborate with each other at will, this

technology could promote greater efficiency, openness, and choices for information systems. It

could even enable a global virtual marketplace where anyone was literally enabled to conduct

business with anyone else.

The SeeCommerce project at Mopar started in April 2000. The SeeChainTM applications

extracted transactions and planning data from a multitude of data systems. Data was retrieved

from Mopars homegrown legacy ERP (Enterprise Resource Planning) system, which was based

on IMS and DB2 on an IBM Mainframe, Forecast Planning and Inventory Planning System. The

data was then organized and presented using SeeCommerces patented technology, from which

<Case Title> <Case Number>

p. 6

metrics and key performance indicators (KPI) were calculated and reports generated, based on

business rules and control hierarchies (i.e. the span of control for the respective KPIs, which

affects the level of aggregation in the reports).

Using personalized MyCommerce home pages, users could have the screen layout designed

according to taste, and set up different forms of information retrieval (performance alerts, emails, reports and annotation notifications, etc.). SeeChainTM had a simple tree structure for

navigation, which allowed users to easily probe and find performance indicators for different

products/locations, and at different aggregation levels (see Exhibit 8). This way, users could get

all required information in one place for fast decision-making. Based on the respective

information, users could launch the appropriate application directly.

Initially, Quell was expecting a payback by the end of year 2000, but SeeCommerce offered the

payback within 12 weeks after implementation. After three months of using the SeeChainTM

application, a cumulative fill rate of about 98.5 percent could be achieved (Exhibit 9) within the

first three to five days. Advanced alerts of inventory and supply conditions at the regional

warehouses, and improved visibility into supplier delivery quantity, timelines and quality

enabled the immediate fill rates to improve by 1 percent, at the field parts distribution center

(PDC) level. This improved fill rate represented an equivalent of $10 million savings annually in

transportation costs by eliminating referral orders while increasing market share. Prompt

creation of exception reports enabled early warning of potential problems and immediate

reaction by inventory planners. Finally, increased flexibility allowed planners to address

remaining inefficiencies in inventory management.

SeeChainTM Demand, SeeChainTM Inventory, and SeeChainTM Supplier offered the Mopar Parts

Group real-time supply chain performance visibility, and helped planning and forecast managers

see how they were doing daily, in terms of forecasted demand versus actual shipments to dealers

and stocking levels. As a result, managers could quickly pinpoint problems, take proactive

actions, and promptly respond to unplanned changes. The applications improved business

velocity by shrinking decision cycle times. The Mopar Parts Group discovered $4.5 million in

avoidable on-order inventory within a week after implementation, and expected to save tens of

millions per year from reduced safety-stock inventory and dealer order-line improvement.

The use of SeeChainTM Supplier also improved supplier performance substantially. The Mopar

group expected to reduce backorder of about 2,200 line orders out of 220,000 total line orders

daily. Quell was pleased with the success of the SeeCommerce implementation:

SeeCommerce gave us information at our fingertips. We have 12 forecast

demand measurements, 17 inventory measurements and 30 supplier performance

measurements that allow us to keep a close watch over the key operating

parameters. By reducing the decision cycle time we are now able to do many

things. For instance, by reducing the forecasting error, we have reduced safety

stock by $7.5 million within the first six months. We believe, with their help, we

can further reduce safety stock by $20 million in year 2001. By improving the

customer service level, we expect to save about $10 million of excess

transportation charges.

<Case Title> <Case Number>

p. 7

The SeeCommerce implementation was undoubtedly a great success. However, Quell was now

faced with another major challenge. Since the economy had slowed down, he had to figure out

how he could further improve the service supply chain in this environment. As he entered into

the conference room for his meeting with top executives, he wondered which performance

measures would be most critical for the Mopar Parts Group to monitor in this new era.

<Case Title> <Case Number>

p. 8

Exhibit 1

Supply Chain Management Cycle

Source: Created by the authors from publicly available information.

<Case Title> <Case Number>

p. 9

Exhibit 2

Pre and Post-2000 Supply Chain Environments

Post -2000

Pre -2000

B2B Portal

Supplier

Supplier

Supplier

Channel

Master

Purchase

Channel

Master

Transp

Channel

Master

Planning

Customer

Customer

Supplier

Supplier

Supplier

Customer

Channel

Master

Center

Supplier

Demand

Material

Production

Inventory

Fulfillment

Supplier

Customer

Fig. 2

Source: Information provided by SeeCommerce.

Customer

Customer

Customer

Supplier

Channel

Master

Sales

Customer

Common Data

Shared Processes

Fig.

Fig.23

<Case Title> <Case Number>

p. 10

Exhibit 3

SeeCommerce Suite of Products1

SeeCommerce enables business managers and trading partners to continuously manage and

improve business performance across complex supply chains. The SeeCommerce suite of

SeeChainTM applications drive performance management, organizational synchronization and

workflow coordination throughout the entire supply network. SeeCommerce improves a

companys ability to compete in the global marketplace, significantly improves ROI and expands

market share by optimizing supply chain performance and creating effective supplier

relationships.

SeeCommerces applications leverage domain expertise in online analytical processing (OLAP),

data warehousing, knowledge management, Internet technologies and supply chain management.

The products are based on industry standards such as JavaTM, XML, relational databases and

standard Web browsers.

The SeeChainTM family includes the following seven applications:

SeeChainTM Supplier

SeeChainTM Supplier measures and improves supplier performance, identifies top performers,

tracks performance over time and negotiates performance-based agreements. The application

also helps in collaboration of supplier-related information to correct problems and improve

performance.

SeeChainTM Demand

SeeChainTM Demand application measures and improves demand forecasting performance,

measures sales accuracy by comparing forecasted sales to actual sales, improves forecasting

accuracy of items not meeting acceptable levels and thus enables better management of raw

materials inventory, production planning and FGI to ensure that supply meets targeted service

levels.

SeeChainTM Materials

SeeChainTM Materials measures and optimizes raw materials availability by measuring inventory

levels of raw materials and semi-finished goods. The application also helps in identifying

potential inventory shortages and sees value of excess inventory in warehouses or distribution

centers.

SeeChainTM Production

SeeChainTM Production measures and improves production performance by measuring the

accuracy of the production plan for a time frame. It identifies which products may affect

customer service levels and notifies sales representatives to manage corresponding customer

1

For detailed product descriptions and information refer to www.seecommerce.com/products/. SeeCommerce,

SeeChain, Dynamic Commerce Server, the SeeCommerce logo, and the SeeChain logo are trademarks of

SeeCommerce in the USA and other countries. All other products and company names may be trademarks of

their respective owners.

<Case Title> <Case Number>

p. 11

relationships. The application also helps in determining if manufacturing capacity is able to

support the planned production.

SeeChainTM Inventory

SeeChainTM Inventory measures and optimizes FGI levels by measuring inventory levels and

identifying potential shortages of finished goods. The application also helps in managing

finished goods levels to avoid obsolescence and take into account the product life cycles.

SeeChainTM Fulfillment

SeeChainTM Fulfillment measures and improves order fulfillment performance, measures on-time

shipping performance and improves customer satisfaction levels by identifying shortages that

impact customers. The application also helps in managing impacted customers, thus signaling to

improve future deliveries, ensuring customer retention and market share growth.

SeeChainTM Logistics

SeeChainTM Logistics enables the timely delivery of the right product, in the right quantity, to the

right location at the right cost. It provides companies with visibility into supply chain velocity,

reliability of process accuracy and asset utilization for the logistics network.

Dynamic Commerce Server is a Web-centric enterprise information portal that allows all levels

of users - management, employees, customers and suppliersto share and collaborate on a wide

range of corporate information within a secure environment. Through their existing browsers,

users can access all information to which they have security privileges. They can dynamically

navigate, publish, subscribe, collaborate, design, generate and share the information in context in

an easy-to-use single screen view.

Source: Information provided by SeeCommerce.

<Case Title> <Case Number>

p. 12

Exhibit 4

Measured Impact on Decision Cycle Time and Other Parameters

0%

20

40

60

80

100%

Decision Cycle Time

DCT Reduction Impacts

Revenues

Inventories

Operational Productivity

Administrative

Productivity

Depreciation

Scrap

Delivery Lead Times

Time-to-Market

Return on Assets

Source: Information provided by SeeCommerce.

= Average

Improvement

<Case Title> <Case Number>

p. 13

Exhibit 5

A Note on Potential Competitors

At the time the case was written, SeeCommerce did not have any direct competitor providing

applications like SeeCommerces SeeChainTM solutions. Instead, there were companies

supplying tools that addressed specific features and functions. These tool vendors could provide

a basis for others to develop packaged applications. Typically, these companies fell into three

categories: visibility, exception/event management, and business process management. Supply

chain performance management was a comparatively new market, so competition was moderate.

Some of the companies in this broad arena were InfoRay, Vigilance and Oracle. Unlike

SeeCommerce, most of the companies in this market provided a portion of the complete

performance measurement and improvement solution. Inforay aimed at providing visibility,

Vigilance focused on event management while Oracle strove to address the business process

aspect.

Oracle (streamlining business processes)

Oracle Corporations software products could be categorized into two broad areas: systems

software and Internet business applications software. As an e-business solutions provider, Oracle

integrated and streamlined both internal and external processes for any business, allowed users to

access information, and automated the performance of specific business data processing

functions for financial management, procurement, project management, human resources

management, supply chain management, and customer relationship management.

InfoRay (visibility)

InfoRay provided personalized business monitors and infostructure for performance

measurement in high-speed businesses. InfoRays patented solutions allowed users to track key

business indicators to impact a companys performance at any level. Founded in the

Netherlands, InfoRay moved its headquarters to Cambridge, Massachusetts, in 1999 and had

offices in the U.S. and Europe.

Vigilance (event management)

Vigilance, Inc. provided a supply chain monitoring/event management system that enabled

people to create personal 1:1 agents that detected any desired event, ubiquitously notified the

appropriate community, and collaboratively resolved an event through workflow.

Source: Compiled by the authors from publicly available information.

<Case Title> <Case Number>

p. 14

Exhibit 6

Potential Improvements Realized through SeeChainTM

Trend Identified /

Demand Drop

FGI

Level

Without SeeChain

Old Product

Completely

Replaced

$$$

Using

SeeChain

Reduced Carrying Cost

Time

Fig. 5

Note: The top line represents the old way of doing business; the bottom line represents the new way. Traditionally,

the trend would not be identified until time period 6. SeeChainTM enables the trend to be identified in period 2.

Source: Information provided by SeeCommerce.

<Case Title> <Case Number>

p. 15

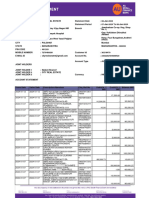

Exhibit 7

Daily Order Fulfillment Performance Prior to SeeCommerce

Weekly Plan

Day 1

Day 2

Cumulative Fill Rate

RW fulfills dealer orders

Unfilled orders immediately

referred; orders created

Unfulfilled orders shipped from CW

Unfulfilled orders referred

immediately

Day 3

89.5%

92.0%

Unfulfilled orders sourced via

cross-ship from RW

94.5%

Days

4&5

Unfulfilled orders sourced from intransits headed for alternate RW

Other, unfulfilled orders dropshipped from supplier

Remaining orders

backordered

Source: Information provided by SeeCommerce.

96.5%

<Case Title> <Case Number>

p. 16

Exhibit 8

The Tree Navigation Structure of SeeChainTM

Source: Information provided by SeeCommerce.

<Case Title> <Case Number>

p. 17

Exhibit 9

Daily Order Fulfillment Performance with SeeCommerce

Weekly Plan

Cumulative Fill Rate

Advanced alerts and improved

visibility into supplier delivery

quantities, timelines and quality

enables improved fill rates

Unfilled orders referred

immediately

Increase level of service from RW

decreases the amount of cross

shipment and drop ship and lowers

expediting costs.

Exception report of unfulfilled orders

created

Increased flexibility allows planners

to address remaining inefficiencies

in inventory management

Day 1

Day 2

Days

3-5

91.5% -->

92.5%

96.5% -->

97.5%

97.5% -->

98.5%

98.5%

Source: Information provided by SeeCommerce.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 50 Top Trending Products To Sell Online in 2020 For High ProfitsDocumento1 página50 Top Trending Products To Sell Online in 2020 For High ProfitsDip PerAinda não há avaliações

- What Is Network Security - Cisco PDFDocumento6 páginasWhat Is Network Security - Cisco PDFbhavesh_balasAinda não há avaliações

- Beacon House ReportDocumento23 páginasBeacon House ReportRacing Sangers100% (4)

- Blockchain-based Homomorphic Encryption for Secure E-ballotingDocumento3 páginasBlockchain-based Homomorphic Encryption for Secure E-ballotingGayathriRajiAinda não há avaliações

- Demystifying the future of beauty and personal careDocumento38 páginasDemystifying the future of beauty and personal careDurant DsouzaAinda não há avaliações

- Case5 IKEA Cost Efficiency of Supply Chain PDFDocumento15 páginasCase5 IKEA Cost Efficiency of Supply Chain PDFRacing Sangers100% (3)

- Case5 IKEA Cost Efficiency of Supply Chain PDFDocumento15 páginasCase5 IKEA Cost Efficiency of Supply Chain PDFRacing Sangers100% (3)

- Literature Review Youngsters' Attitude Towards Online ShoppingDocumento7 páginasLiterature Review Youngsters' Attitude Towards Online ShoppingMayur PatelAinda não há avaliações

- Case3 Tesco Supply Management PDFDocumento19 páginasCase3 Tesco Supply Management PDFRacing Sangers82% (11)

- Digital Marketing Strategy DevelopmentDocumento35 páginasDigital Marketing Strategy DevelopmentJhagantini Palanivelu100% (1)

- Case2 Supply Chain Risk at Unilever PDFDocumento16 páginasCase2 Supply Chain Risk at Unilever PDFRacing SangersAinda não há avaliações

- Livestock Business BoostsDocumento3 páginasLivestock Business BoostsRacing SangersAinda não há avaliações

- Case4 HandM Supply Management PDFDocumento19 páginasCase4 HandM Supply Management PDFRacing SangersAinda não há avaliações

- About Brands Increasing Globalisation of The Communication Industry Means We Can MoreDocumento7 páginasAbout Brands Increasing Globalisation of The Communication Industry Means We Can Moremake_iteasyAinda não há avaliações

- SMEDA Dairy Farm (50 Animal)Documento17 páginasSMEDA Dairy Farm (50 Animal)Racing SangersAinda não há avaliações

- Presented By: Khizer Hayat Khagga: Click To Edit Master Subtitle StyleDocumento6 páginasPresented By: Khizer Hayat Khagga: Click To Edit Master Subtitle StyleRacing SangersAinda não há avaliações

- Presented By: Khizer HayatDocumento8 páginasPresented By: Khizer HayatRacing SangersAinda não há avaliações

- General Electric Report 10Documento140 páginasGeneral Electric Report 10Racing SangersAinda não há avaliações

- The Land Reforms of 1959Documento3 páginasThe Land Reforms of 1959Racing Sangers100% (1)

- CH 14Documento44 páginasCH 14Tanang AjuhAinda não há avaliações

- Pro Curve Network Security Student GuideDocumento414 páginasPro Curve Network Security Student GuideyemlawzAinda não há avaliações

- Penelusuran GoogleDocumento1 páginaPenelusuran GoogleSakti MaulanaAinda não há avaliações

- IHM - Service Deck PERSENTATIONDocumento16 páginasIHM - Service Deck PERSENTATIONinheaven ManagementAinda não há avaliações

- Shopsy (The Ken)Documento9 páginasShopsy (The Ken)ALLtyAinda não há avaliações

- Lesson 3Documento4 páginasLesson 3Monique VillaAinda não há avaliações

- Session 4Documento34 páginasSession 4Rashvindar KaurAinda não há avaliações

- Strategy Analysis of Conforama: by CHEN Junxing LIU Qingwei LI Siqi WU Xinzhu WANG JingDocumento44 páginasStrategy Analysis of Conforama: by CHEN Junxing LIU Qingwei LI Siqi WU Xinzhu WANG JingSiqi LIAinda não há avaliações

- Series B Thru E July19 20Documento193 páginasSeries B Thru E July19 20MAHESH SHRAMAAinda não há avaliações

- EBAY Audit ReportDocumento26 páginasEBAY Audit ReportHaywire UmarAinda não há avaliações

- Smartmoney: Digital Payments Strategy in IndiaDocumento11 páginasSmartmoney: Digital Payments Strategy in IndiaJaswasi SahooAinda não há avaliações

- E CommerceDocumento38 páginasE CommerceMaulana HasanudinAinda não há avaliações

- Managing Local Linux Users and GroupsDocumento10 páginasManaging Local Linux Users and GroupsBipul KumarAinda não há avaliações

- Idea - Eco-Friendly Subscription Box For Garden EnthusiastsDocumento9 páginasIdea - Eco-Friendly Subscription Box For Garden EnthusiastsArthur EarlAinda não há avaliações

- GIT-28 Access Control PDFDocumento9 páginasGIT-28 Access Control PDFvarma_43Ainda não há avaliações

- Startup Funding in Logistics New Money For An Old IndustryDocumento24 páginasStartup Funding in Logistics New Money For An Old IndustryJohn PatlolAinda não há avaliações

- The Digital Firm: Electronic Business and Electronic CommerceDocumento27 páginasThe Digital Firm: Electronic Business and Electronic Commerceamitdubey786Ainda não há avaliações

- 08 Jan 2024 - 514002AccStmtDownloadReportDocumento12 páginas08 Jan 2024 - 514002AccStmtDownloadReportshas2sriAinda não há avaliações

- Eselectplus PHP Ig-MpiDocumento15 páginasEselectplus PHP Ig-MpiMuhammad AzeemAinda não há avaliações

- Ucash: Information System and SecurityDocumento23 páginasUcash: Information System and SecurityZidan ZaifAinda não há avaliações

- Career Opportunities For MBA Operation ManagementSpecializationDocumento18 páginasCareer Opportunities For MBA Operation ManagementSpecializationShweta VidpiAinda não há avaliações

- Return of The Pop-Up Shop - Trends by The HustleDocumento10 páginasReturn of The Pop-Up Shop - Trends by The HustlegregbrandAinda não há avaliações

- Study On The Strategies of Financial Management in E-Commerce EnterprisesDocumento3 páginasStudy On The Strategies of Financial Management in E-Commerce EnterprisesmmmAinda não há avaliações

- Interview With Michael Corbo of Colgate-Palmolive FTFDocumento4 páginasInterview With Michael Corbo of Colgate-Palmolive FTFVaideeshwariAinda não há avaliações