Escolar Documentos

Profissional Documentos

Cultura Documentos

Franklin India Opportunities Fund

Enviado por

Aj_2006Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Franklin India Opportunities Fund

Enviado por

Aj_2006Direitos autorais:

Formatos disponíveis

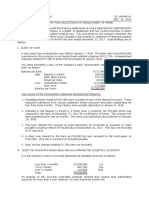

Factsheet as of December 2014

Franklin India Opportunities

S&P

Franklin

Bse 200

Fund

India-Opportunities

Growth

Fund

Equity - Large Cap

Equity - Large Cap

Important Information

CRISIL Mutual Fund Rank

Franklin India Opportunities

Fund

Investment Objective

Inception Date

21-Feb-2000

R.Janakiraman

Fund Manager

Anil Prabhudas

VP & Portfolio mgr AVP & Port. mgr

Expense Ratio (%)*

2.76

Designation

Min. Investment (Rs.)

5000

Qualification

BE, PGDBM

CA

Yrs of Experience

16

24

*data as of half-yearly portfolios of Sept 2014

Key Portfolio Attributes

Trailing Returns (%)

Portfolio P/E

Portfolio P/B

24.70

5.67

Dividend Yield (%)

53.68

34

Benchmark Index

Index P/E

S&P BSE 200

NA

Index P/B

Blend

Growth

N.A

N.A

Diversified

N.A

N.A

N.A

Small & Mid

Cap

3 YR SIP

Amt Invested

Value (Rs)

Scheme

S&P BSE 200

Large Cap

N.A

Period

Fund

N.A

SIP Returns

60.00

50.00

40.00

30.00

20.00

10.00

0.00

0.90

NAV as on 31/12/2014

No. of Total Holdings

Value

N.A

329.29

1.00

capitalisation

Avg AUM: Oct-Dec 2014 (Rs Cr.)

Exit Load (Max %)

Investment Style

Seeks to provide long term capital appreciation by capitalising on the

long-term growth opportunities in the Indian economy

58.58

2Yrs

^

27.27

3Yrs

^

27.29

11.97

35.47

18.91

22.76

10.12

6ms

1Yr

23.47

9.72

Returns (%)

SI^

Value (Rs)

Benchmark

Returns (%)

5 YR SIP

7 YR SIP

36000

60000

84000

58436

34.07

100859

20.87

156322

17.41

50810

23.66

87383

15.01

138417

14.01

NA

^ Annualized

Important Ratios *

Concentration Analysis

Portfolio Beta

R Squared (%)

Standard Deviation (%)

Sharpe Ratio

Treynor Ratio

Jenson's Alpha (%)

0.98

86.39

16.99

3.79

0.66

25.42

Sortino Ratio

* Annualized

% to NAV

Exposure to CNX Nifty

Exposure to Benchmark

Top 5 Companies Exposure

Top 5 Sectors Exposure

64.34

84.26

32.75

63.60

Market Captialisation

Small Cap

3%

Mid Cap

14%

5.49

Large Cap

83%

Top 10 Company Holdings

Top 10 Sector Holdings

Fund

10

8

6

4

2

0

Benchmark

40

Fund

Benchmark

30

20

Passenger/Uti

lity Vehicles

Cables Electricals

Refineries/Ma

rketing

Telecom Services

Batteries

Automobile

Cement

Engineering

Pharma

Banks

Finolex

Cables

Lupin

Computers Software

BPCL

Bharti Airtel

Amara Raja

Batteries

Axis Bank

L&T

HDFC Bank

ICICI Bank

Yes Bank

10

History

Dec-14

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

CRISIL Mutual Fund Rank

AUM (Rs. Cr.)

Quarter End NAV

52 Weeks High NAV

52 Weeks Low NAV

1

329.29

53.68

54.48

32.13

2

318.13

48.23

49.84

29.94

3

287.14

43.47

43.47

27.19

3

261.73

36.73

36.73

27.19

NA

267.17

33.85

34.45

27.19

NA

257.69

29.94

33.78

27.19

NA

279.27

31.06

33.78

27.91

Fund vis--vis Benchmark Historic Performance

Quarter on Quarter Performance

20.00

7000

6000

5000

4000

3000

2000

1000

0

Fund

Fund

Benchmark

Benchmark

10.00

0.00

All data as on December 31, 2014

Address

Website

Phone No

Registrars

Dec-14

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

Dec-12

Sep-12

Jun-12

-10.00

Mar-12

Jan-14

Dec-14

Feb-13

Mar-12

Mar-11

Apr-10

May-09

Jul-07

Jun-08

Aug-06

Oct-04

Sep-05

Nov-03

Dec-02

Jan-01

Dec-01

Feb-00

Portfolio features equated with comparable NSE indices in place of S&P BSE indices

Franklin Templeton Investments, Indiabulls Finance Centre, Tower 2, 12th Floor, Elphinstone Road, Mumbai 400013

service@templeton.com

www.fraklintempletonindia.com

1800-425-4255

Karvy Computershare Private Limited

Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers

reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of

Data / Report. This Report is not a recommendation to invest / disinvest in any company covered in the Report. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/

transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISILs Ratings Division / CRISIL Risk and Infrastructure Solutions

Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISILs Ratings Division / CRIS.

No part of this Report may be published / reproduced in any form without CRISILs prior written approval.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Additional Schemes TableDocumento6 páginasAdditional Schemes TableAj_2006Ainda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Companies Profile Mutual FundDocumento3 páginasCompanies Profile Mutual FundAj_2006Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Marketing Strategies of NestleDocumento54 páginasMarketing Strategies of NestleAj_2006Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Top MF CompaniesDocumento7 páginasTop MF CompaniesAj_2006Ainda não há avaliações

- Canara Robeco Emerging EquitiesDocumento1 páginaCanara Robeco Emerging EquitiesAj_2006Ainda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Latest Nav Report 0703151549 SsDocumento253 páginasLatest Nav Report 0703151549 SsAj_2006Ainda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Tata Equity Opportunities FundDocumento1 páginaTata Equity Opportunities FundAj_2006Ainda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Pirangut Plant of Coca IN IndiaDocumento11 páginasPirangut Plant of Coca IN IndiaAj_2006Ainda não há avaliações

- SideshwarDocumento1 páginaSideshwarAj_2006Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- P PlantDocumento1 páginaP PlantAj_2006Ainda não há avaliações

- Three (3) Major Decisions The Finance Manager Would TakeDocumento11 páginasThree (3) Major Decisions The Finance Manager Would TakeJohn Verlie EMpsAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- SAUDA DETAIL REPORT cl3Documento1 páginaSAUDA DETAIL REPORT cl3Prachi PatwariAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- QAU Bulletin: No. 1 Series of 2016Documento34 páginasQAU Bulletin: No. 1 Series of 2016Stephn GrayAinda não há avaliações

- Frick++Annual+Return Fy2010 11Documento371 páginasFrick++Annual+Return Fy2010 11Reiki Channel Anuj BhargavaAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Amiram (2012) PDFDocumento26 páginasAmiram (2012) PDFFuad BachtiyarAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Home Work Dec 26 2018Documento5 páginasHome Work Dec 26 2018shejaguarAinda não há avaliações

- #22 Revaluation & Impairment (Notes For 6206)Documento5 páginas#22 Revaluation & Impairment (Notes For 6206)Claudine DuhapaAinda não há avaliações

- Book Value Per ShareDocumento18 páginasBook Value Per ShareRechelleAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Formation of Reinsurance AgreementsDocumento2 páginasFormation of Reinsurance AgreementsDean RodriguezAinda não há avaliações

- SUBROGATIONDocumento2 páginasSUBROGATIONRESEARCH86% (7)

- How To Define Your Brand and Determine Its Value.: by David Haigh and Jonathan KnowlesDocumento7 páginasHow To Define Your Brand and Determine Its Value.: by David Haigh and Jonathan KnowlesMahesh SavanthAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Road NPV Irr AnalysisDocumento403 páginasRoad NPV Irr AnalysisJay BadiyaniAinda não há avaliações

- A Var Is UsefulDocumento8 páginasA Var Is UsefulanilAinda não há avaliações

- FIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New IssuesDocumento6 páginasFIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New Issuestania_afaz2800Ainda não há avaliações

- SDF SDFDF 32 SDFDSF SDFDSFDocumento2 páginasSDF SDFDF 32 SDFDSF SDFDSFDineshan PAinda não há avaliações

- Business Ownership PresentationDocumento24 páginasBusiness Ownership Presentationfarie ahmadAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Company LawDocumento100 páginasCompany LawPranay PasrichaAinda não há avaliações

- Stock ExchangeDocumento43 páginasStock ExchangeGaurav JindalAinda não há avaliações

- Chapter 12 - Job-Order-Process and Hybrid Costing SystemsDocumento52 páginasChapter 12 - Job-Order-Process and Hybrid Costing Systems朱潇妤100% (2)

- Kaveri Seed Company LimitedDocumento27 páginasKaveri Seed Company LimitedAgarwal SaranshAinda não há avaliações

- Advanced Accounting1Documento8 páginasAdvanced Accounting1lykaAinda não há avaliações

- Supreme Court: Republic of The Philippines Manila Third DivisionDocumento22 páginasSupreme Court: Republic of The Philippines Manila Third DivisionneichusAinda não há avaliações

- HW 1 SolutionsDocumento7 páginasHW 1 Solutionsjinny6061Ainda não há avaliações

- Voluntary Disclosure of Black MoneyDocumento6 páginasVoluntary Disclosure of Black Money777priyankaAinda não há avaliações

- WP5 EpsteinDocumento26 páginasWP5 EpsteinererereretrterAinda não há avaliações

- Chapter 23 - Ç Æ¡Documento14 páginasChapter 23 - Ç Æ¡張閔華Ainda não há avaliações

- Black Derman Toy ModelDocumento4 páginasBlack Derman Toy ModelLore-Anne A. CadsawanAinda não há avaliações

- Investment Analysis and Portfolio Management: Efficient FrontierDocumento22 páginasInvestment Analysis and Portfolio Management: Efficient Frontiermahantesh123100% (1)

- Bank Code Br. Code Bank & Branch NameDocumento6 páginasBank Code Br. Code Bank & Branch Namemmsr387042Ainda não há avaliações

- Real Property Gain TaxDocumento4 páginasReal Property Gain Taxlcs1234678100% (1)