Escolar Documentos

Profissional Documentos

Cultura Documentos

BFD Notes

Enviado por

Huzaifa AhmedDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BFD Notes

Enviado por

Huzaifa AhmedDireitos autorais:

Formatos disponíveis

Business Finance Decisions

The dividend decision

Dividend irrelevancy theory

In an efficient market, dividend irrelevancy theory suggests that, provided all retained earnings are invested in

positive NPV projects, existing shareholders will be indifferent about the pattern of dividend payouts. But there

are certain points against dividend irrelevance:

Reductions in dividend can convey bad news to shareholders (dividend signalling).

Changes in dividend policy, particularly reductions, may conflict with investor liquidity requirements

Changes in dividend policy may upset investor tax planning

Companies attract a certain clientele of shareholders precisely because of their preference between income

and growth (Clientele effect)

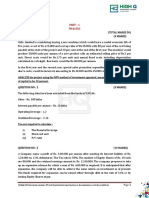

Example 1

X limited has in issue 5 million shares having market value of Rs 50 each. The dividend proposed for the

current year is Rs 5 per share. The company can invest cash surpluses at 10% pa at the same level of risk as

current operations. Compute the effect on shareholders wealth of the following options:

(a) continuing with the current dividend

(b) retaining an extra Rs 10 millions and investing it at 10%

(c) paying out normal dividend and raising an additional Rs 10 million for investment at 10% by right issue

Practical influences on dividend policy

levels of profitability

inflation

growth

control

tax

liquidity/cash

other sources of finance.

Types of dividend policy

Stable dividend policy

Constant payout ratio

Zero dividend policy

Residual dividend policy

Winter 2011Q1 (a) Briefly discuss the Dividend Irrelevance Theory developed by Miller and Modigliani

(MM). State three arguments against the validity of this theory. (05 marks)

(b) Al-Ghazali Pakistan Limited (AGPL) is a listed company whose shares are currently traded at Rs. 80 per

share. AGPLs Board has approved a proposal to invest Rs. 600 million in a project which is expected to

commence on 31 December 2012. There are no internal funds available for this investment and the company

would have to finance the project from the profit for the year ending 31 December 2012 and through right

issue. AGPL has a share capital consisting of 20 million shares of Rs. 10 each and its profit for the year ending

31 December 2012 is projected at Rs. 250 million. The annual return on 1-year treasury bills, the standard

deviation of returns on AGPLs shares and the estimated correlation of returns with market returns are 7.5%,

8% and 0.8 respectively. The current market return is 12.9% with a standard deviation of 5%.

Required:

Using MM Theory of Dividend Irrelevance, estimate the price of AGPLs shares as at 31 December 2012, if the

company declares:

(i) 20% dividend

(ii) Nil dividend (05 marks)

(c) Justify the MM Theory of Dividend Irrelevance, based on your computation in (b) above.(05 marks)

Page 1 of 2

Business Finance Decisions

Right issues

Theoretical ex-right price

It is the price of the shares after the issue of right shares: MV of old shares + cash from new shares

Total no of shares in issue

Value of a right

Ex-right price minus issue price

Example 2

ABC has 1 million shares in issue having a market value of Rs 20 per share. A one for four right issues at Rs 15

per share has been made. Determine the ex-right price and the value of a right.

Winter 2009 Q5 Sajawal Sugar Mills Limited (SSML), a medium sized listed company, is planning to expand

its production capacity. The management has estimated that the expansion would require an outlay of Rs. 300

million. Following have been extracted from SSMLs financial statements for the year ended June 30, 2009.

To finance the expansion, SSML is considering a right issue. However, the management of SSML wants to

maintain its existing debt equity ratio, return on total assets ratio and dividend payout percentage. Moreover,

they wish to keep the ex-right price to be the same as current market price. SSML follows a policy of retaining

30% of its profits. The current market price of its shares is Rs. 20 whereas its share price beta is 1.23. Presently,

market return is 16% whereas yield on one year treasury bills is 12%. Market is assumed to be strong form

efficient.

Required: Under the circumstances referred to in the above situation, what should be:

(a) The right ratio

(b) The right offer price

(c) Theoretical ex-right price

(d) Value of each right (17)

Past papers

Qs. no in paper

5

1

5

1

Attempt

W 09

S 10

S 10

W 11

Topic

Right issues

Dividend policy calculations

Right issues

Dividend irrelevance

Page 2 of 2

Level of difficulty

Average

Average

Difficult

Average

Você também pode gostar

- A) Walter's Model:: Advanced Financial Management Examples On Unit No - 5 Dividend Policy and Firm ValueDocumento6 páginasA) Walter's Model:: Advanced Financial Management Examples On Unit No - 5 Dividend Policy and Firm Valuesakshisharma17164Ainda não há avaliações

- 1.3 M1 - Dividends Question SetDocumento3 páginas1.3 M1 - Dividends Question Setshyla negiAinda não há avaliações

- 2820003Documento3 páginas2820003ruckhiAinda não há avaliações

- Paper - 2: Management Accounting and Financial Analysis Questions SwapDocumento31 páginasPaper - 2: Management Accounting and Financial Analysis Questions Swapअंजनी श्रीवास्तवAinda não há avaliações

- Gujarat Technological UniversityDocumento3 páginasGujarat Technological UniversityAmul PatelAinda não há avaliações

- Cost of CapitalDocumento8 páginasCost of CapitalAreeb BaqaiAinda não há avaliações

- FM II Assignment 18 19Documento1 páginaFM II Assignment 18 19RaaziaAinda não há avaliações

- Tutorial 3 For FM-IDocumento5 páginasTutorial 3 For FM-IarishthegreatAinda não há avaliações

- CH 15 QuestionsDocumento4 páginasCH 15 QuestionsHussainAinda não há avaliações

- FN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsDocumento5 páginasFN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsBaraka100% (1)

- Institute of Professional Education and Research (Technical Campus) Financial Management Practice BookDocumento3 páginasInstitute of Professional Education and Research (Technical Campus) Financial Management Practice Bookmohini senAinda não há avaliações

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Documento71 páginasQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- SFM RTP Nov 22Documento16 páginasSFM RTP Nov 22Accounts PrimesoftAinda não há avaliações

- Section e - QuestionsDocumento4 páginasSection e - QuestionsAhmed Raza MirAinda não há avaliações

- Ca Inter May 2023 ImpDocumento23 páginasCa Inter May 2023 ImpAlok TiwariAinda não há avaliações

- Dividend DecisionsDocumento3 páginasDividend DecisionsRatnadeep MitraAinda não há avaliações

- Financial Management: Thursday 9 June 2011Documento9 páginasFinancial Management: Thursday 9 June 2011catcat1122Ainda não há avaliações

- Importanat Questions - Doc (FM)Documento5 páginasImportanat Questions - Doc (FM)Ishika Singh ChAinda não há avaliações

- 18Documento4 páginas18Aditya Wisnu P100% (1)

- Quiz 4 (Final)Documento2 páginasQuiz 4 (Final)KavinShangariAinda não há avaliações

- Cost CalculationlDocumento5 páginasCost CalculationlIshan ShingneAinda não há avaliações

- All Math pdf2Documento6 páginasAll Math pdf2MD Hafizul Islam HafizAinda não há avaliações

- GTU Exam - Financial Management QuestionsDocumento3 páginasGTU Exam - Financial Management QuestionsMRRYNIMAVATAinda não há avaliações

- Financial Management Dividend ModelsDocumento10 páginasFinancial Management Dividend ModelsSavya Sachi50% (2)

- Financial Management-1Documento6 páginasFinancial Management-1chelseaAinda não há avaliações

- CF Pre Final 2022Documento3 páginasCF Pre Final 2022riddhi sanghviAinda não há avaliações

- Afm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Documento2 páginasAfm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Abhishek BangAinda não há avaliações

- Cost of Capital Exercise ProblemDocumento4 páginasCost of Capital Exercise ProblemDhruv MahajanAinda não há avaliações

- Cost of Capital - TaskDocumento15 páginasCost of Capital - TaskAmritesh MishraAinda não há avaliações

- Revision Question 2023.11.21Documento5 páginasRevision Question 2023.11.21rbaambaAinda não há avaliações

- MB0029Documento3 páginasMB0029Tenzin KunchokAinda não há avaliações

- Mock Test Paper 2: Financial Management & Economics for FinanceDocumento6 páginasMock Test Paper 2: Financial Management & Economics for FinanceMayank RajputAinda não há avaliações

- Dividend Policy - Problems For Class DiscussionDocumento5 páginasDividend Policy - Problems For Class Discussionchandel08Ainda não há avaliações

- Dividend Policy and Firm Value Assignment 2Documento2 páginasDividend Policy and Firm Value Assignment 2riddhisanghviAinda não há avaliações

- Institute of Cost and Management Accountants of Pakistan Fall 2012 ExamsDocumento4 páginasInstitute of Cost and Management Accountants of Pakistan Fall 2012 Examsmagnetbox8Ainda não há avaliações

- d15 Hybrid f9 Q PDFDocumento8 páginasd15 Hybrid f9 Q PDFhelenxiaochingAinda não há avaliações

- CA Final Paper 2Documento32 páginasCA Final Paper 2MM_AKSIAinda não há avaliações

- MOCK P4 DecDocumento5 páginasMOCK P4 DecHunainAinda não há avaliações

- 7 Corporate Finance - Prof. Gagan SharmaDocumento4 páginas7 Corporate Finance - Prof. Gagan SharmaVampireAinda não há avaliações

- Assignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Documento2 páginasAssignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Ramesh Chand GuptaAinda não há avaliações

- Final Final Mock BFD Winter 2022Documento7 páginasFinal Final Mock BFD Winter 2022Mohammad AtherAinda não há avaliações

- Cost of Capital Questions FinalDocumento4 páginasCost of Capital Questions FinalMadhuram SharmaAinda não há avaliações

- GTU MBA Semester 2 Financial Management Exam QuestionsDocumento3 páginasGTU MBA Semester 2 Financial Management Exam QuestionsAmul PatelAinda não há avaliações

- Master of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsDocumento4 páginasMaster of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsjyothishwethaAinda não há avaliações

- Cost of CapitalDocumento3 páginasCost of CapitalNikhil AgarwalAinda não há avaliações

- Finance RTP Cap-II June 2016Documento37 páginasFinance RTP Cap-II June 2016Artha sarokarAinda não há avaliações

- Cost of Capital Quiz AnswersDocumento3 páginasCost of Capital Quiz Answersrks88srk50% (2)

- Advanced Financial Management 3.3 IcagDocumento23 páginasAdvanced Financial Management 3.3 IcagmohedAinda não há avaliações

- 4 2illustrationDocumento4 páginas4 2illustrationRitwik BasudeoAinda não há avaliações

- Year CF To Equity Int (1-t) CF To Firm: Variant 1 A-MDocumento5 páginasYear CF To Equity Int (1-t) CF To Firm: Variant 1 A-MNastya MedlyarskayaAinda não há avaliações

- QUIZDocumento5 páginasQUIZNastya MedlyarskayaAinda não há avaliações

- Leverages Only QuestionsDocumento3 páginasLeverages Only QuestionsÐíñkár PáhâríýâAinda não há avaliações

- FINC3015 Final Exam Sample QuestionsDocumento5 páginasFINC3015 Final Exam Sample QuestionsTecwyn LimAinda não há avaliações

- Chapter 1 - CompleteDocumento27 páginasChapter 1 - Completemohsin razaAinda não há avaliações

- Part 1 - FM & ECO - 27145216 PDFDocumento3 páginasPart 1 - FM & ECO - 27145216 PDFMaharajan GomuAinda não há avaliações

- 73153bos58999-p8Documento27 páginas73153bos58999-p8Sagar GuptaAinda não há avaliações

- Security Analysis and Valuation Blue Red Ink (1) - WatermarkDocumento22 páginasSecurity Analysis and Valuation Blue Red Ink (1) - WatermarkKishan RajyaguruAinda não há avaliações

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Ainda não há avaliações

- ACCA Financial Management: A Comprehensive GuideNo EverandACCA Financial Management: A Comprehensive GuideAinda não há avaliações

- Quickbiz Pakistan & UAE Training Calendar March 2020Documento4 páginasQuickbiz Pakistan & UAE Training Calendar March 2020Huzaifa AhmedAinda não há avaliações

- Home Musharkah CalculatorDocumento10 páginasHome Musharkah CalculatorHuzaifa Ahmed0% (1)

- Code CorporateGovernance 2012Documento42 páginasCode CorporateGovernance 2012araza_962307Ainda não há avaliações

- Amendments in Labour LawsDocumento22 páginasAmendments in Labour LawsHuzaifa AhmedAinda não há avaliações

- IAS 19 Employee BenefitsDocumento48 páginasIAS 19 Employee BenefitsHuzaifa AhmedAinda não há avaliações

- 6.2 Sample Partnership DeedDocumento6 páginas6.2 Sample Partnership DeedAbhishek Dwivedi100% (1)

- Applying IAS 19 Revisions For Employee Benefits PDFDocumento24 páginasApplying IAS 19 Revisions For Employee Benefits PDFnicolai aquinoAinda não há avaliações

- Car Sale AgreementDocumento1 páginaCar Sale AgreementHuzaifa AhmedAinda não há avaliações

- ACCA F9 Notes by Seah Chooi KhengDocumento75 páginasACCA F9 Notes by Seah Chooi KhengHuzaifa Ahmed100% (2)

- BFD Refresher SessionsDocumento13 páginasBFD Refresher SessionsATIFREHMANWARRIACHAinda não há avaliações

- Excel 2007: Basics: Learning GuideDocumento0 páginaExcel 2007: Basics: Learning GuideEsha PandyaAinda não há avaliações

- Financial Analysis - Ratio AnalysisDocumento26 páginasFinancial Analysis - Ratio AnalysisHuzaifa Ahmed100% (2)

- BFD FormulasDocumento57 páginasBFD Formulasfarooq_maqboolAinda não há avaliações

- SBP Pakistan Investment Bonds Auction Calendar Q4 FY13Documento1 páginaSBP Pakistan Investment Bonds Auction Calendar Q4 FY13Huzaifa AhmedAinda não há avaliações

- Marginal CostingDocumento8 páginasMarginal CostingHuzaifa AhmedAinda não há avaliações

- ProposalDocumento8 páginasProposalHuzaifa AhmedAinda não há avaliações

- Acca p3 - Professional LevelDocumento31 páginasAcca p3 - Professional Levelmshahza89% (9)

- Sponsorship ProposalDocumento7 páginasSponsorship ProposalHuzaifa Ahmed0% (1)

- Additional Responsibilities Q2Documento1 páginaAdditional Responsibilities Q2Huzaifa AhmedAinda não há avaliações

- Past Papers Analysis (Corporate Laws)Documento2 páginasPast Papers Analysis (Corporate Laws)Huzaifa AhmedAinda não há avaliações

- Inventory issuance and receipt processesDocumento1 páginaInventory issuance and receipt processesHuzaifa AhmedAinda não há avaliações

- IcebreakersDocumento1 páginaIcebreakersHuzaifa AhmedAinda não há avaliações

- E15 CLS Course 23.04Documento10 páginasE15 CLS Course 23.04Huzaifa AhmedAinda não há avaliações

- Derivative SecurityDocumento1 páginaDerivative SecurityHuzaifa AhmedAinda não há avaliações

- Malawi Dividend PolicyDocumento31 páginasMalawi Dividend Policymages87Ainda não há avaliações

- The Effect of Dividend Policy On Share Prices of BDocumento7 páginasThe Effect of Dividend Policy On Share Prices of BRobbyShougaraAinda não há avaliações

- Full PDF VersionDocumento132 páginasFull PDF VersionPutin PhyAinda não há avaliações

- Grade Curricular de Medicina Da UfcDocumento3 páginasGrade Curricular de Medicina Da UfcDerrickAinda não há avaliações

- Module Title: International Finance: Module Handbook 2020/21 Module Code: BMG704 (86966)Documento16 páginasModule Title: International Finance: Module Handbook 2020/21 Module Code: BMG704 (86966)Osman Iqbal100% (1)

- Dividend PolicyDocumento8 páginasDividend PolicySumit PandeyAinda não há avaliações

- Dividend Policy True or False QuestionsDocumento29 páginasDividend Policy True or False QuestionsBui Thi Thu Hang (K13HN)Ainda não há avaliações

- Syllabus 3310 Master-Tdeeo8Documento39 páginasSyllabus 3310 Master-Tdeeo8Trudy YayraAinda não há avaliações

- Dividend Policy Signal TheoryDocumento30 páginasDividend Policy Signal TheoryAhmednoor HassanAinda não há avaliações

- Merger Motivations and ConsiderationsDocumento15 páginasMerger Motivations and ConsiderationsSam Sep A SixtyoneAinda não há avaliações

- Total Cash Outlay: P3.5M and Up: Rough Roi EstimatesDocumento15 páginasTotal Cash Outlay: P3.5M and Up: Rough Roi EstimatesRena Mae Lava MuycoAinda não há avaliações

- Major Decisions in Finance ManagementDocumento33 páginasMajor Decisions in Finance ManagementNandita ChouhanAinda não há avaliações

- SFM NotesDocumento11 páginasSFM NotesHanuma GonellaAinda não há avaliações

- Kieso Inter Ch15 IFRS (Equity)Documento55 páginasKieso Inter Ch15 IFRS (Equity)Peter Arya PrimaAinda não há avaliações

- Netsanet BelayDocumento150 páginasNetsanet BelayTibebu MerideAinda não há avaliações

- Funds Flow Statement of Reliance CommunicationDocumento65 páginasFunds Flow Statement of Reliance CommunicationDr.P. Siva Ramakrishna100% (1)

- List of Finance VariablesDocumento18 páginasList of Finance VariablesMuhammad Ali MeerAinda não há avaliações

- Navitas Financial ReportDocumento70 páginasNavitas Financial ReportAbhishekAinda não há avaliações

- Chapter 17 BBDocumento48 páginasChapter 17 BBTaVuKieuNhiAinda não há avaliações

- Question 686785 1Documento11 páginasQuestion 686785 1rishu53840% (1)

- Dividend PolicyDocumento10 páginasDividend Policyanuramaharjan78% (9)

- The Guide To Management StudiesDocumento52 páginasThe Guide To Management StudiesShrey Mehta100% (2)

- FMDocumento499 páginasFMRajiv Kumar100% (1)

- Case Studies Unit 9 & 10 0f Business StudiesDocumento14 páginasCase Studies Unit 9 & 10 0f Business StudiesSuchi SinghAinda não há avaliações

- Dividend Policy Exercise ReviewerDocumento1 páginaDividend Policy Exercise ReviewerpolxrixAinda não há avaliações

- Ch-9 Financial ManagementDocumento27 páginasCh-9 Financial Managementrawan khanAinda não há avaliações

- Gainesboro's 20% Dividend PayoutDocumento21 páginasGainesboro's 20% Dividend PayoutBayu Aji PrasetyoAinda não há avaliações

- DuhaDocumento26 páginasDuhaKhánh LyAinda não há avaliações

- FM FormulasDocumento13 páginasFM Formulassudhir.kochhar3530Ainda não há avaliações