Escolar Documentos

Profissional Documentos

Cultura Documentos

KPMG

Enviado por

BencAoDeDeusDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

KPMG

Enviado por

BencAoDeDeusDireitos autorais:

Formatos disponíveis

ijcrb.webs.

com

MARCH 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 4, NO 11

OPPORTUNITIES AND CONSTRAINTS IN EXPENDING E- BANKING IN

DEVELOPING COUNTRIES

ABDUL GHAFFAR WAINCE

SUPERIOR UNIVERSITY LAHORE (PAKISTAN)

PROF. DR. MUHAMMAD RAMZAN

DIRECTOR LIBRARY, LAHORE UNIVERSITY OF MANAGEMENT SCIENCES,

LAHORE, (PAKISTAN)

Abstract

The objective of study is to find out the prospects of adoption of E-banking in developing

countries like Pakistan. The study is based on the questionnaire pertaining to different variables

that affect the adoption of E-banking in the developing countries. These variables are mainly

categories into three main variables. These variables are bank variables, IT variables and

customer variables. These all variables affect

the adoption of E-banking in the developing

countries. The 100 Nos respondents were taken randomly. The study is proved with the help of

descriptive statistics and simple linear regression method. Customer variables include

demographic, age, education, monthly income; saving and family size .IT variables include

computer and internet. Bank variables include trained staff, service efficiency. The literacy level,

access to IT facilities and appropriate infrastructure may be provided to banks for boosting up Ebanking expansion in developing countries. Our conclusion leads to successfully find out

opportunities and constraints in the adoption of E-banking in the developing countries.

Keywords: Opportunities, Constraints, E-banking, Variables of E-banking.

Introduction:

A

study

pertaining

to

opportunities

and

constraints

in

expending

E-banking

in

Rawalpindi/Islamabad area, Pakistan was conducted. The objective of study was to determine the

prospects of adoption of E-banking in Rawalpindi/Islamabad. The study was based on a

questionnaire

pertaining to Bank variables, IT variables and customer variables that affect E-

banking. The 100 respondents were taken randomly. The Bank variables, building, trained Staff;

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

335

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

service efficiency all affected the adoption of E-banking by the customers. The IT Variables viz

access to computers, Internet, online banking and ATM facility were determinant factor in

adoption of E-Banking. The customer variables viz age, education, Income and saving of people,

all affected growth of E-banking. The younger people with age less than 36 years opted to Ebanking more readily than older people. The education level was important variable but

paramount important variables were income / saving of the customers, Higher the income higher

the degree of adoption of E-banking. This may be postulated from the study conducted that there

is great potential /opportunities in adoption of E-banking in Pakistan, provided the constraints are

redressed properly. The literacy level, access to IT facility and appropriate infrastructure may be

provided to bank for boosting up E-banking growth. The above study has been proved with the

help of descriptive statistics and simple linear regression method.

Objectives:

The objectives of study were:1. To determine the opportunities of adoption of E-banking in Rawalpindi/ Islamabad

area.

2. To determine the constraint in adoption of E-banking in Rawalpindi/ Islamabad area

and devise ways and means for redresser of constraints encountered in adoption of Ebanking.

Literature Review

The global economy has been changed into an informative society at present. The

conventional banking sector is undergoing radical transformations because of technological

development in the field of telecommunications and information technology. The financial sector

as key components of the global economy has set in motion a new delivery channels for banking

such as ATM, internet banking, tele banking, PC banking and many other related items as

modern banking no more exits between four walls of a bank. In USA and UK in 1960s Ebanking was prevalent for electronic fund transfers and credit card facility. At present 40% bank

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

336

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

transaction are performed through internet (Furst, Lang and Nolle (2000) reported in developed

countries that in 1999, 20% national banks offered internet banking to its customers. Almost all

larger banks offered internet banking while only 7% of small bank provided the internet banking

facility. They further narrated that institutions with internet banking had higher profit than

institution with non internet banking. Furthermore, the banks with higher profit are likely to

adopt internet banking readily than banks with small profit. In developing countries the Ebanking is still in infancy however there are high potential and intense opportunities for

introduction of E-banking in these countries. Rajesh kumar (2007): Narrated that in the usage of

internet banking gender factor, income factor and education factor has a pivotal role. These areas

were not enriched with research because main focus was on technology rather than on people.

This research has been proved with conceptual theory that stated if skills were upgraded then

there will be more courage to adopt e-banking by the customer. Inhibitory elements like,

religion, trust, price, culture, education, secrecy may have less effect on consumer mind set

towards adoption of e- banking. Samane & Monadjemi(2011): They revealed the factors that

affect the adoption of e-banking in the Iran. According to their research four factors usage,

accessibility, speed and secrecy affect the adoption of internet banking. To check the acceptance

level of internet banking in the Iran, it has also been observed in this paper whether usage of ebanking in Iran was constrained by the technology based on various factors. These factors were

advertisement campaign, various age groups of the consumers, education level, monthly income

and usage of internet by the consumers. It was also observed that old people low literacy level

have more resisted to adopt e- banking. Sherah Kurenia, Fei Peng,Yi Rao Liu(2010): stated that

there were major issues that affected the expension of e- banking which were proper legal

procedure or system, lack of technology development with regard to China e- banking

development requirement. There were also fewer trends to accept the banking by the people of

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

337

ijcrb.webs.com

MARCH 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 4, NO 11

china.Batin & kamil (2010): Narrated that low literacy factor and IT infrastructure factors were

main hurdles with regard

to adoption of e-banking by the people of Banglades. Required

security arrangements were not provided by the banks .Literacy level is low in the Bangladesh

due to this reason people are not technology familiar. In addition to that the people who are

literate, a portion of them have computer phobia. So, it is difficult for them to build up their trust

on e-banking services. There should be enhancement in the computer or literacy for the purpose

of build up confidence on e- banking in Bangladesh. To boost up the literacy level in the country

the Government of Bangladeh has taken many initiatives. In the Bangladesh people are not well

aware regarding e- banking. They do not know the power of technology. So, due to this reason

they are unable to enjoy better banking operations. E-banking can offer many other things such

as to reduce administrative and operational cost. They may increase more new markets. These

elements are more beneficial for the e-banking competitiveness. To conclude it Bangladesh

should avail the opportunity of e-banking (Salimon-2006) narrated that in Nigeria modernization

of banking sector is in process and in 1993, Central bank of Nigeria introduced payment card for

transactions. The ATMs were used for money drawal, checking of account balance and payment

of utility bills. In 2004, Central bank of Nigeria provided guidelines on E-banking that included

information about ATMs, credit card and debit cards. Polatoglu and Ekin (2001) stated that in

turkey banking sector has adopted technological innovation like E-banking and providing a

number of services to the customers. At present internet banking of paramount importance to the

economy of Turkey. Sohail and Shanmughaus (2002) conducted a study pertaining to customers

preferences for E-banking in Malaysia and the factors that affect E-banking. Among the

demographic variables age and educational qualification of customers of E-banking and

conventional banking had little effect, however monthly income was of pivotal importance in

adoption of E-banking, higher the income, more the adoption of E-banking by the customers.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

338

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

They also elaborated that accessibility of internet and awareness of E-banking was main

constraints in adoption of E-banking in Malaysia. Bolongkikit (2006) studied E-readiness index

of SAARC countries and inferred that there is position trend in e-adoption in all SAARC nations,

while Pakistan had highest change level of 15 during 2003-2004. Ahmad (2006) reported that

internet banking in Pakistan started in year 2000, when the government laid concentrated

emphasis on Information Technology (IT). He illustrated that many factors are affecting the

adoption of E-banking in Pakistan. Among these three variables are most important: these

variables are infrastructure, consisting of telecommunication, power, electronic devices and

buildings, service variables comprising of service structure and business models and fairly

application of database management system. In Pakistan internet is mostly use in cities and this

may be a big constraint in adoption of E-banking in Pakistan. Economic intelligent unit (2006)

carried out e-readiness ranking survey and reported that all countries improved e-readiness score

in 2006 compared to 2005.The developing countries have high e-readiness scale than developed

countries. The gap between the best and rest has narrowed, Pakistan attained 67 position with

score 3.0/10 in 2006 compared to 2.93/10 in 2005.It indicates that there is great opportunities for

adoption of E-banking in Pakistan.

Importance of E-Banking in Developing Countries like Pakistan:

The E-banking is rapidly replacing conventional banking bounded by four walls

in developed world. In developing countries like Pakistan .E-banking is still in infancy. There are

7000 commercial bank braches in Pakistan, out of which 90% branches are in urban areas .The

National Institutional Facilitation technologies (NIFT), reported that an automated cheque

clearing house, was operating in 14 cities. The ATM and E-banking use is gaining momentum

and most of the bank established ATMs system. The E-banking and internet banking increase

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

339

ijcrb.webs.com

MARCH 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 4, NO 11

will open avenue of online banking. The number of customers using ATMs has increased in

resent years and E-banking offered more alternative and choices to customers.

Research Model & Variables:

In this study, I have included the following variables which impact expending of

E-Banking. Although E-banking is on the increase, yet it is confronted with a number of

constraints and is affected by variables like, IT variables, Bank Variables and Customers

Variable and results of all these variables determine the E-banking expending available in a

specific region/area.

i)

Customer Variable includes demographic, age, education, monthly income,

saving, Family size.

ii)

IT Variable. Includes computer, Internet.

iii)

Bank Variable includes trained staff, services Efficiencies.

The E-banking model is depicted in the figure below:Customer

Variables

IT

Variables

E-Banking

expansion

Bank

Variables

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

340

ijcrb.webs.com

MARCH 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 4, NO 11

Hypothesis:

Hypothesis is as under:Ho. E-banking can not replace conventional banking.

H1.IT variable have positive impact on E-banking.

H2.Banking variable have positive impact on E-banking.

H3.Customer variable have positive impact on E-banking.

Research Methodology:

To study opportunities and constraints in adoption of E-banking in

Rawalpindi/Islamabad area, a survey was conducted. The survey was based on a comprehensive

questionair, comprising of bank, IT and customer variables. The IT variable includes computer

and internet. The customer variables include age, education, income, family size and savings.

The bank variable includes trained staff and service efficiencies. E-banking growth is dependent

variable where as customer, IT & bank variables are independent variables.

In

all

100

respondents were interviewed in persons. The respondents were taken at random. The data

collected was subjected to statistical analysis and inferences were drawn according. The

statistical method used was Regression that show impact of variables on the E-banking growth.

In this research methodology SPSS software was used. The constraints in adoption of E-banking

were highlighted and ways and means were suggested to overcome these constraints and

opportunities of E-banking were explored in Rawalpindi/Islamabad area was used.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

341

ijcrb.webs.com

MARCH 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 4, NO 11

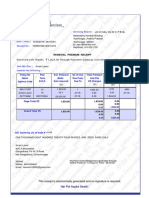

Table 1:

Description of Customer, Bank and Information Technology Variables:

_____________________________________________________________

Variable

Description

Mean

S/Deviation

_____________________________________________________________

A.

Customer Variable

Age

Age of customer in years

36

12.71

Education

Years of Education

14

5.73

Income

Per month income in rupees

27343

12500

Family Size

Number of family members in the house

Savings

Per month savings in rupees

6.30

5000

2300

Trained staff Number of trained persons in the bank

2.88

3.76

Services Efficiencies1 if service efficiencies, 0 otherwise

0.53

0.62

B.

C.

Bank Variables

Information Technology

Computer

1 if customer have computer, 0 otherwise

0.64

0.44

Internet

1 if customer uses internet, 0 otherwise

0.51

0.59

Source: Own calculations.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

342

ijcrb.webs.com

MARCH 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

Table-2:

VOL 4, NO 11

OLS Regression Results:

_____________________________________________________________

Variable

Coefficient

t-value

_____________________________________________________________

i) Customer Variables:

Age (Number of years)

-0.009

-1.71*

Education (Number of years of schooling)

0.019

1.99**

Income (Rupees per month)

0.021

2.13**

Monthly Transaction

0.023

0.69

Family size (Number of family members)

0.081

2.61***

Computer

0.024

2.31**

Internet

0.036

2.66***

Trained Staff

0.018

1.65*

Service Efficiency

0.006

0.84

Constant

0.599

1.69*

Number of respondents

100

ii) IT variables

iii) Bank Variables

______________________________________________________________

Note *, **, *** indicates that results are significant at 10, 5 and 1 percent respectively.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

343

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

Results and Discussion:

The result pertaining to opportunities and constraints in expanding E-banking in

Rawalpindi /Islamabad region of Pakistan are discussed in the following text.

Customer Variables:

Customer variable has overall positive impact on e-banking growth except age

that has negative and significant impact on enjoying E- banking facility i.e. mean aged people

have mostly enjoy the conventional banking as compared to young people. Education has

positive impact on E-banking mean mostly educated persons are enjoying the E-banking facility

and vice versa. The income have positive and high significant impact mean that more the house

hold or individual income more is the probability that he will be using E-banking and vice versa.

This study was conducted in line with finding for Sohail and Shanmughan (2002) in Malaysia.

They observed that younger generation relatively of less age was using computers and avail Ebanking facility compared to old people. The higher the literacy rate, more the prospectus that

customers will adopt E-banking. Same has happened in Rawalpindi/Islamabad area of Pakistan,

as in these cities people are mostly literate; hence 56% had opted E-banking in a period of nine

year since advent of E-banking in year 2000 in Pakistan. Sohail and Shanmughan (2002) also

inferred that people with more income are high user of computers and also avail E-banking

facility readily. They further elucidated that income was the pivotal factor in adoption of Ebanking. The results of present study are also confirmatory to those of Abid and Noreen (2007)

of COMSATS institute of information technology that most of E-banking account holders were

of younger age group, 18-30 year old. They also reported that lack of awareness online banking

was main impediment in adoption of E-banking in Pakistan.

IT Variables:

As far as IT variables are concerned, the computers have positive and significant

impact on using the E-banking facility, while internet impact is also positive. The data in table

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

344

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

reveals that IT Variables are important in expansion of E-banking in Pakistan. However, IT

facility in Pakistan is still a distance task, as 2/3 population live in rural areas with low literacy

rate that is main constraint in expansion of E-banking specifically in rural areas. It is assumed

that E-banking and E-commerce and computer intervention are mostly business of urban area

and rural areas have little to do with these innovated banking services. Moreover mostly 90%

banks are located in cities and there is not much banking in rural areas. Kazmi (2002) also

narrated that main constraints in E-banking was slow penetration of computers in Pakistan. The

Government of Pakistan in 2002 introduced electronic transaction ordinance that provides legal

cover to digital signatures and documentation that curtail the risk associated with use of

electronic medium of business. The electronic transactions in world were trillion of dollars in

2004 and Pakistan is alive to these global phenomena and has focused his efforts in development

of IT in the country and as such opportunities of E-banking are expanding day by day.

At

present banking sector is undergoing radical transformation and easiness, quickness and

cheapness are ultimate motives of E-banking that will propagate the spread of E-banking in

Pakistan. Ahmad (2006) reported that telecommunication and power are main component of any

digital intervention. The use of E-banking in microfinance has great opportunities in Pakistan

especially in promoting the small scale agriculture and industrial units. The sustainability of

these units will provides employment opportunities and will boost up country economy to

considerable degree.

Bank Variables:

The bank variables viz trained staff and service efficiency are positive and highly

significant, mean more trained the bank staff and more efficient are the facilities, more is the

probability that customers will be using or enjoying the E-banking facility. In expansion of Ebanking the trained staff is prerequisite. Since the advent of E-banking in 2000 in Pakistan the ECOPY RIGHT 2013 Institute of Interdisciplinary Business Research

345

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

banking is on the increase everyday but not at the rate it ought to be, because lack of trained

staff. The efficiency of untrained staff will be low and may be impediment in growth of Ebanking. The awareness pertaing to E-banking is other constraints in expansion of E-banking

.The awareness campaign may be arranged by the banks, so that common customers get

acquaintance of E-banking Business. In brief, all the variables viz bank; IT and customer

affected the expansion of E-banking. The Government of Pakistan has already taken steps toward

informative society. However the task of introduction of E-banking in Pakistan is gigantic, as 2/3

people live in rural areas which are mostly illiterate and even not conversant to conventional

banking. Also in rural areas only 10%bank exist, remaining 90% are located in urban areas .The

education, access to computer, internet and appropriate awareness about E-banking will

guarantee expansion of E-banking in the country. Bank should also provide architecture and

infrastructure for E-banking. The customers should also be demonstrated and trained in use of Ebanking facility. It is high time that Government, banks and customers must realize that without

adoption of innovative technology such as E-banking, we will lag behind the rest of world that is

not to be opted in any way. The opportunities for expansion of E-banking in the country may be

explored to full extent, so that Pakistan may play active role in global revolutionary economy of

the world.

Conclusions/ Suggestions:

In this study, impact of customer, IT and bank variables on e banking growth has

been analyzed through application of simple linear regression method and these variables has

positive and significant impact on e-banking growth. Study pertaining to constraints and

opportunities in expansion of E-banking in Rawalpindi/Islamabad was an exploratory study. In

future comprehensive study in this regard may be conducted specifically focusing on rural areas.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

346

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

The literacy level, access to IT facility and appropriate infrastructure may be

provided to banks for boosting up E- banking growth. Trained staff for adoption of e-banking is

very much important. In this way e-banking can perform a pivotal role in the economic

development of the country. The study led to the conclusion that there is great opportunity for

growth of E-banking in Pakistan; however the concerted efforts are needed for removal of

constraints that encounter in expansion of E-banking

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

347

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

References:

1. Sathye, M (1999), Adoption of Internet banking by Australian consumers: an empirical

Investigation, International Journal of Bank Marketing, Vol. 17 No. 7, pp. 324-34.

2. Wai-C

hing P (2008), Users Adoption of E-Banking Services: The Malaysian

Perspective, J. Bus. Ind. Mark, 23 (1): 59-69.

3. Adesina A. A & Ayo C.K. (2010): An Empirical Investigation of the Level of Users

Acceptance of E-Banking in Nigeria Journal of Internet Banking and Commerce, Vol. 15,

No.1.

4. Amrit B., (2007): Prospects and Challenges of E-banking in Nepal, The Journal of

Nepalese Business Studies. Vol. IV No. 1 2007.

5. Mohammad M.R., (2009) E-Banking in Bangladesh: Some Policy Implications.

6. Adesina A. A. and Ayo C. K. (2010). An empirical investigation of the level of users

7. Acceptance of e-banking in Nigeria. Journal of Internet Banking and Commerce, Vol. 15,

No. 1, Pp. 1-13.

8. G. M. Kundi and Bahadar. S (2009), IT in Pakistan: Threats and opportunities for eBusiness. . EJISDC .Vol 36,8,1-31.

9. R. Mascha, Norman. C and S. Zindiye (2010), E-banking adopt on by customer in rural

milieus of South Africa. Vol. 5(5), pp1857-1863. African journal of business

management.

10. Adeyinka Adeyemi , Adoption of E-Banking Service Arising in Nigeria, Trade Invest

Nigeria.

11. Rajesh Kumar (2007): customers perception on usage of internet banking. Vol-3.

12. Baten & Kamil (2010): Journal of internet banking and commerce. Vol-15, No.2.

13. Sherah Kurnia, Fei Peng (2010): Understanding the adoption of Electronic Banking in

China.

14. Samneh & Monadjemi (2011): Effective Factors on adoption of customer in the internet

banking services, case study Iran.

15. Waqas Danish (2007): E-Banking and Pakistan.

16. Wai-Ching P 2008: Users adoption of E-Banking Services.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

348

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

MARCH 2013

VOL 4, NO 11

17. Black N.J. Lockett A., Ennew C. &Winklhofer H. (2001), Adoption of Internet banking,

a qualitative study, International Journal of Retail & Distribution Management 29 (8),

390-8.Innovative Marketing, Volume 3, Issue 4, 2007, 73

18. Corrocher, N. (2002), Does Internet banking substitute traditional banking? Empirical

evidence from Italy, Working Paper, CESPRI, No. 134, November.

19. Journal of Internet Banking and Commerce (2006), Impact of demographics on the

consumption of different service online in India, vol. 11, No. 3, 353-355.

20. Journal of Service Research (2007), Profiling of internet banking users in India, vol. 6,

No. 2, March, 77-125.

21. Polatoglu, V. N. &Ekin S. (2001), An Imperial investigation of Turkish consumer

acceptance of internet banking service, International Journal of Bank Marketing 19 (4),

156-65.

22. Rao, G. R. and Prathima, K. (2003), Internet Banking in India, Mondaq Business

Briefing, April 11.

23. Suganthi, Balachander and Balachandran (2001), Internet Banking Patronage: An

Empirical Investigation of Malaysia, Journal of Internet Banking and Commerce, Vol. 6,

No. 1, May.

24. Jasimuddin, Sajjad M. (2001) Saudi Arabian Banks on the Web. Journal of Internet

Banking and Commerce, 6(l).

25. Broderick, A.J and Vachirapornpuk, S (2002), Service quality in Internet banking: the

importance of customer role, Marketing Intelligence &Planning, Vol. 6, No. 20, pp 327335.

26. Jayawardhena, C. and Foley, P (2000), Changes in the banking sector: the case of

Internet banking in the UK, Internet Research: Electronic Networking Applications and

Policy, Vol. 10 No. 1, pp.19-30.

COPY RIGHT 2013 Institute of Interdisciplinary Business Research

349

Você também pode gostar

- Prof of Practice Implem Guidelines PDFDocumento10 páginasProf of Practice Implem Guidelines PDFBencAoDeDeusAinda não há avaliações

- BEC Case Study on Impact of Project Structure ChangeDocumento5 páginasBEC Case Study on Impact of Project Structure ChangeBencAoDeDeusAinda não há avaliações

- To Do ListDocumento1 páginaTo Do ListBencAoDeDeusAinda não há avaliações

- Final Engro Report 2013Documento130 páginasFinal Engro Report 2013BencAoDeDeusAinda não há avaliações

- Value ChainDocumento4 páginasValue ChainBencAoDeDeusAinda não há avaliações

- BreakfastDocumento1 páginaBreakfastBencAoDeDeusAinda não há avaliações

- Graph-I: X-Axis: Percentage of ClayDocumento2 páginasGraph-I: X-Axis: Percentage of ClayBencAoDeDeusAinda não há avaliações

- Fulltext01 PDFDocumento68 páginasFulltext01 PDFareebaAinda não há avaliações

- Chpt2trait TheoryDocumento11 páginasChpt2trait TheoryBencAoDeDeusAinda não há avaliações

- Banking Sep 12 OverviewDocumento18 páginasBanking Sep 12 OverviewZubair MirzaAinda não há avaliações

- Pakistan Stock Rates 2015Documento1 páginaPakistan Stock Rates 2015BencAoDeDeusAinda não há avaliações

- Hazrat Abu BakarDocumento10 páginasHazrat Abu BakarBencAoDeDeusAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Nitesh Fadiya ResumeDocumento2 páginasNitesh Fadiya ResumeTanvi Gatecha KanabarAinda não há avaliações

- Vertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterDocumento26 páginasVertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterNikkiAinda não há avaliações

- Customer Relationship Management of Birla Sun LifeDocumento72 páginasCustomer Relationship Management of Birla Sun LifeTarun NarangAinda não há avaliações

- Loan Amortization Schedule1Documento8 páginasLoan Amortization Schedule1Keshav VarpeAinda não há avaliações

- Received With Thanks ' 1,824.00 Through Payment Gateway Over The Internet FromDocumento1 páginaReceived With Thanks ' 1,824.00 Through Payment Gateway Over The Internet FromQC&ISD1 LMD COLONYAinda não há avaliações

- OG - Aruba Central On PremisesDocumento10 páginasOG - Aruba Central On PremisesRizfan AriefAinda não há avaliações

- 5G Network Roll-Out and Its Impact On The Current Existing 3G and 4G Based Systems - A Case Study of ZambiaDocumento3 páginas5G Network Roll-Out and Its Impact On The Current Existing 3G and 4G Based Systems - A Case Study of ZambiaInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Style Summary Detail:: Break Bulk DBN Edgars DBN DCDocumento1 páginaStyle Summary Detail:: Break Bulk DBN Edgars DBN DCGalib HossainAinda não há avaliações

- Housekeeping Forms and Front Office RelationshipDocumento14 páginasHousekeeping Forms and Front Office RelationshipKaren GumatayAinda não há avaliações

- Insurance in India An Overview: Ashwani Gupta Amherst Advisory ServicesDocumento10 páginasInsurance in India An Overview: Ashwani Gupta Amherst Advisory ServicesRupam PatelAinda não há avaliações

- METRO1Documento12 páginasMETRO1Bhagyashri KulkarniAinda não há avaliações

- 1 - Brief Description of GAAPs-3Documento6 páginas1 - Brief Description of GAAPs-3samkitAinda não há avaliações

- FINAL Civil Registrar General - Registry Return ReceiptDocumento2 páginasFINAL Civil Registrar General - Registry Return ReceiptGreta Almina Costales Garcia75% (4)

- VASS 2016-17 Superintendent PayDocumento36 páginasVASS 2016-17 Superintendent PayWSETAinda não há avaliações

- MCQ 1 SakshuDocumento196 páginasMCQ 1 SakshuSakshi mishraAinda não há avaliações

- Central Depository Statement SummaryDocumento166 páginasCentral Depository Statement Summaryabhinav_samaiya9497Ainda não há avaliações

- Increasing Consumables Sales at Myntra Through Online MarketingDocumento67 páginasIncreasing Consumables Sales at Myntra Through Online MarketingSwetha SrinivasanAinda não há avaliações

- UNIT 1 Lecture 7 TelemedicineDocumento33 páginasUNIT 1 Lecture 7 TelemedicineRithisha JaganAinda não há avaliações

- 270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)Documento3 páginas270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)yogarajanAinda não há avaliações

- 2008 New Media Merger Acquisition RoundupDocumento44 páginas2008 New Media Merger Acquisition Roundupbanjoysl100% (2)

- Product Distribution BasicsDocumento8 páginasProduct Distribution BasicsNicol Katherine Sierra RodríguezAinda não há avaliações

- NAACP Membership FormDocumento1 páginaNAACP Membership FormLenette HoldenAinda não há avaliações

- Dr. Devi Shetty Chairman: Narayana Hrudayalaya, Bangalore Asia Heart Foundation, KolkataDocumento38 páginasDr. Devi Shetty Chairman: Narayana Hrudayalaya, Bangalore Asia Heart Foundation, KolkataPrudhvinadh KopparapuAinda não há avaliações

- Project For Tally Prime - 013659 (1) (Mith)Documento39 páginasProject For Tally Prime - 013659 (1) (Mith)Or IyerAinda não há avaliações

- Updated PayPal and Streaming Bins from Philippines DocumentDocumento36 páginasUpdated PayPal and Streaming Bins from Philippines DocumentKeith cantel25% (4)

- Account statement for Mr. MAHESH JAGANNATH SONAVANEDocumento7 páginasAccount statement for Mr. MAHESH JAGANNATH SONAVANEMahesh SonavaneAinda não há avaliações

- Fdic Call Report Instructions PDFDocumento2 páginasFdic Call Report Instructions PDFHeatherAinda não há avaliações

- 9bac42 CareerFiles PDFDocumento226 páginas9bac42 CareerFiles PDFRoshan ToshniwalAinda não há avaliações

- Ranges 06.03.24Documento14 páginasRanges 06.03.24allkreeyAinda não há avaliações

- Travel Agent vs. Tour OperatorDocumento17 páginasTravel Agent vs. Tour OperatorStephanie Aira LumberaAinda não há avaliações