Escolar Documentos

Profissional Documentos

Cultura Documentos

Online Tax Payment Guide

Enviado por

Trishnee MunusamiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Online Tax Payment Guide

Enviado por

Trishnee MunusamiDireitos autorais:

Formatos disponíveis

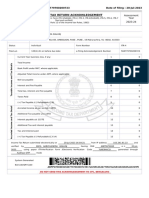

Personal Internet Banking

Pay Your MRA Tax Online

Two Steps to Pay your Tax Online

Logon HSBC

Internet Banking

(If you have already set MRA as a Payee,

please proceed to Step 2)

Prepare your

a. MRA* Tax Account

Number (TAN)

Set-up MRA as a Payee

Pay your MRA Tax

b. Total amount of Tax**

* MRA Mauritius Revenue Authority

** The Amount of tax you have to pay, is as per calculation on your Income Tax Form.

Step 1: Set-up MRA as a Payee

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

1.1 Click on Pay bills then Add payee

Step 1: Set-up MRA as a Payee

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

1.2 Click on Search button and then Click on

MAURITIUS REVENUE AUTHORITY to proceed.

Step 1: Set-up MRA as a Payee

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

1.3 Input your Tax Account Number (TAN) in the Utility Account

Number field and click on Add to proceed.

Step 1: Set-up MRA as a Payee

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

1.4 On the Review Details page, either you click on the 'Change'

button to make any modification to the Tax Account Number or

'Confirm' to accept correctness of Tax Account Number provided

Step 1: Set-up MRA as a Payee

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

1.5 An Acknowledgment page for successful creation of the Payee

will be displayed.

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

2.1 Click on Pay bills then Pay a bill

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

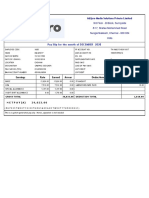

2.2 Select your 'From account', which can be a Savings Account,

Current Account or even a Credit Card

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

2.3 Under Pay to, select the Payee, MAURITIUS REVENUE

AUTHORITY [utility account number] from the drop down

10

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

2.4 Enter the amount, as per calculation on your Income Tax Form

11

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

2.5 Select Pay now

12

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

2.6 Enter any details for your own reference and Click on Pay

**

** The above detail(s) will appear on your bank statement.

13

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

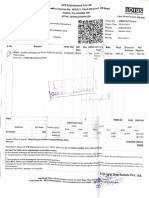

2.7 On the Review Details page, either you click on the 'Change'

button to make any modification to the payment or 'Confirm' to

conclude the payment

14

Step 2: Pay Your MRA Tax

Logon HSBC

Internet Banking

Set-up MRA

as a payee

Pay your MRA Tax

2.8 After successful payment processing, an Acknowledgment page

will be displayed**

** Please note if the payment is made after 3PM on business day, the transaction would

be only processed on the next business day.

15

Você também pode gostar

- Arithmetic and Geometric Progressions APGP SummaryDocumento4 páginasArithmetic and Geometric Progressions APGP SummaryFaisal RaoAinda não há avaliações

- Sin KL 28dec To 09jan161Documento2 páginasSin KL 28dec To 09jan161Trishnee MunusamiAinda não há avaliações

- Medical Physics, Telecommunications and Op Amp RevisionDocumento9 páginasMedical Physics, Telecommunications and Op Amp RevisionTrishnee MunusamiAinda não há avaliações

- Electrice Ty DiagDocumento2 páginasElectrice Ty DiagTrishnee MunusamiAinda não há avaliações

- 1 DaDocumento17 páginas1 DaTrishnee MunusamiAinda não há avaliações

- G484 Module 1 Newtons Laws and Momentum Questions MSDocumento3 páginasG484 Module 1 Newtons Laws and Momentum Questions MSTrishnee MunusamiAinda não há avaliações

- Online Tax Payment GuideDocumento15 páginasOnline Tax Payment GuideTrishnee MunusamiAinda não há avaliações

- PHYSICSreportDocumento3 páginasPHYSICSreportTrishnee MunusamiAinda não há avaliações

- OCR S2 Rsdadevision SheetDocumento7 páginasOCR S2 Rsdadevision SheetTrishnee MunusamiAinda não há avaliações

- Lower 6 Paper 3 (30 Marks)Documento2 páginasLower 6 Paper 3 (30 Marks)Trishnee MunusamiAinda não há avaliações

- E Field: F V U Constant, Time Cross E Field T L UDocumento4 páginasE Field: F V U Constant, Time Cross E Field T L UTrishnee MunusamiAinda não há avaliações

- Electromagnetism WsDocumento3 páginasElectromagnetism WsTrishnee MunusamiAinda não há avaliações

- His To Grams ExtractDocumento4 páginasHis To Grams ExtractTrishnee MunusamiAinda não há avaliações

- List of WinnersDocumento1 páginaList of WinnersTrishnee MunusamiAinda não há avaliações

- PVNRT pVnmc2Documento3 páginasPVNRT pVnmc2Trishnee MunusamiAinda não há avaliações

- Physics Planning Practice 1Documento2 páginasPhysics Planning Practice 1Trishnee MunusamiAinda não há avaliações

- SHM WSDocumento3 páginasSHM WSTrishnee MunusamiAinda não há avaliações

- PVNRT pVnmc2Documento3 páginasPVNRT pVnmc2Trishnee MunusamiAinda não há avaliações

- Hf662sp2 - Location PlanDocumento1 páginaHf662sp2 - Location PlanTrishnee MunusamiAinda não há avaliações

- Price List 11.11.2013Documento1 páginaPrice List 11.11.2013Trishnee MunusamiAinda não há avaliações

- Physics Test July 2014Documento1 páginaPhysics Test July 2014Trishnee MunusamiAinda não há avaliações

- Mark Scheme 2014Documento4 páginasMark Scheme 2014Trishnee MunusamiAinda não há avaliações

- Cahier Des Charges CodesDocumento4 páginasCahier Des Charges CodesTrishnee MunusamiAinda não há avaliações

- Scalar and Vectors: Parallelogram Rule: The Resultant R Is The Diagonal of The Parallelogram Drawn From The Point atDocumento2 páginasScalar and Vectors: Parallelogram Rule: The Resultant R Is The Diagonal of The Parallelogram Drawn From The Point atMichael LeungAinda não há avaliações

- Exercises On RadioactivityDocumento2 páginasExercises On RadioactivityTrishnee MunusamiAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- G.R. No. L-25043 J EN BANC J April 26 J 1968 J BENGZON J J.P J JDocumento2 páginasG.R. No. L-25043 J EN BANC J April 26 J 1968 J BENGZON J J.P J JarzaianAinda não há avaliações

- Tax Digest Mobil Philippines Vs City Treasurer of MakatiDocumento2 páginasTax Digest Mobil Philippines Vs City Treasurer of MakatiCJAinda não há avaliações

- TCDN Clc63d - Peony Coffee-V1Documento4 páginasTCDN Clc63d - Peony Coffee-V111219775Ainda não há avaliações

- Taxguru - In-Taxes and Constitutional LimitationsDocumento4 páginasTaxguru - In-Taxes and Constitutional LimitationsAbi CherubAinda não há avaliações

- 1.1. Problems On VAT (With Answers and Solutions) - PDF - Value Added Tax - Invoice PDFDocumento60 páginas1.1. Problems On VAT (With Answers and Solutions) - PDF - Value Added Tax - Invoice PDFMarjorie Joyce BarituaAinda não há avaliações

- February 2023 NewsLetterDocumento23 páginasFebruary 2023 NewsLetterSabrina CanoAinda não há avaliações

- Cash Flow Statement ProblemDocumento2 páginasCash Flow Statement Problemapi-3842194100% (2)

- PayrollDocumento6 páginasPayrollAlireza T.Ainda não há avaliações

- New Jeevan Anand: Benefits Illustration SummaryDocumento4 páginasNew Jeevan Anand: Benefits Illustration SummaryVuppala RavitejaAinda não há avaliações

- Accounting For Income TaxDocumento21 páginasAccounting For Income Taxkara mAinda não há avaliações

- CIR v. Wyeth Suaco - CTADocumento3 páginasCIR v. Wyeth Suaco - CTADaLe AparejadoAinda não há avaliações

- Itr Fy 22-23Documento6 páginasItr Fy 22-23Omkar kaleAinda não há avaliações

- 1600 SalarySlip December 2020Documento1 página1600 SalarySlip December 2020Mickey CreationAinda não há avaliações

- Bir RequirmentsDocumento4 páginasBir RequirmentsMa Therese MontessoriAinda não há avaliações

- LTZ-0006260-IN-57101 Liquid Telecom March 2020Documento1 páginaLTZ-0006260-IN-57101 Liquid Telecom March 2020Tadiwanashe ChikoworeAinda não há avaliações

- Nepal TaxDocumento7 páginasNepal Taxsanjay kafleAinda não há avaliações

- Semester Teaching Plan 2021-2022 Semester 1: Subject Code and Title Course Convenor Course InstructorsDocumento5 páginasSemester Teaching Plan 2021-2022 Semester 1: Subject Code and Title Course Convenor Course InstructorsDimitriAinda não há avaliações

- InvoiceDocumento1 páginaInvoiceKarshan GarhewalAinda não há avaliações

- Hfma Cpe Report 11.15.2023Documento3 páginasHfma Cpe Report 11.15.2023ElfawizzyAinda não há avaliações

- GSTR 3B Vs GSTR 1 Tax Comparison Report 2Documento14 páginasGSTR 3B Vs GSTR 1 Tax Comparison Report 2Mani SinghAinda não há avaliações

- RemediesDocumento45 páginasRemediesCzarina100% (1)

- Principles of Accounting Midterm Exam - Sum 2022Documento7 páginasPrinciples of Accounting Midterm Exam - Sum 2022Yến Hoàng HảiAinda não há avaliações

- Tutorial 3 QDocumento3 páginasTutorial 3 Q謝中豪Ainda não há avaliações

- Tax QuizzerDocumento33 páginasTax QuizzerClarisse Peter86% (14)

- IT ProjectDocumento13 páginasIT ProjectMichel EricAinda não há avaliações

- Business Finance: Management of Working Capital AccountsDocumento17 páginasBusiness Finance: Management of Working Capital AccountsNicole Ann RamosAinda não há avaliações

- Chapter 10-Compensation Income: True or FalseDocumento15 páginasChapter 10-Compensation Income: True or FalseJarren Basilan57% (7)

- GST Returns NotesDocumento5 páginasGST Returns NotesvishnureachmeAinda não há avaliações

- Congressional Record: March 27,1943, Page 2580Documento10 páginasCongressional Record: March 27,1943, Page 2580Luis A del MazoAinda não há avaliações

- Calculating MAGIDocumento1 páginaCalculating MAGIf0123250Ainda não há avaliações