Escolar Documentos

Profissional Documentos

Cultura Documentos

Virginia Corporation To LLC Coversion Guide

Enviado por

rghimTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Virginia Corporation To LLC Coversion Guide

Enviado por

rghimDireitos autorais:

Formatos disponíveis

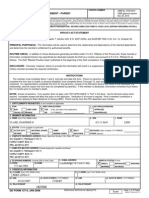

COMMONWEALTH OF VIRGINIA

STATE CORPORATION COMMISSION

SCC722.12-LLC

GUIDE FOR ARTICLES OF ENTITY CONVERSION

(01/15)

(Virginia stock corporation converting to a Virginia limited liability company)

ARTICLES OF ENTITY CONVERSION OF

(name of corporation)

The undersigned, on behalf of the corporation set forth below, pursuant to Title 13.1, Chapter 9, Article 12.2 of the

Code of Virginia, states as follows:

1. The name of the corporation immediately prior to the filing of these articles of entity conversion is

(name of the corporation as set forth on the Commissions records)

. The corporation shall convert

to a Virginia limited liability company and its name shall be

(name of resulting limited liability company) .

2. The plan of entity conversion, pursuant to 13.1-722.10 of the Code of Virginia, is set forth as follows:

A. The full text of the articles of organization of the resulting limited liability company as they will be in effect

immediately after consummation of the conversion is attached hereto.

B. (Set forth the terms and conditions of the plan of entity conversion, including the manner and basis by

which the outstanding shares of the corporation will be converted into interests of the resulting limited

liability company. See Instructions.)

C. (Set forth any additional provisions that are included in the plan of entity conversion.)

3. (State how the plan was adopted by the corporation. See the Instructions for additional information and options.)

A. The plan of entity conversion was adopted by the unanimous consent of the shareholders. OR

B. The plan of entity conversion was adopted by the board of directors and submitted to the shareholders in

accordance with the provisions of Chapter 9 of Title 13.1 of the Code of Virginia, and:

(1) The designation, number of outstanding shares, and number of votes entitled to be cast by each

voting group entitled to vote separately on the plan of entity conversion were:

Designation

_______________

_______________

Number of outstanding shares

________________________

________________________

Number of votes

____________

____________

(2) The total number of:

b

(a) Votes cast for and against the plan by each voting group entitled to vote separately on the plan was:

Voting group

Total votes FORTotal votes AGAINST

____________

_____________

_________________

____________

_____________

_________________

OR

(b) Undisputed votes cast for the plan separately by each voting group was:

Voting group

____________

____________

Total undisputed votes FOR

______________________

______________________

(3) And the number cast for the plan by each voting group was sufficient for approval by that voting group.

Executed in the name of the corporation by:

(signature)

(date)

(printed name)

(title)

(corporations SCC ID no.)

(telephone number (optional))

Personal Information, such as a social security number, should NOT be included in a business entity document submitted to the Office of the

Clerk for filing with the Commission. For more information, see Notice Regarding Personal Identifiable Information at www.scc.virginia.gov/clk.

THIS FORM IS TO BE USED AS A GUIDE ONLY.

REVIEW THE INSTRUCTIONS THAT FOLLOW BEFORE SUBMITTING THE ARTICLES.

INSTRUCTIONS TO FORM SCC722.12-LLC

Guideform SCC722.12-LLC has been produced by the Commission as a guide to help prepare articles of entity

conversion for a Virginia corporation that wants to convert to a Virginia limited liability company. Please note,

however, that a marked-up version of this guideform will not be accepted. You must separately type and prepare

your articles, using this form as a guide, inserting appropriate information and omitting all inapplicable portions,

including the header, seal of the Commission, italicized text, and the text of options not utilized.

The articles must be in the English language, typewritten or printed in black on white, opaque paper 8 1/2" by 11"

in size, legible and reproducible, and free of visible watermarks and background logos. A minimum of 1" must be

provided on the left, top and bottom margins and 1/2" on the right margin. Use only one side of a page.

This form can be downloaded from our website at www.scc.virginia.gov/clk/dom_corp.aspx.

The articles of organization of the resulting limited liability company, which comply with the requirements of

Chapter 12 of Title 13.1 of the Code of Virginia, must be separately attached to the plan of entity conversion

that is included as a part of the articles of entity conversion. Form LLC-1011, which contains the minimum

provisions required by Virginia law to be set forth in the articles of organization of a Virginia limited liability

company, can be downloaded from our website at www.scc.virginia.gov/clk/dom_llc.aspx.

The name of the resulting limited liability company must satisfy the requirements of 13.1-1012 of the Code of

Virginia. The limited liability company name must contain the words "limited company" or "limited liability

company" or the abbreviation "LC", "L.C.", "LLC" or "L.L.C.". The proposed limited liability company name must

be distinguishable upon the records of the Commission. See 13.1-1012 of the Code of Virginia. To check the

availability of a limited liability company name, please contact the Clerks Office Call Center at (804) 371-9733 or

toll-free in Virginia at (866) 722-2551.

The plan of entity conversion must set forth the manner and basis of converting the outstanding shares of the

corporation's stock into interests in the resulting limited liability company. This is often expressed as a ratio, as it

allows one to determine the membership interests each shareholder will receive when the corporation becomes a

limited liability company. The conversion ratio can be determined by dividing 100% by the number of issued and

outstanding shares. For example, if 500 shares of common stock are issued and outstanding, the plan could

provide that Each outstanding share of common stock will be converted into a 0.2% membership interest in the

resulting limited liability company. However, if one person holds all of the outstanding shares, it would be sufficient

to state that the shares held by the sole shareholder will be converted into a 100% membership interest in the

resulting limited liability company. IMPORTANT: The manner and basis of converting the shares of the corporation

into interests in the resulting limited liability company must preserve the ownership proportion and the relative rights,

preferences, and limitations of each share. See 13.1-722.10 of the Code of Virginia.

The plan of entity conversion must be adopted (i) by the unanimous consent of the shareholders, (ii) by the board

of directors and approved by each voting group of shareholders entitled to vote on the plan by more than twothirds of all the votes entitled to be cast by that voting group, unless the board of directors requires a greater vote

or the articles of incorporation provide for a greater or lesser vote, (iii) by a majority of the initial board of directors

if the corporation has not issued shares, or (iv) by a majority of the incorporators if the corporation has not issued

shares and there is no board of directors. See 13.1-722.11 of the Code of Virginia.

The articles of entity conversion must be signed in the name of the corporation by the chairman or any vice-chairman

of the board of directors, the president, or any other of its officers authorized to act on behalf of the corporation.

It is a Class 1 misdemeanor for any person to sign a document he or she knows is false in any material

respect with intent that the document be delivered to the Commission for filing. See 13.1-612 of the

Code of Virginia.

These articles may not be filed with the Commission until all fees and penalties to be collected by the Commission

under the Virginia Stock Corporation Act have been paid by or on behalf of the corporation; provided, however, that

an assessed annual registration fee does not have to be paid prior to filing if these articles are filed with an effective

date that is on or before the due date of the annual registration fee payment. See 13.1-615 of the Code of Virginia.

Submit the original, signed articles of entity conversion and articles of organization to the Clerk of the State

Corporation Commission, P.O. Box 1197, Richmond, Virginia 23218-1197, (Street address: 1300 East Main

Street, Tyler Building, 1st Floor, Richmond, Virginia 23219), along with a check for the filing fee in the amount of

$100.00, payable to the State Corporation Commission. DO NOT SEND CASH. If you have any questions,

please call (804) 371-9733 or toll-free in Virginia, 1-866-722-2551.

Você também pode gostar

- Amendment of Solicitation/Modification of ContractDocumento45 páginasAmendment of Solicitation/Modification of Contractb4031429Ainda não há avaliações

- Postmates Letter Re NYSLA Draft AdvisoryDocumento3 páginasPostmates Letter Re NYSLA Draft AdvisoryThe Capitol PressroomAinda não há avaliações

- 15 G Form (Pre-Filled)Documento2 páginas15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Military Out of State Vehicle Registration Forms For FloridaDocumento17 páginasMilitary Out of State Vehicle Registration Forms For Floridapnguin1979Ainda não há avaliações

- 16-15595 - 8400 Edes Ave PDFDocumento11 páginas16-15595 - 8400 Edes Ave PDFRecordTrac - City of OaklandAinda não há avaliações

- GZ200734 TX-DVM5845 17-Aug-2019: Green CommuterDocumento1 páginaGZ200734 TX-DVM5845 17-Aug-2019: Green CommuterJason WolfeAinda não há avaliações

- DocumentDocumento4 páginasDocumentIrwin William DavisAinda não há avaliações

- Lost Passport DeclarationDocumento2 páginasLost Passport DeclarationKerren PerdomoAinda não há avaliações

- Go to ApplicationDocumento4 páginasGo to Applicationashishgaur007Ainda não há avaliações

- Rebate FormDocumento1 páginaRebate FormDrew MoretonAinda não há avaliações

- Dependency Statement - Parent: Clark, Ranisher N. 422-21-8645 LSSNDocumento5 páginasDependency Statement - Parent: Clark, Ranisher N. 422-21-8645 LSSNAllison RodriguezAinda não há avaliações

- REG 195, Application For Disabled Person Placard or PlatesDocumento3 páginasREG 195, Application For Disabled Person Placard or Platestech20000Ainda não há avaliações

- This Is Only A Summary.: Important Questions Answers Why This MattersDocumento10 páginasThis Is Only A Summary.: Important Questions Answers Why This MattersAnonymous D47ZzQZDtAinda não há avaliações

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocumento8 páginasHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This Mattersapi-252555369Ainda não há avaliações

- National Health Service Corps Application - Loan Repayment Program - HHS HRSA NHSC LRPDocumento17 páginasNational Health Service Corps Application - Loan Repayment Program - HHS HRSA NHSC LRPAccessible Journal Media: Peace Corps DocumentsAinda não há avaliações

- APSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDocumento2 páginasAPSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDominic ChalmersAinda não há avaliações

- PDFDocumento2 páginasPDFpatluAinda não há avaliações

- Document PDFDocumento1 páginaDocument PDFAnonymous 1Ggwu1yAinda não há avaliações

- Disaster Unemployment Assistance Certification QuestionsDocumento5 páginasDisaster Unemployment Assistance Certification Questionsdavid wheelerAinda não há avaliações

- Credit Card Application For Principal CardholderDocumento1 páginaCredit Card Application For Principal CardholderLoay RashadAinda não há avaliações

- Zara Bill5 PDFDocumento1 páginaZara Bill5 PDFSushma KumariAinda não há avaliações

- Dusty YearEnd 2022 FEC RepotDocumento140 páginasDusty YearEnd 2022 FEC RepotPat PowersAinda não há avaliações

- Consular Electronic Application Center - Print ApplicationDocumento6 páginasConsular Electronic Application Center - Print ApplicationmeesumAinda não há avaliações

- Eticket 0149564965066 2Documento1 páginaEticket 0149564965066 2carlo boniolAinda não há avaliações

- OHRA Application FormDocumento4 páginasOHRA Application FormwangchanghuiAinda não há avaliações

- Ky Studen Drivers License Verification PDFDocumento1 páginaKy Studen Drivers License Verification PDFAnonymous FV7mWYAinda não há avaliações

- Remington & Vernick Engineers II, Inc.-2020 - BE - FormDocumento140 páginasRemington & Vernick Engineers II, Inc.-2020 - BE - FormRise Up Ocean CountyAinda não há avaliações

- Neustar (Rodney Joffe Co) FPDS Search - Contract AwardsDocumento139 páginasNeustar (Rodney Joffe Co) FPDS Search - Contract AwardsFile 411Ainda não há avaliações

- Financial Statement 2020Documento3 páginasFinancial Statement 2020Fuaad DodooAinda não há avaliações

- GetR229Form PDFDocumento3 páginasGetR229Form PDFGerson RegisAinda não há avaliações

- Dental BS Delta 1500 PPO Benefit Summary 2018Documento4 páginasDental BS Delta 1500 PPO Benefit Summary 2018deepchaitanyaAinda não há avaliações

- DMV CT Driver's License ApplicationDocumento1 páginaDMV CT Driver's License ApplicationMuneer A ShAinda não há avaliações

- Jahrid Burgess Court Summary ReportDocumento2 páginasJahrid Burgess Court Summary ReportLeigh EganAinda não há avaliações

- 2022 SHW Nursing LicenseDocumento1 página2022 SHW Nursing Licenseapi-488538030Ainda não há avaliações

- CignaDocumento7 páginasCignaUNKNOWN LSAAinda não há avaliações

- Courtesy LetterDocumento4 páginasCourtesy LetterMariella Grace VillaricoAinda não há avaliações

- AutoCheck - Vehicle History Reports 1FMZU72K12ZC84591 VIN Check, Your ReportDocumento4 páginasAutoCheck - Vehicle History Reports 1FMZU72K12ZC84591 VIN Check, Your Reportgungadin57% (7)

- Unemployment Insurance Oui/Duio April 27, 2020Documento25 páginasUnemployment Insurance Oui/Duio April 27, 2020Jennifer JohnsonAinda não há avaliações

- Chetan GehlotDocumento1 páginaChetan GehlotSamaAinda não há avaliações

- Emily Stallard ChargesDocumento1 páginaEmily Stallard ChargesErin LaviolaAinda não há avaliações

- Blue Cross Writ and Presuit Irog Regarding HK Porter Trust ClaimsDocumento25 páginasBlue Cross Writ and Presuit Irog Regarding HK Porter Trust ClaimsKirk HartleyAinda não há avaliações

- 081 - Alb-Ducros Tepelena SHDocumento1 página081 - Alb-Ducros Tepelena SHapi-283005704Ainda não há avaliações

- Inversiones Alsacia Disclosure StatementDocumento648 páginasInversiones Alsacia Disclosure StatementDealBookAinda não há avaliações

- Motor Vehicle Inspection Appointment 15052018165442Documento1 páginaMotor Vehicle Inspection Appointment 15052018165442Gilbert KamanziAinda não há avaliações

- SBI e-receipt for NPCIL recruitment application feeDocumento1 páginaSBI e-receipt for NPCIL recruitment application feeAshwin GRAinda não há avaliações

- ULAPSADocumento2 páginasULAPSANew GlobalAinda não há avaliações

- Japan Visa Application FormDocumento2 páginasJapan Visa Application FormPartheebanAinda não há avaliações

- Kurnia Travel Insurance DetailsDocumento26 páginasKurnia Travel Insurance DetailsBhavaniAinda não há avaliações

- 2019-H-294-01023 Acosta Bridge Decorative Lighting Permit - RedactedDocumento28 páginas2019-H-294-01023 Acosta Bridge Decorative Lighting Permit - RedactedAnne SchindlerAinda não há avaliações

- Kings County MERS To Bank of NY Assignment of 23 Jul 2008 Bank of NY V AlderaziDocumento4 páginasKings County MERS To Bank of NY Assignment of 23 Jul 2008 Bank of NY V AlderaziWilliam A. Roper Jr.Ainda não há avaliações

- Denver Emergency Operations Center April 4, 2020 Situation ReportDocumento9 páginasDenver Emergency Operations Center April 4, 2020 Situation ReportMichael_Roberts2019Ainda não há avaliações

- Iowa Applicarion FormDocumento4 páginasIowa Applicarion FormRajat PatelAinda não há avaliações

- ACFrOgBwQvRHVNt3wkSr-iydMTJjUhN0otU2QiaOeFXKNgOBS1ualGRA - Kc8UvsaB0f7Ives8JzHU3-QYGpyrFZ-czYWYeJHxN6jogwOK3wzaxX7skgOVRzszt-ovdE PDFDocumento3 páginasACFrOgBwQvRHVNt3wkSr-iydMTJjUhN0otU2QiaOeFXKNgOBS1ualGRA - Kc8UvsaB0f7Ives8JzHU3-QYGpyrFZ-czYWYeJHxN6jogwOK3wzaxX7skgOVRzszt-ovdE PDFJade JonesAinda não há avaliações

- State Inspection of Vicky Bakery in Pembroke PinesDocumento3 páginasState Inspection of Vicky Bakery in Pembroke PinesAmanda RojasAinda não há avaliações

- FY 2022 April 20 2022 Comptroller LetterDocumento18 páginasFY 2022 April 20 2022 Comptroller LetterHelen BennettAinda não há avaliações

- Geico New Theft Claim Signed Form of October 3, 2016Documento4 páginasGeico New Theft Claim Signed Form of October 3, 2016Stan J. CaterboneAinda não há avaliações

- Gov - Us CourtsDocumento49 páginasGov - Us CourtsVerónica SilveriAinda não há avaliações

- Virginia Articles of IncorporationDocumento2 páginasVirginia Articles of IncorporationRocketLawyerAinda não há avaliações

- Saddle Creek Avon Ohio Homeowners Association 2012Documento20 páginasSaddle Creek Avon Ohio Homeowners Association 2012James LindonAinda não há avaliações

- Home Fit LLC - Operating - AgreeementDocumento13 páginasHome Fit LLC - Operating - AgreeementChad TierneyAinda não há avaliações

- Consumer Protection LawDocumento22 páginasConsumer Protection LawHarmanSinghAinda não há avaliações

- Socrates vs. Commission On Elections, G.R. No. 154512 - Case DigestDocumento2 páginasSocrates vs. Commission On Elections, G.R. No. 154512 - Case DigestAlena Icao-AnotadoAinda não há avaliações

- Guideline Answers: Executive Programme (New Syllabus)Documento88 páginasGuideline Answers: Executive Programme (New Syllabus)Jasmeet KaurAinda não há avaliações

- AMLA 4 PDIC V Gidwani GR 234616 PDFDocumento17 páginasAMLA 4 PDIC V Gidwani GR 234616 PDFMARIA KATHLYN DACUDAOAinda não há avaliações

- Allen V USCIS/DHS FOIA Release - Lolo Soetoro (Obama's Step-Father) U.S. Records - 7/29/10Documento97 páginasAllen V USCIS/DHS FOIA Release - Lolo Soetoro (Obama's Step-Father) U.S. Records - 7/29/10ObamaRelease YourRecords100% (2)

- Pre Trial BriefDocumento21 páginasPre Trial BriefRonna Faith MonzonAinda não há avaliações

- Engagement Contract SampleDocumento2 páginasEngagement Contract SampleGerry OmbrogAinda não há avaliações

- Partnerships: Termination and Liquidation: Chapter OutlineDocumento51 páginasPartnerships: Termination and Liquidation: Chapter OutlineJordan Young100% (1)

- Sample Thesis Title For Criminology Students in The PhilippinesDocumento5 páginasSample Thesis Title For Criminology Students in The Philippinesh0nuvad1sif2100% (1)

- DOJ Circular No. 70Documento3 páginasDOJ Circular No. 70Sharmen Dizon Gallenero100% (1)

- RST Adult Criminal Arraignments October 1 - 31, 2018Documento22 páginasRST Adult Criminal Arraignments October 1 - 31, 2018Ojinjintka News0% (1)

- Reglamento de Construccion en BeliceDocumento18 páginasReglamento de Construccion en BeliceLuis NoveloAinda não há avaliações

- Pre-Trial Memorandum: Superior Court (Toronto Region)Documento4 páginasPre-Trial Memorandum: Superior Court (Toronto Region)Azirah Yoj Ripalda HembraAinda não há avaliações

- SAMPLE Exam Foundations Jan 2019Documento6 páginasSAMPLE Exam Foundations Jan 2019Laura KeohaneAinda não há avaliações

- Policy & Consultation Unit: Meeting Dpas From Western Balkans and Eastern Partnership CountriesDocumento17 páginasPolicy & Consultation Unit: Meeting Dpas From Western Balkans and Eastern Partnership CountriesAdialAinda não há avaliações

- Ironridge Breathes LIFE Into Debt ExchangesDocumento2 páginasIronridge Breathes LIFE Into Debt ExchangesIronridge Global PartnersAinda não há avaliações

- Taxation Multiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocumento6 páginasTaxation Multiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRandy ManzanoAinda não há avaliações

- Notification Assam Apex Bank Assistant Branch Manager Assistant Manager PostsDocumento2 páginasNotification Assam Apex Bank Assistant Branch Manager Assistant Manager PostsSunil SinghAinda não há avaliações

- People vs. TevesDocumento6 páginasPeople vs. TevesnathAinda não há avaliações

- Arrieta vs. LlosaDocumento5 páginasArrieta vs. LlosaJoni PurayAinda não há avaliações

- Ortega v. CA - DigestDocumento3 páginasOrtega v. CA - DigestJaysieMicabalo100% (1)

- Special Power of AttorneyDocumento2 páginasSpecial Power of Attorneyariel camusAinda não há avaliações

- Subway Surfers Privacy PolicyDocumento9 páginasSubway Surfers Privacy PolicyArpana MishraAinda não há avaliações

- Vasquez v. Philippine National BankDocumento11 páginasVasquez v. Philippine National BankKristine Faith CenizaAinda não há avaliações

- LL Project PDFDocumento31 páginasLL Project PDFKoustubh MohantyAinda não há avaliações

- Article 1590 and 1591Documento3 páginasArticle 1590 and 1591MariaHannahKristenRamirezAinda não há avaliações

- Mangahas vs. Paredes, 2007Documento4 páginasMangahas vs. Paredes, 2007SophiaFrancescaEspinosaAinda não há avaliações

- The Role of A Lawyer in SocietyDocumento16 páginasThe Role of A Lawyer in SocietyDAWA JAMES GASSIMAinda não há avaliações

- Corpus Juris Secundum On Grand JuryDocumento2 páginasCorpus Juris Secundum On Grand JurycelticfyrAinda não há avaliações

- HR and IHLDocumento7 páginasHR and IHLahmedistiakAinda não há avaliações