Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Assets and Liabilities Guide

Enviado por

Chota H MpukuTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Assets and Liabilities Guide

Enviado por

Chota H MpukuDireitos autorais:

Formatos disponíveis

8/14/2014

Introduction

FINANCIAL

ASSETS AND

LIABILITIES

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Learning outcomes

Explain what financial instruments are

Define financial instruments in terms of

financial assets and financial liabilities

Distinguish between the categories of

financial instruments

Distinguish between debt and equity

capital

Account for compound instruments

14/08/2014

Introduction

IAS 32 Financial instruments: presentation

IAS 39 Financial instruments: recognition

Account for issue of equity shares & payment

and measurement

of equity dividends

for the issue of redeemable

preference shares and payment of preference

share dividends

Understand the recognition, Presentation and

disclosure of financial instruments

IFRS 7 Financial instruments: disclosures

IFRS 9 Financial instruments

Account

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Note :IFRS 9 was issued in 2009 and is

effective January 2015 but earlier adoption

is permitted will eventually replace IAS 39

&32

3

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Definition of Financial instrument

Definition of financial asset

A financial instrument is any

contract that gives rise to a

financial asset of one entity and a

financial liability or equity on

another entity e.g.

Bonds ,stocks

and derivative

instruments

A financial asset is any asset that has:

A contractual right to receive cash or another

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Accounting standards

Learning outcomes

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

financial asset from another entity

contractual right to exchange financial

assets/liabilities with another entity under

conditions that are potentially favorable

An equity instrument of another entity

E.G

Trade receivables(note), Options,

Investment in equity shares. Investment in

Bond, or loans

A

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

8/14/2014

Definition of financial

liability/asset

Definition of financial liability

A financial liability is any liability that is a

contractual obligation:

To deliver cash or another financial asset to another

entity, or

To exchange financial instruments with another

entity under conditions that are potentially un

favorable, or

That will or may be settled in the entitys own equity

instruments.

E.g. trade payables, Bonds, Debenture loans,

Redeemable preference shares

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

A 'contract' need not be in writing, but it

must comprise an agreement that has 'clear

economic consequences' and which the

parties to it cannot avoid, usually because

the agreement is enforceable in law.

There should be a contractual obligation

to receive cash or another financial

instrument

7

Examples

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Which of the following are financial

Assets /liabilities

1. inventories,

2. property, plant and equipment

3. Investment in ordinary shares

4. Prepayment for goods or service

5. Income tax liability

9

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Solution

Solution

1. Inventory :no present or contractual right

3.Investment in ordinary shares; Yes there

is contractual obligation and it is an

instrument of another entity.

4. Prepayment for goods or service. No

future economic benefit is goods or service

not a financial asset

5. Income tax liability. No it is a statutory

not contractual obligation.

to receive cash

2. property, plant and equipment; Control

of physical assets creates an opportunity

to generate an inflow of cash or other

assets, but it does not give rise to a

present right to receive cash or other

financial asset

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Question to think about

When a company borrow a loan or sells

a Bond that's a financial liability

When a company lends out a loan or

buys a Bond that's a financial asset

14/08/2014

14/08/2014

11

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

10

12

8/14/2014

Classification of financial

instruments

Classification of financial

instruments(asset/liability)

A financial liability has a contractual obligation:

to deliver cash or another financial asset to another

entity, or to exchange financial instruments with

another entity under conditions that are potentially un

favorable, or

A financial asset has a contractual right to

receive cash or another financial asset from another

entity, or to exchange financial instruments with

another entity under conditions that are potentially

favorable

Eg Bonds ,loans ,redeemable preference shares

Classified in to 2

1. Asset /liability instruments

2. Equity instruments

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

13

14/08/2014

Classification of financial

instruments(equity)

An entity recognize a financial asset or

a financial liability in the statement of

financial Position when, and only

when, it becomes a party to the

contractual provisions of the

instrument.

contractual obligation/ right

Although the holder of an equity instrument may be

entitled to receive dividends , the holder cannot under

law force the issuer to declare dividends, so the issuer

does not have a contractual obligation to make such

distributions

E.g. common stoke and preference shares

Note: redeemable preference shares are classified as a

liability because the issuer has a contractual

obligation to deliver cash to the order on the

redemption date.(if the company bought then its in

asset

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

15

14/08/2014

Derecognition of financial

asset/liability

when, and only when, the

contractual rights to the cash flows of the

financial asset have expired

Liability when, and only when, the

obligation specified in the contract is

discharged, cancelled or expires

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

16

Measurement of financial

instrument

Asset

14/08/2014

14

Recognition of financial

instruments

An equity financial instrument does not give rise to a

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

How the instrument is measured depends

on its classification

a liability /asset or equity

We will start with Liabilities then assets and

conclude with a equity

17

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

18

8/14/2014

Subsequent measurement of

financial liability

Measurement of financial Liability

all financial Liabilities are initially

Liabilities incurred for speculative purposes

measured at fair value. This is likely to be

the purchase consideration received for the

financial liability less issue costs

Fair value =Cost discount issue costs

Transaction costs/gains are expensed to the

income statement

are measured at fair value any gains

/losses are taken to the income statement

All other liabilities are measured

at

amortised cost using the effective

interest rate method

Examples of liabilities include, loans

payable and deep discount bonds

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

19

Method used to calculate how much should

be charge to income statement and in the

statement of Financial position

amount or the face value of the bond/loan

Effective interest rate=the periodic

interest rate charged for the debt

Coupon payment =periodic payment

made toward the interest

At maturity =par value should be paid

together with the interest outstanding

repayments

Interest is charged at the effective rate

Note: Financial management principles

needed to apply this method

21

Reminders BAC 331 features of

debt

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Example

Discount means fair value amount received

A K2, 500 8 % bond debt is redeemable at

is less than face value

Par means amount received is equal to face

value

Premium means amount received is greater

than face value

K3, 125. The debt will mature after 5 years.

The effective rate of interest is 10%

What is the annual rate of interest to be

charged

What is the annual rate of interest to be paid

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

22

Reminders BAC 331 features of

debt

Debt can be at discount ,par or premium

14/08/2014

20

Par value or nominal value=the principle

Amortised cost=Initial cost + interest-

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Reminders BAC 331 features of

debt

Amortised cost method

14/08/2014

14/08/2014

23

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

24

8/14/2014

Reminders BAC 331 features of

debt

Amortised cost method

Solution

annual rate of interest to be charged is 10%

of the Of outstanding amount (not fixed)

annual rate of interest to be paid is 8% of

Amortised cost=Initial cost + interest-

par value (fixed) 2,500 X 0.08 =200

repayments

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

Method used to calculate how much should be

charge to income statement and in the statement

of Financial position

25

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Solution

Example

A company issues 4% loan notes with a nominal

value of K100, 000. The loan notes are issued at

a discount of 2.5% and K2, 670 of issue costs are

incurred. The loan notes will be repayable at a

premium of 10% after 5 years. The effective rate of

interest is 7%.

a)What amount will be recorded as a financial

liability when the loan notes are issue

b)What amounts will be shown in the income

statement and statement of financial

position for years 1 5?

c) Show the journal entries for (a)and (b)

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

27

a)Liability initially recorded at fair value

Fair Value =Cost discount-issue cost

Cost =100,000

Discount=2,500(100,000 x 0.025)

Issue cost K2,670

Fair Value =100,000-2,500-2670

K 94,830

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Solution

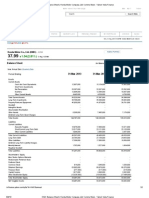

1

2

3

4

5

Cash paid 4%

Finance cost are charged to the income statement

Closing

The closing balance is the liability in the statement of

financial position

Year Finance cost(i/s)

(4,000)

97,468

(4,000)

100,290

(4,000)

103,310

(4,000)

106,542

(4,000)

(110,000)

0

Note the balance at year 5 would have been (110,00) which is repaid

as principle

If interest is paid at the beginning subtract from the opening

balance then calculate the finance charge

14/08/2014

94,830

97,468

100,290

103,310

106,542

Finance

costs 7%

6,638

6,822

7,020

7,232

7,457

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

28

Solution

B)Amount to be shown in income statement

Year Opening

26

1

2

3

4

5

29

14/08/2014

6,638

6,822

7,020

7,232

7,457

Non-current

liabilities(SFP)

97,468

100,290

103,310

106,542

0

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

30

8/14/2014

Solution

Example 2

A company issues 0% loan notes at their

nominal value of K20, 000. The loan notes are

repayable at a premium of K5, 900 after 3 years.

The effective rate of interest is 9%.

a)What amount will be recorded as a

financial liability when the loan notes are

issued?

b)What amounts will be shown in the

statement of profit or loss and statement of

financial position 1 -3-?

c)Show the journals for (a) and (b)

Journal entries

a)when loan is issued

Dr

cashbook

N.C.Liability

94,830

During the years(1-5)

Finance Charge

N.C.Liability

as calculated

as calculated

Payments(year 1-5)

N.C.Liability

Cash book

loan Repayment year 5

N.C.Liability

Cash book

14/08/2014

Cr

94,830

4,000

4,000

110,000

110,000

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

31

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

Solution

32

solution

B)Amount to be shown in income statement

a)Liability initially recorded at fair value

Fair Value =Cost discount-issue cost

Cost =20,000

Discount=0

Issue cost =00

Fair Value =K20,000

Year

Opening

20,000

Finance

costs 9%

1,800

21,800

1,962

23,762

2,138

Cash paid 0%

Closing

(0)

21,800

(0)

23,762

(0)

(25,900)

The loan notes are repaid at par i.e. K20, 000, plus a premium of K5,

900 at the end of yea 3.

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

33

14/08/2014

Solution

Preference shares

K20,000

During the years(1-3)

Finance Charge

as calculated

N.C.Liability

loan Repayment year 3

N.C.Liability

25,900

Cash book

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

34

Redeemable preference shares are classified as

When the loan notes are issue:

Dr cash book

Cr Loan notes

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

a liability because the issuer has a contractual

obligation to deliver cash to the order on the

redemption date.(if the company bought then

its in asset

Irredeemable preference shares are classified as

equity

Redeemable shares are initially measure at fair

value and subsequent at amortised cost if not

held for resale

K20,000

as calculated

25,9000

35

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

36

8/14/2014

example

Solution

On 1 April 2007, a company issued 80,000 K1

redeemable preference shares with a coupon rate of

8% at par. They are redeemable at a large premium

which gives them an effective finance and cost of 12%

per annum.

How would these redeemable preference shares

appear in the financial statements for the years

ending 31 March 2008 and 2009?

Show the journal entries

Annual payment =80,000 x K1 x 8% =

Period Opening

Finance Cash

ended

balance

cost

paid

31 March

@ 12% @8%

2008

80,000

2009

83,200

9,600

9,984

(6,400)

(6,400)

i/s

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

37

Solution

86,784

SFP

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

38

all financial assets are initially measured at

fair value. This is likely to be the purchase

consideration paid to acquire the financial

asset

Dr cash book K80,000

Cr Ncliability

K80,000

2. Finance charge during the period

Dr interest expense amount calculated

Cr Ncliability amount calculated

3Cash payment

Dr

Ncliability

6400 (per year)

Cr

Cash book

6400

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Transaction costs are expensed to the

income statement

39

14/08/2014

Subsequent measurement depends upon

whether the financial asset is an investment

held for Speculative(sale) or to hold it till

maturity

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

40

Subsequent measurement of

financial assets

Subsequent measurement of

financial assets

14/08/2014

83,200

Measurement of Financial assets

Journals

1. When stock is issued

14/08/2014

14/08/2014

K6,400

Closing

balance

41

Assets can be measured using either of the

following methods.

1. Fair value method-based on the

consideration received or given( any gain

/losses are taken to income statement)

2. Amortised

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

42

8/14/2014

Amortised cost method

The business model test

The amortised cost = initial cost + interestrepayments.

The interest will be charged at the effective rate. This

is the internal rate of return of the instrument

This test establishes whether the entity holds

Amortised cost is only used if the 2 test are met

1.The business model test

2.Contractual cash f low characteristics

test

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

43

the financial asset to collect the contractual

cash flows or sell the financial asset prior

to maturity to realize changes in fair value.

If its to collect the cash flows then the asset has

passed this test and the amortized cost method

can be used

IF its for sell the fair value should be used

14/08/2014

The contractual cash flow

characteristics test

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Example

This test determines whether the contractual

A company invests K5, 000 in 10% loan notes. The loan

terms of the financial asset give rise to cash

flows on specified dates that are solely of

principal and interest based upon the

principleamount outstanding.

.If this is not the case, the test is failed and the

financial asset cannot be measured at

amortised cost but at fair value.

EG convertible bonds have a right to convert the

bond to equity so dont qualify

notes are repayable at a premium after 3 years. The

effective rate of interest is 12%. The company intends to

collect the contractual cash flows which consist solely of

repayments of interest and capital and have therefore

chosen to record the financial asset at amortised cost.

What amounts will be shown in the income statement

and statement of financial position for the financial

asset for years 1 -3?

Show the journal entries

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

45

14/08/2014

Solution

Year Opening Investment

Income 12%

1

5,000

600

2

5,100

612

3

5,212

625

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

46

Solution

Cash

Closing

received 10%

(500)

5,100

(500)

5,212

(500)

(5,337)

0

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

44

1.

Journals

When loan is given

Dr asset (investment)

Cr Cash book

K5,000

K5,000

2. Investment income during the period

Dr Asset(investment )

amount calculated

Cr investment income

amount calculated

3Cash payment

Dr Cash book

5,000 (per year)

Cr

Asset(investment )

5,000

4 Final receipt repayment

Dr cash book

5,337

Cr

Asset(investment )

5,337

47

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

48

8/14/2014

Measurement of Equity

instrument

Measurement of Equity

instrument held for trading

The equity instruments are measured

Measured at Fair value through Income

depends on whether they are held for

trading or as an investment (not for trading)

statement

This means that equity instrument is always recorded

at market value in the statement of financial position

The difference between original price and the market

price is taken to the income statement under

investment income

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

49

14/08/2014

Measurement of Equity

instrument not held for trading

Example

company in November 2007 at a cost of K4. 20 per

share. At 31 December 2007 the shares a market

value of K4.90. The company is planning on

selling these shares in April 2008.

Prepare extracts from the statement of profit

or loss for the year ended 31 December 2007

and a statement of financial position as at that

date.

Show the journal entries

The difference between original price and the market

price is taken to the reserves in the statement of

comprehensive income

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

51

14/08/2014

solution

This an investment held for trading purposes as the

company plans to sell these shares. The investment

should therefore be measured at fair value through

income statement.

Statement of profit or loss

Investment Income (10,000 x (4.90 4.20))

7,000

Statement of Financial Position

Current assets

Investments (10,000 x 4.90)

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

50

(2) A company invested in 10,000 shares of a listed

Measured at Fair value through other

comprehensive income

Other comprehensive income is income and expenses

that are not recognized in the income statement but

are recorded in reserves

This means that equity instrument is always recorded

at market value in the statement of financial position

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

49,000

53

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

52

Solution

Journals

Initial investment

Dr investment in equity K42,000 (4.2 x 10,000)

Cr cash book

K42,000

Change in market value

Dr investment in equity 700((4.9-4.2)x10,000)

Cr investment income

700

Note if the price has gone down the asset is cr and

investment expense Dr

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

54

8/14/2014

Example 2

Solution

The investment is a financial asset at fair value

through through other comprehensive income.

Statement of profit or loss

Revaluation reserves (20,000 x (3.40 3.80)) (8,000)

A company invested in 20,000 shares of a listed

company in October 2007 at a cost of K3.80 per share.

At 31 December 2007 the shares have a market value of

K3.40. The company is not planning on selling these

shares in the short term.

Prepare extracts from the statement of profit or

loss for the year ended 31 December 2007 and a

statement of financial position as at that date

Show the journal entries

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

Statement of Financial Position

Non-current assets

Investments (20,000 x 3.40)

55

14/08/2014

Journals

56

Off setting not allowed except when the entity

Initial investment

Dr investment in equity K76,000 (3.8 x 20,000)

Cr cash book

K76,000

Change in market value

Cr investment in equity

8000((3.4-3.8)x20,000)

Dr Revaluation reserves 8000

Note if the price has gone up the asset is Dr and

Reserves Cr

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Has a legally enforceable right to set off the

amounts, and

Intends either to settle on a net basis or to realize the

asset and settle the liability simultaneously

57

14/08/2014

Compound instruments

58

IAS

32 required compound financial

instruments be split into their component

parts:

A financial liability (the debt)

An equity instrument (the option to convert

into shares).

These must be shown separately in the

financial statements.

characteristics of both equity and liability .E.g.

debt that can be converted into shares like

convertible bonds

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Compound instruments

This is a financial instrument that has

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Offsetting financial

assets/financial liabilities

Solution

14/08/2014

68.000

59

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

60

10

8/14/2014

Compound instruments how to

split and record

Compound instruments how to

split and record

Step 3

Step 1

Basing on the amortized cost method ,and using

Calculate liability component first by finding the value of

the bond( present value of future cash flows assuming

non-conversion)

Apply discount rate equivalent to interest on similar nonconvertible debt instrument (i.e. discount the cash flows at

the market rate of interest)

Step 2

Calculate the equity component by

deducting the present value of the debt from the proceeds

of the issue

the amount of liability found as the opening

balance calculate amounts to be recorded in

income statement and statement of financial

position

Step 4

Calculate the conversion amount basing on

information given

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Note use financial management principles on

calculating present value(time value of money )

61

Reminders BAC 331 present value

The process of finding the present

value is called discounting

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

62

Reminders BAC 331 present value

Present Value is the current value of the

future sum discounted back to the

present at an appropriate interest rate.

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

PV= FV

or

(1+r) n

PV = FV = ( 1+r)- n

discount factor

PV is the present value to be calculated

FV is the future value given

r is the interest rate

n is the number of periods interest is earned

63

Reminders BAC 331 present value

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

14/08/2014

64

Reminders BAC 331 present value

Solution

Example

( 1+r)- n

Barclays bank issues 2500o 5% loan that

attracts interest rate of 10 % and is

repayable in full after three years.

What is the present value of the loan?

Year Cash

flow

1

1,250

2

3

3

1,250

1,250

25000

Discount factor

( 1+0.1)- 1 =0.909

Fv X discount factor

Present value

1,250X0.909=1,136

( 1+0.1)- 2 =0.826

1+0.1)- 3 =0.751

(

(1+0.1)-3 0.7513

1,250X0.826=1,033

1,250X0.751=939

25000X0.751=18,775

PV=1,136+1033+939+18,782=21,890

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

65

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

66

11

8/14/2014

Reminders BAC 331 present value

alternative

Reminders BAC 331 present value

PV =

PV =

1- (1+r)-n

r

+ Par(1+r)-n

PVA is present value of an annuity to be calculated

a is the installment payment/receipt

r is the interest rate

n is number of periods interest is given

8/14/2014

TIME VALUE OF MONEY

67

Example compound instrument

8/14/2014

1,250 1- (1.1)-3

0.1

+25000(1+0.1)-3

3,108.56+18,782.87

21,891.43

TIME VALUE OF MONEY

68

Example compound instrument

The present value of K1 payable at the end of year, based on rates of

2% and 9% are as follows:

A company issues 2% convertible bonds at their nominal

value of K36, 000.

End of year

1

2

3

The bonds are convertible at any time up to maturity

into 120 ordinary shares for each K100 of bond.

Alternatively the bonds will be redeemed at par after 3

years.

2%

0.98

0.96

0.94

9%

0.92

0.84

0.77

What amounts will be shown as a financial liability and as

equity when the convertible bonds are issued?

Similar non-convertible bonds would carry an interest

rate of 9%.

What amounts will be shown in the income statement and

statement of financial position for years 1 3?

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

69

14/08/2014

Solution

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

70

solution

Step 1 Calculate liability component

Cash flow = 2% x 36,000 = 720

YearCash flow Discount factor 9%Present value

1

720

0.92

662.4

2

720

0.84

604.8

3

720

0.77

554 .4

3

36,000

0.77

27,720

29,541.6

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

Calculate the equity component

proceeds of the issue-liability component

36,000- 29,541.6=6,458

Journal entry

When the convertible bonds are issued:

Dr Bank

K36, 000

Cr Financial Liability

K29,542

Cr Equity

K6,458

71

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

72

12

8/14/2014

Solution

Solution

Step 4 Calculate the conversion of bond

Caring amount as at end of year 3

Equity

6,458

Bond

36,000

42,458

120 ordinary shares for each K100 of bond.

Step 3 measurement of liability amortized cost

Year Opening

Finance

Cash paid 2% Closing

costs 9%

1

29,542

2,65

(720)

31,481

2

31,481

2,853

(720)

33,594

3

33,594

3,023

(720)

(36,000)

I/S

14/08/2014

X shares for 36,000 bond

( 120X 36,000) /100

=43,200

The difference between the Caring amount and the

conversion amount is recorded as either discount or

premium 42,458-43,200=742 discount

0

SFP

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

73

14/08/2014

Disclosure must be made for each type of financial

instrument (Liability ,asset or equity)

dividends depends upon the accounting

treatment of the underlying instrument

itself. E.g.

Equity dividends declared are reported

directly in equity

Dividends on redeemable preference shares

classified as a liability are an expense in the

income statement .

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

74

Disclosure

Interest dividends ,loses and gains

The accounting treatment of interest and

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

gains expenses and losses should be shown

appropriately

75

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

76

Any questions

14/08/2014

FINANCIAL ASSETS AND LIABILITIES(IFRS

7,IFRS9,IAS 32,39)

77

13

Você também pode gostar

- Cash & ReceivablesDocumento53 páginasCash & Receivablesnati100% (1)

- Cash Budget Sums Mcom Sem 4Documento14 páginasCash Budget Sums Mcom Sem 4Prachi BhosaleAinda não há avaliações

- Financial AssetDocumento14 páginasFinancial AssetkhushboogeetaAinda não há avaliações

- #15 Investment in AssociatesDocumento3 páginas#15 Investment in AssociatesZaaavnn VannnnnAinda não há avaliações

- FM - Cost of CapitalDocumento26 páginasFM - Cost of CapitalMaxine SantosAinda não há avaliações

- Tutorial 1: 1. What Is The Basic Functions of Financial Markets?Documento6 páginasTutorial 1: 1. What Is The Basic Functions of Financial Markets?Ramsha ShafeelAinda não há avaliações

- 03-IAS 8 Accounting Policies, Changes in Estimates and Correction of ErrorsDocumento20 páginas03-IAS 8 Accounting Policies, Changes in Estimates and Correction of Errorsrfhunxaie100% (2)

- Chapter 7: Receivables: Principles of AccountingDocumento50 páginasChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Understanding Cash and Cash EquivalentsDocumento43 páginasUnderstanding Cash and Cash EquivalentsMarriel Fate CullanoAinda não há avaliações

- Managerial Economics: Unit 9: Risk AnalysisDocumento49 páginasManagerial Economics: Unit 9: Risk AnalysisPablo SheridanAinda não há avaliações

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocumento15 páginasCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroAinda não há avaliações

- Ias-40 - Investment PropertyDocumento16 páginasIas-40 - Investment PropertyPue Das100% (2)

- Investment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldDocumento7 páginasInvestment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldMark Anthony SivaAinda não há avaliações

- Financial ManagementDocumento49 páginasFinancial ManagementBabasab Patil (Karrisatte)Ainda não há avaliações

- Cost of CapitalDocumento31 páginasCost of CapitalAnamAinda não há avaliações

- IA For Prelims FinalDocumento438 páginasIA For Prelims FinalCeline Therese BuAinda não há avaliações

- Fundamentals of Accounting I: Conceptual Framework (ACCT 1A&BDocumento12 páginasFundamentals of Accounting I: Conceptual Framework (ACCT 1A&BericacadagoAinda não há avaliações

- CH 15Documento86 páginasCH 15saadsaaidAinda não há avaliações

- Shareholder's Equity: ReviewDocumento12 páginasShareholder's Equity: ReviewG7 HexagonAinda não há avaliações

- Credit Risk Management at Awash BankDocumento67 páginasCredit Risk Management at Awash BankMelesAinda não há avaliações

- Financial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksDocumento5 páginasFinancial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksAnamMalikAinda não há avaliações

- Banking and Insurance PPT Unit-2,3 and 4Documento88 páginasBanking and Insurance PPT Unit-2,3 and 4d Vaishnavi OsmaniaUniversityAinda não há avaliações

- Financial Management Among StudentsDocumento4 páginasFinancial Management Among Students우김민Ainda não há avaliações

- Cash & Cash Equivalents Composition & Other Topics CashDocumento5 páginasCash & Cash Equivalents Composition & Other Topics CashEurich Gibarr Gavina EstradaAinda não há avaliações

- Financial Management - Chapter 1 NotesDocumento2 páginasFinancial Management - Chapter 1 Notessjshubham2Ainda não há avaliações

- C8 Recievable Financing Pledge Assignment FactoringDocumento32 páginasC8 Recievable Financing Pledge Assignment FactoringAngelie LaxaAinda não há avaliações

- Auditing Liabilities ModuleDocumento4 páginasAuditing Liabilities ModuleAngela AralarAinda não há avaliações

- BSA2A WrittenReports Thrift-BanksDocumento5 páginasBSA2A WrittenReports Thrift-Banksrobert pilapilAinda não há avaliações

- Bank ReserveDocumento11 páginasBank ReserveNicole Ocampo100% (1)

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocumento56 páginasModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoAinda não há avaliações

- Chapter 2: Introducing Money EssayDocumento1 páginaChapter 2: Introducing Money EssayhsjhsAinda não há avaliações

- Debt Securities Drill AnswersDocumento7 páginasDebt Securities Drill AnswersJoy RadaAinda não há avaliações

- Decision Theory GuideDocumento15 páginasDecision Theory GuideEngr Evans OhajiAinda não há avaliações

- FIN - Cash ManagementDocumento24 páginasFIN - Cash Management29_ramesh170Ainda não há avaliações

- H2 Accounting ProfessionDocumento9 páginasH2 Accounting ProfessionTrek ApostolAinda não há avaliações

- WCM - Unit 2 Cash ManagementDocumento51 páginasWCM - Unit 2 Cash ManagementkartikAinda não há avaliações

- 1 - Decentralization-Responsibility AccountingDocumento40 páginas1 - Decentralization-Responsibility AccountingZedie Leigh VioletaAinda não há avaliações

- What Is The Difference Between An Adjunct Account and A Contra AccountDocumento1 páginaWhat Is The Difference Between An Adjunct Account and A Contra AccountDarlene SarcinoAinda não há avaliações

- Loanable Funds TheoryDocumento21 páginasLoanable Funds TheoryluckvinothAinda não há avaliações

- NAS 20 Government GrantsDocumento15 páginasNAS 20 Government GrantsSushant MaskeyAinda não há avaliações

- Chapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That Is EstablishedDocumento11 páginasChapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That Is EstablishedJahangir AlamAinda não há avaliações

- Fixed Income Chapter4Documento51 páginasFixed Income Chapter4Sourabh pathakAinda não há avaliações

- Working Capital Management - Introduction - Session 1 & 2Documento56 páginasWorking Capital Management - Introduction - Session 1 & 2Vaidyanathan RavichandranAinda não há avaliações

- Financial Institutions and MarketsDocumento20 páginasFinancial Institutions and MarketsCome-all NathAinda não há avaliações

- Week 05 - 02 - Module 11 - Investment in Equity InstrumentsDocumento10 páginasWeek 05 - 02 - Module 11 - Investment in Equity Instruments지마리Ainda não há avaliações

- Provisions, Cont. Liability, & Cont. AssetsDocumento40 páginasProvisions, Cont. Liability, & Cont. Assetsyonas alemuAinda não há avaliações

- Investment PropertyDocumento26 páginasInvestment PropertyLovemore ChigwandaAinda não há avaliações

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaDocumento9 páginas6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghAinda não há avaliações

- Virtual Stock Trading Journal: in Partial Fulfilment of The RequirementsDocumento13 páginasVirtual Stock Trading Journal: in Partial Fulfilment of The RequirementsIrahq Yarte TorrejosAinda não há avaliações

- Compound Financial InstrumentDocumento1 páginaCompound Financial InstrumentMarissaAinda não há avaliações

- Ch14 Capital BudgetingDocumento20 páginasCh14 Capital BudgetingPatrick GoAinda não há avaliações

- Financial SystemDocumento32 páginasFinancial Systemneelabh1984Ainda não há avaliações

- The Conceptual Framework of Accounting and Its Relevance To Financial ReportingDocumento24 páginasThe Conceptual Framework of Accounting and Its Relevance To Financial Reportingmartain maxAinda não há avaliações

- Banking CH 2 Central BankingDocumento10 páginasBanking CH 2 Central BankingAbiyAinda não há avaliações

- Discounting Notes ReceivableDocumento3 páginasDiscounting Notes ReceivablerockerAinda não há avaliações

- Bonds CH08Documento16 páginasBonds CH08Hendrickson Cruz SaludAinda não há avaliações

- MFRS 139 Receivables GuideDocumento62 páginasMFRS 139 Receivables GuideRAUDAHAinda não há avaliações

- Financial Instruments Recognition and Measurement Group 1Documento5 páginasFinancial Instruments Recognition and Measurement Group 1Naurah Atika DinaAinda não há avaliações

- ACCT 302 Financial Reporting II Lecture 7Documento63 páginasACCT 302 Financial Reporting II Lecture 7Jesse NelsonAinda não há avaliações

- Financial Instruments: Presentation: Technical SummaryDocumento1 páginaFinancial Instruments: Presentation: Technical SummarydskrishnaAinda não há avaliações

- IAS 7 CASH FLOW STATEMENTDocumento14 páginasIAS 7 CASH FLOW STATEMENTChota H MpukuAinda não há avaliações

- Construction ContractsDocumento9 páginasConstruction ContractsChota H Mpuku100% (1)

- Conceptual Frame WorrkDocumento10 páginasConceptual Frame WorrkChota H MpukuAinda não há avaliações

- THE ACCOUNTING CYCLE and Presentention of Financial StatementsDocumento10 páginasTHE ACCOUNTING CYCLE and Presentention of Financial StatementsChota H MpukuAinda não há avaliações

- Facts Book February 2011 v1Documento52 páginasFacts Book February 2011 v1Harris MirzaAinda não há avaliações

- Revenue IAS 18Documento7 páginasRevenue IAS 18Chota H MpukuAinda não há avaliações

- Business Strategy: © CMA. John D. Nevin Source: ICAI BSSCM Study MaterialDocumento21 páginasBusiness Strategy: © CMA. John D. Nevin Source: ICAI BSSCM Study MaterialHari RamAinda não há avaliações

- A Systematic Approach To Optimizing CollateralDocumento7 páginasA Systematic Approach To Optimizing CollateralCognizantAinda não há avaliações

- HMC Balance Sheet - Honda Motor Company, LTD PDFDocumento2 páginasHMC Balance Sheet - Honda Motor Company, LTD PDFPoorvi JainAinda não há avaliações

- About BNYDocumento1 páginaAbout BNYAmjad KhanAinda não há avaliações

- Ability For Action and Response Outcomes Drivers of Competitive Behavior Interfirm RivalryDocumento30 páginasAbility For Action and Response Outcomes Drivers of Competitive Behavior Interfirm Rivalrylucky123321Ainda não há avaliações

- Asset Valuation Methods and FactorsDocumento4 páginasAsset Valuation Methods and FactorsSteffany RoqueAinda não há avaliações

- DigitalMarketing SampleDocumento34 páginasDigitalMarketing SampleVibrant PublishersAinda não há avaliações

- ECON7Documento2 páginasECON7DayLe Ferrer AbapoAinda não há avaliações

- P4-5 Consolidation Entries and Financial StatementsDocumento3 páginasP4-5 Consolidation Entries and Financial StatementsErnike SariAinda não há avaliações

- Services Marketing Christopher LovelockDocumento297 páginasServices Marketing Christopher LovelockKapilGhanshaniAinda não há avaliações

- American Greetings' Pricing StrategyDocumento6 páginasAmerican Greetings' Pricing StrategyAsma AliAinda não há avaliações

- Financial Management:: An Introduction To Risk and Return - History of Financial Market ReturnsDocumento70 páginasFinancial Management:: An Introduction To Risk and Return - History of Financial Market Returnsfreakguy 313Ainda não há avaliações

- ATRAM Alpha Opportunity Fund - Fact Sheet - Apr 2020Documento2 páginasATRAM Alpha Opportunity Fund - Fact Sheet - Apr 2020anton clementeAinda não há avaliações

- SAPM Punithavathy PandianDocumento22 páginasSAPM Punithavathy PandianVimala Selvaraj VimalaAinda não há avaliações

- Reading ComprehensionDocumento6 páginasReading ComprehensionDayana BettinAinda não há avaliações

- Summarizing Chapter 2Documento10 páginasSummarizing Chapter 2Walaa Ragab100% (1)

- Bhagyalaxmi Cotton: Bank Name - Icici Bankaccount No.-655705502528 IFCI CODE-ICIC0006557Documento2 páginasBhagyalaxmi Cotton: Bank Name - Icici Bankaccount No.-655705502528 IFCI CODE-ICIC0006557patni psksAinda não há avaliações

- Sample Earnest Money Receipt AgreementDocumento2 páginasSample Earnest Money Receipt AgreementRamil AustriaAinda não há avaliações

- Slides Session 4Documento37 páginasSlides Session 4matthiaskoerner19Ainda não há avaliações

- Stock AnalysisDocumento5 páginasStock AnalysisArun Kumar GoyalAinda não há avaliações

- Multiple-Choice Questions On E-CommerceDocumento5 páginasMultiple-Choice Questions On E-Commercevishal GAYAinda não há avaliações

- Alternative Investments - Cheat SheetDocumento6 páginasAlternative Investments - Cheat SheetUchit MehtaAinda não há avaliações

- Please List Team Members BelowDocumento35 páginasPlease List Team Members BelowHarshit Verma17% (6)

- MFEDocumento3 páginasMFEEmille Martin Crisostomo Munsayac IIAinda não há avaliações

- Assignment Giant Consumer Products: The Sales Promotion Resource Allocation DecisionDocumento5 páginasAssignment Giant Consumer Products: The Sales Promotion Resource Allocation DecisionKhushbooAinda não há avaliações

- Financial Markets 1Documento8 páginasFinancial Markets 1Nicole Andrea BernabeAinda não há avaliações

- Kraft AustraliaDocumento5 páginasKraft AustraliaAlbert John Velasco79% (19)

- Chapter - 2 Literature ReviewDocumento23 páginasChapter - 2 Literature ReviewMotiram paudelAinda não há avaliações

- A Parasailing Company Case StudyDocumento4 páginasA Parasailing Company Case StudyOla AlyousefAinda não há avaliações

- Final Sanjeev Sir PDFDocumento78 páginasFinal Sanjeev Sir PDFAmit SinghAinda não há avaliações