Escolar Documentos

Profissional Documentos

Cultura Documentos

Pps WP Payments

Enviado por

santhoshiharikaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Pps WP Payments

Enviado por

santhoshiharikaDireitos autorais:

Formatos disponíveis

W H I T E PA P E R

A Division of FTS

PRINCETON

PAYMENT

SOLUTIONS

TM

Implementing

Payments in SAP:

Dos and Donts for Implementing

Payments in SAP

April 2012

White Paper: Implementing Payments in SAP

Introduction / Overview

Quick Reference Guide

1

The Business of Card Payments

1 Behind the Scenes

3 Encryption

Card Payment in an SAP

Environment

4 Reports

4 Tuning

4 Reconciliation

Getting the Best Rates from the

Banking System

6 Collect Additional Data

6 In Person, MOTO and Web

Transactions

6 International Transactions in SAP

7 Chargebacks

7 Shop Around for Your Processor

7 Connect Directly to Processors

and Card Companies

A Quick List of Dos and Donts

Princeton Payment Solutions:

The Experts in SAP

10 Conclusion

10 About FTS | PPS

As a company, your goal is to serve your customer effectively and profitably, efficiently

generating sales and collecting revenue. The nature of the sale and payment can take

many forms, but more SAP users have noticed that many customers are shifting their

expectations, and want to use credit cards as the method of payment.

While card payment is a convenient payment form for customers, it can be costly for

a vendor. Processing fees can range as high as 2.5 to 3.4%, or more, of the transaction

total. And although SAP includes some of the capabilities required for card payment

(known as the payment card interface), it requires additional software (known as

middleware) in order to complete the transaction with the payment system, secure

the customers information, and provide critical data to the finance group to reconcile

the transactions and deposits at the end of the day. The SAP ERP solution does not

include its own middleware (or payment application, i.e. the electronic bank connection) there are too many communications formats to maintain and complex issues to

consider. Rather, SAP has designated that its users should obtain middleware from certified SAP partners. These independent middleware providers offer a menu of options,

from plain vanilla to very sophisticated tools designed to manage and reduce your

payments processing expenses.

This white paper explains the business of credit card payments and describes SAPs requirements for processing payment cards. It also presents tips for getting the best bank

rates and simple Dos and Donts that help you optimize payment processing, save

employees time in managing back-office payment functions, and substantially lower

overall interchange fees to reduce processing costs. Using the best practices described

in this paper, companies can save $5,000-7,000 for every million dollars in payments

processed.

The Business of Card Payments

Most people are familiar with the basics of a credit card transaction: the customer supplies the card information to the vendor company, which runs the transaction and

receives authorization for the payment. The charge posts to the customers card and the

companys bank account receives the funds.

The Action Behind the Scenes

When the customer swipes the card information (or provides it via telephone, printed

form, or Web), the data is sent to the vendors payment processor. The payment processor handles communications with the credit card associations, who ultimately communicate with the customers bank (the issuing bank) to collect payment and deposit the

cash in the vendors bank.

1. The processor electronically sends the card details to the appropriate card association (Visa or MasterCard) or card company (such as American Express), and

requests permission to charge the specified amount. This request is called authorization. The authorization process reserves the amount of the sale on that

card account to ensure that the customer doesnt go over his or her spending

limit.

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

2. The issuing bank verifies both that the card is valid and has not exceeded its

spending limit. This approval is transmitted back to the company through the

processor. From the customers perspective, the purchase is completed almost

instantly. Not so for the company.

Debit Cards

In general, debit cards are

not widely used for corporate

purchases, although the

industry is starting to see

more debit card purchases.

Debit card purchases follow

the same basic processes as

credit cards, so the issues

described in this paper apply

to them as well.

5454-5454-5454-5454

3. After a payment card sale is completed, the company receives cash by a process called settlement. Unlike authorizations, which are performed individually in real-time (before the order is accepted), a vendor company typically

submits settlements in a batch at end of day (or a few batches per day). The

companys bank (the acquiring bank) receives the funds from the issuing

banks and deposits them to the companys account 1-3 days after that.

For some businesses, such as hotels and auto rentals, the transaction itself proceeds over time: authorization is obtained up front, but settlement cannot be

accomplished until the transaction is completed and the final amount known,

an amount which often varies (within a limit) from the authorization amount.

4. The vendors finance department balances the books (usually once a day)

against their bank deposit information to verify that all transactions settled as

expected, and that the vendors transaction detail records match those of the

processor and the acquiring bank. The amount of the deposit should equal

the purchase price minus the interchange fees, and penalty fees (if any). This

process of balancing the books is known as reconciliation of deposit detail; a

smaller vendor might do this manually, on paper.

Merchant

In-Person and

MOTO Transactions

Issuing Bank

Copyright 2012 Princeton Payment Solutions

5454-5454-5454-5454

Web Transactions

Payment Processor

Merchant Bank

www.prinpay.com

White Paper: Implementing Payments in SAP

5. If a vendors card payment volume becomes sufficient, manual reconciliation

will become time-consuming and error-prone. If volume warrants, a vendor

may seek out a middleware provider which also offers automated reconciliation processing, posting, reporting and exception handling.

Theres more to a payment

system than just capturing

transaction details and

conducting authorization,

settlement, and reconciliation.

Your company should focus

on three main considerations

when implementing a payment

system:

1. The core functionality of

processing card transactions

and collecting revenue from

them, and the optimization

of processing functions to

lower interchange fees.

2. Compliance issues related

to securing customer data,

usually through encryption.

3. Easing the back-office

burden of tracking

transactions and reconciling

the books at the end of the

month.

Encryption Requirements from the Card Associations

Another critical consideration in payments processing is the encryption of customers

personal card data, a security measure that is now mandated. In 2004 the credit card

associations, acting jointly as the PCI-SSC published the Payment Card Industry Data

Security Standard (DSS), which outlines the best practices companies must utilize if

they store, process, or transmit sensitive payment card information such as the card

number. In the revised 2010 PCI Data Security Standard (DSS), the card brands mandated that companies secure payment data with strong encryption techniques, using

encryption engines that are segregated from the payment applications themselves.

The card associations now require larger companies which participate in the payment

card system to be audited by a Qualified Security Assessor (QSA) or, for smaller companies, to vouch for their compliance with PCI-DSS through a self-assessment questionnaire, to ensure vendor compliance with data security standards. Companies who fail

to meet these standards may face heavy fines from their acquiring bank.

In addition to meeting PCI-enforced requirements, deploying a strong encryption strategy and other safeguards is also good customer policy. It saves a lot of time, headache,

and money should attempts at hacking occur.

Card Payment in an SAP Environment

The SAP ERP was designed to accept and store customers payment data (the payment

card interface), but not to transmit it to payment processors, nor to receive data back

from the processor. SAP needs a payment application, known as middleware, in order to electronically connect to the payment system. Middleware is configured for both

the vendor companys SAP and for the specific communications protocols of its card

processor(s). Your middleware should be a PCI-SSC Certified Payment Application.

PPSs CardConnect became the first SAP-Certified Payment Application middleware in

1999.

Middleware adds both mission-critical capabilities and optimization features that enable

SAP to process payments, including:

Basic payment functionality (processor communications, authorization, settlement files)

Encryption of data in processing, transmission and in storage ( via segregated

encryption tool)

Reports

System tuning functions, such as collection of supplemental data

Reconciliation capabilities (optional)

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

The Payment Application

A Good SAP Payment Card

Interface Saves Time and

Money

Collects and encrypts the customers payment data for transmission

Generates the request for permission to charge the card (authorization)

Builds a list of transactions that have been authorized (and delivered, if done

after the sale, and that is a condition of settlement)

Securely transmits this settlement file to the processor and tracks acceptance

of the file by the processor

In addition to providing core

payment processing capabilities,

a Payment Card Interface also

saves companies time and

money. It would take a backoffice employee about 60

man-hours to process 1000

payment transactions in SAP

without Payment Card Interface

software. Using the software,

the processing takes only about

15 man-hours.

These functions are critical; SAP cannot process, settle or reconcile credit card payments without

middleware. In addition, some payment applications vendors also offer a number of addon features that optimize the payment and reconciliation process. (For more information on implementing a solid encryption solution in SAP, request a copy of the white

paper, Passing the PCI Audit: Best Practices for Securing Payment Card Data in SAP from PPS.)

An optimized payment

infrastructure also saves money

on processing fees.

Tuning

Transaction Reports

While SAP features certain basic financial reports, over the years the SAP ERP community has requested more detail for easier summation and use. Some vendors of

middleware have a library of add-on reports to enhance SAPs basic capabilities. These

augmented reports give you fast access to both high-level data and information about

individual transactions. Many reports can be customized for needs specific to a clients

specific business needs.

It is possible to tune your SAP payment system to qualify for lower interchange fees.

Implementing capabilities such as address verification (AVS), card security code verification (CVV or CID), and collection of additional data about the customer and purchase

(Level 2 and Level 3 data) can all reduce your interchange fees (the rates you pay for

payment processing). Your middleware can fill in a gap if your version of SAP was not

patched to capture this information.

The next section, Getting the Best Rates from the Banking System, discusses these optimization techniques.

Reconciliation

Reconciliation is the process of balancing the books after a batch of transactions have

settled. SAP user companies may do this manually, or in a more automated fashion if

enhancements have been made via the middleware packages optional add-on, if available. During reconciliation, SAP user companies:

1. Verify that transactions on the SAP settlement reports and their bank deposit

statements are the same, and ensure that all transactions sent for settlement

went through properly. Any failed transactions must be investigated.

2. Review the summary of processing fees, to ensure that charges are correct. For

example, a batch of transactions might contain $1,000 worth of purchases but

only $965 is deposited into the companys account. The summary file describes

where the $35 in fees went.

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

3. Research specific problematic transactions, such as a transaction that wasnt

paid because the card number turned up invalid.

Many people do not realize

that SAP was not designed

to process electronic card

payments. Unless they use a

Payment Card Interface tool

for reconciliation, companies

who accept card payments

through SAP must manually

compare this settlement file

to their own records.

Manual reconciliation of discrepancies is a human-resource-intensive and error-prone

process. SAP user companies with heavier transaction volume like to automate this

processing using reconciliation software, such as CardDeposit from PPS. Reconciliation

software can automatically receive the deposit file from the payment processor directly

into SAP and then reconcile it with the companys own transaction/settlement file,

highlighting information such as:

Fees may be assessed daily or monthly

Chargebacks can be positive or negative

Transactions rejected by the processor when the settlement is received

Transactions rejected in the overnight settlement processing

SAP Authorization

or Settlement

Tokenization

SAP Deposit

Posting

Remote Function Calls

RFC Listener

CardSecure

RFC Callback

Encryption

Clearinghouse Interface

Middleware

Clearinghouse

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

Getting the Best Processing Rates from the Banking

System

Lower Risk +

Increased Data =

Lower Fees

Once you have appropriately powerful middleware in place, you can improve the interchange rates you are charged by your acquiring bank for transaction processing.

In general, interchange fees are lower for transactions with reduced risk and for transactions that include more data (which ultimately reduces risk). Consider the following

steps to achieve the best interchange rates.

Collect Additional Data

Companies can reduce fees by providing as much information as possible about the

customer using the card and about the products being purchased. Collecting the following details with the transaction helps bring down interchange fees:

Customers billing address The payment system can then use the Address

Verification Service (AVS) to validate the accuracy of data. Having an accurate

billing address that matches the card number substantially lowers the risk of

fraud for the transaction.

Security code also called card verification value (CVV) or card identification

number (CID). The security code is the three- or four-digit number printed on

the card itself. This code is not printed on sales receipts or account statements,

nor is it stored in payment systems, so providing a valid CVV helps customers

prove that they have the printed card in their possession, again lowering the

risk associated with the transaction.

Data about the purchase For transactions conducted with purchase cards,

companies can collect Level 2 and Level 3 data, which provides additional

details about the customer and items being purchased (itemized sales tax, item

codes, descriptions, units of measure, etc.)

In-Person, MOTO and Web Transactions

Companies pay higher rates for transactions where the card is not physically present,

such as for mail order/ telephone order (MOTO) and Web-based transactions. As a result, they have a higher incidence of fraud than face-to-face transactions. Companies

pay a higher rate to process them, a fee which can be as high as 3-3.4% of the transaction. In contrast, processing rates for transactions where the card is physically presented are about 1.9% of the transaction value. You can implement additional processes

and procedures in your payment system, which bring down the rates for MOTO and

web transactions to 2.6 or 2.7%.

International Transactions in SAP

A versatile middleware, such as CardConnect from PPS, enables SAP to accept multicurrency payments. If you need to process transactions with other countries, make sure

to choose a payment application that works with international processors, (communications protocols may differ from US processors). If you connect directly to the international processor, your rate will likely be lower too.

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

Chargebacks

A chargeback occurs when a customer disputes a charge with the card company, usually on the grounds that the charge was unauthorized or fraudulent. Chargebacks are

expensive to process, and they are often associated with fraudulent transactions, so the

payment community penalizes chargebacks heavily.

Following these best

If your company incurs many chargebacks, your interchange rate will increase. Its a

much less expensive alternative (not to mention better customer service) to address

any disputes directly with customers, and to credit their cards if necessary. Credits, or

returns, are a normal part of payment and do not incur penalties like chargebacks do.

practices and those

listed in the next section

to optimize payment

processing in SAP. They

can help you lower

interchange fees by as

much as 0.8%, which

saves you $8000 for every

Shop Around for Your Processor

Just as many companies have different prices for similar products, payment processors have varying rates and rules. Its worth your time to shop around for a processor

and to read the fine print in their agreements. Look for rates that suit your transaction

volume and keep an eye out for exorbitant hidden fees. A single processor may not

have the ability to process a varied portfolio of domestic and international, credit and

debit transactions. Either confirm that your chosen processor can work with all of your

transaction processing needs, or be absolutely certain that your payment application

software can manage more than one processor.

$1M in transactions

Connect Directly to Processors and Card Companies

processed.

Companies can lower their interchange rates by connecting directly to a payment processor rather than through an intermediary such as CyberSource or FirstData. This is

most likely to occur with American Express, so consider a direct connection to them if

your transaction volume is sufficient.

A Quick List of Dos and Donts

1. Do research the options for direct connections to payment processors to get

the best rates. All fee structures are not created equal.

2. Do ask your bank which processors are available. Dont just settle for the first

one they suggest. Ask about what they like and dont like about the various

candidates (downtime, processing speeds, etc.)

3. Do read the fine print in processor agreements. They are normally quoted for

the ideal transaction. Transactions that are late in settlement, get involved in

disputes, are non-US currency, or do not have proper AVS or CVV data will

typically cost more than the advertised rate.

4. Do ask your bank to identify the break points at which you are entitled to

better rates these may be based on transaction volume or dollar volume.

5. Do turn on the Address Verification System (AVS) to validate the customers

billing address.

6. Do use the cards three- or four-digit security code (CVV or CID) to validate

that customer is in possession of a legitimate card.

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

7. Don't accept expired cards. Make sure to check the expiration date before

accepting the card. This issue is particularly important for subscription (recurring) charges. Often your processor will provide an update service investigate

this.

8. Do settle transactions within three days of authorization or create a $1 authorization at the beginning of the purchase to confirm the validity of the card.

9. Do connect directly to American Express if your company has a high volume

of their transactions.

10. Do collect and pass on Level 2 and Level 3 data for purchase card transactions.

11. Don't do multiple authorizations for the same transaction, since each authorization ties up customers available credit.

12. Don't increase the charge amount over the amount that is authorized if possible. If the price increases, youll have to change the authorization. You can

settle for up to 15% more than what you have authorized if it has to do with

shipping or taxes, etc. But if its more than that, the transaction can bounce

and a chargeback can occur.

13. Do watch actively for chargebacks or disputes from your processor. Since no

native SAP function accepts this data back from the processor, you either have

to manually identify it, or use an automated reconciliation tool. If you dont

act on a customers dispute before the time limit expires, you lose the case

even if your claim is valid.

14. Do make sure you properly designate recurring transactions, such as subscriptions, in your payment system. They typically qualify for a much lower fee

than initial or one-time transactions.

15. Do monitor your processor account regularly for any significant change in

fees, and to verify that youre being charged the correct rates. If you find

any discrepancies or changes, contact your processor. Ask for a report of all

transactions that are not within a certain, agreed-upon discount rate and have

them include reasons.

16. Do automate payment and reconciliation functions to reduce errors. You will

save hundreds, if not thousands, of man-hours in your back-office processing

department.

17. Don't let a dispute with a customer progress to the point of a chargeback (a

reversal of the transaction in which the cost is credited back to the customer).

Chargebacks occur when customers dispute charges with the card association,

claiming an unauthorized or fraudulent transaction. Encourage customers

with any concerns to call you before they call their bank. A return is a lot less

expensive than a chargeback.

By shopping for the best rates and then applying these best practices, companies can

lower interchange rates from 3.3 or 3.4% of the transaction value down to 2.6 or

2.7%. For every million dollars in transactions processed, this lower rate saves $6,0008,000.

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

Princeton Payment Solutions: The Experts in SAP

SAP commissioned PPS (formerly Trintech, Inc.) to build the first Certified Payment

Application for SAP in 1998. We also built the first SAP encryption solution that passed

PCI-SSC audits, and we offer an automated Reconciliation software package for SAP.

As an ERP payment

application of VeriFone,

Inc., CardConnect

provides the most proven

payment card capability

certified and used by SAP.

Our product suite includes a variety of industry-leading software products designed to

complete and enhance the payment process in SAP:

CardConnect Adds fully-integrated Authorization and Settlement to SAP

CardSecure Protects payment card information in SAP with powerful

encryption and token technology that helps companies to

pass their PCI audits

CardDeposit Adds fully-integrated Reconciliation capability in SAP

CardResolve Adds fully-integrated Chargeback capability in SAP

Princeton Payment Solutions will help your company plan, specify, and implement a

full payment solution for SAP. Our years of experience show themselves in the quality of our products, which are long-proven and exceptionally solid. CardConnect ERP

users appreciate our simple, direct and no-nonsense approach to building out the right

system quickly. And to ensure smooth deployment, our experienced services team is

available for installation, implementation of and training for the new payments infrastructure.

Most importantly, CardConnect ERP works dependably. Even in cases of network

glitches, CardConnect ERP continues its job with auto-recovery tools in place.

Contact us for a free evaluation of your SAP environment, and youll understand why

were regarded throughout the payments industry as the experts in SAP payments.

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

White Paper: Implementing Payments in SAP

10

Conclusion

Without certified payment application middleware, SAP is not able to perform authorizations or conduct settlement activities and no money is received! Optimizing payment processes with proven, tailored, secure software helps companies:

Expedite the order to cash cycle

Protect customer data and comply with card association and government security mandates for data in processing, in transit, and at rest

Reduce cost of electronic payment processing (both interchange rates and cost

of back-office processing)

Improve operational efficiency in the finance/accounting functions

Expand revenue opportunities by supporting global payment options, such as

multiple payment channels, business to business purchase card support, and

multicurrency support

Because there are so many crucial areas to consider when implementing a payment

system in SAP, its important to work with a middleware partner who understands

both payments and security, has experience with SAP and its design, and is fluent in

the demands and restrictions of the payment community. Princeton Payment Solutions

can help you deploy a cost-effective and efficient middleware application that works

flawlessly and saves your company the maximum amount of money and time in its

payment processes.

About FTS | PPS

Princeton Payment Solutions is a division of Financial Transaction Services, LLC (FTS).

FTS|PPS takes a consultative, service-focused approach, partnering with clients to

provide tailored, comprehensive responses to payment components such as back-office

and web-based integration, payment solutions in complex ERP environments, PCI

compliance, interchange and penalty fee reduction, and robust online reporting capabilities. FTS|PPSs CardConnect for SAP is now in its 14th year. FTS|PPS was the first

company to encrypt data within an ERP system and pass the PCI audit standards with

our CardSecure solution, which also offers a proven tokenization option to take ERP

systems out of scope on a PCI audit. FTS|PPS staff participate in both the PCI Security

Council and various technical groups, which inform our innovative approaches to the

latest card payment issues, such as P2PE. Their collective experience includes decades

in bank operations, bank software development, and bank card technology; their credentials include advanced degrees in both business and economics. Our staff understand your business challenges, and offer payments and security expertise to match.

For more information about how to implement and optimize a payment solution in SAP, please

contact Princeton Payment Solutions.

Princeton Payment Solutions

116 Village Boulevard, Suite 300

Princeton, NJ 08540

Contact: Alex Chapman

Email: achapman@prinpay.com

Phone: +1 (203) 952-5715

www.prinpay.com

Copyright 2012 Princeton Payment Solutions

www.prinpay.com

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- QTestDocumento13 páginasQTestsanthoshiharikaAinda não há avaliações

- SPUI5Documento47 páginasSPUI5venkata_swaroopAinda não há avaliações

- Computer Networks by V S Bagad I A Dhotre PDF April 26 2011-9-00 PM 6 2 MegDocumento64 páginasComputer Networks by V S Bagad I A Dhotre PDF April 26 2011-9-00 PM 6 2 Megsanthoshiharika44% (16)

- Advanced Computer Architecture: The Architecture of Parallel ComputersDocumento44 páginasAdvanced Computer Architecture: The Architecture of Parallel ComputerssanthoshiharikaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocumento58 páginasSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiAinda não há avaliações

- Avalon LF GB CTP MachineDocumento2 páginasAvalon LF GB CTP Machinekojo0% (1)

- Fedex Service Guide: Everything You Need To Know Is OnlineDocumento152 páginasFedex Service Guide: Everything You Need To Know Is OnlineAlex RuizAinda não há avaliações

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDocumento2 páginasEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaAinda não há avaliações

- Portrait of An INTJDocumento2 páginasPortrait of An INTJDelia VlasceanuAinda não há avaliações

- Unit Process 009Documento15 páginasUnit Process 009Talha ImtiazAinda não há avaliações

- Edita's Opertionalization StrategyDocumento13 páginasEdita's Opertionalization StrategyMaryAinda não há avaliações

- Zelio Control RM35UA13MWDocumento3 páginasZelio Control RM35UA13MWSerban NicolaeAinda não há avaliações

- GR L-38338Documento3 páginasGR L-38338James PerezAinda não há avaliações

- Walmart, Amazon, EbayDocumento2 páginasWalmart, Amazon, EbayRELAKU GMAILAinda não há avaliações

- Danby Dac5088m User ManualDocumento12 páginasDanby Dac5088m User ManualElla MariaAinda não há avaliações

- BluetoothDocumento28 páginasBluetoothMilind GoratelaAinda não há avaliações

- Anaphylaxis Wallchart 2022Documento1 páginaAnaphylaxis Wallchart 2022Aymane El KandoussiAinda não há avaliações

- Ajp Project (1) MergedDocumento22 páginasAjp Project (1) MergedRohit GhoshtekarAinda não há avaliações

- Electrical ConnectorsDocumento5 páginasElectrical ConnectorsRodrigo SantibañezAinda não há avaliações

- Draft Contract Agreement 08032018Documento6 páginasDraft Contract Agreement 08032018Xylo SolisAinda não há avaliações

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Documento7 páginasExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghAinda não há avaliações

- CoDocumento80 páginasCogdayanand4uAinda não há avaliações

- ESG NotesDocumento16 páginasESG Notesdhairya.h22Ainda não há avaliações

- Assignment - 2: Fundamentals of Management Science For Built EnvironmentDocumento23 páginasAssignment - 2: Fundamentals of Management Science For Built EnvironmentVarma LakkamrajuAinda não há avaliações

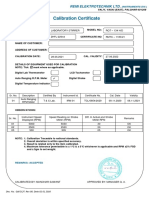

- Calibration CertificateDocumento1 páginaCalibration CertificateSales GoldClassAinda não há avaliações

- Form Three Physics Handbook-1Documento94 páginasForm Three Physics Handbook-1Kisaka G100% (1)

- Production - The Heart of Organization - TBDDocumento14 páginasProduction - The Heart of Organization - TBDSakshi G AwasthiAinda não há avaliações

- Schmidt Family Sales Flyer English HighDocumento6 páginasSchmidt Family Sales Flyer English HighmdeenkAinda não há avaliações

- BMA Recital Hall Booking FormDocumento2 páginasBMA Recital Hall Booking FormPaul Michael BakerAinda não há avaliações

- Dry Canyon Artillery RangeDocumento133 páginasDry Canyon Artillery RangeCAP History LibraryAinda não há avaliações

- Recommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityDocumento49 páginasRecommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityJohn DavisonAinda não há avaliações

- QUIZ Group 1 Answer KeyDocumento3 páginasQUIZ Group 1 Answer KeyJames MercadoAinda não há avaliações

- PeopleSoft Application Engine Program PDFDocumento17 páginasPeopleSoft Application Engine Program PDFSaurabh MehtaAinda não há avaliações

- Perkins 20 Kva (404D-22G)Documento2 páginasPerkins 20 Kva (404D-22G)RavaelAinda não há avaliações