Escolar Documentos

Profissional Documentos

Cultura Documentos

2013 - 09-Private Equity in The IT Services Space PDF

Enviado por

achokhraDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2013 - 09-Private Equity in The IT Services Space PDF

Enviado por

achokhraDireitos autorais:

Formatos disponíveis

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Private Equity in the Cloud and IT Services Sector

September 2013

Financial Investors Taking a Fresh Look at an Evolving Space

INSIDE THIS ISSUE

INTRODUCTION

Page

1. Introduction

2. Key Drivers of Activity

3. Subsector Activity

Managed Hosting

1

3

Systems Integration

Managed Services

Data Center

9

4. Valuation Metrics

10

5. M&A by PE Groups

13

6. Growth and VC Investments 16

Other Redwood IT Services Reports

The following additional reports on the IT

Services space may be found on Redwoods website at www.redcapgroup.com

M&A in the Cloud & IT Services

Sectors July 2012

Cloud Enablement Services November 2011

Managed Service Providers May

2010

SaaS: Hosted Communications and

Information Management Applications August 2009

Contact:

Russell Crafton, Partner

rcrafton@redcapgroup.com

212.508.7110

This report focuses on investment and acquisition activity by

private equity firms in the IT and cloud services sectors.

While for years, financial investors have been intrigued by the

potential opportunities presented by the IT services area,

many have not been willing to put capital to work in the space

until recently. A number of changes are occurring however

including the shift to recurring services, the continued outsourcing of the IT function, and the need for solutions providers to offer broader capabilities, that have now made the area

of IT services an attractive space for private equity. In this

report, we look at the trends that have begun to attract capital,

the spaces in which financial investors are active, and some of

the specific deals actually completed over the past several

years across the venture, growth equity, and buyout landscapes.

OVERVIEW

For years, private equity firms have studied the IT services

market and wrestled with the right way to invest in the sector.

While the highly fragmented nature of the market has presented a compelling opportunity, the one-time nature of the revenue streams for IT consultants and VARs was problematic.

However, with the evolution of cloud and managed services

offerings, the increased shift towards outsourcing, and the ever

increasing need for the integration of technologies (which requires solutions providers to broaden their skill sets), the IT

service sector has suddenly become a very attractive space for

financial investors.

The renewed interest in the space is demonstrated by a number

of recent acquisitions by many leading private equity firms.

On the acquisition side, Oak Hill (acquired managed hosting

provider Intermedia), Silver Lake (acquired API-SPL & GoDaddy), Court Square (acquired Avaya channel partner SPS)

are just of few of the firms active in buyouts. Within the

growth equity area, players like General Atlantic (QTS), Canaan (iYogi), and Columbia Capital (Cloud Sherpas) have also

made sizeable investments.

www.redcapgroup.com

1

Redwood Capital: 885 Thir d Avenue, 25th Floor New Yor k, NY 10022

REDWOOD CAPITAL: SECTOR OVERVIEW

WHERE THE ACTION IS

Private Equity and the IT Services Sector

little capital to start or are not focused on building intellectual property, something

for which venture investors often look.

In looking at where private equity has been most active, we consider this from both

the sub-sector standpoint (such as integrators, managed hosting providers) as well However, within the buyout and growth equity areas, investment activity has been

as by asset class (venture, growth equity and buyouts). On pages 6 through 9, we extremely active with many leading private equity firms with brand names and long

provide a sector by sector review and highlight a few interesting deals in each area. histories actively pursuing acquisitions. See pages 13 through 20 for a list of just

some of the many private equity led deals that have been completed over the past

As for activity by asset class, as the chart below shows, the majority of activity is few years in the IT services sector.

coming from growth equity and buyouts. Venture capital has, and will likely continue to play, a much smaller role given that most services businesses either require

OTHER REDWOOD IT SERVICES REPORTS

(available on Redwoods website at www.redcapgroup.com)

P/E Activity by Investor Class (2009 to Date)

www.redcapgroup.com

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

KEY DRIVERS OF ACTIVITY

KEY DRIVERS OF ACTIVITY

debt. Data center players, in particular, are very capital intensive, and with the benefit of long term contracts with customers, financial owners in this area can see leverage of up to 4.5x to 5.0x EBITDA.

There are a number of drivers impacting the industry; creating significant transitions in the underlying nature of the revenue streams and contractual relationships

that solutions providers have with customers, making the IT services sector attrac- Transition to Managed Services Creates Multiple Expansion

tive.

The market for managed services supporting enterprise IT (including data center,

network infrastructure, information systems, mobility, communications and securiKey Drivers for Private Equity Players include:

ty) has been experiencing very solid growth as businesses continue to adopt this

Attractive Recurring Revenue Models

contractual relationship with their solution providers. According to recent research from Markets and Markets, the managed services market is expected to

Transition to Managed Services Creates Multiple Expansion

growth from $143 billion in 2013 to $256 billion in five years, representing a compounded annualized growth rate of 12.4%.

Opportunity For Build-ups & Consolidations

Increasingly Tight Customer Relationships

Fragmentation and Lack of Market Leaders

Attractive Recurring Revenue Models

Contractually recurring services revenues can be a much more attractive revenue

stream than the one-time sales approach with which many players in the sector have

historically operated. Long term, contracted revenue can come in many forms.

While the managed services contract has been the primary area of focus lately,

many systems integrators have generated some form of contractually recurring revenue for years without necessarily calling it that. Maintenance contracts and financing and leasing fees continue to comprise important recurring streams often overlooked within systems integrators.

Impacting valuations, IT services players with contractually recurring revenues

will likely continue to receive valuation premiums owing to the stickiness of their

relationships with customers. Solution providers that are able to migrate their customers to managed services contracts, and / or introduce new services provided

under such agreements are also likely to achieve an increase in their implied valuation multiple as their mix of recurring revenues increases.

As with any market in transition, these changes present opportunities for players

able to manage the shift. We think IT services players that are able to provide

managed services for the larger end of the SMB market may see the greatest potential upside. To date, much of the transition to managed services has been with

smaller businesses, however, as mid-size companies begin to shift, they are going

to turn to their historical solution providers. While some of these historical players are not developing the capabilities they need, those that do can not only transition their own customers to recurring managed services contracts, but can also

grow their customer base by capturing share from players unable to make the shift.

Recurring revenue streams are particularly important in financial buyouts where the

greater predictability of cash flows allows for increased financial leverage with

www.redcapgroup.com

(Continued on page 4)

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Opportunity for Build-ups and Consolidations

puts more control in the hands of the solutions provider (as opposed to the product

vendor), we believe that consolidation strategies involving the roll up of many

smaller players have a much greater chance of succeeding than in the past. We

think this higher success rate will be due to the higher switching costs for customers thus reducing the risk for the churn as customer bases are acquired and consolidated onto single platforms.

Many buyout firms have increasingly focused on build-ups (making smaller addon acquisitions to a core platform they have acquired) and consolidation plays

(rolling up many similar small players) to help create value beyond purely financial mechanics and leverage. Given its high degree of fragmentation, the IT services sector presents an excellent space for these strategies.

Not surprisingly, private equity groups have been much more active in this space.

Just over the past two years, a number of notable transactions have occurred that

highlight the move by rather large, sophisticated players to take another shot at

creating national players through consolidation (for example, All-Covereds rollup of 20 plus smaller MSPs) to serve the IT services needs of the SMB market.

Build-Ups: The fr agmented natur e of the industr y pr ovides ample sour ces of

both platform companies as well as add-on acquisitions. We believe that build-up

strategies present an excellent opportunity as enterprise customers are increasingly

looking to single source their IT needs with a provider that can handle an ever

growing list of IT resources and be better able to handle the integration amongst

these resources. Many private, entrepreneur-owned businesses lack either the capital or the expertise to expand their businesses into new markets, either through

acquisition or internal investment. This presents financial investors with the opportunity to acquire a platform business with a strong focus and customer base,

and then bring the capital and management talent necessary to grow it beyond

where its current owner can take it.

Increasingly Tight Customer Relationships

(Continued from page 3)

We think this transition will create significant shakeup in the industry and opportunity for those that get it right.

Private equity groups currently pursuing build-up strategies in the IT services include Oak Hill with its acquisition of managed hosting provider Intermedia (see

page 6) and Court Square with invest acquisition of telephony and contact center

integrator SPS (See page 7).

Consolidation Plays: The recent shift to managed services and SaaS models has

provided a new strategy and much better model for consolidating smaller players,

especially in the managed and cloud services areas where there are still numerous

small players with very similar offerings (such as hosted exchange, hosted telephony, data MSPs). As SMB customers become much more closely tied to their

solution provider under recurring services contracts, and as the shift to the cloud

While businesses with contractually recurring revenues, such as data center and

managed hosting providers, have been a main focus for financial investors, there

are many systems integrators, outsourcers and consultancies that have a large recurring revenue element to their business, even though they dont have long term

contracts with their customers. This particularly seems to be the case with players serving mid-sized and larger enterprises where they are regularly generating at

least several million dollars a year in revenue. In many cases, the end customer

has outsourced much of their IT support to the solution provider and as a result,

every year, there is some new project, significant technology refresh, or just the

deployment of dozens of personnel each year to the customer for ongoing support

and maintenance.

Weve seen many systems integrators, especially those supporting large software

applications, that have 80% of their revenue regularly come from existing customers, year after year. While this may not be contractually recurring, the customer

will likely continue to spend and would have difficulty moving to another vendor.

Given this recurring dynamic, we believe players in the space may offer attractive

valuations as there is less capital chasing them, and yet they still provide the stability of a customer base that is desired.

(Continued on page 5)

www.redcapgroup.com

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

(Continued from page 4)

Fragmentation and Lack of Market Leaders

Much of the IT services market still remains highly fragmented, except for the

data center space which has seen a significant consolidation over the past several

years. While the large enterprise market is sourced by a more concentrated group

of vendors including HP EDS, Dell Perot, Accenture, IBM Global Services and a

handful of others, the lack of a few dominant leaders in the SMB market presents

significant opportunity. And given the large number of SMB enterprises, there is

likely room for dozens of successful players.

Our point on this is that one does not need to be overly concerned with competition or the dominance of a few large players (as in the data center market). While

the managed hosting, integration and consulting markets are competitive, they are

very large markets and there are plenty of customers to go around for providers

that can offer a compelling service.

Further, this fragmentation is also a result of the limitations that many of even the

largest players in these markets face. Most IT services players doing under $1

billion in revenue are still privately owned and lack the capital and management

expertise necessary to expand into new areas through acquisition. Likewise, many

managed hosting players are still small and mostly focused on a narrow set of offerings, such as hosting Microsoft Exchange, Oracle databases or even simple

websites. For these players, if a private equity group can integrate the right management talent, and provide capital for growth and acquisition, they may find that

a solid player that has flat lined could be just the right platform for growth; and

these are just the players that can be acquired at realistic, cash flow based multiples.

www.redcapgroup.com

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Subsector Review: Managed Hosting

The managed hosting space has seen some of the highest levels of activity by private equity firms in the last few years due to the contractual nature of the business

and the strong organic growth opportunities. From Silver Lakes acquisition of

GoDaddy to Oak Hills acquisition of Exchange hosting provider Intermedia, a

number of the most recognized leveraged buyout groups have been quite active.

We expect to see a continued steady flow of platform acquisitions by private equity

groups as well as many follow-on consolidation deals by recently acquired players.

Already, the new financial owners of both Intermedia and GoDaddy have been active in leveraging their platforms. In the case of Intermedia, the company has acquired Zlago (cloud services for SMBs) and Telanetix (hosted voice services) as it

Intermedia / Oak Hill Capital:

looks to broaden its solution offering beyond just Microsoft offerings to provide a

complete suite of cloud based services to SMBs.

GoDaddy has also continued its M&A activity after becoming a portfolio company

of SilverLake, recently acquiring LoCu for $70m, providing a service for small

businesses to help get located and found through online channels.

We expect to the managed hosting area to be the most active space going for private equity groups over the next several years, given the fragmentation of the market, the organic growth prospects, and the contractual nature of the revenue

streams.

Cloud Sherpas / Columbia Capital:

GoDaddy / SilverLake

Target: Inter media

Target: Cloud Sher pas

Target: Go Daddy

Acquirer: Oak Hill Capital Par tner s

Investor: Columbia Capital

Acquirer: Silver Lake

Date: May 2011

Date: December 2012 / May 2012

Date: J une 2011

Amount: NA

Amount: $40m / $20m

Amount: $2,250m

Description: Inter media is the lar gest independent provider of managed hosting for Microsoft Exchange. Oak Hill has significant experience in the data center space (having done both

Telecity Redbus and ViaWest). As evidence

that they have big expectations for Intermedia,

Oak Hill installed former Savvis head Phil Coen

as CEO. While Intermedia and Oak Hill are

likely still working through the strategy, we expect it will include at least one or more acquisitions to broaden the solution set and transform

Intermedia into a broad Master MSP.

Description: Cloud Sher pas decision to r aise

additional capital at this time is in response to

accelerating adoption of cloud technology by enterprises and the opportunity to lead the market

transition as a CSB. The new funds will allow

Cloud Sherpas to better serve existing and prospective customers who are rapidly increasing their

use of cloud services and are anxious to move off

legacy on-premise systems. The new capital will

also be used by Cloud Sherpas to grow its presence

in key geographic regions, extend partnerships

with Google and salesforce.com, and expand into

emerging technology categories.

Description: Go Daddy is the wor ld's lar gest on

-ramp for cloud-based software and services. The

company serves more than 9.3 million global customers and manages more than 48 million domain

names. Greg Mondre, Managing Director,

of Silver Lake said: "Go Daddy is powerfully positioned for future growth as it continues to innovate

and add to its truly unique platform of cloud-based

software and services. At the same time, we plan

to maintain and augment all of the attributes that

have made Go Daddy a clear market leader today,

including world class customer support and competitive pricing for its 9.3 million customers."

Source: Cloud Sherpas, 12/20/12, Press Release

Source: Silverlake, 7/1/11, Press Release

Source: Intermedia, 5/26/11, Press Release

www.redcapgroup.com

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Subsector Review: Systems Integration

The systems integration subsector has become of increasing interest to buyout firms tors hope to create value through the multiple expansion resulting from a shift to a

with a number of leading private equity groups including Thomas H. Lee, Court higher quality contractual revenue stream.

Square, Nautic Partners, Platinum Equity, all becoming active.

Additionally, investors have also found that many of these businesses already have

Driving this interest are a couple of important dynamics. First, is the fragmentation a large recurring revenue nature, either through the same of maintenance contracts

and the opportunity to leverage a larger platform to acquire other complementary and leasing arrangements, or just based on steady degree of repeat business from

players and create a more full service solution provider that can better meet the full existing customers. For some larger integrators and consultants, we often see existneeds of mid-size enterprises. Second, is the trend to managed services and recur- ing customers regularly providing 70% to 80% of each years new sales. While

ring revenue models and the ability to acquire one-time revenue oriented businesses much of this is not contractual, given the nature of the customers and solutions supat 4.5x to 6.0x EBITDA now, transitioning some of that stream to a managed ser- ported, it nevertheless tends to be recurring, year after year.

vices model over the next several years. Under this strategy, acquirers and inves-

SPS / Court Square:

CompuCom / Thomas H. Lee:

FishNet Consulting / Investcorp:

Target: Str ategic Pr oducts & Ser vices

Target: CompuCom

Target: FishNet Consulting

Acquirer: Cour t Squar e Par tner s

Acquirer: Thomas H. Lee

Acquirer: Investcor p

Date: October 2011

Date: Apr il 2013

Date: J anuar y 2013

Amount: NA

Amount: $1,100m

Amount: $200m

Description: Cour t Squar e Par tner s has acquired Strategic Products and Services, a leading

integrator of Avaya telephony solutions including

PBXs, call centers and a wide range of other telephony and data solutions. This transaction is one

of several recently in the Avaya channel others

including Genstars acquisition of ConvergeOne

and PAETECs acquisition of Tulsa based Avaya

dealer Xeta Technologies.

Description: CompuCom has established itself

as a clear leader in providing cost-effective IT

service management and solutions and is well

known for its exemplary customer service. We

believe the Company is well-positioned to capture

additional market share in its traditional areas of

strength as it deepens its expansion into new services towers. We look forward to partnering with

the talented CompuCom management team to

further grow the business and to continue building

value, said Seth Lawry, Managing Director at

THL.

Description: FishNet, of Over land Par k, Kan.,

provides information-technology security sales and

consulting services for large- and medium-sized

companies, as well as for the U.S. government.

Andrew Flett of Investcorp said, Whats appealing for us is FishNet is the leading company in a

highly fragmented space, he continued, he majority of the market is comprised of small, regional

players, but FishNet is among the select few companies that has been able to establish a leading

national presence .

Source: CapitalIQ

Source: CompuCom, 4/8/13, Press Release

Source: Chris Dieterich, 1/22/13, www.wsj.com

www.redcapgroup.com

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Subsector Review: Managed Services

The managed services space has been one of the most active in terms of private

equity investment with most of that activity focused on growth equity as opposed to

venture capital (i.e. early stage / start-up). Given that the managed services market

is still relatively small and highly fragmented, there tend to be fewer options of

scale for larger buyout groups looking to invest $50m in equity or more.

and TUC Brands, based in Canada have each been acquiring smaller MSPs, typically focusing on regional players with $3m to $15m in revenue and paying around

1.0x revenue. With each of these players, they are attempting to consolidate MSPs

under a single umbrella and then provide some degree of centralized support, cross

selling or other services to leverage their consolidated scale.

To date, most of the activity in managed hosting involves rounds of expansion capital, like Canaan Partners investment in premium tech services player iYogi or Tudor Growth Equitys investment in SingleDigits.

There have also been a few smaller financial buyers that are specifically targeting

the managed services space. Technology Capital Investors, based in New York,

iYogi / Canaan Partners:

Bravura / Technology Capital Investors:

Single Digits / Tudor Growth Equity:

Target: iYogi

Target: Br avur a Networ ks

Target: Single Digits

Investor: Canaan Par tner s

Acquirer: Technology Capital Investor s

Investor: Tudor Gr owth Equity

Date: December 2010

Date: September 2011

Date: May 2012

Amount: $30m

Amount: NA

Amount: $10m

Description: iYogi r aised $30 million in a new

round of financing to further boost the companys

swift global growth. The new round of investment

in iYogi will expand services outside the existing

consumer market and the Windows Operating

System platform. It will provide the company with

the capability to extend its platform to the global

SME market and also aggressively address the

growing need for supporting mobile consumer

devices. Investors in the round are interested

in the increasing dependency on technology and

anticipate a surging need for continuing ondemand tech support services.

Description: Br avur a Networ ks, a San Diego,

Calif.-based MSP and member of CRN's Next-Gen

250, has been acquired by Technology Capital

Investors (TCI). Sam Attias of TCI said, The

attraction to us was they are vertically focused. We

want to continue to see them vertically focused.

They built a nice business with some efficient

operations providing traditional managed services

over the years. Bravura found TCI as a great

partner to build a full cloud offering to stay competitive in the ever changing marketplace.

Description: New funding will be utilized to

support rapid growth and product development for

ensuring laptops, smartphones, tablets and other

WiFi-enabled devices, are securely connected to

the Internet and managed/supported vis--vis traditional IT infrastructures and new cloud-based services and applications. We look for companies

that have a firm grasp on their target markets

operational challenges, said Jeff Williams, Partner, Tudor Growth Equity. The funding will enable

Single Digits to quickly into the healthcare and

higher education verticals, while strengthening

their core hospitality and retail markets.

Source: iYogi, 12/13/10, Press Release

Source: crn.com, 9/12/11, Press Release

Source: Single Digits, 5/17/12, Press Release

www.redcapgroup.com

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Subsector Review: Data Center

The data center market has probably seen the most activity from private equity over established funds that saw an opportunity with Canadian player Q9. As many comthe past 5 to 7 years, although going forward we expect that private equity players panies increasingly look to move data outside the U.S, the Canadian market may

will be either be building upon existing investments or exiting the space through offer a unique growth opportunity over the next few years.

sales to large strategics like Equinix or some of the major carriers like Verizon

(Terremark) or CenturyLink (Savvis) that have now acquired large data center platforms.

One group active in the space has been Oak Hill, which had also acquired and built

up Telecity Redbus back in 2005 and in 2010 acquired ViaWest. Oak Hill is also

an investor in managed hosting provider Intermedia. Players recently entering the

market including Madison Dearborn and Providence Equity, two very large and

ViaWest / Oak Hill:

QTS / General Atlantic:

Q9 Networks / Madison Dearborn & Providence Equity:

Target: ViaWest

Target: Quality Technology Ser vices (QTS)

Acquirer: Oak Hill

Investor: Gener al Atlantic

Target: Q9 Networ ks

Date: Apr il 2010

Date: May 2012 / October 2009

Amount: $420m

Amount: $25m / $150m

Acquirer: Madison Dear bor n/Pr ovidence Equity

Description: ViaWest offer s cost-effective, highly secure, interconnected data center facilities designed to meet the needs of a wide range of business and public sector clients. Bob Morse, a partner of Oak Hill Capital, said, Explosive growth in

Internet traffic and a growing preference by all but

the largest corporations to outsource their own data

centers is driving tremendous demand for highquality, stand-alone data center solutions. ViaWest

is ideally positioned to serve this growing demand,

and we look forward to supporting the companys

management team as they continue to build the

franchise.

Description: The company is expecting to use

the capital infusion to expand its downtown Atlanta data center and acquire a Virginia property to

serve as a new data center. General Atlantic is

encouraged by QTS current footprint and service

portfolio touch every major component in the data

center and hosting markets, from large customized

data center to colocation to managed services.

This follow on investment by General Atlantic is

a testament to both QTS continued ability to execute on the companys business plan and the overall strength of the hosting sector.

Source: ViaWest, 4/20/10, Press Release

Source: Data Center Knowledge, 5/26/10

www.redcapgroup.com

Date: J une 2012

Amount: $1,058m

Description: Q9 is Canada's leading pr ovider of

outsourced data center solutions such as hosting,

co-location and cloud computing services. The

investor group is encouraged by Q9s management

team and the combination of Q9's innovative data

center services with Bell's world-leading network

and hosting infrastructure offers leading data center and cloud solutions for private and public

sector organizations of all sizes in Canada.

Source: Q9 Networks, 10/17/12, Press Release

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

VALUATION METRICS

Valuations for IT Services players vary rather significantly depending on the nature pectations. These are more at more that double that of the EBITDA multiples for

of the revenues (recurring vs. one-time), the growth trajectory, and the margin po- integrators.

tential. However, from the charts below and over the next several pages, the data

The Market Rewards Growth: The scatter plot below clearly shows that the marhighlights a few key trends that are important to understand.

ket rewards growth. This is perhaps most evident in the relatively significant difRecurring Services Valued at Rich Premium: Recurring services are valued at a ferences in the multiples for the offshore consultants (Wipro and Cognizant) relasignificant premium in the marketperhaps more than double that of non-recurring tive to their North American counterparts. Somewhat surprisingly, the scatter plot

revenues. We believe this premium is due to two key factors. First, recurring ser- also indicates a relatively good correlation between the EBITDA multiple and

vices businesses are currently experiencing rather high growth as businesses in- growth. While this should theoretically be the case, it is not always quite so evident

creasingly adopt managed service offerings. More importantly, recurring services when actually plotted. We believe this tighter correlation in IT services is due to

involve lower risk over time as customers are much more stable. As shown in the the more predictable nature of the business (relative to cutting edge, product techtable below, cloud and managed services and the data center players trade at aver- nology spaces where longer expectations are often not reflected in near term perforage multiples of 11.8x and 18.5x respectively, clearly reflecting strong growth ex- mance.

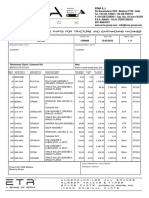

2012 EBITDA and Revenue Multiples

2013 EBITDA / 2013 EBITDA Growth Rate

Sources: Capital IQ, Venturewire, Redwood Capital

www.redcapgroup.com

10

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Publicly Traded IT Services Companies

Sources: Capital IQ, Venturewire, Redwood Capital

www.redcapgroup.com

11

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Public Stock Trends

Shown below are the stock indices for each of the categories of public companies

show on the prior page. As noted below, while the S&P 500 has increased modestly from early October 2009, the indices for cloud and managed services as well as

data center players are up nearly 100%. This reflects the strong growth for cloud

based offerings, although the entire IT sector has also risen rather strongly with

large cap technology actually higher now than its peak in 2007.

Other indices have also performed well, relative to the general market, including

distributors and consultants. Integrators on the other had have underperformed, or

at least Black Box and Insight Enterprises have, these being the two integrators

comprising our index.

Sources: Capital IQ, Venturewire, Redwood Capital

www.redcapgroup.com

12

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

ACQUISTIONS BY FINANICAL BUYERS IN IT AND CLOUD SERVICES

Financial buyers have been increasingly active in the IT services area. As noted

before, businesses with recurring revenue models have been a primary attractor as

these businesses provide a predictable revenue base. In addition, the high growth

prospects as well as the consolidation opportunities in fragmented or emerging markets has also provided an attractive framework.

just a few deals of integration and consulting oriented businesses. In these spaces,

financial buyers see an opportunity to secure a solid platform upon which they can

grow through acquisition by adding complementary product offerings to provide a

more full suite of offerings. This plays on the trend among customers to single

source their IT outsourcing needs.

While recurring revenues are a key focus, there has been an increasing amount of

buyout activity focused on traditional systems integrators and channel partners.

Court Squares acquisition of Avaya channel partner SPS, InvestCorps acquisition

of security integrator Fishnet, and Platinum Equitys Pomeroy acquisition represent

Finally, the players in this area include many of the most well known buyout

groups including Madison Dearborn, Oak Hill, InvestCorp, Thomas H. Lee, SilverLake, and TA Associates. In addition, based on discussions, we know that many

other leading firms are actively looking for opportunities in the sector.

Selected M&A 2009 - Present

www.redcapgroup.com

13

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Selected M&A 2009 - Present (continued)

www.redcapgroup.com

14

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Selected M&A 2009 - Present (continued)

www.redcapgroup.com

15

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

GROWTH AND VENTURE CAPITAL INVESTMENTS

Private fundraising in the IT services area has picked up significantly since the

downturn of 2008 with most investment activity focused on two areas: capital intensive facilities-based businesses like data centers, and managed hosting or managed services business with a recurring revenue model.

Fundraisings for managed services and managed hosting players have been quite

numerous over the past two years (see table below) with many rounds of between

$10 million and $25 million in size. Investors in these businesses are many of the

traditional IT investors or growth equity firms. In addition, companies raising

these rounds tend to be much more geographically dispersed, as opposed to certain

technology areas where they players are highly concentrated in Silicon Valley or

perhaps Boston / New York.

While the introduction of recurring revenue models is certainly attractive to financial investors, we believe that it is more important for buyouts using leverage than

growth equity investors putting pure equity to work. The most significant driver of

growth equity investing in this sector is simply the very high levels of organic

growth taking place in the managed hosting, managed services and cloud services

areas. With the significant shift by businesses to adopt these services, at the expense of the traditional solution provider model or internal IT staffs, the growth

prospects are high. This leads to very attractive ROI opportunities for the investment of new capital. They dont call it growth equity for any other reason.

Selected Venture and Private Equity Investments2009 - Present

www.redcapgroup.com

16

Sources: Capital IQ, Venturewire, Issuer press releases

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Selected Venture and Private Equity Investments2009 - Present (continued)

www.redcapgroup.com

17

Sources: Capital IQ, Venturewire, Issuer press releases

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Selected Venture and Private Equity Investments2009 - Present (continued)

www.redcapgroup.com

18

Sources: Capital IQ, Venturewire, Issuer press releases

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Selected Venture and Private Equity Investments2009 - Present (continued)

www.redcapgroup.com

19

Sources: Capital IQ, Venturewire, Issuer press releases

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Selected Venture and Private Equity Investments2009 - Present (continued)

www.redcapgroup.com

20

Sources: Capital IQ, Venturewire, Issuer press releases

REDWOOD CAPITAL: SECTOR OVERVIEW

Private Equity and the IT Services Sector

Redwood Capital Group is an investment banking firm serving the technology, communications media, business services and other

growth industries. The firm focuses on mergers & acquisitions, corporate finance, restructuring and valuation advisory services for

its clients worldwide.

Member FINRA/SIPC

www.redcapgroup.com

21

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Warehouse Management GuidelinesDocumento76 páginasWarehouse Management GuidelinesfaustinolannieAinda não há avaliações

- NHBDocumento24 páginasNHBimsinowAinda não há avaliações

- ModelProjectReport ICCrevised 030112Documento15 páginasModelProjectReport ICCrevised 030112Dr. Avnish UpadhyayAinda não há avaliações

- Steel Statistical Yearbook 2011Documento124 páginasSteel Statistical Yearbook 2011metalman_mAinda não há avaliações

- Particalboard - Details - GoodRich SugarDocumento9 páginasParticalboard - Details - GoodRich SugarachokhraAinda não há avaliações

- Choosing The Right Private EquityDocumento12 páginasChoosing The Right Private EquityachokhraAinda não há avaliações

- Crime Scenario in The CountryDocumento9 páginasCrime Scenario in The CountryachokhraAinda não há avaliações

- Chapter 11Documento6 páginasChapter 11rekhamodi08Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Executive SummaryDocumento63 páginasExecutive SummaryOm KolapkarAinda não há avaliações

- Script For ReportDocumento4 páginasScript For ReportNeriza PonceAinda não há avaliações

- Pitch Lake: Oiler Network May 2022Documento8 páginasPitch Lake: Oiler Network May 2022lexiAinda não há avaliações

- GCC Telecom Insight - Issued by STC Kuwait - April 2020Documento29 páginasGCC Telecom Insight - Issued by STC Kuwait - April 2020AKAinda não há avaliações

- Property Card: Qty. Qty. Office/Officer Qty. 100,000.00Documento2 páginasProperty Card: Qty. Qty. Office/Officer Qty. 100,000.00kristoffer riveraAinda não há avaliações

- Factbook 2019 Indesign Halaman 2 PDFDocumento180 páginasFactbook 2019 Indesign Halaman 2 PDFerlangga suryarahmanAinda não há avaliações

- Pacific Oil CompanyDocumento2 páginasPacific Oil CompanyAngel Zyra LingaAinda não há avaliações

- LPG Bunkering 2019Documento74 páginasLPG Bunkering 2019ИгорьAinda não há avaliações

- E3sconf Netid2021 02032Documento7 páginasE3sconf Netid2021 02032prabathnilanAinda não há avaliações

- Norton AntiVirus KeyDocumento1 páginaNorton AntiVirus Keyaz1anAinda não há avaliações

- KPMG Professional Qualification PolicyDocumento12 páginasKPMG Professional Qualification PolicyaAinda não há avaliações

- Chapter One-Wps OfficeDocumento19 páginasChapter One-Wps OfficeMwamba HarunaAinda não há avaliações

- DS SalesCloud EdCompare PDFDocumento2 páginasDS SalesCloud EdCompare PDFyoussef MCHAinda não há avaliações

- SSS Law "Managing" Head Not The Same For DirectorsDocumento18 páginasSSS Law "Managing" Head Not The Same For DirectorsIda DawsonAinda não há avaliações

- Abbreviations: Kuwait National Petroleum CompanyDocumento4 páginasAbbreviations: Kuwait National Petroleum CompanybabjihanumanthuAinda não há avaliações

- RODANTA BERCO ETR Stock 20-03-2023Documento4 páginasRODANTA BERCO ETR Stock 20-03-2023Claudiomar da SilvaAinda não há avaliações

- Oktay Urcan: Financial Accounting: Advanced TopicsDocumento39 páginasOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalAinda não há avaliações

- MC 99Documento10 páginasMC 99Henry DiazAinda não há avaliações

- A Synopsis Report ON A Study On Investment Analysis AT Icici Bank LTDDocumento9 páginasA Synopsis Report ON A Study On Investment Analysis AT Icici Bank LTDMOHAMMED KHAYYUMAinda não há avaliações

- You Are Requested To Fill This Form and Upload It Along With Other Relevant Documents As Mentioned in Your Personal Assessment Call LetterDocumento2 páginasYou Are Requested To Fill This Form and Upload It Along With Other Relevant Documents As Mentioned in Your Personal Assessment Call LettervidishaniallerAinda não há avaliações

- Sameer Tikoo: Core Competencies Profile SummaryDocumento4 páginasSameer Tikoo: Core Competencies Profile SummarysameertikooAinda não há avaliações

- Session 3: Creating Accounting Masters in Tally - ERP 9: Go To Gateway of Tally Press F11: FeaturesDocumento12 páginasSession 3: Creating Accounting Masters in Tally - ERP 9: Go To Gateway of Tally Press F11: FeaturesAfritam UgandaAinda não há avaliações

- Issues Governed by The AgreementDocumento9 páginasIssues Governed by The AgreementAravind KumarAinda não há avaliações

- Updates On HDMF Housing Loan Program: Juanito V. Eje Task Force Head Business Development SectorDocumento28 páginasUpdates On HDMF Housing Loan Program: Juanito V. Eje Task Force Head Business Development SectorcehsscehlAinda não há avaliações

- Entrep NotesDocumento17 páginasEntrep NotesAvril EnriquezAinda não há avaliações

- Business Analysis of E-Commerce and Internet Marketing of TescoDocumento77 páginasBusiness Analysis of E-Commerce and Internet Marketing of TescoShubhadip Biswas50% (4)

- Profile of The EntrepreneurDocumento11 páginasProfile of The EntrepreneurViviana IftimieAinda não há avaliações

- MCQ's On Intellectual Property Act - SpeakHRDocumento6 páginasMCQ's On Intellectual Property Act - SpeakHRTkAinda não há avaliações

- Amazon Presentation EditedDocumento19 páginasAmazon Presentation EditedCurious SoulAinda não há avaliações

- Garment Production SystemsDocumento10 páginasGarment Production SystemsMahedi HasanAinda não há avaliações