Escolar Documentos

Profissional Documentos

Cultura Documentos

AFC 2012 Sem 1

Enviado por

Ollie WattsDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AFC 2012 Sem 1

Enviado por

Ollie WattsDireitos autorais:

Formatos disponíveis

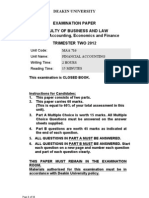

OFFICE USE ONLY

Monash University

Semester One Examination 2012

Faculty of Business and Economics

Department of Accounting and Finance

EXAM CODES:

AFC1000

TITLE OF PAPER:

PRINCIPLES OF ACCOUNTING AND FINANCE

EXAM DURATION:

3 hours

READING TIME:

10 minutes

THIS PAPER IS FOR STUDENTS STUDYING AT: (office use only - tick where

applicable)

Berwick

Clayton

Open Learning

Peninsula Distance Education

Caulfield

Sunway

Gippsland

Hong Kong

Other (specify)

During an exam, you must not have in your possession, a book, notes, paper,

calculator, pencil case, mobile phone or any other material/item which has not been

authorised for the exam or specifically permitted as noted below. Any material or

item on your desk, chair or person will be deemed to be in your possession. You are

reminded that possession of unauthorised materials in an exam is a disciplinable

offence under Monash Statute 4.1.

AUTHORISED MATERIALS

CALCULATORS

YES

NO

(If YES, only calculators with an 'approved for use' Faculty label are permitted)

OPEN BOOK

YES

NO

SPECIFICALLY PERMITTED ITEMS

YES

NO

This paper consists of ten (10) questions printed on a total ofeight (8) pages.

STUDENT ID: ...

DESK NUMBER: .

PLEASE CHECK THE PAPER BEFORE COMMENCING. THIS IS A FINAL PAPER.

THIS EXAMINATION PAPER MUST BE INSERTED INTO THE ANSWER BOOK AT

THE COMPLETION OF THE PAPER. NO EXAMINATION PAPERS SHOULD BE

REMOVED FROM THE EXAMINATION ROOM

AFC1000 John Gerrand

Page 1 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

Question 1

10 marks

You are the accountant for Serry Company which has agreed to act as a

guarantor on a loan of $2 million obtained by Webster and Sons. Serry

Company, as guarantor, is required to pay back the loan if Webster and Sons

cannot pay.

In light of the AASB Framework, justify how the guarantee of the loan would

be shown in the books of Serry Company.

Question 2

14 marks

The following information relates to Judd Ltd and Hayes Ltd respectively. Both

companies operate in the veterinary products industry.

2010

.12

1.41

.38

.27

5.8

Judd Ltd

2011 2012

.13

.17

1.63

1.87

.41

.43

.23

.17

6.7

7.9

Profit Margin (ROS)

Sales turnover

Return on Equity

Debt Ratio

Times interest covered

Hayes Ltd

2010 2011 2012

.12

.10

.09

1.71

1.46

1.26

.36

.32

.27

.51

.56

.58

2.3

2.2

2.1

Required:

Evaluate and compare the profitability and solvency of the two companies. In

doing so, discuss reasons why the profitability and solvency differ between

the two companies.

THIS SPACE HAS BEEN INTENTIONALLY LEFT BLANK

Questions continue on the next page

AFC1000 John Gerrand

Page 2 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

Question 3

(2 + 2 + 2 + 2)=8 marks

The following relates to Morningstar Enterprises. The entity uses the accrual

system of recognising transactions. At the end of the financial year on 30

June 2011, the following balance day adjustments and other information have

not been entered into the general ledger.

(a) Annual rent revenue for the financial year of $60,000 is receivable in

four equal quarterly instalments. To 30 June 2011, only three instalments

have been received.

(b)The account, office supplies on hand, has a debit balance of $410 on 1

July 2010. Supplies of $360 were purchased during the year (the

accounts clerk usedthe asset approach to record inventories of supplies).

On 30 June 2011, $110 of supplies are on hand.

(c) Morningstar Enterprises purchased equipment on 1 July 2009 at a cost of

$200,000 with a residual value of $50,000.The life of the equipment was

expected to last for 5 years but Morningstar Enterprise expected to use

it for 3 years. The company adopted the straight line method of

depreciation.

(d)Morningstar Enterprises pays its insurance annually in advance on 1 May

each year and records it as an expense. On 1 May 2011 the annual

premium was $2,700.

Required:

Prepare the journal entries to record the necessary adjustments on 30 June

2011 for each of the above items (narrations not required).

Question 4

(7 + 3 = 10 marks)

Your accountant has come to you, the CFO of a small company, for advice. He

says he cannot choose between the following competing projects as the

overall profit and return is the same.

Year

0

1

2

3

Project A

$100,000

$60,000

$50,000

$40,000

Project B

Project C

-$100,000

$50,000

$50,000

$50,000

-$100,000

$40,000

$50,000

$60,000

Required:

(a) If the company requires a 12 per cent rate of return, which project would

you choose?

AFC1000 John Gerrand

Page 3 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

(b)Explain your decision to your accountant why you choose the project

you did pointing out the reason that he could not come to a decision.

Question5

(3 + 3 = 6 marks)

Share A is currently trading at $22, and is expected to pay a dividend of

$1.50 in a years time, and dividends are expected to grow at a constant rate

of 5 per cent per year.

Share B is currently trading at $12.5, and is expected to pay a dividend of

$1.50 in a years time, and dividends are expected to grow at a constant rate

of zero per cent.

Share C is currently trading at $8, and is expected to pay a dividend of $1.50

in a years time, and dividends are expected to grow at a constant rate of -2

per cent.

Required:

(a) Calculate the intrinsic value of each share if your required rate of return

is 12 per cent.

(b)Which share would you buy and why? Explain your answer.

Question 6

(2 + 2 = 4 marks)

Define and explain using an example, Business risk and financial risk.

Question 7

(4 + 8 = 12 marks)

a)

Identify and distinguish between the different types of investors.

b)

Identify and distinguish between the main types of financial securities.

THIS SPACE HAS BEEN INTENTIONALLY LEFT BLANK

Questions continue on the next page

AFC1000 John Gerrand

Page 4 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

Question 8

(2 + 2 + 2 + 2 + 3 = 11 marks)

A young student is considering ways to make money while he completes his

university degree. He had an idea to set up an online store selling good

quality, affordable tablet PCs. He has estimated that fixed costs will be

$36,500 per annum, and variable costs associated with each tablet PC will be

$310.

Required:

(a) If the student decides to sell the tablet PCs for $440 each, calculate how

many he must sell to break even.

(b)Advertising campaigns in the media lately have offered similar tablet

PCs for $399 each. Determine how the break-even point will be affected

if the student sells his tablet PCs for the reduced price of $399 to attract

sales.

(c) The student would like to earn a profit of $5,000 in the first year.

Calculate how many tablet PCs he would need to sell at the reduced

price of $399 to achieve this objective.

(d)The student estimates that he could operate the online store from home

up to a capacity of 150 tablet PCs per year, after which he would need to

move to larger premises. Discuss how the relevant range can impact the

break even calculations prepared earlier.

(e) The Australian Securities Exchange has published Principles of Good

Corporate Governance and Best Practice Recommendations for entities

to adopt. Summarise if these principles and best practice

recommendations apply to the students small online business scenario.

THIS SPACE HAS BEEN INTENTIONALLY LEFT BLANK

Questions continue on the next page

AFC1000 John Gerrand

Page 5 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

Question 9

(6 + 4 + 2 = 12 marks)

The owner/manager of Matthews Mechanical Repair Workshop is currently

preparing cash budgets for the coming months in 2012. He requires

assistance in completing the budgets, and has provided you with the

following information:

Service revenue (actual and expected)

May

June

July

August

September

(actual)

(actual)

(expected)

(expected)

(expected)

$75,000

$66,000

$61,000

$82,000

$88,000

The owner/manager expects 40% of service revenue to be in cash each

month, and the remaining 60% to be on credit. Of the credit service revenue,

80% is likely to be collected in the month following service, with the final

20% being collected two months after service.

The owner/manager has provided other information that may be relevant:

He expects to make a loan repayment in August of $15,000.

He will take cash drawings of $2,800 per month.

Depreciation of equipment is $10,000 per month.

He will pay wages of $43,000 per month.

The cost of supplies used in the mechanical repairs average 20% of the

service revenue each month. Supplies are purchased on credit and paid

in full the month following purchase.

Other cash expenses will total $4,100 per month.

Required:

(a) Prepare a schedule of cash receipts expected from credit customers for

the months of July, August and September 2012.

(b)Determine the cash surplus (deficit) for the month of July 2012 by

providing the details of cash receipts and cash payments for July 2012 in

the form of a cash budget.

AFC1000 John Gerrand

Page 6 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

(c) The owner/manager is considering reviewing the credit policy offered to

customers. Explain how budgeting will assist him with that decision.

Question 10

+ 4 + 2 = 13 marks)

(2 + 2 + 3

Sk8boards Incorporated is a small business operating from two locations in

Victoria. One store is located in the inner suburb of Caulfield while the other

is located in country Bendigo. The business sells a wide range of

skateboards, scooters, roller blades and accessories. Financial details for the

past year are presented below:

Caulfield

Bendigo

Total

878,600

226,500

1,105,100

(528,200)

(149,900)

(678,100)

Contribution margin

350,400

76,600

427,000

Less Divisional fixed

costs

(119,700)

(58,600)

(178,300)

230,700

18,000

248,700

(88,200)

(37,800)

(126,000)

142,500

(19,800)

122,700

281,000

119,000

400,000

Sales Revenue

Variable costs

Less Share of corporate

costs

Divisional profit

Cost of capital

5%

Investment required

The management accountant has prepared the above information for the

owner. He must explain the difference in performance across the two

locations. All inventory is purchased by the head office which is located in

Melbourne City. There is no difference in cost price of inventory between

stores, but delivery costs may vary. The owner has a policy of ensuring the

selling price is consistent between locations.

Required:

(a) Calculate the return on investment (ROI) for each of the two divisions.

(b)Calculate the residual income (RI) for each of the two divisions.

(c) Discuss the performance of the Caulfield store in comparison to the

Bendigo store based on absolute profit, and your calculations of ROI and

RI.

AFC1000 John Gerrand

Page 7 of 8

OFFICE USE ONLY

AFC1000 PRINCIPLES OF ACCOUNTING AND FINANCE

(d)The management accountant is concerned that the owner will see the

results and want to close the Bendigo store. Explain whether you agree

with that suggestion.

(e) Analyse possible reasons for the difference in variable costs and fixed

costs between the stores.

END OF EXAMINATION

AFC1000 John Gerrand

Page 8 of 8

Você também pode gostar

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)No EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Nota: 4.5 de 5 estrelas4.5/5 (5)

- Misleading or Deceptive Conduct - Structured AnswerDocumento14 páginasMisleading or Deceptive Conduct - Structured AnswerOllie WattsAinda não há avaliações

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)No EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- Aswath Damodaran - Technology ValuationDocumento115 páginasAswath Damodaran - Technology Valuationpappu.subscription100% (1)

- WTODocumento35 páginasWTOdibya_85100% (10)

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)No Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Nota: 4 de 5 estrelas4/5 (3)

- Final Exam Review QuestionsDocumento18 páginasFinal Exam Review QuestionsArchiePatelAinda não há avaliações

- Labour Economics Notes HRM 201Documento23 páginasLabour Economics Notes HRM 201Losh Min Ryan64% (11)

- Fm202 Exam Questions 2013Documento12 páginasFm202 Exam Questions 2013Grace VersoniAinda não há avaliações

- Expected Questions of FIN 515Documento8 páginasExpected Questions of FIN 515Mian SbAinda não há avaliações

- NVCC Accounting ACC 211 EXAM 1 PracticeDocumento12 páginasNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2Ainda não há avaliações

- 128电子及家电2Documento156 páginas128电子及家电2zhen zengAinda não há avaliações

- McDonald's CDMP - Group PresentationDocumento32 páginasMcDonald's CDMP - Group PresentationNorhan AymanAinda não há avaliações

- 2009 Sem1Documento7 páginas2009 Sem1Ella GorelikAinda não há avaliações

- 2010 Sem 2 Final - LatestDocumento8 páginas2010 Sem 2 Final - LatestArthur NitsopoulosAinda não há avaliações

- AFC 1000 Exam 2012 S2Documento9 páginasAFC 1000 Exam 2012 S2tusharAinda não há avaliações

- Peg Sept11 p1Documento18 páginasPeg Sept11 p1patriciadouceAinda não há avaliações

- BFC2140 Semester2 2016 Tutorial QuestionsDocumento9 páginasBFC2140 Semester2 2016 Tutorial QuestionsRhys CosmoAinda não há avaliações

- Exercise Session 1Documento8 páginasExercise Session 1EdoardoMarangonAinda não há avaliações

- P2 Financial Management June 2012Documento9 páginasP2 Financial Management June 2012Subramaniam KrishnamoorthiAinda não há avaliações

- Test Bank For Accounting For Decision Making and Control 8th 0078025745Documento38 páginasTest Bank For Accounting For Decision Making and Control 8th 0078025745fishintercur1flsg5100% (15)

- QP March2012 p1Documento20 páginasQP March2012 p1Dhanushka Rajapaksha100% (1)

- Time-Bound Home Exam-2020: Purbanchal UniversityDocumento2 páginasTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlAinda não há avaliações

- ISyE 313 Exam 2 2012 FallDocumento8 páginasISyE 313 Exam 2 2012 FallChrisy210Ainda não há avaliações

- Practice Test MidtermDocumento6 páginasPractice Test Midtermzm05280Ainda não há avaliações

- Assignment May2011 ADocumento6 páginasAssignment May2011 AZyn Wann HoAinda não há avaliações

- FFM - FINAL - SPRING 2020 - SECTION 1047 - Muhammad MansoorDocumento3 páginasFFM - FINAL - SPRING 2020 - SECTION 1047 - Muhammad MansoorAbdul Muqsit KhanAinda não há avaliações

- FINA1310 Assignment 1Documento5 páginasFINA1310 Assignment 1timothyAinda não há avaliações

- AF301 Final Exam Semester 2, 2014Documento8 páginasAF301 Final Exam Semester 2, 2014Anonymous 9dEMgo0Ainda não há avaliações

- BUS1AFB - Assignment 2 - Semester 1 2021 - FINALDocumento4 páginasBUS1AFB - Assignment 2 - Semester 1 2021 - FINALChi NguyenAinda não há avaliações

- Corporate Finance AssignmentDocumento5 páginasCorporate Finance AssignmentJason LohAinda não há avaliações

- Afw 1000 Final Q s1 2014Documento17 páginasAfw 1000 Final Q s1 2014Mohammad RashmanAinda não há avaliações

- Sample ExamDocumento17 páginasSample ExamJasonSpringAinda não há avaliações

- CIMA p1 March 2011 Post Exam GuideDocumento18 páginasCIMA p1 March 2011 Post Exam GuidearkadiiAinda não há avaliações

- 2023 Summer Capital AssignmentDocumento2 páginas2023 Summer Capital AssignmentPoetic YatchyAinda não há avaliações

- Soal Uas MK Gasal 2021-2022 KkiDocumento6 páginasSoal Uas MK Gasal 2021-2022 KkiRifqi RinaldiAinda não há avaliações

- Tutorial Sets Bfc2140 2018 S1Documento29 páginasTutorial Sets Bfc2140 2018 S1Deep Bhattacharyya0% (2)

- 2.BMMF5103 - EQ Formattedl May 2012Documento7 páginas2.BMMF5103 - EQ Formattedl May 2012thaingtAinda não há avaliações

- f9 2014 Dec QDocumento13 páginasf9 2014 Dec QreadtometooAinda não há avaliações

- QP March2012 f2Documento16 páginasQP March2012 f2g296469Ainda não há avaliações

- As 1Documento4 páginasAs 1Lê AnhAinda não há avaliações

- EF4313 Final Exam 2022Documento7 páginasEF4313 Final Exam 2022Johnny LamAinda não há avaliações

- Acct1511 Final VersionDocumento33 páginasAcct1511 Final VersioncarolinetsangAinda não há avaliações

- Fina1003abc - Hw#4Documento4 páginasFina1003abc - Hw#4Peter JacksonAinda não há avaliações

- Final Paper 1Documento12 páginasFinal Paper 1ishujain007Ainda não há avaliações

- Practice Test MidtermDocumento6 páginasPractice Test Midtermrjhuff41Ainda não há avaliações

- P1 March 2011 For PublicationDocumento24 páginasP1 March 2011 For PublicationmavkaziAinda não há avaliações

- Assignment-I CF (GCUF)Documento5 páginasAssignment-I CF (GCUF)Kashif KhurshidAinda não há avaliações

- Final Exam - Fall 2023Documento5 páginasFinal Exam - Fall 2023hani.sharma324Ainda não há avaliações

- FFA FA S22-A23 Examiner's ReportDocumento11 páginasFFA FA S22-A23 Examiner's ReportM.Huzaifa ShahbazAinda não há avaliações

- Canadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test BankDocumento7 páginasCanadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test Bankdrkevinlee03071984jki100% (23)

- 9706 June 2011 Paper 41Documento8 páginas9706 June 2011 Paper 41Diksha KoossoolAinda não há avaliações

- Ffa12efmq A Low ResDocumento34 páginasFfa12efmq A Low ResAdi StănescuAinda não há avaliações

- D23 FM Examiner's ReportDocumento20 páginasD23 FM Examiner's ReportEshal KhanAinda não há avaliações

- MAA716 - T2 - 2012 v2Documento11 páginasMAA716 - T2 - 2012 v2ssusasi4769Ainda não há avaliações

- FNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFDocumento3 páginasFNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFC A.Ainda não há avaliações

- ACF 103 Exam Revision Qns 20151Documento5 páginasACF 103 Exam Revision Qns 20151Riri FahraniAinda não há avaliações

- 562 Spring2003Documento5 páginas562 Spring2003Emmy W. RosyidiAinda não há avaliações

- 2009T2 Fins1613 FinalExamDocumento24 páginas2009T2 Fins1613 FinalExamchoiyokbaoAinda não há avaliações

- Gaf 520 Dist Assign 1Documento9 páginasGaf 520 Dist Assign 1Tawanda ZimbiziAinda não há avaliações

- BFF2140 - Practice Questions For Final Exam - With - SolutionsDocumento15 páginasBFF2140 - Practice Questions For Final Exam - With - SolutionsFarah PatelAinda não há avaliações

- Tutorial Questions Spring 2014Documento13 páginasTutorial Questions Spring 2014lalaran123Ainda não há avaliações

- FR SD22 Examiner ReportDocumento26 páginasFR SD22 Examiner Reportfeysal shurieAinda não há avaliações

- FINA3301 - Fall 2021 - Mock Final ExamDocumento4 páginasFINA3301 - Fall 2021 - Mock Final ExamHao SerenaAinda não há avaliações

- FM MJ21 Examiner's ReportDocumento18 páginasFM MJ21 Examiner's ReportZi Qing NgAinda não há avaliações

- Negligence - Structure AnswerDocumento2 páginasNegligence - Structure AnswerOllie Watts100% (1)

- BTC1110 NotesDocumento20 páginasBTC1110 NotesOllie WattsAinda não há avaliações

- PartnershipDocumento8 páginasPartnershipOllie WattsAinda não há avaliações

- Negligence - Structure AnswerDocumento2 páginasNegligence - Structure AnswerOllie Watts100% (1)

- Consumer Guarantee - Structure AnswerDocumento7 páginasConsumer Guarantee - Structure AnswerOllie WattsAinda não há avaliações

- Nisha RuchikaDocumento24 páginasNisha RuchikaRishabh srivastavAinda não há avaliações

- KRF ProgramDocumento15 páginasKRF ProgramVlado SusacAinda não há avaliações

- Tax Ordinance-Books 1-30 FCTBDocumento51 páginasTax Ordinance-Books 1-30 FCTBRaiha MoriyomAinda não há avaliações

- LAS 4 Entrep 4th QuarterDocumento6 páginasLAS 4 Entrep 4th QuarterKawaguchi OerkeAinda não há avaliações

- B2B Marketing - Channel ManagementDocumento7 páginasB2B Marketing - Channel ManagementGoenka VickyAinda não há avaliações

- Operations Strategy in A Global Environment: Prof: Dr. Sadam Wedyan Student: AREEJ KHRAIMDocumento19 páginasOperations Strategy in A Global Environment: Prof: Dr. Sadam Wedyan Student: AREEJ KHRAIMDania Al-ȜbadiAinda não há avaliações

- Accounting in Action: Summary of Questions by Study Objectives and Bloom'S TaxonomyDocumento53 páginasAccounting in Action: Summary of Questions by Study Objectives and Bloom'S TaxonomyLindaLindyAinda não há avaliações

- Chapter 6Documento2 páginasChapter 6Christy Mae EderAinda não há avaliações

- Indian Institute of Management Lucknow Post Graduate Programme, 2012-13Documento3 páginasIndian Institute of Management Lucknow Post Graduate Programme, 2012-13Vikas HajelaAinda não há avaliações

- Sheet 2Documento21 páginasSheet 2yehyaAinda não há avaliações

- The Valuation of Olive Orchards: A Case Study For TurkeyDocumento4 páginasThe Valuation of Olive Orchards: A Case Study For TurkeyShailendra RajanAinda não há avaliações

- SalconDocumento136 páginasSalconJames WarrenAinda não há avaliações

- "Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSDocumento35 páginas"Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSmroys mroysAinda não há avaliações

- Theresa Eshun Rhule Arthur ResumeDocumento1 páginaTheresa Eshun Rhule Arthur ResumetessarhulearthurAinda não há avaliações

- JPMorgan Chase London Whale HDocumento12 páginasJPMorgan Chase London Whale HMaksym ShodaAinda não há avaliações

- Macro Economics NotesDocumento6 páginasMacro Economics NotesPrastuti SachanAinda não há avaliações

- Secret Profit Levels Cheat SheetsDocumento2 páginasSecret Profit Levels Cheat SheetsSangPebisnisAinda não há avaliações

- Long Quiz BSA 1st Yr 2023 2024Documento10 páginasLong Quiz BSA 1st Yr 2023 2024Kenneth Del RosarioAinda não há avaliações

- CH 21Documento44 páginasCH 21nonfiction0650% (2)

- A Study On Financial Performance AnalysisDocumento81 páginasA Study On Financial Performance AnalysisGayathri Rs0% (1)

- Development of Value Stream Mapping From L'Oreal's Artwork Process PDFDocumento25 páginasDevelopment of Value Stream Mapping From L'Oreal's Artwork Process PDFReuben AzavedoAinda não há avaliações

- Crossing of ChequesDocumento22 páginasCrossing of ChequesNayan BhalotiaAinda não há avaliações

- Accounts ManipulationDocumento5 páginasAccounts ManipulationomarahpAinda não há avaliações

- Distribution of WealthDocumento26 páginasDistribution of WealthEllimac AusadebAinda não há avaliações

- Final Uds Sukkur With AddendumDocumento463 páginasFinal Uds Sukkur With AddendumAtifKhanAinda não há avaliações