Escolar Documentos

Profissional Documentos

Cultura Documentos

IAS 18 - Revenue Recognition

Enviado por

khan_ssTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IAS 18 - Revenue Recognition

Enviado por

khan_ssDireitos autorais:

Formatos disponíveis

4/22/2015

IAS18RevenueRecognition

Avail50%discountonallonlineCAclassesforMayExam(accesstillMay20th).UsecouponcodeMAY15

Login Register

MemberStrength1432004andgrowing..

CCIONLINECOACHING

HOME

ARTICLES

NEWS

ACCOUNTS

EXPERTS

ARTICLES

FILES

FORUM

IAS18RevenueRecognition

Follow@4Everproxy

JOBS

BUDGET

EVENTS

STUDENTS

MORE

websearch

http://www.caclubindia.com/articles/ias18revenuerecognition2566.asp

Kram

postedon06July2009

NOTIFICATIONS

IAS18REVENUERECOGNITION

Thearticlemakesanefforttounderstand

basic concepts of Revenue recognition

as stated by IAS 18 in a question and

answermode.

gl

IAS18RevenueRecognition

WhatisRevenue?

Revenue is the gross inflow of economic

benefits during the period arising in the

course of the ordinary activities of an

entity when those inflows result in

increases in equity, other than increases

relating to contributions from equity

participants.

Note that IAS refers to inflow of economic benefits which is wider than cash,

receivablesorotherconsiderationusedbyAS9.

Revenueincludesonlythegrossinflowsofeconomicbenefitsreceivedandreceivable

bytheentityonitsownaccount.Amountscollectedonbehalfofthirdpartiessuchas

sales taxes, goods and services taxes / value added taxes and amounts collected on

behalfofprincipalarenoteconomicbenefitswhichflowtotheentityanddonotresult

inincreasesinequity.

Howtomeasurerevenue?

Revenue shall be measured at the fair value of the consideration received or

receivable.

Note that IAS refers to fair value which is a wider concept and primary concept

referredtoineveryIFRS.

http://yblocker.info/secure.php?u=iH6wyiybmznaYW4NPG4g8ttp%2FDRa74sFqqssgtVfOBSf6INdHuNUlEGIspojID%2BmBQc%2B1eWxuiIklLy%2BCXjche%

1/8

4/22/2015

IAS18RevenueRecognition

WhatisFairvalue?

Fairvalueistheamountforwhichanassetcouldbeexchanged,oraliabilitysettled,

betweenknowledgeable,willingpartiesinanarmslengthtransaction.

Whatifcashflowfromrevenueisdeferred?

Iftheinflowofcashorcashequivalentsisdeferred,thefairvalueoftheconsideration

maybelessthanthenominalamountofcashreceivedorreceivable.Forexample,an

entitymayprovideinterestfreecredittothebuyeroracceptanotereceivablebearing

a belowmarket interest rate from the buyer as consideration for the sale of goods.

Whenthearrangementeffectivelyconstitutesafinancingtransaction,thefairvalueof

the consideration is determined by discounting all future receipts using an imputed

rateofinterest.

Whatifrevenueishavingmorethanonecomponent?

Recognitioncriteriaareappliedtotheseparatelyidentifiablecomponentsofasingle

transaction in order to reflect the substance of the transaction. Example, when the

selling price of a product includes an identifiable amount for subsequent servicing,

that amount is deferred and recognised as revenue over the period during which the

serviceisperformed.Conversely,therecognitioncriteriaareappliedtotwoormore

transactions together. For example, an entity may sell goods and, at the same time,

enterintoaseparateagreementtorepurchasethegoodsatalaterdate,thusnegating

thesubstantiveeffectofthetransactioninsuchacase,thetwotransactionsaredealt

withtogether.

Whenisrevenuefromthesaleofgoodsrecognized?

Allbelowconditionshavebeensatisfied:

Entity has transferred to the buyer the significant risks and rewards of

ownershipofthegoods

Entity retains neither continuing managerial involvement to the degree

usuallyassociatedwithownershipnoreffectivecontroloverthegoodssold

Amountofrevenuecanbemeasuredreliably

Itisprobablethattheeconomicbenefitsassociatedwiththetransactionwill

flowtotheentityand

Costs incurred or to be incurred in respect of the transaction can be

measuredreliably.

NotethatdefinitionismorespecificandwiderthanthatgiveninAS9.

Whendoesentityretainsignificantrisksandrewardsofownership?

Entityretainsanobligationforunsatisfactoryperformancenotcoveredby

normalwarrantyprovisions

Receiptoftherevenuefromaparticularsaleiscontingentonthederivation

ofrevenuebythebuyerfromitssaleofthegoods

Goodsareshippedsubjecttoinstallationandtheinstallationisasignificant

partofthecontractwhichhasnotyetbeencompletedbytheentityand

Buyer has the right to rescind the purchase for a reason specified in the

salescontractandtheentityisuncertainabouttheprobabilityofreturn.

Whenisrevenuefromrenderingofservicesrecognized?

Amountofrevenuecanbemeasuredreliably

Itisprobablethattheeconomicbenefitsassociatedwiththetransactionwill

flowtotheentity

Stageofcompletionofthetransactionattheendofthereportingperiodcan

bemeasuredreliablyand

Costsincurredforthetransactionandthecoststocompletethetransaction

canbemeasuredreliably.

Revenueassociatedwiththetransactionshallberecognisedbyreferencetothestage

ofcompletionofthetransactionattheendofthereportingperiod.

Ifuncertaintyarisesaboutthecollectibilityofanamount?

Ifanamountisalreadyincludedinrevenue,theuncollectibleamount,ortheamount

inrespectofwhichrecoveryhasceasedtobeprobable,isrecognisedasanexpense.

Whencanreliableestimatesbemade?

Ifthepartiestothetransactionagreeto:

http://yblocker.info/secure.php?u=iH6wyiybmznaYW4NPG4g8ttp%2FDRa74sFqqssgtVfOBSf6INdHuNUlEGIspojID%2BmBQc%2B1eWxuiIklLy%2BCXjche%

2/8

4/22/2015

IAS18RevenueRecognition

Eachpartysenforceablerightsregardingtheservicetobeprovidedand

receivedbytheparties

Considerationtobeexchangedand

Mannerandtermsofsettlement.

Whatisrevenuefrominterest,royaltiesanddividends?

Revenuearisingfromtheusebyothersofentityassetsyieldinginterest,royaltiesand

dividendsshallberecognisedwhen:

Itisprobablethattheeconomicbenefitsassociatedwiththetransactionwill

flowtotheentityand

Amountoftherevenuecanbemeasuredreliably.

Basisforrecognitionofrevenueis:

Interestshallberecognisedusingtheeffectiveinterestmethod

Royaltiesshallberecognisedonanaccrualbasisinaccordancewiththe

substanceoftherelevantagreementand

Dividends shall be recognised when the shareholders right to receive

paymentisestablished.

In an interestbearing investment only the postacquisition portion is recognised as

revenue.

Whathavetobedisclosed?

Anentityshalldisclose:

Accountingpoliciesadoptedfortherecognitionofrevenue,includingthe

methodsadoptedtodeterminethestageofcompletionoftransactionsinvolving

therenderingofservices

Amount of each significant category of revenue recognised during the

period,includingrevenuearisingfrom:

oSaleofgoods

oRenderingofservices

oInterest

oRoyalties

oDividendsand

Revenue arising from exchanges of goods or services included in each

significantcategoryofrevenue.

DovistforotherarticlesonIFRShttp://ifrsinindia.blogspot.com/

Print this article

OtherArticlesbyKram

PublishedinAccounts

Source:NoSourceSpecified

Views:5625

gl

http://yblocker.info/secure.php?u=iH6wyiybmznaYW4NPG4g8ttp%2FDRa74sFqqssgtVfOBSf6INdHuNUlEGIspojID%2BmBQc%2B1eWxuiIklLy%2BCXjche%

3/8

Você também pode gostar

- Brief On Ducati Case StudyDocumento1 páginaBrief On Ducati Case Studykhan_ssAinda não há avaliações

- Samsung Brief: OpinionDocumento1 páginaSamsung Brief: Opinionkhan_ssAinda não há avaliações

- 02 ECorp AR 2014 Full PDFDocumento129 páginas02 ECorp AR 2014 Full PDFkhan_ssAinda não há avaliações

- IFRSDocumento26 páginasIFRSkhan_ssAinda não há avaliações

- Apple company overview and historyDocumento3 páginasApple company overview and historykhan_ssAinda não há avaliações

- IAS 38 CasesDocumento4 páginasIAS 38 CasesRonit AhujaAinda não há avaliações

- Ethical Issues in Financial ReportingDocumento10 páginasEthical Issues in Financial Reportingkhan_ssAinda não há avaliações

- Ias 16Documento14 páginasIas 16khan_ssAinda não há avaliações

- Ias 38Documento43 páginasIas 38khan_ssAinda não há avaliações

- Financial Reporting Factors & IAS 1 StandardsDocumento6 páginasFinancial Reporting Factors & IAS 1 Standardskhan_ssAinda não há avaliações

- Most Useful Business Books For Managers - Comprehensive ListDocumento2 páginasMost Useful Business Books For Managers - Comprehensive ListAdrian MihalceaAinda não há avaliações

- 2nd Semester 1.5Documento3 páginas2nd Semester 1.5khan_ssAinda não há avaliações

- Risk N ReturnDocumento59 páginasRisk N ReturnSardar Faisal Bin RaziqAinda não há avaliações

- Financial DerivativesDocumento29 páginasFinancial DerivativesnandukyAinda não há avaliações

- CertifiedDocumento1 páginaCertifiedkhan_ssAinda não há avaliações

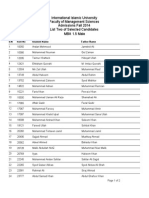

- 2nd Merit List BSEE Morning Program Fall 2014Documento2 páginas2nd Merit List BSEE Morning Program Fall 2014khan_ssAinda não há avaliações

- Theories of interest rates explainedDocumento31 páginasTheories of interest rates explainedkhan_ssAinda não há avaliações

- Risk N ReturnDocumento59 páginasRisk N ReturnSardar Faisal Bin RaziqAinda não há avaliações

- Excel2007 Ess QRGDocumento1 páginaExcel2007 Ess QRGJames WoodsAinda não há avaliações

- 2 MBA 1.5 MaleDocumento2 páginas2 MBA 1.5 Malekhan_ssAinda não há avaliações

- Creating Excel ReportsDocumento7 páginasCreating Excel Reportskhan_ssAinda não há avaliações

- French OnlineDocumento5 páginasFrench Onlinekhan_ssAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Accounting Issues and Solutions For The Retail and Consumer Goods IndustriesDocumento64 páginasAccounting Issues and Solutions For The Retail and Consumer Goods IndustriesMarko GrassmannAinda não há avaliações

- Fasb 115 PDFDocumento2 páginasFasb 115 PDFJosephAinda não há avaliações

- Standalone Accounts 2008Documento87 páginasStandalone Accounts 2008Noore NayabAinda não há avaliações

- ACC 3000 Chapter 1 NotesDocumento14 páginasACC 3000 Chapter 1 NotesAaiysha MistryAinda não há avaliações

- Module 1 4 BUSCOMDocumento40 páginasModule 1 4 BUSCOMNoeme LansangAinda não há avaliações

- Chapter 8Documento31 páginasChapter 8zara afridiAinda não há avaliações

- Ifrs PQDocumento26 páginasIfrs PQpakhok3Ainda não há avaliações

- List of Pfrs 2018Documento5 páginasList of Pfrs 2018Myda Rafael100% (1)

- Debt Valuation Methodologies For Financial Reporting Chatham FinancialDocumento31 páginasDebt Valuation Methodologies For Financial Reporting Chatham FinancialNoel AgbeghaAinda não há avaliações

- AAFR Topic-Wise Test Regards Awais ALIDocumento34 páginasAAFR Topic-Wise Test Regards Awais ALIUmmar FarooqAinda não há avaliações

- Philippine Financial Reporting Standards and Philippine Accounting StandardsDocumento4 páginasPhilippine Financial Reporting Standards and Philippine Accounting StandardsJoness Angela BasaAinda não há avaliações

- IAS 12 Income Taxes OverviewDocumento40 páginasIAS 12 Income Taxes OverviewMyie Cruz-VictorAinda não há avaliações

- FAR Final PreboardDocumento13 páginasFAR Final PreboardMarvin ClementeAinda não há avaliações

- REO CPA Review: Business CombinationDocumento9 páginasREO CPA Review: Business CombinationRoldan Hiano ManganipAinda não há avaliações

- Afar NotesDocumento20 páginasAfar NotesChristian James Umali BrionesAinda não há avaliações

- Classification As PPEDocumento11 páginasClassification As PPEedrianclydeAinda não há avaliações

- Applying International Financial Reporting Standards Picker 3rd Edition Test BankDocumento13 páginasApplying International Financial Reporting Standards Picker 3rd Edition Test Banklisaclarkfgsocdkpix100% (32)

- Accounting Standard 15 RevisedDocumento28 páginasAccounting Standard 15 RevisedGmd NizamAinda não há avaliações

- FAC1601-partnerships - Changes in Ownership StructureDocumento11 páginasFAC1601-partnerships - Changes in Ownership Structuretommy tazvityaAinda não há avaliações

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocumento5 páginasBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Revenue Recognition StandardDocumento9 páginasRevenue Recognition StandardUser PuppyAinda não há avaliações

- Solution Manual For Advanced Accounting 13Th Edition Beams Anthony Bettinghaus Smith 0134472144 9780134472140 Full Chapter PDFDocumento30 páginasSolution Manual For Advanced Accounting 13Th Edition Beams Anthony Bettinghaus Smith 0134472144 9780134472140 Full Chapter PDFrose.carvin242100% (11)

- Ifrs 9 PresentationDocumento26 páginasIfrs 9 PresentationJean Damascene HakizimanaAinda não há avaliações

- Accounts Dec 2017Documento188 páginasAccounts Dec 2017Sibgha100% (1)

- Chapter 03 - AnswerDocumento10 páginasChapter 03 - AnswerGeomari D. BigalbalAinda não há avaliações

- ACCA SBR Notes - AsraDocumento69 páginasACCA SBR Notes - AsraReem JavedAinda não há avaliações

- Quiz 3 UploadDocumento6 páginasQuiz 3 UploadandreamrieAinda não há avaliações

- ACCTG 103 Notes Receivable and Payable ReviewDocumento12 páginasACCTG 103 Notes Receivable and Payable ReviewLyn AbudaAinda não há avaliações

- Midterm Exam - ACTG6257 Intermediate Accounting 3Documento21 páginasMidterm Exam - ACTG6257 Intermediate Accounting 3Kitchie Rose Dala CruzAinda não há avaliações

- Pimco Corp. Opp Fund (Pty)Documento46 páginasPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongAinda não há avaliações