Escolar Documentos

Profissional Documentos

Cultura Documentos

S77-079 Whole Life Options Pamphlet PDF

Enviado por

Dave WottonDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

S77-079 Whole Life Options Pamphlet PDF

Enviado por

Dave WottonDireitos autorais:

Formatos disponíveis

Whole Life

Insurance Options

Achieving

Financial Security

with Whole Life

Insurance

S77-079

Choose from Five Policies

Executive Whole Life

u

Provides

life insurance protection for

the rest of your life

u

Make

equal premium payments up to age 95

u

The

younger you are, the lower your premiums

will be, and the more years youll have to

accumulate value

At COUNTRY Financial, we

understand that one size

does not fit all when it comes

20-Pay Life

u

Make

20 equal payments and have guaranteed

paid-up protection

u

Continues

good choice if you want to make premium

payments during working years with no further

payments after you retire

to life insurance. Thats why

we offer several different types

of whole life policies. You can

also select from a variety of

optional coverages to customize

to increase in value over time

u

A

10-Pay Life

u

Life-long

protection paid for in 10 years

u

Can

help you transfer part of your estate to your

children or grandchildren

u

A

good choice to help with your business

continuation needs if you own a business

Life Paid-Up at 65

u

Make

equal payments until age 65, when you

will have a paid-up policy for the rest of your life

your policy to meet your familys

u

An

financial security goals.

Single Premium Whole Life

excellent way to help plan for your retirement

years

u

Make

a lump sum payment and have a

paid-up policy

u

Can

be given as a gift to a grandchild

u

Continues

to increase in value, but you will

usually pay no income tax on the accumulation1

u

Great

way to transfer tax-advantaged money to

the next generation

COUNTRY and our representatives cannot give tax advice. Any

information we provide reflects our understanding of current

tax laws, which are subject to change and reinterpretation.

Note: The Guaranteed Insurability option is the

only option available on the Single Premium

Whole Life policy.

Child Term Insurance

This optional rider guarantees your childrens

insurability and provides up to $25,000 of term

life insurance for all of your children ages 0-17.

Coverage expires at age 23, and each child

can convert the coverage to the same amount

of whole life insurance prior to age 23, without

evidence of insurability.

Term Insurance for You

or Your Spouse

Adding optional 10, 20 or 30-year term

insurance to your whole life policy is an

economical way to provide additional life

insurance for you or to add coverage for your

spouse. The term policy can be converted

later to a whole life policy without evidence of

insurability (as long as the conversion is made

during the level-premium period and before

age 65).

Accelerated Benefit Endorsement

With this endorsement, you can use up to

50 percent of the policys death benefit

while youre living if youre terminally ill,

and still provide a reduced death benefit

for your loved ones.

Disability Waiver of Premium 260

If you become totally disabled prior to age

60, we will waive your whole life premiums for

up to two years if you cant work in your own

occupation. After two years, we will continue

to waive the premiums until you reach age

95, as long as you are unable to work in any

occupation because of your disability.

Special Tenants Coverage

The Keeperh

Optional Whole Life Insurance

Benefits (at additional cost):

Disability Waiver of Premium 565

If you become totally disabled prior to age

65, we will waive your whole life premiums for

up to five years if you cant work in your own

occupation. After five years, we will continue

to waive the premiums until you reach age

95, as long as you are unable to work in any

occupation because of your disability.

Guaranteed Insurability

This option guarantees you the right to increase

the amount of your life insurance protection

within specified limits every three years,

beginning at age 22 through age 43, regardless

of your health.

Accidental Death Benefit

If you select this option, a specified amount

will be paid if you die as a result of an accident

prior to age 70.

Paid Up Additions Rider

This rider provides the opportunity to purchase

additional paid-up whole life insurance with a

single premium.

Long Term Care Accelerated

Benefit Rider*

Having a life insurance plan in place is

If you are chronically ill**, this optional

insurance rider will pay a monthly benefit

while you need it. The total amount available

for Long Term Care is equal to the original

death benefit amount of the whole life

insurance policy. Each monthly payment will

reduce the amount available for a death

benefit. Or, if you dont require Long Term Care,

you can leave money to your loved ones.

picture. Your financial representative,

an important part of your overall financial

backed by a team of experts, will work

one-on-one with you to help you reach

your goals.

Benefit Overview

The Long Term Care benefit has a range

of options available to suit your needs and

budget. Whether you use this insurance

rider as your main source of Long Term Care

coverage or as a supplement to an existing

Long Term Care policy, youll find this is

an economical way to get Long Term Care

coverage and still have life insurance.

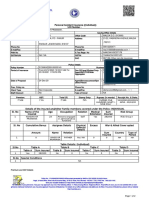

If you purchase a life

policy with a death

benefit amount of

You can choose monthly Long

Term Care payments within the

following range

Form Number

Whole Life Policy

ICC13(WL)

Single Premium Whole Life

ICC13(WLSP)

Accelerated Benefit

AB(12/04); in OR, AB(OR12/04)

Term Life Insurance:

Spouse Rider

ICC13(TLIS)

ICC13(TLII)

50,000

$ 1,000 - $ 4,000

Term Life Insurance:

Insured Rider

$ 100,000

$ 1,000 - $ 8,000

Child Term Rider

ICC13(CR5000)

$ 250,000

$ 2,500 - $10,000

Accidental Death Option

ADB(13)

$ 500,000

$ 5,000 - $10,000

$1,000,000

$10,000

Payor Death Waiver

of Premium Rider

ICC13(PDO)

Disability Waiver

of Premium Benefit

DWP260(13), ICC13(DWP565)

The Long Term Care optional insurance rider is

available on the following whole life policies at

the time of issue:

10-Pay Life

P

20-Pay Life

P

Life Paid Up at 65

P

Single Premium Whole Life

P

Executive Whole Life

P

*Not available in Minnesota. This option is called the

Chronic Care Accelerated Benefit in Oregon.

Description

**You must be certified by a licensed healthcare

practitioner as being chronically ill.

Paid-Up Life Insurance Rider ICC13(PUAR)

Guaranteed Insurance

Option Rider

ICC13(GIO)

Long Term Care Rider

In OR: CCAB(OR13), WPRLIB(OR13),

RLIB(OR13)

In TN: LTCAB(TN03/06), RLIB(03/06),

WPRLIB(03/06)

This flyer briefly describes the options available on the

This pamphlet briefly describes the options available on the

ExecutiveWhole

WholeLife,

Life,10-Pay

10-PayLife,

Life,20-Pay

20-PayLife,

Life,Life

LifePaid-Up

PaidExecutive

at

65 and

Single

Premium

Whole

Life insurance

policies

UpAge

at Age

65 and

Single

Premium

Whole

Life insurance

issued by COUNTRY Life Insurance Company and is not

policies issued by COUNTRY Life Insurance Company and

a statement of contract. For a complete description of all

is not a statement

contract.and

Forlimitations,

a completeand

description

coverages,

options, of

exclusions

the terms

under

which the policies

be continued

in force, please

of all coverages,

options,may

exclusions

and limitations,

and

refer to the policies, or call your financial representative.

the terms under which the policies may be continued in

The

Long

Termrefer

CaretoAccelerated

Benefit

not provide

force,

please

the policies,

or callRider

yourwill

financial

benefits for any care or services which: (1) result from an

representative.

act of war; (2) result from participation in a felony, riot, or

insurrection; (3) are provided at no charge in the absence

of insurance; (4) result directly or indirectly from attempted

suicide or intentionally self-inflicted injury while sane or

insane; (5) are received while outside the United States

of America or its territories or possessions; (6) are due to

mental or nervous disorders without evidence of organic

disease. The policy does provide benefits for treatment of

Alzheimers disease, senile dementia, other organic brain

syndromes or other types of senility diseases; (7) result from

alcoholism or drug addiction; (8) are provided by a family

member; (9) are payable under a workers compensation,

occupational disease or employers liability law; (10) are

provided by or in a Veterans Administration or federal

government facility. This limitation does not apply where a

liability exists for charges made to or on your behalf; or (11)

are available under Medicare or other governmental programs

(except Medicaid) or would be so reimbursable but for the

application of a deductible or coinsurance amount.

Coordination with Medicare: We will not pay benefits for

services for which benefits are payable by Medicare (including

amounts that would be reimbursable but for the application

of a deductible or coinsurance amount); except that this

provision shall not apply to expenses payable under Medicare

only as a secondary payor.

Exclusions may vary by state.

If you would like more information on long term care

insurance from your states senior insurance counseling

program, see your financial representative for the programs

contact information.

www.countr yfinancial.com

COUNTRY Life Insurance Company

PO Box 2000, Bloomington, IL

61702-2000

S77-079-04 (09/13)

2013 CC Services, Inc.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The New India Assurance Co. Ltd. (Government of India Undertaking)Documento2 páginasThe New India Assurance Co. Ltd. (Government of India Undertaking)rajib paulAinda não há avaliações

- Heather Clift Resume 2017Documento3 páginasHeather Clift Resume 2017api-414335713Ainda não há avaliações

- Sarbati Devi v. Usha Devi AnalysisDocumento10 páginasSarbati Devi v. Usha Devi AnalysisSameer Khedkar100% (1)

- Corporate Finance & Financial Services Emerging TrendsDocumento74 páginasCorporate Finance & Financial Services Emerging TrendsSridher BashattyAinda não há avaliações

- Product Disclosure SheetDocumento3 páginasProduct Disclosure SheetshamsulAinda não há avaliações

- Financial InstitutionDocumento8 páginasFinancial InstitutionankitAinda não há avaliações

- Harvardian College vs. Country BankersDocumento1 páginaHarvardian College vs. Country BankersChaAinda não há avaliações

- Percentage Change PDFDocumento8 páginasPercentage Change PDFAlbert OmaribaAinda não há avaliações

- Click Here To View Your Aliyah Benefits at A GlanceDocumento1 páginaClick Here To View Your Aliyah Benefits at A GlanceAyelen FlintAinda não há avaliações

- Star Health and Allied Insurance Company LTDDocumento3 páginasStar Health and Allied Insurance Company LTDKishan NandamuriAinda não há avaliações

- Panaton VDocumento2 páginasPanaton VEdward Kenneth KungAinda não há avaliações

- HR Budget TrainingDocumento32 páginasHR Budget Trainingsaidul islamAinda não há avaliações

- Form A2 PDFDocumento2 páginasForm A2 PDFkiran_nyusAinda não há avaliações

- Bagrao Raviraj Kashinath: A Project Synopsis FOR Life Insurance Submitted byDocumento26 páginasBagrao Raviraj Kashinath: A Project Synopsis FOR Life Insurance Submitted byJai GaneshAinda não há avaliações

- Quality Management in Health Care: Concepts, Principles and StandardsDocumento8 páginasQuality Management in Health Care: Concepts, Principles and StandardsMartin BringasAinda não há avaliações

- Discussion Paper TPBIDDocumento20 páginasDiscussion Paper TPBIDPaulAinda não há avaliações

- Claremont COURIER Classifieds 10-24-14Documento6 páginasClaremont COURIER Classifieds 10-24-14Claremont CourierAinda não há avaliações

- PMJDY Claim OfficerDocumento116 páginasPMJDY Claim OfficerKsr Naidu KammaAinda não há avaliações

- Kotak Endowment PlanDocumento2 páginasKotak Endowment PlanMichael GreenAinda não há avaliações

- Finman General Assurance Corp Vs CADocumento3 páginasFinman General Assurance Corp Vs CAPearl Ponce de LeonAinda não há avaliações

- 03.1 Insular Life V NLRCDocumento2 páginas03.1 Insular Life V NLRCElaineMarcillaAinda não há avaliações

- 7 Sunlife Assurance Co of Canada V CA and Sps BacaniDocumento3 páginas7 Sunlife Assurance Co of Canada V CA and Sps BacaniGin FranciscoAinda não há avaliações

- FORMAL CLAIM FOR FIRE LOSS-newDocumento1 páginaFORMAL CLAIM FOR FIRE LOSS-newMyty CaracuelAinda não há avaliações

- IMBEX 2015 - Exhibitor Manual & Order FormDocumento50 páginasIMBEX 2015 - Exhibitor Manual & Order FormBebiLuck Makanan Pendamping AsiAinda não há avaliações

- Continental Casualty Company v. William S. Burton, Audrey H. Buckner, Mary R. Thweatt, 795 F.2d 1187, 4th Cir. (1986)Documento11 páginasContinental Casualty Company v. William S. Burton, Audrey H. Buckner, Mary R. Thweatt, 795 F.2d 1187, 4th Cir. (1986)Scribd Government DocsAinda não há avaliações

- Managing Finance in Health and Social CareDocumento26 páginasManaging Finance in Health and Social CareShaji Viswanathan. Mcom, MBA (U.K)Ainda não há avaliações

- HDFC Life Sampoorn Samridhi Plus - Brochure PDFDocumento12 páginasHDFC Life Sampoorn Samridhi Plus - Brochure PDFmonicaAinda não há avaliações

- Marketing Opportunities For HCFDocumento12 páginasMarketing Opportunities For HCFKyu Hyoung KangAinda não há avaliações

- Export Merchandising and Exim End Term Jury Report: National Institute of Fashion TechnologyDocumento24 páginasExport Merchandising and Exim End Term Jury Report: National Institute of Fashion TechnologyGaurav RawatAinda não há avaliações

- Finding The Present Value For N Not An Integer: SolutionDocumento7 páginasFinding The Present Value For N Not An Integer: Solutiondame wayneAinda não há avaliações