Escolar Documentos

Profissional Documentos

Cultura Documentos

Service Tax

Enviado por

AnanyaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Service Tax

Enviado por

AnanyaDireitos autorais:

Formatos disponíveis

4/10/2015

Contents

SERVICE TAX

O Service Tax

O Need for Service Tax

O Meaning of Service

O Declared Services

O Taxable services

Group members:Pratiksha Karambe{22}

Noopur Koli{24}

Pallavi Dalvi{25}

O Negative List of services

O Liability to pay service tax

O Service Tax Rate

O Example

Concept of Service Tax

Service Tax is a form of indirect tax imposed on

specified services called taxable service.

It is an indirect tax.

First brought into force with effect from 1st July 1994.

Need for Service Tax

The objective behind levying service tax is to reduce

degree of intensity of taxation on manufacturing and trade.

The intension of the govt is to gradually increase the list

of taxable.

Meaning of Service

O SERVICE,First time in the history of this law the term

It is prime responsibility of the govt is

to fulfill the increasing developmental

Service has been defined u/s 65B(44) of theAct

inserted w.e.f. 01-07-2012.

needs of the country and

its people by way of public expenditure.

O Service means any ACTIVITY carried out by a person

for another for CONSIDERATION and includes

declared services.

4/10/2015

Declared Services

O constitutes merely transfer of title in Goods or Immovable

Declared Services

O Agreeing for not doing any act or tolerate any act, or to do an act;

Property

O Section 66E of the Act provides certain activities

O Renting of Immovable Property;

Construction of a Complex, building, civil structure

Temporary transfer or permitting the use or enjoyment of any

intellectual rights;

O Transfer of Goods by way of hiring, licensing without transfer of right to use

such goods;

O Activities in relation to delivery of goods on hire purchase;

O Service portion in Works Contract; and

O Service portion in an activity where food or any article for human

consumption or any drink is supplied in any manner as part of such activity.

O Development, Designing, Programming, Up- gradation,

Customizing, Adaption, Implementation, Enhancement of

Information Technology Software;

Taxable Services

Construction includes additions, alterations, replacements or remodelling of

any existing civil structure.

What services are taxable?

O Prior to July, 2012 Service Tax was charged on specified list of

services.

There are about 116 services covered under the

service tax.

Some of the major services are as follows:

Telephone

Stockbroker

Courier agencies

General Insurance

Commercial Training and coaching

Works contract

NEGATIVE LIST OF SERVICES

O chargeability of service tax has been shifted from Positive List to

Negative List.W.e.f. 01-07-2012,

O Service Tax shall be charged by virtue of Section 66B of the Act

which reads as under:

There shall be levied a tax at the rate of 12% on the value of all

services, other than those services specified in the negative list,

provided or agreed to be provided in the taxable territory by one

person to another and collected in such manner as may be

prescribed

NEGATIVE LIST OF SERVICES

O Section 66D of the Act specifies 17 categories of

services on which no tax shall be levied.

Following are such categories listed in negative list:

Services by RBI,

Foreign Diplomatic Mission in India,

Government or Local Authority;

Trading or Manufacture of Goods;

Betting, gambling or lottery &

Funeral, burial, crematorium or mortuary services including

conveyance of deceased;

Selling of space or time slots for advertisements other than

broadcasted by radio or television;

Admission to entertainment events or amusement facilities;

Services relating to agriculture or agricultural produce like

supply of farm labour, loading, unloading, storage or

warehousing of agricultural produce;

Transmission or distribution of Electricity;

4/10/2015

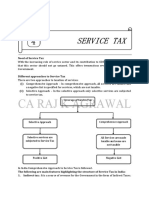

Who is liable to pay Service Tax?

1.INSURER

in case of

service provided

by insurance

agent

O (Sec.68 (1) of the Act) says thatthat-the Person

who provides the taxable service is

responsible for paying the Service Tax to the

Government.

5.SPECIFIED

CONSIGNOR

OR CONSIGNEE

in case of service

provided by

goods transport

agency

Persons

Liable to Pay

Service Tax

in Certain

Cases

4.ASSET

MANAGEMEN

T COMPANY

in case

service

provided by a

distributor to

them

Service Tax Rate

The current of service tax rate is 12.36%

Service Tax

12%

(+)Education Cess[2%]

0.2%

(+)Senior and Higher Education Cess[1%] 0.1%

Effective Service Tax Rate

12.36

2.INDIAN

RESIDENT

in case of

import of

service

3.BODY

CORPORATE

OR FIRM

in case of

receipt of

sponsorship

service

Example

If a CA, provides services in the capacity of auditor to

ABC Ltd. And the audit fees is Rs.100000 then the

service tax chargeable will be 12.36% on Rs.100000

i.e INR 12360. Hence, the total billing to be done by

CA to ABC Ltd will be Rs.112360.

Thank You

Você também pode gostar

- KNCCI Vihiga: enabling county revenue raising legislationNo EverandKNCCI Vihiga: enabling county revenue raising legislationAinda não há avaliações

- Service TaxDocumento55 páginasService Taxtushar vatsAinda não há avaliações

- KNCCI Vihiga: enabling county revenue raising legislationNo EverandKNCCI Vihiga: enabling county revenue raising legislationAinda não há avaliações

- Service Tax - Based On Negative List ApproachDocumento22 páginasService Tax - Based On Negative List ApproachRajavati NadarAinda não há avaliações

- Procurement and Supply Chain Management: Emerging Concepts, Strategies and ChallengesNo EverandProcurement and Supply Chain Management: Emerging Concepts, Strategies and ChallengesAinda não há avaliações

- Variant 3 REVISED Jan13 LDocumento96 páginasVariant 3 REVISED Jan13 LGopakumar PAinda não há avaliações

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchNo EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchNota: 5 de 5 estrelas5/5 (1)

- Service Tax Qick RevisionDocumento91 páginasService Tax Qick RevisiongouthamAinda não há avaliações

- Service Tax: Aiaims Mms-ADocumento31 páginasService Tax: Aiaims Mms-AAbbas Haider NaqviAinda não há avaliações

- Service Tax - Negative ListDocumento46 páginasService Tax - Negative ListShabaaz ShaikhAinda não há avaliações

- Service Tax BasicsDocumento5 páginasService Tax BasicsKiran RaviAinda não há avaliações

- Background To The Introduction of The Negative ListDocumento42 páginasBackground To The Introduction of The Negative ListVinay GoyalAinda não há avaliações

- PunjabDocumento5 páginasPunjabUsaid KhanAinda não há avaliações

- 1 Budget Impact 2012-13Documento5 páginas1 Budget Impact 2012-13Rajkamal TiwariAinda não há avaliações

- Service TaxDocumento17 páginasService Taxvenky_1986100% (2)

- Payment of Service Tax Under Reverse Charge - A Comprehensive StudyDocumento13 páginasPayment of Service Tax Under Reverse Charge - A Comprehensive Studyav_meshramAinda não há avaliações

- VAT ReviewerDocumento18 páginasVAT ReviewerNash Ortiz LuisAinda não há avaliações

- Material - Mr. A. R. Krishnan - 21.8.2013Documento29 páginasMaterial - Mr. A. R. Krishnan - 21.8.2013mld2017Ainda não há avaliações

- Service Tax - 1.1Documento18 páginasService Tax - 1.1Arun ChopraAinda não há avaliações

- ELP Tax Alert - Clarification On Services by Government or Local AuthorityDocumento4 páginasELP Tax Alert - Clarification On Services by Government or Local AuthorityNITINAinda não há avaliações

- Taxation of Services in IndiaDocumento11 páginasTaxation of Services in IndiaJagadishBagreeAinda não há avaliações

- Presentation On Service Tax AmendmentsDocumento19 páginasPresentation On Service Tax AmendmentsSmriti KhannaAinda não há avaliações

- Reverse Charge Mechanism by Bimal Jain Tax ExpertDocumento4 páginasReverse Charge Mechanism by Bimal Jain Tax ExpertYogesh ChaudhariAinda não há avaliações

- Sopore Law CollegeDocumento7 páginasSopore Law Collegelone NasirAinda não há avaliações

- Indirec TaxDocumento8 páginasIndirec TaxSubashAinda não há avaliações

- Sudipta Bhattacharjee Managing Associate BMR AdvisorsDocumento29 páginasSudipta Bhattacharjee Managing Associate BMR AdvisorsAshish Wade100% (1)

- Tax on Services in India: Introduction, Concepts, and Governing ProvisionsDocumento11 páginasTax on Services in India: Introduction, Concepts, and Governing Provisionsnishantjain95Ainda não há avaliações

- Amendment ST and CCR For Nov 2016Documento11 páginasAmendment ST and CCR For Nov 2016J K Siva KumarAinda não há avaliações

- Law of TaxationDocumento9 páginasLaw of TaxationShailesh KumarAinda não há avaliações

- Concept of Service TaxDocumento47 páginasConcept of Service TaxSrinivas ReddyAinda não há avaliações

- Service TaxDocumento7 páginasService TaxmurusaAinda não há avaliações

- Service Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreDocumento7 páginasService Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreChetan ShivankarAinda não há avaliações

- Administration of VAT in KenyaDocumento13 páginasAdministration of VAT in KenyaRuth NyawiraAinda não há avaliações

- Validity of VAT on Tollway Fees UpheldDocumento3 páginasValidity of VAT on Tollway Fees UpheldMa. Melissa Jamella LindoAinda não há avaliações

- SERVICE DELIVERY REVOLUTIONDocumento29 páginasSERVICE DELIVERY REVOLUTIONLizette SyAinda não há avaliações

- Answer 4: Custom DutyDocumento3 páginasAnswer 4: Custom DutyAshlee RobertsAinda não há avaliações

- Service Tax On Goods Transport Agency (GTADocumento11 páginasService Tax On Goods Transport Agency (GTARaveendran P MAinda não há avaliações

- CA. Bimal Jain: CA Final Paper 8 Indirect Tax Laws Section B: Service Tax and VAT, Chapter 1Documento64 páginasCA. Bimal Jain: CA Final Paper 8 Indirect Tax Laws Section B: Service Tax and VAT, Chapter 1jonnajon92-1Ainda não há avaliações

- Service Tax Structure in India: By: Vardah SaghirDocumento18 páginasService Tax Structure in India: By: Vardah SaghirBhagavatheeswaran HariharanAinda não há avaliações

- Provisons On Service TaxDocumento37 páginasProvisons On Service TaxSunita NitinAinda não há avaliações

- Diaz Vs Secretary of FinanceDocumento3 páginasDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEDocumento2 páginasDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusAinda não há avaliações

- Taxation: The Train Law in FocusDocumento9 páginasTaxation: The Train Law in FocusLj Paul YumulAinda não há avaliações

- TAXATIONDocumento17 páginasTAXATIONLamaire Abalos BatoyogAinda não há avaliações

- 9Th Semester: Taxation LawDocumento7 páginas9Th Semester: Taxation LawHena khanAinda não há avaliações

- CIR v. COMASERCO - DigestDocumento2 páginasCIR v. COMASERCO - DigestMark Genesis RojasAinda não há avaliações

- Raising Revenues Through Municipal Taxes in DelhiDocumento16 páginasRaising Revenues Through Municipal Taxes in DelhibharthiaeAinda não há avaliações

- 2 Digested Cir Vs CA and Commonwealth Management and Services CorporationDocumento1 página2 Digested Cir Vs CA and Commonwealth Management and Services CorporationRoli Sitjar ArangoteAinda não há avaliações

- Practice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332Documento16 páginasPractice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332musaAinda não há avaliações

- Union Budget 2012-2013 Service Tax ProposalsDocumento35 páginasUnion Budget 2012-2013 Service Tax ProposalssbgcoAinda não há avaliações

- Service Tax Act - FAQsDocumento80 páginasService Tax Act - FAQsvarada2Ainda não há avaliações

- Final Service TaxDocumento33 páginasFinal Service TaxDeepak SainiAinda não há avaliações

- T2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVADocumento1 páginaT2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVACJVAinda não há avaliações

- Tax2 DigestDocumento28 páginasTax2 DigestRizza MoradaAinda não há avaliações

- Supply and Its TypesDocumento30 páginasSupply and Its TypesAmit GuptaAinda não há avaliações

- Service TaxDocumento12 páginasService TaxdeepikaAinda não há avaliações

- Cir V CA ComasercoDocumento2 páginasCir V CA ComasercoJoel G. AyonAinda não há avaliações

- VatDocumento4 páginasVatColeenAinda não há avaliações

- CHISOMO EEC PresentationDocumento10 páginasCHISOMO EEC PresentationKèréñAinda não há avaliações

- Contemporary Tax Issues PresentationDocumento38 páginasContemporary Tax Issues PresentationSamuel DwumfourAinda não há avaliações

- Consumer Awareness and Preferences for Traditional Medicine SystemsDocumento14 páginasConsumer Awareness and Preferences for Traditional Medicine SystemsAnanyaAinda não há avaliações

- Vertical Balance Sheet & Income Statment FormatDocumento9 páginasVertical Balance Sheet & Income Statment FormatAnanyaAinda não há avaliações

- Noopur SIP ReportDocumento75 páginasNoopur SIP ReportAnanyaAinda não há avaliações

- Topic: Cost, Price, Competition, Monopoly & ProfitDocumento18 páginasTopic: Cost, Price, Competition, Monopoly & ProfitAnanyaAinda não há avaliações

- Market Research & MIS Lect No.3.1Documento25 páginasMarket Research & MIS Lect No.3.1AnanyaAinda não há avaliações

- Comparing SBI Magnum and IDFC Mutual Fund RatiosDocumento4 páginasComparing SBI Magnum and IDFC Mutual Fund RatiosJenifer Chrisla TAinda não há avaliações

- 2011 Houlihan Lokey PPA Study PDFDocumento49 páginas2011 Houlihan Lokey PPA Study PDFSoloUnico100% (1)

- Quiz On FUNDA ABM 2Documento2 páginasQuiz On FUNDA ABM 2Baby Irish Estares Marcelo100% (1)

- The Relevance of Leverage, Profitability, Market Performance, and Macroeconomic To Stock PriceDocumento11 páginasThe Relevance of Leverage, Profitability, Market Performance, and Macroeconomic To Stock PriceHalimahAinda não há avaliações

- A Brief Introduction To Valuation PDFDocumento2 páginasA Brief Introduction To Valuation PDFsumanta maitiAinda não há avaliações

- Note Purchase Agreement Template - 1Documento16 páginasNote Purchase Agreement Template - 1David Jay Mor100% (2)

- Business Taxation Notes Income Tax NotesDocumento39 páginasBusiness Taxation Notes Income Tax NotesvidhyaaravinthanAinda não há avaliações

- Sample Exam Questions (And Answers)Documento22 páginasSample Exam Questions (And Answers)Diem Hang VuAinda não há avaliações

- COMP255 Question Bank Chapter 7Documento9 páginasCOMP255 Question Bank Chapter 7Ferdous RahmanAinda não há avaliações

- Lecture Law On Negotiable InstrumentDocumento27 páginasLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Financial Markets Meaning, Types and WorkingDocumento15 páginasFinancial Markets Meaning, Types and WorkingRainman577100% (1)

- Sample of Corporation PapersDocumento102 páginasSample of Corporation PaperstopguncreditrepairllcAinda não há avaliações

- Bank Strategic Planning and Budgeting ProcessDocumento18 páginasBank Strategic Planning and Budgeting ProcessBaby KhorAinda não há avaliações

- Articles of Incorporation for Alpha Sigma Lex FraternityDocumento4 páginasArticles of Incorporation for Alpha Sigma Lex FraternityBianca PastorAinda não há avaliações

- Chapter 8-SHEDocumento77 páginasChapter 8-SHEVip Bigbang100% (1)

- IPPTChap 008Documento81 páginasIPPTChap 008Nia ニア MulyaningsihAinda não há avaliações

- BLS18234 BRO Book 006.1 CH5Documento20 páginasBLS18234 BRO Book 006.1 CH5G.D SinghAinda não há avaliações

- SEC Memorandum No. 15 Dated Nov. 7 2018Documento17 páginasSEC Memorandum No. 15 Dated Nov. 7 2018Bulatlat MultimediaAinda não há avaliações

- Cfa Level 1 Ethics-Code - Standard Class 6Documento21 páginasCfa Level 1 Ethics-Code - Standard Class 6pamilAinda não há avaliações

- Sakthi Fianance Project ReportDocumento61 páginasSakthi Fianance Project ReportraveenkumarAinda não há avaliações

- LT Tax Advantage FundDocumento2 páginasLT Tax Advantage FundDhanashri WarekarAinda não há avaliações

- Balance Sheet AnalysisDocumento2 páginasBalance Sheet AnalysisNavmeen KhanAinda não há avaliações

- Performance of Mutual Fund Schemes in IndiaDocumento8 páginasPerformance of Mutual Fund Schemes in IndiaPankaj GuravAinda não há avaliações

- IFRS 9 Financial Instruments Quiz.Documento4 páginasIFRS 9 Financial Instruments Quiz.حسين عبدالرحمنAinda não há avaliações

- All FormulaDocumento7 páginasAll FormulaLeeshAinda não há avaliações

- Sampa Video Group 5Documento6 páginasSampa Video Group 5Ankit MittalAinda não há avaliações

- Ib AgreementDocumento17 páginasIb AgreementYod SamecAinda não há avaliações

- Top AA+ rated tax-free bonds under 15 yearsDocumento3 páginasTop AA+ rated tax-free bonds under 15 yearsumaganAinda não há avaliações

- APPLICABLE ACCOUNTING STANDARDSDocumento18 páginasAPPLICABLE ACCOUNTING STANDARDSSourav ChamoliAinda não há avaliações