Escolar Documentos

Profissional Documentos

Cultura Documentos

Separate Benchmark For Islamic Banks

Enviado por

Ammar ZafarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Separate Benchmark For Islamic Banks

Enviado por

Ammar ZafarDireitos autorais:

Formatos disponíveis

Separate Benchmark for Islamic Banks

What is Banking System?

A Bank is a financial institution and a financial intermediary

that accepts deposits and channels those deposits into lending

activities,

either

directly

or

through

capital

deficits

markets. A bank connects customers that have capital deficits

to customers with capital surpluses.

Due to their critical status within the financial system and

the

economy generally,

countries.

Most

as fractional

banks

reserve

banks

are highly

operate

regulated in

under

banking where

they

system

hold

most

known

only

small reserve of the funds deposited and lend out the rest for

profit.

They

are

requirements which

generally

are

based

subject

on

an

to minimum

international

capital

set

of

capital standards, known as the Basel Accords.

Types of Banks:

Banks activities can be divided into

Retail Banking, dealing directly with individuals and small

businesses;

Business Banking, providing services to mid-market business;

corporate banking, directed at large business entities;

Private banking, providing wealth management services to high

net worth individuals and families;

Investment banking, relating to activities on the financial

markets.

Other Types of Banks:

Central Banks are normally government-owned and charged with

quasi-regulatory

responsibilities,

Essentials Of Islamic Finance

Page 1

such

as

supervising

Separate Benchmark for Islamic Banks

commercial banks, or controlling the cash interest rate. They

generally provide liquidity to the banking system and act as

the lender of last resort in event of a crisis.

Islamic Banks adhere to the concepts of Islamic law. This form

of banking revolves around several well-established principles

based on Islamic canons. All banking activities must avoid

interest, a concept that is forbidden in Islam. Instead, the

bank

earns

profit

(markup)

and

fees

on

the

financing

facilities that it extends to customers.

Most banks are profit-making, private enterprises. However,

some are owned by government, or are non-profit organizations.

Islamic Banks in Pakistan

1) Dawood Islamic Bank Limited

2) Dubai Islamic Bank Pakistan limited

3) Meezan Bank Premier Islamic Bank In Pakistan

4) AlBaraka Islamic Bank

5) BankIslami Pakistan Limited

6) Emirates Global Islamic Bank

Essentials Of Islamic Finance

Page 2

Separate Benchmark for Islamic Banks

What is Islamic Banking?

Islamic

banking

system

of

refers

banking

or

to

banking

activity that is consistent with

the

principles

(Islamic

of

the

rulings)

Shari'ah

and

its

practical application through the

development of Islamic economics.

The

principles

which

emphasize

moral and ethical values in all

dealings

have

wide

appeal.

Shari'ah

interest

charges

universal

prohibits

(riba)

the

for

payment

the

or

lending

and

acceptance

of

accepting

of

money, as well as carrying out trade and other activities that

provide

goods

or

services

considered

contrary

to

its

principles. While these principles were used as the basis for

a flourishing economy in earlier times, it is only in the late

20th century that a number of Islamic banks were formed to

provide

an

alternative

basis

to

Muslims

although

Islamic

banking is not restricted to Muslims.

Islamic banking has the same purpose as conventional banking

except

that

Shariah,

it

known

operates

as

in

Fiqh

accordance

al-Muamalat

with

the

(Islamic

rules

rules

of

on

transactions). Islamic banking activities must be practiced

consistent with the Shariah and its practical application

through the development of Islamic economics. Many of these

principles upon which Islamic banking is based are commonly

accepted

all

decades.

These

over

the

world,

principles

are

for

not

centuries

new

but

rather

arguably,

original state has been altered over the centuries.

Essentials Of Islamic Finance

Page 3

than

their

Separate Benchmark for Islamic Banks

It is evident that Islamic finance was practiced predominantly

in

the

Muslim

world

throughout

the

middle

Ages,

fostering

trade and business activities. In Spain and the Mediterranean

and

Baltic

middlemen

States,

for

Islamic

trading

merchants

activities.

It

became

is

indispensable

claimed

that

many

concepts, techniques, and instruments of Islamic finance were

later adopted by European financiers and businessmen.

The revival of Islamic banking coincided with the world-wide

celebration

of

the

advent

of

the

15th

Century

of

Islamic

calendar (Hijra) in 1976. At the same time financial resources

of Muslims particularly those of the oil producing countries,

received a boost due to rationalization of the oil prices,

which

had

hitherto

been

under

the

control

of

foreign

oil

Corporations.

Disenchantment with the value neutral capitalist and socialist

financial systems led not only Muslims but also others to look

for ethical values in their financial dealings and in the West

some

financial

organizations

have

opted

for

ethical

operations.

Origin of Islamic Bank

The origin of the modern Islamic bank can be traced back to

the very birth of Islam when the Prophet himself acted as an

agent for his wife's trading operations. Islamic partnerships

(mudarabah) dominated the business world for centuries and the

concept of interest found very little application in day-today transactions.

Essentials Of Islamic Finance

Page 4

Separate Benchmark for Islamic Banks

Such partnerships performed an important economic function.

They combined the three most important factors of production,

namely: capital, labour and entrepreneurship, the latter two

functions usually combined in one person. The capital-owner

contributed the money and the partner managed the business.

Each shared in a pre-determined share of the profits. If there

was

loss,

the

capital-provider

lost

his

money

and

the

manager lost his time and labour.

Islamic Banking Principles

The Shariah prohibits the payment of charges for the renting

of

money (riba,

which in

the

definition of Islamic scholars

covers any excess in financial

dealings, usury or interest) for

specific

terms,

investing

in

as

well

businesses

as

that

provide goods or services considered

contrary

to

its

forbidden).

principles

basis

for

principles

While

were

a

(Haram,

these

used

as

flourishing

the

economy

in

earlier times, it is only in the late

century

that

Islamic

banks

number

were

20th

of

formed

to

apply these principles to private or

private

commercial

semi-

institutions

within the Muslim community.

"While

basic

Islamic

banking

tenant

-

the

of

outlawing

of

riba,

term

that

encompasses not only the concept of usury, but also that of

interest - has seldom been recognized as applicable beyond the

Essentials Of Islamic Finance

Page 5

Separate Benchmark for Islamic Banks

Islamic

world,

many

of

its

guiding

principles

have.

The

majority of these principles are based on simple morality and

common

sense,

which

form

the

of

these

bases

of

many

religions,

is

immediately

including Islam.

"The

universal

nature

principles

apparent even at a cursory glance of non-Muslim literature.

Usury was prohibited in both the Old and New Testaments of the

Bible, while Shakespeare and many other writers, particularly

those writing in the 19th century, have attacked the barbarity

of the practice. Much of the morality championed by Victorian

writers

such

as

Dickens

ranging

from

the

equitable

distribution of wealth through to man's fundamental right to

work - is clearly present in modern Islamic society.

"Although the western media frequently suggest that Islamic

banking in its present form is a recent phenomenon, in fact,

the basic practices and principles date back to the early part

of

the

seventh

century."

(Islamic

Finance:

system

has

Euromoney

Publication, 1997)

Basis of Islamic Banking

In

order

to

be

Islamic,

the

banking

to

avoid

interest. Consequently, much of the literature on the theory

of Islamic banking has grown out of a concern as to how the

monetary and banking system would function if interest were

abolished by law.

Another Islamic principle is that there should be no reward

without risk-bearing. This principle is applicable to both

labour and capital. As no payment is allowed to labour unless

it is applied to work, so no reward for capital should be

allowed unless it is exposed to business risks.

Essentials Of Islamic Finance

Page 6

Separate Benchmark for Islamic Banks

Consider two persons, one of whom has capital but no special

skills in business, while the other has managerial skills but

possesses no capital. They can co-operate in either of two

ways:

1. Debt-financing (the western loan system). The businessman

borrows the capital from the capital-owner and invests it

in

his

trade.

The

capital-owner

is

to

get

back

his

principal and an additional amount on the basis of a

fixed rate, called the interest rate, as his compensation

for parting with liquidity for a fixed period. The claim

of the lender for repayment of the principal plus the

payment of the interest becomes viable only after the

expiry of this period. This payment is due irrespective

of whether the businessman has made a profit using the

borrowed money. In the event of a loss, the borrower has

to repay the principal amount of the loan, as well as the

accrued

interest,

capital-owner

from

loses

his

nothing.

own

resources,

Islam

views

while

this

as

the

an

unjust transaction.

2. Mudarabah (the Islamic way, or PLS). The two persons cooperate

where

with

the

each

other

capital-owner

on

the

provides

basis

the

of

partnership,

capital

and

the

other party puts his management skills into the business.

The capital-owner is not involved in the actual day-today operation of the business, but is free to stipulate

certain conditions that he may deem necessary to ensure

the

best

use

of

his

funds.

After

the

expiry

of

the

period, which may be the termination of the contract or

such time that returns are obtained from the business,

the capital-owner gets back his principal amount together

with a pre-agreed share of the profit.

Essentials Of Islamic Finance

Page 7

Separate Benchmark for Islamic Banks

The ratio in which the total profits of the enterprise are

distributed between the capital-owner and the manager of the

enterprise is determined and mutually agreed at the time of

entering the contract, before the beginning of the project. In

the event of loss, the capital-owner bears all the loss and

the principal is reduced by the amount of the loss. It is the

risk of loss that entitles the capital-owner to a share in the

profits. The manager bears no financial loss, because he has

lost

his

time

and

his

work

has

been

wasted.

This

is,

in

essence, the principle of mudarabah.

Rules of Permissibility

Muslims believe that all things have been provided by God, and

the benefits derived from them, are essentially for mans use,

and so are permissible except what is expressly prohibited in

The Quran or Hadith. When guidance is not clearly given in

the

Quran

example,

there

are

several

guidance

can

be

understanding

and

is

the

other

sought

sources

from

science

of

Fiqh,

of

law.

which

For

means

jurisprudence:

the

science of human intelligence, debate and discussion

Financing Modes of Islamic Banks

Islamic

financing

in

its

first

stages

used

only

the

partnership modes of musharakah and mudarabah. Later it was

realized

that,

to

avoid

moral

hazards,

yet

compete

successfully with conventional banks, it was necessary to use

all permissible Islamic modes and so trade-based and leasing

techniques were developed.

The general rule is that all financial arrangements that the

contracting parties agree to use are lawful, as long as they

do

not

include

an

element

Essentials Of Islamic Finance

of

interest.

Page 8

Equity-holding

and

Separate Benchmark for Islamic Banks

commodity and asset-trading are an integral part of Islamic

financing.

The two basic categories of financing are:

1) profit-and-loss-sharing (PLS), also called participatory

modes, i.e., musharakah and mudarabah and

2) Purchase and hire of goods or assets and services on a

fixed-return

basis,

i.e.,

murabaha,

istisna'a,

salam

and

leasing.

Legitimate modes include financing trade, industry or budget

deficits through domestic or foreign sources. Islamic banks

may design diversified investment portfolios and instruments

that generate profit with the required liquidity. To maximise

its profits, a bank needs to look for investments that yield

the

highest

return,

minimize

risks

and

provide

adequate

liquidity. At the same time, it is necessary for the bank's

liabilities and assets to be matched.

A pyramid of financial assets can be built based on liquidity

and profitability, which are the criteria of prudent banking.

At the top would be high-risk and less-liquid assets, such as

long-term investments out of its own equity or from deposits

of its risk-accepting account-holders. At the bottom of the

pyramid

would

be

assets,

based

on

the

least

murabaha

risky

and

(leasing)

most

or

highly

short-term

liquid

(even

overnight) Mudarabah Certificates (PLS).

Musharakah and mudarabah can be used for short, medium and

long-term

project-financing,

import-financing,

export

financing, working capital financing and financing of single

transactions. Diminishing musharakah can be used for large

Essentials Of Islamic Finance

Page 9

Separate Benchmark for Islamic Banks

fixed

assets

such

as

houses,

transport,

machinery,

etc.

Murabaha can be used for purchases of goods needed by the

bank's clients. Salam is useful for financing farmers, trading

commodities

for

the

public

and

private

sectors

and

other

purchases of measurable and countable things. But it must be

kept in mind that buyback and rollover modes may not be used,

because they are seen as a back door to interest.

With

Islamic

financing,

the

need

to

assess

clients'

acceptability is more important than it is for conventional

banks.

The

bank

needs

to

be

vigilant

and

prudent

by

concentrating on the client's integrity as well as his status

regarding property and particularly his willingness to comply

with Shari'ah-compliant contracts.

Islamic

perform

banks,

the

while

functioning

crucial

task

of

within

resource

the

Shari'ah,

can

mobilization

and

efficient allocation on the basis of both PLS and non-PLS

modes. Sharing modes can be used for short, medium and longterm

financing,

import

financing,

pre-shipment

export

financing, working capital financing and financing of single

transactions. To ensure the maximum use of Islamic finance in

the development of the economy, it is necessary to create an

environment that can induce financiers to earmark more funds

for

musharakah-

or

mudarabah-based

financing

of

productive

units, particularly those of small enterprises.

The

non-PLS

complement

modes

the

PLS

acceptable

to

modes,

also

but

the

Shari'ah

provide

not

only

flexibility

of

choice to meet the needs of different sectors and economic

agents in the society. Trade-based modes, such as murabaha,

having less risk and better liquidity options, have several

advantages over other techniques, but may not be as fruitful

Essentials Of Islamic Finance

Page 10

Separate Benchmark for Islamic Banks

in

reducing

income

inequalities

and

generation

of

capital

goods as participatory techniques are.

Ijarah-based

financing,

that

requires

Islamic

banks

to

purchase and maintain the assets and afterwards dispose of

them according to Shari'ah rules, requires the banks to engage

in activities beyond financial intermediation and are very

much conducive to the formation of fixed assets and mediumand long-term investments.

On the basis of the above, it can be said that supply and

demand of capital in an interest-free environment have the

additional benefit of providing a greater supply of risk-based

capital.

There

resources

and

is

an

also

active

more

efficient

role

for

banks

allocation

and

of

financial

institutions to play, as required in the asset-based Islamic

theory of finance.

Islamic banks can not only survive without interest, but are

also

helpful

justice

by

in

achieving

increasing

the

the

objective

supply

of

risk

of

distributive

capital

in

the

economy and facilitating capital formation and the growth of

fixed assets and real-sector business activities.

Salam (forward purchase with prepayment of price) has a vast

potential to finance productive activities in crucial sectors,

particularly agriculture, agro-based industries and the rural

economy as a whole. It also provides an incentive to enhance

production, as the seller will spare no effort to produce at

least the quantity needed for settlement of the loan taken by

him as the advance price of the goods.

Salam can also lead to creating a stable commodities market,

especially of seasonal commodities, and therefore to stability

Essentials Of Islamic Finance

Page 11

Separate Benchmark for Islamic Banks

of their prices. It enables savers to direct their savings to

investment outlets, without waiting, for instance, until the

harvesting time of agricultural products or the time when they

actually need industrial goods and without being forced to

spend their savings on consumption.

Banks might engage in fund and portfolio management through a

number of asset-managing and leasing and trading companies.

Such companies can exist on their own or can be an integral

part of some big companies or subsidiaries, as in the case of

Universal

Banking

in

Europe.

They

would

manage

Investors

Schemes to mobilize resources on a mudarabah basis, and to

some extent on an agency basis, and use the funds so collected

on

murabaha,

leasing

or

equity-participation

basis.

Subsidiaries can be created for specific sectors or operations

and would enter into genuine trade and leasing transactions.

Low-risk

funds

based

on

short-term

murabaha

and

leasing

operations of the banks, in both local and foreign currencies,

would be best suited to risk-averse savers who cannot afford

the possible losses of PLS-based investments.

Under equity-based funds, banks can offer a type of equity

exposure

through

specified

investment

accounts

where

they

identify possible investment opportunities from existing or

new business clients and invite account-holders to subscribe.

Instead of sharing in the bank's profits, the investors share

in the profit of the enterprise in which the funds are placed

and the bank takes a management fee for its work. Banks can

also offer open-ended multiple-equity funds to be invested in

stocks.

The small and medium enterprises (SME) sector has a great

potential

for

expanding

Essentials Of Islamic Finance

production

Page 12

capacity

and

self-

Separate Benchmark for Islamic Banks

employment

opportunities

in

developing

countries.

Islamic

banks may introduce SME-financing funds for various places.

Enhancing the role of the financial sector in the development

of the SME sub-sector can mitigate the serious problems of

unemployment and the low level of exports of such countries.

Problems faced by Islamic Banks in Pakistan:

There are many problems to Islamic banking in Pakistan as

compared to conventional banking system. There is no legal

framework,

lack

of

professionals,

no

central

bank,

Benchmarking for Islamic Banks, to educate the people about

Islamic banking to increase Islamic finance in the market,

innovation and new technology and experience. Fiqa problems

educated scholars are required to compete conventional banking

in Pakistan

Essentials Of Islamic Finance

Page 13

Separate Benchmark for Islamic Banks

Benchmark

What Does Benchmark Mean?

A standard against which the performance of a security, mutual

fund, or investment manager can be measured. Generally, broad

market and market-segment stock and bond indexes are used for

this purpose.

Benchmark:

Robert Demilio (1995) defines

Benchmarking as an improvement process used to discover and

incorporate best practice into your operation. Benchmarking is

the

preferred

process

used

to

identify

and

understand

the

elements (causes) of a superior or world class performance in

a particular work process.

Xerox

Corporation,

which

is

the

pioneer

of

the

techniques

application in management practice, defines it as the search

for industry best practices which lead to superior performance

(Codling, S 1992).

From

above

two

definitions

key

points

identified

are

best

practice and superior performance.

For instance Allah says in the Quran, Indeed in the Messenger

of Allah you have an excellent example (best practice) to

follow

for

whoever

hopes

in

Allah

and

the

Last

Day

and

remembers Allah much (best performance).

So any Muslim wants to worship Allah in the best possible

manner should follow the sunnah of the prophet (pbuh). For

instance, if you want to be a best husband, you need to look

and follow the way prophet (pbuh) has behaved with his wife.

So a Muslim is expected to benchmark the sunnah of prophet

(pbuh)

in

each

and

every

sphere

of

life

to

performance in both worlds, here and hereafter.

Essentials Of Islamic Finance

Page 14

get

the

best

Separate Benchmark for Islamic Banks

The Islamic Benchmark

Definition

The IIBR is defined as the profit rate that an individual

Contributor Panel bank would perceive to be reasonable for

Shariah compliant funding

were it to do so by asking for and

then accepting inter-bank offers in reasonable market size,

just prior to 11.00 am Makkah local time (GMT + 3). The value

dates for settlement are T+0 for Overnight funds and T+2 for

all other tenors.

Background

Since the establishment of the first Islamic commercial bank

in 1975, the Islamic finance industry has been searching for

an indigenous benchmark that can be applicable to transactions

compliant with Islamic law (Shariah compliant).

As

an

ethical

interest

and

financial

shuns

all

system,

Islamic

finance

interest-related

prohibits

transactions

and

instruments as these are contradictory to the core principles

of

Islam.

reliable

Despite

Islamic

this

prohibition,

interbank

in

benchmark,

the

absence

Islamic

of

banks

and

financial institutions have continued to utilize conventional

interest based benchmarks to calculate their cost of funding

with no reference to either their assets risk profile or the

regional particularities of Islamic banks.

The Islamic Interbank Benchmark Rate (IIBR) serves to address

some

of

these

concerns

by

developing

rate

that

is

contributed by and is indigenous to a global panel of Islamic

banks and Islamic Banking windows with fully segregated funds.

Essentials Of Islamic Finance

Page 15

Separate Benchmark for Islamic Banks

Logic against Interest rate Benchmarking:

Prophet (pbuh) has forbidden copying non Muslims. He suggested

fasting for two days on Muharram while Jews fast for one day, only

to differentiate practice of Muslims from non Muslims. Riba is a

practice of non Muslims. So it should not be benchmarked. Every

kinds

of

transaction

in

Islamic

finance

should

be

able

to

differentiate from the practice of conventional finance.

Dr, Zakir Naik, the most famous Islamic scholar of time argued that

Profit rate of Islamic banking products cannot be same for

all the products. In a general day to day sale transaction we

can see that profit rate of sale of computer and vegetable is not

same. Therefore Islamic banks should have a price index or profit

index for different types of products. In a recent study by post

graduate students of International Islamic university Malaysia shows

that using rental rate is better than interest rate as because it is

stable and linked with real economy. They suggested that there

should be different rental index for different areas to fix rental

rate

to

implement

ijara

contract

for

home

financing

based

on

Musharakah Mutanaqisah Partnership (MMP).

Impact

of

interest

rate

benchmarking

on

Islamic

banking:

Benchmarking interest rate though does not invalidate sharia rulings

but it resembles like a conventional banking product from the

outfit. That is why some critics of Islamic banking say, Islamic

banking allows riba from the back door. Benchmarking interest

rate cannot completely differentiate between an Islamic products and

conventional

products.

Hence,

stakeholders

lose

confidence

on

Islamic branding. Mohammad Amin (2011) has shown how interest rate

benchmarking brings same result in fixed rate mortgage and property

finance using Murabaha (See Appendix A)

Essentials Of Islamic Finance

Page 16

Separate Benchmark for Islamic Banks

The Islamic Interbank Benchmark Rate ('IIBR')

Definition

The

Islamic

Benchmark

Rate

Interbank

('IIBR')

is calculated by Thomson

Reuters based on a time

tested methodology agreed

upon in consultation with

the

Islamic

Benchmark

Committee and approved by

the Shariah Committee.

The IIBR is defined as the profit rate that an individual

Contributor Panel bank would perceive to be reasonable for

Shariah compliant funding

were it to do so by asking for and

then accepting inter-bank offers in reasonable market size,

just prior to 11.00 am Makkah local time (GMT + 3).

The value dates for settlement are T+0 for Overnight funds and

T+2 for all other tenors.

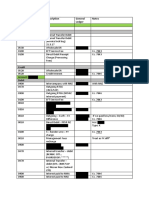

Methodology

A

poll

of

approximately

16

pre-selected

banks

contributed

rates are snapped by Thomson Reuters contributions technology

(Thomson Reuters Spreadsheet Publisher or TRSP) at 10.45 AM on

every business day (Sunday - Thursday).

Banks are asked to contribute rates between 9.00 AM - 10.44 AM

Makkah local time (GMT +3) as per the following question:

Essentials Of Islamic Finance

Page 17

Separate Benchmark for Islamic Banks

What is the expected profit rate that you would distribute for

an interbank Shariah compliant funding transaction, were you

to do so by asking for and then accepting inter-bank offers

for a market amount of USD for the tenors specified below?

Over Night

3 Months

1 week

6 Months

1 Months

9 Months

2 Months

12 Months

Thomson Reuters undertakes both automated and manual audit and

review

procedures

at

this

stage

to

ensure

that

the

rates

contributed are genuine.

The rates are ranked from highest to lowest and the top and

bottom quartiles (25%) of the rates are excluded to ensure

that

outliers

contributed

do

rates,

not

8

influence

rates

are

the

distribution

excluded

(from

each

of

16

the

highest and lowest rates).

The arithmetic mean (average) of the remaining mid quartiles

values is then calculated to produce the IIBR, rounded to 5

decimal places.

Criteria:

In

order

to

publish

the

rate,

certain

conditions

fulfilled; which include:

A minimum of 8 banks contributing to each tenor

Essentials Of Islamic Finance

Page 18

must

be

Separate Benchmark for Islamic Banks

Banks must supply rates to all points on the curve (all

tenors)

Banks must quote every day Sun-Thurs (although as a

fallback and to help reduce the incidence of non fixing

days a minimum number will be required (8)

contributor

will

be

permitted

rates for one additional day

Essentials Of Islamic Finance

Page 19

to

maintain

the

same

Separate Benchmark for Islamic Banks

Timing of Publication

Official Reference Time:

The official reference time in relation to the IIBR is Makkah

time (GMT +3)

Makkah is regarded as the holiest city in Islam and is located

in

the

Hejaz

region

of

Saudi

Arabia,

approximately

73

km

11.00

AM

inland from Jeddah.

Publication Timings:

The

official

publication

time

for

the

IIBR

is

(Makkah)

The publication will follow the

1. Rate contributions for the IIBR will be accepted from

9.00 AM - 10.44 AM (Makkah)

2. The official snapping time will be 10.45 AM

3. An audit period will follow from 10.45 AM -10.59 AM

4. The

official

rate

for

that

particular

day

will

be

published at 11.00 AM.

Publication Days:

The IIBR is published every business day in the GCC: Sunday Thursday (provided minimum number of contributors is achieved

except for the two major Muslim festivals (Eid) and New Years

Day 1st of January. For certainty, the IIBR will not be

Essentials Of Islamic Finance

Page 20

Separate Benchmark for Islamic Banks

published on the 1st Shawwal and 10th Dhul Hijjah, the exact

dates of which are determined by the official authorities in

Saudi Arabia.

Contributory Panel:

The

Contributory

coordination

Benchmark

their

with

Committee

rates

Reuters

Panel

to

in

is

the

to

order

calculate

the

banks

in

Islamic

contribute

for

Thomson

the

IIBR.

The official Contributory Panel for the

as of 22 November 2011 includes:

a) Abu Dhabi Islamic Bank

b) Ahli United Bank

c) Al Baraka Bank

d) Al Hilal Bank

e) Alinma Bank

f) Al Salam Bank

g) Bahrain Islamic Bank

h) Barwa Bank

i) Dubai Islamic Bank

j) Ithmaar Bank

Essentials Of Islamic Finance

selected

Page 21

IIBR

Separate Benchmark for Islamic Banks

k) Kuwait Finance House

l) Masraf Al Rayan

m) National Commercial Bank (Al Ahli)

n) Noor Islamic Bank

o) National Bank of Kuwait

p) Qatar Islamic Bank

q) Sharjah Islamic Bank

Unless

advised

otherwise,

this

Contributor

panel

remains

current at the time of viewing.

A stringent and transparent governance framework advised by

the Islamic Benchmark Committee and approved by the Shariah

Committee regulates the selection, admission and exclusion of

Contributor panel banks.

Governance:

The IIBR is governed by a stringent and transparent governance

framework,

which

includes

the

appointment

body, the Islamic Benchmark Committee and

appointment

of

Shariah

Committee

to

ensure that the benchmark is in compliance

with principles and laws of Islam.

Islamic Benchmark Committee

Shariah Committee

Islamic Benchmark Committee:

Essentials Of Islamic Finance

Page 22

of

an

oversight

the

Separate Benchmark for Islamic Banks

The IIBR is advised by the Islamic Benchmark Committee which

meets at least once annually for an Annual Review and under

extraordinary circumstances, can meet as called, to remove or

include contributors.

The

Committee

members

are

appointed

by

quorum

(quorate

defined as at least 2 representative banks, Thomson Reuters,

AAOIFI and the Chairperson or the Vice Chairperson (where the

Chairperson

is

unable

to

attend)).

New

members

may

be

nominated by any of the existing members, Thomson Reuters or

by the applicant itself.

The current members of the Islamic Benchmark Committee are:

1)Independent Members

2) Representative Bank Members

Essentials Of Islamic Finance

Page 23

Separate Benchmark for Islamic Banks

1)Independent Members

a) Professor Abbas Mirakhor

b) Mr. Ismail Dadabhoy

c) Accounting

and

Auditing

Organisation

for

Islamic

Financial Institutions (AAOIFI)

d) Association of Islamic Banking Institutions Malaysia

e) Bahrain Association of Banks

f) Hawkamah Institute for Corporate Governance

g) Islamic Development Bank

h) Statistical, Economic and Social Research and Training

Centre for Islamic Countries (SESRIC)

i) Thomson Reuters

2)Representative bank members

a) Abu Dhabi Islamic Bank

b) Ahli United Bank

c) Al Baraka Bank

d) Al Hilal Bank

e) Alinma Bank

f) Al Salam Bank

g) Bahrain Islamic Bank

Essentials Of Islamic Finance

Page 24

Separate Benchmark for Islamic Banks

h) Bank Muamalat Malaysia Berhad

i) Barwa Bank

j) CIMB Islamic Bank

k) Dubai Islamic Bank

l) Ithmaar Bank

m) Kuwait Finance House

n) Masraf Al Rayan

o) National Commercial Bank (Al Ahli)

p) Noor Islamic Bank

q) Qatar Islamic Bank

r) RHB Islamic Bank

s)

Sharjah Islamic Bank

Shariah Committee:

A Sharia Board certificates the Islamic financial products as

being

Sharia-compliants.

contracts

and

provides

It

thereby

reviews

an

opinion

about

the

whether

related

those

agreements would be permissible under Islamic Law.

Duties of Sharia Committee:

The duties of a Shariah Supervisory Board or Shariah Committee

are to advise and certify in form of a legal opinion (fatwa)

certain financial products of a financial institution.

Essentials Of Islamic Finance

Page 25

Separate Benchmark for Islamic Banks

A decision of a Shariah Board is made binding by internal

decision to the Islamic financial institution. Between the

institution and the client contracts are typically governed by

non

Islamic

law

which

raises

enforcement.

Essentials Of Islamic Finance

Page 26

the

question

of

legal

Separate Benchmark for Islamic Banks

Proposed Alternative Islamic benchmarks:

However

some

efforts

have

been

made

to

develop

Islamic

financial benchmark. The best effort has been made by a group

of the prominent academicians from Islamic university Malaysia

under supervision of ISRA (Islamic Sharia Research Academy for

Islamic

Finance).

In

that

research

paper

named

Islamic

Pricing Benchmarking; authors have composed all the previous

proposals

on

Islamic

benchmark.

They

found

mainly

five

proposals:

1

21.

Rate of Profit Mechanism Model

3Proposed by Abd al Hamed al-Ghazalie (1414 AH): According

to him, this can be achieved by analyzing the rate of

profits in the money market. He proposes that it is a

more rational way that promotes justice for all and fits

the nature of economics.

1

22. Rate of Dividend of Islamic Bank Deposits and

Investment Accounts Model

3Suggestion by Muhammad Abdul Halim Umar (2000): According

to him, a benchmark can be created from the dividends

distributed by Islamic banks to their depositors. It will

remove uncertainty and doubt by replacing the interest

rate

with

mathematical

rate

index

of

as

profit.

It

will

compared

to

its

provide

conventional

counterpart.

1

23. The Creation of an Inter Islamic Banks Market

Based on Islamic

According to Shaykh Muhammad Taqi Usmani, the purpose can be

achieved by creating a common pool which invests in asset-

Essentials Of Islamic Finance

Page 27

Separate Benchmark for Islamic Banks

backed

instruments

like

musharakah,

ijarah,

etc.

If

the

majority of the asset pool is in tangible form, like leased

property or equipment, shares in business concerns etc. its

units can be sold and purchased on the basis of their net

asset value determined on a periodic basis. These units may be

negotiable and may be used for overnight financing as well.

Banks having surplus liquidity can purchase these units, and

when they need liquidity they can sell them. This arrangement

may create an inter-bank market, and the value of the units

may

serve

as

an

indicator

for

determining

the

profit

in

murabaha and leasing also.

1

24.

Tobins Q

Theory proposed

by Abbas

Mirakhor

(1996).

3He proposes a method by which, the cost of capital can be

measured

without

resort

to

fixed

and

predetermined

interest rate. The suggested procedure is simple. It is

based on the well known Tobins q, and can be used in the

private

as

well

as

the

public

sector

to

obtain

benchmark in reference to which investment decisions can

be made.

1

25.

Benchmark

That

Fits

both

Islamic

and

Conventional Banks by Aznan Hasan.

According

to

him,

in

Malaysia

there

are

various

ways

to

determine the interest rate based on different sectors; for

instance,

KLIBOR,

Interbank

Money

Market,

BLR,

BFR

and

Overnight Policy Rate (OPR). It is possible to use the rate of

OPR in line with Shariah principles which suit both Islamic

banks as well as conventional banks. It is usually determined

by BNM in order to strengthen the monetary policy as well as

Essentials Of Islamic Finance

Page 28

Separate Benchmark for Islamic Banks

to control the supply and demand and fair circulation of funds

in the money market. Then, based on that rate, the banks will

determine their own respective interest rates that will be

used

to

price

all

loans

and

financing.

Indeed,

all

the

previously mentioned pricing rates are affected directly by

OPR, which is determined by BNM.

After

analyzing

all

previously

offered

model

for

Islamic

benchmark, ISRA research team have tested two models based on

CAPM

(Capital

Asset

Pricing

Model)

and

APT

(The

Arbitrage

Pricing Theory). After examining both models with different

theory of economics, they found some limitation of CAPM model.

With the objective of linking benchmark with real economic

performances, they proposed APT model for Islamic benchmark.

Their study recognized four macroeconomic variables as having

good

return

predictability

for

all

the

sectors:

industry

production growth, to capture the overall economic growth; the

money supply changes (M2), to capture the monetary liquidity;

the

ringgit

exchange

rate,

to

reflect

the

relative

global

competitiveness; and the Kuala Lumpur Composite Index returns,

to reflect the overall market condition. A weighted average of

the sectors returns determined through the APT is suggested

here as a viable Islamic pricing benchmark rate for the market

as a whole.

From the above discussion, it is seen that criticizing Islamic

finance

for

practice,

benchmarking

there

are

interest

many

rate

is

limitations

in

easy

but

in

findings

an

alternative of it. Many researchers have been done on this

issue,

but

still

Islamic

finance

is

waiting

for

viable

solution. There is no do doubt that Islamic finance should get

rid of this criticism as early as possible. Hopefully, with

the maturity of Islamic finance better suggestions will come

in future.

Essentials Of Islamic Finance

Page 29

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- 1, FB Lotto-1Documento5 páginas1, FB Lotto-1Precious Clement88% (112)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Cash Receipts CycleDocumento19 páginasCash Receipts CycleYenAinda não há avaliações

- MFE Solutions 2016 021517Documento473 páginasMFE Solutions 2016 021517david smithAinda não há avaliações

- 1.session Plan Financial Management-1 Module 1Documento22 páginas1.session Plan Financial Management-1 Module 1Ankit MaheshwariAinda não há avaliações

- Guide For Refund of Bid SecurityDocumento2 páginasGuide For Refund of Bid SecurityPragya281850% (2)

- Statement 78537738 EUR 2024-02-29 2024-03-28Documento2 páginasStatement 78537738 EUR 2024-02-29 2024-03-28radostnyyrefundAinda não há avaliações

- Bus.-Finance LAS Qtr1Documento36 páginasBus.-Finance LAS Qtr1Matt Yu EspirituAinda não há avaliações

- Mock Test Q2 PDFDocumento5 páginasMock Test Q2 PDFManasa SureshAinda não há avaliações

- Application FormDocumento5 páginasApplication FormJagadeesh SuraAinda não há avaliações

- Chapter 3 - Value and Logistics CostsDocumento19 páginasChapter 3 - Value and Logistics CostsTran Ngoc Tram AnhAinda não há avaliações

- Dishonor of Cheque.: Adv. Shoaib ADocumento3 páginasDishonor of Cheque.: Adv. Shoaib AAzad SamiAinda não há avaliações

- Sap Guide 2 0 1Documento13 páginasSap Guide 2 0 1api-359265393Ainda não há avaliações

- QSI 2022-2023 Key HabbeningsDocumento12 páginasQSI 2022-2023 Key HabbeningsJAinda não há avaliações

- Accounts Journal Ledger Trial Balance PostingDocumento39 páginasAccounts Journal Ledger Trial Balance PostingSwarna MishraAinda não há avaliações

- Changes in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade Other ExpensesDocumento1 páginaChanges in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade Other ExpensesSanam TAinda não há avaliações

- UntitledDocumento2 páginasUntitledGunvi AroraAinda não há avaliações

- Practice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementDocumento12 páginasPractice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementMay ChenAinda não há avaliações

- Sabbath CompanyDocumento5 páginasSabbath CompanyMarsa Syahda NabilaAinda não há avaliações

- Subject Link 5 WB KeysDocumento18 páginasSubject Link 5 WB Keyssolsol0125Ainda não há avaliações

- Cashless Eco SystemDocumento43 páginasCashless Eco SystemAnirudh PrabhuAinda não há avaliações

- Self Employed Operations Underwriting Activities Group 5Documento31 páginasSelf Employed Operations Underwriting Activities Group 5Nguyễn LinhAinda não há avaliações

- A2 Level Essential Vocabulary: The Global Economy (Economics)Documento10 páginasA2 Level Essential Vocabulary: The Global Economy (Economics)A Grade EssaysAinda não há avaliações

- Barclays Global FX Quarterly Fed On Hold Eyes On GrowthDocumento42 páginasBarclays Global FX Quarterly Fed On Hold Eyes On GrowthgneymanAinda não há avaliações

- Robert Campbell and Carol Morris Are Senior Vice Presidents ofDocumento2 páginasRobert Campbell and Carol Morris Are Senior Vice Presidents ofAmit PandeyAinda não há avaliações

- Fin 123 SyllabusDocumento3 páginasFin 123 SyllabusErjanSalangwaAinda não há avaliações

- Adobe Scan Feb 11, 2024Documento20 páginasAdobe Scan Feb 11, 2024DEVIL RDXAinda não há avaliações

- Audited Consolidated Financial StatementDocumento42 páginasAudited Consolidated Financial StatementAbigail EjiroAinda não há avaliações

- How To Be A Smart ShopperDocumento23 páginasHow To Be A Smart ShopperJohn BoyAinda não há avaliações

- Government BorrowingDocumento19 páginasGovernment BorrowingMajid AliAinda não há avaliações