Escolar Documentos

Profissional Documentos

Cultura Documentos

Re: Three-Year Review of The Private Company Council

Enviado por

api-2497858990 notas0% acharam este documento útil (0 voto)

9 visualizações3 páginasThe U.S. Chamber of Commerce supports the Private Company Council (PCC) and its efforts to simplify accounting standards for private companies. In a letter to the Financial Accounting Foundation, the Chamber provides recommendations to improve the PCC, including maintaining transparency in its processes, considering compensation for PCC members, and allowing the PCC to determine its own agenda to address needs of private company users. The Chamber believes the PCC plays an important role in tailoring accounting standards to the unique needs of private companies and their users while still maintaining US GAAP as the foundation.

Descrição original:

Título original

Untitled

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe U.S. Chamber of Commerce supports the Private Company Council (PCC) and its efforts to simplify accounting standards for private companies. In a letter to the Financial Accounting Foundation, the Chamber provides recommendations to improve the PCC, including maintaining transparency in its processes, considering compensation for PCC members, and allowing the PCC to determine its own agenda to address needs of private company users. The Chamber believes the PCC plays an important role in tailoring accounting standards to the unique needs of private companies and their users while still maintaining US GAAP as the foundation.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

9 visualizações3 páginasRe: Three-Year Review of The Private Company Council

Enviado por

api-249785899The U.S. Chamber of Commerce supports the Private Company Council (PCC) and its efforts to simplify accounting standards for private companies. In a letter to the Financial Accounting Foundation, the Chamber provides recommendations to improve the PCC, including maintaining transparency in its processes, considering compensation for PCC members, and allowing the PCC to determine its own agenda to address needs of private company users. The Chamber believes the PCC plays an important role in tailoring accounting standards to the unique needs of private companies and their users while still maintaining US GAAP as the foundation.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 3

May 26, 2015

Ms. Teresa Polley

President and CEO

Financial Accounting Foundation

401 Merritt 7

P.O. Box 5116

Norwalk, CT 06856-5116

Re: Three-Year Review of the Private Company Council

Dear Ms. Polley:

The U.S. Chamber of Commerce1 (Chamber) created the Center for Capital

Markets Competitiveness (CCMC) to promote a modern and effective regulatory

structure for capital markets to fully function in a 21st century economy. To achieve

these goals, the CCMC has supported the development of robust financial reporting

systems and encouraged efforts to improve standards and reduce complexity. The

CCMC appreciates the opportunity to comment on the Financial Accounting

Foundation (FAF) Request for Comment on the Three-Year Review of the Private

Company Council (RFC).

As a member of the Blue-Ribbon Panel on Standard Setting for Private

Companies (Blue Ribbon Panel),2 the CCMC supported its findings and

recommendations. The crucial decisions made by the Blue Ribbon Panel were that

U.S. Generally Accepted Accounting Principles (USGAAP) must be the foundation

of public company and private company report. However, the users and uses of

public company and private company reporting are different and USGAAP must be

The Chamber is the worlds largest federation of businesses and associations, representing the interests of more than

three million U.S. businesses and professional organizations of every size and in every economic sector. These members

are both users and preparers of financial information.

2 The Blue Ribbon Panel created by FAF, the American Institute of Certified Public Accountants (AICPA), and the

National Association of State Boards of Accountancy (NASBA) to explore and make recommendations to resolve

private company accounting issues.

1

Ms. Teresa Polley

May 26, 2015

Page 2

tailored to reflect those differences for to meet the needs of private company users.

Even though the FAF decided to go down a different path than the recommendations

of the Blue Ribbon Panel and created the Private Company Council (PCC), the

CCMC has been fully committed to working with FAF to make this system successful

for all stakeholders in private company financial reporting.

The CCMC applauds FAF for establishing the PCC in May 2012. The CCMC

also commends FAF for its commitment to post-implementation review processes,

such as this one, which allow for feedback from stakeholders to determine whether

the PCC is meeting its primary responsibilities and mission; provide an assessment of

the PCCs continuing role and effectiveness; and address changes that might be made

to improve the PCCs effectiveness.

Since its formation, the PCC has established a number of alternatives in

USGAAP for private companies that seek to decrease costs and complexity, while

improving or maintaining the usefulness of USGAAP reporting to meet the particular

needs of users of private company financial reports. The PCC has also provided

input to FASB on projects under active consideration for the FASBs technical

agenda. This communication of private company assists the development of standards

in a positive manner

Particularly noteworthy, the PCC has been an important impetus for the

movement to simplify financial reporting for both public and private companies. The

CCMC is pleased that FAF, the PCC, and FASB, like the Securities and Exchange

Commission (SEC), are determined to reduce the complexity and overlap in

financial reporting and disclosure requirements, mitigate disclosure overload, and

enhance disclosure effectiveness.3 The CCMC also appreciates that FASB is adding

projects to its agenda to simplify USGAAP in certain areas for public companies

based on feedback to and the recommendations of the PCC.

3

The CCMC has a similar initiative underway that emphasizes the importance of modernizing our financial reporting

system. For example, the U.S. Chamber of Commerce held an event on July 29, 2014 on Corporate Disclosure

Reform: Ensuring a Balanced System that Informs and Protects Investors and Capital Formation to discuss the state of

corporate disclosure and hear from stakeholders and experts on how the business community can be part of the solution

to improve the structure of disclosure requirements. We anticipate that our initiative will complement FASBs initiative

and we stand ready to assist in this effort.

Ms. Teresa Polley

May 26, 2015

Page 3

The CCMC would make several recommendations for possible improvements

to the PCC. The RFC suggests that PCC members should develop their own

informal networks to broaden the input considered by the PCC and FASB

collectively. While the CCMC appreciates the spirit of this recommendation, we

would like to emphasize the need for maintaining transparency in process, including

those providing input to the PCC.

Further, the RFC recognizes that FAF should continue to seek individuals with

the skills, expertise, and resources necessary to commit the time and energy to the

PCC and advise FASB on active projects. In this regard, the CCMC understands that

PCC members are not compensated. As the role of the PCC evolves and

expectations for its involvement in the standard setting process increase, it might be

appropriate for FAF to consider revisiting and revising the current model of

uncompensated service on the PCC.

Mechanisms should also be established to allow the PCC to decide its project

agenda in order to address the needs of private company users. This is not mutually

exclusive from the ability of the PCC to work with FASB regarding on-going projects.

Rather, this will allow the PCC to continue working on existing standards and

exploring their efficacy for private company users and any tailoring that may or may

not need to be done for an effective private company financial reporting system to

meet the unique needs of its users.

The CCMC appreciates the work and dedication of FAF, the PCC, and FASB

in addressing the needs of private company financial reporting. This is an issue of

importance to the more than 20 million businesses that are private and the capital

formation tools they need to develop and grow. We hope that you will consider these

suggestions and look forward to continuing our dialogue on these issues of

importance to investors and businesses alike.

Sincerely,

Tom Quaadman

Você também pode gostar

- Sponsorship Prospectus - FINALDocumento20 páginasSponsorship Prospectus - FINALAndrea SchermerhornAinda não há avaliações

- Financial Accounting Standards BoardDocumento9 páginasFinancial Accounting Standards BoardTarun GuntnurAinda não há avaliações

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocumento148 páginasHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerAinda não há avaliações

- FTP Treasurer LetterDocumento9 páginasFTP Treasurer LetterealinushAinda não há avaliações

- Sarbanes-Oxley Compliance: Using BMC CONTROL-M Solutions For Operations ManagementDocumento9 páginasSarbanes-Oxley Compliance: Using BMC CONTROL-M Solutions For Operations ManagementguddupraveenAinda não há avaliações

- Banking&Security UpdateDocumento19 páginasBanking&Security Updateseunnuga93Ainda não há avaliações

- Presentation NGODocumento6 páginasPresentation NGODulani PinkyAinda não há avaliações

- Limitations of Conceptual Framework PDFDocumento20 páginasLimitations of Conceptual Framework PDFGeorge Buliki100% (25)

- BCG Executive Perspectives CEOs DilemmaDocumento30 páginasBCG Executive Perspectives CEOs DilemmaageAinda não há avaliações

- BS 6206-1981 PDFDocumento24 páginasBS 6206-1981 PDFwepverro100% (2)

- Cooperative Reform and Modernization Program CRMPDocumento37 páginasCooperative Reform and Modernization Program CRMPteamconsultwork100% (1)

- Ch1 Financial Accounting and Accounting StandardsDocumento19 páginasCh1 Financial Accounting and Accounting Standardssomething82Ainda não há avaliações

- Packing List PDFDocumento1 páginaPacking List PDFKatherine SalamancaAinda não há avaliações

- Re: Financial Accounting Foundation (Working Draft, December 2014)Documento3 páginasRe: Financial Accounting Foundation (Working Draft, December 2014)api-249785899Ainda não há avaliações

- Notes To Financial Statements: Re: Proposed Statement of Financial Accounting Concepts On (File Reference No. 2014-200)Documento12 páginasNotes To Financial Statements: Re: Proposed Statement of Financial Accounting Concepts On (File Reference No. 2014-200)api-249785899Ainda não há avaliações

- Jessica Chang ACCT 606 Personal Paper 1Documento2 páginasJessica Chang ACCT 606 Personal Paper 1Jessica ChangAinda não há avaliações

- Invitation To Comment: Psabc CSPDocumento21 páginasInvitation To Comment: Psabc CSPNithyananda PatelAinda não há avaliações

- MICPA AttachmentDocumento10 páginasMICPA AttachmentsonicgeatAinda não há avaliações

- Paris, September 23, 2008: Conseil National de La Comptabilité Téléphone InternetDocumento5 páginasParis, September 23, 2008: Conseil National de La Comptabilité Téléphone InternetYounis Mohammed KhalafAinda não há avaliações

- Budget Benchmarking: A Report of The Policy Review and Performance Scrutiny CommitteeDocumento21 páginasBudget Benchmarking: A Report of The Policy Review and Performance Scrutiny CommitteeKarthik KsAinda não há avaliações

- Technical Assistance Consultant's ReportDocumento7 páginasTechnical Assistance Consultant's ReportBernard Dela CruzAinda não há avaliações

- National Financial Reporting Authority (NFRA) - A PerspectiveDocumento4 páginasNational Financial Reporting Authority (NFRA) - A PerspectiveSajan CvAinda não há avaliações

- Disclosure and Accounting Standards Committee Final ReportDocumento24 páginasDisclosure and Accounting Standards Committee Final ReportIlya TavshavadzeAinda não há avaliações

- Public Company Accounting Oversight Board Strategic Plan:: NOVEMBER 26, 2014Documento50 páginasPublic Company Accounting Oversight Board Strategic Plan:: NOVEMBER 26, 2014Fabio PeresAinda não há avaliações

- Evaluating The Costing Journey: A Costing Levels Continuum Maturity ModelDocumento28 páginasEvaluating The Costing Journey: A Costing Levels Continuum Maturity ModelUUliAAAinda não há avaliações

- TOPIC 1 - PUBLIC SECTOR ACCOUNTING STANDARDS (IPSAs)Documento13 páginasTOPIC 1 - PUBLIC SECTOR ACCOUNTING STANDARDS (IPSAs)samnjiru466Ainda não há avaliações

- Re: Prompt Corrective Action, Risk Based Capital. 12 CFR Parts 700, 701, 702, 703, 713, 723 and 747, RIN 3133-AD77Documento8 páginasRe: Prompt Corrective Action, Risk Based Capital. 12 CFR Parts 700, 701, 702, 703, 713, 723 and 747, RIN 3133-AD77api-249785899Ainda não há avaliações

- Coop ExamDocumento4 páginasCoop Examchrisjun.delacruzAinda não há avaliações

- BAC1634 - Tutorial 1 QDocumento1 páginaBAC1634 - Tutorial 1 QLee Hau SenAinda não há avaliações

- ROSC - Accounting&Auditing - MalaysiaDocumento54 páginasROSC - Accounting&Auditing - MalaysiaquyenAinda não há avaliações

- Blue Ribbon Panel ReportDocumento70 páginasBlue Ribbon Panel ReportDuong DoAinda não há avaliações

- Ed Ifrs-SmeDocumento44 páginasEd Ifrs-SmeNatalie EeeAinda não há avaliações

- Financial ReportingDocumento10 páginasFinancial ReportingMayank AroraAinda não há avaliações

- Financial Reporting Under The Cash Basis of Accounting ACCA GlobalDocumento6 páginasFinancial Reporting Under The Cash Basis of Accounting ACCA GlobalTariq BashirAinda não há avaliações

- TECH-CDR-1961 - FRC - Future - of - Corporate - Reporting - ACCA FinalDocumento11 páginasTECH-CDR-1961 - FRC - Future - of - Corporate - Reporting - ACCA FinalCharles SantosAinda não há avaliações

- Solution Manual For Financial Accounting Theory and Analysis Text and Cases Tenth 10th by Richard G Schroeder Myrtle W Clark Jack M CatheyDocumento38 páginasSolution Manual For Financial Accounting Theory and Analysis Text and Cases Tenth 10th by Richard G Schroeder Myrtle W Clark Jack M Catheybilgeallowedly1c0v0d100% (14)

- Report Competition CLRCDocumento219 páginasReport Competition CLRCMRIGAinda não há avaliações

- The Path To Corporate Rescue Reform in Malaysia - LexologyDocumento11 páginasThe Path To Corporate Rescue Reform in Malaysia - LexologyanonymouseAinda não há avaliações

- Regulatory Implementation of The Statement of Principles Regarding The Activities of Credit Rating AgenciesDocumento38 páginasRegulatory Implementation of The Statement of Principles Regarding The Activities of Credit Rating AgenciesChou ChantraAinda não há avaliações

- The Conceptual Framework: Technical ArticlesDocumento10 páginasThe Conceptual Framework: Technical ArticlesZareen AbbasAinda não há avaliações

- Re-Energizing FinanceDocumento8 páginasRe-Energizing Financebconner80Ainda não há avaliações

- FH13 1 RecommendatioDocumento10 páginasFH13 1 RecommendatioImprovingSupportAinda não há avaliações

- Bulletin V4 I11 ProtivitiDocumento6 páginasBulletin V4 I11 ProtivitiTanmoy ChakrabortyAinda não há avaliações

- 10-09-22 SACCO Automation ReportDocumento88 páginas10-09-22 SACCO Automation ReportTomBiko100% (1)

- Pembangunan Standard Perakaunan Di MalaysiaDocumento17 páginasPembangunan Standard Perakaunan Di Malaysiavoguegirls820% (1)

- BUSN 2nd Edition Kelly Solutions Manual 1Documento3 páginasBUSN 2nd Edition Kelly Solutions Manual 1sandra100% (34)

- Afp Whitepaper FINALDocumento17 páginasAfp Whitepaper FINALManikantan NatarajanAinda não há avaliações

- Handle 404Documento55 páginasHandle 404Akm EngidaAinda não há avaliações

- Fca Consultation Paper ResearchDocumento5 páginasFca Consultation Paper Researchc9r0s69n100% (1)

- Discussion Questions (SHD) N (GHH) TOPIC4 Accounting TheoryDocumento8 páginasDiscussion Questions (SHD) N (GHH) TOPIC4 Accounting Theoryayuclover100% (1)

- Accounting and Auditing Update: January 2011Documento32 páginasAccounting and Auditing Update: January 2011Leksang Dumpa BhutiaAinda não há avaliações

- UK Stewardship CodeDocumento4 páginasUK Stewardship CodeCharity ChikwandaAinda não há avaliações

- BC PreExploration Oct09Documento48 páginasBC PreExploration Oct09Prashant KhadeAinda não há avaliações

- Draft Guide For Strengthening SAIsDocumento53 páginasDraft Guide For Strengthening SAIsDondon PermanaAinda não há avaliações

- Global Systemically Important Banks in ResolutionDocumento10 páginasGlobal Systemically Important Banks in Resolutionapi-249785899Ainda não há avaliações

- Evaluation of Conceptual Framework Wk6Documento15 páginasEvaluation of Conceptual Framework Wk6Nor Ihsan Abd LatifAinda não há avaliações

- MIA Competency Framework Exposure DraftDocumento58 páginasMIA Competency Framework Exposure DraftLuqman HakimAinda não há avaliações

- The Auditor'S Responsibilities Relating To Other Information and Proposed Consequential and Conforming Amendments To Other IsasDocumento7 páginasThe Auditor'S Responsibilities Relating To Other Information and Proposed Consequential and Conforming Amendments To Other Isasapi-249785899Ainda não há avaliações

- No. 2013-12 December 2013: Definition of A Public Business EntityDocumento25 páginasNo. 2013-12 December 2013: Definition of A Public Business EntityBrandace HopperAinda não há avaliações

- Barry MelanconDocumento7 páginasBarry MelanconMarketsWikiAinda não há avaliações

- The Role of The National Audit Department of Malaysia (NAD) in Promoting Government AccountabilityDocumento10 páginasThe Role of The National Audit Department of Malaysia (NAD) in Promoting Government AccountabilityNana DureynaAinda não há avaliações

- COSO Internal Control - Integrated Framework Update Project Frequently Asked QuestionsDocumento5 páginasCOSO Internal Control - Integrated Framework Update Project Frequently Asked QuestionsRossi XavierAinda não há avaliações

- Release 2015 005Documento61 páginasRelease 2015 005javisAinda não há avaliações

- CH 2Documento4 páginasCH 2amysilverbergAinda não há avaliações

- UntitledDocumento2 páginasUntitledapi-249785899Ainda não há avaliações

- Proposed Rules On Pay Versus Performance 17 CFR Parts 229 and 240 Release No. 34-74835 File No. S7-07-15 RIN 3235-AL00Documento12 páginasProposed Rules On Pay Versus Performance 17 CFR Parts 229 and 240 Release No. 34-74835 File No. S7-07-15 RIN 3235-AL00api-249785899Ainda não há avaliações

- Consultative Document (2nd) : Assessment Methodologies For Identifying Non-Bank Non-Insurer Global Systemically Important Financial InstitutionsDocumento16 páginasConsultative Document (2nd) : Assessment Methodologies For Identifying Non-Bank Non-Insurer Global Systemically Important Financial Institutionsapi-249785899Ainda não há avaliações

- Examining The Main Street Benefits of Our Modern Financial MarketsDocumento28 páginasExamining The Main Street Benefits of Our Modern Financial Marketsapi-249785899Ainda não há avaliações

- How Main Street Businesses Use Financial Services: Key Survey FindingsDocumento15 páginasHow Main Street Businesses Use Financial Services: Key Survey Findingsapi-249785899Ainda não há avaliações

- UntitledDocumento2 páginasUntitledapi-249785899Ainda não há avaliações

- UntitledDocumento3 páginasUntitledapi-249785899Ainda não há avaliações

- Re: Announcement Regarding Rule 14a-8 (I)Documento4 páginasRe: Announcement Regarding Rule 14a-8 (I)api-249785899Ainda não há avaliações

- 1615 H Street NW - Washington, DC - 20062Documento11 páginas1615 H Street NW - Washington, DC - 20062api-249785899Ainda não há avaliações

- Re: FINRA Regulatory Notice 14-37: FINRA Requests Comment On A Rule Proposal To Implement The Comprehensive Automated Risk Data SystemDocumento7 páginasRe: FINRA Regulatory Notice 14-37: FINRA Requests Comment On A Rule Proposal To Implement The Comprehensive Automated Risk Data Systemapi-249785899Ainda não há avaliações

- Re: 2015 Benchmark Policy ConsultationDocumento7 páginasRe: 2015 Benchmark Policy Consultationapi-249785899Ainda não há avaliações

- UntitledDocumento4 páginasUntitledapi-249785899Ainda não há avaliações

- 1615 H Street NW - Washington, DC - 20062Documento8 páginas1615 H Street NW - Washington, DC - 20062api-249785899Ainda não há avaliações

- UntitledDocumento8 páginasUntitledapi-249785899Ainda não há avaliações

- 1615 H Street NW - Washington, DC - 20062Documento12 páginas1615 H Street NW - Washington, DC - 20062api-249785899Ainda não há avaliações

- Global Systemically Important Banks in ResolutionDocumento10 páginasGlobal Systemically Important Banks in Resolutionapi-249785899Ainda não há avaliações

- In The United States Court of Appeals For The Fourth CircuitDocumento30 páginasIn The United States Court of Appeals For The Fourth Circuitapi-249785899Ainda não há avaliações

- UntitledDocumento2 páginasUntitledapi-249785899Ainda não há avaliações

- 30 January 2015: To The Members of The Committee On Legal Affairs of The European ParliamentDocumento2 páginas30 January 2015: To The Members of The Committee On Legal Affairs of The European Parliamentapi-249785899Ainda não há avaliações

- Relation To, This Bill in Our Annual How They Voted ScorecardDocumento1 páginaRelation To, This Bill in Our Annual How They Voted Scorecardapi-249785899Ainda não há avaliações

- Re: Announcement Regarding Application of Rule 14a-8 (I) (9) During The Current Proxy SeasonDocumento4 páginasRe: Announcement Regarding Application of Rule 14a-8 (I) (9) During The Current Proxy Seasonapi-249785899Ainda não há avaliações

- Re: Exposure Draft: Responding To A Suspected Illegal ActDocumento4 páginasRe: Exposure Draft: Responding To A Suspected Illegal Actapi-249785899Ainda não há avaliações

- Re: Consultative Document, Basel III:: The Net Stable Funding RatioDocumento10 páginasRe: Consultative Document, Basel III:: The Net Stable Funding Ratioapi-249785899Ainda não há avaliações

- WWW - Sec.gov/cgi-Bin/ruling-Comments: Subject: Cybersecurity Roundtable, File No. 4-673Documento6 páginasWWW - Sec.gov/cgi-Bin/ruling-Comments: Subject: Cybersecurity Roundtable, File No. 4-673api-249785899Ainda não há avaliações

- Consider Including Votes On, or in Relation To, Both of These Bills in Our Annual How TheyDocumento1 páginaConsider Including Votes On, or in Relation To, Both of These Bills in Our Annual How Theyapi-249785899Ainda não há avaliações

- UntitledDocumento3 páginasUntitledapi-249785899Ainda não há avaliações

- The Auditor'S Responsibilities Relating To Other Information and Proposed Consequential and Conforming Amendments To Other IsasDocumento7 páginasThe Auditor'S Responsibilities Relating To Other Information and Proposed Consequential and Conforming Amendments To Other Isasapi-249785899Ainda não há avaliações

- Malta in A NutshellDocumento4 páginasMalta in A NutshellsjplepAinda não há avaliações

- Application Form For Subscriber Registration: Tier I & Tier II AccountDocumento9 páginasApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghAinda não há avaliações

- Environment Case Alcoa 2016Documento4 páginasEnvironment Case Alcoa 2016Victor TorresAinda não há avaliações

- Request BADACODocumento1 páginaRequest BADACOJoseph HernandezAinda não há avaliações

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocumento5 páginasMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuAinda não há avaliações

- Thai LawDocumento18 páginasThai LawsohaibleghariAinda não há avaliações

- Why The Strengths Are Interesting?: FormulationDocumento5 páginasWhy The Strengths Are Interesting?: FormulationTang Zhen HaoAinda não há avaliações

- JDocumento2 páginasJDMDace Mae BantilanAinda não há avaliações

- Exim BankDocumento79 páginasExim Banklaxmi sambre0% (1)

- Presentation On " ": Human Resource Practices OF BRAC BANKDocumento14 páginasPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziAinda não há avaliações

- BiogasForSanitation LesothoDocumento20 páginasBiogasForSanitation LesothomangooooAinda não há avaliações

- Clerks 2013Documento12 páginasClerks 2013Kumar KumarAinda não há avaliações

- Ekspedisi Central - Google SearchDocumento1 páginaEkspedisi Central - Google SearchSketch DevAinda não há avaliações

- Nissan Leaf - The Bulletin, March 2011Documento2 páginasNissan Leaf - The Bulletin, March 2011belgianwafflingAinda não há avaliações

- Chapter Five: Perfect CompetitionDocumento6 páginasChapter Five: Perfect CompetitionAbrha636Ainda não há avaliações

- Business Economics - Question BankDocumento4 páginasBusiness Economics - Question BankKinnari SinghAinda não há avaliações

- A Glossary of Macroeconomics TermsDocumento5 páginasA Glossary of Macroeconomics TermsGanga BasinAinda não há avaliações

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDocumento12 páginasReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryAinda não há avaliações

- Zubair Agriculture TaxDocumento3 páginasZubair Agriculture Taxmunag786Ainda não há avaliações

- BIR Form 1707Documento3 páginasBIR Form 1707catherine joy sangilAinda não há avaliações

- Designing For Adaptation: Mia Lehrer + AssociatesDocumento55 páginasDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Ainda não há avaliações

- Measuring The Economy TciDocumento2 páginasMeasuring The Economy Tciapi-261761091Ainda não há avaliações

- Sbi Code of ConductDocumento5 páginasSbi Code of ConductNaved Shaikh0% (1)

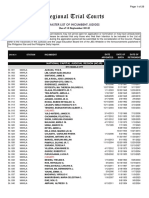

- Regional Trial Courts: Master List of Incumbent JudgesDocumento26 páginasRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaAinda não há avaliações