Escolar Documentos

Profissional Documentos

Cultura Documentos

Pagini 468-471 Stefan

Enviado por

Olaru LorenaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Pagini 468-471 Stefan

Enviado por

Olaru LorenaDireitos autorais:

Formatos disponíveis

Universitatea de tiine Agricole i Medicin Veterinar Iai

THE COMPETITIVE ENVIRONMENT`S ANALYSIS ON THE WINE

MARKET

Gavril TEFAN1, Oana COCA1

E-mail: stefang@uaiasi

Abstract

The competitive environment`s analysis on the wine market has as objective the characterisation of the main variables

that define the sectorial realities. The research is materialized in: the analysis of the market shares, the analysis of the

competitive position, the analysis of the competitive structure and the analysis of the competitive advantage. The

competitve position is analized using the key factors of success, such as: market share, average price/1 litre wine,

average production cost/ 1 litre wine, profitability and finnacial force, entreprise`s image and commercial

implementation.

The analysis of competitive structure emphasizes one of the most important characteristic of the wine market, such as

its concentration, expressed by the market concentration index. The calculated index reveals what is the level of the

market pression and how permeable is the market for the new entrants.

The market performance was determinated by analyzing the turnover growth index and the product portfolio, in terms

of diversity, quality and prices.

Key words: competitive environment, market share, key factors of success, market concentration

The starting point of the work is the

determination of national market size and the

identification of the major players on the wine

market from Romania. This work seeks the answer

of this questions:

How important is the market share in the

diagnose of company status?

What are the variables that give the

importance to the company on the market?

What are the chances for a new

entrepreneur to enter on the wine market?

RESULTS AND DISCUSSIONS

Romania ranks the sixth in the top of the

European wine countries, producing in 2009, 5.2

million hectoliters of wine, and in 2010 it has

produced a quantity of 4.1 million hectoliters of

wine.

Analysis of market shares

Was achieved by using the rate method,

which outlines in a relative manner the

variation of this indicator in a given period

(2009-2010).

According to the NEVV, the wine market

turnover had in 2010, the value of 398 million

euros, decreasing with 8% , compared to 2009

(432 million euro). The turnover of red wine

market represented in 2009, 39% of total

turnover of the wine market, namely 168.5

million euro, and in 2010, 35% of total market

turnover of wine, respectively 139.3 million

euro.

In the research, it were analyzed the first

three actors on the red wine market, namely:

MATERIAL AND METHOD

The analysis of the competitive wine market

was carried out using three research methods,

namely: the rate method, the evaluation grids

method and the scores method.

They were calculated the following

indicators: the market growth rate, the absolute

market share, the relative market share, the market

concentration index, the cost advantage and the

price advantage.

The material used to calculate the indicators

consists in: enterprise contable balance and data

sheets provided by the National Institute of

Statistics and the National Employers of Vine and

Wine (NEVV).

I. S.C. MURFATLAR ROMANIA S.A.;

II. S.C. VINCON VRANCEA S.A.;

III. S.C. CRAMELE RECAS S.A..

University of Agricultural Sciences and Veterinary Medicine Iasi

468

Lucrri tiinifice - vol. 54, Nr. 2/2011, seria Agronomie

Ti - turonover of the i enterprise;

Tt - turnover of total red wine market.

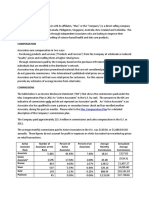

From table 1 we can see that red wine

market is lead by SC MURFATLAR ROMANIA

SA, with a absolute market share of 10.6% in

2010.

The hierachy of the companies on the

market was done by calculating the absolute

market shares, using the formula:

Mi = ( Ti / Tt)*100

where:

Mi - absolute market share of the i

enterprise;

Table 1

The turnover and market share of the first three competitors on the red wine market

The place on

the market

The enterprise

The turnover (mil.

euro)

2009

2010

The absolute market

share(%)

2009

2010

S.C. MURFATLAR

17,4

14,8

10,3

ROMANIA S.A.

S.C. VINCON VRANCEA

2

10,2

7,9

6,1

S.A.

S.C. CRAMELE RECAS

3

3,5

4,2

2,1

S.A.

Source: Contable enterprise balances on 2010, NEVV - own calculations

1

The relative

market share (%)

2009

2010

10,6

5,7

59,2

53,8

3,0

20,4

28,3

firm market position appears as a variable

influenced by market dynamics of the analyzed

sector and not by the actual results of company.

To get a clearer picture of companies

position on the red wine market, it was calculated

another indicator, namely the relative market share,

using the following formula:

Mr = (Ti / Tl)*100

Mr - relative market share of the i

enterprise;

Ti - turonover of the i enterprise;

Tl - turnover of the leader.

The competitive environment analysis based

on this indicator answer the question: What

percentage of the market of leader, is owned by the

"i" company?

If on the red wine market, the leadership is

occupied by SC MURFATLAR ROMANIA SA,

then the next companies are permanently reported

to it.

The relative market share of S.C.

VRANCEA Vincon S.A. was in 2010, 53.8%, that

represents over half of the leader`s market.

The analised indicator allows us to form a

image of the firm performance, usind always the

same reference, namely the leader.

The analysis of competitive position

The competitive position of firms is

analyzed by means of variables, called in the

literature "the key factors of success". They do not

have a fixed structure, it have an infinity of forms,

depending on the enterprise type and size, its level

of maturity, the entrepreneurial management, the

market of company etc.

The analysis of competitive position answers

the question:

What are the variables that give the

importance to the company on the market?

The turnover of the company suffered in

2010 a decline of 14.9%, from 17.4 million euro in

2009 to 14.8 million euro in 2009. We note

however, that in 2010 the leader has an

improvement of market position, increasing its

absolute market share by 0.3%, compared to 2009

(from 10.3 to 10.6%). This raises the question:

How is justified the growth of market position, if

company sales declined? The answer is: the total

wine market registered a decrease in 2010

(17.3%), which is higher than the company's

turnover decreased (14.9%), due to the fact that the

companies which could not withstand the pressure

of the economic crisis quit the market and the

production of enterprises decreased.

The second major player in this market is

SC VINCON VRANCEA SA, which in 2010 had a

market share of 5.7%, less with 6.6% comparing to

the previous year (6.1%). The company sales in

2010 registered a decrease of 22.5% compared to

2009, which may explain the decrease of market

share.

Unlike the first two competitors, SC

CRAMELE RECAS S.A. improves in 2009-2010

the both analyzed indicators. Turnover increased

by 20% in 2010 compared to 2009, and the

indicator relative market share growth in 2010 by

43%.

The first three players in the wine market

register different variations of the indicators

"turnover" and "market share", namely variations

in the same direction (both indicators of SC

CRAMELE RECAS SA increase and both

decrease at SC VINCON VRANCEA SA) or in the

opposite (first indicator decreases, and the second

increases at SC MURFATLAR ROMANIA SA)

It follows that the absolute market share

analysis does not reflect the true state of the

company and its dynamics on the market. Thus, the

469

Universitatea de tiine Agricole i Medicin Veterinar Iai

The three competitors from the red wine

market were analyzed through the following key

success factors: market share, average price/1 liter

of wine, average production cost/1 liter of wine,

profitability and financial strength, company image

and commercial implementation.

The first method used to analyze the

competitive position is the scores method.

To each key success factor is assigned a

score from 1 to 5, depending on its performance in

the analyzed company.

Then it was used the evalaution grids

method. With its help, we calculated the actual

market position of the company. The 7 criteria

were weighted by degrees of importance, which

allowed to calculate a weighted average note (N

has the value between 1 and 5).

Table 4

Evaluation grid S.C. CRAMELE RECAS S.A.

Key factors of

Importance

Note

success

degree (%)

Market share

10

3

Average price

15

4

(13 lei/liter)

Average production

cost

10

2

( 5,6 lei/liter)

Profitability and

30

4

financial strenght

Companys image

and commercial

15

4

implementation

productivity

20

3

N = 0,10*3 + 0,15*4 + 0,10*2 + 0,30*4 + 0,15*4+

+ 0,20*3 = 3,35

N = gi*ni

where:

gi significance coefficient

criterion (in absolute terms);

ni note of each criterion.

Positioning the three companies on a scale

from 1 to 5, depending on competitive market

position, we can see the following hierarchy:

- First place S.C. MURFATLAR S.A.,

where N = 3,85;

- Second place S.C. CRAMELE RECAS

S.A., where N = 3,35;

- Third place S.C. VINCON VRANCEA

S.A., unde N = 3,30.

In in analyzing of the competitive position

of firms on the market, it reverses the order in top

of the two companies, on second and third place.

Thus, S.C. CRAMELE RECAS S.A. company,

although it has a market share smaller than S.C.

VINCON VRANCEA S.A., it has a better

competitive position than this. That dues to the

profitability and financial strength of the company,

remarked on the market with quality products for

picky buyer, who is willing to pay a higher price

for a bottle of wine.

Analysis of competitive structure

Highlights an important feature of red wine

market, namely its concentration, expressed by

index of market concentration.

Competitive structure of market it answers

the question:

What are the chances of a new

entrepreneur to enter the wine market?

To answer these question we must have a

clear picture of analizied market size, in terms of

number of competitors and their size (expressed by

absolute market share).

In this sense, it was calculated the partial

index of market concentration, using the formula:

Ipc = Mi,

where,

Ipc partial index of market concentration

Mi absolut market share of company i

(we can analyze the first 4, 8 or 12 companies on

national market).

of each

Table 2

Evaluation grid S.C. MURFATLAR S.A.

Key factors of

Importance

Note

success

degree (%)

Market share

10

5

Average price

15

3

(12 lei/liter)

Average production

10

2

cost ( 5,4 lei/liter)

Profitability and

30

5

financial strenght

Companys image

and commercial

15

4

implementation

Productivity

20

3

N = 0,10*5 + 0,15*3 + 0,10*2 + 0,30*5 + 0,15*4 +

+ 0,20*3 = 3,85

Table 3

Evaluatin grid S.C. VINCON VRANCEA S.A.

Key factors of

Importance

Note

success

degree (%)

Market share

10

4

Average price (13

15

4

lei/liter)

Average production

10

2

cost ( 5,6 lei/liter)

Profitability

and

30

3

financial strenght

Companys image

15

4

and

commercial

implementation

Productivity

20

3

N = 0,10*5 + 0,15*4 + 0,10*2 + 0,30*3 + 0,15*4 +

+ 0,20*3 = 3,30

470

Lucrri tiinifice - vol. 54, Nr. 2/2011, seria Agronomie

S.C. CRAMELE RECAS S.A. company

holds in its portfolio recognized brands, such as:

Scwaben Wein, V Legend of Transylvania, La

putere, Cocos Shyrah, Castele Rock. The company

is also present each year in international fairs and

gets many medals for its quality wines, creating in

this way a very good image, on national and

international market.

In specialized literature, at values of market

concentration index smaller than 50%, we meet a

dispersed market, and at values over 50%, the

market is concentrated.

To calculate the market concentration partial

index it were used the market shares of the first 8

companies in the wine field.

CONCLUSIONS

The characterization of the competitive

environment was made on the red wine market

from Romania. The main actors on the red wine

market from Romania are: SC MURFATLAR

ROMANIA S.A. (10.6%), S.C Vincon VRANCEA

S.A. (5.7%) and S.C. Cramele Recas S.A. (3.0%).

The variables that give importance to the

companies on the market are mainly: the

profitability, the financial strength, the company

image and the commercial implementation. The

market leader is Murfatlar, with an average note of

competitive position of 3.85, followed by Cramele

Recas with 3.35 and Vincon Vrancea with 3.30.

The red wine market in Romania is

dispersed, the market concentration index has a

value of 19.46%. This highlights the existence of

an open market without barriers to entry for the

new firms. The level of competition in this market

is low and the product quality requirements are

reduced.

Figure 1 The market shares of the first 8 companies

in the red wine field

Ipc=10,60%+5,70%+3,0%+0,06%+0,04%+0,03%

+0,02%+0,01% = 19,46%

Analyzing the obtained value, we see that

the red wine market from Romania is dispersed,

because the market concentration index has a

value of 19,46. This highlights the existence of an

open market, without entry barriers for new firms.

On this market the competitive level is low,

and products quality requirements are reduced.

Analysis of competitive advantage

In terms of products portfolio offered on the

market, the leader has over 15 brands covering the

full range of quality segments: low, medium and

premium. The first 5 brands are: Zestrea Murfatlar,

Lacrima lui Ovidiu, Premiat Eticheta Neagra, Sec

de Murfatlar and Conu Alecu.

S.C. VINCON VRANCEA S.A. aims to

increase substantially the quality of those wines

that have high prospects in entering the foreign

markets and at the same time to reduce the

production costs at those types made exclusively

for the internal market, so as to achieve an increase

in profit from sales of quality wines and also for

the basic consumer.

The most recognized brands: Comoara

Pivnitei (collection wines), Beciul Domnesc

(premium), Vita Romaneasca, Poroles Pontica,

Cabernet Auslese (mid). Beciul Domnesc includes

red wines (Cabernet Sauvignon, Merlot, Pinot

Noir, Fteasca Neagra) 5 - 6 yers old.

BIBLIOGRAPHY

Anghel, I., Dinu, E., 2000 Strategia i analiza

economico-financiar studii de caz, Editura

ASE.

Chiran, A., Gndu, Elena,tefan, G., Lokar, A., Doga,

V., 1999 Agromarketing, Editura Evrica,

Chiinu.

Grdinaru, M., 1994 Instrumente de analiz

economico-financiar a ntreprinderii agricole,

Editura Univ. Al.I. Cuza, Iai.

Isfrnescu, A., et al., 2006 - Analiza economicofinanciar, Publishing house Cartea Universal

Bucureti.

Moteanu, Tatiana, 2000 Concurena: abordri

teoretice

i

practice,

Bucureti,

Editura

Economic.

Popescu, C., Ciucur, D., 1997 Microeconomia

concurenial, Bucureti, Editura Economic.

Stancu, S., 2002 Competiia pe pia i echilibrul

economic, Bucureti, Editura Economic.

tefan, G. i colab., 2006 Economie i politici

agroalimentare, Editura ALFA, Iai.

tefan, G. i colab., 2007 Economie i filiera

produselor agroalimentare, Editura ALFA, Iai.

***, 2000 - Romanian Statistical Yearbook, 2000-2010.

***, 2007 - National Employers of Vine and Wine

(NEVV),

Contable

balance,

2007-2010.

471

Você também pode gostar

- Luxury Brand Management in Digital and Sustainable TimesNo EverandLuxury Brand Management in Digital and Sustainable TimesAinda não há avaliações

- The Competitiveness of The Romanian ExportDocumento8 páginasThe Competitiveness of The Romanian ExportMoon boonbonAinda não há avaliações

- What Drives The Market Share Changes - Price Versus Non-Price FactorsDocumento46 páginasWhat Drives The Market Share Changes - Price Versus Non-Price FactorsBrotherTasadAinda não há avaliações

- The Hedonic Price For Italian Red Wine: Do Chemical and Sensory Characteristics Matter?Documento13 páginasThe Hedonic Price For Italian Red Wine: Do Chemical and Sensory Characteristics Matter?Rodrigo Alejandro Romo MuñozAinda não há avaliações

- QuantifyingDocumento32 páginasQuantifyingbahadır muratAinda não há avaliações

- Marketing Project - Beer Market AnalysisDocumento11 páginasMarketing Project - Beer Market AnalysisIrina StefanaAinda não há avaliações

- Capex Report Q1 2013Documento21 páginasCapex Report Q1 2013Laurent LequienAinda não há avaliações

- COMPETE Working Paper 3 Trade Import CompetitionDocumento28 páginasCOMPETE Working Paper 3 Trade Import CompetitionaleskuhAinda não há avaliações

- Working Papers: Competition in The Portuguese Economy: Insights From A Profit Elasticity ApproachDocumento33 páginasWorking Papers: Competition in The Portuguese Economy: Insights From A Profit Elasticity Approachjooo93Ainda não há avaliações

- The Contribution Made by Beer 2011Documento290 páginasThe Contribution Made by Beer 2011Alina AleksyeyenkoAinda não há avaliações

- Baseline Survey On Competition and Markets in EthiopiaDocumento112 páginasBaseline Survey On Competition and Markets in Ethiopiaasfawm3Ainda não há avaliações

- 18 5 KurmaiDocumento8 páginas18 5 KurmaiMera SamirAinda não há avaliações

- Esma50 165 639 - Esma Rae - Asr Derivatives - 2018Documento48 páginasEsma50 165 639 - Esma Rae - Asr Derivatives - 2018VICTORIA WEYULUAinda não há avaliações

- China Wine Market ReportDocumento3 páginasChina Wine Market ReportDrink SectorAinda não há avaliações

- UK Fragrance IndustryDocumento43 páginasUK Fragrance IndustrySurousheh KhanAinda não há avaliações

- 40 Congress of The European Regional Science Association: The Romanian Regions CompetitivenessDocumento14 páginas40 Congress of The European Regional Science Association: The Romanian Regions CompetitivenessRoiniță LilianaAinda não há avaliações

- Beverages: The German Wine Market: A Comprehensive Strategic and Economic AnalysisDocumento29 páginasBeverages: The German Wine Market: A Comprehensive Strategic and Economic AnalysisAlexandru IaurumAinda não há avaliações

- Project Marketing (Repaired)Documento16 páginasProject Marketing (Repaired)nataliakeskinAinda não há avaliações

- China Sugar Market ProfileDocumento9 páginasChina Sugar Market ProfileAllChinaReports.comAinda não há avaliações

- Chitu Si TecauDocumento6 páginasChitu Si TecaussandrraAinda não há avaliações

- Project Servemploi: Retail Sector Retail SectorDocumento41 páginasProject Servemploi: Retail Sector Retail SectorGovind RbAinda não há avaliações

- Recent Trends in The International Wine Market and Arising Research QuestionsDocumento3 páginasRecent Trends in The International Wine Market and Arising Research QuestionsYussef KhanAinda não há avaliações

- 2009 09 3rd Crisis BarometerDocumento2 páginas2009 09 3rd Crisis BarometerHitendra Nath BarmmaAinda não há avaliações

- Wine Distribution How Online Is Changing The Off-Trade WorldDocumento38 páginasWine Distribution How Online Is Changing The Off-Trade WorldcrazychocoAinda não há avaliações

- Global Ice Cream - Data MonitorDocumento44 páginasGlobal Ice Cream - Data MonitorPrathibha Prabakaran100% (1)

- Economic Analysis of Subcontract Distilleries by Simulation Modeling MethodDocumento14 páginasEconomic Analysis of Subcontract Distilleries by Simulation Modeling MethodCsaba AndrásAinda não há avaliações

- Italian CoffeeDocumento19 páginasItalian CoffeeChosen RamosAinda não há avaliações

- Retailers 2018 Main Report - enDocumento208 páginasRetailers 2018 Main Report - enConnie GonzalezAinda não há avaliações

- Art - Nr. 282-Pag. 199-204Documento6 páginasArt - Nr. 282-Pag. 199-204BUIAinda não há avaliações

- When Will Sustainable Economic Recovery Really Begin?: Driving Forward TogetherDocumento19 páginasWhen Will Sustainable Economic Recovery Really Begin?: Driving Forward Togetherapi-109061352Ainda não há avaliações

- SlozkaDocumento8 páginasSlozkaNicoleta AlexandraAinda não há avaliações

- AnalysisDocumento9 páginasAnalysisIonela EneAinda não há avaliações

- The Economic Impact of Tourism. An Input-Output AnalysisDocumento20 páginasThe Economic Impact of Tourism. An Input-Output AnalysisMade HandiAinda não há avaliações

- Диплом маркетингове дослідження ТМ Звени ГораDocumento31 páginasДиплом маркетингове дослідження ТМ Звени Гораolefirt9Ainda não há avaliações

- European Wine Exports The Key Role of TradeDocumento8 páginasEuropean Wine Exports The Key Role of Tradeasaaca123Ainda não há avaliações

- ReportRomanian Market Study-Eng (Final)Documento85 páginasReportRomanian Market Study-Eng (Final)Organizația de Atragere a Investițiilor și Promovarea Exportului din Moldova100% (1)

- The Impact of Cartels On National Economy and CompetitivenessDocumento20 páginasThe Impact of Cartels On National Economy and CompetitivenessSri BalajiAinda não há avaliações

- Romania Gained From Joining The EU, Despite Huge Opportunity LossesDocumento7 páginasRomania Gained From Joining The EU, Despite Huge Opportunity LossesAnonymous iPygecAinda não há avaliações

- Raport Sar 2014 FinalDocumento86 páginasRaport Sar 2014 FinalLucian DavidescuAinda não há avaliações

- LindtDocumento15 páginasLindtiramala100% (2)

- 264 293 ForumDocumento30 páginas264 293 ForumAnkur MittalAinda não há avaliações

- Fruit Juices: Bulletin MNS March 2011Documento22 páginasFruit Juices: Bulletin MNS March 2011Ekoh EnduranceAinda não há avaliações

- Cohort: September 2009Documento26 páginasCohort: September 2009ZedAinda não há avaliações

- List of ContentsDocumento7 páginasList of ContentsMaria-Madalina BodescuAinda não há avaliações

- EC Retail Food StudyDocumento3 páginasEC Retail Food StudyTomşa AndreiAinda não há avaliações

- UFI Global Exhibition Barometer ReportDocumento32 páginasUFI Global Exhibition Barometer ReportTatianaAinda não há avaliações

- JABR, 2014, Vol.3Documento12 páginasJABR, 2014, Vol.3MariaCiupac-UliciAinda não há avaliações

- Value Proposition (VP) & Unique SellingDocumento10 páginasValue Proposition (VP) & Unique SellingchuAinda não há avaliações

- European Automotive After Market LandscapeDocumento21 páginasEuropean Automotive After Market LandscapeSohom KarmakarAinda não há avaliações

- 87Documento80 páginas87Can YangAinda não há avaliações

- Address: B-Dul Regina Maria Nr. 19, Ap. 1, Sector 4, Bucuresti, RomaniaDocumento5 páginasAddress: B-Dul Regina Maria Nr. 19, Ap. 1, Sector 4, Bucuresti, Romaniaromand2308Ainda não há avaliações

- Gerolsteiner Brunnen GMBHDocumento21 páginasGerolsteiner Brunnen GMBHNihad MatinAinda não há avaliações

- China Candy Chocolate Market ReportDocumento10 páginasChina Candy Chocolate Market ReportumairyasirAinda não há avaliações

- Kalenchuk Ilya VKR - Ru.enDocumento57 páginasKalenchuk Ilya VKR - Ru.enNabeel AdilAinda não há avaliações

- Business Economics Unit 2: Market Structure: Kedar Subramanian Asst. Prof, MPSTMEDocumento15 páginasBusiness Economics Unit 2: Market Structure: Kedar Subramanian Asst. Prof, MPSTMEAakash ChhariaAinda não há avaliações

- Soft Drinks Industry Strategic AnalysisDocumento56 páginasSoft Drinks Industry Strategic AnalysisPiotr Bartenbach100% (2)

- The Stationery, Office and School Supplies Market in The EUDocumento51 páginasThe Stationery, Office and School Supplies Market in The EUZiaAinda não há avaliações

- Europe Rum Sales Market Report 2021 PDFDocumento8 páginasEurope Rum Sales Market Report 2021 PDFallen BondAinda não há avaliações

- World: Melon - Market Report. Analysis and Forecast To 2020Documento7 páginasWorld: Melon - Market Report. Analysis and Forecast To 2020IndexBox MarketingAinda não há avaliações

- About Acetic Acid MarketDocumento3 páginasAbout Acetic Acid MarketNoranierahNohoAinda não há avaliações

- Eco-Products, Inc Final SCDocumento13 páginasEco-Products, Inc Final SCOlaru Lorena71% (7)

- Case Study Orange FinalDocumento8 páginasCase Study Orange FinalOlaru LorenaAinda não há avaliações

- Journal of Business Venturing: Jan Brinckmann, Dietmar Grichnik, Diana KapsaDocumento17 páginasJournal of Business Venturing: Jan Brinckmann, Dietmar Grichnik, Diana KapsaOlaru LorenaAinda não há avaliações

- CV Tip Paragrafe EnglezaDocumento1 páginaCV Tip Paragrafe EnglezaOlaru LorenaAinda não há avaliações

- Asa Romeo Asa Analysis On The Factors That Determine Sustainable Growth of Small Firms in NamibiaDocumento7 páginasAsa Romeo Asa Analysis On The Factors That Determine Sustainable Growth of Small Firms in NamibiaOlaru LorenaAinda não há avaliações

- Smes Financial Reporting and Entrepreneurs Concern For Financial Accounting InformationDocumento11 páginasSmes Financial Reporting and Entrepreneurs Concern For Financial Accounting InformationOlaru LorenaAinda não há avaliações

- Global Ethics: "SAP ERP": MIS 261 - Fall 2009Documento37 páginasGlobal Ethics: "SAP ERP": MIS 261 - Fall 2009Olaru LorenaAinda não há avaliações

- Corporate Social Responsibility: A Case Study of TATA Group: March 2016Documento12 páginasCorporate Social Responsibility: A Case Study of TATA Group: March 2016akash bhardwajAinda não há avaliações

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocumento3 páginasThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderAinda não há avaliações

- Company Analysis of IHCL by M. Shanthan - 19FMUCHH010231Documento25 páginasCompany Analysis of IHCL by M. Shanthan - 19FMUCHH010231Shanthan ReddyAinda não há avaliações

- Mozambican EconomicDocumento19 páginasMozambican Economicgil999999Ainda não há avaliações

- EY AlpineValuation PDFDocumento36 páginasEY AlpineValuation PDFStuff NewsroomAinda não há avaliações

- Quiz 2 PermansysDocumento10 páginasQuiz 2 PermansysKristen StewartAinda não há avaliações

- Financial Management ManualDocumento65 páginasFinancial Management ManualReggie LattimoreAinda não há avaliações

- Ratio Calculator 1Documento10 páginasRatio Calculator 1Anahisa QuintanillaAinda não há avaliações

- Correction of ErrorsDocumento2 páginasCorrection of ErrorsZvioule Ma FuentesAinda não há avaliações

- Sultan Mahmud: Road To BB Ad 2020Documento4 páginasSultan Mahmud: Road To BB Ad 2020TAWHIDAinda não há avaliações

- Max International Income Disclosure Statement - enDocumento2 páginasMax International Income Disclosure Statement - enDialllAinda não há avaliações

- ING Bank v. CIR (2015)Documento50 páginasING Bank v. CIR (2015)Rain CoAinda não há avaliações

- BUSINESS MATH pt.2Documento15 páginasBUSINESS MATH pt.2Antonette ColladoAinda não há avaliações

- HP Final... GRP 04Documento6 páginasHP Final... GRP 04Sowjanya Reddy PalagiriAinda não há avaliações

- Assertions in The Audit of Financial StatementsDocumento4 páginasAssertions in The Audit of Financial StatementsAselleAinda não há avaliações

- by Avinash Gupta On Transfer Pricing 09 Nov 13 PDFDocumento68 páginasby Avinash Gupta On Transfer Pricing 09 Nov 13 PDFManoj KakkarAinda não há avaliações

- DR Ashraf Elsafty E SC 50A Samer Sohry FinalDocumento41 páginasDR Ashraf Elsafty E SC 50A Samer Sohry FinalMahmoud SaeedAinda não há avaliações

- Farm Business Planning and StartupDocumento15 páginasFarm Business Planning and Startupdchammer3171Ainda não há avaliações

- What Are The Sources of Revenue For The Local Government UnitDocumento3 páginasWhat Are The Sources of Revenue For The Local Government UnitKris UngsonAinda não há avaliações

- Cost Accounting-Task No. 1Documento11 páginasCost Accounting-Task No. 1Aguilar Desirie P.Ainda não há avaliações

- PC No (1) - 67Documento3 páginasPC No (1) - 67Debasish MondalAinda não há avaliações

- PowerPoint Slides PPEDocumento21 páginasPowerPoint Slides PPEAndrew ChongAinda não há avaliações

- Examples TransferpricingDocumento15 páginasExamples Transferpricingpam7779Ainda não há avaliações

- Chapter 11 CaseDocumento4 páginasChapter 11 CaseTina CastilloAinda não há avaliações

- Chapter 15Documento13 páginasChapter 15IshahAinda não há avaliações

- Financial Performance in Maruti Suzuki: August 2019Documento8 páginasFinancial Performance in Maruti Suzuki: August 2019shivam singhAinda não há avaliações

- Introduction To Hospitality Fifth Edition John R. Walker: Chapter 3: The Hotel BusinessDocumento24 páginasIntroduction To Hospitality Fifth Edition John R. Walker: Chapter 3: The Hotel BusinessScotch PelosoAinda não há avaliações

- Revision II (Ratio Analysis)Documento6 páginasRevision II (Ratio Analysis)Allwin GanaduraiAinda não há avaliações

- Introduction To Managerial Economics: Dr. Smita ShuklaDocumento20 páginasIntroduction To Managerial Economics: Dr. Smita Shuklamanukoshy76Ainda não há avaliações

- 2012 Pumpkin Patch Case StudyDocumento23 páginas2012 Pumpkin Patch Case StudyDistingAinda não há avaliações

- NFJPIA - Mockboard 2011 - P2 PDFDocumento6 páginasNFJPIA - Mockboard 2011 - P2 PDFLei LucasAinda não há avaliações

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 5 de 5 estrelas5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterNo EverandMind over Money: The Psychology of Money and How to Use It BetterNota: 4 de 5 estrelas4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNo EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNota: 5 de 5 estrelas5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsAinda não há avaliações

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)No EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Nota: 4 de 5 estrelas4/5 (5)