Escolar Documentos

Profissional Documentos

Cultura Documentos

Cta Eb CV 00253 D 2007sep11 Ref

Enviado por

Bobby Olavides SebastianTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cta Eb CV 00253 D 2007sep11 Ref

Enviado por

Bobby Olavides SebastianDireitos autorais:

Formatos disponíveis

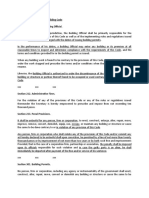

REPUBLIC OF THE PHILIPPINES

COURT OF TAX APPEALS

QUEZON CITY

ENBANC

ANNO DOMINI DRUG, INC.,

EB No. 253

(CTA Case No. 6929)

Petitioner,

Present:

ACOSTA, PJ.

CASTANEDA JR.,

BAUTISTA

-versus-

UY,

COMMISSIONER OF INTERNAL

REVENUE,

Respondent.

CASANOVA, and

PALANCA-ENRIQUEZ, JJ:

Promulgated:

SEP 1 1 2007

4~/;*/~

X- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - X

DECISION

CASANOVA, J:

This is a Petition for Review, 1 filed by the petitioner-An no Domini Drug,

Inc., with the Court En Bane, pu rsuant to Section 18 of Republic Act No. 1125, as

amended by Republic Act No. 9282, from the Decision 2 (Assailed Decision) of the

Court of Tax Appeals Second Division ( CTA Second Division) dated July 20, 2006

in CTA Case No. 6929 entitled, "Anno Domini Drug, Inc., petitioner vs.

Commissioner of Internal Revenue, respondent," denying the Petition for Review3

in the above-mentioned case for insufficiency of evidence, and from the-a

CTA En Bane Rollo, pp. 7-28.

Annex "A", CTA En Bane Rollo, pp.29-43.

3

CT A Second Division Rollo, pp. 1-22.

2

eTA EB CASE NO. 253

(trA CASE NO. 6929)

DECISION

Page 2 of 14

Resolution 4 (Assailed Resolution) dated January 3, 2007 denying petitioner's

Motion for Reconsideration 5 for lack of merit.

The facts of the case, as culled from the records, are as follows:

''Petitioner, Anno Domini Drug/ Inc./ is a domestic corporation

duly organized and existing under the laws of the Republic of the

Philippines with business address at J.P. Rizal Streec Laoag City. As a

franchisee under the business name and style of "Mercury Drug'; it is

duly licensed to operate drug stores by the Department of Trade and

Indust~ Bureau of Food and Drug~ and the local government unit of

Laoag City.

On the other hand, respondent Commissioner of Internal Revenue

is the duly appointed Commissioner of Internal Revenue with office

address at BIR National Building/ Diliman Quezon City.

On April 1~ 2002 and Apnl 1~ 2003/ petitioner filed its Annual

Income Tax Returns under protest for the taxable years 2001 and 200Z

respectively, reflecting the following.fi

2001

Sales

Less: Cost of Sales

Gross Income from Operation

Non -Operating & Other Income

Add:

Total Gross Income

Less: Deductions

Taxable Income

Tax Rate

Income Tax

MCIT

Tax Due

Less: Tax Credits / Payments

Prior Year's Excess Credits

Tax Payments for the First Three Quarters

Creditable Tax Withheld for the First Three

Quarters

Creditable Tax Withheld for the Fourth

Quarter

Total Tax Credits/Payments

Tax Payable/ (Overpayment)

On February 19/

4

200~

2002

P54,576,453.47

51,439,142.41

p 3,137,311 .06

504.59

p 3,137,815.65

2,961,895.29

p

175,920.36

32%

p

56,294.52

p

62,746.22

p

62 ,746.22

P58 ,050 ,085.13

54 ,799,280.36

p 3,250 ,804. 77

49 450. 13

p 3, 300,254.90

3,041 I 969.54

p

258,285.36

32%

p

82,651 .32

p

65 ,016. 10

p

82 ,651 .32

39,045 .80

60 ,615.03

p

p

2,811 .22

41,857.02

20,889.20

p

p

5,289.06

65,904.09

16 747.23

petitioner filed its claim for a tax credit

o~

Annex "8 ", CTA En Bane Rollo, pp. 44-49.

CTA Second Di vision Rollo, pp. 25http://www.youtube.com/watch?v=m06J_ UgmGxA6-257.

6

Exhibits " 8 ", Annual Income Tax Return (SIR Form 1702), Rollo, pp. 140-142 and Exhib it "0",

2002 Annual Income Tax Return (SIR Form 1702), CTA Second Division Rollo, pp. 157- 159.

5

CTA EB CASE NO. 253

('CTA CASE NO. 6929)

DECISION

Page 3 of 14

refund in the total amount of P78fi118.88 allegedly representing the

twenty percent (20%) discount it granted to qualified senior citizens from

their purchases of medicines covering the period from January 1/ 2001 to

December 31/ 2002/ as well as/ petitioners alleged overpaid income taxes

less income taxes payable/ both for the taxable years 2001 and 2002/

computed as follows: 7

Taxable Year 2001

P54,576,453 .47

Sales, Net

Add:

585,408.69

Cost of 20% Discounts to Senior Citizens

P55 , 161 ,862.16

Sales, Gross

Less :

Cost of Sales

Merchandise Inventory, Beginning

p 6,005,861 .61

Purchases

52, 112,494.51

Merchandise Inventory, Ending

(6,679,213. 71)

51,439,142.41

p 3, 722,719 .75

Gross Profit

Add:

Other Income (Net of Interest Income Subject to Final Tax)

504.59

p 3,723 ,224.34

Total Income

Less :

Operating Expenses

2,961,895.29

Net Income Before Income Tax

Income Tax

Less:

761.329.05

243 ,625.30

(62, 746.22)

Income Tax Actually Paid

(585,408.69)

Cost of 20% Discounts to Senior Citizens

p (404,529.61)

Income Tax (Refundable/Creditable)

Taxable Year 2002

Sales, Net

Add:

P58,050,085 .13

561,160 .69

Cost of 20% Discounts to Senior Citizens

P58,611 , 245.82

Sales, Gross

Less:

Cost of Sales

Merchandise Inventory, Beginning

p 6,679,213. 71

Purchases

54,971,367.21

Merchandise Inventory, Ending

(6,851,300.56)

54,799,280 .36

p 3,811 '965.46

Gross Profit

Add :

Other Income

49 450 .13

p 3,861 ,415 . 59

Total Income

Less:

Operating Expenses

Net Income Before Income Tax

Income Tax

Less :

Income Tax Actually Paid

Cost of 20% Discounts to Senior Citizens

3,041,969 .54

819,446.05

262,222.74

(82,651.32)

(561,160.69)

?P-

Exhibit "Y", Petitioner's Written Claim for Tax Credit Refund addressed to Commissioner of Internal

Revenue dated February 19, 2004, CT A Second Division Rollo, pp. 175-177.

CTA EB CASE NO. 253

(<CTA CASE NO. 6929)

DECISION

Page 4 of 14

Income Tax (Refundable/Creditable)

p (381,589 .27)

Total Income Tax (Refundable/Creditable)

p (786.118.89)

Before it could be barred by prescription, petitioner deemed it

proper to elevate its case to this Court through this instant Petition for

Review on April 13, 2004.

On May 1 ~ 2004, respondent filed his Answer, raising the

following as his Special and Affirmative Defenses, to quote:

'4. Revenue Regulations No. 2-94 did not alter, modify or

amend the intent of the law to constder the 20% discount

granted to qualified senior citizen as deduction from

petitioner's gross income and not as credit against its tax

liability as petitioner insists;

5. With the accumulation of experience and growth of

specialized capabilities by the agency charged with

implementing a particular statute, it is now a recognized

principle that the construction given to a statute by an

administrative agency charged with the interpretation and

application of that statute is entitled to great respect and

should be accorded great weight by the courts, unless

such construction is clearly shown to be in sharp conflict

with the governing statute or the constitution and other

laws (Nestle Philippines, Inc., vs. CA, et.al., 203 SCRA

504);

6. R.A. 7432 allows the discounts granted to senior

citizens to be claimed as a tax credit but is silent as to the

mechanics of availing the same. For clarification and as a

curative measure, Revenue Regulations No. 2-94 was

issued defining the term "tax credit// as used in the law

and providing therein the manner of claiming the same,

which is be deduction from the establishment's gross

income and not from its income tax liability. Otherwise an

absurdity, not intended by the law, will arise;

7. Petitioner's alleged claim for refund is subject to

administrative routinary investigation/examination by the

Bureau;

8. The amount of P786,118.88 being claimed by

petitioner as alleged sales discount to senior citizens on

their purchases of medicines for taxable years 2001 and

2002 were not properly documented;t('ll.,

eTA EB CASE NO. 253

(CTA CASE NO. 6929)

DECISION

Page 5 of 14

9. In an action for refunft the burden of proof ls on the

taxpayer to establish lts right to refunft and failure to

sustain the burden ls fatal to the claim for refund/credit;

10. Petitioner must show that lt has compiled with the

provisions of Sections 204 (C) and 229 of the Tax Code on

the prescriptive period for claiming refund/credit; and

11. Claims for refund are construed strictly against the

claimant for the same partake the nature of exemption

from taxation. ' 8

After presentation of petitioner's testimonial evidence and the

admission of lts documentary exhibits, respondent's counsel, Atty. Mar/eel

G. Qullates/ manifested that she ls not presenting testimonial evidence

because the issues raised ln the instant petition are purely legal. The

parties were thereafter directed to file their respective Memorandum. On

March 1/ 2006/ this case was submitted for decision after the submission

of the parties' respective memorandum.

The issues as stipulated by the parties are as follows:

1.

Whether or not the claim of petitioner for tax

credit/refund was administratively and judicially filed wlthln

the two-year statutory per/oft

2.

Whether the 20% sales discount granted to

qualified senior citizens on their purchases of medicines

should be treated as tax credit/refund deductible from the

tax due as provided under Republic Act No. 7432 or merely

as a deduction from gross income as provided under

Revenue Regulations No. 2-94;

3.

Whether or not petitioner granted discounts ln

to qualified senior citizens on their

2001 and 2002

purchases of medicines pursuant to Republic Act No. 7432

ln the total amount of One Million One Hundred Forty Slx

Thousand Five Hundred Sixty Nine and 38/100 Pesos

(P1/ 14~569.38); and

4.

Whether or not the petitioner ls entitled to a tax

credit/refund ln the amount of Seven Hundred Eighty Slx

Thousand One Hundred Eighteen and 88/100 Pesos

(P78~118.88) representing the cost of the twenty (20%k

--------------------8

Answer, CTA Second Division Roll o, pp. 34-35 .

CTA EB CASE NO. 253

(CTA CASE NO. 6929)

DECISION

Page 6 of 14

percent discount granted to qualified senior citizens on

their purchases of medicines during the period from

January 1/ 2001 to December 31/ 2002 and overpaid

income taxes less income taxes payable for 2001 and 2002

taxable years. " 9

After trial on the merits, the CTA Second Division promulgated the

assailed Decision, the dispositive portion of which reads:

"WHEREFORE, in view of the foregoing/ the subject Petition for

Review is hereby DENIED for insufficiency of evidence.

SO ORDERED."

Not satisfied with the above pronouncement, petitioner filed a "Motion for

Reconsideration on August 31, 2006. Respondent, on the other hand, filed an

Opposition (Re: Motion for Reconsideration) on September 27, 2006. On January

3, 2007, the CTA Second Division promulgated the assailed Resolution, the

dispositive portion of which reads:

"WHEREFORE, there being no other new matters or arguments

advanced in petitioners Motion for Reconsideration which may compel

this Court to reverse/ modify or amend the assailed Decision the same is

hereby DENIED for lack of merit.

SO ORDERED. //

Records show that the assailed Resolution was received by the petitioner

on January 9, 2006 10, thus, it has fifteen (15) days from said date within which

to file a Petition for Review with the Court En Bane pursuant to Section 3(b) Rule

8 of the Revised Rules of the Court of Tax Appeals 11 . On January 24, 2007,

petitioner filed a "Motion for Extension of Time to File Petition for Review

wit~

Joint Stipulation of Facts and Issues, CT A Second Division Rollo, pp. 55-57 .

CTA Second Division Rollo, p. 264. Shoul d be January 9, 2007.

11

Sec. 3. Who may appeal; period to file petition(a) XXX

XXX

(b) A party adversely affected by a decision or resolution of a Divis ion of the Court on a motion

for reconsideration or new trial may appeal to the Court by fi ling before it a petition for review

within fifteen days fro m rece ipt of a copy of the questioned decision or resolution. Xxx xxx.

CTA EB CASE NO. 253

(CTA CASE NO. 6929)

DECISION

Page 7 of 14

the erA En Banc"12 On January 25, 2007, the Court En Bane issued a Minute

Resolution 13 granting the said motion thus, giving petitioner a final and nonextendible period of fifteen (15) days from January 24, 2007 or until February 9,

2007 within which to file a Petition for Review with the Court En Bane. In

compliance with the Court's Resolution, petitioner filed a Petition for Review 14 on

February 8, 2007.

In support of the instant petition for review, petitioner raised the same

issues as jointly stipulated by both parties in erA Second Division Case No. 6929 .

In addition, petitioner points out whether or not it is required by Republic Act No.

7432 or the Senior Citizens Law to file its tax returns and to prove that its net

sales to qualified senior citizens were included in its financial statements and tax

returns before it can claim for reimbursement in the form of tax credit for the

discounts it granted.

After a careful and thorough evaluation and consideration of the records

of the case, the Court En Bane finds the issues raised in the instant petition as

mere reiteration of the issues exhaustively discussed by the CTA Second Division

in its assailed Decision and Resolution .

As correctly held by the CTA Second Division, and We agree:

The first issue on the timeliness of petitioner's administrative and

judicial claims for refund/tax credit is ruled in the affirmative.

Petitioner filed its Annual Income Tax Returns on April 1~ 2002

and April 1~ 2003 for the taxable years 2001 and 200Z respectively, and

it had until April 14, 2004 and April 14, 2005 within which to file both its

administrative and judicial claim for tax creditjrefund, respectively.15

Considering that petitioner's administrative claim was filed on February

1~ 2004 and the judicial claim was filed on April 1~ 2004, evidently, the

requirements provided under the laws have been complied with.

The second issue refers to the manner by which the 20%

-------------------12

13

CTA En Bane Rollo, pp. 3-5.

CT A En Bane Rollo, p. 6.

14

Ibid.

The taxable year 2004 being a leap year

15

sale~

eTA EB CASE NO. 253

(CTA CASE NO. 6929)

DECISION

Page 8 of 14

discount granted to qualified senior citizens on their purchases of

medicines: whether it should be treated as tax credit/refund deductible

from the tax due as provided under Republic Act No. 7432 or merely as a

deduction from gross income as provided under Revenue Regulations No.

2-94. This issue was resolved by the Supreme Court in the case of

Commissioner of Internal Revenue vs. Central Luzon Drug

Corporation in this wise:

''Section 4 (a) of RA 743.2'- 6 grants to senior citizens the privilege

of obtaining a 20 percent discount on their purchase of medicine

from any private establishment in the country. The latter may

then claim the cost of the discount as a tax credit. x x x

"The 20 percent discount required by law to be given to senior

citizens is a tax credit not merely a tax deduction from the

gross income or gross sale of the establishment concerned. A

tax credit is used by a private establishment only after the tax

has been computed/ a tax deduction, before the tax is

computed. RA 7432 unconditionally grants a tax credit to all

covered entities. Thus, the provisions of the revenue regulation

that withdraw or modify such grants are void. Basic is the rule

that administrative regulations cannot amend or revoke the law.

Tax Credit versus

Tax Deduction

Although the term is not specifically defined in our Tax Code,

tax credit generally refers to an amount that is ''subtracted

directly from one's total tax liability." It is an ''allowance against

the tax itselr' or ''a deduction from what is owed" by a taxpayer

to the government. Examples of tax credits are withheld taxes,

payments of estimated tax, and investment tax credits.

Tax credit should be understood in relation to other tax

concepts. One of these is tax deduction - defined as a

subtraction ''from income for tax purposes, " or an amount that is

''allowed by law to reduce income prior to [the} application of

the tax rate to compute the amount of tax which is due. " An

example of a tax deduction is any of the allowable deductions

enumerated in Section 34 of the Tax Code:$-

16

Entitled "An Act to Maxi mize the Contribution of Senior Citizens to Nation Building, Grant Benefits

and Special Privileges and for other purposes," this law took effect in 1992 . See Santos, Jr. v. Llamas, 379

Phil. 569, 577, January 20, 2000.

CTA EB CASE NO. 253

GCTA CASE NO. 6929)

DECISION

Page 9 of 14

A tax credit differs from a tax deduction. On the one hand, a

tax credit reduces the tax due, including - whenever

applicable - the income tax that is determined after applying

the corresponding tax rates to taxable income. A tax

deduction, on the othe~ reduces the income that is subject to

tax in order to arrive at taxable income. To think of the

former as the latter is to avoid, if not entirely confuse, the issue.

A tax credit is used only after the tax has been computed, a

tax deduction, before.

XXX

XXX

XXX

Laws Not Amended

by Regulations

Second, the law cannot be amended by a mere regulation. In

fac~ a regulation that "operates to create a rule out of harmony

with the statute is a mere nullity '~ it cannot prevail.

It is a cardinal rule that courts "will and should respect the

contemporaneous construction placed upon a statute by the

executive officers whose duty it is to enforce it x x x. " In the

scheme ofj udicial tax administration, the need for certainty and

predictability in the implementation of tax laws is crucial. Our

tax authorities fill in the details that "Congress may not have the

opportunity or competence to provide. " The regulations these

authorities issue are relied upon by taxpayers, who are certain

that these will be followed by the courts. Courts, however,

will not uphold these authorities' interpretations when

clearly absurd, erroneous or improper.

In the present case, the tax authorities have given the term

tax credit in Sections 2.i and 4 of RR 2 -94 a meaning

utterly in contrast to what RA 7432 provides. Their

interpretation has muddled up the intent of Congress in

granting a mere discount privilege, not a sales discount.

The administrative agency issuing these regulations may

not enlarge, alter or restrict the provisions of the law it

administers; it cannot engraft additional requirements

not contemplated by the legislature.

In case of conflic~ the law must prevail. A ''regulation adopted

pursuant to law is law. " Conversely, a regulation or any portion

thereof not adopted pursuant to law is no law and has neither

the force nor the effect of law.

XXX

XXX

Grant of Tax Credit

Intended by the Legislature t2;:l-

XXX

CTA EB CASE NO. 253

~CTA CASE NO. 6929)

DECISION

Page 10 of 14

Fifth, RA 7432 itselfseeks to adopt measures whereby senior

citizens are assisted by the community as a whole and to

establish a program beneficial to them. These objectives are

consonant with the constitutional policy of making ''health x x x

services available to all the people at affordable cost" and of

giving ''priority for the needs of the x x x elderly. " Sections 2.i

and 4 of RR 2-94, however, contradict these constitutional

policies and statutory objectives.

Furthermore, Congress has allowed all private establishments a

simple tax credit, not a deduction. In fact, no cash outlay is

required from the government for the availment or use of such

credit. The deliberations on February S, 1992 of the Bicameral

Conference Committee Meeting on Social Justice, which finalized

RA 7432, disclose the true intent of our legislators to treat the

sales discounts as a tax credit, rather than as a deduction

from gross income 17 ''

Clearly from the foregoing jurisprudence interpreting pertinent

provisions of Republic Act No. 7432, the 20% sales discounts granted to

qualified senior citizens should be treated as tax credits instead of as

mere deductions from gross income.

The third issue is a factual issue, that is, whether or not petitioner

granted discounts in 2001 and 2002 to qualified senior citizens on their

purchases of medicines pursuant to Republic Act No. 7432 in the total

amount of One Million One Hundred Forty Six Thousand Five Hundred

A resolution in the

Sixty Nine and 38/100 Pesos (Php1,146,569.38).

affirmative will likewise favorably resolve the fourth issue as to whether

or not the petitioner is entitled to a tax credit/refund in the amount of

Seven Hundred Eighty Six Thousand One Hundred Eighteen and 88/ 100

Pesos (Php786,118.88) representing the cost of the twenty (20%)

percent discount granted to qualified senior citizens on their purchases of

medicines during the period from January 1, 2001 to December 31, 2002

and overpaid income taxes less income taxes payable for 2001 and 2002

taxable years. Thus, the third and fourth issues will be resolved jointly.

In proving that petitioner actually granted the twenty (20%)

percent sales discounts to its qualified senior citizen clientele, the

following supporting documents were presented by petitioner:

a.

Various cash slips issued by its entity covering the

taxable years 2001 and 2002 (Exhibits ''Z-64201 to Z-_a.

17

G.R. No. 159647, Apri l 15, 2005

CTA EB CASE NO. 253

(CTA CASE NO. 6929)

DECISION

Page 11 of 14

65100, Z-66301 to Z-67200, Z-68901 to Z-69900, Z-71401

to Z-72700, Z-74501 to Z-75500, Z-77201 to Z-78000, Z78501 to Z-78800, Z-79201 to Z-80000, Z-82401 to Z83000, Z-64703, DD-83001 to DD-83400, DD-84201 to

DD-84300, DD-84401 to DD-85300, DD-85901 to DD86300, DD-86501 to DD-87600, DD-90201 to DD-90500,

DD-91101 to DD-91300, DD-91601 to DD-91800, DD92001 to DD-92100, DD-92301 to DD-92400, DD-92701 to

DD-92800, DD-92901 to DD-93100, DD-93301 to DD93400, DD-93601 to DD-94600, DD-95401 to DD-95600,

DD-96201 to DD-97400, DD-99001 to DD-99200, DD99401 to DD-99800, and DD-84326'};

b.

2001 and 2002 Summary of Sales and Discounts

for Senior Citizens (Exhibits "'I, II-1, JJ, and JJ-1 '};

c.

Special Record Book for the taxable years 2001 and

2002 as required under the implementing rules of Republic

Act No. 7432 (Exhibits ':44, AA-3, AA-4, EE, EE-3, and EE4'};

d.

Cash Receipts Book for January 2001 and January

2002 (Exhibits ''88, BB-1 to BB-3, FF, FF-1 to FF-3'};

e.

2001 and 2002 General Ledger (Exhibits "Cc; CC-1

to CC-3, GG to GG-3");

f.

2001 and 2002 Annual Income Tax Returns

(Exhibits " B and 0 '}; and

g.

2001 and 2002 Audited Financial Statements

(Exhibits ''Nand X'}.

After a thorough examination of the various cash slips, in relation

to petitioner's submitted Summary of Sales and Discounts for Senior

Citizens and the Special Record Books for 2001 and 2002, the Court finds

the Report of the Court-commissioned Independent Certified Public

Accountant to be in order. It is stated therein, among others, that the

sales discounts given to senior citizens for the taxable years 2001 and

2002, wherein the required details for the issuance of the cash slips are

complete, amounted to Php1, 096,878.28.

However, despite the existence of the cash slips supporting the

20% sales discounts of Php1,096,878.28, petitioner's claim for refund/ tax

credit will nevertheless be denied because it failed to prove that the sales

made to senior citizens (net of the 20% sales discounts) were actual/~

CTA EB CASE NO. 253

CTA CASE NO. 6929)

DECISION

Page 12 of 14

declared in petitioner's 2001 and 2002 Annual Income Tax Returns in

relation to its Audited A"nancial Statements for the same taxable years.

It must be emphasized that petitioner is claiming tax

credits/refunds for the twenty percent (20%) sales discounts it granted to

its qualified senior citizens clientele/ thus/ it is necessary that it be shown

that the related eighty percent (80%) sales to senior citizens were indeed

reported as part of its taxable income for 2001 and 2002, on the

assumption that the 20% sales discounts were indeed originally treated

as deductions from its gross income.

To illustrate/ petitioner reported its sales of Php5~57~453.47 for

the taxable year 2001 and Php5~050/ 085.13 for the taxable year 2002

marked as Exhibits ''8-3, and "0-3'/ 8 respectively, under item 14

pertaining to ''Sales/ Revenues/ Fees (Sch.1) , of its Annual Income Tax

Return for the year 2001 and 2002 (BIR Form No. 1702). These amounts

were likewise reflected on petitioner's Audited Financial Statements for

the same years.19

In this regard, and to further prove that these amounts correctly

included petitioner's sales to its senior citizens (which is net of the

mandated 20% sales discounts), petitioner presented in evidence its Cash

Receipts Books for the taxable year 2001 and 2002 showing/ on certain

page~ the transactions for January 2001 and 2002/ its Special Records

Book as well as its General Ledgers for the same years. 20

Unfortunately, petitioner failed to present a detailed breakdown of

its daily net sales as reflected in the Cash Receipts Books/ to enable this

Court to verify or trace whether the daily net sales to senior citizens as

recorded in the Special Records Books indeed formed part of the daily net

sales amounts in the Cash Receipts Books. To illustrate/ petitioner's net

sales to its senior citizens clientele for January 2~ 2001 was recorded in

its 2001 Special Records Book as amounting to Php4/207.04 (where Cash

Slip No. 64703 with corresponding net sales amount of Php697.20 formed

part of). For the same date/ petitioner's Cash Receipts Book reflected a

net sales of Php141/518.32. Without petitioner providing for the details

as to the breakdown of the net sales amounC this Court finds it

impossible to establish whether the net sales of Php4,207.04 (as reflected

on the Special Receipts Book) was indeed included therein.&-.

18

CTA Second Division Rollo, pp. 140 and 157, respectively.

Exh ibits "N-3", Income Statement , For the Year Ended December 31 , 200 I , Rollo, p. 156, and Exhibit

"X-3", Income Statement For the Year Ended December 31,2002, CT A Second Division Rollo, p. 174.

20

Exhibits "CC to CC-2", 200 I General Ledger, CT A Second Division Roll o, pp. 183 - 184, and Exhibits

"GG to GG-2", 2002 General Ledger, CTA Second Division Ro ll o, pp. 190-191.

19

CTA EB CASE NO. 253

~ CTA CASE NO. 6929)

DECISION

Page 13 of 14

Considering that petitioner is claiming tax credits for the 20%

sales discounts it granted to senior citizens/ it is necessary that petitioner

proves that the related 80% sales to senior citizens were indeed reported

as part of its net taxable income for 2001 and 2002/ i.e./ on the

assumption that the said 20% discounts were originally treated as

deductions from gross income.

For failure of petitioner to sufficiently prove that its net sales to

senior citizens were in fact declared in its 2001 and 2002 income tax

returns/ the instant petition will not prosper. Settled in the rule that a

claim for refund is in the nature of a claim for exemption hence/ should

be construed in strictissimi juris against the taxpayer. 21

To reiterate, considering that petitioner is claiming tax credits for the 20%

sales discounts it granted to senior citizens, it is necessary that petitioner proves

that the related 80% sales to senior citizens were indeed reported as part of the

net taxable income for 2001 and 2002, on the assumption that the said 20%

discounts were originally treated as deductions from gross income.

In sum, the Court En Bane finds no cogent justification to disturb the

findings and conclusion spelled out in the assailed July 20, 2006 Decision and

January 3, 2007 Resolution of the CTA Second Division. What the instant petition

seeks is for the Court En Bane to view and appreciate the evidence in their own

perspective of things, which unfortunately had already been considered and

passed upon by the CTA Second Division.

WHEREFORE, the instant Petition for Review is hereby DISMISSED for

lack of merit. Accordingly, t he July 20, 2006 Decision and January 3, 2007

Resolution of the CTA Second Division are hereby AFFIRMED

SO ORDERED .

in toto.

J2

CAESAR A. CASANOVA

Associate Justice

21

Commissioner of Internal Revenue vs. Tokyo Shipping Co., Ltd. , 244 SCRA 332 .

CTA EB CASE NO. 253

(CTA CASE NO. 6929)

DECISION

Page 14 of 14

WE CONCUR:

~ \Il l

.....--vL_

ERNESTO D. ACOSTA

Presiding Justice

<A..~tf. G. ~~ .Q.. .

J6ANITO C. CASTANEDA, jR:

Associate Justice

fk-e_

. UY

OLGA

~RIQUEZ

Associate Justice

CERTIFICATION

Pursuant to Article VIII, Section 13 of the Constitution, it is hereby

certified that the conclusions in the above decision were reached in consultation

before the case was assigned to the writer of the opinion of the Court.

~ - c~

ERNESTO D. ACOSTA

Presiding Justice

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Film Financing and Television Programming - PhilippinesDocumento20 páginasFilm Financing and Television Programming - PhilippinesBobby Olavides SebastianAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- SEC Advisory Secret2SuccessDocumento3 páginasSEC Advisory Secret2SuccessBobby Olavides SebastianAinda não há avaliações

- Airport Construction Influencing FactorsDocumento4 páginasAirport Construction Influencing FactorsIbrahim AdelAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Managing Airport Construction ProjectsDocumento10 páginasManaging Airport Construction ProjectsTATATAHER100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- SEC MSRD Request For Comments On The Updated Proposed Rules On Initial Coin OfferingDocumento46 páginasSEC MSRD Request For Comments On The Updated Proposed Rules On Initial Coin OfferingBobby Olavides SebastianAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- SEC Advisory Re MiningDocumento3 páginasSEC Advisory Re MiningBobby Olavides SebastianAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- BSP Warning Advisory On Virtual CurrenciesDocumento2 páginasBSP Warning Advisory On Virtual CurrenciesBobby Olavides SebastianAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- BSP Circular No. 944-2017 (Guidelines For Virtual Currency (VC) Exchanges)Documento6 páginasBSP Circular No. 944-2017 (Guidelines For Virtual Currency (VC) Exchanges)Bobby Olavides SebastianAinda não há avaliações

- SEC Advisory PhilcrowdDocumento2 páginasSEC Advisory PhilcrowdBobby Olavides SebastianAinda não há avaliações

- SEC Advisory PHILIPPINE GLOBAL COINDocumento2 páginasSEC Advisory PHILIPPINE GLOBAL COINBobby Olavides SebastianAinda não há avaliações

- SEC Advisory PluggleDocumento3 páginasSEC Advisory PluggleBobby Olavides SebastianAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- SEC Advisory Public Participation in Initial Coin OfferingDocumento2 páginasSEC Advisory Public Participation in Initial Coin OfferingBobby Olavides SebastianAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Guidelines On VideoconferencingDocumento23 páginasGuidelines On VideoconferencingBobby Olavides SebastianAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- SEC Advisory OnecashDocumento2 páginasSEC Advisory OnecashBobby Olavides SebastianAinda não há avaliações

- Occupancy Permit Violation SourcesDocumento6 páginasOccupancy Permit Violation SourcesBobby Olavides SebastianAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- TIN Card As ID For Notarization PurposesDocumento9 páginasTIN Card As ID For Notarization PurposesBobby Olavides SebastianAinda não há avaliações

- TESDA - Program Registration Forms Land-BasedDocumento26 páginasTESDA - Program Registration Forms Land-BasedBobby Olavides SebastianAinda não há avaliações

- Regulatory Framework For The Accreditation of Gaming SystemDocumento8 páginasRegulatory Framework For The Accreditation of Gaming SystemBobby Olavides SebastianAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- 2021NOTICE Extension of Enrollment in OSTDocumento1 página2021NOTICE Extension of Enrollment in OSTBobby Olavides SebastianAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- UTPRAS Guidelines (HTTP://WWW - Tesda.gov - ph/About/TESDA/42)Documento5 páginasUTPRAS Guidelines (HTTP://WWW - Tesda.gov - ph/About/TESDA/42)Bobby Olavides SebastianAinda não há avaliações

- 2019OpinionNo19 40Documento3 páginas2019OpinionNo19 40Bobby Olavides SebastianAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- E-Filing RuleDocumento6 páginasE-Filing RuleThe Supreme Court Public Information Office100% (1)

- RMC 66-03 (Taxability of PAL)Documento4 páginasRMC 66-03 (Taxability of PAL)Bobby Olavides SebastianAinda não há avaliações

- Supreme Court: Administrative Circular No. 15 - 2021Documento2 páginasSupreme Court: Administrative Circular No. 15 - 2021Eunice SagunAinda não há avaliações

- Notice: Bulletin Date Subject Clarification/Details No. MatterDocumento5 páginasNotice: Bulletin Date Subject Clarification/Details No. MatterAbraham GuiyabAinda não há avaliações

- All POGOs SPs - Compliance With The 60-40 Foreign Equity RequirementDocumento1 páginaAll POGOs SPs - Compliance With The 60-40 Foreign Equity RequirementBobby Olavides SebastianAinda não há avaliações

- Republic of The Philippines: Scale Projects Are Defined As Those Construction Projects That Are Intended For PurelyDocumento12 páginasRepublic of The Philippines: Scale Projects Are Defined As Those Construction Projects That Are Intended For PurelyBobby Olavides SebastianAinda não há avaliações

- Supreme Court: Administrative Circular No. 14 - 2021Documento1 páginaSupreme Court: Administrative Circular No. 14 - 2021Bobby Olavides SebastianAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Cheaper Medicines Act of 2008Documento28 páginasCheaper Medicines Act of 2008Bobby Olavides SebastianAinda não há avaliações

- SB 1564Documento59 páginasSB 1564Bobby Olavides SebastianAinda não há avaliações

- Proficiency Testing 17020Documento11 páginasProficiency Testing 17020ss1222100% (1)

- Kotak-ING Vysya Merger: First Profit Making Merger in Indian Banking SectorDocumento26 páginasKotak-ING Vysya Merger: First Profit Making Merger in Indian Banking Sectorpradnya sikiAinda não há avaliações

- DAD68504 Access To The Fore Peak Tank - DecryptedDocumento2 páginasDAD68504 Access To The Fore Peak Tank - DecryptediagoramonAinda não há avaliações

- World Fuel Services Technical Brochure AviationDocumento4 páginasWorld Fuel Services Technical Brochure AviationВладимир КостенкоAinda não há avaliações

- Revision L4M1 LO4 ChamberDocumento12 páginasRevision L4M1 LO4 ChamberAtik ShaikhAinda não há avaliações

- Standard Diving: PrintDocumento52 páginasStandard Diving: PrintWale OyeludeAinda não há avaliações

- Mitul Chawda: Management SkillsDocumento5 páginasMitul Chawda: Management Skillsanon_907856858Ainda não há avaliações

- 75 Servando V Philippine Steam Navigation - VisitacionDocumento2 páginas75 Servando V Philippine Steam Navigation - VisitacionJanlo Fevidal100% (2)

- Construction Bid Guidelines and Requirements: Public Information Office (PIO)Documento22 páginasConstruction Bid Guidelines and Requirements: Public Information Office (PIO)Melvin EsguerraAinda não há avaliações

- Ordination Committee of Artists and Technicians of W.B. Film and Television and OrsDocumento5 páginasOrdination Committee of Artists and Technicians of W.B. Film and Television and OrsRithvik MathurAinda não há avaliações

- Chapter 9 Group Accounts FINALDocumento3 páginasChapter 9 Group Accounts FINALGayathri SukumaranAinda não há avaliações

- SourceGuardian Loader License PDFDocumento2 páginasSourceGuardian Loader License PDFJohn C. YoungAinda não há avaliações

- Indo-China Seminar Paper On Auditing StandardsDocumento19 páginasIndo-China Seminar Paper On Auditing StandardsFareha RiazAinda não há avaliações

- Management Accounting and Control SystemsDocumento6 páginasManagement Accounting and Control SystemsnarunsankarAinda não há avaliações

- Lic Nir QuestionaireDocumento3 páginasLic Nir Questionaireneville79Ainda não há avaliações

- Proforma of ApplicationDocumento3 páginasProforma of ApplicationJeshiAinda não há avaliações

- Lecture 5 - Acceptance, CommunicationDocumento70 páginasLecture 5 - Acceptance, CommunicationMuhammad Farid Ariffin100% (1)

- Bernas vs. CincoDocumento35 páginasBernas vs. CincoKrizia FabicoAinda não há avaliações

- Quality Management Systems Fundamentals Vocabulary AwarenessDocumento6 páginasQuality Management Systems Fundamentals Vocabulary AwarenesssbtharanAinda não há avaliações

- Revenue Generation Strategies in Sub Saharan African Universities Compatibility ModeDocumento15 páginasRevenue Generation Strategies in Sub Saharan African Universities Compatibility ModeLakim ArsenalAinda não há avaliações

- 5star - Hotel Lucknow Boot Project RFQDocumento119 páginas5star - Hotel Lucknow Boot Project RFQPotluri Phani Ratna KumarAinda não há avaliações

- Nigerian EIA ActDocumento31 páginasNigerian EIA ActOribuyaku DamiAinda não há avaliações

- Springfield Building Department Inspectional Services Notice of ViolationsDocumento6 páginasSpringfield Building Department Inspectional Services Notice of ViolationsThe Republican/MassLive.comAinda não há avaliações

- Ifrs Challenges PDFDocumento8 páginasIfrs Challenges PDFMehak AyoubAinda não há avaliações

- Paul Coward, Tullow Oil, On EISA in Ghana and UgandaDocumento18 páginasPaul Coward, Tullow Oil, On EISA in Ghana and Ugandatsar_philip2010Ainda não há avaliações

- PD 957 Irr PDFDocumento100 páginasPD 957 Irr PDFAnna Katrina Jorge0% (1)

- The Impact of IFRS On Financial StatementsDocumento84 páginasThe Impact of IFRS On Financial StatementsPrithviAinda não há avaliações

- Garuda Indonesia: Electronic Ticket ReceiptDocumento2 páginasGaruda Indonesia: Electronic Ticket ReceiptIrbarAysarAinda não há avaliações

- Petition 143 of 2014Documento9 páginasPetition 143 of 2014Andrew OkoitiAinda não há avaliações

- Declaration of Nominee TrustDocumento4 páginasDeclaration of Nominee Trust123pratus50% (2)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyAinda não há avaliações

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsAinda não há avaliações

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNo EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNota: 4 de 5 estrelas4/5 (52)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNo EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNota: 4.5 de 5 estrelas4.5/5 (43)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesNo EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesNota: 4 de 5 estrelas4/5 (9)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNo EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNota: 5 de 5 estrelas5/5 (27)