Escolar Documentos

Profissional Documentos

Cultura Documentos

Aas

Enviado por

Mohammed Rabeeh IbrahimDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Aas

Enviado por

Mohammed Rabeeh IbrahimDireitos autorais:

Formatos disponíveis

Contents

1.

Recruitment process................................................................................ 3

1.1. Weaknesses in the recruitment and payroll system, their errors and the

recomendations.......................................................................................................... 3

1.2. Strengths................................................................................................. 5

1.3 Internal control........................................................................................... 6

2.

Auditor Independence.............................................................................8

2.1 Types of auditor independence...............................................................8

Examples of audit independence..................................................................9

2.2 Audit quality............................................................................................ 9

2.3. Audit firm rotation................................................................................ 10

3.

Threats to auditor independence...........................................................11

3.1 Self-review threat..................................................................................11

3.2 Self-interest threat................................................................................11

3.3 Multiple referrals threat........................................................................12

3.4 Ex-staff and partners threat..................................................................12

3.5 Advising threat...................................................................................... 12

3.6 Relationships threat.............................................................................. 12

Recommendations to overcome the above threats.....................................12

References..................................................................................................... 14

2 | Page

3 | Page

1. Recruitment process

Recruitment is the procedure of finding the most suitable individuals for the position,

selection is the methodology of picking the best individual for the position, and induction is

acquainting the individual with the position. In the event that recruitment is done well, the

business will benefit from more effective and more beneficial individuals, provides good

working relationships and ultimately maximising the profits.

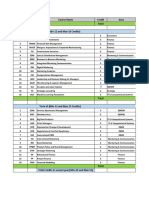

An illustration on how the recruitment process is done is shown below:

Figure 1: Recruitment process (Aboutus.org, 2015)

In case scenario:

4 | Page

1.1. Weaknesses in the recruitment and payroll system,

their errors and the recomendations

i)

Lack of segregation of duties

Johnny Stark Oil inc. is a big firm consisting of 40 employees. In the company, the

managing director normally does the recruiting process. Recently the work has been given to Ms.

Pepper, the human resource development officer. The company has a lot of positions to fill.

Segregation of duties is important to a firms effectiveness in internal control. It reduces the risk

of inappropriate action. Segregation of duties will reduce the possibility of fraud since

segregation requires working with other people in the company. Since one person is assigned to

do all the recruitment process, it is possible for falsification to happen as the manager of human

resource is also the one who set up the payment rate for each recruited employee. Hence the

company will set higher margin rate for employees

In Johnny Stark oil inc. the duties should be segregated to more people in the managerial

power to bring in efficiency in control and reduce the risk of fraud.

ii)

No time card and review

As you can see in the case study, there is no time card and proper review is absent. This

can lead to falsification of date. The workers can duplicate the hours of work done in the

company and also even the number of employees working at a certain period as the documents is

taken manually.

The company should introduce time card and review. This will help the company to avoid

the falsification of working hours and data which can occur when done manually. Time card

makes it computerised, so the employees put in the data correctly and the company can avoid the

threats.

iii)

Signing of cheque without further check of the amount

5 | Page

This can be seen as a weakness since the amount written in the cheque can be duplicated

and since it is signed without further check the cheque will be passed accordingly. This can incur

a great loss to the company if the employees decide to duplicate the data. This shows there is

lack of verification power and authority.

As for finance manager this shouldnt happen since it is his/her job to verify the amount

written in the cheques so as to avoid fraud activities. This can bring in loss to the company as the

cheques are not verified properly. Proper verification of the cheques should be implemented in

order to make the finance more efficient.

iv)

Providing loans irrespective of the periods

The company tends to provide loans to all employees irrespective of when they joined the

company. This can be seen as a weakness. The case study also shows giving away of marriage

loans. The employees may take loans from the company and later it effects the funding off the

company.

Ms Pepper and Selena have similar roles in recording and putting datas in the payroll.

The loan forms can be duplicated for personal gains. There is no regulations to stop this.

v)

No receipts given out

The employees collect the pay cheques and payslips on payday without any

acknowledgement or receipts. This can be a weakness. This can bring in employees claiming

they never received the payments since there is no proof to show the same.

In this case, the employees can falsify the data and claim payment. This can be avoided

if the payments made are properly acknowledged and recorded in receipts.

1.2. Strengths

i)

Authority to decide on the payments to employees

6 | Page

Ms. Pepper is given the authority to decide on the payments of the employees based on

their qualification. This ensures the employees the right amount of pay based on the qualification

of the employees

ii)

Input of data to the payroll master file

Ms. Pepper keeps the data in order. She shows all the information including the pay to the

employees in the appointment letter and stores it in the payroll master file. This ensure credibility

of the firm.

iii)

Filing triplicate deduction form

After the loan gets approved by Ms. Pepper, a triplicate deduction form is filed stating the

payment and deduction periods. This enables the company to see the progress of the loans.

iv)

Cross checking of deduction files

Another strength in the payroll procedures is the cross checking of the deduction files.

Ms. Pepper forwards the deduction files to Selena who in turn prepares a payroll sheets. These

payroll sheets are then forwarded to the finance manager to cross check and then returned back

to Selena. This helps in avoiding frauds and falsification of the datas for personal gains since the

work is segregated.

v)

Double check of cheques more thatn RM 10,000

If the cheques exceed RM 10,000 the general manager is requiredto sign the cheques.

These cheques are verified with the payment voucher packages.

1.3 Internal control

The process of internal control is to maintain an environment in the company to avoid

corruption and frauds within the company. The components of an internal control are evaluated

in the planning phase by the independent auditor. The result of the evaluation influence the

auditors reliability and henceforth the auditor fee. In order to avoid the auditor fee, some

7 | Page

common features are implemented to achieve internal control. Some of them are mentioned

below (Small Business - Chron.com, 2015):

i)

Management integrity

It refers to the moral character of the managers in power. This is important for the overall

efficiency in the organisation. Manegerial intergrity is passed on to the employees through

manuals and employee handbooks.

ii)

Competent Personnel

Another important process in internal control is to recruit or retain competent personnel.

This will increase the confidence of the auditor in auditing the financial statements as he can see

the reliability of the personnel. Moreover, by retaining the employees the organisation can

increase the scope of comparability of financial statements from year to year.

iii)

Segregation of duties

Segregation of duties is critical to avoid frauds and falsification of data. An effective

system of internal control makes sure that the work is segregated and given to different personnel

which in turn increase the effectiveness.

iv)

Records Maintenance

The organisation should make sure that all the records are maintained and recorded in a

systematic manner. This in turn will ensure that the data wont be recorded again. Record

management includes recording, safeguarding and deleting tangible records.

v)

Safequards

This is a form of security over the companys valuables. Safeguarding the companies

valuables avoid unauthorized personnel from accessing the data of the company. This in turn can

avoid theft of personal information of the company.

8 | Page

2. Auditor Independence

SAS No. 1, section 220 states that To be independent, the auditor must be intellectually

honest: to be recognized as independent, he must be free from any obligation to or interest in the

client, its management, or its owners. Additionally, Independent auditors should not only be

independent in fact: they should avoid situations that may lead outsiders to doubt their

independence.

In simple words, the main objective of audit independence is to serve the audit. It helps

the auditor to serve the objectives and purpose of the audit. According to Financial times, Audit

independence refers to the independace of the auditors from the people that are related to the

business who have financial interest in the business which are being audited. The purpose of an

auditor is to show in writings the credibility of the firms financial statements. In this process, the

auditor has to present a true and fair view of the financial statement from an independent source

in accordance with the accounting standards.

2.1 Types of auditor independence

Muatz & Sharaf (1961), who are among the experts on the study of auditor independence,

have developed their own concept of understanding auditor independence with two components.

They are

i)

ii)

Practitioner-independence

Professional independence

Practitioner independence, also known as independence in fact refers to the independence

of the auditors towards the firm in terms of professional integrity.

9 | Page

On the other hand, Profession-independence, also known as independence in appearance

is the independence of auditors to the public as a professional group.

Examples of audit independence

AU section 220 of the American Institute of Certified Public Accountants (AICPA) states

that for auditor independence the auditor "must be without bias with respect to the client since

otherwise he [or she] would lack that impartiality necessary for the dependability of his [or her]

findings, however excellent his [or her] technical proficiency may be." The International

Federation of Accountants (IFAC) gives a system of standards that individuals from auditing

groups ought to distinguish the threats to independence, assess the importance of those threats,

and recognize and apply security to remove the threats or lessen them to an adequate level, such

that the independence of fact and independence in appearance are not compromised. There may

occur situations where security to auditor independence is scarce. In such situations, the

activities or the interest which causes the threat should be eliminated.

The SEC, PCAOB and AICPA are the bodies which govern the auditor independence in

the US. On account of Enron fall in 2001, there was a violation of Auditor independence and

Arthur and Anderson fell alongside its customer. This caused in reducing the big five audit firms

to four, which is now known as 'the big four'.

2.2 Audit quality

Audit quality can be defined as the likelihood that an auditor will find all the errors and

ommissions in the financial report and truthfully report it in his audit report (DeAngelo, 1981).

Audit quality can be defined in many ways. Few of the definitions given by several authors are

given below.

An auditor will find all the errors and ommissions in the financial report and truthfully

report it in his audit report (DeAngelo, 1981).

Probability that an unqualified report will not be issued by an auditor in which there are

material errors (Lee et al., 1999)

Accuracy in the data reporting by the auditors (Davidson and Neu, 1993)

10 | P a g e

Measure of the auditor's capacity to improve meticulously in accounting data by

reducing noise and bias (Wallace, 1980).

The audit administration is the procurement of free check of the credibility of financial

statements to clients. So as to guarantee that the audit improves the credibility of the same, it

must be of a sufficient audit quality (Sucher et al., 1998) and, thus, audit credibility (Gaynor,

2000). The users of financial statement will change appraisals of audit quality in light of new

publicly accessible data about an auditor (Dopuch and Simunic, 1982). New data, for example,

audit independence as auditor's moral conduct, lower perceived auditor independence, may be

lower perceived financial statement dependability and, therefore, the apparent quality of audit

administrations provided (Palmrose, 1988). Increase in the audit fees show that the cost incurred

for audit is higher and this should reflect to the audit quality. Therefore, the auditors should build

their reputations in order to get higher fees (Moizer, 1997).

2.3. Audit firm rotation

Experts argue and debates that mandatory rotation of audit firm can improve the auditor

independence. The argument further explains that if the auditor has no contract with the company

for a forseable future, it is unlikely to have a relation with the client personnel (Icaew.com,

2015). Additionally, since the auditors know that they are going to be replaced in the near future,

they will produce quality audit reports to avoid having shortcomings revealed by the following

audit team.

There is a mixure of empirical evidence. Most of the researches suggest that when firms

rotate the auditors, the audit quality tends to reduce. That is, audit quality reduces when the audit

tenure is less (American Accounting Association, 2015). In order to conduct a successful audit,

the auditor has to be familiar with the financial statements. Moreover, it is costly to obtain the

client-specific knowledge required to conduct an audit with quality.

Research also suggest that rotation and audit quality will have more effect on small audit

firms, but the tenure of five years is too small to even make any impact. The relationship

between audit quality and audit partner tenure is more of hyperbolic kind of relation. Even

though the audit quality might be reduced at the time of rotation, it will gradually improve over

11 | P a g e

several years. But keeping the same audit partner for a long time will lead to decline in quality

again. This was found in the research done by experts from Australia, when the mandatory audit

partner rotation was introduced by the CLERP 9 legislation in the year 2004 (American

Accounting Association, 2015).

3. Threats to auditor independence

Auditor independence is not a black and white issue. There are cases every year in which

the auditors have failed to meet the required objective, despite the fact that they have signed

declaring independence. Amir Ghandar, audit and assurance policy advisor at CPA Australia said

that The second most common issue in terms of auditing standard breaches that we identify in

our quality review program is independence breaches related to SMSFs,. SMSF stands for selfmanaged super fund (Intheblack.com, 2015).

According to Ghandar, there are six threats to SMSF auditor independence.

i)

ii)

iii)

iv)

v)

vi)

Self-review threat

Self-interest threat

Multiple referrals threat

Ex-staff and partners threat

Advising threat

Relationships threat

3.1 Self-review threat

This threat occurs when the auditors prepare the accounting for the fund. According to

Ghandar this threat is seen mostly in the breach of independence. In large firms, this threat can

be eliminated by delegating the accounting and auditing works to two distinguished parties.

However this is not possible in short firms as the staffs and partners are close to each other.

Moreover it is impossible for a sole practitioner to gain independence.

3.2 Self-interest threat

This threat occurs when an auditor is having only one client and that client represents the

business by a great margin. Ghandar mentioned about this threat as "Their independence is

12 | P a g e

threatened because they'll be less likely to want to issue a qualified audit opinion or something

that will cause an issue for the client because they're worried about losing the client."

3.3 Multiple referrals threat

This threat occurs when number of referrals is received by the auditor from one client.

This threat can be also related as self-interest threat. Ghandar says "Issuing a qualified report

could impact on that referral relationship and in turn impact on their business."

3.4 Ex-staff and partners threat

This threat occurs when a staff or partner leaves the firm to open their own business and

later audits their former firm. Just because they have different titles doesnt mean they are

independent. Several criterions should also be noted like the familiarity between the people in

the audit and accounting firms.

3.5 Advising threat

This threat happens when the auditor is the same person who give financial advice to the

firm. It is very difficult to meet independence when the auditor is the person giving financial

advices.

3.6 Relationships threat

This threat covers al the factors which shows any relationship between the auditor and

SMSF on a personal level. Ghandar says "If you have a close family or business relationship

with a trustee or member of the SMSF, you can't achieve independence in auditing that SMSF."

Recommendations to overcome the above threats

If any of the above threats happens, it is not necessary to stop the audit, rather the auditor

can have safeguards. Safeguards can be used to remove these threats and further the safeguards

used must be mentioned in the audit report. It should also be noted that when addressing threats,

more threats can arise and each threats should be addressed accordingly.

13 | P a g e

Ghandar emphasize that used of framework provided in APES 110 Code of Ethics for

professional Accountants, should be used to identify and eliminate the threats. These are:

i)

ii)

iii)

Identify the threat

Evaluate the significance of the threat

Consider safequards to address the threats

To address the threats, auditors can use safeguards (Intheblack.com, 2015). An external

reviewer can be appointed in order to prevent multiple referrals threat. And in the case of Exstaff and partner threat also, this can be a remedy. Ghandar proposes that "It can be a real

positive because they will know the business and have a good working relationship, but it is also

making sure that independence has been fully considered and that the appropriate safeguards are

in place,"

Every situation cannot be dealt the same way. Therefore every situation should be studied

well and the auditors are to determine whether the safequards are significant for the situation.

14 | P a g e

References

References

Aboutus.org, (2015). Human Resource Software. [online] Available at:

http://www.aboutus.org/Human_Resource_Software [Accessed 16 Apr. 2015].

American Accounting Association, (2015). Audit Partner Tenure and Cost of Equity Capital.

[online] Available at: http://aaajournals.org/doi/abs/10.2308/ajpt-50308 [Accessed 16 Apr.

2015].

American Accounting Association, (2015). Exploring the Term of the AuditorClient

Relationship and the Quality of Earnings: A Case for Mandatory Auditor Rotation?.

[online] Available at: http://aaajournals.org/doi/abs/10.2308/accr.2003.78.3.779 [Accessed

16 Apr. 2015].

Anon, (2015). [online] Available at: http://raw.rutgers.edu/docs/Elliott/06Audit%20independence

%20concepts.pdf [Accessed 16 Apr. 2015].

Anon, (2015). [online] Available at:

http://pcaobus.org/rules/rulemaking/docket037/release_2011-006.pdf [Accessed 16 Apr.

2015].

Freepatentsonline.com, (2015). Audit independence, quality, and credibility: effectson reputation

and sustainable success of CPAs inThailand.. [online] Available at:

http://www.freepatentsonline.com/article/International-Journal-BusinessResearch/208535065.html [Accessed 16 Apr. 2015].

Icaew.com, (2015). ICAEW's review of 6/2002 on Mandatory rotation of audit firms. [online]

Available at: http://www.icaew.com/~/media/Files/Library/collections/ICAEW

%20archive/mandatory-rotation-of-audit-firms-review-of-current-requirements-researchand-publications [Accessed 16 Apr. 2015].

15 | P a g e

Independence, T. (2015). Threats to Auditor Independence. [online] Academia.edu. Available at:

http://www.academia.edu/260449/Threats_to_Auditor_Independence [Accessed 16 Apr.

2015].

Intheblack.com, (2015). 6 key threats to auditor independence. [online] Available at:

http://intheblack.com/articles/2015/01/06/6-key-threats-to-auditor-independence [Accessed

16 Apr. 2015].

Lexicon.ft.com, (2015). Auditor Independence Definition from Financial Times Lexicon. [online]

Available at: http://lexicon.ft.com/Term?term=auditor-independence [Accessed 16 Apr.

2015].

Small Business - Chron.com, (2015). Five Common Features of an Internal Control System of

Business. [online] Available at: http://smallbusiness.chron.com/five-common-featuresinternal-control-system-business-430.html [Accessed 16 Apr. 2015].

Thepeopleindairy.org.au, (2015). Introduction to Recruitment. [online] Available at:

http://www.thepeopleindairy.org.au/recruitment/introduction.htm [Accessed 16 Apr. 2015].

Yale.edu, (2015). Segregation of Duties: Balancing Risks & Controls: Auditing. [online]

Available at: http://www.yale.edu/auditing/balancing/segregation_duties.html [Accessed 16

Apr. 2015].

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- HR Staffing ProposalDocumento11 páginasHR Staffing ProposalPavan KumarAinda não há avaliações

- Final Project On Stock MarketDocumento329 páginasFinal Project On Stock MarketAllan07563% (27)

- The Supply Chain Management Concept 1aDocumento20 páginasThe Supply Chain Management Concept 1aMRK466100% (1)

- Summer Internship Project ReportDocumento32 páginasSummer Internship Project ReportAbhilasha Singh33% (3)

- 4PS and 4esDocumento32 páginas4PS and 4esLalajom HarveyAinda não há avaliações

- Integrated Auditing of ERP Systems (PDFDrive)Documento289 páginasIntegrated Auditing of ERP Systems (PDFDrive)Chaima LejriAinda não há avaliações

- Case Study of RecruitmentDocumento2 páginasCase Study of RecruitmentJuliana Chancafe IncioAinda não há avaliações

- Section 2 Theories Chapter 20Documento53 páginasSection 2 Theories Chapter 20Sadile May KayeAinda não há avaliações

- Electives Term 5&6Documento28 páginasElectives Term 5&6GaneshRathodAinda não há avaliações

- Kotler Mm15e Inppt 10Documento20 páginasKotler Mm15e Inppt 10Wildan BagusAinda não há avaliações

- Introduction To Banking: Basics, Savings, Current, CCOD, Remittance, CashDocumento54 páginasIntroduction To Banking: Basics, Savings, Current, CCOD, Remittance, CashcutesunyAinda não há avaliações

- PPT, Final Report, Kshitij Negi, C-41Documento12 páginasPPT, Final Report, Kshitij Negi, C-41Kshitij NegiAinda não há avaliações

- Case 2 9 Coping With Piracy in ChinaDocumento3 páginasCase 2 9 Coping With Piracy in ChinaChin Kit YeeAinda não há avaliações

- Fintech and The Transformation of The Financial IndustryDocumento9 páginasFintech and The Transformation of The Financial Industryrealgirl14Ainda não há avaliações

- Assignment 2 - Termination of EmploymentDocumento5 páginasAssignment 2 - Termination of EmploymentAraceli Gloria-FranciscoAinda não há avaliações

- PJMT Dismas Assignment 3Documento10 páginasPJMT Dismas Assignment 3Tony Joseph100% (1)

- Quality Function of The Deployment NewDocumento22 páginasQuality Function of The Deployment NewMuhammad IrfanAinda não há avaliações

- Subject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Documento4 páginasSubject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Rimpa SenapatiAinda não há avaliações

- Taxation 2nd PreboardDocumento17 páginasTaxation 2nd PreboardJaneAinda não há avaliações

- Coa M2015-007Documento12 páginasCoa M2015-007Abraham Junio80% (5)

- Working Capital Ultra Tech CementDocumento91 páginasWorking Capital Ultra Tech CementGnaneswari GvlAinda não há avaliações

- Buying AlliancesDocumento4 páginasBuying AlliancesZubair AhmadAinda não há avaliações

- Marketing Strategy of NestléDocumento27 páginasMarketing Strategy of Nestléshami00992Ainda não há avaliações

- TC2014 15 NirdDocumento124 páginasTC2014 15 Nirdssvs1234Ainda não há avaliações

- Business EthicsDocumento29 páginasBusiness Ethicslalith kumarAinda não há avaliações

- h8 Cirr h1 2021Documento2 páginash8 Cirr h1 2021Fadhlur RahmanAinda não há avaliações

- Risk Management PolicyDocumento2 páginasRisk Management PolicyAkhilesh MehtaAinda não há avaliações

- Eaas Executive SummaryDocumento15 páginasEaas Executive SummarystarchitectAinda não há avaliações

- Introduction To LocoNavDocumento29 páginasIntroduction To LocoNavShivansh AgarwalAinda não há avaliações

- Building The Resilience of Small Coastal BusinessesDocumento60 páginasBuilding The Resilience of Small Coastal BusinessesMona PorterAinda não há avaliações