Escolar Documentos

Profissional Documentos

Cultura Documentos

Installment Sales Exercises

Enviado por

Marlon A. RodriguezDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Installment Sales Exercises

Enviado por

Marlon A. RodriguezDireitos autorais:

Formatos disponíveis

Advanced Accounting 1

Alfred D. Abao, CPA

Gordon College

Installment Sales

Frederick

Exercises

Problem 1

On October 31, 2007, R Company sold for P1,406,250 property that had cost of P1,125,000. R Company

received a P375,000 down, the balance is payable in monthly installments, with the first payment due at

the end of November. R Company decides to report the profit on the sale on the installment basis. Assume

the monthly payments are sums consisting of P11,250 with a portion of each payment representing

interest of 12% on the outstanding balance of the principal and the remainder representing a reduction in

the aforementioned balance.

How much is the realized gross profit for 2007?

Problem 2

B Company started its operation in January 1, 2007. During the year, it had cash sales of P6,875,000 and

installment sales of P16,500,000. B Company imposes a mark up on cost of 25% for cash sales and 50%

for installment sales. During 2007, installment receivable balance amounted to P6,600,000. How much is

the realized gross profit for 2007?

Problem 3

Presented below is the unadjusted trial balance of Pinky Corporation at December 31, 2010:

Debit

Credit

Cash

P 5,000

Installment accounts receivable, 2009

40,000

Installment accounts receivable, 2010

140,000

Inventory, 12/31/2010

200,000

Other assets

497,000

Accounts payable trade

50,000

Unrealized gross profit 2008

10,000

Unrealized gross profit 2009

86,000

Unrealized gross profit 2010

100,000

Capital stock

600,000

Retained earnings

80,000

Gain on repossession

6,000

Operating expenses

50,000

Total

P932,000

P932,000

Cost of goods sold had been uniform over the years at 60% of sales.

Pinky adopts perpetual inventory procedures. On installment sales, the corporation charges installment

accounts receivable and credits inventory gross profit accounts.

Repossessions of merchandise have been made during 2010 due to some customers failure to pay

maturing installments. Analyses of these transactions were summarized as follows:

Inventory

Unrealized gross profit, 2008

Unrealized gross profit, 2009

Installment accounts receivable 2008

Installment accounts receivable 2009

Gain on repossession

7,500

800

2,400

2,700

2,000

6,000

The repossessed merchandise was unsold at December 31, 2010. It was ascertained that they were

booked upon repossession at original costs. A fair valuation of these items would be a sale price of the

repossessed merchandise at P10,000 after incurring costs of reconditioning of P5,000 and cost to dispose

them in the market value at P500.

Required:

A. Realized gross profit on 2010 sale

B. Gain/loss on repossession

Você também pode gostar

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Assignment Fin AccDocumento4 páginasAssignment Fin AccShaira SalandaAinda não há avaliações

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityAinda não há avaliações

- Chapter One Accounting Principles and Professional PracticeDocumento22 páginasChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- Chapter-Six Accounting For General, Special Revenue and Capital Project FundsDocumento31 páginasChapter-Six Accounting For General, Special Revenue and Capital Project FundsMany Girma100% (1)

- Chapter 1 Advanced Acctg. SolmanDocumento20 páginasChapter 1 Advanced Acctg. SolmanLaraAinda não há avaliações

- Ias 16 Property Plant Equipment v1 080713Documento7 páginasIas 16 Property Plant Equipment v1 080713Phebieon MukwenhaAinda não há avaliações

- Liquidity Ratios - Practice QuestionsDocumento14 páginasLiquidity Ratios - Practice QuestionsOsama SaleemAinda não há avaliações

- Accounts Receivable and Inventory ManagementDocumento16 páginasAccounts Receivable and Inventory ManagementAbbyRefuerzoBalingitAinda não há avaliações

- Advanced FA I - Chapter 02, BranchesDocumento137 páginasAdvanced FA I - Chapter 02, BranchesUtban AshabAinda não há avaliações

- Operating Budget DiscussionDocumento3 páginasOperating Budget DiscussionDavin DavinAinda não há avaliações

- Chapter-7 Installment Sales PDFDocumento29 páginasChapter-7 Installment Sales PDFrgnrgy100% (2)

- Installment Sales Tutee ExamDocumento8 páginasInstallment Sales Tutee ExamBuday Lavilla ReyesAinda não há avaliações

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocumento4 páginasBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Fair ValueDocumento8 páginasFair Valueiceman2167Ainda não há avaliações

- Source Document of AccountancyDocumento7 páginasSource Document of AccountancyVinod GandhiAinda não há avaliações

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDocumento30 páginasCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanAinda não há avaliações

- Cost Volume Profit Analysis Review NotesDocumento17 páginasCost Volume Profit Analysis Review NotesAlexis Kaye DayagAinda não há avaliações

- Quiz Budgeting and Standard CostingDocumento2 páginasQuiz Budgeting and Standard CostingAli SwizzleAinda não há avaliações

- Terrific Temps Fills Temporary Employment Positions For Local Businesses SomeDocumento2 páginasTerrific Temps Fills Temporary Employment Positions For Local Businesses SomeAmit PandeyAinda não há avaliações

- Budgeting Quizer - MASDocumento5 páginasBudgeting Quizer - MASPrincess Joy VillaAinda não há avaliações

- F8 Workbook Questions & Solutions 1.1 PDFDocumento188 páginasF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterAinda não há avaliações

- Cdee Worksheet #3Documento4 páginasCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- TOPIC 6 - Responsibility AccountingDocumento1 páginaTOPIC 6 - Responsibility AccountingAnthony OtiatoAinda não há avaliações

- Management Accounting Chapter 1Documento4 páginasManagement Accounting Chapter 1Ieda ShaharAinda não há avaliações

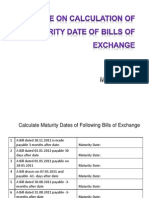

- Calculation of Maturity DateDocumento4 páginasCalculation of Maturity Dateyogeshdhuri22Ainda não há avaliações

- Chapters 11 and 12 EditedDocumento13 páginasChapters 11 and 12 Editedomar_geryesAinda não há avaliações

- 2-Quiz Chapter 9 Foreign Currency TransactionDocumento2 páginas2-Quiz Chapter 9 Foreign Currency Transactionnoproblem 5555Ainda não há avaliações

- Chapter 1 Intro To AccoutingDocumento32 páginasChapter 1 Intro To Accoutingprincekelvin09Ainda não há avaliações

- Intermediate Accounting Chapter 12Documento64 páginasIntermediate Accounting Chapter 12Kevin DenAinda não há avaliações

- The Balanced Scorecard: A Tool To Implement StrategyDocumento39 páginasThe Balanced Scorecard: A Tool To Implement StrategyAilene QuintoAinda não há avaliações

- Standard Unmodified Auditor ReportDocumento3 páginasStandard Unmodified Auditor ReportRiz WanAinda não há avaliações

- Chapter 4 SolutionsDocumento85 páginasChapter 4 SolutionssevtenAinda não há avaliações

- SolDocumento3 páginasSolilovevietnam007Ainda não há avaliações

- Multiple Choice QuestionsDocumento8 páginasMultiple Choice QuestionsPrashant Sagar Gautam100% (1)

- 109Documento34 páginas109danara1991Ainda não há avaliações

- ch04.ppt - Income Statement and Related InformationDocumento68 páginasch04.ppt - Income Statement and Related InformationAmir ContrerasAinda não há avaliações

- Answer Guidance For c6Documento13 páginasAnswer Guidance For c6thicknhinmaykhoc100% (1)

- Cost AccountingDocumento14 páginasCost AccountingAdv Kamran Liaqat50% (2)

- Chapter Three CVP AnalysisDocumento65 páginasChapter Three CVP AnalysisBettyAinda não há avaliações

- Ias 12Documento33 páginasIas 12samrawithagos2002Ainda não há avaliações

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Documento7 páginasFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesAinda não há avaliações

- Audit of PPEDocumento6 páginasAudit of PPEJuvy DimaanoAinda não há avaliações

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Documento10 páginasACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- Ap 06 REO Receivables - PDF 074431Documento19 páginasAp 06 REO Receivables - PDF 074431Christian100% (1)

- Conceptual FrameworksDocumento17 páginasConceptual FrameworksShah KamalAinda não há avaliações

- E-14 AfrDocumento5 páginasE-14 AfrInternational Iqbal ForumAinda não há avaliações

- ACC16 - HO 2 Installment Sales 11172014Documento7 páginasACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- Installment Sales. HO1Documento6 páginasInstallment Sales. HO1Apolinar Alvarez Jr.Ainda não há avaliações

- Practical Accounting 1Documento14 páginasPractical Accounting 1Anonymous Lih1laaxAinda não há avaliações

- Review Session 6 TEXTDocumento6 páginasReview Session 6 TEXTAliBerradaAinda não há avaliações

- Local Media3172437425380563588Documento20 páginasLocal Media3172437425380563588Candy SchrendiAinda não há avaliações

- Final Examination AK (60 COPIES)Documento9 páginasFinal Examination AK (60 COPIES)Sittie Ainna A. UnteAinda não há avaliações

- P2Documento20 páginasP2Jemson YandugAinda não há avaliações

- Practical Accounting 1-MockboardzDocumento9 páginasPractical Accounting 1-MockboardzMoira C. Vilog100% (1)

- 5rd Batch - P1 - Final Pre-Boards - EditedDocumento11 páginas5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- P1-02 Loans and ReceivablesDocumento5 páginasP1-02 Loans and ReceivablesRachel LeachonAinda não há avaliações

- AttDocumento8 páginasAttKath LeynesAinda não há avaliações

- Revenue RecognitionDocumento6 páginasRevenue RecognitionnaserAinda não há avaliações

- Chapter 7 Advance Accounting Volume 1 2008Documento15 páginasChapter 7 Advance Accounting Volume 1 2008andrewhomil_17199886% (7)

- Rebuilt - chapTER 08Documento6 páginasRebuilt - chapTER 08Marlon A. RodriguezAinda não há avaliações

- 73594792314-Chapter 09Documento16 páginas73594792314-Chapter 09Marlon A. RodriguezAinda não há avaliações

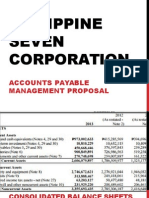

- Philippine Seven Corporation: Accounts Payable Management ProposalDocumento10 páginasPhilippine Seven Corporation: Accounts Payable Management ProposalMarlon A. RodriguezAinda não há avaliações

- Ok Lang AkoDocumento7 páginasOk Lang AkoMarlon A. RodriguezAinda não há avaliações

- Accounts Payable Management Proposal Philippine Seven CorporationDocumento5 páginasAccounts Payable Management Proposal Philippine Seven CorporationMarlon A. RodriguezAinda não há avaliações

- Time Value of MoneyDocumento7 páginasTime Value of MoneyMarlon A. RodriguezAinda não há avaliações

- Leverage Leverage Refers To The Effects That Fixed Costs Have On The Returns That Shareholders Earn. by "Fixed Costs" WeDocumento8 páginasLeverage Leverage Refers To The Effects That Fixed Costs Have On The Returns That Shareholders Earn. by "Fixed Costs" WeMarlon A. RodriguezAinda não há avaliações

- Interest Rates and BondsDocumento7 páginasInterest Rates and BondsMarlon A. RodriguezAinda não há avaliações

- Payout Policy Elements of Payout PolicyDocumento6 páginasPayout Policy Elements of Payout PolicyMarlon A. RodriguezAinda não há avaliações

- Chapter 16 - AnswerDocumento14 páginasChapter 16 - AnswerMarlon A. RodriguezAinda não há avaliações

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!No EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Nota: 4.5 de 5 estrelas4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNo EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNota: 4.5 de 5 estrelas4.5/5 (760)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsAinda não há avaliações

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNo EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNota: 5 de 5 estrelas5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNo EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNota: 5 de 5 estrelas5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNo EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNota: 4.5 de 5 estrelas4.5/5 (14)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessNo EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessNota: 4.5 de 5 estrelas4.5/5 (28)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceNo EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceNota: 4 de 5 estrelas4/5 (1)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!No EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Nota: 4.5 de 5 estrelas4.5/5 (8)

- Project Control Methods and Best Practices: Achieving Project SuccessNo EverandProject Control Methods and Best Practices: Achieving Project SuccessAinda não há avaliações

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyAinda não há avaliações

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessAinda não há avaliações

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsNo EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsNota: 4.5 de 5 estrelas4.5/5 (2)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookNo EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookAinda não há avaliações