Escolar Documentos

Profissional Documentos

Cultura Documentos

Impulse-Response Functions Analysis: An Application To The Exchange Rate Pass-Through in Mexico

Enviado por

mm1979Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Impulse-Response Functions Analysis: An Application To The Exchange Rate Pass-Through in Mexico

Enviado por

mm1979Direitos autorais:

Formatos disponíveis

Impulse-Response Functions

Analysis: An application to the

Exchange Rate Pass-Through in

Mexico

Sylvia Beatriz Guillermo Peon

Facultad de Economia. Benemerita Universidad Autonoma de Puebla

Martin Alberto Rodriguez Brindis

Escuela de Economia y Negocios Universidad Anahuac Campus Oaxaca

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

Outline

Exchange Rate Pass-Through Definition

Time Series Frameworks and Estimation strategies for

Impulse-Response Functions

SVAR model Estimation

VEC model Estimation using Stata VEC command

VEC model Estimation using a Two-Stage Procedure

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

Definition

The Exchange Rate Pass-Through (ERPT) can be

understood as the degree to which exchange rate

changes are passed on into domestic prices along the

distribution chain.

Exchange rate shocks may affect prices at different

stages both directly as well as indirectly.

The conventional transmission mechanism of the

exchange rate works in two stages:

Stage 1: the exchange rate changes have a direct effect on

import prices

Stage 2: the mechanism works through its impact on producer

prices and consumer prices

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

Two Estimation Approaches for

IRFs

Our work presents an analysis of the ERPT mechanism for the

Mexican economy after the formal adoption of inflation targeting

(Jan 2001), using impulse-response functions (IRFs) as a tool to

estimate the degree and timing of the effect of exchange rate

depreciation changes on domestic prices

The analysis is carried out using two time series frameworks.

Recursive SVAR model: unlike the traditional VAR model, allows us to

impose restrictions on the contemporaneous and lagged matrices of

coefficients in order to improve estimation results.

VEC model: considers the possibility of valid cointegrating relationships

among the variables and allows us to incorporate the deviations from the

long run equilibrium) as explanatory variables when modeling the short run

behavior of the variables.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

Data Set

We use monthly observations of the following variables:

Oil price index (oilp)

Global Indicator of Economic Activity for Mexico (igae)

Nominal Exchange Rate Pesos/ USD (ex_rate)

Import price Index (impi)

Producer price Index (ppi)

Consumer price Index (cpi)

Nominal Interest Rate (i_rate)

Sources: IFS, INEGI and Banxico

Period of Analysis: 2001m1 to 2013m2

All series are I (1) except the Interest Rate, which is I (0): used ADFT

All series are expressed in natural logs except the Interest Rate

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model

Given that we have monthly observations, we use the twelveseasonal difference (or difference of order twelve) of each I(1)

variable; that is, for the k-th I (1) variable in the system (Stata Seasonal

Difference Operator S12.y):

The structural form model can be expressed as:

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model

Normalization restrictions together with a Wold causal ordering (recursive

structure), provide the K(K+1)/2 necessary restrictions to uniquely identify the

structural shocks and impulse-responses (Just-identified SVAR). Thus, we can

define A as a lower triangular matrix:

This set of restrictions also ensure just-identified IRFs which are qualitatively

the same as the orthogonalized IRFs based on a Cholesky decomposition of

the variance-covariance matrix of the reduced form VAR disturbances.

However, we use an SVAR model in our study (Stata SVAR command)

because it allows us to place some additional short run constraints in

addition to the traditional recursive structure to help us improve the

estimation of the structural impulse-response functions (IRFs). In other words,

we estimate an overidentified SVAR model to analyze the structural IRFs.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model

The lag order of the model is 2 and it was chosen according to Akaike

Information Criterion (AIC) and Final Prediction Error (FPE) criterion (Ltkepohl

(2005, pp 152)

In small samples, AIC and FPE may have better properties (choose the correct order

more often).

Models based on these criteria may produce superior forecasts, because AIC and FPE

are designed for minimizing the forecast error variance, in small as well as large samples.

Before placing any constraints (on matrix A and/or on the underlying VAR), we

tested for residual autocorrelation using LM test (Stata command: varlmar)

Note: when used after SVAR with constraints

valmar shows only zeros and ones for the

chi2-statistic and p-values respectively

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model

Restrictions on the underlying VAR parameters

The aim of this estimation stage is to specify an underlying VAR model containing

all necessary right-hand side variables and as parsimonious as possible; a model

which could also help us to improve the accuracy of the implied impulseresponses

We used sequential elimination of regressors procedure suggested in Brggemann et al

(2003) and Ltkepohl (2005).

The procedure involves testing zero restrictions on individual coefficients (to eliminate lags of

variables of the underlying VAR) in each of the seven equations.

At each step of the procedure a single regressor was sequentially eliminated in one equation

if its corresponding P-value was higher than 0.1

66 insignificant regressor were eliminated in the model.

Checking Model Stability

Note: varstable command may not be used after fitting

An overidentified SVAR model.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model

Over identifying restrictions on the matrix of contemporaneous effects A

were determined following a procedure similar to the sequential

elimination of regressors.These additional zero restrictions correspond

to setting

Note: Using stata SVAR, this implies a definition of matrix A in the following way:

matrix A = (1,0,0,0,0,0,0\0,1,0,0,0,0,0\.,0,1,0,0,0,0\.,0,.,1,0,0,0\.,0,.,.,1,0,0\.,.,.,.,.,1,0\.,0,.,0,0,.,1)

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model: Results

Responses to a one-percent Exchange Rate Depreciation Shock

svar2, dln_exrate, dln_cpi

svar2, dln_exrate, dln_exrate

svar2, dln_exrate, dln_impi

svar2, dln_exrate, dln_ppi

.04

.03

.02

.01

0

.04

.03

.02

.01

0

0

10 12 14 16

18 20 22 24

10

12 14 16 18 20

22 24

step

95% CI

structural irf

Graphs by irfname, impulse variable, and response variable

Note:

Stata does not compute cumulative Structural IRFs

Stata does not compute bootstrap standard errors for overidentified structural VAR models. However, the structural IRFs

and forecast-error variance decompositions were estimated using the small-sample correction for the maximum likelihood

estimator of the underlying VAR disturbances variance-covariance matrix (see Stata Time-Series Reference Manual).

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model: Results

Cumulative Responses to a one-percent change in Exchange Rate depreciation

Note:

Stata does not compute cumulative Structural IRFs

Because structural shocks are standardized to one-percent shock, the vertical axis in the figures indicates the

estimated percentage point change in the respective response variable due to a one-percent shock, after s periods.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

SVAR Model : Results

Cumulative Pass-Through Elasticity

The CPTE at period s is the ratio of the cumulative response of the

corresponding price index inflation to the cumulative response of the

exchange rate depreciation, both evaluated s periods after the exchange rate

Pass-through degree to import prices is the highest

shock (Capistrn, et al 2011).

and it occurs immediately, with an impact elasticity

(at s = 0) very close to one. It remains quite high

(0.903), implying an almost complete ERPT at this

stage of the distribution chain.

The impact effect of the pass-through on producer

prices is about 0.11 which increases to 0.17 after

nine months and decreases thereafter. By month 18

after the shock, 13.3 percent of the exchange rate

depreciation is passed on into producer prices and it

stays the same afterwards.

The CPTE of consumer prices is zero on impact

and one month after the exchange rate shock. It

barely increases to 0.026 after four months and

because inflation responses to the exchange rate

depreciation are zero thereafter, the elasticity of

consumer prices ends up being 0.015 implying that

only 1.5 percent of the exchange rate depreciation

is passed on into consumer prices.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model

The VEC approach uses the Cholesky decomposition of the residual variance

covariance matrix by imposing some necessary restrictions so that causal

interpretation of the simple IRFs is possible. If cointegration exists, estimation

of the IRFs provides a tool to identify when the effect of a shock to the

exchange rate is transitory and when it is permanent.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model

Exploring graphically some possible cointegrating relations

Starting the estimation process by selecting the lag-order

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model

vecrank stata command to determine the number of cointegrating

equations

. vecrank oilp igae_s ex_rate impi ppi cpi i_rate if time>=tm(2001m7), trend(rtrend) lags(2)

Johansen tests for cointegration

Trend: rtrend

Number of obs =

Sample: 2001m7 - 2013m2

Lags =

maximum

rank

0

1

2

3

4

5

6

7

parms

56

70

82

92

100

106

110

112

LL

3380.4367

3412.624

3439.3949

3456.5343

3467.6735

3475.1093

3480.1689

3481.7194

eigenvalue

.

0.36860

0.31781

0.21718

0.14712

0.10078

0.06973

0.02191

140

2

5%

trace

critical

statistic

value

202.5653

146.76

138.1909

114.90

84.6490*

87.31

50.3702

62.99

28.0919

42.44

13.2201

25.32

3.1009

12.25

Case 2: No linear trends

in the differenced data

(trends in levels are linear

but NOT quadratic)

and linear trend in

cointegrating equations

(cointegrating equations

are trend stationary)

. vecrank oilp igae_s ex_rate impi ppi cpi i_rate if time>=tm(2001m7), trend(rconstant)

Johansen tests for cointegration

Trend: rconstant

Number of obs =

Sample: 2001m7 - 2013m2

Lags =

maximum

rank

0

1

2

3

4

5

6

7

parms

49

63

75

85

93

99

103

105

LL

3353.3722

3391.2838

3417.5048

3432.6352

3443.8631

3450.78

3455.2083

3458.161

eigenvalue

.

0.41818

0.31243

0.19438

0.14820

0.09409

0.06130

0.04130

5%

trace

critical

statistic

value

209.5776

131.70

133.7543

102.14

81.3124

76.07

51.0516*

53.12

28.5958

34.91

14.7619

19.96

5.9054

9.42

140

2

Case 4: NO linear trends

in the levels of the data

and cointegrating

equations stationary

around a constant mean.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model

Unrestricted Estimation (no contraints on alfa and beta) was carried out

with rtrend and rconstant

Stability and autocorrelation tests were also performed :

Model versions are stable: there are only K-r = 7-3 = 4 unit moduli and the remaining

are less than 1. However, the estimated model with no linear trend in the levels of the

variables, shows one additional moduli of 0.97, indicating that the rtrend model is

better.

Found evidence of autocorrelation for lag orders 1 and 2. So we included one more lag

in the estimation process.

. vecstable, graph

Eigenvalue stability condition

The VECM specification imposes 4 unit moduli.

1

.5

.2373584i

.2373584i

.4493658i

.4493658i

.4798507i

.4798507i

.5762072i

.5762072i

.1045511i

.1045511i

.1217736i

.1217736i

.1314984i

.1314984i

.2062843i

.2062843i

Roots of the companion matrix

. veclmar, mlag(6)

Imaginary

0

+

+

+

+

+

+

+

+

-

1

1

1

1

.885101

.885101

.883564

.883564

.631935

.631935

.580015

.580015

.431338

.431338

.352334

.352334

.297567

.297567

.226187

.226187

.129336

Lagrange-multiplier test

-.5

1

1

1

1

.8526805

.8526805

.7607602

.7607602

.4111996

.4111996

-.06635141

-.06635141

-.4184748

-.4184748

.330621

.330621

-.2669352

-.2669352

.0927761

.0927761

-.1293363

Modulus

-1

Eigenvalue

-1

-.5

0

Real

.5

The VECM specification imposes 4 unit moduli

lag

chi2

df

Prob > chi2

1

2

3

4

5

6

63.6236

66.9149

51.7154

44.6348

50.2668

64.1920

49

49

49

49

49

49

0.07819

0.04529

0.36825

0.65057

0.42303

0.07139

H0: no autocorrelation at lag order

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model : Results

The estimated cointegrating equations are the following:

Identification:

beta is exactly identified

Johansen normalization restrictions imposed

_ce1

_ce2

_ce3

beta

Coef.

Std. Err.

P>|z|

[95% Conf. Interval]

ppi

cpi

ex_rate

impi

oilp

igae_s

i_rate

_trend

_cons

1

-1.11e-16

(omitted)

-.368181

.0071384

-.28302

-.2627054

-.0020348

-1.513062

.

.

.

.

.

.

.

.

.

.

.033584

.0118649

.0783093

.1516362

.000329

.

-10.96

0.60

-3.61

-1.73

-6.19

.

0.000

0.547

0.000

0.083

0.000

.

-.4340045

-.0161163

-.4365033

-.5599069

-.0026795

.

-.3023575

.0303931

-.1295367

.0344961

-.00139

.

ppi

cpi

ex_rate

impi

oilp

igae_s

i_rate

_trend

_cons

-5.55e-17

1

-1.73e-18

-.0688288

.0416488

.1169235

-.6321417

-.0040413

-4.748528

.

.

.

.022502

.0079497

.0524687

.1015992

.0002204

.

.

.

.

-3.06

5.24

2.23

-6.22

-18.34

.

.

.

.

0.002

0.000

0.026

0.000

0.000

.

.

.

.

-.1129318

.0260677

.0140866

-.8312726

-.0044733

.

.

.

.

-.0247257

.0572299

.2197603

-.4330109

-.0036093

.

ppi

cpi

ex_rate

impi

oilp

igae_s

i_rate

_trend

_cons

-4.44e-16

-1.78e-15

1

-1.559882

.7249673

-1.77411

-6.545463

-.0007387

10.26017

.

.

.

.2749397

.0971331

.641088

1.241388

.002693

.

.

.

.

-5.67

7.46

-2.77

-5.27

-0.27

.

.

.

.

0.000

0.000

0.006

0.000

0.784

.

.

.

.

-2.098754

.5345899

-3.03062

-8.978538

-.0060169

.

.

.

.

-1.02101

.9153446

-.5176008

-4.112388

.0045394

.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

Estimation with overidentifying restrictions on beta (cointegrating parameters)

and restrictions on alfa (adjustment parameters) was carried out. However,

STATA estimation results indicate that beta is underidentified.

We used Stata dforce option to get the beta and alfa parameter estimates

when they are not identified.

LM test for identifying restrictions report chi2( 8) = 12.26 Prob > chi2 = 0.140

so restrictions are valid.

Stability test shows that the restricted model is stable, and veclmar command

cannot be used in this case because it requires that the parameters in the

cointegrating equations be exactly identified or overidentified.

Orthogonal Impulse-functions are estimated for both unrestricted and restricted

models.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

* DEFINING CONSTRAINTS ON

* COINTEGRATING PARAMETERS

* bconstraints

constraint 10 [_ce1]ppi = 1

constraint 11 [_ce1]cpi = 0

constraint 12 [_ce1]ex_rate = 0

constraint 13 [_ce1]oilp = 0

constraint 20 [_ce2]ppi = 0

constraint 21 [_ce2]cpi = 1

constraint 22 [_ce2]ex_rate = 0

constraint 30 [_ce3]ppi = 0

constraint 31 [_ce3]cpi = 0

constraint 32 [_ce3]ex_rate = 1

* DEFINING CONSTRAINTS ON

* ADJUSTMENT PARAMETERS

* aconstraints

constraint 103 [D_ppi]L1._ce3 = 0

constraint 201 [D_cpi]L1._ce1 = 0

constraint 402 [D_impi]L1._ce3 = 0

constraint 501 [D_oilp]L1._ce1 = 0

constraint 502 [D_oilp]L1._ce2 = 0

constraint 701 [D_i_rate]L1._ce1 = 0

constraint 703 [D_i_rate]L1._ce2 = 0

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

Identification:

( 1)

( 2)

( 3)

( 4)

( 5)

( 6)

( 7)

( 8)

( 9)

(10)

_ce1

_ce2

_ce3

beta is underidentified

[_ce1]ppi = 1

[_ce1]cpi = 0

[_ce1]ex_rate = 0

[_ce1]oilp = 0

[_ce2]ppi = 0

[_ce2]cpi = 1

[_ce2]ex_rate = 0

[_ce3]ppi = 0

[_ce3]cpi = 0

[_ce3]ex_rate = 1

beta

Coef.

ppi

cpi

ex_rate

impi

oilp

igae_s

i_rate

_trend

_cons

1

(omitted)

(omitted)

-.3867741

(omitted)

-.2682843

-.1549083

-.001845

-1.467958

ppi

cpi

ex_rate

impi

oilp

igae_s

i_rate

_trend

_cons

(omitted)

1

(omitted)

-.170387

.1519226

-.176478

-1.68635

-.0045418

-3.336873

ppi

cpi

ex_rate

impi

oilp

igae_s

i_rate

_trend

_cons

(omitted)

(omitted)

1

-2.639899

2.044834

-5.076288

-19.66606

-.0080073

25.86042

Std. Err.

P>|z|

[95% Conf. Interval]

.0389851

-9.92

0.000

-.4631834

-.3103647

.0805167

.1461662

.000359

.

-3.33

-1.06

-5.14

.

0.001

0.289

0.000

.

-.4260942

-.4413887

-.0025487

.

-.1104743

.1315721

-.0011413

.

.0682048

.0174384

.1506555

.2842763

.0006493

.

-2.50

8.71

-1.17

-5.93

-6.99

.

0.012

0.000

0.241

0.000

0.000

.

-.3040659

.117744

-.4717573

-2.243521

-.0058145

.

-.036708

.1861012

.1188014

-1.129179

-.0032691

.

.

.8264322

.2336303

1.850847

3.516928

.0079241

.

.

-3.19

8.75

-2.74

-5.59

-1.01

.

.

0.001

0.000

0.006

0.000

0.312

.

.

-4.259676

1.586927

-8.703881

-26.55911

-.0235382

.

.

-1.020121

2.502741

-1.448694

-12.77301

.0075236

.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

VECM: Response to a unit shock on the Exchange Rate

Restricted Model: vec3_R_rtrend, ex_rate, ex_rate

Restricted Model: vec3_R_rtrend, ex_rate, impi

Unrestricted Model: vec3_rtrend, ex_rate, ex_rate

Unrestricted Model: vec3_rtrend, ex_rate, impi

.02

.015

.01

.005

0

.02

.015

.01

.005

0

0

10 12 14 16 18 20 22 24

10 12 14

16 18 20 22 24

step

Graphs by irfname, impulse variable, and response variable

Note: Stata does not compute Std. Errors for OIRFs estimated with VECM

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

VECM: Responses to a unit shock on the Exchange Rate

vec3_R_rtrend, ex_rate, cpi

Restricted Model: vec3_R_rtrend, ex_rate, ppi

Unrestricted Model: vec3_rtrend, ex_rate, cpi

Unrestricted Model: vec3_rtrend, ex_rate, ppi

.002

.001

-.001

.002

.001

-.001

0

10

12 14 16 18 20 22 24

step

Graphs by irfname, impulse variable, and response variable

Note: PPI Response is very sensitive to constraints

10 12 14 16 18 20

22 24

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

Some inconveniences found (for our particular study) when estimating the

model using Stata VEC command:

If the order of the variables is important (as in our model) there could be a conflict with

Johansen normalization restrictions used by Stata vec command. Keeping the recursive

(Wold causal) order imposed in the SVAR model (if possible) becomes very difficult

because it implies to place several restrictions on the beta coefficients which easily lead to

convergence NOT achieved when maximizing the log-likelihood function.

Stata PDF documentation files specify as technical note:

vec uses a switching algorithm developed by Boswijk (1995) to maximize the loglikelihood when constraints are placed on the parameters. The starting values

affect both

the ability of the algorithm to find a maximum and its speed in finding that maximum.

Specifying starting values for BETA is complicated.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Results

Some inconveniences found (for our particular study) when estimating the

model using Stata VEC command:

IRFs results are very sensitive to constraints on cointegrating parameters.

IRFs are now estimated based on shocks to the levels of the variables, so these IRFs are

not directly comparable with the ones obtained with the SVAR model. The analysis must

be different under the two approaches.

The variables in differences are the simple first differences (not the seasonal differences

that we used with the SVAR model). First differences represent (in our model) monthly

growth rates, and we used annual growth rates with the SVAR.

We cannot asses the statistical significance of the IRFs because standard errors are not

computed when using vec command.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Two Stage Procedure

As alternative estimation approach we use a two-stage procedure.

We also follow Stata Time Series Manual two-step estimation method

suggested when using veclmar command for VECM when the

parameters of the cointegrating vectors (beta) are exactly identified

or overidentified.

This method requires to have explored reasonable cointegrating

relations, and requires to perform the corresponding stationarity tests

to verify that each cointegrating relation is I(0).

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Two Stage Procedure

Advantages:

We keep Wold causal ordering of variables

Can impose constraints on contemporaneous and underlying VAR parameters

and on adjustment parameters in order to improve estimation precision .

Can estimate Structural IRFs with corresponding Std. Errors

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Two Stage Procedure: Results

Responses to a one-percent Exchange Rate Depreciation Shock

svar2, dln_exrate, dln_exrate

svar2, dln_exrate, dln_impi

svec2, dln_exrate, dln_exrate

svec2, dln_exrate, dln_impi

.04

.03

.02

.01

0

.04

.03

.02

.01

0

0

10 12 14 16

18 20 22 24

10

step

95% CI

Graphs by irfname, impulse variable, and response variable

structural irf

12 14 16 18 20

22 24

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Two Stage Procedure

Responses to a one-percent Exchange Rate Depreciation Shock

svar2, dln_exrate, dln_cpi

svar2, dln_exrate, dln_ppi

svec2, dln_exrate, dln_cpi

svec2, dln_exrate, dln_ppi

.008

.006

.004

.002

0

.008

.006

.004

.002

0

0

10

12 14 16 18

20 22 24

10 12 14

step

95% CI

Graphs by irfname, impulse variable, and response variable

structural irf

16 18

20 22

24

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

VEC Model: Two Stage Procedure

.98

.9

.05

.92

.1

.94

.15

.96

.2

.25

Cumulative ERPT Elasticties of Prices along the distribution chain

10

12

step

E_ppi_SVAR

E_cpi_SVAR

E_impi_SVAR (right axis)

14

16

18

20

22

24

E_ppi_SVEC

E_cpi_SVEC

E_impi_SVEC (right axis)

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

Conclusions

The SVAR model over-estimates the size and persistence (except for consumer

price inflation) of responses to a one-percent Exchange Rate Depreciation shock.

However, the SVAR model under-estimates the CPT Elasticities. In other words,

the estimated percentage of the exchange rate depreciation that is passed on into

prices along the distribution chain is higher under the SVEC estimation approach.

The difference on CPTE between the two approaches is more evident for the

consumer price index. Ten months after the shock, the SVEC and SVAR models

estimate that 10% and 1.7% of the exchange rate depreciation is passed on into

consumer prices respectively. This implies that taking into account deviations from

the long-run equilibrium relationships in our ERPT analysis is important.

Impulse-Response Functions Analysis: An Application to the Exchange Rate Pass-Through in Mexico

References

Bruggemann, Ralf, Krolzig Hans-Martin and Ltkepohl, Helmut (2003). Comparison of

Model Reduction Methods for VAR processes. Economics Papers 2003-W13,

Economics Group, Nuffield College, University of Oxford.

Capistrn, Carlos, Ibarra-Ramirez, Ral and Ramos-Francia, Manuel. (2011). El

Traspaso de Movimientos del Tipo de Cambio a los Precios: Un Anlsis para la

Economa Mexicana. Banco de Mxico. Documentos de Investigacin. Working Paper

No. 2011-12.

Ltkepohl, Helmut. (2005). New Introduction to Multiple Time Series Analysis. SpringerVerlag.

Você também pode gostar

- Advanced Forecasting Models Using Sas SoftwareDocumento10 páginasAdvanced Forecasting Models Using Sas SoftwareSarbani DasguptsAinda não há avaliações

- Multiple Models Approach in Automation: Takagi-Sugeno Fuzzy SystemsNo EverandMultiple Models Approach in Automation: Takagi-Sugeno Fuzzy SystemsAinda não há avaliações

- VAR and VECDocumento12 páginasVAR and VECOladipupo Mayowa PaulAinda não há avaliações

- Financial Derivative and Energy Market Valuation: Theory and Implementation in MATLABNo EverandFinancial Derivative and Energy Market Valuation: Theory and Implementation in MATLABNota: 3.5 de 5 estrelas3.5/5 (1)

- VAR, VECM, Impulse Response TheoryDocumento12 páginasVAR, VECM, Impulse Response Theorysaeed meo100% (4)

- Aravind Rangamreddy 500195259 cs4Documento7 páginasAravind Rangamreddy 500195259 cs4Aravind Kumar ReddyAinda não há avaliações

- Understanding DSGE models: Theory and ApplicationsNo EverandUnderstanding DSGE models: Theory and ApplicationsAinda não há avaliações

- Introduction To VAR ModelDocumento8 páginasIntroduction To VAR ModelibsaAinda não há avaliações

- ModulesDocumento40 páginasModulesagung septiaAinda não há avaliações

- Import Demand Function For Japan - Razvan CucuDocumento8 páginasImport Demand Function For Japan - Razvan CucuRazvan CucuAinda não há avaliações

- The Econometric Society, Wiley Econometrica: This Content Downloaded From 193.227.1.29 On Sat, 23 Jul 2016 23:17:22 UTCDocumento22 páginasThe Econometric Society, Wiley Econometrica: This Content Downloaded From 193.227.1.29 On Sat, 23 Jul 2016 23:17:22 UTCahmed22gouda22Ainda não há avaliações

- PID ControlDocumento3 páginasPID ControlDraganAinda não há avaliações

- An Introduction To Nonlinear Model Predictive ControlDocumento23 páginasAn Introduction To Nonlinear Model Predictive ControlSohibul HajahAinda não há avaliações

- Sequential Function ChartDocumento6 páginasSequential Function ChartLuciano Cardoso Vasconcelos100% (1)

- Robust Nonlinear Control Based On Describing Function MethodsDocumento8 páginasRobust Nonlinear Control Based On Describing Function MethodstfakkkAinda não há avaliações

- Advanced Econometric Problem SetDocumento4 páginasAdvanced Econometric Problem SetJonnysimpsonAinda não há avaliações

- Theory SERVO Linear Position ControlDocumento7 páginasTheory SERVO Linear Position ControlEnMaa 96Ainda não há avaliações

- Linear - Regression & Evaluation MetricsDocumento31 páginasLinear - Regression & Evaluation Metricsreshma acharyaAinda não há avaliações

- ECSE 425 - Branch Predictor For Pipelined 8-Bit MIPS Machine - ReportDocumento5 páginasECSE 425 - Branch Predictor For Pipelined 8-Bit MIPS Machine - ReportpiohmAinda não há avaliações

- SPSS 16.0 Tutorial To Develop A Regression ModelDocumento12 páginasSPSS 16.0 Tutorial To Develop A Regression ModelSatwant SinghAinda não há avaliações

- State Testing, and Testability Tips. Power of A Matrix, Node Reduction AlgorithmDocumento13 páginasState Testing, and Testability Tips. Power of A Matrix, Node Reduction AlgorithmSeerapu RameshAinda não há avaliações

- Automatic Control Systems Optimization and SensitiDocumento9 páginasAutomatic Control Systems Optimization and SensitiOmar Q AdaylehAinda não há avaliações

- Test Plan and CalibrationDocumento8 páginasTest Plan and CalibrationDaniel LiawAinda não há avaliações

- Multivariable Model Predictive Control: Real-World ProblemsDocumento24 páginasMultivariable Model Predictive Control: Real-World Problemssiamak001Ainda não há avaliações

- Introduction To Fault Diagnosis and Isolation (FDI) : by Hariharan KannanDocumento21 páginasIntroduction To Fault Diagnosis and Isolation (FDI) : by Hariharan KannansukanyagggAinda não há avaliações

- Lecture 1 Non Linear ControlDocumento21 páginasLecture 1 Non Linear ControlShivan BiradarAinda não há avaliações

- Dizzle 4Documento8 páginasDizzle 4ezioliseAinda não há avaliações

- Matlab Aided Control System Design - ConventionalDocumento36 páginasMatlab Aided Control System Design - ConventionalGaacksonAinda não há avaliações

- Model Predictive Control of An Inverted Pendulum, MPCDocumento4 páginasModel Predictive Control of An Inverted Pendulum, MPCerdsan100% (1)

- Model Estimation and ApplicationDocumento40 páginasModel Estimation and ApplicationlycancapitalAinda não há avaliações

- Instruction Manual: Test Signal GeneratorDocumento7 páginasInstruction Manual: Test Signal GeneratornileshsawAinda não há avaliações

- Assignment AnswersDocumento16 páginasAssignment AnswersPalashKulshresthaAinda não há avaliações

- An Introduction To Nonlinear Model Predictive ControlDocumento23 páginasAn Introduction To Nonlinear Model Predictive ControlsaeedAinda não há avaliações

- AnswersDocumento5 páginasAnswersShaik RoshanAinda não há avaliações

- Kalman ObserverDocumento5 páginasKalman Observerkhadars_5Ainda não há avaliações

- Modern Control TheoryDocumento137 páginasModern Control TheorypragatinareshAinda não há avaliações

- Probability & Statistics Unit 2-5Documento23 páginasProbability & Statistics Unit 2-5senthilAinda não há avaliações

- Applying Kalman Filtering in Solving SSM Estimation Problem by The Means of EM Algorithm With Considering A Practical ExampleDocumento8 páginasApplying Kalman Filtering in Solving SSM Estimation Problem by The Means of EM Algorithm With Considering A Practical ExampleJournal of ComputingAinda não há avaliações

- Econometrics NotesDocumento72 páginasEconometrics NotesRitvik DuttaAinda não há avaliações

- Markov ProcessesDocumento60 páginasMarkov ProcessesAyushi YadavAinda não há avaliações

- Ec3351 Control SystemsDocumento18 páginasEc3351 Control SystemsParanthaman GAinda não há avaliações

- AUTOMATIC - CONTROL - SYSTEM - UNIT - 1 - For MergeDocumento45 páginasAUTOMATIC - CONTROL - SYSTEM - UNIT - 1 - For MergemanishaAinda não há avaliações

- PPGEL - CEFET-MG & CEFET-MG / Campus Divin Opolis R. Alvares Azevedo, 400, 35500-970 Divin Opolis, MG, BrasilDocumento6 páginasPPGEL - CEFET-MG & CEFET-MG / Campus Divin Opolis R. Alvares Azevedo, 400, 35500-970 Divin Opolis, MG, BrasilPTR77Ainda não há avaliações

- Time Series Forecasting Using Holt-Winters Exponential SmoothingDocumento13 páginasTime Series Forecasting Using Holt-Winters Exponential Smoothingphu_2000_99Ainda não há avaliações

- Forecasting Bangladesh'S Inflation Using The Box-Jenkins (Arima) MethodologyDocumento27 páginasForecasting Bangladesh'S Inflation Using The Box-Jenkins (Arima) MethodologyAronno TonmoyAinda não há avaliações

- Pubdoc 12 29420 1565Documento18 páginasPubdoc 12 29420 1565MuhammadAbdulRasoolAinda não há avaliações

- Calculation of Composite Leading Indicators: A Comparison of Two Different MethodsDocumento12 páginasCalculation of Composite Leading Indicators: A Comparison of Two Different MethodsRajalakshmi13Ainda não há avaliações

- Machine Learning: Bilal KhanDocumento20 páginasMachine Learning: Bilal KhanOsama Inayat100% (1)

- Forecasting FundamentalsDocumento5 páginasForecasting FundamentalsSusiedeLeonAinda não há avaliações

- Control SystemDocumento30 páginasControl SystemGarimaAsthaAinda não há avaliações

- Model Reference Adaptive ControlDocumento22 páginasModel Reference Adaptive Controlasusd112550% (4)

- Eviews6a KartsDocumento3 páginasEviews6a Kartssarvary117Ainda não há avaliações

- Annie StabDocumento6 páginasAnnie StabAnshul SharmaAinda não há avaliações

- Liam - Mescall - Mapping and PCA ProjectDocumento8 páginasLiam - Mescall - Mapping and PCA ProjectLiam MescallAinda não há avaliações

- Indirect Adaptive ControlDocumento24 páginasIndirect Adaptive Controlhondo tinemi dAinda não há avaliações

- State Observer - Wikipedia, The Free EncyclopediaDocumento6 páginasState Observer - Wikipedia, The Free EncyclopediaNhà Của CọpAinda não há avaliações

- Feedback LinearizationDocumento4 páginasFeedback LinearizationMutaz RyalatAinda não há avaliações

- Nonlinear P-I Controller Design For Switchmode Dc-To-Dc Power ConvertersDocumento8 páginasNonlinear P-I Controller Design For Switchmode Dc-To-Dc Power ConvertersDipanjan DasAinda não há avaliações

- Questions On Financial ManagementDocumento2 páginasQuestions On Financial Managementmm1979Ainda não há avaliações

- 3 B B A SyllabusDocumento23 páginas3 B B A SyllabusmiboyfrendAinda não há avaliações

- Questions On International Financial ManagementDocumento1 páginaQuestions On International Financial Managementmm1979Ainda não há avaliações

- Questions On International BusinessDocumento1 páginaQuestions On International Businessmm1979Ainda não há avaliações

- Research MethodologyDocumento14 páginasResearch Methodologymm1979Ainda não há avaliações

- Questions On Financial Derivatives and Risk ManagementDocumento1 páginaQuestions On Financial Derivatives and Risk Managementmm1979Ainda não há avaliações

- Seat Matrix 2015Documento40 páginasSeat Matrix 2015mm1979Ainda não há avaliações

- Draft 19 September 2011: Agriculture and Inclusive Growth-Key Questions and Diagnostic Tools For Country EconomistsDocumento29 páginasDraft 19 September 2011: Agriculture and Inclusive Growth-Key Questions and Diagnostic Tools For Country Economistsmm1979Ainda não há avaliações

- North Eastern Regional Institute of Science and Technology Centre For Management Studies Time Table For The Session (July-Dec, 2018)Documento1 páginaNorth Eastern Regional Institute of Science and Technology Centre For Management Studies Time Table For The Session (July-Dec, 2018)mm1979Ainda não há avaliações

- 1o InstitutionDocumento1 página1o Institutionmm1979Ainda não há avaliações

- B. Tech.Documento2.608 páginasB. Tech.mm1979Ainda não há avaliações

- BRM Jay4Documento6 páginasBRM Jay4rakshaksinghaiAinda não há avaliações

- 1o InstitutionDocumento1 página1o Institutionmm1979Ainda não há avaliações

- Amazon PDFDocumento1 páginaAmazon PDFmm1979Ainda não há avaliações

- Rs. 12,571.00 Rs. 12,571.00 CST 5% Rs. 571.43Documento1 páginaRs. 12,571.00 Rs. 12,571.00 CST 5% Rs. 571.43mm1979Ainda não há avaliações

- Protege FigureDocumento1 páginaProtege Figuremm1979Ainda não há avaliações

- Bharat Sanchar Nigam Limited: Telephone Bill Name and Address of The CustomerDocumento1 páginaBharat Sanchar Nigam Limited: Telephone Bill Name and Address of The Customermm1979Ainda não há avaliações

- Multiple Choice Questions (The Answers Are Provided After The Last Question.)Documento6 páginasMultiple Choice Questions (The Answers Are Provided After The Last Question.)Sialhai100% (2)

- AboutDocumento3 páginasAboutmm1979Ainda não há avaliações

- AmazonDocumento1 páginaAmazonmm1979Ainda não há avaliações

- Business Research Methods MCQDocumento4 páginasBusiness Research Methods MCQApurvaa Patil87% (30)

- M Mall FeedbackDocumento16 páginasM Mall Feedbackmm1979Ainda não há avaliações

- Deployment of Bank CreditDocumento2 páginasDeployment of Bank Creditmm1979Ainda não há avaliações

- Daily Call Money RatesDocumento150 páginasDaily Call Money Ratesmm1979Ainda não há avaliações

- Cs AccumDocumento2 páginasCs Accummm1979Ainda não há avaliações

- MBA MAT February 2013 Reasoning Question PaperDocumento11 páginasMBA MAT February 2013 Reasoning Question Papermm1979Ainda não há avaliações

- Put Futures Credit Spread Out-Of-The-Money DownsideDocumento8 páginasPut Futures Credit Spread Out-Of-The-Money Downsidemm1979Ainda não há avaliações

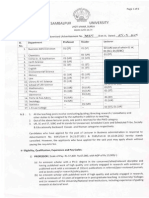

- Notification of Posts - Eligibility EtcDocumento6 páginasNotification of Posts - Eligibility Etcmm1979Ainda não há avaliações

- FNPostdoc Reference Report FormDocumento1 páginaFNPostdoc Reference Report Formmm1979Ainda não há avaliações

- Role of Statistics: in Mathematical ModellingDocumento7 páginasRole of Statistics: in Mathematical ModellingKumar ShantanuAinda não há avaliações

- Jurnal Ilmu KehutananDocumento15 páginasJurnal Ilmu KehutananAngelius M NababanAinda não há avaliações

- MirtDocumento200 páginasMirthasanahAinda não há avaliações

- 04 - Notebook4 - Additional InformationDocumento5 páginas04 - Notebook4 - Additional InformationLokesh LokiAinda não há avaliações

- ANOVADocumento3 páginasANOVAAbir HasanAinda não há avaliações

- Meanings of StatisticsDocumento28 páginasMeanings of StatisticspapaoniAinda não há avaliações

- Review: I Am Examining Differences in The Mean Between GroupsDocumento44 páginasReview: I Am Examining Differences in The Mean Between GroupsAtlas Cerbo100% (1)

- Linear - Regression & Evaluation MetricsDocumento31 páginasLinear - Regression & Evaluation Metricsreshma acharyaAinda não há avaliações

- Chapter 4 (Compatibility Mode)Documento66 páginasChapter 4 (Compatibility Mode)Hope KnockAinda não há avaliações

- Chapter 13. Time Series Regression: Serial Correlation TheoryDocumento26 páginasChapter 13. Time Series Regression: Serial Correlation TheorysubkmrAinda não há avaliações

- Chapter 4: Answer Key: Case Exercises Case ExercisesDocumento9 páginasChapter 4: Answer Key: Case Exercises Case ExercisesPriyaprasad PandaAinda não há avaliações

- Auto Sales Forecasting For Production Planning at FordDocumento12 páginasAuto Sales Forecasting For Production Planning at FordPrashant KumbarAinda não há avaliações

- Complete Exam EcDocumento6 páginasComplete Exam EcLabh JanjuaAinda não há avaliações

- A Comprehensive Literature Review On Construction Project Risk AnalysisDocumento16 páginasA Comprehensive Literature Review On Construction Project Risk AnalysisSovan SahooAinda não há avaliações

- Unit 3 Simple Correlation and Regression Analysis1Documento16 páginasUnit 3 Simple Correlation and Regression Analysis1Rhea MirchandaniAinda não há avaliações

- StatisticsDocumento22 páginasStatisticsbenjamin212Ainda não há avaliações

- Ch5 ForecastingDocumento89 páginasCh5 ForecastingMuhammad Arslan QadirAinda não há avaliações

- ANOVA of Equal Sample SizesDocumento7 páginasANOVA of Equal Sample SizesSHARMAINE CORPUZ MIRANDAAinda não há avaliações

- Lecture 2 Simple Regression ModelDocumento47 páginasLecture 2 Simple Regression ModelZhaokun Zhang100% (1)

- Formulae For Mhrm510: Descriptive StatisticsDocumento3 páginasFormulae For Mhrm510: Descriptive StatisticsDon Rayburn PilanAinda não há avaliações

- Simple Linear Regression Part 1Documento63 páginasSimple Linear Regression Part 1_vanitykAinda não há avaliações

- Darren Biostatistics Past MCQ CompilationDocumento19 páginasDarren Biostatistics Past MCQ CompilationARINDAM SAHAAinda não há avaliações

- Project 4Documento5 páginasProject 4A KAinda não há avaliações

- Balance Dan Budaya Kerja Terhadap Kepuasan KerjaDocumento17 páginasBalance Dan Budaya Kerja Terhadap Kepuasan KerjaFerio Lambang PutraAinda não há avaliações

- SOB 1040B Statistics Practice QuestionsDocumento14 páginasSOB 1040B Statistics Practice QuestionsCaroline KapilaAinda não há avaliações

- Ordinary Least Square Technique: Advantage of The Principle of Least SquaresDocumento9 páginasOrdinary Least Square Technique: Advantage of The Principle of Least SquaresGiri PrasadAinda não há avaliações

- Modelbased Clustering Classification Data Science PDFDocumento447 páginasModelbased Clustering Classification Data Science PDFWilliamette Core100% (2)

- Course: Basic Econometrics: Question Number: 1, 2, 3, 4Documento24 páginasCourse: Basic Econometrics: Question Number: 1, 2, 3, 4Sania WadudAinda não há avaliações

- Dummy VariablesDocumento2 páginasDummy Variablessaeedawais47Ainda não há avaliações

- Lapres Olah Data DBP - Prasdira Ayu Maithsa Hasna - 26040121120033 - Kel1Documento9 páginasLapres Olah Data DBP - Prasdira Ayu Maithsa Hasna - 26040121120033 - Kel1Yusuf RPAinda não há avaliações