Escolar Documentos

Profissional Documentos

Cultura Documentos

PPSAS 23 - Revenue From Non-Exchange Trans Oct - 18 2013

Enviado por

Ar LineDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

PPSAS 23 - Revenue From Non-Exchange Trans Oct - 18 2013

Enviado por

Ar LineDireitos autorais:

Formatos disponíveis

Revenue from Non-Exchange Transactions (Taxes and Transfers)

Philippine Public Sector Accounting Standards 23

Revenue from Non-Exchange Transactions

(Taxes and Transfers)

Table of Contents

PAG

Number

BACKGROUND

INTRODUCTION TO THE IPSAS 23

PHILIPPINE APPLICATION GUIDANCE TO IPSAS 23

Scope

Taxes

Services In-Kind

Effective Date

PPSAS 23 Revenue from Non-Exchange Transactions

January 2014

Page 1

Revenue from Non-Exchange Transactions (Taxes and Transfers)

Philippine Public Sector Accounting Standards 23 Revenue from Non-Exchange Transactions (Taxes and Transfers)

Background

This Philippine Public Sector Accounting Standard (PPSAS) 23 consists

of International Public Sector Accounting Standard (IPSAS) 23,

Revenue from Non-Exchange Transactions (Taxes and Transfers), and

the Philippine Application Guidance (PAG) prepared to suit the

Philippine public sector situation.

The IPSAS 23 was issued in December 2006 by the International Public

Sector Accounting Standards Board (IPSASB) of the International

Federation of Accountants (IFAC). This includes amendments resulting

from IPSASs issued up to January 15, 2012.

The PAG (in italics) provides supplementary guidance on the proper

implementation of

IPSAS 23 and also the reason for not adopting

some paragraphs of the IPSAS 23.

Introduction to the IPSAS 23

This IPSAS was developed by the IPSASB because: (a) Non-exchange

revenues (taxes and transfers) form the majority of revenue for most

public sector entities; and (b) Until now there has been no generally

accepted international financial reporting standard that addresses the

recognition and measurement of taxation revenue.

The objective of this Standard is to prescribe requirements for the

financial reporting of revenue arising from non-exchange transactions,

other than non-exchange transactions that give rise to an entity

combination. This Standard deals with issues that need to be

considered in recognizing and measuring revenue from non-exchange

transactions, including the identification of contributions from owners.

Philippine Application Guidance to IPSAS 23

Scope

PAG1.Paragraph 3 deals with the applicability of this Standard to all

public sector entities other than Government Business

Enterprises (GBEs).

GBE is an entity that has all the following characteristics: (a) Is an

entity with the power to contract in its own name; (b) Has been

assigned the financial and operational authority to carry on a

PPSAS 23 Revenue from Non-Exchange Transactions

January 2014

Page 2

Revenue from Non-Exchange Transactions (Taxes and Transfers)

business; (c) Sells goods and services, in the normal course of its

business, to other entities at a profit or full cost recovery; (d) Is

not reliant on continuing government funding to be a going

concern (other than purchases of outputs at arms length); and

(e) Is controlled by a public sector entity.

This standard shall be applied to all National Government

Agencies (NGAs), Local Government Units (LGUs) and

Government-Owned and/or Controlled Corporations (GOCCs) not

considered as GBEs.

Taxes

PAG2.Paragraph 59 and 60 provide that an entity shall recognize an

asset in respect of taxes when the taxable event occurs and the

asset recognition criteria are met. Resources arising from taxes

satisfy the criteria for recognition as an asset when it is probable

that the inflow of resources will occur and their fair value can be

reliably measured. The degree of probability attached to the

inflow of resources is determined on the basis of evidence

available at the time of initial recognition, which includes, but is

not limited to, disclosure of the taxable event by the taxpayer.

The aforestated provisions shall not be adopted. Instead, taxes

and the related fines and penalties shall be recognized when

collected or when these are measurable and legally collectible.

The related refunds, including those that are measurable and

legally collectible, shall be deducted from the recognized tax

revenue.

Services In-kind

PAG3.Paragraph 98 provides that an entity may, but is not required, to

recognize services in-kind as revenue and as an asset. While

paragraphs 99 to 101 define and give examples of services-in

kind. Paragraph 99 also provides that since these assets are

immediately consumed, an expense is simultaneously recognized

with a corresponding reduction of the asset.

Considering the complexity of the determination and recognition

of an asset and income and the eventual recognition of

expenses, the provisions of these paragraphs shall not be

adopted. However, these shall be disclosed in accordance with

paragraph 108.

Effective Date

PAG4.This PPSAS shall apply for annual financial statements covering

periods beginning January 1, 2014.

PPSAS 23 Revenue from Non-Exchange Transactions

January 2014

Page 3

Você também pode gostar

- Overview Obnbn PPSASDocumento44 páginasOverview Obnbn PPSASJenofDulwn0% (1)

- PPSAS 32 - Service Concession Oct - 18 2013Documento3 páginasPPSAS 32 - Service Concession Oct - 18 2013Ingrid CaobleclolalAinda não há avaliações

- A32 Ipsas - 23Documento58 páginasA32 Ipsas - 23Marius SteffyAinda não há avaliações

- 03 Boa ResolutionsDocumento5 páginas03 Boa ResolutionsMarielle DominguezAinda não há avaliações

- PPSAS 26 Impairment of Cash Generating AssetsDocumento3 páginasPPSAS 26 Impairment of Cash Generating AssetsAr LineAinda não há avaliações

- Module For Public Accounting and BudgetingDocumento113 páginasModule For Public Accounting and BudgetingLlyr Bryant100% (1)

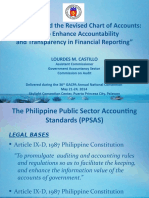

- The PPSAS and The Revised Chart of AccountsDocumento98 páginasThe PPSAS and The Revised Chart of AccountsDaniel Salmorin87% (15)

- The PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingDocumento98 páginasThe PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingJhopel Casagnap EmanAinda não há avaliações

- PPSAS 29 - Financial Instruments - Recog & Measure Oct - 18 2013Documento3 páginasPPSAS 29 - Financial Instruments - Recog & Measure Oct - 18 2013Ar Line0% (1)

- Philippine Public Sector Accounting Standards 9 Revenue From Exchange TransactionsDocumento3 páginasPhilippine Public Sector Accounting Standards 9 Revenue From Exchange TransactionsIngrid CaobleclolalAinda não há avaliações

- Summary Government Accounting Chapter 1Documento13 páginasSummary Government Accounting Chapter 1Beatrice ErilloAinda não há avaliações

- Tax Audit PresentationDocumento12 páginasTax Audit PresentationChirag KarmadwalaAinda não há avaliações

- Philippine Public Sector Accounting Standard 12 InventoriesDocumento3 páginasPhilippine Public Sector Accounting Standard 12 InventoriesIngrid Caobleclolal100% (1)

- Philippine Public Sector Accounting Standard 32 Service Concession Arrangements: GrantorDocumento3 páginasPhilippine Public Sector Accounting Standard 32 Service Concession Arrangements: GrantorAr LineAinda não há avaliações

- CIR vs. Lancaster Phils. GR. 183408, July 12, 2017Documento20 páginasCIR vs. Lancaster Phils. GR. 183408, July 12, 2017Roxanne PeñaAinda não há avaliações

- Current Applicable International Accounting Standard (IAS) Under IASBDocumento11 páginasCurrent Applicable International Accounting Standard (IAS) Under IASBEZEKIEL100% (1)

- Disclosures Under ICDSDocumento11 páginasDisclosures Under ICDScadrjainAinda não há avaliações

- Article TPDocumento3 páginasArticle TPpawanagrawal83Ainda não há avaliações

- Pas 12 Income TaxesDocumento9 páginasPas 12 Income TaxesAllegria AlamoAinda não há avaliações

- PPSAS Report For PowerpointDocumento6 páginasPPSAS Report For PowerpointButchoy GemaoAinda não há avaliações

- General Provisions, Basic Standards and PoliciesDocumento9 páginasGeneral Provisions, Basic Standards and PoliciesDianna Sevilla RabadonAinda não há avaliações

- Philippine Public Sector Accounting Standards 16 Investment PropertyDocumento3 páginasPhilippine Public Sector Accounting Standards 16 Investment PropertyAr LineAinda não há avaliações

- PPSAS 03 - Changes in P & E and Errors Oct - 18 2013Documento3 páginasPPSAS 03 - Changes in P & E and Errors Oct - 18 2013Ingrid CaobleclolalAinda não há avaliações

- Solved by Verified Expert: Answer & ExplanationDocumento9 páginasSolved by Verified Expert: Answer & ExplanationDegoAinda não há avaliações

- Chapter 1 - General Provisions, Basic Standards and PoliciesDocumento10 páginasChapter 1 - General Provisions, Basic Standards and Policiesdar •Ainda não há avaliações

- TAX 2 Group 1 Handout PDFDocumento6 páginasTAX 2 Group 1 Handout PDFMi-young SunAinda não há avaliações

- PPSAS 31 - Intangible Assets Oct - 18 2013Documento3 páginasPPSAS 31 - Intangible Assets Oct - 18 2013Ingrid CaobleclolalAinda não há avaliações

- Re: Accrual BasisDocumento7 páginasRe: Accrual BasisEmmanuel Emigdio DumlaoAinda não há avaliações

- Income Tax in GeneralDocumento6 páginasIncome Tax in GeneralMatt Marqueses PanganibanAinda não há avaliações

- Notes To Interim Finacial StatementsDocumento7 páginasNotes To Interim Finacial StatementsJhoanna Marie Manuel-AbelAinda não há avaliações

- Chapter 1 - GOV'T ACCOUNTINGDocumento11 páginasChapter 1 - GOV'T ACCOUNTINGCristel TannaganAinda não há avaliações

- Balucan, in Acc Final RequirementDocumento95 páginasBalucan, in Acc Final RequirementLuigi Enderez BalucanAinda não há avaliações

- LkasDocumento19 páginasLkaskavindyatharaki2002Ainda não há avaliações

- ABA - Annual Report 2018Documento146 páginasABA - Annual Report 2018Ivan ChiuAinda não há avaliações

- Chapter Two International Public Sector Accounting Standard (Ipsas) Ipsas 1 Presentation of Financial StatementsDocumento21 páginasChapter Two International Public Sector Accounting Standard (Ipsas) Ipsas 1 Presentation of Financial StatementsSara NegashAinda não há avaliações

- Course Module - Chapter 1 - Overview of Government AccountingDocumento13 páginasCourse Module - Chapter 1 - Overview of Government Accountingssslll2Ainda não há avaliações

- BIR Audit ManualDocumento89 páginasBIR Audit ManualRivera RwlrAinda não há avaliações

- PSA Chapter 3 TeacherDocumento9 páginasPSA Chapter 3 TeacherEbsa AbdiAinda não há avaliações

- Sop 98-5Documento14 páginasSop 98-5chanti0999Ainda não há avaliações

- Draft Explanatory MaterialDocumento12 páginasDraft Explanatory MaterialMohammed SeidAinda não há avaliações

- Summary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheDocumento28 páginasSummary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheSangram PandaAinda não há avaliações

- Sas 1-18Documento165 páginasSas 1-18btee2Ainda não há avaliações

- Clarification on allowable deductions for PEZA enterprisesDocumento9 páginasClarification on allowable deductions for PEZA enterprisesKenneth Bryan Tegerero TegioAinda não há avaliações

- Updates in Financial Reporting StandardsDocumento24 páginasUpdates in Financial Reporting Standardsloyd smithAinda não há avaliações

- Exploring The Salient Points of The Ease of Paying TaxesDocumento4 páginasExploring The Salient Points of The Ease of Paying TaxespepyAinda não há avaliações

- Pa1 To 27Documento63 páginasPa1 To 27iyahvrezAinda não há avaliações

- Philippines Revenue Regulations on Financial StatementsDocumento2 páginasPhilippines Revenue Regulations on Financial StatementsButch AmbataliAinda não há avaliações

- Adamay International Co., Inc.: Note 1 - General InformationDocumento36 páginasAdamay International Co., Inc.: Note 1 - General Informationgrecelyn bianesAinda não há avaliações

- Summary of IASDocumento10 páginasSummary of IASSongs WorldAinda não há avaliações

- Transfer Pricing in The PhilippinesDocumento8 páginasTransfer Pricing in The PhilippinesJayson Berja de LeonAinda não há avaliações

- Financial StatementsDocumento4 páginasFinancial StatementsBobby VisitacionAinda não há avaliações

- AS 1-6 ACCOUNTING STANDARDS OVERVIEWDocumento13 páginasAS 1-6 ACCOUNTING STANDARDS OVERVIEWJohanna Pauline SequeiraAinda não há avaliações

- Notes To FsDocumento10 páginasNotes To FsCynthia PenoliarAinda não há avaliações

- Conceptual Framework For Financial ReportingDocumento26 páginasConceptual Framework For Financial ReportingJem ValmonteAinda não há avaliações

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeNo Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeNota: 1 de 5 estrelas1/5 (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Ainda não há avaliações

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18No EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Ainda não há avaliações

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideNo EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideAinda não há avaliações

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018No EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Ainda não há avaliações

- Kierulf vs. CADocumento4 páginasKierulf vs. CAAr LineAinda não há avaliações

- Pantaleon Vs American ExpressDocumento2 páginasPantaleon Vs American ExpressAr LineAinda não há avaliações

- Murder Conviction UpheldDocumento1 páginaMurder Conviction UpheldAr LineAinda não há avaliações

- BF vs Lomotan Ruling on DamagesDocumento4 páginasBF vs Lomotan Ruling on DamagesAr LineAinda não há avaliações

- Gonzales Vs PCIBDocumento2 páginasGonzales Vs PCIBAr LineAinda não há avaliações

- Cuddy Liable for Damages After Renting Film to Another PartyDocumento3 páginasCuddy Liable for Damages After Renting Film to Another PartyAr LineAinda não há avaliações

- Francisco v. Ferrer-FullecidoDocumento1 páginaFrancisco v. Ferrer-FullecidoAr LineAinda não há avaliações

- Silahis vs. SolutaDocumento1 páginaSilahis vs. SolutaAr LineAinda não há avaliações

- Arcoma y Moban v. CADocumento2 páginasArcoma y Moban v. CAAr LineAinda não há avaliações

- Candano Shipping Lines vs. Sugata-OnDocumento2 páginasCandano Shipping Lines vs. Sugata-OnAr LineAinda não há avaliações

- Twin Ace vs. RufinaDocumento1 páginaTwin Ace vs. RufinaAr LineAinda não há avaliações

- Civil Law Q and ADocumento36 páginasCivil Law Q and AAr LineAinda não há avaliações

- Afiada Vs HisoleDocumento1 páginaAfiada Vs HisoleAr LineAinda não há avaliações

- Philippine Bank of Commerce vs. CADocumento3 páginasPhilippine Bank of Commerce vs. CAAr LineAinda não há avaliações

- Madeja vs. CaroDocumento3 páginasMadeja vs. CaroAr Line100% (1)

- Philippine Bank of Commerce vs. CADocumento3 páginasPhilippine Bank of Commerce vs. CAAr LineAinda não há avaliações

- Torts DigestsDocumento19 páginasTorts DigestsAr LineAinda não há avaliações

- Amadora Vs CADocumento5 páginasAmadora Vs CAAr LineAinda não há avaliações

- Cuddy Liable for Damages After Renting Film to Another PartyDocumento3 páginasCuddy Liable for Damages After Renting Film to Another PartyAr LineAinda não há avaliações

- Candano Shipping Lines vs. Sugata-OnDocumento2 páginasCandano Shipping Lines vs. Sugata-OnAr LineAinda não há avaliações

- NPC liable for driver's tortDocumento4 páginasNPC liable for driver's tortAr LineAinda não há avaliações

- The Heirs of Redentor Completo and Elpidio Abiad vs. Sgt. Amando C. Albayda, Jr.Documento4 páginasThe Heirs of Redentor Completo and Elpidio Abiad vs. Sgt. Amando C. Albayda, Jr.Ar LineAinda não há avaliações

- Judicial Forms - Arline C. Halina (Prac 1)Documento9 páginasJudicial Forms - Arline C. Halina (Prac 1)Ar LineAinda não há avaliações

- Culion Ice, Fish & Electric Co., Inc., vs. Philippine Motors CorporationDocumento3 páginasCulion Ice, Fish & Electric Co., Inc., vs. Philippine Motors CorporationAr LineAinda não há avaliações

- Marinduque Iron Mines Agents, Inc. vs. The Workmen's Compensation CommissionDocumento2 páginasMarinduque Iron Mines Agents, Inc. vs. The Workmen's Compensation CommissionAr LineAinda não há avaliações

- Estrada V SandiganDocumento3 páginasEstrada V SandiganAr LineAinda não há avaliações

- Ateneo Labor Law ReviewerDocumento112 páginasAteneo Labor Law ReviewerSui98% (47)

- Andamo vs. Iac DigestDocumento3 páginasAndamo vs. Iac DigestAr LineAinda não há avaliações

- Republic Act No. 9369Documento23 páginasRepublic Act No. 9369Ar LineAinda não há avaliações

- Peralta Vs BugarinDocumento2 páginasPeralta Vs BugarinAr LineAinda não há avaliações

- PDCA Cycle Reduces Sauce Losses 86.75% in Food IndustryDocumento14 páginasPDCA Cycle Reduces Sauce Losses 86.75% in Food IndustrymonicaAinda não há avaliações

- Nilson 1183 PDF Way2pay 99 07 15Documento16 páginasNilson 1183 PDF Way2pay 99 07 15Elena Elena100% (1)

- Chapter 1 - International Business: Environments and Operations - SummaryDocumento10 páginasChapter 1 - International Business: Environments and Operations - SummarySimón Acuña López100% (1)

- Public-Private Partnerships (PPPS) in Egovernment: Definition, Rationale, and Regulatory FrameworksDocumento34 páginasPublic-Private Partnerships (PPPS) in Egovernment: Definition, Rationale, and Regulatory FrameworksSoenarto SoendjajaAinda não há avaliações

- SAP MM Interview Questions and Answers For Freshers - Experienced - Top Companies - MNC Job FAQ - STechiesDocumento6 páginasSAP MM Interview Questions and Answers For Freshers - Experienced - Top Companies - MNC Job FAQ - STechiesManas Kumar SahooAinda não há avaliações

- CAIIB BFM Sample Questions by MuruganDocumento158 páginasCAIIB BFM Sample Questions by MuruganManish Kumar Masram94% (16)

- Management Project "Nirala Sweets"Documento6 páginasManagement Project "Nirala Sweets"tamur_ahan100% (1)

- Tugas Review Jurnal PDFDocumento71 páginasTugas Review Jurnal PDFMelpa GuspariniAinda não há avaliações

- Aged Accounts Receivable: (Enter UW Department Name) (Enter Date)Documento5 páginasAged Accounts Receivable: (Enter UW Department Name) (Enter Date)Walter LeongAinda não há avaliações

- Distribution Management Quiz TestDocumento3 páginasDistribution Management Quiz TestMehedul Islam Sabuj100% (2)

- Distribution Channels Explained: The Key Players and Their RolesDocumento17 páginasDistribution Channels Explained: The Key Players and Their Rolesleni thAinda não há avaliações

- Sanjoy Das 23-021: Ans of Question 01 Ans of ADocumento2 páginasSanjoy Das 23-021: Ans of Question 01 Ans of ASanjoy dasAinda não há avaliações

- English Oven Company ProfileDocumento10 páginasEnglish Oven Company ProfileAadil Kakar100% (1)

- Artificial Intelligence IN Insurance: Team MembersDocumento10 páginasArtificial Intelligence IN Insurance: Team MembersASHWINI KUMAR 22Ainda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)kris_ice1981Ainda não há avaliações

- Supply Chain at Indian Chemical CompanyDocumento4 páginasSupply Chain at Indian Chemical CompanySagar RelanAinda não há avaliações

- Case RecruitingDocumento2 páginasCase RecruitingSalsabilaAinda não há avaliações

- Laptop Industry Final ReportDocumento7 páginasLaptop Industry Final Reportapi-700918564Ainda não há avaliações

- Project Topic - Company Law-I, Batch 2018-23Documento26 páginasProject Topic - Company Law-I, Batch 2018-23Fagun SahniAinda não há avaliações

- FARR CeramicsDocumento17 páginasFARR CeramicsKawsurAinda não há avaliações

- VIII. Consideration of Internal ControlDocumento15 páginasVIII. Consideration of Internal ControlKrizza MaeAinda não há avaliações

- Business LawsDocumento3 páginasBusiness LawsVsubramanian VsmAinda não há avaliações

- Dell-Using E-Commerce For Success: Application CaseDocumento12 páginasDell-Using E-Commerce For Success: Application CaseAri MuhardonoAinda não há avaliações

- Introduction to SAP Global Trade Services (GTSDocumento3 páginasIntroduction to SAP Global Trade Services (GTSGuru PrasadAinda não há avaliações

- PDF Consumer Buying Behaviour On LaptopDocumento11 páginasPDF Consumer Buying Behaviour On LaptopPrameela PoudelAinda não há avaliações

- Digital Business Strategizing: The Role of Leadership and Organizational LearningDocumento17 páginasDigital Business Strategizing: The Role of Leadership and Organizational LearningfarraAinda não há avaliações

- Capital Assets Taxation RulesDocumento5 páginasCapital Assets Taxation Rulesaki_0915296457Ainda não há avaliações

- MBA VocabularyDocumento41 páginasMBA VocabularyadjerourouAinda não há avaliações

- Financial PositionDocumento15 páginasFinancial PositionedsonAinda não há avaliações

- Man MCQDocumento26 páginasMan MCQ49saquib khanAinda não há avaliações