Escolar Documentos

Profissional Documentos

Cultura Documentos

Crisil Rport

Enviado por

Gaurav GuptaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Crisil Rport

Enviado por

Gaurav GuptaDireitos autorais:

Formatos disponíveis

June 09, 2015

Mumbai

Nestle India Ltds ratings unaffected by recent developments over Maggi

noodles

CRISILs ratings on the long-term loans and short-term debt programme of Nestle India Ltd (Nestle

India; rated CRISIL AAA/Stable/CRISIL A1+) remain unaffected by the recent developments regarding

the companys instant noodles product under the Maggi brand. Local health authorities of various states

have raised issues that the product contains excessive levels of certain ingredients considered unsafe

for human consumption, and about the declaration, on the product label, that Maggi noodles contain

no added monosodium glutamate. Following bans on sales of this product by some state governments,

Nestle India, on June 5, 2015, announced that it has decided to temporarily withdraw Maggi noodles

from the market. On the same date, the Food Safety and Standards Authority of India issued an order

directing Nestle India to withdraw all variants of Maggi noodles from the market and to stop further

production and sale of the product until the above issues are addressed.

Maggi noodles is estimated to account for around 20 per cent of Nestle Indias revenue; therefore,

CRISIL believes that the stoppage of sale of this product will impact the companys operating

performance over the near term. However, Nestle Indias business risk profile continues to be

supported by its diversified revenue profile and its leading market position in several product categories,

including milk products, beverages, and chocolates and confectionery. CRISIL believes that the recent

developments with respect to Maggi noodles is unlikely to have any significant adverse impact on

Nestle Indias other business segments. Nestle India also continues to benefit from technical support

from its parent, Nestle SA (rated AA/Stable/A-1+ by Standard & Poors), which is one of the worlds

largest players in the branded and packaged foods sector.

Furthermore, Nestle Indias financial risk profile is robust, marked by strong cash generation, minimal

debt, and ample liquidity. For 2014 (refers to calendar year, January 1 to December 31), the company

reported healthy operating profit (before depreciation, interest, and taxes) and net cash accruals of

over Rs.21 billion and Rs.8 billion, respectively; it had liquid surplus of around Rs.9.5 billion as on

December 31, 2014. CRISIL believes that Nestle Indias operating cash flows will remain sizeable even

with reduced contribution from Maggi noodles and the companys strong (and nearly debt-free) balance

sheet will withstand the impact of any temporary business pressures.

CRISIL will nevertheless continue to monitor developments, including regulatory action, relating to

Nestles prepared foods and cooking aids business (dominated by Maggi), and the consequent impact

on Nestle Indias credit risk profile.

For the rating rationale for Nestle India, please refer to the link below:

Company Name

Link to Rating Rationale

Nestle India Limited

June 09, 2015

Click here

www.crisil.com

Media Contacts

Analytical Contacts

Customer Service Helpdesk

Tanuja Abhinandan

Media Relations

CRISIL Limited

Phone: +91 22 3342 1818

Mobile: +91 98 192 48980

Email:

tanuja.abhinandan@crisil.com

Anuj Sethi

Director - CRISIL Ratings

Phone: +91 44 6656 3100

Email: anuj.sethi@crisil.com

Timings: 10.00 am to 7.00 pm

Toll free number: 1800 267 1301

Email:CRISILratingdesk@crisil.com

Jyoti Parmar

Media Relations

CRISIL Limited

Phone: +91 22 3342 1835

Email: jyoti.parmar@crisil.com

Amit Bhave

Director - CRISIL Ratings

Phone: +91 22 3342 3113

Email: amit.bhave@crisil.com

Note:

This Press Release is transmitted to you for the sole purpose of dissemination through your newspaper / magazine / agency. The press

release may be used by you in full or in part without changing the meaning or context thereof but with due credit to CRISIL. However, CRISIL

alone has the sole right of distribution of its Releases for consideration or otherwise through any media including websites, portals etc.

About CRISIL Limited

CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services. We are India's

leading ratings agency. We are also the foremost provider of high-end research to the world's largest banks and leading

corporations.

About CRISIL Ratings

CRISIL Ratings is India's leading rating agency. We pioneered the concept of credit rating in India in 1987. With a tradition

of independence, analytical rigour and innovation, we have a leadership position. We have rated over 75,000 entities, by far

the largest number in India. We are a full-service rating agency. We rate the entire range of debt instruments: bank loans,

certificates of deposit, commercial paper, non-convertible debentures, bank hybrid capital instruments, asset-backed

securities, mortgage-backed securities, perpetual bonds, and partial guarantees. CRISIL sets the standards in every aspect

of the credit rating business. We have instituted several innovations in India including rating municipal bonds, partially

guaranteed instruments and microfinance institutions. We pioneered a globally unique and affordable rating service for Small

and Medium Enterprises (SMEs).This has significantly expanded the market for ratings and is improving SMEs' access to

affordable finance. We have an active outreach programme with issuers, investors and regulators to maintain a high level of

transparency regarding our rating criteria and to disseminate our analytical insights and knowledge.

CRISIL PRIVACY NOTICE

CRISIL respects your privacy. We use your contact information, such as your name, address, and email id, to fulfil your request and service

your account and to provide you with additional information from CRISIL and other parts of McGraw Hill Financial you may find of interest.

For further information, or to let us know your preferences with respect to receiving marketing materials, please visit www.crisil.com/privacy.

You can view McGraw Hill Financials Customer Privacy at http://www.mhfi.com/privacy.

Last updated: August 2014

Disclaimer: CRISIL has taken due care and caution in preparing this Press Release. Information has been obtained by

CRISIL from sources which it considers reliable. However, CRISIL does not guarantee the accuracy, adequacy or

completeness of information on which this Press Release is based and is not responsible for any errors or omissions or for

the results obtained from the use of this Press Release. CRISIL, especially states that it has no financial liability whatsoever

to the subscribers/ users/ transmitters/ distributors of this Press Release.

Stay Connected |

June 09, 2015

CRISIL

Website

Twitter |

LinkedIn |

YouTube |

www.crisil.com

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Failure of Corporate Governance at Infrastructure Leasing and Financial Services Limited: Lessons LearntDocumento14 páginasThe Failure of Corporate Governance at Infrastructure Leasing and Financial Services Limited: Lessons LearntGaurav GuptaAinda não há avaliações

- ForecastingDocumento11 páginasForecastingGaurav GuptaAinda não há avaliações

- DHFL Meltdown: The Corporate Governance Lapses: Daitri Tiwary and Arunaditya SahayDocumento14 páginasDHFL Meltdown: The Corporate Governance Lapses: Daitri Tiwary and Arunaditya SahayGaurav GuptaAinda não há avaliações

- Soya Express: Kalyan Bhaskar, Vijayta Doshi and Poojan ChokshiDocumento7 páginasSoya Express: Kalyan Bhaskar, Vijayta Doshi and Poojan ChokshiGaurav GuptaAinda não há avaliações

- ResourcesDocumento1 páginaResourcesGaurav GuptaAinda não há avaliações

- 2 Digital Marketing Glossary PDFDocumento5 páginas2 Digital Marketing Glossary PDFdenizsensozAinda não há avaliações

- Article 01 AJC - Flipkart Case - Thomason Rajan2020Documento18 páginasArticle 01 AJC - Flipkart Case - Thomason Rajan2020Pragati JoshiAinda não há avaliações

- Forecasting and Marketing ControlDocumento15 páginasForecasting and Marketing ControlGaurav GuptaAinda não há avaliações

- Rural Marketing, 2eDocumento7 páginasRural Marketing, 2eGaurav GuptaAinda não há avaliações

- Rural Marketing ResearchDocumento25 páginasRural Marketing ResearchGaurav GuptaAinda não há avaliações

- Green MarketingDocumento12 páginasGreen MarketingGaurav GuptaAinda não há avaliações

- 16 Designing and Integrating Marketing CommunicationsDocumento23 páginas16 Designing and Integrating Marketing CommunicationsGaurav GuptaAinda não há avaliações

- Rural Marketing, 2eDocumento14 páginasRural Marketing, 2eGaurav GuptaAinda não há avaliações

- Marketing in Small TownsDocumento16 páginasMarketing in Small TownsGaurav GuptaAinda não há avaliações

- AISHE Final Report 2018-19 PDFDocumento310 páginasAISHE Final Report 2018-19 PDFSanjay SharmaAinda não há avaliações

- Marketing Mgmt. 1Documento3 páginasMarketing Mgmt. 1Gaurav GuptaAinda não há avaliações

- Mevlana Exchange ProgrammeDocumento18 páginasMevlana Exchange ProgrammeGaurav GuptaAinda não há avaliações

- Rural Consumer BehaviourDocumento23 páginasRural Consumer BehaviourGaurav GuptaAinda não há avaliações

- Entrepreneur Ship Development: DR - Gaurav GuptaDocumento17 páginasEntrepreneur Ship Development: DR - Gaurav GuptaGaurav GuptaAinda não há avaliações

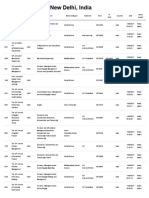

- Welcome To UGC, New Delhi, IndiaDocumento3 páginasWelcome To UGC, New Delhi, IndiaGaurav Gupta100% (1)

- Crisil RportDocumento2 páginasCrisil RportGaurav GuptaAinda não há avaliações

- Faculty in Charge: Prof - Gaurav Gupta Dr. Priti VermaDocumento13 páginasFaculty in Charge: Prof - Gaurav Gupta Dr. Priti VermaGaurav GuptaAinda não há avaliações

- Nestle India Annual Report 2014Documento88 páginasNestle India Annual Report 2014Gaurav GuptaAinda não há avaliações

- Academic Policy Document For Bachelor of Business Administration (Dual Specialization) ProgrammeDocumento6 páginasAcademic Policy Document For Bachelor of Business Administration (Dual Specialization) ProgrammeGaurav GuptaAinda não há avaliações

- DirectionDocumento14 páginasDirectionGaurav GuptaAinda não há avaliações

- Introduction of Marketing ResearchDocumento2 páginasIntroduction of Marketing ResearchGaurav GuptaAinda não há avaliações

- Academic Policy Document For Bachelor of Business Administration BBA-Entrepreneurship ProgrammeDocumento6 páginasAcademic Policy Document For Bachelor of Business Administration BBA-Entrepreneurship ProgrammeGaurav GuptaAinda não há avaliações

- Evolution of Personal Selling: Partnership Strategies Business Management NegotiationDocumento22 páginasEvolution of Personal Selling: Partnership Strategies Business Management NegotiationGaurav GuptaAinda não há avaliações

- CoronaDocumento30 páginasCoronaGaurav Gupta100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Robbie Hemingway - Text God VIP EbookDocumento56 páginasRobbie Hemingway - Text God VIP EbookKylee0% (1)

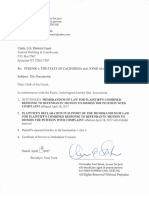

- STRUNK V THE STATE OF CALIFORNIA Etal. NYND 16-cv-1496 (BKS / DJS) OSC WITH TRO Filed 12-15-2016 For 3 Judge Court Electoral College ChallengeDocumento1.683 páginasSTRUNK V THE STATE OF CALIFORNIA Etal. NYND 16-cv-1496 (BKS / DJS) OSC WITH TRO Filed 12-15-2016 For 3 Judge Court Electoral College ChallengeChristopher Earl Strunk100% (1)

- Bankers ChoiceDocumento18 páginasBankers ChoiceArchana ThirunagariAinda não há avaliações

- Cs205-E S3dec18 KtuwebDocumento2 páginasCs205-E S3dec18 KtuwebVighnesh MuralyAinda não há avaliações

- Straw Bale ConstructionDocumento37 páginasStraw Bale ConstructionelissiumAinda não há avaliações

- Sample Valuation ReportDocumento15 páginasSample Valuation Reportayush singlaAinda não há avaliações

- Wordbank 15 Youtube Writeabout1Documento2 páginasWordbank 15 Youtube Writeabout1Olga VaizburgAinda não há avaliações

- Drawbot 1Documento4 páginasDrawbot 1SayanSanyalAinda não há avaliações

- Performance Evaluation Report For Practicum TraineesDocumento2 páginasPerformance Evaluation Report For Practicum TraineesJ.S100% (3)

- Chapter 15: Religion in The Modern World: World Religions: A Voyage of DiscoveryDocumento11 páginasChapter 15: Religion in The Modern World: World Religions: A Voyage of DiscoverysaintmaryspressAinda não há avaliações

- Cad32gd - Contactor ManualDocumento28 páginasCad32gd - Contactor Manualhassan karimiAinda não há avaliações

- Discover It For StudentsDocumento1 páginaDiscover It For StudentsVinod ChintalapudiAinda não há avaliações

- Name: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Documento2 páginasName: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Kathleen MercadoAinda não há avaliações

- Javascript NotesDocumento5 páginasJavascript NotesRajashekar PrasadAinda não há avaliações

- What Is Terrorism NotesDocumento3 páginasWhat Is Terrorism NotesSyed Ali HaiderAinda não há avaliações

- Propp Function's Types:: 1-Absentation: One of The Members of A Family Absents Himself From HomeDocumento10 páginasPropp Function's Types:: 1-Absentation: One of The Members of A Family Absents Himself From HomeRohith KumarAinda não há avaliações

- Human Capital PlanningDocumento27 páginasHuman Capital Planningalokshri25Ainda não há avaliações

- Present Perfect Tense ExerciseDocumento13 páginasPresent Perfect Tense Exercise39. Nguyễn Đăng QuangAinda não há avaliações

- Space Saving, Tight AccessibilityDocumento4 páginasSpace Saving, Tight AccessibilityTran HuyAinda não há avaliações

- PDF Synopsis PDFDocumento9 páginasPDF Synopsis PDFAllan D GrtAinda não há avaliações

- Journal Articles: Types of JournalsDocumento4 páginasJournal Articles: Types of JournalsOtieno SteveAinda não há avaliações

- AT10 Meat Tech 1Documento20 páginasAT10 Meat Tech 1Reubal Jr Orquin Reynaldo100% (1)

- Wall Panel SystemsDocumento57 páginasWall Panel SystemsChrisel DyAinda não há avaliações

- GT I9100g Service SchematicsDocumento8 páginasGT I9100g Service SchematicsMassolo RoyAinda não há avaliações

- SLTMobitel AssignmentDocumento3 páginasSLTMobitel AssignmentSupun ChandrakanthaAinda não há avaliações

- CSR Report On Tata SteelDocumento72 páginasCSR Report On Tata SteelJagadish Sahu100% (1)

- Multi Core Architectures and ProgrammingDocumento10 páginasMulti Core Architectures and ProgrammingRIYA GUPTAAinda não há avaliações

- EC105Documento14 páginasEC105api-3853441Ainda não há avaliações

- Fike ECARO-25 Frequently Asked Questions (FAQ)Documento8 páginasFike ECARO-25 Frequently Asked Questions (FAQ)Jubert RaymundoAinda não há avaliações

- Firing OrderDocumento5 páginasFiring OrderCurtler PaquibotAinda não há avaliações