Escolar Documentos

Profissional Documentos

Cultura Documentos

Cir Vs Algue

Enviado por

Yan Lean DollisonDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cir Vs Algue

Enviado por

Yan Lean DollisonDireitos autorais:

Formatos disponíveis

CIR vs. Algue Inc.

Commissioner of Internal Revenue vs. Algue Inc.

GR No. L-28896 | Feb. 17, 1988

Facts:

Algue Inc. is a domestic corp engaged in engineering, construction and other allied activities

On Jan. 14, 1965, the corp received a letter from the CIR regarding its delinquency income taxes from 1958-1959,

amtg to P83,183.85

A letter of protest or reconsideration was filed by Algue Inc on Jan 18

On March 12, a warrant of distraint and levy was presented to Algue Inc. thru its counsel, Atty. Guevara, who

refused to receive it on the ground of the pending protest

Since the protest was not found on the records, a file copy from the corp was produced and given to BIR Agent

Reyes, who deferred service of the warrant

On April 7, Atty. Guevara was informed that the BIR was not taking any action on the protest and it was only then

that he accepted the warrant of distraint and levy earlier sought to be served

On April 23, Algue filed a petition for review of the decision of the CIR with the Court of Tax Appeals

CIR contentions:

the claimed deduction of P75,000.00 was properly disallowed because it was not an ordinary reasonable or

necessary business expense

payments are fictitious because most of the payees are members of the same family in control of Algue and that

there is not enough substantiation of such payments

CTA: 75K had been legitimately paid by Algue Inc. for actual services rendered in the form of promotional fees.

These were collected by the Payees for their work in the creation of the Vegetable Oil Investment Corporation of

the Philippines and its subsequent purchase of the properties of the Philippine Sugar Estate Development Company.

Issue: W/N the Collector of Internal Revenue correctly disallowed the P75,000.00 deduction claimed by Algue as

legitimate business expenses in its income tax returns

Ruling:

Taxes are the lifeblood of the government and so should be collected without unnecessary hindrance, made in

accordance with law.

RA 1125: the appeal may be made within thirty days after receipt of the decision or ruling challenged

During the intervening period, the warrant was premature and could therefore not be served.

Originally, CIR claimed that the 75K promotional fees to be personal holding company income, but later on

conformed to the decision of CTA

There is no dispute that the payees duly reported their respective shares of the fees in their income tax returns

and paid the corresponding taxes thereon. CTA also found, after examining the evidence, that no distribution of

dividends was involved

CIR suggests a tax dodge, an attempt to evade a legitimate assessment by involving an imaginary deduction

Algue Inc. was a family corporation where strict business procedures were not applied and immediate issuance of

receipts was not required. at the end of the year, when the books were to be closed, each payee made an

accounting of all of the fees received by him or her, to make up the total of P75,000.00. This arrangement was

understandable in view of the close relationship among the persons in the family corporation

The amount of the promotional fees was not excessive. The total commission paid by the Philippine Sugar Estate

Development Co. to Algue Inc. was P125K. After deducting the said fees, Algue still had a balance of P50,000.00 as

clear profit from the transaction. The amount of P75,000.00 was 60% of the total commission. This was a

reasonable proportion, considering that it was the payees who did practically everything, from the formation of

the Vegetable Oil Investment Corporation to the actual purchase by it of the Sugar Estate properties.

Sec. 30 of the Tax Code: allowed deductions in the net income Expenses - All the ordinary and necessary

expenses paid or incurred during the taxable year in carrying on any trade or business, including a reasonable

allowance for salaries or other compensation for personal services actually rendered xxx

the burden is on the taxpayer to prove the validity of the claimed deduction

In this case, Algue Inc. has proved that the payment of the fees was necessary and reasonable in the light of the

efforts exerted by the payees in inducing investors and prominent businessmen to venture in an experimental

enterprise and involve themselves in a new business requiring millions of pesos.

Taxes are what we pay for civilization society. Without taxes, the government would be paralyzed for lack of the

motive power to activate and operate it. Hence, despite the natural reluctance to surrender part of one's hard

earned income to the taxing authorities, every person who is able to must contribute his share in the running of

the government. The government for its part, is expected to respond in the form of tangible and intangible

benefits intended to improve the lives of the people and enhance their moral and material values

Taxation must be exercised reasonably and in accordance with the prescribed procedure. If it is not, then the

taxpayer has a right to complain and the courts will then come to his succor

Algue Inc.s appeal from the decision of the CIR was filed on time with the CTA in accordance with Rep.

Act No. 1125. And we also find that the claimed deduction by Algue Inc. was permitted under the

Internal Revenue Code and should therefore not have been disallowed by the CIR

Você também pode gostar

- CIR vs. AlgueDocumento1 páginaCIR vs. AlgueprincessconsuelaAinda não há avaliações

- Cir vs. Algue DigestDocumento1 páginaCir vs. Algue DigestTinyssa Paguio50% (2)

- 14 Philippine Fisheries Development Authority Vs CADocumento2 páginas14 Philippine Fisheries Development Authority Vs CAPia SottoAinda não há avaliações

- ATP01 - 03 - Eurotech Industrial Technologies, Inc. vs. CuizonDocumento1 páginaATP01 - 03 - Eurotech Industrial Technologies, Inc. vs. CuizonLea Gabrielle FariolaAinda não há avaliações

- CIR vs. BOAC 1987Documento17 páginasCIR vs. BOAC 1987JoyceAinda não há avaliações

- CIR vs. ESTATE OF BENIGNO TODADocumento2 páginasCIR vs. ESTATE OF BENIGNO TODAAngela Mericci G. Mejia100% (1)

- Domingo vs. Garlitos (8 SCRA 443, G.R. No. L-18994, June 29, 1963)Documento2 páginasDomingo vs. Garlitos (8 SCRA 443, G.R. No. L-18994, June 29, 1963)Kent UgaldeAinda não há avaliações

- Francia V IACDocumento2 páginasFrancia V IACChino SisonAinda não há avaliações

- Chaves Vs OngpinDocumento2 páginasChaves Vs OngpinkizztarAinda não há avaliações

- Cir Vs Estate of Benigno TodaDocumento2 páginasCir Vs Estate of Benigno TodaHarvey Leo RomanoAinda não há avaliações

- Hilado v. CIRDocumento1 páginaHilado v. CIRJoy RaguindinAinda não há avaliações

- Davao Gulf Lumber Corporation V Cir July 23Documento2 páginasDavao Gulf Lumber Corporation V Cir July 23IyahAinda não há avaliações

- Digests TaxDocumento17 páginasDigests TaxMav ZamoraAinda não há avaliações

- 51 Raymundo v. Luneta MotorDocumento2 páginas51 Raymundo v. Luneta MotorJul A.Ainda não há avaliações

- 04 CIR v. St. Lukes Medical Center IncDocumento3 páginas04 CIR v. St. Lukes Medical Center IncMark Anthony Javellana SicadAinda não há avaliações

- Smart Communications Vs City of DavaoDocumento1 páginaSmart Communications Vs City of DavaoMark Gabriel B. MarangaAinda não há avaliações

- Pal vs. Edu DigestDocumento2 páginasPal vs. Edu DigestVincent Ferrer100% (3)

- Minimum Corporate Income Tax Cir Vs Pal GR. No.: 180066 May 2009Documento1 páginaMinimum Corporate Income Tax Cir Vs Pal GR. No.: 180066 May 2009Royalhighness18Ainda não há avaliações

- Caltex Philippines v. Commission On Audit - Page 5Documento13 páginasCaltex Philippines v. Commission On Audit - Page 5Roma MicuAinda não há avaliações

- CD - 6. Tio v. Videogram Regulatory BoardDocumento1 páginaCD - 6. Tio v. Videogram Regulatory BoardAlyssa Alee Angeles JacintoAinda não há avaliações

- Planters Product Vs Fertiphil Corp DigestDocumento1 páginaPlanters Product Vs Fertiphil Corp Digestristocrat100% (1)

- Phil. Guaranty Co. v. CIRDocumento2 páginasPhil. Guaranty Co. v. CIRIshAinda não há avaliações

- CIR vs. Cebu Portland Cement Company and CTA, G.R. No. L-29059, December 15, 1987Documento6 páginasCIR vs. Cebu Portland Cement Company and CTA, G.R. No. L-29059, December 15, 1987Emil BautistaAinda não há avaliações

- GR 182729 Kukan Intl Corp Vs Amor ReyesDocumento10 páginasGR 182729 Kukan Intl Corp Vs Amor ReyesNesrene Emy LlenoAinda não há avaliações

- Week Three Case DigestDocumento4 páginasWeek Three Case DigestdondzAinda não há avaliações

- LTO Vs City of ButuanDocumento3 páginasLTO Vs City of ButuanhappymabeeAinda não há avaliações

- Ernesto M. Maceda, vs. Hon. Catalino Macaraig, JR., in His Capacity As Executive SecretaryDocumento1 páginaErnesto M. Maceda, vs. Hon. Catalino Macaraig, JR., in His Capacity As Executive SecretaryI.G. Mingo MulaAinda não há avaliações

- Civil Procedure - Atty. Custodio AY 2018 - 2019 (1st Sem) Joan PernesDocumento12 páginasCivil Procedure - Atty. Custodio AY 2018 - 2019 (1st Sem) Joan PernesGillian BrionesAinda não há avaliações

- Digests Tax I (2003)Documento57 páginasDigests Tax I (2003)Berne Guerrero92% (13)

- Naguiat V CADocumento3 páginasNaguiat V CADinnah Mae AlconeraAinda não há avaliações

- Hilado Vs CIRDocumento6 páginasHilado Vs CIRMi AmoreAinda não há avaliações

- Pascual V Secretary of Public Works and Communications (Summary)Documento2 páginasPascual V Secretary of Public Works and Communications (Summary)Coyzz de GuzmanAinda não há avaliações

- DEUTSCHE BANK vs. CIRDocumento2 páginasDEUTSCHE BANK vs. CIRStef Ocsalev100% (1)

- 241-Cagayan Electric Light & Power Co. v. CIR G.R. No. L-60126 September 25, 1985Documento2 páginas241-Cagayan Electric Light & Power Co. v. CIR G.R. No. L-60126 September 25, 1985Jopan SJAinda não há avaliações

- Case DigestDocumento10 páginasCase DigestEqui TinAinda não há avaliações

- Tax Case DigestsDocumento107 páginasTax Case DigestsMenchu G. Maban100% (1)

- Cir v. Estate of Benigno Toda, JRDocumento2 páginasCir v. Estate of Benigno Toda, JRJf Maneja100% (3)

- BANCO DE ORO V REPUBLICDocumento2 páginasBANCO DE ORO V REPUBLICJoanna Reyes100% (1)

- CIR Vs Tokyo ShippingDocumento2 páginasCIR Vs Tokyo ShippingKim Lorenzo Calatrava100% (1)

- Diaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Documento24 páginasDiaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Alfred GarciaAinda não há avaliações

- 142-Heng Tong Textiles Co., Inc. v. CIR, August 26, 1968Documento2 páginas142-Heng Tong Textiles Co., Inc. v. CIR, August 26, 1968Jopan SJAinda não há avaliações

- 001 CIR v. Algue and CTADocumento2 páginas001 CIR v. Algue and CTAEarlAinda não há avaliações

- Transpo Cases and NotesDocumento579 páginasTranspo Cases and NotesPaul Christopher PinedaAinda não há avaliações

- Mactan Cebu International Airport Authority Vs MarcosDocumento3 páginasMactan Cebu International Airport Authority Vs MarcosRaymond RoqueAinda não há avaliações

- CALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentsDocumento5 páginasCALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentspatrickAinda não há avaliações

- Nirc Codal ProvisionsDocumento165 páginasNirc Codal ProvisionsGia Remo100% (2)

- CIR Vs Isabela Cultural CorporationDocumento2 páginasCIR Vs Isabela Cultural CorporationLauren KeiAinda não há avaliações

- Tan V. Rodil: What Need Not Be Proved: Judicial AdmissionsDocumento3 páginasTan V. Rodil: What Need Not Be Proved: Judicial AdmissionsclarkorjaloAinda não há avaliações

- Case 182 - Limitations On Revenue, Appropriations and Tariff MeasuresDocumento3 páginasCase 182 - Limitations On Revenue, Appropriations and Tariff MeasuresannamariepagtabunanAinda não há avaliações

- Bank of The Philippine Islands Vs Casa Montessorri InternationaleDocumento5 páginasBank of The Philippine Islands Vs Casa Montessorri InternationaleEdgardo MimayAinda não há avaliações

- Paterno Santos V Rod of ManilaDocumento4 páginasPaterno Santos V Rod of ManilaDiane Dee YaneeAinda não há avaliações

- Assignment No. 9 Rules On AccessionDocumento21 páginasAssignment No. 9 Rules On AccessionyetyetAinda não há avaliações

- Balmaceda Vs CorominasDocumento9 páginasBalmaceda Vs Corominaskoey100% (1)

- Issue: W/N The Collector of Internal RevenueDocumento2 páginasIssue: W/N The Collector of Internal RevenueRalph Romeo BasconesAinda não há avaliações

- Commissioner of InternalDocumento3 páginasCommissioner of InternalNaif OmarAinda não há avaliações

- General Principles of TaxationDocumento2 páginasGeneral Principles of TaxationemgraceAinda não há avaliações

- CIR Vs Algue IncDocumento2 páginasCIR Vs Algue IncQuoleteAinda não há avaliações

- G.R. No. L-28896Documento7 páginasG.R. No. L-28896Klein CarloAinda não há avaliações

- Commissioner of Internal Revenue vs. Algue IncDocumento8 páginasCommissioner of Internal Revenue vs. Algue IncBesprenPaoloSpiritfmLucenaAinda não há avaliações

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsDocumento9 páginasCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsPer PerAinda não há avaliações

- In God's Will, I Will Become A Lawyer. Pray, Study Hard and Everything Will Follow. Atty (.) Rhea L. DollisonDocumento1 páginaIn God's Will, I Will Become A Lawyer. Pray, Study Hard and Everything Will Follow. Atty (.) Rhea L. DollisonYan Lean DollisonAinda não há avaliações

- Buzzdock Ads: Kumonekta Sa Mga Kaibigan Online. Sumali Sa Grupong Facebook - Libre!Documento3 páginasBuzzdock Ads: Kumonekta Sa Mga Kaibigan Online. Sumali Sa Grupong Facebook - Libre!Yan Lean DollisonAinda não há avaliações

- Penalties in GeneralDocumento30 páginasPenalties in GeneralYan Lean DollisonAinda não há avaliações

- Jud AffDocumento4 páginasJud AffYan Lean DollisonAinda não há avaliações

- Cus Tom KƏSTƏM/ : "The Old English Custom of Dancing Around The Maypole" Synonyms:, ,, ,, ,,, M OreDocumento1 páginaCus Tom KƏSTƏM/ : "The Old English Custom of Dancing Around The Maypole" Synonyms:, ,, ,, ,,, M OreYan Lean DollisonAinda não há avaliações

- Philippine Tariff FinderDocumento1 páginaPhilippine Tariff FinderYan Lean DollisonAinda não há avaliações

- Sanc Tion Sang (K) SH (Ə) NDocumento2 páginasSanc Tion Sang (K) SH (Ə) NYan Lean DollisonAinda não há avaliações

- For Other Uses, See and - This Article Is About A - For The Theory of Law, See - "Legal Concept" Redirects HereDocumento2 páginasFor Other Uses, See and - This Article Is About A - For The Theory of Law, See - "Legal Concept" Redirects HereYan Lean DollisonAinda não há avaliações

- VatDocumento1 páginaVatYan Lean DollisonAinda não há avaliações

- Construing Bigamy and Articles 40 and 41: What Went Wrong?Documento13 páginasConstruing Bigamy and Articles 40 and 41: What Went Wrong?Yan Lean DollisonAinda não há avaliações

- Breaking BadDocumento3 páginasBreaking BadYan Lean DollisonAinda não há avaliações

- Levels of Organization: LEVEL 1 - CellsDocumento2 páginasLevels of Organization: LEVEL 1 - CellsYan Lean DollisonAinda não há avaliações

- GalaxyDocumento1 páginaGalaxyYan Lean DollisonAinda não há avaliações

- Biology: For Other Uses, SeeDocumento1 páginaBiology: For Other Uses, SeeYan Lean DollisonAinda não há avaliações

- Ethics: (Eth-Iks) IPA SyllablesDocumento1 páginaEthics: (Eth-Iks) IPA SyllablesYan Lean DollisonAinda não há avaliações

- Filipino Drama in Japanese PeriodDocumento1 páginaFilipino Drama in Japanese PeriodYan Lean DollisonAinda não há avaliações

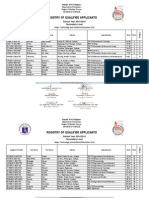

- Registry of Qualified Applicants: School Year 2014-2015 Secondary LevelDocumento5 páginasRegistry of Qualified Applicants: School Year 2014-2015 Secondary LevelYan Lean DollisonAinda não há avaliações

- Del Rosario Vs FerrerDocumento2 páginasDel Rosario Vs FerrerYan Lean Dollison100% (1)

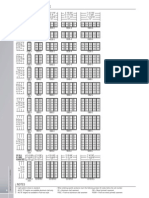

- Sizing Windows 400series Casement Casement AwningtransomDocumento3 páginasSizing Windows 400series Casement Casement AwningtransomYan Lean Dollison100% (1)

- SPES 2015 Application FormDocumento1 páginaSPES 2015 Application FormYan Lean DollisonAinda não há avaliações

- Casement ElevationsDocumento10 páginasCasement ElevationsYan Lean DollisonAinda não há avaliações

- Statistics and Data CollectionDocumento11 páginasStatistics and Data CollectionRichimon LicerioAinda não há avaliações

- October 2014 1413376166 06 PDFDocumento3 páginasOctober 2014 1413376166 06 PDFDineshAinda não há avaliações

- Criminal InvestigationDocumento11 páginasCriminal Investigationjohn martin urbinaAinda não há avaliações

- Brochure Bucket SolutionsDocumento20 páginasBrochure Bucket Solutionsmuhammad febri faizinAinda não há avaliações

- Motivation MBADocumento31 páginasMotivation MBAAkshitaAinda não há avaliações

- Title Toolbox 1 ADocumento2 páginasTitle Toolbox 1 AGet LiveHelpAinda não há avaliações

- ReflectionDocumento2 páginasReflectionBảo HàAinda não há avaliações

- Bcos 186Documento3 páginasBcos 186Shiv KumarAinda não há avaliações

- Essentials of Materials Science and Engineering Si Edition 3rd Edition Askeland Solutions ManualDocumento11 páginasEssentials of Materials Science and Engineering Si Edition 3rd Edition Askeland Solutions Manualjeffreyhayesagoisypdfm100% (13)

- 10 Biological-HazardsDocumento31 páginas10 Biological-HazardsjvAinda não há avaliações

- Install NotesDocumento6 páginasInstall NotesSchweinsteiger NguyễnAinda não há avaliações

- AtharvasheershamDocumento5 páginasAtharvasheershamforthegroupsAinda não há avaliações

- Material Safety Data Sheet: Manufacturer Pt. Bital AsiaDocumento3 páginasMaterial Safety Data Sheet: Manufacturer Pt. Bital AsiaediAinda não há avaliações

- NMC CBT Sample Q&a Part 3 AcDocumento14 páginasNMC CBT Sample Q&a Part 3 AcJoane FranciscoAinda não há avaliações

- WWW Creativebloq Com Infographic Tools 2131971Documento20 páginasWWW Creativebloq Com Infographic Tools 2131971Martin_Arrieta_GAinda não há avaliações

- Airplus CDF3 Technical SpecsDocumento38 páginasAirplus CDF3 Technical Specssadik FreelancerAinda não há avaliações

- Implementasi Fault Management (Manajemen Kesalahan) Pada Network Management System (NMS) Berbasis SNMPDocumento11 páginasImplementasi Fault Management (Manajemen Kesalahan) Pada Network Management System (NMS) Berbasis SNMPIwoncl AsranAinda não há avaliações

- Regional Trial Court National Capital Judicial Region: ComplainantDocumento5 páginasRegional Trial Court National Capital Judicial Region: ComplainantNeil Patrick QuiniquiniAinda não há avaliações

- Antibullying Presentation 1Documento23 páginasAntibullying Presentation 1Martin Ceazar HermocillaAinda não há avaliações

- South WestDocumento1 páginaSouth WestDarren RadonsAinda não há avaliações

- Settlement Geography: Unit No-1&2Documento11 páginasSettlement Geography: Unit No-1&2Arindam RoulAinda não há avaliações

- Wipro Home Office RangeDocumento8 páginasWipro Home Office RangePrashant RawatAinda não há avaliações

- Learning Competencies: Table of SpecificationDocumento2 páginasLearning Competencies: Table of Specificationyolanda renos0% (1)

- Legal Framework On Sexual Violence in Sri Lanka - Policy BriefDocumento4 páginasLegal Framework On Sexual Violence in Sri Lanka - Policy BriefwmcsrilankaAinda não há avaliações

- Contractions 29.01Documento1 páginaContractions 29.01Katita la OriginalAinda não há avaliações

- SwahiliDocumento7 páginasSwahiliMohammedAinda não há avaliações

- Dialogue-2: Problem of Our CountryDocumento6 páginasDialogue-2: Problem of Our CountrysiamAinda não há avaliações

- (Bible in History - La Bible Dans L'histoire 8) John T. Willis - Yahweh and Moses in Conflict - The Role of Exodus 4-24-26 in The Book of Exodus-Peter Lang International Academic Publishers (2010)Documento244 páginas(Bible in History - La Bible Dans L'histoire 8) John T. Willis - Yahweh and Moses in Conflict - The Role of Exodus 4-24-26 in The Book of Exodus-Peter Lang International Academic Publishers (2010)Anonymous s3LTiHpc8100% (2)

- STAS 111 - Information AgeDocumento20 páginasSTAS 111 - Information AgeMayeee GayosoAinda não há avaliações

- This Study Resource WasDocumento2 páginasThis Study Resource Waskaye nicolasAinda não há avaliações