Escolar Documentos

Profissional Documentos

Cultura Documentos

Flowchart Remedies of A Taxpayer

Enviado por

Rab Thomas BartolomeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Flowchart Remedies of A Taxpayer

Enviado por

Rab Thomas BartolomeDireitos autorais:

Formatos disponíveis

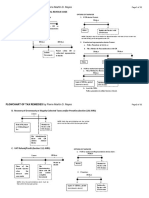

Flowchart VIII: Taxpayers Remedies from Customs AssessmentTariff and Customs Code

START

Collector causes

entry of imported

goods in customs

house

178

Taxpayer pays under protest. File

written protest within 15 days from

payment

Collector

assesses duties

Protest made

within 15 days?

Action of collector

becomes final and

conclusive (Sec.

2309)

No

Yes

Appeal made

within 15 days

from notice?

Taxpayer appeals

to the

Commissioner

within 15 days

from notice

Collector conducts

hearing within 15

days from receipt of

protest. Decide within

30 days

Collectors

decision in favor

of taxpayer/

adverse to govt?

No

END

Yes

No

Customs

Commissioner

decides

Automatic review by

Customs

Commissioner

Yes

Customs Commissioner decides

Commissioners

decision made

within 30 days

from receipt of

record?

Yes

Commissioners

decision in favor of

taxpayer/adverse

to govt?

no

Decision of

collector becomes

final (sec. 2313)

Commissioners

decision in favor of

taxpayer/adverse

to govt?

Yes

Automatic review

by Sec of Finance

(CMO 3-2002, Sec

2315)

SOFs Decision

made within 30

days from

receipt of

record?

END

Yes

Yes

Is decision in

favor of

taxpayer/

adverse to

govt?

No

No

Decision becomes

final and executory

(sec. 2313)

Yes

No

Appeal to the CTA Division

within 30 days from receipt of

decision of Commissioner/

SOF (Sec.2401/RA9282)

MR within 15 days

from receipt of

decision

END

No

Appeal to CTA en banc

15 days from receipt of

decision denying MR

Appeal to the

Supreme Court

w/in 15 days

END

179

Você também pode gostar

- Notes On Tax Remedies of The Government and TaxpayersDocumento74 páginasNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- Tax RemediesDocumento51 páginasTax RemediesBevz23100% (6)

- Tax Rem FlowchartDocumento4 páginasTax Rem FlowchartDennisSaycoAinda não há avaliações

- Tax Administration Powers and RemediesDocumento16 páginasTax Administration Powers and Remediescristiepearl100% (6)

- Flowchart of Tax Remedies I. Remedies UnDocumento12 páginasFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Remedies and Additions To Tax Handouts PDFDocumento13 páginasTax Remedies and Additions To Tax Handouts PDFdang0% (1)

- Legal MaximsDocumento72 páginasLegal Maximsk0ch3100% (2)

- Tax Remedies Principles and CasesDocumento75 páginasTax Remedies Principles and CasesGeorge PandaAinda não há avaliações

- Answer With Counterclaims COMES NOW DefendantDocumento6 páginasAnswer With Counterclaims COMES NOW DefendantRab Thomas BartolomeAinda não há avaliações

- Review Business and Transfer TaxDocumento201 páginasReview Business and Transfer TaxReginald ValenciaAinda não há avaliações

- Improperly Accumulated Earnings TaxDocumento4 páginasImproperly Accumulated Earnings TaxSophia OñateAinda não há avaliações

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocumento20 páginasW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzAinda não há avaliações

- Final Tax LectureDocumento7 páginasFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Tax Remedies in Flowchart 102019Documento2 páginasTax Remedies in Flowchart 102019Cecilbern ayen BernabeAinda não há avaliações

- Taxation Under The Train Law: 1 - PageDocumento30 páginasTaxation Under The Train Law: 1 - PageMae50% (2)

- Republic vs. Mercadera Case DigestDocumento1 páginaRepublic vs. Mercadera Case DigestRab Thomas BartolomeAinda não há avaliações

- TAX REMEDIES by Sababan Reviewer 2008 EdDocumento11 páginasTAX REMEDIES by Sababan Reviewer 2008 Edolaydyosa95% (20)

- Tax Remedies under NIRCDocumento32 páginasTax Remedies under NIRCCire GeeAinda não há avaliações

- Tax Judicial Remedies of GovernmentDocumento34 páginasTax Judicial Remedies of GovernmentNoullen Banuelos100% (5)

- Agency ReviewerDocumento20 páginasAgency ReviewerJingJing Romero92% (72)

- The Rules On Recovery of Tax Erroneously or Illegally Collected Can Be Found Under Section 229 of The Tax CodeDocumento2 páginasThe Rules On Recovery of Tax Erroneously or Illegally Collected Can Be Found Under Section 229 of The Tax CodeFrancisJosefTomotorgoGoingo100% (1)

- Value Added Taxes Part 1 ExplainedDocumento75 páginasValue Added Taxes Part 1 ExplainedLEILALYN NICOLAS100% (1)

- Tax RemediesDocumento13 páginasTax RemediesYan MoretzAinda não há avaliações

- RA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsDocumento66 páginasRA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsAgui S. T. PadAinda não há avaliações

- PM Reyes Tax Audit Assessment Primer PDFDocumento6 páginasPM Reyes Tax Audit Assessment Primer PDFAnge Buenaventura SalazarAinda não há avaliações

- Flowchart Remedies of A TaxpayerDocumento2 páginasFlowchart Remedies of A TaxpayerRab Thomas BartolomeAinda não há avaliações

- NIRC - Notes On Accounting Periods and Methods of AccountingDocumento5 páginasNIRC - Notes On Accounting Periods and Methods of AccountingJeff SarabusingAinda não há avaliações

- Taxpayer Tax Assessment Process BIR IssuesDocumento3 páginasTaxpayer Tax Assessment Process BIR IssuesPetrovich Tamag50% (4)

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocumento38 páginasBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoAinda não há avaliações

- Flowchart Remedies of A TaxpayerDocumento2 páginasFlowchart Remedies of A TaxpayerGENEVIE TALANG0% (1)

- Answer For Saturday Legal FormsDocumento6 páginasAnswer For Saturday Legal FormsRab Thomas BartolomeAinda não há avaliações

- Notes On VATDocumento15 páginasNotes On VATRica BlancaAinda não há avaliações

- TaxationBarQ26A TaxRemediesDocumento32 páginasTaxationBarQ26A TaxRemediesjuneson agustinAinda não há avaliações

- Assessment Process FlowchartDocumento4 páginasAssessment Process FlowchartMaria Reylan GarciaAinda não há avaliações

- Fujiki vs. Marinay Case DigestDocumento1 páginaFujiki vs. Marinay Case DigestRab Thomas Bartolome100% (4)

- Fujiki vs. Marinay Case DigestDocumento1 páginaFujiki vs. Marinay Case DigestRab Thomas Bartolome100% (4)

- Tax Review Q and A Quiz 1 and 2 FinalsDocumento19 páginasTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaAinda não há avaliações

- Deductions On Gross IncomeDocumento34 páginasDeductions On Gross IncomeKathlyn PostreAinda não há avaliações

- Tax Remedies Under The NircDocumento119 páginasTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- YTLC Tax Remedy FlowchartDocumento3 páginasYTLC Tax Remedy Flowchartalfx216100% (1)

- VAT Guide: Understanding Value-Added Tax PrinciplesDocumento32 páginasVAT Guide: Understanding Value-Added Tax Principlessei1davidAinda não há avaliações

- Tax Remedies ReviewerDocumento9 páginasTax Remedies ReviewerheirarchyAinda não há avaliações

- Police Senior Superintendent Macawadib vs. PNP Case DigestDocumento1 páginaPolice Senior Superintendent Macawadib vs. PNP Case DigestRab Thomas BartolomeAinda não há avaliações

- VAT 101: Understanding Value Added TaxDocumento13 páginasVAT 101: Understanding Value Added TaxKara Clark100% (1)

- Complaint - Sample PleadingDocumento7 páginasComplaint - Sample PleadingBryan Arias100% (1)

- Valencia & Roxas Income Taxation - IndividualsDocumento12 páginasValencia & Roxas Income Taxation - IndividualsJonathan Junio100% (1)

- Senior Citizen and PWD Benefits ActDocumento8 páginasSenior Citizen and PWD Benefits ActAngelica Nicole TamayoAinda não há avaliações

- Consumption Tax RulesDocumento8 páginasConsumption Tax RulesDenvyl MangsatAinda não há avaliações

- 3 Floor, Business & Engineering Building, Matina, Davao City Telefax: (082) 300-1496 Phone No.: (082) 244-34-00 Local 137Documento13 páginas3 Floor, Business & Engineering Building, Matina, Davao City Telefax: (082) 300-1496 Phone No.: (082) 244-34-00 Local 137Abigail Ann PasiliaoAinda não há avaliações

- Everything You Need to Know About Value-Added Tax (VATDocumento67 páginasEverything You Need to Know About Value-Added Tax (VATkmabcdeAinda não há avaliações

- Calculating Output VAT on Sales of Goods and PropertiesDocumento118 páginasCalculating Output VAT on Sales of Goods and PropertiesRenz Francis LimAinda não há avaliações

- Accounting Review: TaxationDocumento3 páginasAccounting Review: TaxationPatriciaAinda não há avaliações

- Taxation Answer Key Highlights Business VAT RulesDocumento11 páginasTaxation Answer Key Highlights Business VAT RulesKim AranasAinda não há avaliações

- Tax 2 Flexible Obtl Midyear 2021Documento13 páginasTax 2 Flexible Obtl Midyear 2021Jamaica DavidAinda não há avaliações

- Regular Output Vat 1Documento39 páginasRegular Output Vat 1Samantha Tayone100% (1)

- Gross Incom TaxationDocumento32 páginasGross Incom TaxationSummer ClaronAinda não há avaliações

- Accountancy Department: Taxation Quizzer (Transfer and Business Tax)Documento2 páginasAccountancy Department: Taxation Quizzer (Transfer and Business Tax)Kenneth Bryan Tegerero Tegio100% (1)

- Notes On Value Added TaxDocumento7 páginasNotes On Value Added TaxPines MacapagalAinda não há avaliações

- Chapter 2 Part 4 Income TaxDocumento50 páginasChapter 2 Part 4 Income TaxGirlie Kaye Onongen PagtamaAinda não há avaliações

- Price Tag Laws in The PhilippinesDocumento2 páginasPrice Tag Laws in The PhilippinesCjhay MarcosAinda não há avaliações

- Corporate Income Tax RateDocumento3 páginasCorporate Income Tax RateJuliana ChengAinda não há avaliações

- Implementing The Government Accounting Manual (Gam) : (For National Government Agencies)Documento25 páginasImplementing The Government Accounting Manual (Gam) : (For National Government Agencies)Joann Rivero-SalomonAinda não há avaliações

- TAXATION ON INDIVIDUALS Lecture NotesDocumento4 páginasTAXATION ON INDIVIDUALS Lecture NotesLucille Rose MamburaoAinda não há avaliações

- Procedure in Protest Cases - TCCDocumento2 páginasProcedure in Protest Cases - TCCattyaarongocpa9645Ainda não há avaliações

- Issues On Remedies Under TCCDocumento18 páginasIssues On Remedies Under TCCLheila MendozaAinda não há avaliações

- Train LawDocumento3 páginasTrain LawREVERITA BUGTONGAinda não há avaliações

- The Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Documento10 páginasThe Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Daryl DumayasAinda não há avaliações

- 12 - Handout - 1 RemediesDocumento5 páginas12 - Handout - 1 RemediesAldrin John HiposAinda não há avaliações

- Chio, Rahma S. - Tax Ii AssignmentDocumento4 páginasChio, Rahma S. - Tax Ii AssignmentPIKACHUCHIEAinda não há avaliações

- Case 4Documento1 páginaCase 4Rab Thomas BartolomeAinda não há avaliações

- Case 1Documento1 páginaCase 1Rab Thomas BartolomeAinda não há avaliações

- Case 3Documento1 páginaCase 3Rab Thomas BartolomeAinda não há avaliações

- CA Rules on Filing of Petition for ReviewDocumento2 páginasCA Rules on Filing of Petition for ReviewRab Thomas BartolomeAinda não há avaliações

- LGU MR JurisprudenceDocumento2 páginasLGU MR JurisprudenceRab Thomas BartolomeAinda não há avaliações

- Case 2Documento1 páginaCase 2Rab Thomas BartolomeAinda não há avaliações

- Artemis JurisprudenceDocumento2 páginasArtemis JurisprudenceRab Thomas BartolomeAinda não há avaliações

- Jurisprudence MFEDocumento2 páginasJurisprudence MFERab Thomas BartolomeAinda não há avaliações

- Conflicts of Law Set B CasesDocumento10 páginasConflicts of Law Set B CasesRab Thomas BartolomeAinda não há avaliações

- Labor JurisprudenceDocumento4 páginasLabor JurisprudenceRab Thomas BartolomeAinda não há avaliações

- Direct Examination On Civil AspectDocumento1 páginaDirect Examination On Civil AspectRab Thomas BartolomeAinda não há avaliações

- Rescission of reciprocal obligationsDocumento2 páginasRescission of reciprocal obligationsRab Thomas BartolomeAinda não há avaliações

- Business OrgDocumento5 páginasBusiness OrgRab Thomas BartolomeAinda não há avaliações

- A Comprehensive Report On The Tariff and Customs CodeDocumento15 páginasA Comprehensive Report On The Tariff and Customs CodeRab Thomas BartolomeAinda não há avaliações

- Poli Review 2015Documento15 páginasPoli Review 2015Rab Thomas BartolomeAinda não há avaliações

- Adoption of Stephanie Nathy AstorgaDocumento1 páginaAdoption of Stephanie Nathy AstorgaRab Thomas BartolomeAinda não há avaliações

- Flowchart JudicialDocumento2 páginasFlowchart JudicialRab Thomas BartolomeAinda não há avaliações

- Criminal Law OutlineDocumento3 páginasCriminal Law OutlineRab Thomas BartolomeAinda não há avaliações

- Rule 79 Guzman Vs AngelesDocumento4 páginasRule 79 Guzman Vs AngelesRab Thomas BartolomeAinda não há avaliações