Escolar Documentos

Profissional Documentos

Cultura Documentos

Problem 10 and 13

Enviado por

jiiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Problem 10 and 13

Enviado por

jiiDireitos autorais:

Formatos disponíveis

MGT111

M.A. Perez

Problem 10

Classify the following items as:

a) Deferred expense (prepaid expense)

b) Deferred revenue (unearned revenue)

c) Accrued expense (accrued liability)

d) Accrued revenue (accrued asset)

e) Depreciation

1. A three-year premium paid on a fire insurance policy.

2. Utilities owed but not yet paid.

3. Supplies on hand.

4. Salary owed but not yet paid.

5. Interest owed but payable in the following period.

6. Subscriptions received in advance by a newspaper publisher.

7. Professional Fees received but not yet earned.

8. Professional Fees earned but not yet received.

9. Interest paid in advance from a bank loan.

10. Rent collected in advance.

11. Services rendered but uncollected.

12. Advertising paid in advance for 3 months.

13. Income collected but not yet earned.

14. Rent paid in advance.

15. Interest collected in advance by the creditor.

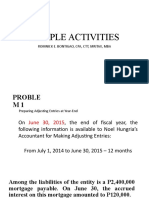

Problem 11 (Weygant, et al, page 122)

Greg Toohey opened a dental practice on 1 January. During the first month of operations the following transactions occurred.

1.

2.

3.

4.

5.

Performed services for patients. As at 31 January, P1,560 of such services was earned but not yet recorded.

Utility expense incurred but not paid prior to 31 January totaled P800.

Purchased dental equipment on 1 January for P80,000, paying P20,000 in cash and signing a P60,000, 3 year-note payable. The equipment

depreciates P400 per month. Interest is P500 per month.

Purchased a 1-year professional indemnity insurance policy on 1 January for P24,000.

Purchased P1,600 of dental supplies. On 31 January, determined that P800 of supplies were on hand.

Instructions:

Prepare the adjusting entries on 31 January. Account titles are Accumulated Depreciation Dental Equipment, Depreciation Expense, Service Revenue,

Account Receivable, Insurance Expense, Interest Expense, Interest Payable, Prepaid Insurance, Supplies, Supplies Expense, Utilities Expense and

Utilities Payable.

Problem 12

Selected account balances before adjustment for Horizon Company at December 31, 2012 are as follows:

Accounts Receivable

Supplies

4,625

1,375

Prepaid Rent

15,000

Equipment

16,250

Accumulated Depreciation

4,450

Wages Payable

Unearned Fees

3,500

Fees Earned

Wages Expense

48,975

19,700

Rent Expense

Depreciation Expense

Supplies Expense

MGT111

M.A. Perez

Data needed for year-end adjustments are as follows:

a)

b)

c)

d)

e)

f)

Unbilled fees at December 31, P1,575.

Supplies on hand at December 31, P278.

Rent expired during the year, P9,000.

Equipment was purchased on January 1, 2010 with estimated salvage value of P2,900 and 6 years useful life.

Unearned Fees at December 31, P2,700.

Wages accrued but unpaid at December 31, P438.

Required:

Journalize the adjusting entries required at December 31, 2012.

Show computations after each entry if any.

Problem 13 (Weygant, et al, page 165-166)

The adjusted trial balance columns of the worksheet for Quickest Typing are as follows.

QUICKEST TYPING

Worksheet (Partial)

For the month ended 30 April 2010

Account Titles

Adjusted Trial Balance

Dr

Cr

Cash

29,504

Accounts Receivable

15,680

Prepaid Rent

Equipment

Income Statement

Dr

9,842

11,400

Accounts Payable

11,344

V. Quickest, Capital

67,920

7,300

Service Revenue

25,180

19,680

Rent Expense

1.520

Depreciation Expense

1,342

Interest Expense

114

Interest Payable

Total

Cr

46,100

Notes Payable

Salaries Expense

Cr

4,560

Accumulated Depreciation

V. Quickest Drawings

Cr

Balance Sheet

114

125,800

125,800

Net Income or (Net Loss)

T O TAL S

Instructions:

1.

2.

3.

4.

5.

Complete the worksheet.

The owner did not make any additional investments in the business in April. Prepare an Income Statement, Statement of Changes in

Equity and a classified Statement of Financial Position.

Journalize the closing entries as at 30 April.

Post the closing entries to Profit and Loss Summary and V. Quickest, Capital. Use T- Accounts.

Prepare a post- closing trial balance as at 30 April

Você também pode gostar

- Prob Basic AcctDocumento3 páginasProb Basic AcctSamuel Ferolino50% (2)

- Chapter 3 ExercisesDocumento9 páginasChapter 3 ExercisesDyenAinda não há avaliações

- Gfia - 10 1Documento55 páginasGfia - 10 1Dan Lachica NarcisoAinda não há avaliações

- Chapter 1 - 2 Problems Problem 1: RequiredDocumento5 páginasChapter 1 - 2 Problems Problem 1: RequiredManpreet SinghAinda não há avaliações

- Unit V - Audit of Employee Benefits - Final - T31415 PDFDocumento5 páginasUnit V - Audit of Employee Benefits - Final - T31415 PDFSed ReyesAinda não há avaliações

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocumento11 páginasName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaAinda não há avaliações

- Adjustments Quiz 1Documento5 páginasAdjustments Quiz 1Christine Mae BurgosAinda não há avaliações

- Income Tax 2Documento12 páginasIncome Tax 2You're WelcomeAinda não há avaliações

- (Problems) - Audit of Prepayments and Intangible AssetsDocumento13 páginas(Problems) - Audit of Prepayments and Intangible Assetsapatos0% (1)

- Week 4 Discussion ProblemsDocumento10 páginasWeek 4 Discussion ProblemsGokul Kumar100% (1)

- ACCTBA1 - Quiz 2Documento4 páginasACCTBA1 - Quiz 2Marie Beth BondestoAinda não há avaliações

- ACT 501 - AssignmentDocumento6 páginasACT 501 - AssignmentShariful Islam ShaheenAinda não há avaliações

- (Module 4) ExerciseDocumento10 páginas(Module 4) ExerciseYanie Dela CruzAinda não há avaliações

- Wrwftauditing Problems Watitiw: Page 1 of 7Documento7 páginasWrwftauditing Problems Watitiw: Page 1 of 7Ronnel TagalogonAinda não há avaliações

- 10 31 Fabm QS 2Documento10 páginas10 31 Fabm QS 2Fat AjummaAinda não há avaliações

- Adjusting Entries LectureDocumento9 páginasAdjusting Entries LectureABCAinda não há avaliações

- 1B-FNDC003 BOM12 2S2021 EA07: Adjusting Entries: End of QuizDocumento9 páginas1B-FNDC003 BOM12 2S2021 EA07: Adjusting Entries: End of QuizNina Donato100% (1)

- CH 03Documento6 páginasCH 03Tien Thanh DangAinda não há avaliações

- Question Chapter1 Final 1Documento11 páginasQuestion Chapter1 Final 1Mạnh Đỗ ĐứcAinda não há avaliações

- Sheet (6) Tegara English First Year Financial Accounting: GroubDocumento11 páginasSheet (6) Tegara English First Year Financial Accounting: Groubmagdy kamelAinda não há avaliações

- Elms Mock Board ReviewerDocumento121 páginasElms Mock Board Reviewerbths6rxq6fAinda não há avaliações

- Exercises Adjusting EntriesDocumento3 páginasExercises Adjusting EntriesFria Mae Aycardo AbellanoAinda não há avaliações

- Basic Accounting Cup AnswerkeyDocumento6 páginasBasic Accounting Cup AnswerkeyChichiAinda não há avaliações

- CAT Challenge - Answers PDFDocumento6 páginasCAT Challenge - Answers PDFnivea gumayagayAinda não há avaliações

- CPA ReviewDocumento14 páginasCPA ReviewnikkaaaAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- Accountancy Philippines Daily Review For Far June 05 2020: Question No. 1Documento10 páginasAccountancy Philippines Daily Review For Far June 05 2020: Question No. 1Danna NuquiAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- Adjustments Quiz 1Documento6 páginasAdjustments Quiz 1Christine Mae BurgosAinda não há avaliações

- POA - D. Adjusting EntriesDocumento40 páginasPOA - D. Adjusting EntriesMariñas, Romalyn D.Ainda não há avaliações

- AnswerDocumento21 páginasAnswerStephanie EspalabraAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- Practice Questions 1 (AIS)Documento8 páginasPractice Questions 1 (AIS)UroobaShiekhAinda não há avaliações

- DK Goel Solutions Class 11 Chapter 22 DK Goel Book Available For FreeDocumento1 páginaDK Goel Solutions Class 11 Chapter 22 DK Goel Book Available For Freetwinkle banganiAinda não há avaliações

- ADJUSTING Activities With AnswersDocumento5 páginasADJUSTING Activities With AnswersRenz RaphAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- Qualifying Exam ReviewerDocumento11 páginasQualifying Exam ReviewerJohn Oliver OcampoAinda não há avaliações

- Take Home Activity 3Documento6 páginasTake Home Activity 3Justine CruzAinda não há avaliações

- Sheet (6) Tegara English First Year Financial Accounting: GroubDocumento11 páginasSheet (6) Tegara English First Year Financial Accounting: Groubmagdy kamelAinda não há avaliações

- 08 Sample-ActivitiesDocumento19 páginas08 Sample-ActivitiesPrincess Anne MendozaAinda não há avaliações

- Unit Vi - Audit of Leases - Final - T11415 PDFDocumento4 páginasUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesAinda não há avaliações

- Far 2 LQDocumento14 páginasFar 2 LQJennifer AdvientoAinda não há avaliações

- Auditing Problem ReviewerDocumento10 páginasAuditing Problem ReviewerTina Llorca83% (6)

- CH 03Documento8 páginasCH 03waresh360% (1)

- Quizzer 1Documento4 páginasQuizzer 1Arvin John MasuelaAinda não há avaliações

- C. Liability - 2, 3 - 4 SessionDocumento18 páginasC. Liability - 2, 3 - 4 SessionBareera NasirAinda não há avaliações

- Adjustments Quiz 1Documento7 páginasAdjustments Quiz 1Sheena GaborAinda não há avaliações

- College of Business and Management: Central Mindanao University Department of AccountancyDocumento11 páginasCollege of Business and Management: Central Mindanao University Department of AccountancyErwin Dave M. DahaoAinda não há avaliações

- Acc 112 RevisionDocumento16 páginasAcc 112 RevisionhamzaAinda não há avaliações

- EO Encounter ElimsDocumento8 páginasEO Encounter ElimsMJ YaconAinda não há avaliações

- Finacc Quiz 2Documento11 páginasFinacc Quiz 2Chayne RodilAinda não há avaliações

- Comprehensive Exam EDocumento10 páginasComprehensive Exam Ejdiaz_646247100% (1)

- Adjusting Entry QuizDocumento3 páginasAdjusting Entry Quizaccounting probAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)No EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- QuickBooks for People Who Refuse to be called 'Dumb'No EverandQuickBooks for People Who Refuse to be called 'Dumb'Ainda não há avaliações

- Quickbooks for those who refuse to be called DumbNo EverandQuickbooks for those who refuse to be called DumbAinda não há avaliações

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)No Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Nota: 4 de 5 estrelas4/5 (3)

- Solvent Assisted Extraction of Oil From Moringa Oleifera Lam. Seeds PDFDocumento7 páginasSolvent Assisted Extraction of Oil From Moringa Oleifera Lam. Seeds PDFjii100% (1)

- Extraction of Sunflower Oil Using Ethanol As Solvent PDFDocumento8 páginasExtraction of Sunflower Oil Using Ethanol As Solvent PDFjiiAinda não há avaliações

- Extraction of Phenols From Lignin Microwave-Pyrolysis Oil Using A Switchable Hydrophilicity Solvent PDFDocumento8 páginasExtraction of Phenols From Lignin Microwave-Pyrolysis Oil Using A Switchable Hydrophilicity Solvent PDFjiiAinda não há avaliações

- Lignin Removal and Benzene-Alcohol Extraction Effects On Lignin Measurements of The Hydrothermal Pretreated Bamboo Substrate PDFDocumento5 páginasLignin Removal and Benzene-Alcohol Extraction Effects On Lignin Measurements of The Hydrothermal Pretreated Bamboo Substrate PDFjiiAinda não há avaliações

- Extraction of Phenolic Compounds From Virgin Olive Oil by Deep Eutectic Solvents PDFDocumento8 páginasExtraction of Phenolic Compounds From Virgin Olive Oil by Deep Eutectic Solvents PDFjiiAinda não há avaliações

- Extraction of Hydrocarbons From Microalga Botryococcus Braunii With Switchable Solvents PDFDocumento6 páginasExtraction of Hydrocarbons From Microalga Botryococcus Braunii With Switchable Solvents PDFjiiAinda não há avaliações

- Comparison of Solvent Extraction and Solid-Phase Extraction For The Determination of Polychlorinated Biphenyls in Transformer Oil PDFDocumento4 páginasComparison of Solvent Extraction and Solid-Phase Extraction For The Determination of Polychlorinated Biphenyls in Transformer Oil PDFjiiAinda não há avaliações

- Ensc 11 Problem Set 5Documento3 páginasEnsc 11 Problem Set 5jiiAinda não há avaliações

- Take Home Quiz - Shear and Bending MomentDocumento1 páginaTake Home Quiz - Shear and Bending MomentjiiAinda não há avaliações

- ENG 10 Course Guide - Second Sem 2014 2015Documento8 páginasENG 10 Course Guide - Second Sem 2014 2015jiiAinda não há avaliações

- Project No 2Documento1 páginaProject No 2jiiAinda não há avaliações

- Aaa - Characterization and Process Optimization of Castor Oil PDFDocumento6 páginasAaa - Characterization and Process Optimization of Castor Oil PDFjiiAinda não há avaliações

- Step11 Reversing EntriesDocumento4 páginasStep11 Reversing EntriesjiiAinda não há avaliações

- Statement of Cash Flow IllustrationDocumento2 páginasStatement of Cash Flow IllustrationjiiAinda não há avaliações

- MATH 38: Mathematical Analysis III: Unit 3: Differentiation of Functions of More Than One VariableDocumento255 páginasMATH 38: Mathematical Analysis III: Unit 3: Differentiation of Functions of More Than One VariablejiiAinda não há avaliações

- Project No. 3: Special Journals: Debit Credit Debit CreditDocumento2 páginasProject No. 3: Special Journals: Debit Credit Debit CreditjiiAinda não há avaliações

- Sample Problem Indexing of Accounts and JournalizingDocumento3 páginasSample Problem Indexing of Accounts and JournalizingjiiAinda não há avaliações

- Project No. 1: Accounting Cycle Step 1 To 4 For Service Business (Weygant, Et Al, Page 86)Documento1 páginaProject No. 1: Accounting Cycle Step 1 To 4 For Service Business (Weygant, Et Al, Page 86)jiiAinda não há avaliações

- Chapter 24Documento32 páginasChapter 24Nuts420Ainda não há avaliações

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Documento4 páginasSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiAinda não há avaliações

- Sathya's Iob ProjectDocumento35 páginasSathya's Iob ProjectVenkatesh ChowdaryAinda não há avaliações

- Financial Accounting AssignmentDocumento4 páginasFinancial Accounting AssignmentRana SohailAinda não há avaliações

- Halifax StatementDocumento4 páginasHalifax StatementSW ProjectAinda não há avaliações

- SURVEY QUESTIONNAIRE On CSCMDocumento6 páginasSURVEY QUESTIONNAIRE On CSCMavie71% (7)

- Uncp Comdor PDFDocumento7 páginasUncp Comdor PDFLucaAinda não há avaliações

- SOC Branchless Banking April June 2023 PDFDocumento2 páginasSOC Branchless Banking April June 2023 PDFVijay VijdanAinda não há avaliações

- Deutsche V HoldenDocumento8 páginasDeutsche V HoldenTL AndersonAinda não há avaliações

- Guidelines On Fraud Reporting (EBA GL-2018-05) - ENDocumento33 páginasGuidelines On Fraud Reporting (EBA GL-2018-05) - ENayalewtesfawAinda não há avaliações

- Internship Report On Habib Bank Limited: University of GujratDocumento65 páginasInternship Report On Habib Bank Limited: University of GujratMehran RiazAinda não há avaliações

- US Bank of Washington - Executive SummaryDocumento5 páginasUS Bank of Washington - Executive SummaryJoshua Sullivan100% (2)

- Company Profile - Quebral Diaz & Co.Documento6 páginasCompany Profile - Quebral Diaz & Co.Achie DennaAinda não há avaliações

- VP Marketing Communications Brand Management in Hartford CT Resume Christine FitzgeraldDocumento2 páginasVP Marketing Communications Brand Management in Hartford CT Resume Christine FitzgeraldChristineFitzgeraldAinda não há avaliações

- ES 1 - General Guidelines On Gold LoanDocumento3 páginasES 1 - General Guidelines On Gold LoanVishnu AppuAinda não há avaliações

- Plutus'15 Case StudyDocumento12 páginasPlutus'15 Case StudyGopi223Ainda não há avaliações

- The Institute of Chartered Accountants of India Icai Bhawan CHENNAI 600034 A Project Report Submitted byDocumento59 páginasThe Institute of Chartered Accountants of India Icai Bhawan CHENNAI 600034 A Project Report Submitted byHarish ShettyAinda não há avaliações

- Ffa12efmq A Low ResDocumento34 páginasFfa12efmq A Low ResAdi StănescuAinda não há avaliações

- Assesable ValueDocumento3 páginasAssesable Valuevishnu0072009Ainda não há avaliações

- MCB 11Documento157 páginasMCB 11ubshahidAinda não há avaliações

- 10.public Private Partnership in Housing For The Poor - HDFCDocumento32 páginas10.public Private Partnership in Housing For The Poor - HDFCA VENKATA SAI KASYAPAinda não há avaliações

- Assignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Documento24 páginasAssignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Mrinal Kanti DasAinda não há avaliações

- Try To Figure OutDocumento9 páginasTry To Figure OutMaria25% (8)

- H LQZ Eewd 4 M XRSNCPDocumento8 páginasH LQZ Eewd 4 M XRSNCPrahul yadavAinda não há avaliações

- Thesis - Alpesh Gajera PDFDocumento367 páginasThesis - Alpesh Gajera PDFPrakash KhundrakpamAinda não há avaliações

- Introduction To Islamic Capital MarketsDocumento5 páginasIntroduction To Islamic Capital MarketsSon Go HanAinda não há avaliações

- Cert in Maths SAM Collation WEB 9781446932575 Issue3 PDFDocumento84 páginasCert in Maths SAM Collation WEB 9781446932575 Issue3 PDFNazir RashidAinda não há avaliações

- 2013 Overview of ESG Rating AgenciesDocumento52 páginas2013 Overview of ESG Rating AgenciesMickey EvaAinda não há avaliações

- F&OAnalysis 23 Mar 21Documento8 páginasF&OAnalysis 23 Mar 21Siddharth TripathiAinda não há avaliações

- Industrial Profile: Submitted By: Parvathy.S.Menon Reg No: 22052 BBA V SEMDocumento13 páginasIndustrial Profile: Submitted By: Parvathy.S.Menon Reg No: 22052 BBA V SEMreshma_reuben8Ainda não há avaliações