Escolar Documentos

Profissional Documentos

Cultura Documentos

AUD2 Non-Audit Service

Enviado por

Linus TrevorTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AUD2 Non-Audit Service

Enviado por

Linus TrevorDireitos autorais:

Formatos disponíveis

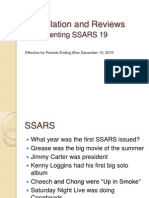

Compliation

3 services/associations

Assembling, no assurance, no need for evidence, but must disclose significant assumptions

Standards

Contents

No opinion or assurance

Prospective results may not be achieved

No responsibility to update

Express an opinion on conformity with AICPA and assumption are reasonable

Examination

Independence and evidence required

Projection must be "restricted use"

No AICPA presentation guide - "Except for" qualified or adverse

Modifications to the opinion

No Assumption disclosure - adverse

Assumption not reasonable - adverse

Scope limitation - disclarimer

Partial presentation is not appropriate for general use

PFS must include a summary of significant assumptions

Agree-upon procedures

Conformity with AICPA guideline

Human Resources

Prospective F/S

Standard (HELPME)

Engagement Client Policy

Financial Forecast

General & Limited use

Leadership Responsibilities

Performance of engagement

Peer Review every 3 years between CPA firms for QC

Limited Use

Financial Projection (what if)

Monitoring

Second Partner "Pre-issue" Review

A summary of significant assumptions

No aggressive/Confidential Tax Consulting

Agree-upon procedure

Corporate Tax is ok (noted in writing to Audit Committee)

Required Elements

Independence

SOX requirement

Prohibits other services for auditor of issuers

Restriction of use

Ethical Requirement

Prohibits personal tax service for corporate officers/family

Measurablity

5-year rotation for lead/review partners

Partner to Officer (One-year cool off)

Maintain public confidence

Positive opinion, High-level assurance

Conclusion

Quality Control

Qualified, Disclaimer, or Withdrawal

Examination

Moderate/Negative assurance

All staffs subject to Independence Requirement confirmed in writing

Withdrawal

Review

No assurance

Agreed-upon procedure

Attest Engagement (SSAE)

Focus on overall professional activities

vs.

Individual audit engagement by GAAS

Not someone from engagement team

Audit/Exam something other than historical F/S

Training & Proficiency

Five general standard

Independence

Professional and due professional care

Engagement Quality Reviewer

Professional and adequate knowledge

Internal/External is ok

Review of Interim F/S must be performed

Letter from underwriter

Your belief that the subject can be measured

Before the audit report is released

Modify audit release date if qualify control is later than release date

Planning and supervision

Two field standard

CPA'S independence

Positive Assurance on

Appropriate, sufficient evidence

Required for Examination & Review

Written Assertion

"Due diligence" defense for underwriter with a statement of restricted use

Compliance as to form with SEC audit if F/S is audited

Unaudited F/S

Negative Assurance on

Subsequent Changes after F/S date

Withdrawal

Incomplete presentation of Single FS, added a explanatory paragraph

Client responsible for lacking

Non F/S information conform with Regulation S-K

Relevant Explanatory Paragraph on Complete F/S added to Single FS

Modified opinion on Complete Set cause Disclaimer or Adverse on individual report

Client not responsible for lacking

No comment/assurance on Market Risk sensitive instruments or qualitative disclosure

Report may be issued with restriction

Materiality to determined at single FS/Specific level

Single FS/Specific Element

Part of complete F/S (Opinions for both) or Separate Engagement

Procedure on any inter-related items

Indicate the date of complete F/S on individual report

Understanding with client

Unless not issued with and not significant part of Complete F/S

Piece Meal Opinion is not allowed

Management: F/S & I/C

Other-matter paragraph in auditor's report (restricted use)

Report on separate report

Scope

Review report (SAS or PCAOB)

Procedure (U LIAR CPA)

If noncompliance found

Limitation : No opinion

Compliance

Must have audited F/S

Learn industry accounting & business (Misstatement? Inquiry and Analytic plan)

Inquire Internally (Optional with corporate lawyer)

Negative assurance if no noncompliance found

Analytical : Ratio & Historical

Review: read other stuff

Tell users it is not GAAP

Interim F/S review for Issuer/Public company (SAS/PCAOB)

Contractual

Restricted Use in other matter paragraph

Client representation (F/S. If not complete, add I/C)

Professional Judgement (Misstatement or Scope Limitation?)

Regulatory

Restricted Use in other matter paragraph

Accountant (CPA) Communication (Fraud, Illegal Acts, or I/C issues)

Special Framwork

OCBOA

Special Consideration

AUD2 Non-audit service

No description of purpose why OCBOA used

Cash

No description of purpose why OCBOA used

Tax

Dual Opinion (GAAP & OCBOA)

No emphasis-of-matter about using special purpose framework

Reason not justified

Regulatory (General Use)

Withdraw if

Modifications (Departure from framework)?

Change between Compilation/Review request

Scope Limitation

Compilation (Prior) to Review (Current) - Upgrade

Reporting on Comparative F/S

Disclosure or Withdraw

Departure from reporting framework

No ("We are not aware of any material modification")

Yes ("Add Basis for modification paragraph" before conclusion

Optional to note "Going concern/lack consistency"

Upgrade Prior report to include in Current)

Add a paragraph to explain in current report

Review (Prior) to Compliation (Current) - Download

or Re-issue the prior report (combined with current or issued separately)

Consistent with audited F/S

Summary Adequate?

Management, Board, then Withdraw (seek legal help)

Issue Communcations

Step

F/S available for summary users if F/S not attached

Not intend for misleading

Summary

Disclosure the omission

IF omission of substantial disclosure is found

Different accountants involved

Must have audited F/S

Unmodified or Adverse, no qualifed

Read new F/S

Old accountant decides to issue (optional)

Communicate on Fraud/Illegal Act

Get a representation letter from new accountant

Documentation

Any significant finding

Old accountant not reissue

Withdraw if Adverse/Disclaimer opinion of F/S

Perform that level of service themselves

The engagement Letter

Reissue prior report or

Date later than audited F/S

Service Upgrade

Compilation (No assurnace)

No assurance/No independence requirement (Must be documented)

Industry accounting/practice knowledge

Reference to old accoutant's report

Report when one period is audited

Service Downgrade

Additional paragraph: Previous is less in scope and no opinion

Additional paragraph: Current not audited

Requirement

Understand Client Business

Compilation and Review (SSARS)

Read F/S. Never associated with false, fraudulent, or misleading F/S

Use report appropriate for highest level of service

Otherwise report to Management

Fraud & Illegal acts

No need for inconsequential items

If find inaccurate info

Evidence

No required to review

Withdraw if rejected

Go to client for revision

No need for accuracy/completeness

Review (Limited Assurance)

Sufficient for "No material modification necessary for conforming financial Framework

SSARS not required from personal F/S if no credit

Understanding engagement

Requirement

Not used by 3rd party and restricted use

Learn client (ex-accountant communication is optional)

Engagement letter to replace report ok if

Inquires (inside of the company)

Analytical procedure

Review (F/S Confirmity and other audit/review report)

Private company/non-issuers

Adjusting entries

SSARS

Client representation letter required - date on completion of review

Not applicable

Professional Judgement (Incomplete then not issued)

Tax

Accountant (CPA) Communications

Consulting

S: Management responsibility (fair presentation and I/C)

TAIS

Bookkeeping rendering

S: Accountant responsibility (SSARS and Limited assurance)

Data Processing

Modification appropriate?

Interim F/S review (SAS)

A separate paragraph for disclosure

Departure from framework

Withdraw (No adverse or except for opinion)

Modification in appropriate

Request client to revise and disclose

Subsequent discovery after report date

If effects cannot be determined, notification the report not to be relied on

Dis-associate

If rejection

Notify regulatory agency

Notify users

Supplementary information

An explanation in review report or a separate report

Você também pode gostar

- Deed of Assignment: Test All Results Data andDocumento3 páginasDeed of Assignment: Test All Results Data andkumag2Ainda não há avaliações

- Notes Chapter 1 AUDDocumento7 páginasNotes Chapter 1 AUDcpacfa90% (21)

- Gothic Voodoo in Africa and HaitiDocumento19 páginasGothic Voodoo in Africa and HaitiJames BayhylleAinda não há avaliações

- CPA Audit Notes PDFDocumento38 páginasCPA Audit Notes PDFMark Butaya100% (3)

- Notes Chapter 2 AUDDocumento6 páginasNotes Chapter 2 AUDcpacfa100% (7)

- CPA AUD Becker Chapter 2 NotesDocumento9 páginasCPA AUD Becker Chapter 2 Notesgoldenpeanut0% (1)

- CPA Audit NotesDocumento38 páginasCPA Audit NotesDivjot Singh100% (1)

- Insurance OperationsDocumento5 páginasInsurance OperationssimplyrochAinda não há avaliações

- Horizon Trial: Witness Statement in Support of Recusal ApplicationDocumento12 páginasHorizon Trial: Witness Statement in Support of Recusal ApplicationNick Wallis100% (1)

- Audit Report: AS/NZS ISO 9001:2008Documento18 páginasAudit Report: AS/NZS ISO 9001:2008Phuong NguyenAinda não há avaliações

- Smeta CaprDocumento11 páginasSmeta CaprRashedul IslamAinda não há avaliações

- P7 Audit and Assurance SummaryDocumento31 páginasP7 Audit and Assurance SummaryJunaedur Rahman Jesun80% (5)

- ReinsuranceDocumento142 páginasReinsuranceabhishek pathakAinda não há avaliações

- PSA PPT by Sir JekellDocumento96 páginasPSA PPT by Sir JekellNeizel Bicol-ArceAinda não há avaliações

- Smeta Version 4.0 CaprDocumento11 páginasSmeta Version 4.0 CaprJuan Carlos0% (1)

- The Financial Statement Audit 1 2Documento100 páginasThe Financial Statement Audit 1 2Peter BanjaoAinda não há avaliações

- Agile Scrum MCQDocumento6 páginasAgile Scrum MCQHarshith InjamAinda não há avaliações

- Pre PlanningDocumento5 páginasPre Planningemc2_mcv100% (1)

- 2012 03 13 - 044632 - 2011 2012 AUDStudy Guide 12pages BiggsDocumento12 páginas2012 03 13 - 044632 - 2011 2012 AUDStudy Guide 12pages Biggsjklein2588Ainda não há avaliações

- AUD NOTES 2011/2012 (12 Pages) Shared By: Biggs: To Help You Pass, Prepare Your Own NotesDocumento7 páginasAUD NOTES 2011/2012 (12 Pages) Shared By: Biggs: To Help You Pass, Prepare Your Own Notesjklein2588Ainda não há avaliações

- Reports On Comparative Statements: AUD - Notes Chapter 1Documento34 páginasReports On Comparative Statements: AUD - Notes Chapter 1Divjot SinghAinda não há avaliações

- 8 Pages SummaryDocumento8 páginas8 Pages Summarydipak tAinda não há avaliações

- Notes Chapter 2 AUDDocumento6 páginasNotes Chapter 2 AUDbooperszAinda não há avaliações

- Auditing Summary Notes Chapter 1Documento1 páginaAuditing Summary Notes Chapter 1dipak tAinda não há avaliações

- Qualified "Except For" GAAP: Justified Departure Gaap Going Concern: (After Opinion Paragraph)Documento11 páginasQualified "Except For" GAAP: Justified Departure Gaap Going Concern: (After Opinion Paragraph)Steffan MilesAinda não há avaliações

- Audit Report and OpinionsDocumento31 páginasAudit Report and OpinionsHillary MageroAinda não há avaliações

- Auditing Assurance ServicesDocumento24 páginasAuditing Assurance ServicesMicaela Marimla100% (1)

- PSA 210 Terms of Audit Engagement SummaryDocumento3 páginasPSA 210 Terms of Audit Engagement SummaryAbraham ChinAinda não há avaliações

- Aud Theo Compilation1Documento97 páginasAud Theo Compilation1AiahAinda não há avaliações

- Summary AuditDocumento8 páginasSummary AuditMarie Joy ButilAinda não há avaliações

- 2b. Publicly Available SMETA CAPR Template 10112015Documento11 páginas2b. Publicly Available SMETA CAPR Template 10112015BAlaAinda não há avaliações

- Audit Notes CH 1 & 2Documento5 páginasAudit Notes CH 1 & 2DoWorkCPAAinda não há avaliações

- SSARS 19 - Compilation and ReviewsDocumento72 páginasSSARS 19 - Compilation and ReviewsCharles B. HallAinda não há avaliações

- Ocean ManufacturingDocumento5 páginasOcean ManufacturingАриунбаясгалан НоминтуулAinda não há avaliações

- Audit Report Important FactsDocumento1 páginaAudit Report Important FactszenvioAinda não há avaliações

- WatchList 0062t000005KMGfAAO-Soumyadeep BhuniaDocumento8 páginasWatchList 0062t000005KMGfAAO-Soumyadeep BhuniaSunita ChandaAinda não há avaliações

- Auditing Summary Notes Chapter 1Documento1 páginaAuditing Summary Notes Chapter 1dipak tAinda não há avaliações

- 05 Preliminary Engagement ActivitiesDocumento2 páginas05 Preliminary Engagement ActivitiescarloAinda não há avaliações

- ACCT601 Tutorial Questions - Chapter 5Documento6 páginasACCT601 Tutorial Questions - Chapter 5Ṁysterious ṀarufAinda não há avaliações

- Audit Report NotesDocumento7 páginasAudit Report NotesSer Yev Javier NuguidAinda não há avaliações

- Chapter 3Documento4 páginasChapter 3Trường Nguyễn CôngAinda não há avaliações

- Audit Planning and MaterialityDocumento11 páginasAudit Planning and MaterialityTigRao UlyMelAinda não há avaliações

- Quidos QA Standards For Retrofit AssessorsDocumento12 páginasQuidos QA Standards For Retrofit AssessorsQuidos Technical SupportAinda não há avaliações

- NotesDocumento2 páginasNotespngandhiAinda não há avaliações

- Completing The AuditDocumento21 páginasCompleting The AuditvevericeAinda não há avaliações

- Ibtisam MurtazaDocumento4 páginasIbtisam MurtazaMR AAinda não há avaliações

- Welfare Transition: DEO Monitoring ResultsDocumento60 páginasWelfare Transition: DEO Monitoring Resultsapi-213329838Ainda não há avaliações

- Wiley Review Notes Part1Documento5 páginasWiley Review Notes Part1Mae Ann KongAinda não há avaliações

- Document 2Documento8 páginasDocument 2sohamAinda não há avaliações

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsAinda não há avaliações

- Guidance To Completing A SMETA CAPR 29-06-12Documento13 páginasGuidance To Completing A SMETA CAPR 29-06-12Rashedul KarimAinda não há avaliações

- Third SessionDocumento32 páginasThird SessionroshandimanthaofficialAinda não há avaliações

- Statement of Cash FlowsDocumento21 páginasStatement of Cash FlowsJomerAinda não há avaliações

- Solutions To Selected Textbook Problems - Pre-Midterm (3rd Ed)Documento17 páginasSolutions To Selected Textbook Problems - Pre-Midterm (3rd Ed)NicoleAinda não há avaliações

- Futurehind Techies India Forum - The New Horizone of IT in India, August 2013Documento29 páginasFuturehind Techies India Forum - The New Horizone of IT in India, August 2013Dr. Paritosh BasuAinda não há avaliações

- Chapter - 5Documento11 páginasChapter - 5dejen mengstieAinda não há avaliações

- 12-18 AuditDocumento15 páginas12-18 AuditAvinash KumarAinda não há avaliações

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsAinda não há avaliações

- The Audit Report Is The Final Step in The Entire Audit ProcessDocumento4 páginasThe Audit Report Is The Final Step in The Entire Audit ProcessAbdifatah AbdilahiAinda não há avaliações

- 17the Auditor's ReportDocumento8 páginas17the Auditor's ReportIrish SanchezAinda não há avaliações

- The Once and Future AuditorsDocumento7 páginasThe Once and Future AuditorsFlexykwanAinda não há avaliações

- Audit ReportDocumento41 páginasAudit ReportMariden Danna BarbosaAinda não há avaliações

- A Standard Unqualified Audit Report Indicates That The Opinion Expressed IsDocumento7 páginasA Standard Unqualified Audit Report Indicates That The Opinion Expressed IsAnkit KapoorAinda não há avaliações

- APB Ethical Standards - Auditor RotationDocumento5 páginasAPB Ethical Standards - Auditor RotationJayson LeybaAinda não há avaliações

- Aeb SM CH25 1Documento16 páginasAeb SM CH25 1Rafael GarciaAinda não há avaliações

- Discussion: Functions, Advantages and Disadvantages of BIOPOT Cassava Peel and Husk CharcoalDocumento4 páginasDiscussion: Functions, Advantages and Disadvantages of BIOPOT Cassava Peel and Husk CharcoalAhmad BurhanudinAinda não há avaliações

- Cartographie Startups Françaises - RHDocumento2 páginasCartographie Startups Françaises - RHSandraAinda não há avaliações

- 12.2 ModulesDocumento7 páginas12.2 ModulesKrishna KiranAinda não há avaliações

- Abnormal Psychology: A Case Study of Disco DiDocumento7 páginasAbnormal Psychology: A Case Study of Disco DiSarah AllahwalaAinda não há avaliações

- Nestle Corporate Social Responsibility in Latin AmericaDocumento68 páginasNestle Corporate Social Responsibility in Latin AmericaLilly SivapirakhasamAinda não há avaliações

- Mock 10 Econ PPR 2Documento4 páginasMock 10 Econ PPR 2binoAinda não há avaliações

- RBI ResearchDocumento8 páginasRBI ResearchShubhani MittalAinda não há avaliações

- Full Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions ManualDocumento20 páginasFull Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions Manualadenose.helveo0mvl100% (39)

- Roof Structure Collapse Report - HongkongDocumento11 páginasRoof Structure Collapse Report - HongkongEmdad YusufAinda não há avaliações

- Dewi Handariatul Mahmudah 20231125 122603 0000Documento2 páginasDewi Handariatul Mahmudah 20231125 122603 0000Dewi Handariatul MahmudahAinda não há avaliações

- Macquarie Equity Lever Adviser PresentationDocumento18 páginasMacquarie Equity Lever Adviser PresentationOmkar BibikarAinda não há avaliações

- PoetryDocumento5 páginasPoetryKhalika JaspiAinda não há avaliações

- Martin, BrianDocumento3 páginasMartin, Brianapi-3727889Ainda não há avaliações

- Anglais OverconsumptionDocumento3 páginasAnglais OverconsumptionAnas HoussiniAinda não há avaliações

- Why Study in USADocumento4 páginasWhy Study in USALowlyLutfurAinda não há avaliações

- Paytm Wallet TXN HistoryDec2021 7266965656Documento2 páginasPaytm Wallet TXN HistoryDec2021 7266965656Yt AbhayAinda não há avaliações

- Chapter 1 - DiscussionDocumento15 páginasChapter 1 - DiscussionArah OpalecAinda não há avaliações

- Assets Book Value Estimated Realizable ValuesDocumento3 páginasAssets Book Value Estimated Realizable ValuesEllyza SerranoAinda não há avaliações

- Allama Iqbal Open University, Islamabad: WarningDocumento3 páginasAllama Iqbal Open University, Islamabad: Warningمحمد کاشفAinda não há avaliações

- Henry IV Part 1 Study GuideDocumento21 páginasHenry IV Part 1 Study GuideawtshfhdAinda não há avaliações

- Curriculam Vitae: Job ObjectiveDocumento3 páginasCurriculam Vitae: Job ObjectiveSarin SayalAinda não há avaliações

- Breterg RSGR: Prohibition Against CarnalityDocumento5 páginasBreterg RSGR: Prohibition Against CarnalityemasokAinda não há avaliações

- Principles of Natural JusticeDocumento20 páginasPrinciples of Natural JusticeHeracles PegasusAinda não há avaliações

- Climate Change and Mitigation Programs in Davao CityDocumento64 páginasClimate Change and Mitigation Programs in Davao CityChona BurgosAinda não há avaliações