Escolar Documentos

Profissional Documentos

Cultura Documentos

Overview of Auditing and Assurance

Enviado por

JadeFerrerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Overview of Auditing and Assurance

Enviado por

JadeFerrerDireitos autorais:

Formatos disponíveis

DE LA SALLE UNIVERSITY MANILA

RVR COB DEPARTMENT OF ACCOUNTANCY

REVDEVT 3rd Term AY 14-15

Integrated Accounting Review

Auditing Theory

Prof. Francis H. Villamin

AT Lecture 1

================================================================================

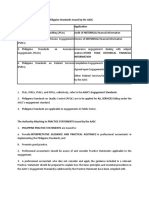

Preface to Philippine Standards on Quality Control, Auditing, Review, Other Assurance

and Related Services

1. Auditing and Assurance Standards Council (AASC) has its mission to promulgate the auditing

standards, practices and procedures which shall be generally accepted by the accounting profession

in the Philippines.

2. To facilitate the preparation by the AASC of its pronouncements and to attain uniformity of those

pronouncements with international accounting standards , the AASC has approved the adoption of

the International Standards on Auditing (ISAs), International Standards on Assurance Engagements

(ISAEs), International Standards on Review Engagements (ISREs) and International Standards on

Related Services (ISRSs) issued by International Auditing and Assurance Board (IAASB) created by

the International Federation of Accountants (IFAC).

3. Pronouncements of the AASC shall be in the form of:

Philippine Standards on Quality Control (PSQCs)

Philippine Standards on Auditing (PSAs)

Philippine Standards on Review Engagements (PSREs)

Philippine Standards on Assurance Engagements (PSAEs)

Philippine Standards on Related Services (PSRSs)

Philippine Auditing Practice Statements (PAPSs)

Philippine Review Engagement Practice Statements (PREPSs)

Philippine Assurance Engagement Practice Statements (PAEPSs)

Philippine Related Services Practice Statements (PRSPSs)

4. AASC was created by the Professional Regulation Commission upon the recommendation of the

Board of Accountancy (BOA) to assist the BOA in the establishment and promulgation of auditing

standards in the Philippines. The AASC replaced the Auditing Standards and Practices Council

(ASPC) which was established by the Philippine Institute of CPAs (PICPA) and the Association of

CPAs in Public Practice (ACPAPP) and previously set generally accepted auditing standards in the

Philippines, also based on International Standards and Practice Statements.

5. Authority attaching to the Philippine Standards issued by the AASC:

PSAs are to applied, as appropriate, in the audit of historical financial statements.

PSREs are to be applied in the review of historical financial information.

PSAEs are to be applied in assurance engagements dealing with subject matters other than

historical information.

PSRSs are to be applied to compilation engagements, engagements to apply agreed-upon

procedures to information and other related services engagements as specified by the AASC.

PSAs, PSREs, PSAEs, PSRSs are collectively referred to as the AASCs Engagements

Standards.

PSQCs are to be applied for all services falling under the AASCs Engagement Standards.

The AASCs engagement standards contain basic principles and essential procedures

(identified in bold type lettering) together with related guidance in the form of explanatory and

other material, including appendices. The basic principles and essential procedures are to be

understood and applied in the context of the explanatory and other materials that provide

guidance for their application. It is therefore necessary to consider the whole text of a Standard

to understand and apply the basic principles and essential procedures.

They also represent pronouncements on generally accepted auditing standards, interpretations

and opinions issued by the AASC to apply whenever an independent examination of financial

statements of any entity, whether profit-oriented or not, for the purpose of expressing an opinion

thereon. They may have application, as appropriate, to other activities of the auditor.

AT Lecture 1

Overview of Auditing and Assurance Services

6. The nature

of the Philippine Standards issued by the AASC requires professional

accountants to exercise professional judgment

in applying them. In

exceptional

circumstances, a professional accountant may judge it to depart from a basic principle or essential

procedure of an Engagement Standard to achieve more effectively the objective of the engagement.

When such a situation arises, the professional accountant should be prepared

to justify the

departure.

7. Authority attaching to the Practice Statements issued by the AASC:

PAPS are issued to provide interpretative guidance and practical assistance to professional

accountants in implementing PSAs and to promote good practice.

PREPSs, PAEPSs and PRSPSs are issued to serve the same purpose for the implementation of

PSREs, PSAEs and PSRSs, respectively.

8. Professional accountants should be aware of and consider Practice Statements applicable to the

engagement. A professional accountant who does not consider and apply the guidance included in a

relevant Practice Statement should be prepared to explain how the basic principles and essential

procedures in the Engagement Standard(s) addressed by the Practice Statement have been

complied with.

9. Exposure period for the proposed Philippine Standard or Practice Statement is generally not shorter

than 90 days. Exposure draft is widely distributed to interested organizations and persons for

comment. The exposure draft shall also be published in the PICPA Accounting Times and ACPAPP

Bulletin to give it further exposure.

10. Issuance of exposure drafts requires approval by a majority of the members of the Council; issuance

of the Philippine Standards and Practice Statements, as well as interpretations, requires approval of

at least ten (10) members.

11. Each final Philippine Standard and Practice Statement, as well as interpretations, if deemed

appropriate, shall be submitted to the Professional Regulation Commission (PRC) through the Board

of Accountancy (BOA) for approval after which the pronouncements shall be published in the Official

Gazette. After publication, the AASC pronouncement becomes operative from the effective date

stated therein.

12. Numbering of Philippine Standards and Practice Statements that are Philippine specific and are not

adopted from International pronouncements will be numbered consecutively with suffix Ph as

follows:

For Philippine Standards starting from 100Ph

For Philippine Practice Statements starting from 1000Ph

Philippine Standards and Practice Statements adopted from International pronouncements will use the

same numbers as their counterpart International pronouncements.

Philippine Framework for Assurance Engagements

1. Assurance engagement means an engagement in which a practitioner expresses a conclusion

designed to enhance the degree of confidence of the intended users other than the responsible party

about the outcome of the evaluation or measurement of a subject matter against criteria.

2. Objective of an Assurance Engagement

The objective of an assurance engagement is for a professional accountant to evaluate or measure a

subject matter that is the responsibility of another party against identified suitable criteria, and to

express about the subject matter. Assurance engagements performed by professional accountants

are intended to enhance the credibility of information about a subject matter by evaluating whether

the subject matter conforms in all material respects with suitable criteria, thereby improving the

likelihood that the information will meet the needs of an intended user. In this regard, the level of

assurance provided by the professional accountants conclusion conveys the degree of confidence

that the intended user may place in the credibility of the subject matter.

Assurance is a broad concept. Assurance services are designed to improve the quality of decision

making by improving confidence in the information on which decisions are made; the process by

which that information is developed, and the context in which the information is presented to users.

The field of assurance services is much broader than the traditional audits of financial statements.

3. Classification of Assurance Engagements

According to Level of Assurance

a. Reasonable assurance engagement

b. Limited assurance engagement

AT Lecture 1

Overview of Auditing and Assurance Services

The objective of a reasonable assurance engagement is a reduction in assurance engagement risk

to an acceptably low level in the circumstances of the engagement as the basis for a positive form of

expression of the practitioners conclusion.

The objective of a limited assurance engagement is a reduction in assurance engagement risk to a

level that is acceptable in the circumstances of the engagement, but where that risk is greater than for

a reasonable assurance engagement, as the basis for a negative form of expression of the

practitioners conclusion.

According to Structure

a. Assertion-based Engagement (Attestation)

b. Direct Reporting Engagement

In assertion-based engagement, the evaluation or measurement of the subject matter is performed

by the responsible party, and the subject matter information is in the form of assertion by the

responsible party that is made available to the intended users.

Examples of Assertion-based Engagements

a.

b.

An independent audit engagement provides a reasonable (but not absolute) level of assurance

that the subject matter (financial statements) is free of material misstatement.

A review engagement provides a moderate level of assurance that the information subject to

review is free from material misstatement; this is expressed in the form of negative assurance

(i.e. nothing has come to the auditors attention). For the purpose of expressing negative

assurance in the review report, the auditor should obtain sufficient appropriate evidence primarily

through inquiry and analytical procedures to be able to draw conclusions

In direct reporting engagement, the practitioner either directly performs the evaluation or

measurement of the subject matter, or obtains a representation from the responsible party that has

performed the evaluation or measurement that is not available to the intended users. The subject

matter is provided to the intended users in the assurance report.

4. Elements of an Assurance Engagement

1. Three-party relationship involving

a. A practitioner (broader than the term auditor)

b. A responsible party (a private company, a government entity, etc)

1. In a direct reporting engagement, is responsible for the subject matter

2. In an assertion-based engagement, is responsible for the subject matter information (the

assertion), and may be responsible for the subject matter.

c. An intended user (often members of the public or investors or regulatory bodies)

- Are person, persons or class of persons for whom the practitioner prepares the

assurance report.

- Can be any one of the intended users, but not the only one.

2. An appropriate subject matter

a. Financial performance or conditions (e.g. historical or prospective financial position, financial

performance and cash flows) for which the subject matter information may be the recognition,

measurement, presentation and disclosure represented in the financial statements.

b. Non financial performance or conditions (e.g. performance of an entity) for which the subject

matter information may be key indicators of efficiency and effectiveness.

c. Physical characteristics (e.g. capacity of a facility) for which the subject matter information

may be specifications document.

d. Systems and processes (e.g. an entitys internal control or IT system) for which the subject

matter information may be an assertion about effectiveness.

e. Behavior (e.g. corporate governance, compliance with regulation, human resource practices)

for which the subject matter information maybe a statement of compliance or a statement of

effectiveness.

An appropriate subject matter is:

1. Identifiable, and capable of consistent evaluation or measurement against the identifiable

criteria, and

2. Such that the information about it can be subjected to procedures for gathering sufficient

appropriate evidence to support a reasonable assurance or limited assurance conclusion, as

appropriate.

AT Lecture 1

Overview of Auditing and Assurance Services

3. Suitable criteria (PFRS formal; Code of Conduct less formal)

- are the benchmarks used to evaluate or measure the subject matter including, where relevant,

benchmarks for presentation and disclosure.

- are required for reasonably consistent evaluation or measurement of a subject matter within the

context of professional judgment.

Characteristics of suitable criteria:

a. Relevance contribute to conclusions that assist decision-making by the intended users.

b. Completeness no omissions of relevant factors that could affect the conclusions in the

context of the engagement circumstances.

c. Reliability allow reasonably consistent evaluation or measurement of the subject matter

d. Neutrality contribute to conclusions that are free from bias.

e. Understandability contribute to conclusions that are clear, comprehensive, and not subject to

significantly different interpretations.

Criteria are made available to the intended users in one or more of the following ways:

a. Publicly

b. Through inclusion in a clear manner in the presentation of the subject matter information

c. Through inclusion in a clear manner in the assurance report

d. By general understanding, for example the criterion for measuring time in hours and minutes.

Criteria may also be available to specific intended users, for example, the terms of a contract, or

criteria issued by an industry association that are available only those in the industry. When

identified criteria are available only to specific intended users, or are relevant only to a specific

purpose, use of the assurance report is restricted to those users or for that purpose.

4. Sufficient appropriate evidence

Sufficiency is the measure of the quantity of evidence.

Appropriateness is the measure of quality of evidence that is relevance and its reliability.

Generalizations about the reliability of evidence:

Evidence is more reliable when it is obtained from independent sources outside the entity.

Evidence that is generated internally is more reliable when the related controls are effective.

Evidence obtained directly by the practitioner (observation) is more reliable than evidence

obtained indirectly or by inference (inquiry).

Evidence is more reliable when it exists in documentary form.

Evidence provided by original documents is more reliable than evidence provided by

photocopies or facsimiles.

5. A written assurance report in the form appropriate to a reasonable assurance engagement

or a limited assurance engagement.

In a reasonable assurance engagement, the practitioner expresses the conclusion in the positive

form, for example: In our opinion internal control is effective, in all material respects, based on

XYZ criteria. This form of expression conveys reasonable assurance.

In a limited assurance engagement, the practitioner expresses the conclusion in the negative form,

for example: Based on our work described in this report, nothing has come to our attention that

causes us to believe that the internal control is not effective, in all material respects, based on XYZ

criteria. This form of expression conveys a level of limited assurance that is proportional to the

level of the practitioners evidence gathering procedures given the characteristics of the subject

matter and other engagement circumstances described in the assurance report

6. Limitations of Assurance Engagements

a.

b.

c.

d.

The use of selective testing.

The inherent limitations of internal control.

The nature of evidence. (persuasive rather conclusive)

The use of judgment in gathering and evaluating evidence and forming conclusions based on that

evidence.

e. The characteristics of the subject matter when evaluated or measured against the identified

criteria.

AT Lecture 1

Overview of Auditing and Assurance Services

7. Engagements Provided by Practitioners:

Assurance Engagements

1. Audits high level of assurance that the financial statements are free of material misstatements

2. Reviews limited investigation of much narrower scope than the audit and undertaken for the

purpose of providing limited (negative) assurance that the statements are presented in

accordance with identified Financial Reporting Standards. For example, a financial institution

may require debtors to engage CPAs to provide assurance about the debtors compliance with

certain covenant provisions stated in the loan agreement. It may also include providing

assurance about the effectiveness of a clients internal controls over financial reporting,

review of investment performance statistics for organizations such as mutual funds and

computer software review.

3. Other assurance services

4.

CPA Web Trust provide assurance to users of web sites in the Internet. The CPAs

electronic Web Trust Seal is affixed to the website. This seal assures the user that the

website owner has met established criteria related to business practices, transaction integrity

and information processes. Web Trust is an attestation service and Web Trust seal s a

symbolic representation of the CPAs report on management assertions about its disclosure

of electronic commerce practices.

SysTrust provide assurance on any defined electronic system. The system components

include its infrastructure, software, personnel, procedures and data, In a SysTrust

engagement, the CPA is engaged to examine only that a client maintained effective controls

over the system based on the Trust Services Principles and Criteria. The practitioner

performs tests to determine whether those controls were operating as effectively during the

specified report.

Both WebTrust and SysTrust are designed to incorporate a seal management process by

which a seal (logo) may be included on a clients Web site as an electronic representation of

the practitioners unqualified WebTrust report. If a client wishes to use the seal (logo), the

engagement must be updated at least annually. Also, the initial reporting period must include

at least two months.

Eldercare Plus focuses on the needs of the elderly and whether caregivers are providing

services that meet the specified objectives or at an acceptable level.

Business Performance Measurement Services provide assurance about whether

financial and non-financial information being reported from the entitys performance

measurement system (e.g. balanced scorecard) is reliable and whether the performance

measures being used are accurately leading the entity toward meeting its strategic goals and

objectives.

Corporate Sustainability Reporting also known as triple-bottom line reporting involves

reporting of non-financial and financial information to a broader set of stakeholders than just

shareholders. The reports inform stakeholder groups of the reporting organizations ability to

manage key risks.

Information Reliability Services provide assurance that information system has been

designed and operated to produce reliable data including tests of the system to determine

whether the system protects against potential causes of data defects

Risk Assessment Services involves the study of the link between risks and organizations

vision, mission, objectives and strategies and development of new and relevant measures to

address these risks.

CPA Performance View. This service is intended to demonstrate that the public

accountants can aide client firms in developing an integrated set of financial and non financial

performance and measures to employ in managing the clients business. It also identifies

and measures key activities that are critical to the entity.

Health Care Performance Measurement involves the evaluation of the quality of health

care, medical services and outcome.

AT Lecture 1

Overview of Auditing and Assurance Services

Non Assurance Engagements

1. Agreed-upon procedures an engagement in which the auditor is engaged to carry out those

procedures of an audit nature to which the auditor and the entity and any appropriate third parties

have agreed and to report on factual findings. The recipients of the report must form their own

conclusions from the report issued by the auditor. The report is restricted to those parties who

have agreed to the procedures to be performed since others, unaware of the results may

misinterpret the results.

2. Compilation of financial or other information an engagement in which the accountant is

engaged to use his accounting expertise as opposed to auditing expertise to collect, classify and

summarize financial information. This ordinarily entails presenting in the form of financial

statements that is the representation of management (owners) without undertaking to express

any assurance engagements. The procedures employed are not designed and do not enable

the accountant to express any assurance on the financial information. Users of the compiled

financial information derive some benefit as a result of the accountants involvement because the

service has been performed with due professional skill and care.

3. Preparation of tax returns where no conclusion is expressed, and tax consulting.

4. Management consulting and other advisory services professional services that employ the

practitioners technical skills, education, observation, experiences and knowledge of the analytical

approach and procedures used in consulting engagement. Those procedures may involve

determining client objectives, fact-finding definition of problems or opportunities, evaluation of

alternatives, formulation of proposed action, and communication of results, implementation and

follow-up.

Management consulting and other advisory services

Design and installation of accounting system

Computer risk management

Corporate finance

Tax services

E-businesses

Disaster recovery planning

8.

Assurance Engagement Risk

Assurance engagement risk is the risk that the practitioner expresses an inappropriate conclusion

when the subject matter information is materially misstated.

In a reasonable assurance engagement, the practitioner reduces assurance engagement risk to an

acceptably low level in the circumstances of the engagement to obtain reasonable assurance as

the basis for a positive form of expression of the practitioners conclusion. The level of assurance

engagement risk is higher in a limited assurance engagement than in a reasonable assurance

engagement because of the different nature, timing or extent of evidence-gathering procedures.

However, in a limited assurance engagement, the combination of the nature, timing and extent of

evidence gathering procedure is at least sufficient for the practitioner to obtain a meaningful level of

assurance as the basis for a negative form of expression. To be meaningful, the level of assurance

obtained by the practitioner is likely to enhance the intended users confidence about the subject

matter information to a degree that is clearly more than inconsequential.

In general, assurance engagement risk can be represented by the following components, although

not all of these components will necessarily be present or significant for all assurance

engagements:

a) The risk that the subject matter information is materially misstated, which in turn consists of:

i) Inherent risk: the susceptibility of the subject matter information to a material

misstatement, assuming that there are no related controls; and

ii)

Control risk: the risk that a material misstatement that could occur will not be prevented,

or detected and corrected, on a timely basis by related internal controls. When control

risk is relevant to the subject matter; some control risk will always exist because of the

inherent limitations of the design and operation of internal control; and

b) Detection risk: the risk that the practitioner will not detect a material misstatement that

exists.

The degree to which the practitioner considers each of these components is affected by the

engagement circumstances, in particular by the nature of the subject matter and whether a

reasonable assurance or a limited assurance engagement is being performed.

AT Lecture 1

Overview of Auditing and Assurance Services

Introduction to Auditing

Auditing is a systematic process of objectively obtaining and evaluating evidence regarding

selected assertions about economic actions and events to ascertain the degree of

correspondence between those assertions and established criteria and communicating the results

to interested users.

Key elements:

1. Systematic process audits are structured activities

2. Objectivity freedom from bias

3. Obtaining and evaluating evidence allows the auditor to determine the support for assertions or

representations. The auditor must gather evidence that the clients processes are working correctly,

the financial data are recorded and presented correctly and the financial statements as a whole are

fairly presented. The requirement is that the auditor is systematic and objective in obtaining and

evaluating evidence.

4. Assertions about economic actions and events describes the subject matter of the audit. An

assertion is a positive statement about an action, event, condition, or performance over a specified

period of time.

5. Degree of correspondence between those assertions and established criteria the purpose of the

audit is to determine conformity with some specified criteria. To have unbiased and clear

communication, criteria must exist whereby independent observers can assess whether or not such

assertions are appropriate. When management prepares financial statements, they assert those

statements are fairly presented with GAAP. Generally accepted accounting principles become the

criteria by which fairness of a financial statement presentation is judged. Other criteria exist for

other types of audits.

6. Communicating the results the results must be communicated to interested parties. Communication

of audit results to management and interested third parties completes the audit process. To minimize

understandings, this communication generally follows a prescribed format by clearly outlining the

nature of the work performed and the conclusions reached. Most audits result in audit reports that do

not contain any reservations about the fairness of the organizations presentation of its financial

statements. This is referred to as an unqualified audit report.

The audit adds value if the auditor:

a. Has expertise in both obtaining and evaluating evidence regarding the financial statements and

the economic assertions embodied in the financial statements.

b. Is independent of management and the third-parties, and can thus provide an objective opinion

on the fairness of financial statements.

PSA 200 Revised and Redrafted, Overall Objectives of the Independent Auditor and the Conduct

of an Audit in Accordance with PSAs sets out the overall objective of the independent auditor, and

explains the nature and scope of an audit designed to enable the independent auditor to meet those

objectives.

The general purpose of an audit is to enhance the credibility of the financial statements, thus ensuring the

user of the financial statements can make reasonable, informed decisions about an entity. This is

achieved by the expression of an opinion by the auditor on whether the information contained within the

financial statements is presented fairly, in all material respects, in accordance with applicable financial

reporting framework. Auditors who follow the PSAs and the ethical guidelines will be able to form an

opinion provided evidence is available to support their opinion. If the evidence is lacking, the auditor will

not able to form an opinion and should modify their report accordingly.

Overall Objectives of the Auditor

In conducting an audit of financial statements, the overall objectives of the auditor are:

a. To obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether due to fraud or error, thereby enabling the auditor to express an

opinion on whether the financial statements are prepared, in all material respects, in accordance with

an applicable financial reporting framework,

b. To report on the financial statements, and communicate as required by the PSAs, in accordance with

the auditors findings.

Applicable Financial Reporting Framework

-

The financial reporting framework adopted by management and, where appropriate, those charged

with governance in the preparation and presentation of the financial statements that is acceptable in

view of the nature of the entity and the objective of the financial statements, or that is required by law

or regulation.

AT Lecture 1

Overview of Auditing and Assurance Services

Fair presentation framework is used to refer to a financial reporting framework that requires

compliance with the requirements of the framework and

1. Acknowledges explicitly or implicitly that, to achieve fair presentation of the financial statements, it

may be necessary for management to provide disclosures beyond those specifically required by

the framework.

2. Acknowledges explicitly that it may be necessary for management to depart from a requirement

of the framework to achieve fair presentation of the financial statements. Such departures are

expected to be necessary only in extreme rare circumstances.

Compliance framework is used to refer to a financial reporting framework that requires

compliance with the requirements of the framework, but does not contain the acknowledgements in 1

or 2 above.

Scope of an Independent Audit

The term scope of the audit refers to the audit procedures deemed necessary in the circumstances to

achieve the objective of the audit. The procedures required to conduct an audit in accordance with PSAs

should be determined by the auditor having regard to the requirements of PSAs, relevant professional

bodies, legislation, regulations and where appropriate, the terms of the audit engagement and reporting

requirements.

Types of Procedures

1.

2.

3.

Risk Assessment Procedures

Tests of Control or Compliance Tests.

Substantive Tests or Direct Tests

Types of Audits

1. Financial Statements Audit

- Also referred to as Independent Audit or External Audit involves the examination of financial

statements to determine whether they are presented in accordance with applicable reporting

framework (generally accepted accounting principles).

2. Operational Audit

- Also known as Management Audit and Performance Audit are examination of all or part of an

organization for the purpose of determining the effectiveness and/or efficiency of its operations.

- Management implies that the information obtained in the audit process is useful to management.

- Performance implies an evaluation of the performance of persons or units executing the entitys

objectives.

-

Effectiveness is the measure of how well an entity or unit of an entity achieves its goal or

purpose.

Efficiency is the measure of minimization of cost in the achievement of its objective.

Characteristics:

a. Auditors performing the audit are independent of the activity they audit.

b. The audit report is directed to an official or department within the organization that employs the

auditor.

3. Compliance Audit

- Determination of whether the auditee is following specific procedures or rules set down by some

higher authority.

- Are performed by auditors independent of the activity being audited.

- Results are generally reported to someone within the organization/unit audited rather than a

broad spectrum of users.

4. Government audit determination of whether government funds are being handled properly and in

compliance with existing laws and whether the programs are being conducted efficiently and

economically.

Scope of Government Audit

Financial and compliance audit determines whether financial operations are properly

conducted, the financial reports of an audited entity are presented fairly, and the entity has

complied with applicable laws and regulations.

Economy and efficiency audit determines whether the entity is managing and utilizing its

resources economically and efficiently, the causes of inefficiencies or uneconomical practices and

whether the entity has complied with laws and regulations concerning matters of economy and

efficiency.

Programs results determines if the desired results and benefits are being achieved, if the

objectives established by the legislative or other authorizing body are being met and if the agency

has considered alternatives which might yield results at a lower cost.

AT Lecture 1

Overview of Auditing and Assurance Services

The Commission on Audit (formerly General Auditing Office) is recognized as the Supreme Audit

Institution in the Republic of the Philippines. It is the highest and final authority in state auditing,

Three Main Divisions of State Audit (based on 1984 Primer on Government and Auditing in the

Philippines)

a. Compliance Audit - examination, audit, and settlement in accordance with laws and regulations.

b. Financial Audit audit of the accounting, and financial system and controls to ensure reliability of

recorded financial data. The objective of this audit is the expression of an opinion on the fairness

with which the financial condition and results of operation are presented

c. Performance audit objective examination of the financial and operational performance of an

organization, program, activity or function and is oriented towards opportunities for greater

economy, efficiency and effectiveness.

Two forms of performance audit

1. Management audit (economy and efficiency audit) appraisal of management performance

from a least cost point of view and the analysis of relationship between benefits attained and

cost incurred.

2. Program results audit (effectiveness audit) evaluation of

program results vis--vis

management goals and objectives.

5. Internal audit an independent, objective assurance and consulting activity designed to add value

and improve an organizations operations. It helps an organization to accomplish its objectives by

bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk

management, control and governance processes.

a.

Management audit - future-oriented, independent, systematic evaluation of the activities of all

levels of management performed by internal auditor for the purpose of improving the

organizational profitability and increasing attainment of other organizational objectives.

b.

Operational audit future-oriented, independent, systematic evaluation performed by internal

auditor for management of the operational activities controlled by top, middle and lower-level

management for the purpose of improving organizational profitability and increasing attainment of

other organizational objectives.

c.

Financial audit historically oriented, independent evaluation performed by the internal auditor for

the purpose of ensuring the fairness, accuracy, and reliability of the financial data.

6. Comprehensive audit usually includes the components of compliance, performance and financial

statements audit.

7. Integrated audit - covers financial statements audit and internal control audit.

8. Environmental audit covers environmental issues which may have an impact on the financial

statements.

9. Forensic audit (Fraud Audit) refers to the examination of evidence regarding an assertion to

determine its correspondence to established criteria carried out in a manner suitable to the court.

Types of auditors

1. External (independent) auditors public accountants, both individuals and firms, who perform audit,

tax, consulting and other types of services for external clients.

2. Internal auditors perform services for a single organization for which they are employed on a fulltime basis, typically reporting to the board of directors who are the primary users of their work.

3. Government auditors are full-time employees of the government tasked to determine compliance

with laws, statutes, policies and procedures.

4. Forensic auditors financial auditing specialists who focus on unearthing the truth and/or providing

evidence in a legal/financial disputes and/or irregularities (including fraud), as well as providing

preventive advice on the subject.

Audit Risk Engagement Process

1.

2.

3.

4.

5.

6.

7.

Pre-engagement

Audit Planning

Study and Evaluation of Internal Control

Substantive Testing

Completing the Audit

Issuance of the Audit Report

Post-audit Responsibilities

AT Lecture 1

Overview of Auditing and Assurance Services

10

General Principles Governing The Audit of Financial Statements

a. The auditor should comply with the Code of Professional Ethics for Certified Public Accountants

promulgated by the Board of Accountancy and approved by Professional Regulations Commission.

Part A of the Code sets out the fundamental ethical principles that all professional accountants are

required to observe, including: (P O P I C)

1. Professional competence and due care;

2. Objectivity;

3. Professional behavior;

4. Integrity and

5. Confidentiality

b. The auditor should conduct an audit in accordance with Philippine Standards on Auditing.

c.

The auditor should plan and perform the audit with an attitude of professional skepticism

recognizing that circumstances may exist which may cause the financial statements to be materially

misstated.

Why Financial Statements Are Audited

1.

2.

3.

4.

5.

Remoteness of information users from information providers

Potential bias and motives of information providers.

Voluminous data.

Complex exchange transactions

Consequences

Information Risk risk that information upon which a business decision is made is inaccurate,

How Information Risk May Be Reduced

1. Allow the users to verify information.

2. Users share information risk with management.

3. Have the financial statements audited.

Philosophical Theories of Audit

1.

2.

3.

4.

Stewardship or Agency Theory

Motivational Theory

Information Theory

Insurance Theory

Elements of the Theoretical Framework of Auditing

1. The data to be audited can be verified.

2. Short-term conflicts may exist between managers who prepare data and auditors who examine the

data.

3. Auditors must have independence and freedom from managerial constraint.

4. Effective internal control system reduces the possibility of errors and fraud affecting the financial

statements.

5. Consistent application of generally accepted accounting principles (GAAP) or financial reporting

standards results in fair presentation of financial statements.

6. What was held true in the past will continue to hold true in the future in the absence of known

conditions to the contrary.

7. An audit benefits the public.

Economic Benefits of a Financial Statement Audit

1. Access to Capital Markets

2. Lower Cost of Capital

3. Deterrent to Inefficiency and Fraud

4. Control and Operational Improvements

Characteristics Which Make Accounting and Auditing a Profession

1.

2.

3.

4.

5.

Systematic body of theory

Professional authority

Community sanction

Regulative code

Culture

AT Lecture 1

Overview of Auditing and Assurance Services

11

Core Values are the essential and enduring beliefs that a CPA professional upholds over time. These

enable the CPAs to retain their unique character and value as they embrace the changing dynamics of

the global economy.

1.

2.

3.

4.

5.

6.

Integrity

Competence

Lifelong Learning

Objectivity

Commitment to Excellence

Relevance in the Global Marketplace

Core Competencies are the unique combination of human skills, knowledge and technology that

provides value and results to users.

1.

2.

3.

4.

5.

6.

Communication Skills

Leadership Skills

Critical Thinking and Problem Solving Skills

Anticipating and Serving Evolving Needs

Synthesizing Intelligence to Insight

Integration and Collaboration

Organization of CPA Firms

1. Sole Proprietorships

2. Partnerships.

Sycip, Gorres, Velayo & Co.

Isla Lipana & Associates

R. G, Manabat & Co,.

Punongbayan, Araullo & Co.

Navarro Amper Co.

R. Alba & Co.

Ernst & Young

PriceWaterhouse Coopers

KPMG

Grant Thornton

Deloitte Touche Tohmatsu

BDO International (Binder Dijker Otte & Co)

Ranks Within An Accounting Firm

1. Partner

- Concerned about the overall quality of each audit and ultimately responsible for the resolution of

technical matters, such as application of accounting principles or which auditing procedures are to be

performed. An audit partner signs the audit report and is generally involved in maintaining client

relationships, planning audits and evaluating the audit findings.

2. Manager/Supervisor

- Administers important aspects of audit engagements, scheduling the audit work to be done with

client personnel, assigning work to audit staff, supervising audit staff and reviewing staff work.

3. In Charge (Senior) Auditor

- Works under the direction of audit managers and assist in the administration of audit. He

participates in the audit planning and provides supervision to staff auditors.

4. Junior or staff assistant

- Performs various audit procedures that relate to a variety of aspects of a clients activities and

gathers audit evidence to use as a basis for the audit reports

Factors That Influence the Setting of Audit Fees

1.

2.

3.

4.

5.

6.

- (Fair reflection of the value of work)

Risks involved.

Complexity.

Time and volume involved.

Responsibility involved.

Conditions of accounting records and supporting documents.

Cooperation to be extended by the clients staff.

Methods of Setting-Up the Audit Fee

1. Per Diem or hourly rate basis. (also known as Actual Time charge basis)

- Billing is done on the basis of actual time spent by the staff multiplied by the hourly rates agreed

upon.

2. Flat fee basis (Lump-sum).

- Client is billed a flat but all-inclusive pre-arranged amount for the entire engagement.

3. Maximum fee basis (similar to per diem or hourly rate but a maximum limit is imposed by the

agreement between the client and the auditing firm).

4. Retainer fee basis

- Uniform monthly retainer fee and an additional amount as annual charge upon submission of the

audit report).

AT Lecture 1

Overview of Auditing and Assurance Services

12

Influential Accounting and Auditing Standard Setting Bodies/Organizations/Regulatory Bodies

Regulatory Government Agencies

1. Professional Regulation Commission (PRC).

The agency that administers implements and enforces regulatory policies of the National Government

with respect to the regulation and licensing of the various professions under its jurisdiction including

the maintenance of professional standards and ethics and the enforcement of the rules and

regulations thereto. It derives its authority from RA 8981 or PRC Modernization Act of 2000.

2. Professional Regulatory Board of Accountancy (BOA)

It is the body that regulates the practice of accountancy in the Philippines and empowered to

administer the Philippine Accountancy Act of 2004 or RA 9298.

a. It is composed of a chairman and six (6) members to be appointed by the President of the Phils.

from a list of three (3) recommendees for each position ranked by the Commission from a list of

five (5) nominees for each position submitted by the APO.

b. The chairman and members of the BOA shall hold office for a term of three (3) years.

c. Any vacancy occurring within the term shall be filled for the unexpired portion of the term only.

No person who has served two (2) successive complete terms as chairman or member shall be

eligible for reappointment as chairman or member until the lapse of one (1) year.

d. Appointment to fill up an unexpired term is not to be construed as a complete term.

e. No person shall serve the BOA for more than twelve (12) years.

Qualifications

1. Must be a natural-born citizen and resident of the Philippines.

2. Must be a duly registered CPA with at least ten (10) years of work experience in any scope of

practice of accountancy.

3. Must be of good moral character and must not have been convicted of crimes involving moral

turpitude.

4. Must not have any pecuniary interest, directly or indirectly, in any school, college, university or

institution conferring an academic degree necessary for the admission to the practice of

accountancy.

5. Must not be a Director or Officer of the APO at the time of his appointment.

3. Securities and Exchange Commission (SEC)

The government agency that regulates the registration and operations of corporations, partnerships,

and other forms of associations in the Philippines.

The overall objective of SEC is to assist in providing investors with reliable information upon which to

make investment decisions. It has considerable influence in setting financial reporting standards for

specifying reporting requirements considered necessary for fair disclosure to investors. It is

represented in standard-setting bodies such as PFRSC, AASC, and in the Philippine Interpretations

Committee (PIC). The SEC has power to establish roles for any CPA associated with audited

financial statements submitted to the Commission.

SEC is composed of a chairman and four (4) commissioners for a term of seven (7) years.

4. Commission on Audit (COA).

This constitutional commission has the power, authority, and duty to examine, audit, and settle all

accounts pertaining to the revenue and receipts of, and expenditures or uses of funds and property,

owned or held in trust by, or pertaining to, the government, or any of its subdivisions, agencies, or

instrumentalities, including government-owned or controlled corporations and recommend measures

to improve the efficiency and effectiveness of government operations.

The COA is composed of a chairman and two (2) commissioners. Together they are called the

Commission Proper appointed by the President of the Philippines with the consent of Commission

on Appointment for a term of seven (7) years.

5. Bangko Sentral ng Pilipinas (BSP).

The primary objective of this government agency is to maintain price stability conducive to a balanced

and sustainable economic growth. It also aims to promote and preserve monetary stability and the

convertibility of the peso.

The powers and functions of the BSP shall be exercised by the BSP Monetary Board composed of

seven (7) members appointed by the President of the Philippines for a term of six (6) years.

AT Lecture 1

Overview of Auditing and Assurance Services

13

6. Bureau of Internal Revenue

This agency aims to raise revenues for the government through the effective and efficient collection of

taxes, provide quality service to taxpayers and enforce tax laws in an impartial and uniform manner.

7. Insurance Commission

Its mandate is to regulate and supervise the insurance industry for the promotion of national interest.

Professional Organizations

1. Philippine Institute of Certified Public Accountants (PICPA)

This is the accredited national professional organization of CPAs in the Philippines (October 2, 1975

SEC Accreditation No. 15). It serves all members in the different sectors of the accounting profession

which include public practice, education, government and commerce and industry, through a set of

technical and social services. It aims to maintain a responsive organizational structure, committed

leadership, effective professional development programs abreast with state-of-art technology, strict

implementation of professional ethics, promotion of high standards of accounting education and

advocacy and participation in relevant national issues.

PICPA, being a member body of the International Federation of Accountants (IFAC) had initiated

through PFRSC the adoption of IASs in the Philippines.

On December 26, 2004, the PRBOA upon the recommendation of the PFRSCs approved adoption in

the Philippines of all the new, revised and improved IASs and IFRSs effective January 1, 2005 and

designated them as Philippine Financial Reporting Standards (PFRSs).

Sectoral Organizations

a. Association of CPAs in Public Practice (ACPAPP)

b. Association of CPAs in Education (ACPAE)

c. Association of CPAs in Commerce and Industry (ACPACI)

d. Government Association of CPAs (GACPA)

Standard Setting Bodies

1. Philippine Financial Reporting Standards Council (PFRSC)

A new standard setting body that is intended to replace the Accounting Standards Council (ASC)

through the Interpreting Rules and Regulations (IRR) of the Philippine Accountancy Act of 2004. It is

responsible for the promulgation of generally accepted accounting principles in the Philippines.

The PFRSC shall be composed of fifteen (15) members with a Chairman who had been or presently

a senior accounting practitioner in any of the scope of accounting practice and fourteen (14)

representatives/members from the following:

Chairman

Representatives/Members

a. Board of Accountancy

b. Securities and Exchange Commission

c. Bangko Sentral ng Pilipinas

d. Bureau of Internal Revenue

e. A major organization composed of preparers

and users of financial statements

f. Commission on Audit

g Accredited National Professional Organization of CPAs

Public Practice

Commerce and Industry

Academe/Education

Government

Total

1

1

1

1

1

1

1

2

2

2

2

8

____ ____

15

____

Term is three (3) years and renewable for another term

2. Auditing and Assurance Standards Council (AASC)

This is also an independent body. Its main task is to define the auditing standards and procedures

that will govern the examination of financial statements and shall guide the members of the

profession in the Philippines.

AT Lecture 1

Overview of Auditing and Assurance Services

14

The AASC shall be composed of seventeen (17) members with a Chairman who had been or

presently a senior practitioner in public accountancy and sixteen (16) representatives/members from

various sectors of the profession:

Chairman

Representatives/Members

a. Board of Accountancy

b. Securities and Exchange Commission

c. Bangko Sentral ng Pilipinas

d. An association or organization of CPAs in active

public practice of accountancy

e. Commission on Audit

f Accredited National Professional Organization of CPAs

Public Practice

Commerce and Industry

Academe/Education

1

1

1

1

1

1

9

1

1

11

____ ____

Total

17 ***

____

*** In 2009, the Board of Accountancy amended the composition of the AASC.

Term is three (3) years and renewable for another term

3. International Federation of Accountants (IFAC)

It is the worldwide organization for the accountancy profession. Founded in 1977, it is comprised of

173 members and associates in 129 countries worldwide, representing approximately 2.5 million

accountants in public practice, industry and commerce, the public sector, and education.

Primary activities:

a. Serving the public interest.

b. Contributing to the efficiency of global economy

c. Providing leadership and spokesmanship

4. International Accounting Standards Board (IASB)

This board is began its operations in 2001 and is based in London. It is composed of fourteen board

(14) members of whom are full-time and is committed to developing in the public interest, a single

set of high quality, global accounting standards that require transparent and comparable information

in general-purpose financial statements.

In April 2001, the IASB assumed from the IASC the responsibility for setting international accounting

standards. IASB adopted the IASs issued by the IASC and retained designation and format of the

Standards. New standards issued by the IASB were designated as International Financial Reporting

Standards (IFRS). In December 2003, the IASB issued 15 revised IASs, withdrew IAS 15,

Information Reflecting the Effects of Changing Prices and issued IFRS 1 to 5.

5

International Auditing Practices Committee (IAPC)

It is a standing committee of the Council of IFAC and is responsible for the development and

issuance on behalf of the Council, standards and statements on a variety of audit and attest

functions in order to improve the degree of uniformity of auditing practices and related services

throughout the world. IASPC issues the International Standards in Auditing (ISAs) that are to be

applied in the audit of financial statements, audit of other information and related services.

Other Bodies

1. Education Technical Council

This council was created by PRC upon the recommendation of BOA to assist the Board in carrying

out its powers and functions provided in the RA 9298 in the attainment of objective of continuously

upgrading the accountancy education in the Philippines to make the Filipino CPAs globally

competitive.

The ETC shall be composed of seven (7) members with a Chairman who had been or presently a

senior practitioner in the academe/education and six (6) representatives from the following:

Chairman

1

Representatives/Members

a. Board of Accountancy

1

b Accredited National Professional Organization of CPAs

Public Practice

1

Commerce and Industry

1

Academe/Education

2

Government

1

5

____ ____

Total

7

____

AT Lecture 1

Overview of Auditing and Assurance Services

15

Term is three (3) years and renewable for another term

2. Quality Review Committee

This committee is created by PRC upon the recommendation of BOA to conduct an oversight into the

quality of audit of financial statements through a review of the quality control measures instituted by

Individual CPAs, Firms or Partnerships in order to ensure compliance with accounting and auditing

standards and practices.

The QRC shall be composed of seven (7) members with a chairman, who had been or presently a

senior practitioner in public accountancy and six (6) representatives from the following:

Chairman

Representatives/Members

b. Board of Accountancy

b Accredited National Professional Organization of CPAs

Public Practice

Commerce and Industry

Academe/Education

Government

Total

1

1

2

1

1

1

5

____ ____

7

____

Term is three (3) years and renewable for another term

3. PRC CPE Council

The Board upon approval by PRC, shall create a Council which shall assist the Board in

implementing its CPE program.

It shall be composed of a chairperson and two (2) members. The chairperson of CPE Council shall

be chosen from among the members of the Board by the members themselves. The first member

shall be the president or, in his or her absence or incapacity, any officer chosen by the Board of

Directors of PICPA. The second members shall be the president or, in his or her absence or

incapacity, any officer of the organization of deans or department heads of schools, colleges or

universities offering the degree requiring licensure examination.

The term of the office of the Chairman of the PRC-CPE Council shall be co-terminus with his/her

incumbency in the PRC. The terms of the members will be co-terminus with their respective terms in

the PICPA and in the organization of deans or department heads.

The chairperson, first member and second member shall continue to function as such in the PRCCPE Council until the appointment or election of their respective successors in the BOA, PICPA or

organization of deans or department heads.

4. PICPA CPE Council

The PRC CPE Council may delegate if the need arises to the PICPA CPE Council the processing of

application, keeping of all records for CPE providers and their respective programs and credit units

earned by each CPA who avails of the CPE program and related functions.

********************************

Você também pode gostar

- AT ReviewerDocumento10 páginasAT Reviewerfer maAinda não há avaliações

- Auditing Theory - AssuranceDocumento5 páginasAuditing Theory - AssuranceDavidCruzAinda não há avaliações

- Auditing Problems Lecture Notes PDFDocumento24 páginasAuditing Problems Lecture Notes PDFmattAinda não há avaliações

- Auditing Theory 100 Questions 2015Documento22 páginasAuditing Theory 100 Questions 2015Louie de la TorreAinda não há avaliações

- Auditing in A CIS EnvironmentDocumento10 páginasAuditing in A CIS EnvironmentLailanie AcordaAinda não há avaliações

- Attestation Services 2Documento8 páginasAttestation Services 2sana olAinda não há avaliações

- Afar Income Recognition Installment Sales Franchise Long Term Construction PDFDocumento10 páginasAfar Income Recognition Installment Sales Franchise Long Term Construction PDFKim Nicole ReyesAinda não há avaliações

- Auditing Theory SalosagcolDocumento4 páginasAuditing Theory SalosagcolYuki CrossAinda não há avaliações

- Module 1 Fundamentals of Auditing and Assurance ServicesDocumento28 páginasModule 1 Fundamentals of Auditing and Assurance ServicesMary Grace Dela CruzAinda não há avaliações

- TOA CparDocumento12 páginasTOA CparHerald Gangcuangco100% (2)

- 3 - Philippine Standards On Quality ControlDocumento14 páginas3 - Philippine Standards On Quality ControlKenneth PimentelAinda não há avaliações

- Ease of Doing Business PDFDocumento3 páginasEase of Doing Business PDFDwight BlezaAinda não há avaliações

- 1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsDocumento181 páginas1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsLawrence YusiAinda não há avaliações

- Psa 510Documento9 páginasPsa 510Rico Jon Hilario GarciaAinda não há avaliações

- Management Advisory Services Cpa ReviewDocumento30 páginasManagement Advisory Services Cpa ReviewRyan PedroAinda não há avaliações

- Pre Week, PDocumento21 páginasPre Week, PCindy Karla SalnoAinda não há avaliações

- AT Quizzer 1 - Overview of Auditing (2TAY1718)Documento12 páginasAT Quizzer 1 - Overview of Auditing (2TAY1718)JimmyChaoAinda não há avaliações

- Lesson 6 Philippine Standards On Quality Control PDFDocumento17 páginasLesson 6 Philippine Standards On Quality Control PDFazmyla fullonAinda não há avaliações

- Reviewer For Auditing TheoryDocumento10 páginasReviewer For Auditing TheoryMharNellBantasanAinda não há avaliações

- FINALS - Auditing TheoryDocumento8 páginasFINALS - Auditing TheoryAngela ViernesAinda não há avaliações

- IAT 2020 Final Preboard (Source SimEx4 RS)Documento15 páginasIAT 2020 Final Preboard (Source SimEx4 RS)Mary Yvonne AresAinda não há avaliações

- Small & Medium-Sized Entities (Smes)Documento8 páginasSmall & Medium-Sized Entities (Smes)Levi Emmanuel Veloso BravoAinda não há avaliações

- BanksDocumento58 páginasBanksgraceAinda não há avaliações

- Auditing Theory Overview of The Audit Process With AnswersDocumento44 páginasAuditing Theory Overview of The Audit Process With AnswersNikolajay MarrenoAinda não há avaliações

- AT 04 Practice and Regulation of The ProfessionDocumento6 páginasAT 04 Practice and Regulation of The ProfessionEira ShaneAinda não há avaliações

- AP 08 Substantive Audit Tests of EquityDocumento2 páginasAP 08 Substantive Audit Tests of EquityJobby JaranillaAinda não há avaliações

- Fundamentals of Auditing and Assurance ServicesDocumento37 páginasFundamentals of Auditing and Assurance Servicesnicolebrixx100% (1)

- Notes From Sir Red Sirug Handouts On Auditing TheoryDocumento104 páginasNotes From Sir Red Sirug Handouts On Auditing TheoryAmithy GuevarraAinda não há avaliações

- CPAR AT - Philippine Accountancy Act of 2004Documento4 páginasCPAR AT - Philippine Accountancy Act of 2004John Carlo CruzAinda não há avaliações

- TOA - Mock Compre - AnswersDocumento12 páginasTOA - Mock Compre - AnswersChrissa Marie VienteAinda não há avaliações

- Auditing Theory Summary Auditing Theory SummaryDocumento42 páginasAuditing Theory Summary Auditing Theory SummaryCJ TinAinda não há avaliações

- MODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsDocumento8 páginasMODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsJake Bundok100% (1)

- AFAR ProblemDocumento14 páginasAFAR ProblemGil Enriquez100% (1)

- Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceDocumento9 páginasAudit of Inventories: The Use of Assertions in Obtaining Audit EvidencemoAinda não há avaliações

- 07 Rittenberg TB Ch7Documento22 páginas07 Rittenberg TB Ch7Karlo Jude AcideraAinda não há avaliações

- At - (14) Internal ControlDocumento13 páginasAt - (14) Internal ControlLorena Joy Aggabao100% (2)

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDocumento10 páginasQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyAinda não há avaliações

- Auditing Theory ReviewerDocumento19 páginasAuditing Theory ReviewerNathalie PadillaAinda não há avaliações

- Chapter 16Documento16 páginasChapter 16redearth29Ainda não há avaliações

- Auditing The Finance and Accounting FunctionsDocumento19 páginasAuditing The Finance and Accounting FunctionsMark Angelo BustosAinda não há avaliações

- Chapter 10 Identifying and Assessing The Risks of Material MisstatementsDocumento7 páginasChapter 10 Identifying and Assessing The Risks of Material MisstatementsRichard de LeonAinda não há avaliações

- Accounting Changes and Errors - Lecture by Rey OcampoDocumento22 páginasAccounting Changes and Errors - Lecture by Rey OcampoBernadette PanicanAinda não há avaliações

- AT-02 Q Assurance and Non-Assurance ServicesDocumento43 páginasAT-02 Q Assurance and Non-Assurance ServicesNicale JeenAinda não há avaliações

- Fundamentals of Audit and Assurance ServicesDocumento50 páginasFundamentals of Audit and Assurance ServicesAndrea ValdezAinda não há avaliações

- Management Reporting A Complete Guide - 2019 EditionNo EverandManagement Reporting A Complete Guide - 2019 EditionAinda não há avaliações

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)No EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Nota: 3.5 de 5 estrelas3.5/5 (17)

- Operational Auditing A Complete Guide - 2021 EditionNo EverandOperational Auditing A Complete Guide - 2021 EditionAinda não há avaliações

- PSBA - AT Lecture 1 Overview of Auditing (2SAY2021)Documento13 páginasPSBA - AT Lecture 1 Overview of Auditing (2SAY2021)Abdulmajed Unda MimbantasAinda não há avaliações

- AT Lecture 1 Overview of AuditingDocumento15 páginasAT Lecture 1 Overview of AuditingmoAinda não há avaliações

- AAP Lesson 1Documento4 páginasAAP Lesson 1hazel alvarezAinda não há avaliações

- Accounting 16aDocumento93 páginasAccounting 16aLelouch BritanianAinda não há avaliações

- Overview of Assurance, Auditing, and Other ServicesDocumento12 páginasOverview of Assurance, Auditing, and Other ServicesCarms St ClaireAinda não há avaliações

- 1718 01 Fundamentals of Auditng and Assurance EngagementsDocumento5 páginas1718 01 Fundamentals of Auditng and Assurance EngagementsBryan TerceroAinda não há avaliações

- The Authority Attaching To Philippine Standards Issued by The AASC Standards ApplicationDocumento10 páginasThe Authority Attaching To Philippine Standards Issued by The AASC Standards ApplicationCharmaine PamintuanAinda não há avaliações

- AuditmidtermsDocumento26 páginasAuditmidtermsLana sereneAinda não há avaliações

- Auditing TheoryDocumento63 páginasAuditing TheoryJohn Laurence LoplopAinda não há avaliações

- PSA 100 - Philippine Framework For Assurance EngagementDocumento26 páginasPSA 100 - Philippine Framework For Assurance EngagementHezekiah Reginalde Recta100% (1)

- 910-Psa 910Documento26 páginas910-Psa 910Gwenneth BachusAinda não há avaliações

- Auditing Theory Summary NotesDocumento63 páginasAuditing Theory Summary NotesChandria FordAinda não há avaliações

- Overview of Auditing and AssuranceDocumento15 páginasOverview of Auditing and AssuranceJadeFerrer50% (2)

- Chapter 15 - Excise Tax2013Documento3 páginasChapter 15 - Excise Tax2013JadeFerrer67% (3)

- Ferrer, Jade PDFDocumento2 páginasFerrer, Jade PDFJadeFerrerAinda não há avaliações

- Intangible AssetsDocumento17 páginasIntangible AssetsJadeFerrerAinda não há avaliações

- Iso Full Audit PDFDocumento89 páginasIso Full Audit PDFSaid Abdallah100% (2)

- Auditing MCQ Unit 1 To Unit 4Documento6 páginasAuditing MCQ Unit 1 To Unit 4amitAinda não há avaliações

- Literature Review On The Auditorrsquos Independence Between Threats and Safeguards ADocumento9 páginasLiterature Review On The Auditorrsquos Independence Between Threats and Safeguards AMstefAinda não há avaliações

- Inc Tax Chapter 2Documento27 páginasInc Tax Chapter 2Noeme LansangAinda não há avaliações

- Volume 4 - Revenue Administration & Resouce Mobilization Tools and ApproachesDocumento79 páginasVolume 4 - Revenue Administration & Resouce Mobilization Tools and ApproachesBong RicoAinda não há avaliações

- GDEX Annual Report 2009 - 2nd PartDocumento88 páginasGDEX Annual Report 2009 - 2nd PartElaine YeapAinda não há avaliações

- LCCI L3 Certificate in Financial Accounting ASE20101 April 2017Documento24 páginasLCCI L3 Certificate in Financial Accounting ASE20101 April 2017Musthari KhanAinda não há avaliações

- Annual Report DSSA 2018 PDFDocumento320 páginasAnnual Report DSSA 2018 PDFSudarmadi DmaAinda não há avaliações

- Monica Salgado: 5010 S. Rockwell ST Chicago, Illinois 773.562.9029 Mcastro13@ccc - EduDocumento3 páginasMonica Salgado: 5010 S. Rockwell ST Chicago, Illinois 773.562.9029 Mcastro13@ccc - Eduapi-316243999Ainda não há avaliações

- Financial Accounting Introdution To Accounting A) DefinitionDocumento8 páginasFinancial Accounting Introdution To Accounting A) DefinitionWesleyAinda não há avaliações

- OH&S ISO 45001 24th To 28th JuneDocumento4 páginasOH&S ISO 45001 24th To 28th JuneThirumaran MuthusamyAinda não há avaliações

- 2007Documento72 páginas2007anilkumbarAinda não há avaliações

- Timeliness of Financial Reporting Analysis: An Empirical Study in Indonesia Stock ExchangeDocumento31 páginasTimeliness of Financial Reporting Analysis: An Empirical Study in Indonesia Stock ExchangedownloadreferensiAinda não há avaliações

- GT Energy Audit Plan (2016!09!14)Documento30 páginasGT Energy Audit Plan (2016!09!14)Amartya Ahmad AtmawijayaAinda não há avaliações

- Maths Final orDocumento5 páginasMaths Final ortemedebereAinda não há avaliações

- Ahmad Nuriadi TAXDocumento3 páginasAhmad Nuriadi TAXwahyudi0% (1)

- Philippine Christian University: The Problem and Its BackgroundDocumento30 páginasPhilippine Christian University: The Problem and Its BackgroundumbrellaAinda não há avaliações

- Global Technology Audit Guide: The Institute of Internal AuditorsDocumento29 páginasGlobal Technology Audit Guide: The Institute of Internal AuditorsRachel DelgadoAinda não há avaliações

- Apple Conflict Free MineralsDocumento15 páginasApple Conflict Free MineralsMikey CampbellAinda não há avaliações

- M&A Process: Elyse Greenbaum and Gary Patterson Contact InformationDocumento11 páginasM&A Process: Elyse Greenbaum and Gary Patterson Contact InformationarindamAinda não há avaliações

- ISA 320 Audit MaterialityDocumento2 páginasISA 320 Audit MaterialityCasper ChahandaAinda não há avaliações

- Adapting To Audience 2Documento29 páginasAdapting To Audience 2HoàngTrúcAinda não há avaliações

- OSDS Office Functions and JDs PDFDocumento74 páginasOSDS Office Functions and JDs PDFehm_magbujos100% (1)

- Iso 14001Documento61 páginasIso 14001kiranshingote100% (1)

- Auditing - Principles and Practice PDFDocumento171 páginasAuditing - Principles and Practice PDFKiran Ravi Srivastava80% (5)

- Supplier Information Survey PGDocumento68 páginasSupplier Information Survey PGhmp90Ainda não há avaliações

- Waste Auditing Guide Guiding PrinciplesDocumento24 páginasWaste Auditing Guide Guiding PrinciplesChristineAinda não há avaliações

- Auditing and Assurance Strathmore University Notes and Revision KitDocumento287 páginasAuditing and Assurance Strathmore University Notes and Revision KitAx NgAinda não há avaliações

- International Sales Representative AgreementDocumento9 páginasInternational Sales Representative AgreementRaghvendra SinghAinda não há avaliações

- CS-152 Computerized AccountingDocumento126 páginasCS-152 Computerized AccountingMarlic JesseAinda não há avaliações