Escolar Documentos

Profissional Documentos

Cultura Documentos

What Is Implied Volatility

Enviado por

Umesh ThakkarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

What Is Implied Volatility

Enviado por

Umesh ThakkarDireitos autorais:

Formatos disponíveis

What is Implied Volatility?

| Implied Volatility in Options | TradeKing

1 of 1

https://www.tradeking.com/education/options/what-is-implied-volatility

What is Implied Volatility?

Implied volatility (IV) is one of the most important

concepts for options traders to understand for two

reasons. First, it shows how volatile the market might

be in the future. Second, implied volatility can help you

calculate probability. This is a critical component of

options trading which may be helpful when trying to

determine the likelihood of a stock reaching a specific

price by a certain time. Keep in mind that while these

reasons may assist you when making trading

decisions, implied volatility does not provide a

forecast with respect to market direction. Although

implied volatility is viewed as an important piece of

information, above all it is determined by using an

option pricing model, which makes the data theoretical

in nature. There is no guarantee these forecasts will

be correct.

Understanding IV means you can enter an options trade knowing the markets opinion each time. Too many

traders incorrectly try to use IV to find bargains or over-inflated values, assuming IV is too high or too low. This

interpretation overlooks an important point, however. Options trade at certain levels of implied volatility

because of current market activity. In other words, market activity can help explain why an option is priced in a

certain manner. Here we'll show you how to use implied volatility to improve your trading. Specifically, well

define implied volatility, explain its relationship to probability, and demonstrate how it measures the odds of a

successful trade.

Historical vs. implied volatility

There are many different types of volatility, but options traders tend to focus on historical and implied

volatilities. Historical volatility is the annualized standard deviation of past stock price movements. It measures

the daily price changes in the stock over the past year.

In contrast, IV is derived from an options price and shows what the market implies about the stocks volatility

in the future. Implied volatility is one of six inputs used in an options pricing model, but its the only one that is

not directly observable in the market itself. IV can only be determined by knowing the other five variables and

solving for it using a model. Implied volatility acts as a critical surrogate for option value - the higher the IV, the

higher the option premium.

Since most option trading volume usually occurs in at-the-money (ATM) options, these are the contracts

generally used to calculate IV. Once we know the price of the ATM options, we can use an options pricing

model and a little algebra to solve for the implied volatility.

Some question this method, debating whether the chicken or the egg comes first. However, when you

understand the way the most heavily traded options (the ATM strikes) tend to be priced, you can readily see

the validity of this approach. If the options are liquid then the model does not usually determine the prices of

the ATM options; instead, supply and demand become the driving forces. Many times market makers will stop

using a model because its values cannot keep up with the changes in these forces fast enough. When asked,

What is your market for this option? the market maker may reply What are you willing to pay? This means

all the transactions in these heavily traded options are what is setting the options price. Starting from this

real-world pricing action, then, we can derive the implied volatility using an options pricing model. Hence it is not

the market markers setting the price or implied volatility; its actual order flow.

Implied volatility as a trading tool

Implied volatility shows the markets opinion of the stocks potential moves, but it doesnt forecast direction. If

the implied volatility is high, the market thinks the stock has potential for large price swings in either direction,

just as low IV implies the stock will not move as much by option expiration.

To option traders, implied volatility is more important than historical volatility because IV factors in all market

expectations. If, for example, the company plans to announce earnings or expects a major court ruling, these

events will affect the implied volatility of options that expire that same month. Implied volatility helps you gauge

how much of an impact news may have on the underlying stock.

How can option traders use IV to make more informed trading decisions? Implied volatility offers an objective

way to test forecasts and identify entry and exit points. With an options IV, you can calculate an expected

range - the high and low of the stock by expiration. Implied volatility tells you whether the market agrees with

your outlook, which helps you measure a trades risk and potential reward.

Defining standard deviation

First, lets define standard deviation and how it relates to implied volatility. Then well discuss how standard

deviation can help set future expectations of a stocks potential high and low prices - values that can help you

make more informed trading decisions.

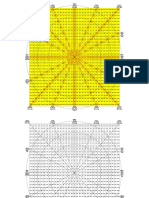

To understand how implied volatility can be useful, you first have to understand the biggest assumption made

by people who build pricing models: the statistical distribution of prices. There are two main types which are

used, normal distribution or lognormal distribution. The image below is of normal distribution, sometimes known

20/07/2015 13:31

Você também pode gostar

- Buying and Selling Volatility - Connolly KevinDocumento218 páginasBuying and Selling Volatility - Connolly Kevinjshew_jr_junk100% (1)

- Zen in The MarketsDocumento85 páginasZen in The Marketsjonnywinchester100% (12)

- Golden Cross vs Death Cross GuideDocumento3 páginasGolden Cross vs Death Cross GuideSandeep MishraAinda não há avaliações

- GANN FindingsDocumento34 páginasGANN FindingsUmesh Thakkar100% (2)

- Predicting The Nifty SensexDocumento5 páginasPredicting The Nifty Sensexnikesh_prasad0% (2)

- IFG Options 301: Advanced Option Trading ConceptsDocumento96 páginasIFG Options 301: Advanced Option Trading ConceptsArizar777100% (1)

- Accuracy of Black Scholes Model for AEX Index OptionsDocumento35 páginasAccuracy of Black Scholes Model for AEX Index OptionsEdwin HauwertAinda não há avaliações

- (Eurex) Interest Rate Derivatives - Fixed Income Trading StrategiesDocumento109 páginas(Eurex) Interest Rate Derivatives - Fixed Income Trading StrategiesJay KabAinda não há avaliações

- (Merrill Lynch, Gatheral) Consistent Modeling of SPX and VIX OptionsDocumento75 páginas(Merrill Lynch, Gatheral) Consistent Modeling of SPX and VIX OptionsanuragAinda não há avaliações

- George Bayer - Complete Course of AstrologyDocumento23 páginasGeorge Bayer - Complete Course of Astrologyydderf71% (7)

- George Bayer - Complete Course of AstrologyDocumento23 páginasGeorge Bayer - Complete Course of Astrologyydderf71% (7)

- Harmonic Pattern CalculatorDocumento6 páginasHarmonic Pattern CalculatorUmesh ThakkarAinda não há avaliações

- Oi Pulse Manual FileDocumento221 páginasOi Pulse Manual Filelakshmipathihsr64246100% (1)

- Basic Derivatives ExplainedDocumento5 páginasBasic Derivatives ExplainedJaymee Andomang Os-ag27% (11)

- ABCs of VolatilityDocumento5 páginasABCs of VolatilityshubhamshklAinda não há avaliações

- What Are Market Sentiment Indicators and How To Use It in Your Trading - The Smart InvestorDocumento8 páginasWhat Are Market Sentiment Indicators and How To Use It in Your Trading - The Smart InvestorRaphael OmoabuganAinda não há avaliações

- Strategize Your Investment In 30 Minutes A Day (Steps)No EverandStrategize Your Investment In 30 Minutes A Day (Steps)Ainda não há avaliações

- Merrill Oster - 76 Rules of Millionaire Traders (2002)Documento78 páginasMerrill Oster - 76 Rules of Millionaire Traders (2002)Carlos Galvan100% (1)

- Basic Option Pricing by BittmanDocumento48 páginasBasic Option Pricing by BittmanJunedi dAinda não há avaliações

- Why The Excess VolatilityDocumento4 páginasWhy The Excess VolatilitysandeepvempatiAinda não há avaliações

- From Dna To Proteins - TestDocumento21 páginasFrom Dna To Proteins - Testapi-377689746Ainda não há avaliações

- Commodity Channel IndexDocumento2 páginasCommodity Channel IndexMeet Darji100% (1)

- Implied VolatilityDocumento3 páginasImplied Volatilityrohit83Ainda não há avaliações

- VixclassDocumento119 páginasVixclassmr12323100% (1)

- Abap Basics MaterialDocumento169 páginasAbap Basics Materialhisri01Ainda não há avaliações

- Which Shorts Are Informed?Documento48 páginasWhich Shorts Are Informed?greg100% (1)

- India's Volatility Index BehaviourDocumento10 páginasIndia's Volatility Index Behaviouraruna2707Ainda não há avaliações

- VIX Reversion Update TSDocumento35 páginasVIX Reversion Update TSAlex BernalAinda não há avaliações

- Options The GreeksDocumento5 páginasOptions The Greekspiwp0wAinda não há avaliações

- 16.volatility Calculation (Historical) - Zerodha VarsityDocumento24 páginas16.volatility Calculation (Historical) - Zerodha Varsityravi4paperAinda não há avaliações

- PioneerITGuruSAPMMCourseTopics 2015Documento15 páginasPioneerITGuruSAPMMCourseTopics 2015Anonymous OjdlMM2YC7Ainda não há avaliações

- The Master Trader: Birinyi's Secrets to Understanding the MarketNo EverandThe Master Trader: Birinyi's Secrets to Understanding the MarketAinda não há avaliações

- Chaikin Money Flow Vs Chaikin OccilatorDocumento12 páginasChaikin Money Flow Vs Chaikin Occilatorhaseeb100% (1)

- Technical Analysis Why Technical Analysis?: Shishir SrivastavaDocumento12 páginasTechnical Analysis Why Technical Analysis?: Shishir SrivastavaShishir Srivastava100% (1)

- Options 101 Get Trading With Options NPDocumento47 páginasOptions 101 Get Trading With Options NPjoseluisvazquezAinda não há avaliações

- FOREX Quant Trading by Atty. Ryan "Ryu" UyDocumento12 páginasFOREX Quant Trading by Atty. Ryan "Ryu" UyRyu UyAinda não há avaliações

- The Greek LettersDocumento18 páginasThe Greek LettersSupreet GuptaAinda não há avaliações

- The Future of Finance: A New Model for Banking and InvestmentNo EverandThe Future of Finance: A New Model for Banking and InvestmentAinda não há avaliações

- Development and Analysis of A Trading Algorithm Using Candlestick PatternsDocumento21 páginasDevelopment and Analysis of A Trading Algorithm Using Candlestick PatternsManziniLeeAinda não há avaliações

- OrderFlow Charts and Notes for Bank Nifty and Nifty Futures on 27th Sept 17Documento12 páginasOrderFlow Charts and Notes for Bank Nifty and Nifty Futures on 27th Sept 17SinghRaviAinda não há avaliações

- Dispersion TradingDocumento2 páginasDispersion TradingPuneet KinraAinda não há avaliações

- Losing To WinDocumento3 páginasLosing To Winartus140% (1)

- Earnings Theory PaperDocumento64 páginasEarnings Theory PaperPrateek SabharwalAinda não há avaliações

- Currency Correlation and Stock HuntsDocumento9 páginasCurrency Correlation and Stock HuntsMichael Mario100% (1)

- Technical Trading Strategies Primer 1Documento10 páginasTechnical Trading Strategies Primer 1JonAinda não há avaliações

- IronbutterplyDocumento3 páginasIronbutterplyCiliaAinda não há avaliações

- Bear Put Spread: Bearish Vertical Spread Options StrategyDocumento4 páginasBear Put Spread: Bearish Vertical Spread Options StrategyjaiswalsnehaAinda não há avaliações

- What Is An OptionDocumento30 páginasWhat Is An OptionsanketgharatAinda não há avaliações

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeAinda não há avaliações

- Training New TradersDocumento3 páginasTraining New TradersLUCKYAinda não há avaliações

- Exam Sections: 1. Infrastructure ObjectivesDocumento2 páginasExam Sections: 1. Infrastructure Objectivesanandaraj280% (1)

- Option Trading Work BookDocumento28 páginasOption Trading Work BookpierAinda não há avaliações

- Minute Option Data FieldsDocumento15 páginasMinute Option Data FieldsJuan LamadridAinda não há avaliações

- Boh Philippines Black Box - 2019.07.31Documento289 páginasBoh Philippines Black Box - 2019.07.31Phi Consistent TraderAinda não há avaliações

- Technical Analysis EngineeringDocumento8 páginasTechnical Analysis EngineeringAbhinav AroraAinda não há avaliações

- The AI Economy by RogerDocumento318 páginasThe AI Economy by RogerRobin SonAinda não há avaliações

- ReversalCandlestickVietnam Updated PDFDocumento7 páginasReversalCandlestickVietnam Updated PDFdanielAinda não há avaliações

- Technical Analysis Predicts Market MovementsDocumento29 páginasTechnical Analysis Predicts Market Movementsramunagati100% (1)

- Butterfly Spread OptionDocumento8 páginasButterfly Spread OptionVivek Singh RanaAinda não há avaliações

- What Makes The VIX Tick PDFDocumento59 páginasWhat Makes The VIX Tick PDFmititeiAinda não há avaliações

- Forex RegistrationDocumento15 páginasForex RegistrationHedge Fund Lawyer100% (2)

- Fibonacci Who: Fibonacci Retracement Levels Fibonacci Extension LevelsDocumento10 páginasFibonacci Who: Fibonacci Retracement Levels Fibonacci Extension LevelsAalon SheikhAinda não há avaliações

- SSRN Id3596245 PDFDocumento64 páginasSSRN Id3596245 PDFAkil LawyerAinda não há avaliações

- World Stock Exange & Web Directory by Money Market, BNGDocumento7 páginasWorld Stock Exange & Web Directory by Money Market, BNGsachinmehta1978Ainda não há avaliações

- 10 Rules For Successful Long Term Investment 270112Documento2 páginas10 Rules For Successful Long Term Investment 270112Ganesh Subramanian100% (1)

- Deep HedgingDocumento21 páginasDeep HedgingRaju KaliperumalAinda não há avaliações

- Gann Solar DaysDocumento3 páginasGann Solar DaysUmesh ThakkarAinda não há avaliações

- Sanjay GuptaDocumento1 páginaSanjay GuptaUmesh ThakkarAinda não há avaliações

- ORB in CommodityDocumento1 páginaORB in CommodityUmesh ThakkarAinda não há avaliações

- AbcDocumento5 páginasAbcUmesh ThakkarAinda não há avaliações

- Banknifty IntradayDocumento117 páginasBanknifty IntradayUmesh ThakkarAinda não há avaliações

- PythagorasDocumento1 páginaPythagorasUmesh ThakkarAinda não há avaliações

- THE HORA AND IT EffectsDocumento7 páginasTHE HORA AND IT EffectsUmesh ThakkarAinda não há avaliações

- Ranger Input Price: 27250: Angle: 329Documento2 páginasRanger Input Price: 27250: Angle: 329Umesh ThakkarAinda não há avaliações

- Sun Saturn and RahuDocumento2 páginasSun Saturn and RahuUmesh ThakkarAinda não há avaliações

- Natal Chart ReadingDocumento13 páginasNatal Chart ReadingUmesh ThakkarAinda não há avaliações

- Moon and Market: An Empirical Study On Effect of Movement of Moon On Bse SensexDocumento10 páginasMoon and Market: An Empirical Study On Effect of Movement of Moon On Bse SensexTJPRC Publications0% (1)

- Day Wise Nifty AstroDocumento28 páginasDay Wise Nifty AstroUmesh ThakkarAinda não há avaliações

- ASTRO Aspects For FinancialDocumento24 páginasASTRO Aspects For FinancialUmesh ThakkarAinda não há avaliações

- The Intraday Trading BossDocumento12 páginasThe Intraday Trading BossUmesh ThakkarAinda não há avaliações

- Value GuideDocumento64 páginasValue GuideUmesh ThakkarAinda não há avaliações

- HLC Higher LowerDocumento66 páginasHLC Higher LowerUmesh ThakkarAinda não há avaliações

- Mars + True Node(rahu) Degrees 1984Documento510 páginasMars + True Node(rahu) Degrees 1984Umesh ThakkarAinda não há avaliações

- Nifty Gann CalcuationDocumento7 páginasNifty Gann CalcuationUmesh ThakkarAinda não há avaliações

- Pair TradingDocumento22 páginasPair TradingUmesh ThakkarAinda não há avaliações

- Gann For NiftyDocumento22 páginasGann For NiftyUmesh ThakkarAinda não há avaliações

- WD Gann's Mathematical Formula for Market PredictionsDocumento10 páginasWD Gann's Mathematical Formula for Market Predictionsjohn2031100% (3)

- ABCD Fibocalulator PointDocumento4 páginasABCD Fibocalulator PointUmesh ThakkarAinda não há avaliações

- Option Trading Work BookDocumento26 páginasOption Trading Work BookUmesh ThakkarAinda não há avaliações

- ABCD Fibocalulator PointDocumento4 páginasABCD Fibocalulator PointUmesh ThakkarAinda não há avaliações

- Nifty Gann CalcuationDocumento6 páginasNifty Gann CalcuationUmesh ThakkarAinda não há avaliações

- 2023APRDocumento56 páginas2023APRZen TraderAinda não há avaliações

- MAC4863 2016 Assignment 4 QuestionsDocumento11 páginasMAC4863 2016 Assignment 4 QuestionsJerome ChettyAinda não há avaliações

- DerivativesDocumento31 páginasDerivativesChandru Mathapati100% (1)

- SWOT Analysis of A Coffee Shop BusinessDocumento3 páginasSWOT Analysis of A Coffee Shop Businessruby singhAinda não há avaliações

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 13: Binomial Trees Multiple Choice Test BankDocumento4 páginasHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 13: Binomial Trees Multiple Choice Test BankKevin Molly KamrathAinda não há avaliações

- Chapter 11Documento31 páginasChapter 11Tam Dinh75% (4)

- Shadin 91053 Operation ManualDocumento36 páginasShadin 91053 Operation Manualmglem100% (1)

- Basic Option StrategiesDocumento48 páginasBasic Option StrategiesRahimullah QaziAinda não há avaliações

- HDFC Sampoorna Jeevan BrochureDocumento25 páginasHDFC Sampoorna Jeevan BrochureLogeshParthasarathyAinda não há avaliações

- MCS of ITCDocumento20 páginasMCS of ITCAbhay Singh ChandelAinda não há avaliações

- 2015 FKT Holdings Limited and Its Subsidiaries DD 12 Jan 2016Documento263 páginas2015 FKT Holdings Limited and Its Subsidiaries DD 12 Jan 2016Ngan Thanh TranAinda não há avaliações

- VIX Market Volatility Index and U.S. Stock ReturnsDocumento14 páginasVIX Market Volatility Index and U.S. Stock Returnsmm1979Ainda não há avaliações

- Equities Crossing Barriers 09jun10Documento42 páginasEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- Midterm ReviewDocumento11 páginasMidterm Reviewjack lambAinda não há avaliações

- Michigan Durable Financial Power of Attorney FormDocumento9 páginasMichigan Durable Financial Power of Attorney Formnazlifathima2023Ainda não há avaliações

- Dilutive Securities and Earnings Per ShareDocumento63 páginasDilutive Securities and Earnings Per ShareTEALEELEE123Ainda não há avaliações

- An Introduction To Computational Finance Without Agonizing PainDocumento109 páginasAn Introduction To Computational Finance Without Agonizing PainCarolyn Matthews100% (1)

- Stock Option Agreement Long Form)Documento7 páginasStock Option Agreement Long Form)Legal FormsAinda não há avaliações

- Backend Developer Resume - Mukul AgarwalDocumento2 páginasBackend Developer Resume - Mukul AgarwalKunal NagAinda não há avaliações

- An Option Pricing Framework For Valuation of Football PlayersDocumento6 páginasAn Option Pricing Framework For Valuation of Football PlayersRicardo MateusAinda não há avaliações

- Fourth Quadrant Oxford LectureDocumento4 páginasFourth Quadrant Oxford LectureStefanAinda não há avaliações

- FinancialTheoryandPractice PDFDocumento96 páginasFinancialTheoryandPractice PDFbaha146Ainda não há avaliações

- Barrick Stock Sensitivity to Gold Price ChangesDocumento41 páginasBarrick Stock Sensitivity to Gold Price ChangesMridul SharmaAinda não há avaliações

- My Mkt624 Quiz 2 Mega File by SobanDocumento28 páginasMy Mkt624 Quiz 2 Mega File by SobanMuhammad SobanAinda não há avaliações

- Review: RM709, Marshall, Module 10 Queens College, CUNYDocumento43 páginasReview: RM709, Marshall, Module 10 Queens College, CUNYtimsingh911Ainda não há avaliações

- Intra-Company Process: System Access InformationDocumento21 páginasIntra-Company Process: System Access InformationJoule974Ainda não há avaliações

- Environgrad Corporation: Evaluating Three Financing AlternativesDocumento25 páginasEnvirongrad Corporation: Evaluating Three Financing AlternativesAbhi Krishna ShresthaAinda não há avaliações