Escolar Documentos

Profissional Documentos

Cultura Documentos

II - 2003-Advancedrp PDF

Enviado por

Javed AliDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

II - 2003-Advancedrp PDF

Enviado por

Javed AliDireitos autorais:

Formatos disponíveis

The workings under the heading of Additional Working

are not required according to the requirement of the examiner.

These are only for understanding the solutions.

For more help, visit www.a4accounting.net

2003

B.COM II ADVANCED

ACCOUNTING

REGULAR /

PRIVATE

Compiled and Solved by:

S.Hussain

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

ADVANCED ACCOUNTING 2003

REGULAR / PRIVATE

Instructions: Attempt any five questions.

Q.No.1

COMPANY ACCOUNTING ABSORPTION

GIVEN The following balances appeared in the balance sheet of Yousuf Ltd. as on June. 30, 2003:

Assets

Equities

Cash

20,000 Accounts payable

20,000

Accounts receivable

60,000 Bonds payable

100,000

Merchandise inventory

160,000 Share capital (ordinary shares of

600,000

Rs.10/= each)

Land and building

240,000 General reserves

160,000

Plant and machinery

400,000 Retained earnings

120,000

Goodwill

120,000

Total

1,000,000

Total

1,000,000

The above company is absorbed by Ghani Ltd. on the following terms:

(i) All the assets (with exception of cash) to be taken over at book values.

(ii) Accounts payable to be paid by Yousuf Ltd.

(iii) Purchase consideration was as follows:

(a) A cash payment of Rs.4 for every share of Yousuf Ltd.

(b) The issue of one share of Rs.10/= each (market value Rs.12.50) in Ghani Ltd. for every

share in Yousuf Ltd.

(c) The issue of 1,100 bonds of Rs.100/= each in Ghani Ltd. to enable Yousuf Ltd. to

discharge its bonds at a premium of 10%.

REQUIRED

(i) Compute the purchase consideration.

(ii) Give the necessary journal entries in the books of both the companies.

SOLUTION 1 (i)

Computation of Purchase Consideration:

To Shareholders:

60,000 Ordinary shares @ Rs.12.50 each

Cash (60,000 x 4)

To Bond Holders:

1,100 bonds @ Rs.100 each

Purchase consideration

750,000

240,000

110,000

1,100,000

SOLUTION 1 (ii)

YOUSUF LTD.

GENERAL JOURNAL

Date

1

Particulars

Receivable from Ghani Ltd.

Realization

(To record the purchase consideration)

P/R

Debit

1,100,000

B.Com II Advanced Accounting 2003 (Regular / Private)

Credit

1,100,000

Page 2

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Date

2

3

5

7

Particulars

P/R

Shares in

Cash

10% Bonds in

Receivable from Ghani Ltd.

(To record the shares and cash received from Ghani Ltd.)

Realization

Accounts receivable

Merchandise inventory

Land and building

Plant and machinery

(To record the closing of assets accounts)

Accounts payable

Cash

(To record the cash payment to creditors)

Bonds payable

Realization

10% Bonds in

(To record the bonds issued to the bonds holders)

Ordinary share capital

General reserves

Retained earnings

Goodwill

Payable to shareholders

(To record the closing of shareholders equity)

Realization

Payable to shareholders

(To record the closing of realization account)

Payable to shareholders

Cash

Shares in

(To record the cash & shares issued to the shareholders)

Assets

Bonds in

Payable to shareholders

Realization

860,000 1

10,000

230,000

1,100,00

Debit

750,000

240,000

110,000

Credit

1,100,000

860,000

60,000

160,000

240,000

400,000

20,000

20,000

100,000

10,000

110,000

600,000

160,000

120,000

120,000

760,000

230,000

230,000

990,000

240,000

750,000

Receivable

1,100,000

1,100,000

GHANI LTD.

GENERAL JOURNAL

Date

1

Particulars

Accounts receivable

Merchandise inventory

Land and building

Plant and machinery

Goodwill

Payable to Yousuf Ltd.

(To record the assets and liabilities taken over)

P/R

Debit

60,000

160,000

240,000

400,000

240,000

B.Com II Advanced Accounting 2003 (Regular / Private)

Credit

1,100,000

Page 3

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Date

2

Particulars

P/R

Payable to Yousuf Ltd.

Ordinary share capital (60,000 x 10)

Ordinary share premium (60,000 x 2.50)

10% Bonds payable

Cash

(To record the shares, cash and bonds issued to Yousuf

Ltd.)

Debit

1,100,000

Credit

600,000

150,000

110,000

240,000

Q.No.2

COMPANY ACCOUNTING RECONSTRUCTION

GIVEN The balance sheet of Zeeshan Ltd. as on Dec. 31, 2002 is as follows:

Assets

Equities

Cash in hand

15,000 Accounts payable

75,000

Accounts receivable

250,000 Allow for depreciation Plant assets

150,000

Merchandise inventory

50,000 Authorized capital

Investment

100,000 250,000 ordinary shares of

Preliminary expense

25,000 Rs.10 each

250,000

Goodwill

35,000 Paid up capital

1,000,000

Profit & loss

150,000 Share premium

50,000

Plant assets

650,000

1,275,000

1,275,000

The following scheme of reconstruction was agreed upon and implemented on July 31, 2003:

(i) Ordinary share of Rs.10 each be reduced to an equal number of fully paid shares of Rs.5 each.

(ii) Share premium was utilized.

(iii) Investment was sold for Rs.90,000.

(iv) The amount thus available be utilized to write off preliminary expenses, profit & loss and

goodwill completely.

(v) Accounts receivable are estimated to realize Rs.200,000, inventory is valued at Rs.40,000 and

plant assets are assigned a book value of Rs.300,000.

REQUIRED

(a) Entries in the General Journal to give effect to the above scheme.

(b) Revised balance sheet of Zeeshan Ltd.

SOLUTION 2 (a)

ZEESHAN LTD.

GENERAL JOURNAL

Date

1

Particulars

Ordinary shares capital (Rs.10)

Ordinary shares capital (100,000 x 5)

Capital reduction

(To record the reduction of share capital)

Share premium

Capital reduction

(To record the closing of share premium account)

Cash

Capital reduction

Investment

(To record the sale of investment on loss)

P/R

Debit

1,000,000

Credit

500,000

500,000

50,000

50,000

90,000

10,000

B.Com II Advanced Accounting 2003 (Regular / Private)

100,000

Page 4

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Date

4

Particulars

P/R

Capital reduction

Preliminary expenses

Goodwill

Profit and loss account

(To record the writing off various assets accounts)

Capital reduction

Allowance for bad debts

Merchandise inventory

Allowance for depreciation Plant assets

Capital reserve

(To record the writing off assets accounts)

Debit

210,000

Credit

25,000

35,000

150,000

330,000

50,000

10,000

200,000

70,000

SOLUTION 2 (b)

ZEESHAN LTD.

BALANCE SHEET

AS ON 31 JULY 2003

Equities

Authorized Capital:

250,000 ordinary shares

@ Rs.5 each

Paid up Capital:

100,000 ordinary shares

@ Rs.5 each

Capital reserve

Total shareholders equity

Liabilities:

Accounts payable

Total liabilities

Total equities

Assets

Fixed Assets:

Plant assets

650,000

1,250,000 Less: All for depreciation

(350,000)

Total fixed assets

75,000

500,000 Current Assets:

70,000 Merchandise inventory

570,000 A/c receivable 250,000

Less: All for b/d (50,000)

Cash

Total current assets

75,000

645,000 Total assets

300,000

40,000

200,000

105,000

345,000

645,000

Q.No.3

FINANCIAL STATEMENT

(a) (i) Name any two tools of analysis (Analytical tools).

(ii) Give the significance of current ratio.

(iii) State the change in quick ratio when merchandise is purchased on account.

(b) GIVEN Mehran Company was registered with an authorized capital of Rs.6,000,000 divided into

600,000 ordinary shares of Rs.10 each. The companys books showed the following balances on

December 31, 2002, the end of the accounting year before the closing process:

Debit Balance:

Cash Rs.40,000; Accounts receivable Rs.65,000; Merchandise inventory (1.1.2002) Rs.25,000;

Machinery cost Rs.1,500,000; Purchase Rs.480,000; Transportation in Rs.20,000; Salaries expense

Rs.58,000; Unexpired insurance Rs.8,000; Rent expense Rs.48,000; Auditors fee expense Rs.20,000;

Directors fee expense Rs.18,000 (total Rs.2,282,000).

Credit Balance:

Accounts payable Rs.45,000; Accumulated depreciation Machinery Rs.140,000; Allowance for

bad debts Rs.8,000; 10% Bonds payable Rs.280,000; Paid up capital Rs.1,000,000; Sales revenue

Rs.750,000; Retained earnings Rs.59,000 (total Rs.2,282,000).

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 5

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Data for Adjustments on December 31, 2002:

(i) Merchandise inventory at Dec. 31, 2002 was valued at Rs.180,000.

(ii) Allowance for bad debts to be increased by Rs.2,000.

(iii) Insurance expired Rs.3,000.

(iv) Machinery is depreciated by 20% Diminishing Balance Method.

(v) Salaries prepaid Rs.8,000.

(vi) Rent payable Rs.12,000.

(vii) Provide Rs.20,000 for income tax.

(viii) Appropriate Rs.10,000 for contingencies.

REQUIRED

(a) Prepare Income Statement for the year ended December 31, 2002 and statement of retained

earnings on the same date.

(b) Prepare balance sheet as of Dec. 31, 2002 in classified form.

SOLUTION 3 (a)

Analytical Tools:

1. Dollar and percentage change.

2. Trend percentage.

Current Ratio:

Current ratio shows the total available current assets for the payment of every one rupee of the

companys current liability. It is calculated by dividing total current assets by total current

liabilities of the company. It shows the liquidity position of the company.

Quick ratio will be reduced by purchasing merchandise on credit because merchandise inventory

is not included in the quick assets while accounts payable is included in the quick assets.

Merchandise purchase on account increases the current liabilities which will reduce quick ratio.

SOLUTION 3 (b)

MEHRAN COMPANY

INCOME STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2002

Sales revenue

750,000

Less: Cost of Goods Sold:

Merchandise inventory (beg)

25,000

Add: Net Purchases:

Purchases

480,000

Add: Transportation in

20,000

Net purchases

500,000

Merchandise available for sale

525,000

Less: Merchandise inventory (end)

(180,000)

Cost of goods sold

(345,000)

Gross profit

405,000

Less: Operating Expenses:

Salaries expense (58,000 8,000)

50,000

Rent expense (48,000 + 12,000)

60,000

Auditors fee expense

20,000

Directors fee expense

18,000

Depreciation expense Machinery

272,000

Insurance expense

3,000

Bad debts expense

2,000

Total operating expenses

(425,000)

Net loss

(20,000)

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 6

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

MEHRAN COMPANY

STATEMENT OF RETAINED EARNINGS

FOR THE PERIOD ENDED 31 DECEMBER 2002

Retained earnings (opening balance)

59,000

Less: Net loss for the period

(20,000)

Total retained earning

39,000

Less: Dividends and Reserves:

Reserve for income tax

20,000

Reserve for contingencies

10,000

Total dividend and reserves

(30,000)

Retained earnings (ending balance)

9,000

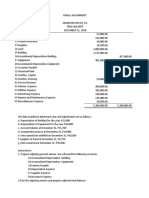

MEHRAN COMPANY

BALANCE SHEET

AS ON 31 DECEMBER 2002

Equities

Assets

Shareholders Equity:

Fixed Assets:

Authorized Capital:

Machinery

1,500,000

600,000 ordinary shares

Less: All for dep.

(412,000)

@ Rs.10 each

6,000,000 Total fixed assets

Issued & Paid-up Capital:

100,000 ordinary shares

Current Assets:

@ Rs.10/- each

1,000,000 Unexpired insurance

5,000

Reserve for income tax

20,000 Prepaid salaries

8,000

Reserve for contingencies

10,000 Merchandise inv.

180,000

Retained earnings

9,000 A/c receivable 65,000

Total shareholders equity

1,039,000 Less:All for b/d(10,000)

55,000

Cash

40,000

Liabilities:

Total current assets

Long Term Liabilities:

10% Bonds payable

280,000

Current Liabilities:

Accounts payable

Rent payable

Total liabilities

Total equities

1,088,000

288,000

45,000

12,000

337,000

1,376,000 Total assets

1,376,000

Q.No.4

FINANCIAL STATEMENT ANALYSIS

(a) GIVEN At the end of year the following information was obtained from the accounting records

of Adnan Ltd.

Sales (all on account)

400,000

Cost of goods sold

240,000

Average inventory

60,000

Average accounts receivable

40,000

Interest expense

3,000

Income taxes

4,000

Net income for the year

18,000

average investment in assets

250,000

Average stockholders equity

200,000

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 7

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

REQUIRED

On the basis of above information compute the following for the year:

(1) Inventory turnover

(2) Accounts receivable turnover

(3) Total operating expenses

(4) Gross profit percentage

(5) Return on average stockholders equity

(6) Return on average assets

(b) GIVEN Compute trend percentages for the following items taken from financial statements of

Modern Fixtures over a five year period. Treat 1998 as the base year. State whether the trends

are favourable or unfavourable.

2002

2001

2000

1999

1998

Sales

85,000

74,000

61,500

59,000

50,000

Cost of goods sold

58,500

46,600

40,500

36,000

30,000

SOLUTION 4 (a)

(1) Inventory Turnover:

Inventory turnover in times =

Inventory turnover in times =

Inventory turnover in times =

Inventory turnover in days =

Inventory turnover in days =

Inventory turnover in days =

Cost of goods sold

Average inventory

240,000

60,000

4 times

365

Inventory turnover in times

365

4

91 days

(2) Accounts Receivable Turnover:

Receivable turnover in times =

Net credit sales

Average receivable

Receivable turnover in times =

400,000

40,000

Receivable turnover in times =

10 times

Receivable turnover in days =

365

Receivable turnover in times

Receivable turnover in days =

365

10

Receivable turnover in days =

37 days

(3) Total Operating Expenses:

Sales

Less: Cost of goods sold

Gross profit

Less: Net income

Less: Income taxes

Less: Interest expenses

Total operating expenses

400,000

(240,000)

160,000

(18,000)

(4,000)

(3,000)

135,000

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 8

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

(4) Gross Profit Percentage:

Gross profit percentage =

Gross profit percentage =

Rate of gross profit on sales =

Gross profit

Net sales

160,000

400,000

40%

X 100

X 100

(5) Return on Average Stockholders Equity:

Return on average stockholders equity =

Income before interest and tax

Average stockholders equity

Return on average stockholders equity =

25,000

200,000

Return on average stockholders equity =

12.5%

(6) Return on Average Assets:

Return on average assets =

Income before interest and tax

Average investment in assets

Return on average assets =

25,000

250,000

Return on average assets =

10%

X 100

X 100

X 100

X 100

SOLUTION 4 (b)

Year

2002

2001

2000

1999

1998

Sales

85,000

74,000

61,500

59,000

50,000

MODERN FIXTURES

TREND PERCENTAGE

(1998 BASE YEAR)

Percentage

85,000 / 50,000 x 100 =

74,000 / 50,000 x 100 =

61,500 / 50,000 x 100 =

59,000 / 50,000 x 100 =

50,000 / 50,000 x 100 =

170%

148%

123%

118%

100%

MODERN FIXTURES

TREND PERCENTAGE

(1998 BASE YEAR)

Year

Cost of Goods Sold

Percentage

2002

58,500

58,500 / 30,000 x 100 =

195%

2001

46,600

46,600 / 30,000 x 100 =

155%

2000

40,500

40,500 / 30,000 x 100 =

135%

1999

36,000

36,000 / 30,000 x 100 =

120%

1998

30,000

30,000 / 30,000 x 100 =

100%

Overall trend is unfavourable because sales are increasing less than the proportionate of cost of

goods sold. Sales increased by 70% in the year 2002 while cost of goods sold increased by 95% in the

year 2002 which is unfavourable.

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 9

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Q.No.5

CASH & FUND FLOW ANALYSIS

GIVEN The accounting records of Kashif Ltd. showed the following balances at the end of year

2001 and 2002:

Debit Balances

2002

2001

Cash

112,000

100,000

Accounts receivable

150,000

140,000

Merchandise inventory

132,000

135,000

Equipment

60,000

40,000

Patents

20,000

25,000

Total

474,000

440,000

Credit Balance

2002

2001

Accounts payable

24,000

30,000

Allowance for bad debts

8,000

10,000

Accumulated depreciation (Equipment)

16,000

12,000

Bonds payable

100,000

120,000

Share capital (Paid up)

290,000

240,000

Retained earnings

36,000

28,000

Total

474,000

440,000

Additional Data:

(i) Fully depreciated equipment that cost Rs.10,000 was discarded and the related accounts closed.

(ii) Cash dividends of Rs.40,000 were declared and paid.

REQUIRED

(a) Compute the amount of cash generated by the operational activities of the company.

(b) Prepare cash flow statement for the year ended December 31, 2002.

(c) Assuming net purchases for the year 2002 to be Rs.175,000 compute the amount of cash

payments to supplier.

SOLUTION 5 (a)

KASHIF LTD.

STATEMENT OF NET INCOME

FOR THE PERIOD ENDED 31 DECEMBER 2002

Retained earnings (2002)

36,000

Less: Retained earnings (2001)

(28,000)

Retained earnings for the period

8,000

Add: Dividends:

Cash dividend

40,000

Total dividends

40,000

Net profit

48,000

KASHIF LTD.

CASH GENERATED BY OPERATION

FOR THE PERIOD ENDED 31 DECEMBER 2002

48,000

Net profit

Adjustments:

Depreciation expense (4,000 + 10,000)

Amortization of patents

Profit before changes in working capital

Less: Increase in accounts receivable (Net)

Add: Decrease in merchandise inventory

14,000

5,000

67,000

(12,000)

3,000

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 10

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Less: Decrease in accounts payable

Net cash generated by operation

(6,000)

52,000

SOLUTION 5 (b)

KASHIF LTD.

CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2002

Cash Flow from Operating Activities:

Net profit

48,000

Adjustments:

Depreciation expense (4,000 + 10,000)

14,000

Amortization of patents

5,000

Bad debts expense

(2,000)

Profit before changes in working capital

65,000

Less: Increase in accounts receivable

(10,000)

Add: Decrease in merchandise inventory

3,000

Less: Decrease in accounts payable

(6,000)

Net cash flow from operating activities

52,000

Cash Flow from Investing Activities:

Purchase of equipment

(30,000)

Net cash flow from investing activities

(30,000)

Cash Flow from Financing Activities:

Issue of shares

50,000

Payment of bonds payable

(20,000)

Cash dividend paid

(40,000)

Net cash flow from financing activities

(10,000)

Net increase in cash and cash equivalents

12,000

Add: Opening cash and cash equivalents balance

100,000

Closing cash and cash equivalents balance

112,000

SOLUTION 5 (c)

Computation of Cash Payment to Supplier:

Accounts payable (beginning)

Add: Net purchases

Less: Accounts payable (ending)

Cash payment to supplier

30,000

175,000

205,000

(24,000)

181,000

Q.No.6 (a)

ACCOUNTING FOR VAT

(NOT INCLUDED IN THE NEW COURSE)

Q.No.6 (b)

INSTALLMENT SALES

GIVEN Ideal Sales Company sells goods on installment basis. Its balances on Dec. 31, 2001 were:

Installment accounts receivable

Rs.14,000

Unrealized gross profit

Rs.4,000

Summary of the transactions for the year 2002 is as follows:

(a) Installment sales Rs.49,000.

(b) Collection of installment of current year Rs.42,000.

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 11

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

(c) Collection of installment of 2001 Rs.5,600.

(d) Cancellation of installment contract 2001 Rs.2,100.

(e) Repossessed goods valued at Rs.1,350.

In both years the goods have been sold at 40% above cost.

REQUIRED

(i) Entries to record the transactions for 2002.

(ii) Adjusting and closing entries for 2002.

(iii) Show how the relevant account will be reported in balance sheet on Dec. 31, 2002.

SOLUTION 6 (b)

Computation of Realized Gross Profit:

Realized gross profit =

Cash collection X DGP%

Realized gross profit (2002) =

42,000 x 40/140

Realized gross profit (2001) =

5,600 x 40/140

Total realized gross profit =

Computation of Cost of Installment Sales (2002):

Cost of installment sales (2002) =

Installment sales

140

Cost of installment sales (2002) =

49,000

140

Cost of installment sales (2002) =

35,000

Computation of Gain or Loss on Repossession:

Installment accounts receivable cancelled (2001)

Less: Unrealized gross profit (2,100 x 40/140)

Book value

Less: Merchandise repossessed at fair market value

Loss on repossession

Date

1

Date

1

IDEAL SALES COMPANY

GENERAL JOURNAL

Particulars

Installment accounts receivable (2002)

Installment sales

(To record the good sold on installment basis)

Cash

Installment accounts receivable (2002)

Installment accounts receivable (2001)

(To record the cash collected on installment basis)

IDEAL SALES COMPANY

ADJUSTING ENTRIES

Particulars

Cost of installment sales

Merchandise

(To record the cost of installment sales)

12,000

1,600

13,600

x 100

x 100

2,100

(600)

1,500

(1,350)

150

P/R

Debit

49,000

Credit

49,000

47,600

42,000

5,600

P/R

Debit

35,000

B.Com II Advanced Accounting 2003 (Regular / Private)

Credit

35,000

Page 12

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Date

2

Date

1

Particulars

P/R

Installment sales

Cost of installment sales

Unrealized gross profit (2002)

(To adjust the unrealized gross profit)

Unrealized gross profit (2002)

Unrealized gross profit (2001)

Realized gross profit

(To adjust the realized gross profit)

Merchandise repossessed

Unrealized gross profit (2001)

Loss on repossession

Installment accounts receivable (2001)

(To adjust the repossession of merchandise)

IDEAL SALES COMPANY

CLOSING ENTRIES

Particulars

Expense and revenue summary

Loss on repossession

(To close the expense accounts)

Realized gross profit

Expense and revenue summary

(To close the income accounts)

Debit

49,000

Credit

35,000

14,000

12,000

1,600

13,600

1,350

600

150

2,100

P/R

Debit

150

Credit

150

13,600

13,600

Q.No.7

BRANCH ACCOUNTING

GIVEN The Nishat Corporation of Karachi sends merchandise to its branch at Lahore at 140% of

cost. The income statement data of the branch is as follows:

Merchandise inventory (Jan. 1, 2002) Rs.16,800.

Shipment from head office Rs.196,000.

Merchandise returned to head office Rs.11,200.

Sales (including cash sales of Rs.100,000 remitted to head office) Rs.230,000.

Salaries expenses (paid by head office) Rs.18,000.

Rent expenses Rs.2,000.

Merchandise inventory Dec. 31, 2002 Rs.22,400.

REQUIRED

(i) Branch income statement for the year ended Dec. 31, 2002.

(ii) Give all reciprocal entries in the head office books including adjusting entry to record profit from

overvaluation for 2002 and also pass the necessary closing entry.

B.Com II Advanced Accounting 2003 (Regular / Private)

Page 13

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

SOLUTION 7 (i)

NISHAT CORPORATION

LAHORE BRANCH

INCOME STATEMENT

FOR THE PERIOD ENDED 31 DECEMBER 2002

Sales

Less: Cost of Goods Sold:

Merchandise inventory (beg)

Add: Merchandise supplied

230,000

16,800

196,000

212,800

(11,200)

201,600

(22,400)

Less: Merchandise returned

Merchandise available for sale

Less: Merchandise inventory (end)

Cost of goods sold

Gross profit

Less: Operating Expenses:

Salaries expense

Rent expense

Advertising expense

Total operating expenses

Net income

SOLUTION 7 (ii)

Computation of Allowance for Overvaluation:

Particulars

Merchandise inventory opening (16,800 x 40/140)

Add: Merchandise supplied (196,000 x 40/140)

Less: Merchandise returned (11,200 x 40/140)

Unadjusted allowance for overvaluation

Less: Merchandise inventory ending (22,400 x 40/140)

Adjusted allowance for overvaluation

Date

1

(179,200)

50,800

18,000

2,000

15,000

(20,000)

30,800

Billed

Cost

16,800

196,000

212,800

(11,200)

201,600

(22,400)

179,200

12,000

140,000

152,000

(8,000)

144,000

(16,000)

128,000

NISHAT CORPORATION

HEAD OFFICE

GENERAL JOURNAL

Particulars

Lahore branch

Merchandise supplied

Allowance for overvaluation

(To record the merchandise supplied to branch)

Merchandise supplied returned

Allowance for overvaluation

Lahore branch

(To record the merchandise returned by branch)

Cash

Lahore branch

(To record the cash received from Lahore branch)

P/R

Allowance for

over valuation

4,800

56,000

60,800

(3,200)

57,600

(6,400)

51,200

Debit

196,000

Credit

140,000

56,000

8,000

3,200

11,200

100,000

B.Com II Advanced Accounting 2003 (Regular / Private)

100,000

Page 14

Compiled & Solved by: S.Hussain

A4accounting@hotmail.com

Date

4

Particulars

Lahore branch

Cash

(To record the branch salaries paid)

Lahore branch

Profit and loss account

(To record the net profit reported by branch)

Allowance for overvaluation

Profit and loss account

(To adjust the allowance for overvaluation)

Profit and loss account

Retained earnings

(To close the profit and loss account)

Q.No.8

CONSIGNMENT

(NOT INCLUDED IN THE NEW COURSE)

Q.No.9

ACCOUNTING FOR INCOMPLETE RECORDS

(NOT INCLUDED IN THE NEW COURSE)

P/R

Debit

18,000

Credit

18,000

30,800

30,800

51,200

51,200

82,000

B.Com II Advanced Accounting 2003 (Regular / Private)

82,000

Page 15

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- ACT1208 - Auditing in CIS EnvironmentDocumento11 páginasACT1208 - Auditing in CIS EnvironmentNancy Jane LaurelAinda não há avaliações

- SQB - Chapter 4 QuestionsDocumento13 páginasSQB - Chapter 4 QuestionsracsoAinda não há avaliações

- Solution Manual For Managerial Accounting Tools For Business Decision Making 3rd Canadian Edition by WeygandtDocumento13 páginasSolution Manual For Managerial Accounting Tools For Business Decision Making 3rd Canadian Edition by Weygandta8899779880% (1)

- Chapter 5 General Ledger SolutionsDocumento15 páginasChapter 5 General Ledger SolutionsShayno MacAinda não há avaliações

- Tax Internship ReportDocumento34 páginasTax Internship ReportTalat MehmoodAinda não há avaliações

- Chapter 4 FARDocumento20 páginasChapter 4 FARSree Mathi SuntheriAinda não há avaliações

- Finals Assignment 1Documento1 páginaFinals Assignment 1Mary Kris CaparosoAinda não há avaliações

- Environmental Accounting and Reporting-An Analysis of Indian Corporate Sector Gupta IIMDocumento19 páginasEnvironmental Accounting and Reporting-An Analysis of Indian Corporate Sector Gupta IIMKishore Kumar KamisettiAinda não há avaliações

- Midterm Mock Exam Questionnaire (With Answers)Documento15 páginasMidterm Mock Exam Questionnaire (With Answers)Ella Mae Magbato100% (1)

- Probset 1 AnswersDocumento24 páginasProbset 1 AnswersRalph LagradaAinda não há avaliações

- Advanced Audit and Assurance (AAA) (INT) : Syllabus and Study GuideDocumento21 páginasAdvanced Audit and Assurance (AAA) (INT) : Syllabus and Study GuideIssa BoyAinda não há avaliações

- Accounting June 2011 Unit 1Documento9 páginasAccounting June 2011 Unit 1nymazeeAinda não há avaliações

- Audit Reports and CommunicationDocumento45 páginasAudit Reports and CommunicationKatie NovriantiAinda não há avaliações

- Ethics For Professional AccountantsDocumento51 páginasEthics For Professional AccountantsNIARAMLIAinda não há avaliações

- Dampak Penerapan IfrsDocumento6 páginasDampak Penerapan IfrsMarsheila Choirunnisa NurizkyAinda não há avaliações

- Syllabus AnswerDocumento24 páginasSyllabus AnswerasdfAinda não há avaliações

- Quiz 2Documento19 páginasQuiz 2Quendrick SurbanAinda não há avaliações

- 2011 UFE Competency MapDocumento116 páginas2011 UFE Competency MapApple DailyAinda não há avaliações

- F7 - BPP PASSCARD (2016) by PDFDocumento145 páginasF7 - BPP PASSCARD (2016) by PDFDiya Hrh100% (1)

- Handout AP 2306 FDocumento14 páginasHandout AP 2306 FDyosa MeAinda não há avaliações

- ACC231-PPT-CH2-modified-week 5Documento24 páginasACC231-PPT-CH2-modified-week 5Crista IyAinda não há avaliações

- Enron Assignment - Dharit Gajjar (SSB10A07)Documento13 páginasEnron Assignment - Dharit Gajjar (SSB10A07)manishpunjabiAinda não há avaliações

- Mcom Po Pso CoDocumento12 páginasMcom Po Pso Co11 - Nima MohanAinda não há avaliações

- BBP TrackerDocumento44 páginasBBP TrackerHussain MulthazimAinda não há avaliações

- Midterm Examination - ABCDocumento5 páginasMidterm Examination - ABCMaria DyAinda não há avaliações

- Latihan AdvanceDocumento9 páginasLatihan AdvanceMellya KomaraAinda não há avaliações

- Pay Fixation FormatDocumento2 páginasPay Fixation FormatshafiqueslicAinda não há avaliações

- SEC Form 17 C As AmendedDocumento12 páginasSEC Form 17 C As AmendedcamileholicAinda não há avaliações

- Fixed Asset Transfer AssignmentDocumento3 páginasFixed Asset Transfer AssignmentGorang PatAinda não há avaliações

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocumento37 páginasChapter 10 Accounting Cycle of A Merchandising BusinessArlyn Ragudos BSA1Ainda não há avaliações