Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Policy Presentation Quidelines

Enviado por

dchristensen5Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Policy Presentation Quidelines

Enviado por

dchristensen5Direitos autorais:

Formatos disponíveis

Accounting 816 Special Tax Topics in Federal Taxation

Summer 2015

Tax Policy Student Presentation Tuesday May 26th & Wednesday May 27th

In recent years, there has been a great deal of discussion regarding the need for tax reform. The Joint Committee

on Taxation prepared the Report to the House Committee on Ways and Means on Present Law and Suggestions for

Reform Submitted to the Tax Reform Working Groups (May 6, 2013).

The report can be found at www.jct.gov ; report JCS-3-13. You are not expected to read the report; it is 558

pages. However, it may give you an idea of the some of the proposals and discussions regarding tax reform.

Additionally, the House Ways and Means Committee issued a draft tax reform The Tax Reform Act of 2014

(February 2014). The Tax Reform Act of 2014 can be found at http://tax.house.gov; the Executive Summary

provides an overview of the proposals which may also be helpful for your presentation.

Another article that may be of interest is a summary of proposals contained in Tax Reform in the 113th Congress:

An Overview of Proposals, March 24, 2014 (Congressional Research Service).

https://www.fas.org/sgp/crs/misc/R43060.pdf

Additional materials posted on blackboard that may helpful are:

Tax News & Views, February 6, 2015: FY 2016 budget blueprint reflects presidents call for business

tax reform, infrastructure spending, middle-class tax relief (Deloitte Publication).

The politics of tax reform in the 114th Congress, April 15, 2015 (Deloitte Publication).

Assignment 100 points

Students will prepare and present an 8 to 10 minute PowerPoint presentation addressing certain

aspects of tax policy

Email your presentation to Kay Maresh at mareshkay@gmail.com by 1:00 PM on Tuesday, May 26th.

Additionally, please bring your presentation to class on a USB drive/flash drive or your computer.

Each student should ask at least two questions to presenters during the two days of presentations.

There are no right or wrong answers. Presentations will be graded based on the students ability to discuss the

tax provisions and provide arguments to support their position.

There is no set format for the PowerPoint slides. No paper is required.

BE CREATIVE and HAVE FUN!

Pick a tax policy topic to discuss in your presentation.

Turn in your topic sections on the attached Topic List in class on Wednesday, May 20th

1 of 3

Tax Policy Student Presentation

Your presentation should include:

1) Why you chose the topic

2) Current Law briefly explain the current law

3) Why do you think the provisions were made law (encourage certain behaviors, discourage

certain behaviors, other reasons)

4) Do you agree with current law why or why not?

5) Explain any proposed changes to the law that you can find

6) Would you leave the current law as is, or change the law? If you would change the law, how

would you change it? (Repeal, revisions to current law, etc.)

7) Last Slide of every presentation: There have been proposals to implement a national sales tax in

the United States. Do you agree with implementing a national sales tax? Why or why not?

(You may consider including information on the percentage of taxpayers that claim the credit/deduction, etc.

and/or dollar impact on tax revenue. This information will not be available on all topics.)

Tax Topic Selection list is on Page 3

2 of 3

NAME: __________________________________

Tax Policy Student Presentation

Topic List

Rank five topics you would like to present from one to five with first choice indicated with a 1, through fifth

choice indicated with a 5.

Turn in this Topic List at the end of class on Wednesday, May 20th, and topics selections will be finalized at the end

of class on Thursday, May 21st.

Topic

Choice Rank

Research & Development Credit

Education Credits

Earned Income Credit

Work Opportunity Credit & other employment credits

Oil & Gas and Alternative Energy Credits

Retirement Savings credits & deductions

Low income housing credit

Child Credit and Child & dependent care credit

Residential Energy Credit

New Markets Tax Credit

Carried Interest

Limit on deduction for executive compensation

Home mortgage interest and real estate tax deductions

Charitable contribution deductions

Investment interest and investment fees & expenses deductions

Minimum tax on foreign earnings

Special lower rate for capital gains and dividends

Estate Tax

Flat tax versus progressive rates

LIFO method of accounting for inventory

Bonus and accelerated tax deprecation

Alternative Minimum Tax

Corporate dividends-received-deduction

Like-Kind Exchanges

Income Averaging

Domestic Production Activities Deduction

Lower tax rate for dividends from foreign companies instead of foreign tax credit

Social Security & Medicare taxes on S corporation earnings and limited partners

Non-qualified deferred compensation plans

Charitable Organizations exempt from taxation (what types, if any, should be permitted)

Tax on Financial Institutions

Deduction for research and experimental expenses

Foreign Earned income exclusion for individuals

Exclusion for employer provided health, group term life, and disability insurance

Excise tax on medical devices

Other ____________________________________________________________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

___________

3 of 3

Você também pode gostar

- Tax Reform Act of 2014 DraftDocumento1.184 páginasTax Reform Act of 2014 Draftdchristensen5Ainda não há avaliações

- ACCT 816 Syllabus Summer 2015Documento1 páginaACCT 816 Syllabus Summer 2015dchristensen5Ainda não há avaliações

- Six Flags 2012 Annual Report FinalDocumento150 páginasSix Flags 2012 Annual Report Finaldchristensen5Ainda não há avaliações

- Auditing Seminar: Advanced CourseDocumento8 páginasAuditing Seminar: Advanced Coursedchristensen5Ainda não há avaliações

- TM Allocation - Darden 2014Documento5 páginasTM Allocation - Darden 2014dchristensen5Ainda não há avaliações

- Ethridge Et Al. (JBER, 2007)Documento8 páginasEthridge Et Al. (JBER, 2007)dchristensen5Ainda não há avaliações

- Carson Et Al. (WP, 2012)Documento124 páginasCarson Et Al. (WP, 2012)dchristensen5Ainda não há avaliações

- AuditingDocumento35 páginasAuditingbabaabbyAinda não há avaliações

- Arya Glover SunderDocumento6 páginasArya Glover Sunderdchristensen5Ainda não há avaliações

- QC 00010Documento32 páginasQC 00010dchristensen5Ainda não há avaliações

- Student Handouts - Fraud CaseDocumento30 páginasStudent Handouts - Fraud Casedchristensen5Ainda não há avaliações

- Away Game Expense InvoicesDocumento2 páginasAway Game Expense Invoicesdchristensen5Ainda não há avaliações

- A Review and Integration of Empirical Research On Materiality: Two Decades LaterDocumento36 páginasA Review and Integration of Empirical Research On Materiality: Two Decades Laterdchristensen5Ainda não há avaliações

- Auditor Going-Concern Opinion Shifts Market ValuationDocumento26 páginasAuditor Going-Concern Opinion Shifts Market Valuationdchristensen5Ainda não há avaliações

- Auditing Seminar: Advanced CourseDocumento8 páginasAuditing Seminar: Advanced Coursedchristensen5Ainda não há avaliações

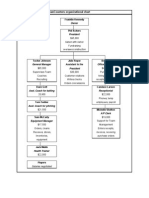

- Handout 1. Tallahassee Beancounters Organizational Chart: OwnerDocumento1 páginaHandout 1. Tallahassee Beancounters Organizational Chart: Ownerdchristensen5Ainda não há avaliações

- Student Handout 4. General Journal EntriesDocumento5 páginasStudent Handout 4. General Journal Entriesdchristensen5Ainda não há avaliações

- Visa StatementsDocumento1 páginaVisa Statementsdchristensen5Ainda não há avaliações

- Equipement Purchase Orders, Invoices, and Receiving SlipsDocumento1 páginaEquipement Purchase Orders, Invoices, and Receiving Slipsdchristensen5Ainda não há avaliações

- ConcessionsDocumento1 páginaConcessionsdchristensen5Ainda não há avaliações

- Construction Invoices Received by TBCDocumento4 páginasConstruction Invoices Received by TBCdchristensen5Ainda não há avaliações

- Game Schedule May - September: Date Opponent LocationDocumento1 páginaGame Schedule May - September: Date Opponent Locationdchristensen5Ainda não há avaliações

- 01 - Problems Solutions - 12EDocumento30 páginas01 - Problems Solutions - 12Edchristensen5Ainda não há avaliações

- Chart of accounts handoutDocumento1 páginaChart of accounts handoutdchristensen5Ainda não há avaliações

- Chapter 1 ChartDocumento1 páginaChapter 1 Chartdchristensen5Ainda não há avaliações

- Problem 1 - CH 11Documento1 páginaProblem 1 - CH 11dchristensen5Ainda não há avaliações

- The Economics of Ethics: A New Perspective On Agency TheoryDocumento11 páginasThe Economics of Ethics: A New Perspective On Agency Theorydchristensen5Ainda não há avaliações

- 01SV Intro To Animal ProductsDocumento16 páginas01SV Intro To Animal Productsdchristensen5Ainda não há avaliações

- FINA 463 Exam PrepDocumento4 páginasFINA 463 Exam Prepdchristensen5Ainda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- FORM16: Signature Not VerifiedDocumento5 páginasFORM16: Signature Not Verifiedmath_mallikarjun_sapAinda não há avaliações

- Nehru S Conception of Socialism PDFDocumento4 páginasNehru S Conception of Socialism PDFBM AZIZ SHAHAinda não há avaliações

- Rural Bank of Makati Vs Municipality of MakatiDocumento1 páginaRural Bank of Makati Vs Municipality of MakatiRenzo JamerAinda não há avaliações

- Sample Green LeaseDocumento54 páginasSample Green Leasestringbender12100% (1)

- Externalities and Public PolicyDocumento36 páginasExternalities and Public PolicyAmalina JuraimiAinda não há avaliações

- R12 FinancialsDocumento64 páginasR12 FinancialsAbderrazak JouiniAinda não há avaliações

- Court upholds CTA jurisdiction over estate tax dispute despite lack of refund claimDocumento5 páginasCourt upholds CTA jurisdiction over estate tax dispute despite lack of refund claimYvon BaguioAinda não há avaliações

- ABAKADA V ErmitaDocumento37 páginasABAKADA V ErmitaCaren Que ViniegraAinda não há avaliações

- Presentation - Mid ThesisDocumento10 páginasPresentation - Mid ThesisMuhammad Murtaza AlizaiAinda não há avaliações

- Experis Key InformationDocumento10 páginasExperis Key InformationManimekalaiAinda não há avaliações

- Hal Varian Intermediate Microeconomics SolutionsDocumento2 páginasHal Varian Intermediate Microeconomics SolutionsHammed AremuAinda não há avaliações

- 1 Latest GSTR 9 and 9C TaxbykkDocumento73 páginas1 Latest GSTR 9 and 9C TaxbykkjitendraktAinda não há avaliações

- Lab 2 (Conditional Statements)Documento3 páginasLab 2 (Conditional Statements)DigiModAinda não há avaliações

- The Star News February 26 2015Documento40 páginasThe Star News February 26 2015The Star NewsAinda não há avaliações

- Q3-Humss-Whlp-Week 7Documento4 páginasQ3-Humss-Whlp-Week 7Cade EscobarAinda não há avaliações

- Instructions - Smithville - Full Version - 16edDocumento53 páginasInstructions - Smithville - Full Version - 16edsachin2727Ainda não há avaliações

- General Reform SummaryDocumento10 páginasGeneral Reform SummaryRaghu RamAinda não há avaliações

- Sunil PayslipDocumento1 páginaSunil PayslipSiyaram MeenaAinda não há avaliações

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocumento4 páginasVCE Summer Internship Program 2020: Smart Task Submission Formatruchit guptaAinda não há avaliações

- Comparative Analysis 8424 and 10963Documento31 páginasComparative Analysis 8424 and 10963Rizza Angela Mangalleno100% (2)

- TAX INVOICE DETAILSDocumento6 páginasTAX INVOICE DETAILSMahesh GowdaAinda não há avaliações

- Stanford PDFDocumento1 páginaStanford PDFNabil MAinda não há avaliações

- Sign Now, Save Time LaterDocumento3 páginasSign Now, Save Time LaterAuguste RiedlAinda não há avaliações

- Economics, Govt BudgetDocumento28 páginasEconomics, Govt BudgetRajinder SinghAinda não há avaliações

- 150 199 PDFDocumento49 páginas150 199 PDFSamuelAinda não há avaliações

- Dissertation Transfer PricingDocumento7 páginasDissertation Transfer PricingHelpMeWithMyPaperAnchorage100% (1)

- California LLC 1Documento1 páginaCalifornia LLC 1Freeman LawyerAinda não há avaliações

- CRCF Annual Report 2008Documento34 páginasCRCF Annual Report 2008nketchumAinda não há avaliações

- Kenya's Legal Framework for Local Ag ProductionDocumento13 páginasKenya's Legal Framework for Local Ag ProductionRodney AmenyaAinda não há avaliações

- Public Finance MCQDocumento23 páginasPublic Finance MCQHarshit TripathiAinda não há avaliações