Escolar Documentos

Profissional Documentos

Cultura Documentos

Appendices Appendix IA: The Budget Cycle

Enviado por

Ahmed IbrahimDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Appendices Appendix IA: The Budget Cycle

Enviado por

Ahmed IbrahimDireitos autorais:

Formatos disponíveis

APPENDICES

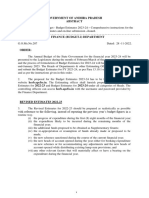

Appendix IA: The Budget Cycle

Establish Organizational Goals and Objectives

Prepare a Budget Calendar

Define Roles of Officers Involved

Prepare Budget Guidelines and Design Budget Estimates

Distribute Guidelines & Forms to all Departments

Departments Prepare Budgets, Discuss and Agree with FAM

FAM consolidates Departments to a Budget Document

Management & Board Discuss and Adopt Budget

Execute and Monitor the Budget

Appendix IB: Budget Preparation Procedures

Responsible

Officer

Finance and

Accounts

Manager

(FAM)

HODs/

Managers

FAM and

HODs

FAM

Description

Document(s)

1. Issue approved guidelines to all Managers and HODs

for preparation of annual budgets and discusses the

requirements with respective staff.

2. Prepare a Memorandum of Guidance for budget

preparation containing basic assumptions for the

forthcoming accounting period and provide budgeting

guidelines which shall emphasize, among others, the

following:

i. the need to align department goals with the

overall Company goals as par the approved

corporate plan;

ii. harmonization of short term performance

programmes with corporate strategic goals and

other statutory requirements.

Guidelines

include:

a) Budget

Preparation

Timetable

b) Standard

rates to be

used for

various

items

c) Spreadsheet

formats and

budget

codes to be

used

3. Discuss the Budget Guidelines with HODs

Draft Budget

Guidelines

Budget

Guidelines

4. Distribute the Budget Instructions and Budget Forms

60 days before the deadline for the submission of

departments budgets.

5. Prepare current year-to-date (YTD) financial data with

projections of year-end totals.

6. Submit departmental budget forms which shall be

reviewed by FAM for completeness and

reasonableness

7. Hold budget negotiations with all managers

8. After review and consultations have been made with

HODs, the Budget is then returned with relevant

changes/comments

9. Prepare the annual Company Draft Budget Plan

10. Forward the draft budget to the Board for discussion

and approval

11. Receives the Approved Budget and effect amendments

according to comments made by the Board.

12. Once adopted, the Budget total should be entered into

the General Ledger for the new Accounting Period

13. Distribute approved budget to all HODs/Managers

Current Year

Projections

Budget Forms

Departments

Budget Estimates

Adjusted/Revised

Budget

Draft Budget

Draft Budget

Approved Budget

Approved Budget

Approved Budget

Appendix IC: Budget Monitoring and Control Procedures

Responsible

Officer

Accountants

Management

Accountant

FAM

Description

Document(s)

1. All payments or expenses must be checked by the

budgeting department or someone charged with the

responsibility of budget compliance assurance to

ensure that they are in accordance with the approved

budget

Monthly Budget

Reports

2. Prepare monthly Budget Monitoring Report and

submit to the Management or Officer in charge of

Budget Preparation and Compliance

a) Period Actual

b) Period Budget

c) Period

Variance

d) Cumulative

YTD actual

e) Cumulative

YTD budget

f) Cumulative

YTD variance

Budget Variance

Analysis

3. Performs a variance analysis of the budget and

provides a report that explains all expenditure of

more than 10% variance. The report shall be

forwarded to the FAM.

4. Reviews the budget analysis report and makes

recommendations which shall be communicated to all

concerned managers for actions.

Budget Variance

Analysis

Appendix IIA: Recording of Loans in Year of Advance Procedures

Responsible

Officer

Accountants

FAM

Description

Debit the relevant Loan Account in the Personal Ledger

with the amount of the payment through the usual

Cashbook posting procedures

Opens the Personal Ledger account as described above;

Calculate interest due on the loan for the remainder of

the financial year by reference to the Loan Schedule

Debit the relevant Loan Account in the Personal Ledger

and Credit the Interest on Loan Ledger Account by

journal entry with the interest so calculated

Calculates monthly repayment of principal and loan

interest based on the loan conditions

Deduct the monthly total of principal and interest from

the borrowers monthly salary starting in the month after

which the loan is given; Credit all deductions to the

relevant salary/wages code

Credit repayments to the relevant Loan Account in the

Personal Ledger and Debit relevant salary/wages

deduction code by journal entry

Document(s)

Loan Repayment

Schedule

Appendix IIB: Loan Year to Year Procedure

Responsible

Officer

FAM

Description

Document(s)

Prepares a Schedule of Loans Outstanding at the end of

each financial year, the total of which shall appear in the

Balance Sheet as an asset under the heading of Staff

debtors

Ascertains the total interest due for the incoming

financial year by add-listing the subsidiary ledger

Debit the relevant Loan Account in the Personal Ledger

and Credit the Interest on Loan Ledger Account by

journal entry with the interest so calculated

Verifies monthly repayments for the year; Notifies each

borrower on any repayments due and ensures that the

Salaries/Wages Section makes the necessary deductions

from pay

Treats the monthly repayments as described in (4.13.2)

above

Schedule of

Loans

Outstanding

Appendix III: Procedure for Handling Accounts Receivables

Responsible

Officer

Revenue

Officer

Description

Revenues shall be entered in the Subsidiary Ledger by

the officer with responsibilities independent of Cash

Management

Posts payments and other adjustments to the Accounts

Receivables Subsidiary Ledger

Reconciles Accounts Receivables Subsidiary Ledger

with Cash Receipts transactions

Revenue

Officer/

Accountant

Prepare monthly reconciliation statements for the

Accounts Receivable Subsidiary Ledger with the General

Ledger Control Account

Document(s)

Data Input

Document

Receipts and

Adjustments

Vouchers

Reconciliation

Statements and

Ledgers

Appendix IV: Procedures for Handling Payroll Deductions

Responsible

Officer

Payroll

Officer

Internal

Audit

FAM/

Internal

Audit

Payroll

Officer

Description

Compute deductions for each employee, summarise them

by pay period and record in General Ledger Account

Reconcile payroll deductions monthly with the amounts

recorded in the Control Accounts

Review payments made to third parties for payroll

deductions to ensure accuracy and timeliness

Document(s)

Pay Sheets

Reconciliation

Pay Sheets

Store Third Party Notices, payment evidences and Pay

Pay Sheets, Third

Sheets in a separate file and make available for review by Party Notices

internal audit

Appendix V: Bank Reconciliation Preparation Procedures

Appendix VA: Preparation of a Bank Reconciliation

Responsible

Officer

Accountant

Description

Document(s)

Indicates Company name, bank account number, and the

date at which the reconciliation is being, i.e. the last date

of the relevant month

The closing balance of the bank statement for the last

working day of the month shall be entered on the form

and the date of the statement indicated.

Bank

Reconciliation

Form

Bank

Reconciliation

Form, Bank

Statement

Bank

Reconciliation

Form

Bank

Reconciliation

Form

The cumulative receipts and payments for the months as

par cashbook(s) shall be entered in the reconciliation

The cashbook balance brought forward from the

Reconciliation previous month shall be added to the net total of above

to ascertain the cumulative balance. There should not be

Officer

any other adjustments, and this balance should agree

with the adjusted bank balance. If there are any

discrepancies, they shall be investigated as they could

be due to unpresented cheques, un-credited cheques,

direct debits by the bank, etc.

Appendix VB: Handling Discrepancies

In the event of the reconciliation failing to balance at the first attempt, the following checks shall

be applied:

Responsible

Officer

Accountant

Description

Re-check that all items in the bank statement are in the

cashbook, except in respect of adjustments such as uncredited cheques and unpresented cheques brought

forward from the previous month. Specific checks are

that:

all non-cheque debits on the bank statement are in

the cashbook and included in the totals;

all receipts on the bank statement are in the

cashbook, or are in respect of the un-credited

cheques figures of the previous months bank

reconciliation

Check that all items in the cashbook are in the bank

statement except for the un-presented and un-credited

cheques adjustments.

Checks the addition of the cashbook and the cumulative

figures are correctly brought forward and added on from

the previous month

Checks the corrections of the payments cashbook totals

total for the month by adding up the totals of the cheque

schedules for the month and then adding on any direct

bank debits. If this reveals a discrepancy, check the

adding up of each individual cheque schedule, and then,

if necessary check item by item from the schedules into

the cashbook.

Document(s)

Bank Statement

Cheque

Schedules

Appendix VIA: Accounts Receivable (AR)

Responsible

Officer

Accountant

Description

Complete accounting processes and reconciliations for

accounts receivables

Enter and post all invoices, debits and credits for the

accounting period.

Enter and post all payments for the accounting period.

Enter deposits into the bank reconciliation file

Prepare the AR Aging Report to reconcile report-aging

balance to the general ledger account balance for AR

Review bad debts and credits and take the appropriate

steps.

Prepare and send customer statements

Provide for bad debts following the defined procedure.

Document(s)

Reconciliation

statement

AR Aging Report

Customer

statements

Appendix VIB: Accounts Payable (AP)

Responsible

Officer

Accountant

Description

Complete accounting processes and reconciliations for

accounts payable.

Generate all vouchers and adjustments from purchasing

section for the accounting period.

Generate and post all AP payments for the accounting

period.

Review and correct any vouchers on-hold

Prepare the AP Aging Report to reconcile report-aging

balance to the general ledger account balance for AR

Prepare the Vouchers Payable Report for accrued

receipts to reconcile the total vouchers amount to the

general ledger account balance for vouchers payable.

Review the official order register to determine the

existence of any orders where the goods have not been

received and consequently the obligation to pay has not

been recognized by the Company.

After the outstanding Official Orders have been verified

and the values determined, make entries to the General

Ledger to ensure that the right liability is recognized.

Review any other orders or contingent liabilities and

entries made to recognize these liabilities in the General

Ledger.

Document(s)

Reconciliation

statement

AP Aging Report

Vouchers Payable

Report

Order Register

Appendix VIC: Payroll

Responsible

Officer

Payroll

Officer

Description

Complete accounting processes and reconciliations

statements for payroll.

Process final payroll for the accounting year.

Enter the post accrual payroll entries as required.

Enter and post all correcting or adjusting payroll entries

for the period.

Process Year-End Payroll Report.

Document(s)

Reconciliation

statement

Pay Sheet

Appendix VID: Closing Fixed Assets Accounts

Responsible

Officer

Accountant

Description

Record all additions, disposals and movements of fixed

assets. Post all monthly depreciation entries.

Carry out physical counts of all assets held at the end of

the year.

Update the fixed asset register.

Document(s)

Fixed Asset

Schedule

Assets Survey

Report/Stock

Taking Sheet

Appendix VIE: Inventories

Responsible

Officer

Store

Keeper,

Accountant,

Internal

Audit

Description

Cary out physical count of all the inventories kept in

stores at the end of the year.

During the count, identify and count obsolete, damaged

and expired items. Obtain the values of these items and

advice management on whether to write them off.

Compare the results of the physical stock counts to the

perpetual records and obtain explanations for any

variances.

In cases where no explanations have been obtained or the

explanations indicate that a write off is a reasonable

option, the perpetual record shall be updated and

corresponding entries shall be made in the General

Ledger.

Compute values based on applicable accounting standard

and make entries in the General Ledger to adjust the

balances.

Document(s)

Inventories

Survey Report

Appendix VIF: General Ledger

Responsible

Officer

Finance and

Accounts

Description

Document(s)

Complete accounting processes and reconciliation

statements for General Ledger

Post all the standard journals for the accounting periods.

Process and post all correcting or adjusting journal

entries for the period.

Process the Financial Statements for the accounting

period and all other financial reporting documents.

Bank Reconciliation Procedures:

Update reconciled transactions from the bank

statement;

Enter miscellaneous charges from bank statement

into bank reconciliation;

Compute balance;

Reconcile posted balance to bank balance with

unreconciled item list (outstanding cheques and

deposits in transit).

Carry out cash count at the end of the year; Prepare Cash

Certificate and a statement reconciling the cash at hand

to the Petty Cash/Imprest amount.

Close the accounting year when completed.

Appendix VII: Organogram of Finance and Accounts Department

Finance and

Accounts

Manager

Internal Auditor

Accountant

Sectional

Officers

Cost and

Management

Accountant

Store Keeper

Other Officers

Cash Officer

Sectional

Officers

Payroll Officer

Sectional

Officers

Journal Vouchers

Financial

Statements

Bank Statements,

Bank

Reconciliation

Statement

Cash Certificate

Você também pode gostar

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsAinda não há avaliações

- Academy Trust External Audit Preparation ChecklistDocumento8 páginasAcademy Trust External Audit Preparation ChecklistAyşe BalamirAinda não há avaliações

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsAinda não há avaliações

- FR Balance Sheet Reconciliations InstructionsDocumento10 páginasFR Balance Sheet Reconciliations Instructionsnarendra990% (1)

- Notes Payable, Long-Term Debt, and Interest NarrativeDocumento3 páginasNotes Payable, Long-Term Debt, and Interest NarrativeCaterina De Luca100% (3)

- BADVAC3X MOD 5 Financial StatementsDocumento9 páginasBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoAinda não há avaliações

- Trial Balance and FSDocumento58 páginasTrial Balance and FSMubarrach MatabalaoAinda não há avaliações

- Accouting (Week 6) - Ch. 15 - 16Documento7 páginasAccouting (Week 6) - Ch. 15 - 16junkmail4akhAinda não há avaliações

- Financial Management Sample PoliciesDocumento9 páginasFinancial Management Sample Policiessofyan timotyAinda não há avaliações

- Audit Program On Inter-Agency ReceivablesDocumento2 páginasAudit Program On Inter-Agency ReceivablesHoven Macasinag100% (1)

- Budget Guildlines 2023-24 GO.207Documento9 páginasBudget Guildlines 2023-24 GO.207EE MI NandyalAinda não há avaliações

- Module 4Documento15 páginasModule 4Jan Mike T. MandaweAinda não há avaliações

- Project Budgeting and Accounting: What Is A Budget?Documento8 páginasProject Budgeting and Accounting: What Is A Budget?Syed YaserAinda não há avaliações

- Trade Payables and AccrualsDocumento5 páginasTrade Payables and Accrualsabdirahman farah AbdiAinda não há avaliações

- Government Accounting Punzalan Solman Chap 2Documento6 páginasGovernment Accounting Punzalan Solman Chap 2Alarich Catayoc100% (1)

- M A SDocumento11 páginasM A SPatricia Delos SantosAinda não há avaliações

- Account Reconciliation PolicyDocumento2 páginasAccount Reconciliation PolicyJoseph Takunda ChidemboAinda não há avaliações

- Financial Management Training For Implementing PartnersDocumento28 páginasFinancial Management Training For Implementing PartnersBenjamin Kofi QuansahAinda não há avaliações

- Subsiquent EventsDocumento8 páginasSubsiquent EventsAsumpta MunaAinda não há avaliações

- Chapter Four Monthly ReportsDocumento34 páginasChapter Four Monthly ReportsGirmaAinda não há avaliações

- Explain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageDocumento5 páginasExplain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageBeyonce SmithAinda não há avaliações

- BudgetingDocumento37 páginasBudgetingMompoloki MontiAinda não há avaliações

- Sample Audit ProgramDocumento119 páginasSample Audit ProgramEcyojEiramMarapaoAinda não há avaliações

- Coa C99-004Documento14 páginasCoa C99-004bolAinda não há avaliações

- Management Directive: Overnor S FficeDocumento12 páginasManagement Directive: Overnor S FficeAnji SanagalaAinda não há avaliações

- Chapter 29 Procedures and Reports On Special Purpose Audit EngagementsDocumento30 páginasChapter 29 Procedures and Reports On Special Purpose Audit EngagementsClar Aaron BautistaAinda não há avaliações

- Finance & Accounts SOP (Final)Documento46 páginasFinance & Accounts SOP (Final)MasterArif Hipnoterapi78% (27)

- Cash NarrativeDocumento4 páginasCash NarrativeCaterina De LucaAinda não há avaliações

- Act08 - Lfca133e022 - Lique GiinoDocumento4 páginasAct08 - Lfca133e022 - Lique GiinoGino LiqueAinda não há avaliações

- (Company Name) Accounting Policies and Procedures ManualDocumento22 páginas(Company Name) Accounting Policies and Procedures ManualPhil Kgobe100% (1)

- Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesDocumento4 páginasRepublic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesJan Carlo SanchezAinda não há avaliações

- A Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaDocumento6 páginasA Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaCA Lokesh MaheshwariAinda não há avaliações

- 09 Financial Report SystemDocumento72 páginas09 Financial Report SystemPeterson ManalacAinda não há avaliações

- Financial & Accounting Policies & ProceduresDocumento34 páginasFinancial & Accounting Policies & ProceduresAnnabel Strange100% (5)

- Accounting For Budgetary AccountsDocumento4 páginasAccounting For Budgetary AccountsMoises A. Almendares0% (1)

- Audit Summary Chapter 25Documento7 páginasAudit Summary Chapter 25bless villahermosaAinda não há avaliações

- Guidelines For Performing Account ReconciliationsDocumento9 páginasGuidelines For Performing Account ReconciliationsNaveen Kumar NaiduAinda não há avaliações

- Bank ReconciliationDocumento19 páginasBank ReconciliationMai SaberolaAinda não há avaliações

- Bank ReconciliationDocumento18 páginasBank ReconciliationAlexandria Ann FloresAinda não há avaliações

- Budgetary ControlDocumento11 páginasBudgetary ControlDurga Prasad NallaAinda não há avaliações

- Budget EstimateDocumento6 páginasBudget EstimateTsering Paldon100% (3)

- Account Reconciliation Policy - Sample 2Documento5 páginasAccount Reconciliation Policy - Sample 2Muri EmJayAinda não há avaliações

- Module 6 - Worksheet and Financial Statements Part IDocumento12 páginasModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- 1Documento35 páginas1Rommel CruzAinda não há avaliações

- Formal List of Organized Audit Request From The ClientDocumento2 páginasFormal List of Organized Audit Request From The ClientTATYANA PAULA GOLONGAinda não há avaliações

- Illustrative Bank Branch Audit FormatDocumento4 páginasIllustrative Bank Branch Audit Formatnil sheAinda não há avaliações

- Lecture File On Bank Reconciliation StatementDocumento2 páginasLecture File On Bank Reconciliation StatementRizwan umerAinda não há avaliações

- Completing The Accounting CycleDocumento9 páginasCompleting The Accounting CycleTikaAinda não há avaliações

- Banking Prepaid Accrued ExpensesDocumento3 páginasBanking Prepaid Accrued ExpensesDivine GraceAinda não há avaliações

- Interim Financial ReportingDocumento27 páginasInterim Financial ReportingChristelle LopezAinda não há avaliações

- New Life School - Appendix 4.2 - List of Financial Reports (Part 1) (N4J6) (NewLifeSchoolPerforArts)Documento10 páginasNew Life School - Appendix 4.2 - List of Financial Reports (Part 1) (N4J6) (NewLifeSchoolPerforArts)Ramabone NyathiAinda não há avaliações

- The Conceptual Framework of AccountingDocumento34 páginasThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Audit GroupDocumento17 páginasAudit GroupYoseph MekonnenAinda não há avaliações

- Close ChecklistDocumento6 páginasClose ChecklistShifan Ishak100% (1)

- Financial Accounting Handout 2Documento49 páginasFinancial Accounting Handout 2Rhoda Mbabazi ByogaAinda não há avaliações

- Illustrative Bank Branch Audit Programme For The Year Ended March 31, 2019Documento21 páginasIllustrative Bank Branch Audit Programme For The Year Ended March 31, 2019rahul giriAinda não há avaliações

- Govt Acctg Ch9a Acctg For LgusDocumento34 páginasGovt Acctg Ch9a Acctg For LgusRachel Sanculi LustinaAinda não há avaliações

- Financial Statements & Analysis, The Day Before ExamDocumento10 páginasFinancial Statements & Analysis, The Day Before Examsukumar59Ainda não há avaliações

- Financial StatementDocumento7 páginasFinancial StatementEunice SorianoAinda não há avaliações

- MSO (A&E) - Vol. - I (Chapter - 8) : The Check of Works Accounts Is Conducted in Three StagesDocumento24 páginasMSO (A&E) - Vol. - I (Chapter - 8) : The Check of Works Accounts Is Conducted in Three StagesChandra ShekharAinda não há avaliações

- Chapter 3 Adjusting The AccountsDocumento28 páginasChapter 3 Adjusting The AccountsNabilla Febry Indriyanti100% (1)

- CH 16 Wiley Kimmel Homework QuizDocumento13 páginasCH 16 Wiley Kimmel Homework Quizmki100% (1)

- SM 1Documento245 páginasSM 1rattolaman100% (1)

- Instructions: Do Not Put Centavos in Your Answers. No Need To Type Comma (,)Documento6 páginasInstructions: Do Not Put Centavos in Your Answers. No Need To Type Comma (,)Victorino LopezAinda não há avaliações

- DEY's Balance of Payments PPTs As Per Revised Syllabus (Teaching Made EasierDocumento325 páginasDEY's Balance of Payments PPTs As Per Revised Syllabus (Teaching Made EasierAditya P NairAinda não há avaliações

- GovAcc HO No. 4 - Revenue and Other ReceiptsDocumento13 páginasGovAcc HO No. 4 - Revenue and Other Receiptsbobo kaAinda não há avaliações

- Achievement Test 3.chapters 5&6Documento9 páginasAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Accountancy XIDocumento628 páginasAccountancy XIAkshay KherAinda não há avaliações

- Audit Final To PrintDocumento6 páginasAudit Final To PrintKHathy AsoiralAinda não há avaliações

- Chapter 2: Overview of Business ProcessDocumento16 páginasChapter 2: Overview of Business ProcessZoe McKenzieAinda não há avaliações

- PartnershipDocumento447 páginasPartnershipSajid Ali100% (2)

- LAPD-VAT-G03 - VAT 409 Guide For Fixed Property and Construction - External GuideDocumento87 páginasLAPD-VAT-G03 - VAT 409 Guide For Fixed Property and Construction - External GuideUrvashi KhedooAinda não há avaliações

- Session 12 CH 17 Partnership LiquidationDocumento33 páginasSession 12 CH 17 Partnership LiquidationAnnie AtmanAinda não há avaliações

- Republic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorDocumento7 páginasRepublic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorJessie Mark AnapadaAinda não há avaliações

- Hire Purchase, Leasing and Venture Capital Dba1751Documento260 páginasHire Purchase, Leasing and Venture Capital Dba1751Santhosh George67% (3)

- Foundation Accounts Suggested Jan21Documento22 páginasFoundation Accounts Suggested Jan21Himanshu RayAinda não há avaliações

- ICO Sample Paper 1 Class 11 - Free PDF DownloadDocumento21 páginasICO Sample Paper 1 Class 11 - Free PDF DownloadNitya AggarwalAinda não há avaliações

- Buku Pembantu Piutang Dan UtangDocumento4 páginasBuku Pembantu Piutang Dan UtangWulan SariAinda não há avaliações

- Chapter 6 Partnership Formation Operation and LiquidationDocumento6 páginasChapter 6 Partnership Formation Operation and Liquidationanwaradem225Ainda não há avaliações

- Gwari P. AccsDocumento59 páginasGwari P. AccsOwen Bawlor ManozAinda não há avaliações

- MBH XRF Master Samples Olids-Catalogue-04Documento112 páginasMBH XRF Master Samples Olids-Catalogue-04Cristian WalkerAinda não há avaliações

- CH 3Documento19 páginasCH 3hey100% (1)

- Topic - Accumulated Profits (Losses)Documento3 páginasTopic - Accumulated Profits (Losses)Kaye ArsadAinda não há avaliações

- Chapter 9 - Results For Multiple Choice Quiz 112Documento5 páginasChapter 9 - Results For Multiple Choice Quiz 112Animaw YayehAinda não há avaliações

- Workshop 2 SolutionsDocumento10 páginasWorkshop 2 SolutionsJohan ShahAinda não há avaliações

- Human Resources 2Documento48 páginasHuman Resources 2Harsh 21COM1555Ainda não há avaliações

- Amalgamation: Question Text Option - A Option - B Option - C Option - D SolutionDocumento13 páginasAmalgamation: Question Text Option - A Option - B Option - C Option - D SolutionPAWAN CHHABRIAAinda não há avaliações

- 53078-2015-Medtecs International Corp. Limited V.20190421-5466-E0telyDocumento38 páginas53078-2015-Medtecs International Corp. Limited V.20190421-5466-E0telyDyan de la FuenteAinda não há avaliações

- Topic 4 A201 Accounting 5th EdDocumento100 páginasTopic 4 A201 Accounting 5th EdNavanithan Anantharajan100% (1)

- (5515) Ext.-301 Business Regulatory Framework (M. Law) (2013 Pattern)Documento88 páginas(5515) Ext.-301 Business Regulatory Framework (M. Law) (2013 Pattern)Dhanashri KoradeAinda não há avaliações