Escolar Documentos

Profissional Documentos

Cultura Documentos

NCX Nifty Weekly Report 24 Aug To 28 Aug

Enviado por

zoidresearchTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

NCX Nifty Weekly Report 24 Aug To 28 Aug

Enviado por

zoidresearchDireitos autorais:

Formatos disponíveis

WEEKLY TECHNICAL REPORT

24 AUG TO 28 AUG 15

CNX NIFTY 8299.95 (-218.05)

(-2.56%)

Last Week Nifty opened with some

positive bias on Monday and made a

high at 8530.60, & close at 8477.30.

The remaining trading session of the

week Nifty continues head at on sell

and continues create a support zone

at low to low. On Thursday nifty close

on a strong bear note at 8372. On

Friday volatile session on a weak note

& nifty breach the support zone &

create a new support at 8225-8210,

the CNX Nifty closed in red, nifty

ended down at 8299.95.

We are

recommended The Nifty is bearish;

sell at 8300 target is near 8150-7950.

The nifty ended the conclude week

with a losing of (-2.56%) or (-218.05)

over the previous weeks closing.

Formations

The 20 days EMA are placed at

8450.36

The 5 days EMA are placed at

8398.78

Future Outlook:

The Nifty daily chart is bearish; Nifty

is downtrend if is trading below 8300

our positional target is 7950. Nifty

selling pressure near 8300-8350.

Nifty Upside weekly Resistance is

www.zoidresearch.com

8650-8480 level. Nifty weeks low

8225.25, this level is strong support

point. The Nifty weekly support is

8220-8050

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

24 AUG TO 28 AUG 15

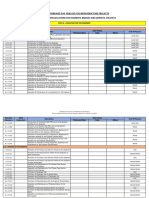

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol

CNX NIFTY

Resistance2

8658

MARUTI

TATAMOTORS

2638.73

2788.55

1428.35

4759.65

375.37

ACC

AMBUJACEM

GRASIM

ULTRACEMCO

1499.95

238.15

3834.52

3283.43

LT

1856.67

ASIANPAINT

939.45

HINDUNILVR

ITC

924.63

345.98

BAJAJ-AUTO

HEROMOTOCO

M&M

Resistance1

Pivot

8479

8352

AUTOMOBILE

2522.47

2453.73

2671.80

2603.40

1375.30

1331.65

4663.50

4596.25

353.88

340.82

CEMENT & CEMENT PRODUCTS

1453.20

1407.60

232.60

226.75

3729.88

3655.37

3128.17

3026.98

CONSTRUCTION

1798.33

1761.67

CONSUMER GOODS

913.10

888.55

905.57

338.37

Support 1

8173

Support 2

8046

2337.47

2486.65

1278.60

4500.10

319.33

2268.73

2418.25

1234.95

4432.85

306.27

1360.85

221.20

3550.73

2871.72

1315.25

215.35

3476.22

2770.53

1703.33

1666.67

862.20

837.65

882.78

323.68

863.72

316.07

840.93

301.38

ENERGY

943.18

156.57

916.42

149.13

892.13

145.57

865.37

138.13

841.08

134.57

TATAPOWER

362.85

133.27

278.12

141.70

992.65

71.90

295.55

120.13

247.98

131.15

881.30

66.10

279.75

116.87

240.02

128.90

854.65

64.20

AXISBANK

594.22

337.10

321.30

128.33

125.07

267.03

259.07

137.55

135.30

950.30

923.65

69.95

68.05

FINANCIAL SERVICES

559.23

536.77

501.78

479.32

BANKBARODA

HDFCBANK

229.68

1122.17

214.67

1091.73

201.28

1071.37

186.27

1040.93

172.88

1020.57

HDFC

ICICIBANK

IDFC

INDUSINDBK

1341.72

315.43

151.85

1001.55

1285.03

305.97

145.90

953.40

1249.52

297.28

140.45

923.35

1192.83

287.82

134.50

875.20

1157.32

279.13

129.05

845.15

KOTAKBANK

PNB

742.33

192.18

715.17

175.77

697.58

164.13

670.42

147.72

652.83

136.08

SBIN

YESBANK

302.37

847.85

284.93

770.00

270.57

724.65

253.13

646.80

238.77

601.45

BPCL

CAIRN

GAIL

NTPC

ONGC

POWERGRID

RELIANCE

www.zoidresearch.com

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

24 AUG TO 28 AUG 15

INDUSTRIAL MANUFACTURING

261.02

252.23

IT

995.23

967.62

BHEL

273.18

HCLTECH

1025.57

INFY

TCS

1219.90

2781.85

1184.90

2729.00

TECHM

WIPRO

591.98

599.53

ZEEL

433.53

COALINDIA

HINDALCO

NMDC

VEDL

397.35

98.90

102.32

113.20

264.62

240.07

231.28

937.28

909.67

1151.20

2700.00

1116.20

2647.15

1082.50

2618.15

546.82

563.97

530.58

551.93

367.82

352.43

334.90

80.80

90.23

89.20

227.53

321.15

75.60

87.42

83.80

217.82

664.00

4159.57

1768.70

893.77

630.60

4075.08

1659.60

849.63

362.08

354.62

148.48

144.47

DRREDDY

LUPIN

SUNPHARMA

778.40

4412.18

2051.70

1010.13

BHARTIARTL

406.12

577.52

561.28

587.77

575.73

MEDIA & ENTERTAINMENT

408.37

392.98

METALS

373.00

359.25

92.45

87.25

97.68

94.87

103.90

98.50

250.93

241.22

PHARMA

737.90

704.50

4328.12

4243.63

1964.75

1855.65

974.02

929.88

TELECOM

387.83

380.37

IDEA

167.77

160.13

TATASTEEL

CIPLA

156.12

Weekly Top gainers stocks

Script Symbol

BANKBARODA

LUPIN

SUNPHARMA

ITC

PNB

Previous Close

176.75

1758.10

879.05

316.35

152.85

Current Price

199.65

1877.80

937.90

330.75

159.35

% Change

12.96%

6.81%

6.69%

4.55%

4.25%

In Points

22.90

119.70

58.85

14.40

6.50

Current Price

692.15

94.60

141.70

348.65

525.30

% Change

-9.18%

-8.51%

-8.11%

-7.53%

-7.44%

In Points

-70.00

-8.80

-12.50

-28.40

-42.25

Weekly Top losers stocks

Script Symbol

YESBANK

VEDL

CARIN

COALINDIA

AXISBANK

www.zoidresearch.com

Previous Close

762.15

103.40

154.20

377.05

567.55

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

24 AUG TO 28 AUG 15

Weekly FIIS Statistics*

DATE

Buy Value

Sell Value

Net Value

21/AUG/2015

4583.50

6924.10

-2340.60

20/AUG/2015

4699.37

5706.63

-1007.26

19/AUG/2015

3132.83

3556.55

-423.72

18/AUG/2015

3436.01

3691.43

-255.42

17/AUG/2015

3507.74

3365.4

142.34

DATE

Buy Value

Sell Value

Net Value

21/AUG/2015

3028.46

1504.36

1524.10

20/AUG/2015

2018.09

1450.22

567.87

19/AUG/2015

1743.89

1360.57

383.32

18/AUG/2015

1194.33

1066.83

127.50

17/AUG/2015

1471.16

1287.44

183.72

Weekly DIIS Statistics*

MOST ACTIVE NIFTY CALLS & PUTS

EXPIRY DATE

TYPE

STRIKE PRICE

VOLUME

OPEN INTEREST

27/AUG/2015

CE

8300

1495308

2608925

27/AUG/2015

CE

8400

1354167

4259975

27/AUG/2015

CE

8500

1075777

5599850

27/AUG/2015

PE

8200

1586403

6363000

27/AUG/2015

PE

8300

1213226

5964175

27/AUG/2015

PE

8100

968854

3124950

MOST ACTIVE BANK NIFTY CALLS & PUTS

EXPIRY DATE

TYPE

STRIKE PRICE

VOLUME

OPEN INTEREST

27/AUG/2015

CE

18500

123902

517150

27/AUG/2015

CE

18000

84759

216200

27/AUG/2015

CE

19000

67890

1002475

27/AUG/2015

PE

17500

126040

639500

27/AUG/2015

PE

18000

84491

397725

27/AUG/2015

PE

17000

42183

340075

www.zoidresearch.com

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

24 AUG TO 28 AUG 15

Weekly Recommendations:

DATE

SYMBOL

STRATEGY

ENTRY

TARGET

STATUS

22 AUG 15

MARUTI

SELL ON RISE

4540-4550

4350-4150

OPEN

8 AUG 15

PETRONET

BUY ON DEEP

185-183

195-205

1ST TARGET

ACHIEVED

1 AUG 15

WIPRO

BUY ON DEEP

570-565

595-625

OPEN

18 JUL 15

CESC

BUY ON DEEP

585-580

610-635

11 JUL 15

COALINDIA

BUY ON DEEP

420-422

438-460

4 JUL 15

CANBK

BUY ON DEEP

286-285

300-315

27 JUN 15

BHEL

BUY ON DEEP

250

260-270

20 JUN 15

CIPLA

BUY ON DEEP

605-600

630-660

6 JUN 15

ADANIPORT

SELL ON RISE

312-315

300-285

30 MAY 15

BPCL

BUY ON DEEP

845

871-896

16 MAY 15

LUPIN

BUY ON DEEP

1680-1690

1740-1800

25 APR 15

YESBANK

BUY ON DEEP

820-810

872-900

18 APR15

SUNPHRAMA

SELL ON RISE

1060-1070

1010-980

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

ALL TARGET

ACHIEVED

ALL TARGET

ACHIEVED

1ST TARGET

ACHIEVED

1ST TARGET

ACHIEVED

ALL TGT

ACHIEVED

1ST TGT

ACHIEVED

ALL TGT

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

Office 101, Shagun Tower

A.B. Commercial Road,

Indore

452001

Mobile : +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com

ZOID RESEARCH TEAM

Você também pode gostar

- Modern Money and Banking BookDocumento870 páginasModern Money and Banking BookRao Abdur Rehman100% (6)

- Sample Business ProposalDocumento10 páginasSample Business Proposalvladimir_kolessov100% (8)

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Documento103 páginas2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- 101 Case Studies In Wall Street (Practical)No Everand101 Case Studies In Wall Street (Practical)Ainda não há avaliações

- Guide To Accounting For Income Taxes NewDocumento620 páginasGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- CNX Nifty Weeklky Report 12 Oct To 16 OctDocumento5 páginasCNX Nifty Weeklky Report 12 Oct To 16 OctzoidresearchAinda não há avaliações

- Technical CNX NIFTY Weekly Report 23Nov-27NovDocumento5 páginasTechnical CNX NIFTY Weekly Report 23Nov-27NovzoidresearchAinda não há avaliações

- CNX NIFTY Technical Report 16 Nov To 20 NovDocumento5 páginasCNX NIFTY Technical Report 16 Nov To 20 NovzoidresearchAinda não há avaliações

- Technical CNX Nifty Report 14 Dec To 18 DecDocumento5 páginasTechnical CNX Nifty Report 14 Dec To 18 DeczoidresearchAinda não há avaliações

- Equity Technical Report (08 - 12 Aug)Documento6 páginasEquity Technical Report (08 - 12 Aug)zoidresearchAinda não há avaliações

- Equity Report 16 Aug To 19 AugDocumento6 páginasEquity Report 16 Aug To 19 AugzoidresearchAinda não há avaliações

- Equity (Nifty50) Technical Report (11 - 15 July)Documento6 páginasEquity (Nifty50) Technical Report (11 - 15 July)zoidresearchAinda não há avaliações

- Equity Technical Report 10 - 14 OctDocumento6 páginasEquity Technical Report 10 - 14 OctzoidresearchAinda não há avaliações

- Equity Technical Report 25 To 29 July - ZoidresearchDocumento6 páginasEquity Technical Report 25 To 29 July - ZoidresearchzoidresearchAinda não há avaliações

- Equity Report 12 Dec To 16 DecDocumento6 páginasEquity Report 12 Dec To 16 DeczoidresearchAinda não há avaliações

- Equity (Nifty50) Technical Report (04 - 08 July)Documento6 páginasEquity (Nifty50) Technical Report (04 - 08 July)zoidresearchAinda não há avaliações

- Equity Report 23 May To 27 MayDocumento6 páginasEquity Report 23 May To 27 MayzoidresearchAinda não há avaliações

- Premarket Technical&Derivatives Angel 16.11.16Documento5 páginasPremarket Technical&Derivatives Angel 16.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Equity Report 14 Nov To 18 NovDocumento6 páginasEquity Report 14 Nov To 18 NovzoidresearchAinda não há avaliações

- Equity Technical Weekly ReportDocumento6 páginasEquity Technical Weekly ReportzoidresearchAinda não há avaliações

- Premarket Technical&Derivative Angel 18.11.16Documento5 páginasPremarket Technical&Derivative Angel 18.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Equity Report 11 Apr To 15 AprDocumento6 páginasEquity Report 11 Apr To 15 AprzoidresearchAinda não há avaliações

- Equity Technical Report (16 May-20 MAy)Documento6 páginasEquity Technical Report (16 May-20 MAy)zoidresearchAinda não há avaliações

- Daily Calls: SensexDocumento7 páginasDaily Calls: Sensexdrsivaprasad7Ainda não há avaliações

- Performance ReportDocumento18 páginasPerformance ReportCommotrendz teamAinda não há avaliações

- Equity Weekly Report 22 Feb To 26 FebDocumento6 páginasEquity Weekly Report 22 Feb To 26 FebzoidresearchAinda não há avaliações

- Premarket Technical&Derivative Ashika 30.11.16Documento4 páginasPremarket Technical&Derivative Ashika 30.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Premarket Technical&Derivative Angel 15.12.16Documento5 páginasPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Daily Equity Newsletter: Indian MarketDocumento4 páginasDaily Equity Newsletter: Indian Marketapi-210648926Ainda não há avaliações

- Morning Call Morning Call: Markets End Lower Infy ZoomsDocumento4 páginasMorning Call Morning Call: Markets End Lower Infy ZoomsrcpgeneralAinda não há avaliações

- Bulls Ready To Take Off Again: Punter's CallDocumento6 páginasBulls Ready To Take Off Again: Punter's CallNeerajMattaAinda não há avaliações

- Premarket Technical&Derivative Angel 21.12.16Documento5 páginasPremarket Technical&Derivative Angel 21.12.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Derivative Report 02 May UpdateDocumento6 páginasDerivative Report 02 May UpdateDEEPAK MISHRAAinda não há avaliações

- Rupee Karvy 130911Documento3 páginasRupee Karvy 130911jitmAinda não há avaliações

- Nse Top 5 Gainers: Dear Must Take Tis in Ur PresentationDocumento7 páginasNse Top 5 Gainers: Dear Must Take Tis in Ur Presentationomi159Ainda não há avaliações

- Premarket Technical&Derivative Ashika 23.11.16Documento4 páginasPremarket Technical&Derivative Ashika 23.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Daily CallsDocumento7 páginasDaily CallsparikshithbgAinda não há avaliações

- Daily Equity Newsletter by Market Magnify 07-03-2012Documento7 páginasDaily Equity Newsletter by Market Magnify 07-03-2012IntradayTips ProviderAinda não há avaliações

- BRS Market Report: Week IV: 19Documento7 páginasBRS Market Report: Week IV: 19Sudheera IndrajithAinda não há avaliações

- Special Report by Epic Reseach 08 August 2013Documento4 páginasSpecial Report by Epic Reseach 08 August 2013EpicresearchAinda não há avaliações

- Equity Technical Weekly Report (9 May - 13 May)Documento6 páginasEquity Technical Weekly Report (9 May - 13 May)zoidresearchAinda não há avaliações

- Way2Wealth Daily Trading Bites Apr1Documento3 páginasWay2Wealth Daily Trading Bites Apr1Srikanth RamakrishnaAinda não há avaliações

- Momentum PicksDocumento20 páginasMomentum PicksxytiseAinda não há avaliações

- Equity Report 31 Oct To 4 NovDocumento6 páginasEquity Report 31 Oct To 4 NovzoidresearchAinda não há avaliações

- Premarket Technical&Derivative Ashika 24.11.16Documento4 páginasPremarket Technical&Derivative Ashika 24.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Weekly Share Market Tips 28 DecDocumento6 páginasWeekly Share Market Tips 28 DecRahul SolankiAinda não há avaliações

- Premarket Technical&Derivative Angel 17.11.16Documento5 páginasPremarket Technical&Derivative Angel 17.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Equity Market Weekly News by Trifid ResearchDocumento6 páginasEquity Market Weekly News by Trifid ResearchSunil MalviyaAinda não há avaliações

- Premarket Technical&Derivative Ashika 25.11.16Documento4 páginasPremarket Technical&Derivative Ashika 25.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Documento11 páginasWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalAinda não há avaliações

- Analysis of ITC Stocks Against BSEDocumento13 páginasAnalysis of ITC Stocks Against BSEAnupam GautamAinda não há avaliações

- Equity Analysis Equity Analysis - Weekl WeeklyDocumento8 páginasEquity Analysis Equity Analysis - Weekl WeeklyTheequicom AdvisoryAinda não há avaliações

- Capitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MDocumento8 páginasCapitalstars Investment Advisors: W W W - C A P I T A L S T A R S - C O MNehaSharmaAinda não há avaliações

- Nifty Daily Outlook 22 June Equity Research LabDocumento8 páginasNifty Daily Outlook 22 June Equity Research Labram sahuAinda não há avaliações

- Equity Research Lab: Derivative ReportDocumento6 páginasEquity Research Lab: Derivative ReportAru MehraAinda não há avaliações

- Equity Analysis - WeeklyDocumento8 páginasEquity Analysis - Weeklyapi-198466611Ainda não há avaliações

- Tech Derivatives DailyReport 200416Documento5 páginasTech Derivatives DailyReport 200416xytiseAinda não há avaliações

- Daily Option News Letter 05 July 2013Documento7 páginasDaily Option News Letter 05 July 2013Rakhi Sharma Tips ProviderAinda não há avaliações

- Analisis Teknikal: Stock PickDocumento4 páginasAnalisis Teknikal: Stock PickGoBlog NgeblogAinda não há avaliações

- NIFTY SPOT: 8467.90: Daily Technical OutlookDocumento4 páginasNIFTY SPOT: 8467.90: Daily Technical OutlookPawani JainAinda não há avaliações

- Daily Calls: ICICI Securities LTDDocumento14 páginasDaily Calls: ICICI Securities LTDAnujAsthanaAinda não há avaliações

- Equity Report 6 To 10 NovDocumento6 páginasEquity Report 6 To 10 NovzoidresearchAinda não há avaliações

- Equity Report 21 Aug To 25 AugDocumento6 páginasEquity Report 21 Aug To 25 AugzoidresearchAinda não há avaliações

- Equity Report 16 - 20 OctDocumento6 páginasEquity Report 16 - 20 OctzoidresearchAinda não há avaliações

- Equity Weekly Report 19-23 NovDocumento10 páginasEquity Weekly Report 19-23 NovzoidresearchAinda não há avaliações

- Equity Report 10 July To 14 JulyDocumento6 páginasEquity Report 10 July To 14 JulyzoidresearchAinda não há avaliações

- Equity Report 19 June To 23 JuneDocumento6 páginasEquity Report 19 June To 23 JunezoidresearchAinda não há avaliações

- Equity Report 26 June To 30 JuneDocumento6 páginasEquity Report 26 June To 30 JunezoidresearchAinda não há avaliações

- Equity Report 12 Dec To 16 DecDocumento6 páginasEquity Report 12 Dec To 16 DeczoidresearchAinda não há avaliações

- Equity Report 22 May To 26 MayDocumento6 páginasEquity Report 22 May To 26 MayzoidresearchAinda não há avaliações

- Equity Report 15 May To 19 MayDocumento6 páginasEquity Report 15 May To 19 MayzoidresearchAinda não há avaliações

- Equity Weekly Report 8 May To 12 MayDocumento6 páginasEquity Weekly Report 8 May To 12 MayzoidresearchAinda não há avaliações

- Equity Weekly ReportDocumento6 páginasEquity Weekly ReportzoidresearchAinda não há avaliações

- Equity Technical Weekly ReportDocumento6 páginasEquity Technical Weekly ReportzoidresearchAinda não há avaliações

- Equity Outlook 13 Feb To 17 FebDocumento6 páginasEquity Outlook 13 Feb To 17 FebzoidresearchAinda não há avaliações

- Equity Report 14 Nov To 18 NovDocumento6 páginasEquity Report 14 Nov To 18 NovzoidresearchAinda não há avaliações

- Equity Report 31 Oct To 4 NovDocumento6 páginasEquity Report 31 Oct To 4 NovzoidresearchAinda não há avaliações

- Equity Technical Report 10 - 14 OctDocumento6 páginasEquity Technical Report 10 - 14 OctzoidresearchAinda não há avaliações

- Equity Report 16 Aug To 19 AugDocumento6 páginasEquity Report 16 Aug To 19 AugzoidresearchAinda não há avaliações

- Equity Technical Report 25 To 29 July - ZoidresearchDocumento6 páginasEquity Technical Report 25 To 29 July - ZoidresearchzoidresearchAinda não há avaliações

- Equity Technical Report (08 - 12 Aug)Documento6 páginasEquity Technical Report (08 - 12 Aug)zoidresearchAinda não há avaliações

- Equity (Nifty50) Technical Report (11 - 15 July)Documento6 páginasEquity (Nifty50) Technical Report (11 - 15 July)zoidresearchAinda não há avaliações

- SWCH 01Documento12 páginasSWCH 01mahakali23Ainda não há avaliações

- Kennedy 11 Day Pre GeneralDocumento16 páginasKennedy 11 Day Pre GeneralRiverheadLOCALAinda não há avaliações

- Business Economics - Question BankDocumento4 páginasBusiness Economics - Question BankKinnari SinghAinda não há avaliações

- Ape TermaleDocumento64 páginasApe TermaleTeodora NedelcuAinda não há avaliações

- Pembayaran PoltekkesDocumento12 páginasPembayaran PoltekkesteffiAinda não há avaliações

- CBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportDocumento2 páginasCBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportMessy Rose Rafales-CamachoAinda não há avaliações

- Democracy Perception Index 2021 - Topline ResultsDocumento62 páginasDemocracy Perception Index 2021 - Topline ResultsMatias CarpignanoAinda não há avaliações

- Aus Tin 20105575Documento120 páginasAus Tin 20105575beawinkAinda não há avaliações

- S03 - Chapter 5 Job Order Costing Without AnswersDocumento2 páginasS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoAinda não há avaliações

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocumento5 páginasMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuAinda não há avaliações

- Part 1Documento122 páginasPart 1Astha MalikAinda não há avaliações

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthDocumento4 páginasPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezAinda não há avaliações

- CMACGM Service Description ReportDocumento58 páginasCMACGM Service Description ReportMarius MoraruAinda não há avaliações

- Presentation On " ": Human Resource Practices OF BRAC BANKDocumento14 páginasPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziAinda não há avaliações

- Working Capital Appraisal by Banks For SSI PDFDocumento85 páginasWorking Capital Appraisal by Banks For SSI PDFBrijesh MaraviyaAinda não há avaliações

- Lecture 6Documento19 páginasLecture 6salmanshahidkhan100% (2)

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDocumento8 páginasMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnAinda não há avaliações

- Monsoon 2023 Registration NoticeDocumento2 páginasMonsoon 2023 Registration NoticeAbhinav AbhiAinda não há avaliações

- Application Form For Subscriber Registration: Tier I & Tier II AccountDocumento9 páginasApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghAinda não há avaliações

- The Global Interstate System Pt. 3Documento4 páginasThe Global Interstate System Pt. 3Mia AstilloAinda não há avaliações

- Coconut Oil Refiners Association, Inc. vs. TorresDocumento38 páginasCoconut Oil Refiners Association, Inc. vs. TorresPia SottoAinda não há avaliações

- Table 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDocumento11 páginasTable 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDeepak SharmaAinda não há avaliações

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Documento17 páginasA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngAinda não há avaliações

- A Glossary of Macroeconomics TermsDocumento5 páginasA Glossary of Macroeconomics TermsGanga BasinAinda não há avaliações

- Nissan Leaf - The Bulletin, March 2011Documento2 páginasNissan Leaf - The Bulletin, March 2011belgianwafflingAinda não há avaliações

- Dimapanat, Nur-Hussein L. Atty. Porfirio PanganibanDocumento3 páginasDimapanat, Nur-Hussein L. Atty. Porfirio PanganibanHussein DeeAinda não há avaliações