Escolar Documentos

Profissional Documentos

Cultura Documentos

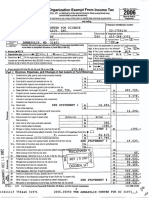

Institute For Humane Studies 941623852 2005 02C75DF5

Enviado por

cmf8926Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Institute For Humane Studies 941623852 2005 02C75DF5

Enviado por

cmf8926Direitos autorais:

Formatos disponíveis

Return of Organization

..

A Forthe 2005 calendaryear, or lax year beginning

SEP 1,

20 05

and ending

B Check

11 PleaseC Nameof organization

applicable use

IRS

labelor

DAddress

FOR HUMANE STUDIES

change pnntor INSTITUTE

type

DName

change See Numberandstreet(or PO box 1fmallis not deliveredto streetaddress)

olnrllal

3301 FAIRFAX DRIVE, SUITE 450

return Specific

lnstrucDFlnal

Cityor town,stateor country,and ZIP+ 4

tlons

return

DArnended

VA 22201-4432

!ARLINGTON,

return

DAppllcatJon Section501(c)(3) organizationsand 4947(a)(1)nonexemptcharitabletrusts

pending

must attacha completedScheduleA (Form990 or 990-EZ)

G

K

AUG 31,

No 1545-0047

2005

Undersection501(c), 527, or 4947(a)(1)of the InternalRevenueCode(exceptblack lung

benel1ttrusl or private foundation)

~ Theorganizationmayhaveto usea copyof this returnto satisfystatereportingrequirements

Jt theTreasury

Department

Internal

Revenue

service

OMB

Exempt From Income Tax

Opento Pllhllc

lnsitllcih)n

2006

D El"!lployerIdentificationnumber

94-1623852

IRoom/suite ETelephonenumber

703-993-4880

rrethod:

D

F Aa:ounbng

D

2g,~1M~

Cash[X] Accrual

Hand I are not appltcable to section 527 organizations.

H(a) Is this a group returnfor affiliates? Dves

IXJNo

N/A

Website:~WWW.THE I HS. ORG

H(b) If "Yes,'enternumberof affiliates~

Organizationtype (checkonly

one)~ [X] 501(c) ( 3

) ..... Onsertno)

4947(a)(1)orD

527 H(c) Are all affiliatesincluded? N/A

Dves

DNo

(If "No,'attacha list)

Checkhere ~

1fthe organization'sgross receiptsarenormallynot morethan $25,000 The

H(d) Is this a separatereturnfiled by an oroamzat1on

coveredbv a oroup rulmo? Dves

organizationneednot file a returnwith the IRS,but 1fthe organizationchoosesto file a return,be

IXJNo

sureto file a completereturn Somestates require a completereturn

N/A

I GrouoExemot1on

Number~

M Check~

1fthe organizationis not requiredto attach

Sch 8 (Form990, 990-EZ,or 990-PF)

3.814.679.

Grossreceipts Add Imes6b, Bb,9b, and 10bto lme12 ~

! Part t l Revenue, Expenses, and Changes in Net Assets or Fund Balances

1

a

b

c

d

!?'=

~

(c:,

r,.J

C\2

C\.2

2

3

4

5

6a

b

c

7

8 a

<

--,

0

UJ

z

zc((

ij

~

>

~

a:

b

c

d

a

u,

Q.

)(

b

c

1o a

b

c

11

12

13

14

15

16

17

18

u,

-;a> 19

z!:l

20

<(

21

523001

02-03-06

2,935,448.

517,449.

1d

2

3

4

5

65,482.

55,108.

6c

7

1,091.

Bd

u,

Contnbut1ons,

gifts, grants,and s1m1lar

amountsreceived

2,935,448.

1a

Directpublicsupport

1b

Indirectpublicsupport

1c

Governmentcontnbut,ons(grants)

2,870,072.

65,376.)

noncash$

Total (addImes1a through1c) (cash$

Programservicerevenuemcludmggovernmentfeesand contracts(from PartVII, lme93)

Membershipduesandassessments

Intereston savingsandtemporarycashinvestments

D1v1dends

and interestfrom secunt1es

6a

Grossrents

6b

Less rentalexpenses

Net rentalincomeor (loss)(subtractlme6b from lme6a)

\

other investmentincome(describe~

IB\ other

IA\ Secunt1es

Grossamountfrom salesof assetsother

215,550.

Ba

than inventory

214,459.

Bb

Lesscost or otherbasisandsalesexpenses

1.091.

Be

Gamor (loss) (attachschedule)

STMT 1

Netgamor (loss) (combinelmeBe,columns(A) and (8))

Specialeventsandact1v1t1es

(attachschedule)If anyamount1sfrom gaming,checkhere ~

of contnbut1ons

Grossrevenue(not mcludmg$

I 9a

reportedon lme1a)

9b

Less directexpensesotherthan fundra1smg

expenses

Net incomeor (loss)from specialevents(subtractlme9b from lme9a)

1oa

Grosssalesof inventory,less returnsandallowances

10b

Less cost of goodssold

Grossprofit or (loss)from salesof inventory(attachschedule)(subtractlme 10bfrom lme10a)

..

Otherrevenue(from PartVII, lme 103)

R2c.r:::tv,,, ......

:1

'--'

Total revenueladd Imes1d 2 3 4 5 6c 7 Bd 9c 10c and 11\

..

Programservices(from lme44, column(8))

0

KO

\"

Managementandgeneral(from lme44, column(C))

. n'.'.

Fundra1smg

(from lme44, column(D))

Paymentsto affiliates(attachschedule)

"n

~-,'

Total exoensesladd Imes16 and44 column(All

Excessor (def1c1t)

for theyear(subtractlme 17from lme12)

..

Net assetsor fund balancesat begmnmgof year(from lme73, column(A))

other changesm netassetsor fund balances(attachexplanation)

$EE STATEMENT 2

Net assetsor fund balancesat endof year(combineImes18, 19,and20)

..

.I

JAN

2007 }w

9c

10c

11

12

13

14

15

16

17

18

19

20

21

.,...:__

oao-.:=;v---'-i

.,_YI_,~-,;.,.

LHA

For PrivacyAct and PaperworkReductionAct Notice,seethe separateinstructions.

25,642.

3,600,220.

4,127,598.

250,720.

554,502.

4,932,820.

<1,332,600.

4,256,985.

<11,574.

2,912,811.

786783

!HS

2005.07000

INSTITUTE

>

Form990 (2005)

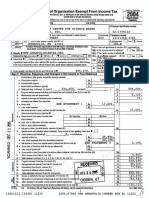

15291228

>

FOR HUMANE STUDIE !HS

13

INSTITUTE

Form 990 (2005)

Part

Stat~ment

, Functional

FOR HUMANESTUDIES

94-1623852

of

Expenses

Do not mctude amounts reported on /me

6b, Bb, 9b, 1Ob, or 16 of Part /.

(Bl Program

(A) Total

(Cl Management

services

$542, 732 noncash$

If this amount includes foreign grants, check here

(0) Fundra1sing

and general

STATEMENT5

22 Grants and allocations (attach schedule)

(cash

e2

Pa

All organizations must complete column (A) Columns (B), (C), and (D) are required for section 501(c)(3)

and (4) organizations and section 4947(a)(1) nonexempt chantable trusts but optional for others

0.

542,732.

542,732.

285,817.

1,263,638.

112,753.

1,102,906.

105,846.

61,525.

67,218.

99,207.

88,143.

109,762.

72,259.

86,325.

6,430.

11,649.

9,454.

11,788.

22,647.

0.

13,129.

1,079.

1,215.

160,393.

17,665.

1,374.

148,278.

562.

302.

22

23 Specific assistance to 1nd1v1duals(attach

23

schedule)

24 Benefits paid to or for members (attach

schedule)

**

25 Compensation of officers, directors, etc

24

25

26 Other salanes and wages

26

27 Pension plan contributions

27

28 Other employee benefits

28

29 Payroll truces

29

30 Professional fundra1s1ng fees

30

31 Accounting fees

31

32 Legal fees

32

33 Supplies

33

34 Telephone

34

35 Postage and sh1pp1ng

35

36 Occupancy

36

37 Equipment rental and maintenance

37

38 Pnnting and publications

38

39

39 Travel

40 Conferences, conventions,

40

and meetings

41 Interest

41

42 Deprec1at1on, depletion, etc (attach schedule)

42

o.

o.

22,647.

13,129.

30,114.

12,476.

223,569.

147,211.

11,706.

259,472.

254,129.

1,385,161.

25,901.

9,898.

62,293.

110,409.

8,843.

111,194.

253,220.

1,383,101.

42,072.

31,554.

5,469.

5,049.

241,042.

214,210.

9,043.

17,789.

250,720.

554,502.

0.

3,134.

1,363.

883.

19,137.

1,489.

347.

1,758.

43 Other expenses not covered above ~tem1ze)

43a

43b

43c

43d

43e

I

g

431

SEE STATEMENT 3

44 Total functional

43a

expenses. Add lines 22

through 43. (Organizations completing

columns (B)(D), carry these totals to lines

13-15)

44

Joint Costs. Check

4,127,598.

4,932,820.

1fyou are following SOP 982.

reported in (B) Program services?

Are any 1ointcosts from a combined educational campaign and fundra1singsol1c1tat1on

If "Yes,' enter (i) the aggregate amount of these Jointcosts$

( iii) the amount allocated to Management and general $

**

NI A

NI A

. (ii)

I

the amount allocated to Program services$ __

and (iv) the amount allocated to Fundra1smg$

Yes [][]

No

NI A

NI A

___.:;"-'-;':...c_--

Form 990 (2005)

SEE STATEMENT 4

523011

02-03-06

15291228

786783

IHS

2005.07000

INSTITUTE FOR HUMANESTUDIE IHS

INSTITUTE FOR HUMANESTUDIES

Form990 2005

Part

m Statement

of Program Service Accomplishments

94-1623852

Page3

(See the instructions)

Form 990'is available for public 1nspect1onand, for some people, serves as the primary or sole source of 1nformat1onabout a particular organization.

How the public perceives an organization 1nsuch cases may be determined by the 1nformat1onpresented on its return. Therefore, please make sure the

return 1scomplete and accurate and fully describes, in Part Ill, the organ1zat1on'sprograms and accomplishments.

What is the organ1zat1on's primary exempt purpose? ~

SEE STATEMENT 7

ProgramService

Expenses

All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number of

clients served, publications issued, etc. Discuss achievements that are not measurable. (Section 501 (c)(3) and (4)

organ1zat1onsand 494 7(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to others.)

(Requiredfor 501(c)(3)

and (4) orgs, and

4947(a)(1) trusts; but

optional for others )

SEE STATEMENT 6

$

7 , 9 0 9 l If this amount includes fore1an arants check here ~ D

!Grants and allocations

b ADVANCEDACADEMIC PROGRAMS - THE ADVANCEDACADEMIC PROGRAMS

DEPARTMENT WORKS TO DEVELOP TALENTED YOUNG PEOPLE WHO ARE

INTERESTED IN CAREERS IN ACADEMIA. IT ACCOMPLISHES THIS

THROUGH MENTORING, CAREER DEVELOPMENT SEMINARS,

SCHOLARSHIPS, FELLOWSHIPS, FOCUSED RESEARCH WORKSHOPS, AND

STRATEGIC GRANTS.

$

4 6 0 , 7 4 4 . l If this amount includes fore1an arants check here ~ D

!Grants and allocations

c COMMUNICATORSPROGRAM- THE COMMUNICATORSPROGRAMDEPARTMENT

ASSISTS YOUNG PEOPLE INTERESTED IN CAREERS IN POLICY,

JOURNALISM, AND CREATIVE MEDIA. THE DEPARTMENTACCOMPLISHES

THIS THROUGH SCHOLARSHIPS, INTERNSHIPS, STRATEGIC GRANTS,

EDUCATIONAL SEMINARS, MENTORING AND NETWORKING.

$

7 4 , 0 7 9 l If this amount includes fore1an arants check here ~ D

(Grants and allocations

d STUDENT MARKETING - THE STUDENT MARKETING DEPARTMENTMARKETS

IHS'S PROGRAMS TO STUDENTS AND INTRODUCES NEW AUDIENCES TO

THE IDEAS OF LIBERTY, THROUGH PRINTED MATERIALS, E-MAILS,

WEBSITES, DIRECT MAIL, NETWORKING, AND PAID ADVERTISEMENTS.

1,667,088.

982,525.

773,618.

check here

422,760.

Other program services (attach schedule)

(Grants and allocations

$

l If this amount includes fore1on arants. check here

Total of Program Service Expenses (should equal line 44, column (B), Program services)

281,607.

4,127,598.

(Grants and allocations

0 l If this amount includes fore1on arants

SEE STATEMENT 8

Form 990 (2005)

523021

02-03-06

15291228

786783

IHS

2005.07000

INSTITUTE FOR HUMANESTUDIE IHS

FOR

INSTITUTE

Form 990 (2005)

I Part 1VI Balance Sheets

HUMANE

94-1623852

STUDIES

(A)

(B)

Begmnmg of year

End of year

Note: Where reqU/red, attached schedules and amounts within the descnpt1on column

should be for end-of-year amounts only.

45

Cash noninterestbearing

46

Savings and temporary cash investments

47 a Accounts

48 a Pledges receivable

b Less: allowance for doubtful accounts

48a

Cl)

Cl)

Grants receivable

54

49

471,869.

51c

51b

52

Inventories for sale or use

8, 451.

962,008.

Prepaid expenses and deferred charges

securitreSTMT

Investments

55 a Investments

equipment:

FMV

53

54

42,100.

905,370.

55a

basis

Investments

[XI

..,. Dcost

land, bu1ld1ngs, and

b Less: accumulated

56

187,794.

50

I 51a I

b Less: allowance for doubtful accounts

53

47c

Receivables from officers, directors, trustees,

51 a Other notes and loans receivable

52

287,405.

1,011,592.

48c

190,000.

Cl)

GI

469,277.

48b

and key employees

<(

46

45

187,794.

47a

receivable

b Less allowance for doubtful accounts

50

..

470,912.

2,193,193.

47b

49

Page4

(See the mstruct,ons)

5511

deprec1at1on

SEE

other

I 5;a I

basis

57 a Land, bu1ld1ngs, and equipment:

57b

b Less. accumulated deprec1at1on

Other assets (describe .... OTHER

58

55c

120,000.

10

602,490.

469,191.

STATEMENT

83,894.

3.000.

4,500.735.

197,421.

56

57c

58

59

59

Total assets lmust eaual lrne 74\ Add Imes 45 throuah 58

60

Accounts

61

Grants payable

61

62

Deferred revenue

62

63

Loans from officers, directors, trustees, and key employees

payable and accrued expenses

60

120,000.

133,299.

3,000.

3,162,429.

203,006.

Cl)

GI

:.a

CV

63

64a

64 a Tax-exempt bond hab1l1t1es

64b

b Mortgages and other notes payable

::i

65

Other l1ab1l1t1es

(describe .... GI FT

66

Total liabilities.

Organizations

ANNUITY

Add lines 60 throunh 65\

that follow SFAS 117, check here ....

[XJ

46.329.

65

46,612.

243,750.

66

249,618.

and complete lines

67 through 69 and lines 73 and 74.

Cl)

GI

67

Unrestricted

CV

68

Temporarily restricted

69

Permanently restricted

u

c

iii

m

"O

c

::::,

u..

..

0

Cl)

-;

Cl)

Cl)

..

z

<(

GI

Organizations

that do not follow SFAS 117, check here

2,860,403.

1,289,362.

107,220.

....Dand

67

68

69

2,254,481.

547,036.

111,294.

complete lines 70 through 74 .

70

70

Capital stock, trust principal, or current funds

71

Pardrn or capital surplus, or land, burldmg, and equipment fund

72

Retained earnings, endowment,

73

Total net assets or fund balances (add Imes 67 through 69 or Imes 70 through 72,

74

column (A) must equal lme 19, column (B) must equal lme 21)

Total liabilities and net assets/fund balances. Add Imes 66 and 73

accumulated

71

72

income, or other funds

..

..

4.256,985.

4,500.735.

73

74

2,912,811.

3,162,429.

Form 990 (2005)

523031

02-00-06

15291228

786783

!HS

2005.07000

INSTITUTE

FOR

HUMANE

STUDIE

!HS

INSTITUTE

Form990(2005J

Part IV-A

Reconciliation

FOR HUMANESTUDIES

94-1623852

of Revenue per Audited Financial Statements

Pa e5

With Revenue per Return (See the

m~truct,ons.)

I

Total revenue, gains, and other support per audited financial statements

Amounts included on line a but not on Part I, line 12.

b1

1 Net unrealized gains on investments

2 Donated services and use of facll1t1es

<11,574.

>

b2

b3

3 Recovenes of prior year grants

4 Other (specify)

b4

Add lines b1 through b4

Subtract line b from line a

Amounts included on Part I, line 12, but not on line a:

Add lines d1 and d2

Reconciliation

of Expenses per Audited Financial Statements

Total expenses and losses per audited financial statements

Amounts included on line a but not on Part I, line 17:

3,600,220.

With Expenses per Return

4,932,820.

a

b1

1 Donated services and use of fac11it1es

2 Pnor year adjustments reported on Part I, line 20

b2

3 Losses reported on Part I. line 20

b3

b4

4 Other (specify):

Add lines b1 through b4

Subtract line b from line a

Amounts included on Part I, line 17, but not on line a:

o.

..

4,932,820.

Id1 I

1 Investment expenses not included on Part I, line 6b

d2

2 Other (specify):

e

0.

Total revenue (Part I line 12). Add lines c and d

o.

Add lines d1 and d2

Total exoenses (Part I line 1?l. Add lines c and d

I Part V-Al

>

d2

2 Other (specify):

e

<11,574.

3,600,220.

Id1 I

1 Investment expenses not included on Part I, line 6b

! Part IV-Bl

3,588,646.

4,932,820.

Current Officers, Directors, Trustees, and Key Employees (List each person who was an officer, director, trustee,

or key employee at any time during the year even 1fthey were not compensated) (See the mstruct1ons.)

(B) Title and averagehours (C) Compensation (D)Contnbubons to

(E) Expense

benefit

(A) Nameand address

per weekdevotedto

accountand

(II not paid, enter employee

plans & deferred

pos1t1on

-0-.)

compensabon plans other allowances

MARTY ZUPAN

3301 NORTH FAIRFAX DRIVE,

ARLINGTON, VA 22201-4411

GARY D. LEFF

3301 NORTH FAIRFAX DRIVE,

ARLINGTON, VA 22201-4411

LEONARD LIGGIO

3301 NORTH FAIRFAX DRIVE,

ARLINGTON, VA 22201-4411

PRESIDENT

SUITE 450

40.00

203,000.

SECRETARY/TREIASURER

3,786.

0.

20.00

IDIST. SR.

3,832.

o.

SUITE 450

54,500.

SCHOLAR

SUITE 450

10.00

19,856.

o.

843.

----------------------------------------------------------------SEE ATTACHED LIST OF NON-COMPENSATED

OFFICERS AND DIRECTORS.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Form 990 (2005)

523041 02-03-06

15291228

786783

!HS

2005.07000

INSTITUTE

FOR HUMANESTUDIE !HS

INSTITUTE FOR HUMANE STUDIES

Form 990 (2005)

! Part v..A.1 Current Officers, Directors, Trustees, and Key Employees

94 - 1623852

Page6

Yes No

(continued}

75 a EntE!rthe total number of officers, directors, and trustees permitted to vote on organ1zat1onbusiness at board

12

meetings

b Are any officers, directors, trustees, or key employees listed 1nForm 990, Part VA, or highest compensated employees

llsted 1nSchedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A,

Part llA or llB, related to each other through family or business relat1onsh1ps? If 'Yes,' attach a statement that identifies

the 1nd1v1dualsand explains the relat1onsh1p(s)

Do any officers, directors, trustees, or key employees listed In Form 990, Part VA, or highest compensated employees

listed 1nSchedule A, Part I, or highest compensated professional and other independent contractors listed 1nSchedule A,

Part llA or llB, receive compensation from any other organ1zat1ons, whether tax exempt or taxable, that are related to this

organ1zat1on through common superv1s1on or common control?

75b

75c

Note. Related organ1zat1ons include section 509(a)(3) supporting organizations.

If 'Yes," attach a statement that 1dent1f1es

the md1v1duals,

explamsthe rela!lonsh1pbetweenthis organizationand the other organizat1on(s),and

descnbes the compensation arrangements,mcludmg amounts paid to each mdlVldualby each relatedorganization

d Does the organ1zat1on have a written conflict of interest policy?

I Part V-B l

75d

Form':r Officers, Directors, Trustees, and Key Employees That Received Compensation or Other

Benefits (If any former officer, director, trustee, or key employee received compensation or other benefits (descnbed below) dunng

the year, list that person below and enter the amount of compensation or other benefits m the appropnate column. Seethe mstruct1ons.)

(D) Contnbutlons to

(E) Expense

(B) Loans and Advances (C) Compensation employee benefit

(A) Nameand address

account and

plans & deferred

NONE

comoensat1on clans other allowances

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------! Part VI I

Other Information

Yes No

(See the instructions)

76

Did the organization engage 1nany act1v1tynot previously reported to the IRS? If 'Yes,' attach a detailed

descnpt1on of each actrv1ty

76

71

Were any changes made 1nthe organizing or governing documents but not reported to the IRS?

71

If 'Yes,' attach a conformed copy of the changes

78 a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return?

78a

N/_A

b If 'Yes,' has rt filed a tax return on Form 990-T for this year?

79

Was there a hqu1dat1on,d1ssolut1on, term1nat1on, or substantial contraction dunng the year? If 'Yes,' attach a statement

78b

membership, governing bodies, trustees, officers, etc., to any other exempt or nonexempt organization?

N/A

and check whether 1t 1s

81 a Enter direct or indirect political expenditures

(See line 81 1nstruct1ons.)

b Did the oroan1zat1on file Form 1120-POL for this vear?

D exempt or D

I a1a I

..

x

x

8Da

nonexempt

0.

..

523161/02-03-06

79

80 a Is the organization related (other than by assoc1at1on with a statewide or nat1onw1deorganization) through common

b If 'Yes,' enter the name of the organization~

81b

Form990 (2005)

15291228

786783

IHS

2005.07000

INSTITUTE

FOR HUMANE STUDIE IHS

INSTITUTE

Form 990 (2005)

! Part

VI

I Other Information

9 4 -16

FOR HUMANE STUDIES

2 3 85 2

(contmued)

Page 7

Yes No

82 a Did the organ1zat1onreceive donated services or the use of materials, equipment, or fac11it1es

at no charge or at substantially

less than fair rental value?

82a

b If 'Yes, you may 1nd1catethe value of these items here. Do not include this

amount as revenue 1nPart I or as an expense 1nPart II.

I 82b I

(See 1nstruct1ons 1nPart Ill)

N/A

83 a Did the organization comply with the public 1nspect1onrequirements for returns and exemption applications?

X

X

83a

b Did the organization comply with the disclosure requirements relating to quid pro quo contributions?

83b

N/ A

84 a Did the organization solicit any contributions or gifts that were not tax deductible?

84a

t--"1----t---

b If 'Yes,' did the organ1zat1oninclude with every solic1tat1onan express statement that such contributions or gifts were not

N/ A

N/ A

N/ A

tax deductible?

85

501 (c}(4), (5), or (6) organ1zat1ons a Were substantially all dues nondeductible by members?

b Did the organization make only in-house lobbying expenditures of $2,000 or less?

~84-"'b-1---1--1-8~5~a-1---1--85b

t--"1----t---

lf 'Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a

waiver for proxy tax owed for the prior year

c Dues, assessments, and s1m1laramounts from members

N/A

l-'-85~c'-l---------,------1

d Section 162(e) lobbying and political expenditures

N/A

t-8_5d--;-------,-------t

e Aggregate nondeductible amount of section 6033(e)(1 )(A) dues notices

N/A

l-"-85"-'e"--+------------1

~8_51~------,------;

Taxable amount of lobbying and political expenditures (line 85d less 85e)

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f?

N/A

N/A

85q

N/A

85h

h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f

to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the

following tax year?

501(c)(7) organ1zat1ons. Enter. a lnit1at1onfees and capital contributions included on

86

87a

87b

N/A

86b

501(c}(12) orgamzat1ons Enter. a Gross income from members or shareholders

87

N/A

N/A

N/A

86a

line 12

b Gross receipts, included on line 12, for public use of club fac11it1es

b Gross income from other sources. (Do not net amounts due or paid to other sources

against amounts due or received from them)

88

At any time dunng the year, did the organ1zat1onown a 50% or greater interest 1na taxable corporation or partnership,

or an entity disregarded as separate from the organization under Regulations sections 301.7701 2 and 301.7701-3?

If 'Yes,' complete Part IX

88

89b

89 a 501(c}(3) orgamzat1ons Enter: Amount of tax imposed on the organ1zat1onduring the year under:

section 4911 ~

0 , section 4912 ~

0 , section 4955 ~

---------=-~

b 501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit

transaction dunng the year or d1d 1tbecome aware of an excess benefit transaction from a pnor year?

If 'Yes,' attach a statement explaining each transaction

c Enter: Amount of tax imposed on the organization managers or disqualified persons dunng the year under

sections 4912, 4955, and 4958

d Enter: Amount of tax on line 89c, above, reimbursed by the organization

90 a List the states wrth which a copy of this return 1sfiled~

SEE STATEMENT 11

b Number of employees employed 1nthe pay penod that ,n-c-lu_d_e_s_M_a_r-ch-12-.-2-0_0_5---------~,-9-0-b~!----------3-0

91 a The books are m care of ~

Locatedat~

3301

_T_H_E_O_R_G_AN

__ I_Z_A_T_I_O_N

____________

FAIRFAX DRIVE,

SUITE 450,

ARLINGTON,

Telephoneno ~

(7

0 3 )

99

3-4

880

ZIP+4 ~ 22201-4411

VA

b At any time dunng the calendar year, d1d the organization have an interest in or a signature or other authonty

Yes No

over a financial account in a foreign country (such as a bank account, securities account, or other f1nanc1al

account)?

If 'Yes,' enter the name of the foreign country ~

91b

91c

N/ A

--------------------------~

See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank

and Financial Accounts.

c At any time during the calendar year, d1dthe organization maintain an office outside of the United States?

If 'Yes,' enter the name of the foreign country ~

A

92

NI

------'-----------------------~

~o

Section 494 7(a)(1) nonexempt chantable trusts fl/mg Form 990 m fleu of Form 1041- Check here

and enter the amount of tax-exempt interest received or accrued during the tax year

92

N/A

Form 990

(2005)

523162

02-03-06

15291228

786783

IHS

2005.07000

7

INSTITUTE

FOR HUMANE STUDIE

IHS

INSTITUTE

Form 990 (2005)

I Part

VII

Paoe 8

Activities (See the instructions J

Unrelatedbusinessincome

(A)

(8)

Business

Amount

code

Note: Enter gross amounts unless otherwise

indicated

93 Program service revenue

a ADMINISTRATIVE

b

94 - 1623852

FOR HUMANE STUDIES

Analysis of Income-Producing

Excluded by section 512, 513, or514

(C)

Exclus1on

(E)

Relatedor exempt

functionincome

(D)

Amount

code

FEES

517,449.

c

d

e

f Med1care/Med1ca1dpayments

g Fees and contracts from government agencies

94 Membership dues and assessments

95 Intereston savingsandtemporarycashinvestments

96 Dividends and interest from securities

97 Net rental income or (loss) from real estate:

a debt-financed property

b not debt-financed property

98 Net rental income or (loss) from personal property

99 Other investment income

100 Gain or (loss) from sales of assets

other than inventory

101 Net income or (loss) from special events

102 Gross profit or (loss) from sales of inventory

103 Other revenue:

a OTHER INCOME

b

14

14

65,482.

55,108.

18

1,091.

25,642.

c

d

e

0.

104 Subtotal (add columns (B), (D), and (E))

105 Total (add line 104, columns (B), (D), and (E))

Note: Lme 105 plus /me 1d, Part/, should equal the amount on /me 12, Part/.

I Part VIiii

Line No.

Relationship

121,681.

543,091.

6_6_4_,

....7_7_2_.

....___

of Activities to the Accomplishment

of Exempt Purposes (See the mstructions.)

Explainhow eachact1v1ty

for which income1sreportedin column(E) of PartVII contributedimportantlyto the accomplishmentof the orgamzatmn's

exemptpurposes(otherthan by providingfundsfor such purposes)

SEE STATEMENT 12

! Part IX I Information Regarding Taxable Subsidiaries and Disregarded Entities

(A)

Name,address,and EINof corporatmn,

oartnershio.or d1sreoarded

ent1tv

(C)

Natureof act1V1t1es

(8)

Percentageof

ownershminterest

(See the mstruct,ons.)

(D)

Totalincome

(E)

End-of-year

assets

%

%

%

%

N/A

! Part X I Information Regarding Transfers Associated with Personal Benefit Contracts

(See the instructions)

(a) Didthe orgamzatmn,

duringthe year,receiveanyfunds,directlyor indirectly,to paypremiumson a personalbenefitcontract?

(b) Didthe orgamzat1on,

duringthe year,paypremiums,directlyor indirectly,on a personalbenefitcontract?

Note: If "Yes" to (b), fife Form 8870 and Form 4720 (see mstruct1ons).

Dves

Oves

[Kl

[Kl

No

No

Please

Sign

Here

Date

CheckIf

Preparer's SSN or PTIN

Preparer's ~

selfPaid

s1gnature

l

\

'(

l--i.o,

employed .... D

Preparer'sI-Fi=-,rm:....,...,

-n-ame---:-(

-,----:::-=1-l::"~L.,.'--'==---::l-----"'---------------'-..:.....:..--!.....::....:--.Jl-._JC..::..:.:+E:..!IN-=-=....

--=--==w.._-------0

5

UseOnly yours 11

523163

02-03-06

NW, SUITE

20036

self-employed),

address, and

ZIP+ 4

600

Phoneno ....

15291228

786783

IHS

2005.07000

-

INSTITUTE

-----------------------------

202

822-5000

Form990 (2005)

FOR HUMANE STUDIE IHS

Organization

SCHEDULE A

(Form 990 or 990,EZ)

OMB No 1545-0047

(ExceptPrivateFoundation)and Section501(e), 501(f). 501(k),

501(n), or 4947(a)(1)NonexemptCharitableTrust

Supplementary

Department

of theTreasu,y

Internal

Revenue

Service

Nameof the organization

Compensation

lnformation-(See

2005

separate instructions.)

MUSTbe completedby the aboveorganizationsandattachedto their Form990 or 990-EZ

Employeridentificationnumber

INSTITUTE

Part I

Exempt Under Section 501 (c)(3)

FOR HUMANESTUDIES

94 1623852

of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees

(Seepage1 of the instructions List eachone If therearenone,enter'None')

(d) Contnbu~ons

to

(b) Titleandaveragehours

(a) Nameand addressof eachemployeepaid

benefit (e) Expense

(c) Compensation employee

perweekdevotedto

plans

& deferredaccountand other

morethan $50,000

pos1t1on

compensation

allowances

NIGEL ASHFORD, 3301 NORTH FAIRFAX DR, SR. PROGRAMOFFICER

40.00

64,600.

SUITE 450, ARLINGTON, VA 22201-4411

DR,

FAIRFAX

ACADEMIC

FROG.

3301

NORTH

DIR

AMANDABRAND,

40.00

76,600.

SUITE 450, ARLINGTON, VA 22201-4411

CHRIS MARTIN, 3301 NORTH FAIRFAX DR. DIR - SEMINARS

40.00

55,000.

SUITE 450, ARLINGTON, VA 22201-4411

DARIN LOWDER, 3301 NORTH FAIRFAX DR, DIR - MARKETI ~G

40.00

60,833.

SUITE 450, ARLINGTON, VA 22201-4411

CHAD THEVENOT, 3301 NORTH FAIRFAX DR, ~00

40.00

98,750.

SUITE 450, ARLINGTON, VA 22201-4411

Totalnumberof other employeespaid

over$50,000

I PartUAl

Compensation

3,430.

0.

3,601.

o.

o.

o.

o.

229.

3,835.

5,311.

of the Five Highest Paid Independent Contractors

for Professional Services

(Seepage2 of the instructmnsList eachone (whetherind1v1duals

or firms) If therearenone,enter'None')

(a) Nameand addressof eachindependentcontractorpaidmorethan$50,000

(b) Typeof service

(c) Compensation

-------------------------------------------NONE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

~I

Totalnumberof others receivingover

$50,000for professionalservices

I PartUB1

Compensation

of the Five Highest Paid Independent Contractors

for Other Services

(List eachcontractorwho performedservicesotherthan professionalservices,whetherindividualsor

firms If thereare none,enter'None' Seepage2 of the mstruct1ons)

(b) Typeof service

(a) Nameand addressof eachindependentcontractorpaidmorethan$50,000

THE HINKEY COMPANY

9058 EUCLID AVE., MANASSAS, VA 20110

ERESOURCES

1725 K STREET NW, SUITE 601, WASHINGTON, DC 20006

(c) Compensation

!PRINTING, MAILING,

!POSTAGE

247,213.

WEBSITE

MANAGEMENT

119,387.

----------------------------------------------------------------------------------------------------------------------------------

~I

Totalnumberof othercontractorsreceivingover

$50,000for other services

s23101102-ro-os

LHA For PaperworkReductmnAct Notice,see the Instructionsfor Form990 and Form990-EZ.

ScheduleA (Form990 or 990-EZ)2005

15291228

786783

IHS

2005.07000

INSTITUTE FOR HUMANESTUDIE IHS

9 4 -16 2 3 8 5 2

!Part U1j

Statements About Activities

(Seepage2 of the instructions)

Page2

Yes No

Duringthe year,hasthe orgamzat1on

attemptedto influencenational,state.or local leg1slat1on,

includinganyattemptto influence

publicopinionon a leg1slat1ve

matteror referendum?If 'Yes,"enterthe totalexpensespaidor incurredin connectionwith the

..... $

$

(Mustequalamountson line 38, PartVI-A, or

lobbyingact1v1t1es

line i of PartVI-B)

Organizations

that madean electionundersection501(h) by filing Form5768must completePartVI-A Otherorganizations

checking'Yes' mustcompletePartVI-B ANDattacha statementgivinga detaileddescriptionof the lobbyingact1v1ties

2 Duringthe year,hasthe organ1zat1on,

eitherdirectlyor indirectly,engagedin any of the followingactswith anysubstantialcontributors,

trustees,directors,officers.creators,keyemployees.or membersof their fam111es,

or with anytaxableorgamzat1on

with whichany such

(If the answer to any question is "Yes,"

person1saff1l1ated

as an officer,director,trustee.ma1orityowner,or principalbenef1c1ary?

attach a deta1/ed statement explaming the transactions)

a Sale,exchange,or leasingof property?

2a

b Lendingof moneyor otherextensionof credit?

2b

c Furnishingof goods,services,or fac1l1t1es?

2c

d Paymentof compensation(or paymentor reimbursementof expenses1fmorethan $1,000)?SEE

PART V-A,

FORM 9 9 0

e Transferof anypart of ,ts incomeor assets?

3 a Doyou makegrantsfor scholarships,fellowships,studentloans,etc ? (If 'Yes,'attachan explanatmnof how

you determinethat rec1p1ents

qualifyto receivepayments)

SEE STATEMENT

b Doyou havea section403(b) annuityplanfor your employees?

c Dunngthe year,did the organizationreceivea contnbutmnof qualifiedrealpropertyinterestundersection170(h)?

4 a Didyou maintainanyseparateaccountfor part1c1pating

donorswheredonorshavethe rightto provideadvice

on the useor d1stnbut1on

of funds?

b Dovou orovidecreditcounselino.debt manaoementcredit repair or debt neoot1at1on

services?

IPart IV!

Reason for Non-Private

2d

2e

13

3a

3b

3c

4a

4b

x

x

x

Foundation Status (Seepages3 through6 of the instructions)

The orgamzat1on

1snot a pnvatefoundationbecause1t1s (Pleasecheckonly ONEapplicablebox )

A church,conventionof churches,or assoc1at1on

of churches Section170(b)(1)(A)(1)

5

6

A school Section170(b)(1)(A)(11)

(AlsocompletePartV)

A hospitalor a cooperativehospitalserviceorgamzat1on

Section170(b)(1)(A)(m)

7

A Federal,state,or localgovernmentor governmentalumt Section170(b)(1)(A)(v)

8

A medicalresearchorganizationoperatedin con1unct1on

with a hospital Section170(b)(1)(A)(m)Enterthe hospital's name, city,

9

andstate .....

10

An organizationoperatedfor the benefitof a collegeor universityownedor operatedby a governmentalunit Section170(b)(1)(A)(1v)

(Alsocompletethe SupportSchedulein PartIV-A)

11a [X]

An organizationthat normallyreceivesa substantialpart of its supportfrom a governmentalunit or from the generalpublic

Section170(b)(1)(A)(v1)(Alsocompletethe SupportSchedulein Part IV-A)

11b

A communitytrust Section170(b)(1)(A)(v1)(Alsocompletethe SupportSchedulein PartIV-A)

12

An organizationthat normallyreceives(1) morethan 331/3% of its supportfrom contributions,membershipfees,and gross

receiptsfrom act1V1t1es

relatedto its charitable,etc , functions- subJectto certainexceptions,and (2) no more than 331/3% of

its supportfrom grossinvestmentincomeand unrelatedbusinesstaxableincome(lesssection511 tax) from businessesacquired

by the organizationafterJune30, 1975 Seesection509(a)(2) (Alsocompletethe SupportSchedulein Part IV-A.)

D

D

D

D

D

D

D

D

13

An organizationthat 1snot controlledby anyd1squalif1ed

persons(otherthanfoundationmanagers)and supportsorganizationsdescnbedin

(1) lines5 through 12above,or (2) sections501(c)(4),(5). or (6), 1fthey meetthe test of section509(a)(2) Checkthe box that descnbes

the type of supportingorgamzat1on

.....

Type1

Type2

Type3

Providethe followinginformationaboutthe supportedorganizatmns(Seepage6 of the instructions.)

(b) Linenumber

from above

(a) Name(s)of supportedorganizat1on(s)

14

An organizationorganizedand operatedto testfor publicsafety Section509(a)(4) (Seepage6 of the instructions)

523111

02-ro-os

15291228

ScheduleA (Form990 or 990-EZ)2005

786783

IHS

2005.07000

10

INSTITUTE

FOR HUMANE STUDIE

IHS

ScheduleA(Form990or990EZ)2005 INSTITUTE FOR HUMANESTUDIES

94-1623852

Page3

Support Schedule (Complete only 1fyou checked a box on lme 10, 11, or 12.) Use cash method ofaccounting.

Note: You may use the worksheet m the mstroct1ons for convertm~ from the accroal to the cash method of accountmo.

Calendaryear(orhscalyear

(c) 2002

(a) 2004

(b) 2003

(d) 2001

beginningIn)

(e) Total

15 Gifts,grants,andcontnbut1ons

received(Do not includeunusual

2,933,555.

6,252,519.

4,510,284.

2,899,693.

!l rants Seelme28 )

16,596,051.

16 Membershipfeesreceived

!Part JV..A j

....

17

18

19

20

21

22

23

24

25

26

Grossreceiptsfrom adm1ss1ons,

merchandisesold or services

performed,or furnishingof

m anyactlVltythat 1s

faci11t1es

relatedto the organization's

chantable,etc, purpose

Grossincomefrom interest,

!l1v1dends,

amountsreceivedfrom

paymentson secunt,esloans(sec

t,on 512(a)(5)).rents,royalties,and

unrelatedbusinesstaxableincome

(lesssection511 taxes)from

businessesacquiredby the

organizationafterJune30, 1975

Netincomefrom unrelatedbusiness

activitiesnot includedm lme 18

Taxrevenuesleviedfor the

organization'sbenefitand either

paidto 1tor expendedon ,ts behalf

264,008.

17,477.

27,860.

30,117.

339,462.

91,917.

40,532.

15,598.

24,280.

172,327.

Thevalueof servicesor fac11it1es

furnishedto the organizationby a

governmentalumtwithoutcharge

Donot includethe valueof services

or fac1l1t1es

generallyfurnishedto

the publicwithoutcharge

Othermcome Attacha schedule

Donot includegamor (loss)from

960.

saleof capitalassets

Totalof Imes15 through22

3,290,440.

Lme23 mmuslme 17

3,026,432.

Enter1% of lme23

32,904.

SEE STATEMENT

2,123.

6,312,651.

6,295,174.

63,127.

26,298.

4,580,040.

4,552,180.

45,800.

14

109.

2,954,199.

2,924,082.

29,542.

....

29,490.

17,137,330.

16,797,868.

335,957

26a

Organizationsdescribedon lines 1Dor 11: a Enter2% of amountm column(e), lme24

Prepare

a

list

for

your

records

to

show

the

name

of

and

amount

contnbuted

by

each

person

(other

than

a

governmental

b

umt or publiclysupportedorganization)whosetotalgifts for 2001through2004exceededthe amountshownm lme26a

1,595,172

26b

Donot file this list with your return. Enterthetotal of all theseexcessamounts

16,797,868

26c

c Totalsupportfor section509(a)(1)test Enterlme24,column(e)

172,327.

19

d Add Amountsfrom column(e) for Imes 18

1,595,172.

29,490.

1,796,989

26b

26d

22

15,000,879

26e

e Publicsupport(lme26c mmuslme26dtotal)

89.3023%

I PublicsuooortoercentaaeI line 26e lnumeratorldivided bv lme 26c ldenominatorll

261

27

Organizationsdescribedon lme 12: a Foramountsincludedm Imes15, 16,and17 that werereceivedfrom a 'd1squal1fied

person,'preparea list for your

recordsto showthe nameof, andtotal amountsreceivedin eachyearfrom, each'disqualifiedperson Donot file this list with your return.Enterthesum of

suchamountsfor eachyear

NI A

(2004)

(2003)

(2002)

(2001)

persons'),preparea list for your recordsto showthe nameof,

b Foranyamountincludedin lme17 that wasreceivedfrom eachperson(otherthan'd1squal1fied

and amountreceivedfor eachyear,that wasmorethanthe larger of (1) theamounton lme 25 for the yearor (2) $5,000 (Includem the list organizations

descnbedm Imes5 through11b, as wellas md1v1duals

) Donot file this list with your return.Aftercomputingthe differencebetweentheamountreceivedand

the largeramountdescribedm (1) or (2), enterthe sum of thesedifferences(theexcessamounts)for eachyear NI A

(2004)

. (2003)

(2002)

(2001)

c Add Amountsfrom column(e) for Imes

N/A

.... 27c

17~~~~~~~N/A

d Add Line27atotal

.... 27d

and lme27b total

N/A

e Publicsupport(line27ctotal mmuslme27dtotal)

.... 27e

f Totalsupportfor section509(a)(2)test Enteramounton fine23, column(e)

....

271

NI A

g Public support percentage {line 27e (numerator) divided by line 27f (denominator))

.... 27

N/ A

%

h Investment income ercenta e line 18 column e numerator divided b line 27f denominator

.... 27h

N/ A

%

28 Unusual Grants: Foran organ1zat1on

describedm lme 10, 11, or 12that recerved

any unusualgrantsduring2001through2004,preparea list for your recordsto

show,for eachyear,the nameof the contnbutor,the dateandamountof the grant,anda bnefdescnpt1on

of the natureof the grant Donot file this list with your

return. Donot includethesegrantsm lme15

523121 02-00-os

NONE

Schedule A (Form 990 or 990.EZ) 2005

11

IHS

15291228

786783

2005.07000

INSTITUTE FOR HUMANESTUDIE IHS

3

....

....

....

....

....

ScheduleA(Form990or990EZ)2005

IPart VI

FOR HUMANE STUDIES

9 4 -16 2 3 8 5 2

N/A

30

31

Doesthe organ1zat1on

maintainthe following

Recordsindicatingthe racialcompos1t1on

of the studentbody,faculty,andadmm1strat1ve

staff?

b Recordsdocumentingthat scholarshipsand otherfinancialassistanceareawardedon a raciallynondiscriminatorybasis?

c Copiesof all catalogues,brochures,announcements.

andotherwrittencommunications

to the publicdealingwith student

adm1ss10ns,

programs,andscholarships?

contributions?

d Copiesof all materialusedby the organizationor on its behalfto sol1c1t

If you answered'No'to anyof the above,pleaseexplain (If you needmorespace.attacha separatestatement)

33

Page4

Yes No

Doesthe organizationhavea raciallynondiscriminatorypolicytowardstudentsby statementin its charter,bylaws,othergoverning

instrument,or in a resolutionof ,ts governingbody?

policytowardstudentsin all its brochures,catalogues,

Doesthe organizationincludea statementof its raciallynondiscriminatory

and otherwrittencommunicationswith the publicdealingwith studentadm1ss1ons,

programs,andscholarships?

Hasthe organizationpubl1c1zed

its raciallynondiscriminatory

policythroughnewspaperor broadcastmediaduringthe periodof

period1f11hasno sol1c1tat1on

program,in a waythat makesthe policy known

sol1c1tat1on

for students,or durmgthe reg1strat1on

to all parts of the generalcommunity11serves?

If "Yes,'pleasedescribe,1f'No,' pleaseexplain (If you needmorespace,attacha separatestatement)

29

32

INSTITUTE

Private School Questionnaire (Seepage7 of the mstrucllons)

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

29

30

31

..

..

32a

32b

32c

32d

Doesthe organizationdiscriminateby racein anywaywith respectto

a Students'nghts or pnv1Jeges?

pol1c1es?

b Adm1ss1ons

staff?

c Employmentof facultyor admm1strat1ve

d Scholarshipsor otherfinancialassistance?

pol1c1es?

e Educat10nal

f Useof fac1l1t1es?

g Athleticprograms?

h Otherextracurncularact1v1t1es?

If you answered"Yes'to any of the above,pleaseexplam(If you needmorespace,attacha separatestatement)

33a

33b

33c

33d

33e

331

330

33h

agency?

34 a Doesthe organizationreceiveany financialaid or assistancefrom a governmental

b Hasthe organization'srightto such aid everbeenrevokedor suspended?

..

If you answered"Yes'to either34a orb, pleaseexplainusingan attachedstatement

Doesthe organizationcertifythat 1thascompliedwith the applicablerequirements

of sections4 01 through4 05 of Rev Proc 75-50,

35

1975-2C B 587, coveringracialnond1scrim1nat1on?

If 'No,' attachan explanation

34a

34b

35

ScheduleA (Form990 or 990-EZ)2005

523131

02-03-06

15291228

786783

IHS

2005.07000

12

INSTITUTE

FOR HUMANE STUDIE

IHS~~3

ScheduleA(Form990or990-EZ)2005

Part VI.-A

INSTITUTE

Lobbying Expenditures

FOR HUMANESTUDIES

by Electing Public Charities

9 4 -16 2 3 8 5 2 Pa e 5

N/A

(Seepage9 of the mstruct1ons)

(To be completedONLYby an el1g1ble

organizationthat filed Form5768)

Check

1fthe oroanizat1on

belonosto an aff1l1ated

arouo

Check

Limits on Lobbying Expenditures

(Theterm "expenditures'meansamountspaidor incurred)

1fvou checked"a" and 11m1ted

control' orov1s1ons

annlv

(a)

(b)

Affiliatedgroup

To be completedfor ALL

totals

electingorganizations

N/A

36

37

38

39

40

41

36

37

38

39

40

Totallobbyingexpendituresto influencepublicopinion(grassrootslobbying)

Totallobbyingexpendituresto influencea leg1slat1ve

body(directlobbying)

Totallobbyingexpenditures(addImes36 and37)

Otherexemptpurposeexpend1tu

res

Totalexemptpurposeexpenditures(addImes38 and 39)

Lobbyingnontaxableamount Enterthe amountfrom thefollowingtableThe lobbyingnontaxableamountis II the amounton lme 40 1s20% of the amount on line 40

Not over $500,000

Over$500,000 but not over$1,000,000

$100,000 plus 15% of the excess over $500,000

Over $1,000,000 but not over $1,500,000

$175,000 plus 10% of the excess over $1,000,000

Over $1,500,000 but not over $17,000,000

$225,000 plus 5% of the excess over$1,500,000

Over $17,000,000

$1,000,000

41

42

43

44

42 Grassrootsnontaxableamount(enter25% of lme41)

43 Subtractlme42 from line 36 Enter-0- 1flme42 1smorethan line 36

44 Subtractline 41 from line 38 Enter-0-1f line41 1smorethanline 38

Caution: If there ts an amount on either /me 43 or /me 44, you must file Form 4720.

4-Year Averaging Period Under Section 501(h)

(Someorganizations

that madea section501(h) electiondo not haveto completeall of the five columns

below Seethe instructionsfor Imes45 through50 on page11 of the instructions)

LobbyingExpendituresDuring4-YearAveragingPeriod

Calendaryear (or

fiscal year beginningin)

(c)

2003

(b)

2004

(a)

2005

N/A

(d)

2002

(e)

Total

45 Lobbyingnontaxable

amount

46 Lobbyingceilingamount

(150%of line451e\\

47 Totallobbying

expend1tures .

48 Grassrootsnontaxable

amount

49 Grassrootsceilingamount

(150%of line481e\\

50 Grassrootslobbying

exoend1tures

I Part VlB I

0.

o.

o.

0.

0.

o.

Lobbying Activity by Nonelecting

Public Charities

(Forreportingonly by organizations

that did not completePartVI-A)(Seepage11 of the mstruct1ons

)

includinganyattemptto

Duringthe year,did the organizationattemptto influencenational,stateor localleg1slat1on,

influencepublicopm1onon a leg1slat1ve

matteror referendum,

throughthe useof

a Volunteers

..

b Paidstaff or management(Includecompensationm expensesreportedon Imesc throughh.)

c Mediaadvertisements

d Mailingsto members,legislators,or the public

e Publications,or publishedor broadcaststatements

I Grantsto otherorganizationsfor lobbyingpurposes

g Directcontactwith legislators,their staffs,governmentofficials,or a leg1slatrve

body

h Rallies,demonstrations,seminars,conventions,speeches,lectures,or any othermeans

i Totallobbyingexpenditures(AddImesc throughh.)

If "Yesto anyof the above,alsoattacha statementgrvmga detaileddescnpt1on

of the lobbyingactrv1t1es

523141

0203-06

15291228

Yes

No

Amount

x

x

x

x

x

x

x

x

, '

o.

ScheduleA (Form990 or 990-EZ)2005

786783

IHS

2005.07000

13

INSTITUTE

FOR HUMANE STUDIE IHS

ScheduleA(Form990or990-EZ)2005

!Part VII I lnfqrmation

INSTITUTE

FOR HUMANESTUDIES

Regarding Transfers To and Transactions

Exempt Organizations (Seepage12 of the instructions)

51

94-1623852

Page6

and Relationships With Noncharitable

Didthe reportingorganizationdirectlyor indirectlyengagein anyof the followingwith anyotherorganization

descnbedin section

501(c) of the Code(otherthansection501(c)(3) organizations)or in section527, relatingto pol1t1cal

organizations?

a Transfersfrom the reportingorganizationto a noncharitableexemptorganizationof

Yes

(i) Cash

(ii) Otherassets

b Othertransactions

(1) Salesor exchangesof assetswith a noncharitableexemptorganization

(ii) Purchasesof assetsfrom a noncharitableexemptorganization

(iii) Rentalof fac1l1t1es,

equipment,or otherassets

(iv) Reimbursement

arrangements

(v) Loansor loanguarantees

(vi) Performanceof servicesor membershipor fundra1smg

sol1c1tat1ons

c Shanngof fac1l1t1es,

equipment,mailinglists, otherassets,or paidemployees

II If the answerto any of the above1s"Yes,'completethe followingscheduleColumn(b) shouldalwaysshowthe fair marketvalueof the

goods,otherassets,or servicesgiven by the reportingorganizationIf the organizationreceivedlessthanfair marketvaluemany

transactionor sharingarrangement,

show in column(d) the valueof the goods,otherassets,or servicesreceived

(a)

Lmeno

(b)

Amountinvolved

(c)

Nameof noncharitableexemptorganization

523151

02-03-06

15291228

b(i)

b(il)

b(iil)

b(iv)

b(v)

b(vi)

x

x

x

x

x

x

x

N/ A

(II)

Descnpt1on

of transfers,transactions,and shanngarrangements

{b)

Typeof organization

x

x

describedin section501(c) of the

52 a Is the organizationdirectlyor indirectlyaffiliatedwith, or relatedto, oneor moretax-exemptorganizations

Code(otherthan section501(c)(3)) or in sectmn527?

~

b If "Yes,'completethe followingschedule

N/ A

(a)

Nameof organization

No

51a(i)

a(il)

Yes

[X]

No

(c)

Descnpt1on

of relat1onsh1p

ScheduleA (Form990 or 990-EZ)2005

786783

!HS

2005.07000

14

INSTITUTE FOR HUMANESTUDIE !HS

INSTITUTE FOR HUMANESTUDIES

94-1623852

GAIN (LOSS) FROM PUBLICLY TRADED SECURITIES

FORM 990.

GROSS

SALES PRICE

DESCRIPTION

SALE OF INVESTMENTS

TO FORM 990,

PART I,

LINE 8

COST OR

OTHER BASIS

215,550.

214,459.

215,550.

214,459.

STATEMENT

EXPENSE

OF SALE

NET GAIN

OR (LOSS)

o.

o.

OTHER CHANGES IN NET ASSETS OR FUND BALANCES

FORM 990

1,091.

1,091.

STATEMENT

AMOUNT

DESCRIPTION

UNREALIZED LOSS ON INVESTMENTS

<11,574.>

TOTAL TO FORM 990,

<11,574.>

PART I,

LINE 20

OTHER EXPENSES

FORM 990

(A)

TOTAL

DESCRIPTION

MISCELLANEOUS

INSURANCE

PROMOTION AND

ADVERTISING

BOOKS AND

SUBSCRIPTIONS

OTHER PROFESSIONAL

FEES

TOTAL TO FM 990,

15291228

786783

LN 43

IHS

( B)

PROGRAM

SERVICES

STATEMENT

(D)

( c)

MANAGEMENT

AND GENERAL

FUNDRAISING

47,036.

6,598.

35,453.

4,951.

7,418.

857.

4,165.

790.

17,056.

17,056.

0.

0.

43,775.

43,059.

190.

526.

126,577.

113,691.

578.

241,042.

214,210.

2005.07000

9,043.

12,308.

17,789.

18

STATEMENT(S) 1,

INSTITUTE FOR HUMANESTUDIE !HS

2,

3

3

INSTITUTE

FOR HUMANE STUDIES

FORM 990,

OFFICER COMPENSATION ALLOCATION

PART II, LINE 25

EMPLOYEE

COMPENSATION BEN. PLANS

ETC.

NAME OF OFFICER,

54,500.

GARY LEFF

5,706.

A. PROGRAM SERVICES

46,036.

B. MANAGEMENTAND GENERAL

c.

94-1623852

2,758.

FUNDRAISING

NAME OF OFFICER,

EXPENSE

ACCOUNTS

o.

3,832.

405.

TOTALS

58,332.

6,111.

3,276.

49,312.

151.

EMPLOYEE

COMPENSATION BEN. PLANS

ETC.

STATEMENT

LEONARD LIGGIO

19,856.

843.

A. PROGRAM SERVICES

19,856.

843.

2,909.

EXPENSE

ACCOUNTS

0.

TOTALS

20,699.

20,699.

B. MANAGEMENTAND GENERAL

C. FUNDRAISING

NAME OF OFFICER,

EMPLOYEE

COMPENSATION BEN. PLANS

ETC.

EXPENSE

ACCOUNTS

TOTALS

203,000.

3,786.

A. PROGRAM SERVICES

83,474.

2,469.

B. MANAGEMENTAND GENERAL

55,987.

547.

56,534.

c.

63,539.

770.

64,309.

MARTY ZUPAN

FUNDRAISING

0.

206,786.

85,943.

TOTAL PROGRAM SERVICES

112,753.

TOTAL MANAGEMENTAND GENERAL

105,846.

67,218.

TOTAL FUNDRAISING

TOTAL OFFICER,

15291228

786783

ETC.,

!HS

COMPENSATION INCLUDED ON PARTS V-A AND V-B

2005.07000

19

INSTITUTE

285,817.

STATEMENT(S) 4

FOR HUMANESTUDIE IHS

3

INSTITUTE

FOR HUMANE STUDIES

FORM 990,

94-1623852

CASH GRANTS AND ALLOCATIONS

DONEE'S ADDRESS

CLASSIFICATION

DONEE'S NAME

TOTAL GRANTS

SEE ATTACHMENT

TOTAL INCLUDED ON FORM 990,

PART II,

STATEMENT

DONEE'S

RELATIONSHIP

NONE

LINE 22

DESCRIPTION

AMOUNT

542,732.

542,732.

STATEMENT OF PROGRAM SERVICE ACCOMPLISHMENTS

FORM 990

STATEMENT

OF PROGRAM SERVICE ONE

EDUCATIONAL PROGRAMS - THE EDUCATIONAL PROGRAMS DEPARTMENT

WORKS TO INTEREST AND EDUCATE A WIDE RANGE OF YOUNG PEOPLE

IN THE IDEAS OF LIBERTY AND TO IDENTIFY AND EVALUATE

STUDENTS WHO HAVE THE POTENTIAL TO MAKE CONTRIBUTIONS TO A

FREER SOCIETY. THE DEPARTMENT ACCOMPLISHES THIS THROUGH

EDUCATIONAL SEMINARS, ON-CAMPUS PROGRAMS, AND ON-LINE

EFFORTS.

GRANTS

TO FORM 990,

PART III,

LINE A

7,909.

STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE

PART III

FORM 990

EXPENSES

1,667,088.

STATEMENT

EXPLANATION

THE INSTITUTE DISCOVERS, DEVELOPS, AND SUPPORTS STUDENTS, SCHOLARS, AND

OTHER INTELLECTUALS WHO MAINTAIN THE HIGHEST STANDARD OF ACADEMIC EXCELLENCE

AND WHO SHARE AN INTEREST IN THE PRINCIPLES OF THE CLASSICAL LIBERAL

TRADITION.

15291228

786783

IHS

2005.07000

20

INSTITUTE

STATEMENT(S) 5,

FOR HUMANE STUDIE IHS

6,

7

3

INSTITUTE

FOR HUMANE STUDIES

FORM 990,

94-1623852

OTHER PROGRAM SERVICES

STATEMENT

GRANTS AND

ALLOCATIONS

DESCRIPTION

PUBLIC AFFAIRS

PROGRAM

TOTAL TO FORM 990,

EXPENSES

0.

PART III,

LINE E

COST/FMV

SECURITY DESCRIPTION

MUTUAL FUNDS

CORPORATE BONDS

TO FORM 990,

LINE 54,

CORPORATE

STOCKS

STATEMENT

CORPORATE

BONDS

FMV

FMV

410,055.

COL B

410,055.

OTHER

PUBLICLY

TRADED

SECURITIES

495,315.

410,055.

495,315.

905,370.

STATEMENT

DESCRIPTION

VALUATION

METHOD

COMMONSTOCK OF A PRIVATELY HELD CORPORATION

MARKET VALUE

TOTAL TO FORM 990,

FORM 990

PART IV,

LIST

LINE 56,

COLUMN B

TOTAL

NON-GOV'T

SECURITIES

495,315.

OTHER INVESTMENTS

FORM 990

281,607.

281,607.

NON-GOVERNMENTSECURITIES

FORM 990

10

AMOUNT

120,000.

120,000.

OF STATES RECEIVING COPY OF RETURN

PART VI, LINE 90

STATEMENT

11

STATEMENT(S) 8, 9, 10,

FOR HUMANE STUDIE !HS

11

3

STATES

FL,AK,AZ,AR,CA,CO,CT,DE,DC,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS

MO,MT,NE,NV,NH,NJ,NM,NY,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VA,VT,WA,WY

15291228

786783

!HS

2005.07000

21

INSTITUTE

INSTITUTE

FOR HUMANESTUDIES

94-1623852

PART VIII - RELATIONSHIP OF ACTIVITIES

ACCOMPLISHMENTOF EXEMPT PURPOSES

FORM 990

TO

STATEMENT 12

LINE

EXPLANATION OF RELATIONSHIP OF ACTIVITIES

93A

FEES FOR APPLYING FOR FELLOWSHIPS, SEMINARS AND CONFERENCES IN

RELATION TO THE INSTITUTE'S EDUCATIONAL MISSION. ALSO INCLUDES

FEES PAID BY ANOTHER CHARITABLE ORGANIZATION FOR RUNNING CONFERENCES

DIRECTLY RELATED TO THE EXEMPT PURPOSES OF THE INSTITUTE.

103A

OTHER REVENUE GENERATED FOR THE ACCOMPLISHMENTOF THE ORGANIZATION'S

EXEMPT PURPOSE.

SCHEDULE A

EXPLANATION OF QUALIFICATIONS TO RECEIVE PAYMENTS STATEMENT 13

PART III,

LINE 3A

SEE ATTACHED STATEMENT ENTITLED "CRITERIA

FOR AWARDINGGRANTS" FOR DETAILS

OTHER INCOME

SCHEDULE A

2004

AMOUNT

DESCRIPTION

STATEMENT 14

2003

AMOUNT

2002

AMOUNT

2001

AMOUNT

OTHER INCOME

960.

2,123.

26,298.

109.

TOTAL TO SCHEDULE A, LINE 22

960.

2,123.

26,298.

109.

15291228

786783

IHS

2005.07000

22

STATEMENT(S) 12, 13,

INSTITUTE FOR HUMANESTUDIE IHS

14

3

Institute for Humane Studies

Form 990, P.art IT, Line 22 -- Grants and Allocations

YearEnded August 31, 2006

94-1623852

Amount

Educational Programs

Seminars

Monko

Mitchell

On-campus Education

Freedom Alliance

George Mason University Dept of Economics

Total Graduate and Undergraduate

Education Programs

400

400

l, 109

6,000

$

7,909

970

948

890

865

865

865

865

860

840

840

840

840

835

815

795

785

770

770

760

755

750

745

745

740

730

730

730

730

730

730

730

725

723

720

720

720

Communicators Programs

Charles G. Koch Summer Fellow Pro!!Tam

Joshua Parker

Theodore Wold

Joseph Adamson

Macy Hanson

Philip Santer

Ray Se11ie

Zachary Dietert

Nicole Kurokawa

Andrew Perraut

Claire Thompson

Marisa Maleck

Stephanie Stoddard

Jeanne Mane Hoffman

Albert Cahn

John Farr

Michael Reasonover

Erin Wildermuth

Shreya Shah

Stuart Ditsier

V1ctorra Strokova

Jonathan Dingel

Anthony Sknba

V1ctona Kurzweg

Anthony Henke

Douglas Rogers

Gary Barnett

Gaurav T1wan

Jacob Loup

Justus Myers

Peter Gregory

Robert Herntt

Sarah Anzia

Satya Thallam

Alexander Hams

Diana Weinert

Elizabeth Anderson

Page I of 6

Institute for Humane Studies

Form 990, P.art II, Line 22 -- Grants and Allocations

YearEnded August 31, 2006

94-1623852

Amount

Name

720

720

720

720

700

700

695

590

550

515

400

379

370

90

35

35

30

25

25

20

20

L. Bnan Andrew

Malta Pohtzer

Matthew Schneider

Will Cromer

Hallee Morgan

Joseph Smith

Scott Wagner

Jonathan Burns

Pedro Rodnguez

Shrutl RaJagopalan

Joshua Thompson

Yao Chen

Raphael Pra1s

Gregory Shambram

Amber Thomason

Greg Demers

Luis Pmeda Rodas

Lauren Miller

Qiang Liu

Jeffrey Johnson

Pieter Cleppe

Journalism

Tobm Spratte

Kevin S1eff

Addy L1tfin

Robin Schramm

Jolene Pinder

Claire Mnchell

Nathan Lock

Adam Weinberg

1,100

350

2,600

2,000

2,000

2,000

1,500

1,000

Young Communicators Fellowsh1gs

Megan Rudebeck

Monica Mercer

Andrew Humphnes

Yelena Shagall

Timothy Bouley

Jesse Roesler

500

500

1,000

500

500

1,000

MFA Scholarsh10s

University of Southern California

Ennne Dobson

Schterna W1rcberg

Bret Eckhardt - Other

Jeremy W. Ball

Nie Shearer

Nathan Marshall

3,000

2,000

2,000

2,000

5,000

2,000

5,000

Total Communicators

Program

Page 2 of 6

----

74,079

Institute for Humane Studies

Form 990, Part II, Line 22 -- Grants and Allocations

Year Ended August 31, 2006

94-1623852

Amount

Academic Programs

$

Leigh Jenco

Carmen Pavel

Stefani Smith

Michael Muldoon

Michael Gilbert

Wilham English

Saum1tra Jha

Pengyu He

Justin Grewell

Jonathan Tsou

Jason Brennan

Inna Manta

Cohn Wilder

Wilham Baude

Scott Brave

Ryan Oprea

Rahul Sagar

Mark Dmcecco

Mane Gryphon

Jeremy Garrett

Han Ping Chor

Ermr Kamemca

David Baugh

Basak Kus

Yuksel Sezgin

Victor Mumz-Frat1celh

Syed Nageeb Ah

Stamslav Dolgopolov

Simone Pohllo

Samuel DeCamo - other

Robert Deforest McDuff

Ricardo Serrano-Pad1al

Peter Northup

Michael DeAless1

Meehs K1tsing

Matthew Spence

Matthew Glassman

Matthew Bedke

Marc Gersen

Luis Zegarra

Lisa Blaydes

Linda Peia

Laura Phillips

Laura Inglis

Kyle Volk

Joanna Guidi

Jin Zeng

James Prescott

Emily Schleicher

Page 3 of 6

12,000

12,000

10,000

10,000

10,000

8,000

8,000

8,000

8,000

8,000

8,000

8,000

8,000

6,000

6,000

6,000

6,000

6,000

6,000

6,000

6,000

6,000

6,000

6,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

Institute for Humane Studies

Form 990, Part II, Line 22 -- Grants and Allocations

Year Ended August 31, 2006

94-1623852

Name

Amount

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

Elsa Vila-Artad1

Elizabeth Wolfram

Christopher Freiman

Christopher Alcantara

Bnan Smith

Bnan Broughman

Brandon Thibodeaux

BenJamm Schwab

Art Carden

Alvaro Herrero

Ahmet Kuru - Expenses

Adam Rachhs

Adam Hofn-Wmgradow

Wenwe1 Guan

Todd Neumann

Thomas Kelly

Terrence Watson

Satya Thallam

Sally Sadoff

Robert Bateman

Richard E. Ekins

Richard Bell

Ralf Bader

Quoc-Anh Do

Oren Ziv

N1kola1Roudev

Nicholas Lehmann-Ziebarth

Naveen Mandava

Monica Mornll

Mohammad Jahan-Parvar

Michael Waldron

Matthew Grow

Laura Davis

Kurtulus Gem1c1

Kenneth Ahern

Julia Gray

Joshua Hall

Jason Ross

Jamus Lim

Jamie Smeder

James Stanfield

Imogen Goold

Howard Padwa

Greg Eow

Fang-Yi Chiou

Fan Zhang

Fabnce Jotterand

Enk Kimbrough

Eric Wearne

Enc Pullin

Enc Morgan

Page 4 of 6

Institute for Humane Studies

Form 990, Part II, Line 22 Grants and Allocations

Year Ended August 31, 2006

94-1623852

Amount

Name

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

2,000

Emily Meyer

EdmLm

Domm1c Draye

David Skarbek

Daniel D1Salvo

Daniel BenJamm

Carl LeBeck

Bogdan Rabanca

Barbara Hmze

Andrew Humphries

Andrew Bailey

Andrei Zlate

Alexander Baturo

Alex Potapov

Adnan Vatansever

Adam Doverspike

Adam Cureton

Hayek Fund for Scholars

Steve Z1hak

Nikolai Wenzel

Navm Kart1k

Ben Powell

Is1k Ozel

Anna Dotrelova

Andrew Murphy

Wilham Arthur Carden

James Stacey Taylor

Bnan Smith

Syed Nageeb Mustafa Ah

Steven Lugauer

Reza Hasmath

Paul Lewis

Melvin Schutt

Matthew Glassman

Kevin Portteus

James Prescott

Grant Madsen

Daniel Pellerin

Amy Sanders

Ahmet Kuru

Helen Knowles

Yvonne Chiu

Yossi Nehushtan

Victor Muniz-Fraticelh

Robert Bateman

Nicolas Malobert1

Nadiya Kravets

Maria Petrova

Kenneth Ahern

Jules Gehrke

500

500

500

500

450

400

400

350

350

350

300

300

300

300

300

300

300

300

300

300

300

300

276

250

250

250

250

250

250

250

250

250

Page 5 of 6

Institute for Humane Studies

Form 990, Part II, Line 22 -- Grants and Allocations

Year.Ended August 31, 2006

94-1623852

Amount

250

250

250

250

250

250

250

250

250

249

200

200

200

200

100

119

300

250

250

Joshua Teitelbaum

Jennifer Burns

Jason Ross

Hyon Joo Yoo

Hong Zhang

Doron Shultziner

David Zetland

Carne Ann S1tren

Carmen Pavel

Matt Zwolmsk1

Samuel DeCamo

Owen Yeates

Luke Willard

Joshua Wnght

Scott Orr

Syed Nageeb Alt

Walter Hernandez Lopez

Bogdan Iacob

Petr Koblovsky

Total Acedemic Program

460,744

Total Grants and Allocations

542,732

Page 6 of 6

Institute for Humane Studies

Form 990, Part II, Line 42 - Depreciation expense

Form 990, Part IV, Line 57 - Land, Buildings, and Equipment

Year Ended August 31, 2006

94-1623852

ASSETS

Begmmng

of Year

Add1l!ons

Disposals

End

of Year

Office Furmture and Equipment

Leasehold Improvements

$ 386,013

125,000

91,477

$ 477,490

125,000

Total

$ 511,013

91,477

$ 602,490

Begmmng

of Year

Current Year

Depreciation

Office Furniture and Equipment

Leasehold Improvements

$ 360,446

66,673

42,072

$ 402,518

66,673

Total

$ 427,119

42,072

$ 469,191

ACCUMULATED

DEPRECIATION

Disposals

End

of Year

Note: Property and equipment are stated at cost and are depreciated using the stra1ght-hne method over

estimated useful hves of five to ten years, with no salvage value Leasehold improvements are recorded

at cost and amortized usmg the stra1ght-hne method over the1r estimated useful hves or the remaining

lease term, whichever 1s shorter

Institute for Humane Studies

Form 990, Part V - List of Officers, Directors, Trustees and Key Employees (Non-compensated)

Year Ended August 31, 2006

Name

Charles G Koch

Tyler Cowen

Timothy Otis Browne

John Blundell

Richard H. Frnk

Jerome M. Fulhnw1der

David C Humphreys

Donald J. Boudreaux

Enc S. O'Keefe

James Arthur Pope

Roger D. Siik

Wilham 0. Sumner

94-1623852

Title

Chairman

Vice-Chairman

Director

Director

Director

Director

D!fector

Director

D!fector

D!fector

Director

Director

All of the md1v1duals listed above are volunteers and are not compensated m their role as officers and directors of the