Escolar Documentos

Profissional Documentos

Cultura Documentos

Lingerie Model Carlee Costello Sues Delilah's

Enviado por

PhiladelphiaMagazineDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Lingerie Model Carlee Costello Sues Delilah's

Enviado por

PhiladelphiaMagazineDireitos autorais:

Formatos disponíveis

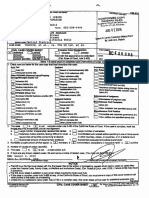

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 1 of 37

CIVIL COVER SHEET

<il>JS 44 (Rev. 12/07)

The JS 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of_pleadings or other papers as required by law, except as provided

by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating

the civil docket sheet. (SEE INSTRUCTIONS ON THE REVERSE OF THE FORM.)

I.

(a)

PLAINTIFFS

DEFENDANTS

Carlee Costello individually and on behalf of all others similarly

Delilah's Den of Philadelphia, Inc., et al.

situated

County of Residence of First Listed Plaintiff -"N-"J""--------(EXCEPT IN U.S. PLAINTIFF CASES)

(b)

County of Residence of First Listed Defendant

Philadelphia, PA

(IN U.S. PLAINTIFF CASES ONLY)

NOTE: IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE

LAND INVOLVED.

(C)

Kalikhman

&

1051 County Line Road,

19006 215 364-5030

Rayz, LLC

Huntin don Valle , PA

II. BASIS OF JURISDICTION

Cl 1

Cl 2

IV.

Attorneys (If Known)

Attorney's (Firm N rune, Address, and Telephone Number)

Suite "A"

(Place an "X" in One Box Only)

U.S. Government

Plaintiff

1!!I 3 Federal Question

U.S. Government

Defendant

Cl 4 Diversity

III. CITIZENSHIP OF PRINCIPAL P ARTIES(P!ace an ''X" in 0ne Box for Plaintiff

and One Box for Defendant)

(For Diversity Cases Only)

PTF

DEF

PTF

DEF

Citizen of This State

Cl 1

Cl 1 Incorporated or Principal Place

Cl 4

Cl 4

of Business In This State

(U.S. Government Not a Party)

Citizen of Another State

(Indicate Citizenship of Parties in Item

Cl 2

Cl

Cl

Cl

1m

Incorporated and Principal Place

of Business In Another State

Cl

Cl 5

Foreign Nation

Cl

Cl 6

NATURE OF SUIT IP!acean"X"inOneBoxOnlvl

lji;;i!tl~;;;,,;coNTRACT.""'''~'r.'~'im" '~~mf,r!~~ORTSiC,-;',~i.:'~~:,~~J~:::c;; ,;,,;pnRFE:ITlJREIPEN)l.l'i~ ~,,~ . ,,.;,~ ;ii!'iiii'-',i!;l;~iSTATilTESi~I

Cl

Cl

Cl

Cl

Cl

Cl 610 Agriculture

Cl 422 Appeal 28 USC 158

Cl 620 Other Food & Drug

Cl 423 Withdrawal

Cl 625 Drug Related Seizure

28 USC 157

of Property 21 USC 881

Cl 630LiquorLaws

''ii!i!PRUP

m"i~'f,;;;;;.

Cl 640 R.R. & Truck

Cl 820 Copyrights

Cl

Cl 650 Airline Regs.

Cl 830 Patent

Cl

Cl 660 Occupational

Cl 840 Trademark

Safety/Health

Cl 690 Other

Cl

;ii~~"

;;;.;;;;o;;::.~........; ~ ;;.i,iif~ui.. ''

".;.,:;i._,

l!!l 7!0FairLaborStandards

Cl 861 HIA(l395ft)

Cl

Act

Cl 862 Black Lung (923)

Cl

Cl 720 Labor/Mgmt. Relations

Cl 863 DIWC/DIWW (405(g))

Cl

Cl 730 Labor/Mgmt.Reporting

Cl 864 SSID Title XVI

Cl

& Disclosure Act

Cl 865 RSI (405(2))

lt"""':.;;;,;.:imAE,PROPERT\';C;1'!~ ~~Clvili1iBIGBTS1li~c~ ~PRISONEIUPETFti:Oi'IS.,;~ Cl 740 Railway Labor Act

~ ..,,il!i'.RAlrn"TH'stlITS~

Cl 210 Land Condemnation

Cl 441 Voting

Cl 510 Motions to Vacate

Cl 790 Other Labor Litigation

l!!I 870 Taxes (U.S. Plaintiff

Cl 220 Foreclosure

Cl 442 Employment

Sentence

Cl 791 Empl. Ret. Inc.

or Defendant)

Cl 230 Rent Lease & Ejectment Cl 443 Housing/

Habeas Corpus:

Security Act

Cl 871 IRS-Third Party

Cl 240 Torts to Land

Accommodations

Cl 530 General

26 USC 7609

Cl 245 Tort Product Liability

Cl 444 Welfare

Cl 535 Death Penalty

ir~i!iilMMIGkATION:l/i~~:

Cl 290 All Other Real Property

Cl 445 Amer. w/Disabilities - Cl 540 Mandamus & Other Cl 462 Naturalization Application

Employment

Cl 550 Civil Rights

Cl 463 Habeas Corpus Cl 446 Amer. w/Disabilities - Cl 555 Prison Condition

Alien Detainee

Other

Cl 465 Other Immigration

Cl 440 Other Civil Rights

Actions

llO Insurance

120 Marine

130 Miller Act

140 Negotiable Instrument

150Recoveryof0verpayment

& Enforcement ofJudgment

151 Medicare Act

152 Recovery of Defaulted

Student Loans

(Exel Veterans)

153 Recovery of Overpayment

ofVeteran'sBenefits

160 Stockholders' Suits

190 Other Contract

195 Contract Product Liability

196 Franchise

V.

~

ORIGIN

1 Original

Proceeding

PERSONAL INJURY

Cl 310 Airplane

Cl 315 Airplane Product

Liability

Cl 320Assault,Libel&

Slander

Cl 330 Federal Employers'

Liability

Cl 340 Marine

Cl 345 Marine Product

Liability

Cl 350MotorVehicle

Cl 355 Motor Vehicle

Product Liability

Cl 360 Other Personal

Injury

(Place an "X" in One Box Only)

Removed from

0

State Court

0 2

PERSONAL INJURY

362 Personal Injury Med. Malpractice

Cl 365 Personal Injury ProductLiability

Cl 368 Asbestos Personal

Injury Product

Liability

PERSONAL PROPERTY

Cl 370 Other Fraud

Cl 371 Truth in Lending

Cl 3800therPersonal

Property Damage

Cl 385 Property Damage

Product Liability

Cl

Remanded from

Appellate Court

0 4

Reinstated or

Reopened

5 Transferr~d J!om O 6

anoth.er district

s ec1

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Cl

Multidistrict

Litigation

400 State Reapportionment

410 Antitrust

430 Banks and Banking

450 Commerce

460Deportation

470 Racketeer Influenced and

Corrupt Organizations

480 Consumer Credit

490 Cable/Sat TV

810 Selective Service

850 Securities/Commodities/

Exchange

875 Customer Challenge

12 USC 3410

890 Other Statutory Actions

891 Agricultural Acts

892 Economic Stabilization Act

893 Environmental Matters

894 Energy Allocation Act

895 Freedom of Information

Act

900Appeal of Fee Determination

Under Equal Access

to Justice

950 Constitutionality of

State Statutes

0 7

Appeal to District

Judge from

Magistrate

Jud ent

C~9t1() Y,~ci~l}(j1f1~tu~~~hich you are filing (Do not cite jurisdictional statutes unless diversity):

VI.

CAUSE OF ACTION

VII.

1-----.;;.._-----''----------------------------

REQUESTED IN

COMPLAINT:

VIII.

RELATED CASE(S)

IF

ANY

Brief description of cause:

Violation ot the Fair Labor Standards Act

~ CHECK 1F TIIIS IS A CLASS ACTION

UNDER F.RC.P. 23

(See instructions):

DEMAND$

CHECK YES only if demanded in complaint:

JURY DEMAND:

JUDGE

DOCKET NUMBER

DATE

APPLYING IFP

JUDGE

ill' Yes

0 No

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 2 of 37

UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF PENNSYLVANIA- DESIGNATION FORM to be used by counsel to indicate the category of the case for the purpose of

assignment to appropriate calendar.

AddressofPlaintiff: c/o Kalikhman & Rayz,

LLC 1051 County Line Rd.,

AddressofDefendant: 100 Spring Garden Street Philadelphia,

Suite "A" Huntingdon Valley,

PA

PA

Place of Accident, Incident or Transaction:_P_h_i_l_a_d_e_l""p_h_i_a__

c_o_u_n_t--"-y-----------------------------(Use Reverse Side For Additional Space)

Does this civil action involve a nongovernmental corporate party with any parent corporation and any publicly held corporation owning 10% or more of its stock?

(Attach two copies of the Disclosure Statement Form in accordance with Fed.R.Civ.P. 7.1 (a))

Does this case involve multidistrict litigation possibilities?

Yes D

No l&l

YesD

No~

RELATED CASE, IF ANY:

Case Number: _ _ _ _ _ _ _ _ _ _ _ Judge _ _ _ _ _ _ _ _ _ _ _ _ _ Date T e r m i n a t e d : - - - - - - - - - - - - - - - - - Civil cases are deemed related when yes is answered to any of the following questions:

1. Is this case related to property included in an earlier numbered suit pending or within one year previously terminated action in this court?

YesD NoD

2. Does this case involve the same issue of fact or grow out of the same transaction as a prior suit pending or within one year previously tenninated

action in this court?

YesD NoD

3. Does this case involve the validity or infringement of a patent already in suit or any earlier numbered case pending or within one year previously

YesD

terminated action in this court?

NoD

4. Is this case a second or successive habeas corpus, social security appeal, or pro se civil rights case filed by the same individual?

YesD

CIVIL: (Place t/ in ONE CATEGORY ONLY)

A Federal Question Cases:

1. D Indemnity Contract, Marine Contract, and All Other Contracts

NoD

B. Diversity Jurisdiction Cases:

1. D Insurance Contract and Other Contracts

2. D FELA

2. D Airplane Personal Injury

3. D Jones Act-Personal Injury

3. D Assault, Defamation

4. D Antitrust

4. D Marine Personal Injury

5. D Patent

5. D Motor Vehicle Personal Injury

6. D Labor-Management Relations

6. D Other Personal Injury (Please

specify)

7. D Civil Rights

7. D Products Liability

8. D Habeas Corpus

8. D Products Liability - Asbestos

9. D Securities Act(s) Cases

9. D All other Diversity Cases

10. D Social Security Review Cases

(Please specify)

11. IXI All other Federal Question Cases

(Please specify)

Fair Labor Standards Act,

2 9 U.S. C.

2 01,

et seq.

ARBITRATION CERTIFICATION

Arkady "Eric" Rayz,

Esq.

~~~-------------~

elief, the damages recoverable in this civil action case exceed the sum of

$150,000.00 exclusive of interest and costs;

J!I Relief other than monetary damages is sought.

DATE:

8/21/2015

Attorney-at-Law

NOTE: A trial de novo will be a trial by ju

87976

Attorney I.D.#

a..i..rl1"1'1;1'1N,as been compliance with F.R.C.P. 38.

I certify that, to my knowledge, the within case is not related to an

except as noted above.

DATE:

8/21/2015

CIV. 609 (6/08)

. 87976

Attorney I.D.#

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 3 of 37

IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF PENNSYLVANIA

CASE MANAGEMENT TRACK DESIGNATION FORM

COSTELLO

CIVIL ACTION

v.

DELILAH'S DEN OF PHILADELPHIA,

INC. , ET AL ..

NO.

In accordance with the Civil Justice Expense and Delay Reduction Plan of this court, counsel for

plaintiff shall complete a Case Management Track Designation Form in all civil cases at the time of

filing the complaint and serve a copy on all defendants. (See 1:03 of the plan set forth on the reverse

side of this form.) In the event that a defendant does not agree with the plaintiff regarding said

designation, that defendant shall, with its first appearance, submit to the clerk of court and serve on

the plaintiff and all other parties, a Case Management Track Designation Form specifying the track

to which that defendant believes the case should be assigned.

SELECT ONE OF THE FOLLOWING CASE MANAGEMENT TRACKS:

(a) Habeas Corpus - Cases brought under 28 U.S.C. 2241 through 2255.

( )

(b) Social Security - Cases requesting review of a decision of the Secretary of Health

and Human Services denying plaintiff Social Security Benefits.

( )

(c) Arbitration - Cases required to be designated for arbitration under Local Civil Rule 53 .2.

( )

(d) Asbestos - Cases involving claims for personal injury or property damage from

exposure to asbestos.

( )

(e) Special Management - Cases that do not fall into tracks (a) through (d) that are

commonly referred to as complex and that need special or intense management by

the court. (See reverse side of this form for a detailed explanation of special

management cases.)

( x)

(f) Standard Management - Cases that do

( )

Plaintiff

8/21/15

Date

(215)

y one of the other tracks.

Attorney for

364-5030

Telephone

(Civ. 660) 10/02

(215)

364-5029

FAX Number

erayz@kalraylaw.com

E-Mail Address

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 4 of 37

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF PENNSYLVANIA

CARLEE COSTELLO, on behalf of herself

and all others similarly situated,

Plaintiff,

Civil Action No.:

CLASS AND COLLECTIVE

ACTION COMPLAINT

v.

DELILAHS DEN OF PHILADELPHIA, INC. JURY TRIAL DEMANDED

D/B/A DELILAHS DEN, DELILAHS DEN

OF PLEASANTVILLE F/D/B/A DELILAHS

DEN, DELILAHS DEN OF ATLANTIC

CITY D/B/A DELILAHS DEN, SPRING

GARDEN SOCIAL CLUB, INC. D/B/A ZEE

BAR, JEM HOSPITALITY, INC. D/B/A

REBEL ROCK & BAR, JENNIFER SHAMY,

and DOE DEFENDANTS 1-10,

Defendant(s).

Plaintiff Carlee Costello (Plaintiff), on behalf of herself and all others similarly

situated, alleges as follows:

INTRODUCTION

1.

This is a class and collective action brought on behalf of employees who work or

have worked at one or more of Defendants (defined herein) bar and/or restaurant locations,

operating under the trade names Delilahs Den, Delilahs The Gentlemans Club &

Steakhouse, Zee Bar, or Rebel Rock Bar. These entities include (but are not limited to)

Delilahs Den of Philadelphia, Inc., located at 100 Spring Garden Street, Philadelphia, PA

(Delilahs Philly), Delilahs Den of Pleasantville, located at 201 E. Delilah Rd., Pleasantville,

NJ,1 Delilahs Den of Atlantic City, located at 2405 Pacific Avenue, Atlantic City, NJ

1

Upon information and belief, Delilahs Den of Pleasantville closed its business and reopened as

the Crazy Horse. Upon further information and belief, the Crazy Horse is not owned or operated

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 5 of 37

(Delilahs AC), Spring Garden Social Club, Inc. d/b/a Zee Bar, located at 100 Spring Garden

Street, Philadelphia, PA (Zee Bar), and JEM Hospitality, Inc. d/b/a Rebel Rock Bar, located at

100 Spring Garden Street, Philadelphia, PA (Rebel). These locations are collectively referred

to as the Clubs.

2.

At the Clubs, Defendants employ one or more of the following groups of

employees waitresses, hostesses, shot girls, and bartenders. The individuals comprising these

groups of employees are collectively referred to herein as Tipped Employees.

3.

As set forth more fully below, the Tipped Employees are employees of

Defendants whom Defendants pay based on purported compliance with applicable wage laws

based on the tip credit provisions. Stated another way, Tipped Employees are primarily paid

based on tips received from customers.

4.

Indicative of the Clubs, Delilahs Philly touts itself as a premiere destination for

business travelers, celebrities, and uninhibited Philadelphians alike and home of The Worlds

Most

Beautiful

Showgirls,

barmaids,

servers,

shot

girls

and

masseuses.

See

http://www.delilahs.com/about.html (last visited August 9, 2015).

5.

Unbeknownst to the paying public, the Clubs festive attitude was a ruse and

Defendants success was predicated on its systematic and willful violation of the Fair Labor

Standards Act (FLSA), 29 U.S.C. 201 et seq., the Pennsylvania Minimum Wage Act

(PMWA), 43 P.S. 333.101 et seq., the Pennsylvania Wage Payment and Collection Law

(WPCL), 43 P.S. 260.1 et seq., and Pennsylvania common law.

6.

As set forth below, Defendants violated the aforementioned laws by failing to pay

by Defendants and, as such, is not subject to this lawsuit. Should Plaintiff determine that

Defendants do, in fact, own, operate, and subject employees of Crazy Horse to the same policies

and procedures complained of herein, Plaintiff shall seek leave to amend this Complaint to add

such culpable parties.

2

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 6 of 37

Plaintiff and other Tipped Employees the applicable minimum wage and inappropriately

retaining a portion of their gratuities in violation of federal and state law.

7.

As detailed herein, Defendants systematically deprived Tipped Employees from

receiving all wages due and owing under the FLSA, PMWA, WPCL, and Pennsylvania common

law.

8.

As more fully explained below, Defendants did not comply with the strict

requirements of the FLSAs tip notification provisions and are, therefore, ineligible to use

Section 203(m) of the FLSA. In order to utilize Section 203(m), and, thus, claim part of the tips

received by customers as the employees pay, an employer must adhere to all five notification

requirements. As detailed herein, Defendants either ignored or outright violated these key

requirements. Accordingly, Defendants cannot claim any tip-credit and must pay all Tipped

Employees, including Plaintiff, the applicable minimum wage for each hour worked.

9.

Defendants also employed a practice whereby Tipped Employees were paid $2.83

per hour, regardless of the number of hours worked or the amount of tips received by a Tipped

Employees. As set forth herein, this practice also violates applicable wage and hour laws,

including the FLSA and PMWA, because an employee must be paid, at all times, at least the

applicable minimum wage for each hour worked and premium overtime compensation for all

hours worked in excess of forty per workweek.

10.

In addition, Defendants had a practice whereby its Tipped Employees were not

compensated for (i) the time spent donning or doffing their employer-mandated uniforms, (ii)

mandatory bi-annual cleaning shifts, (iii) attendance at mandatory promotional events occurring

outside the Clubs.

Plaintiff and her fellow Tipped Employees were not paid for this

compensable off-the-clock time by Defendants.

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 7 of 37

11.

Defendants also required its Tipped Employees to effectively purchase these

employer-mandated uniforms which, in certain instances, drove the Tipped Employees pay rate

for the pay period in which the uniform was purchased below the minimum wage.

12.

Finally, Defendants took and retained a portion of Tipped Employees tips in

contravention of applicable law. Additionally, Defendants required Tipped Employees to forfeit

a portion of their tips to cover cash shortages and walk outs by customers who refused to pay

their bill.

13.

Due to Defendants unlawful practices concerning gratuities, Defendants have

improperly applied a tip credit against the wages paid to Plaintiff and current and former

Tipped Employees, thus paying them less than the mandated minimum wage.

14.

As a result of the aforementioned pay practices, Plaintiff and the members of the

Classes (defined below) were illegally under-compensated for their work.

SUMMARY OF CLAIMS

15.

Plaintiff brings this action as a collective action to recover unpaid wages, pursuant

to the FLSA.

16.

In particular, Plaintiff brings this suit on behalf of the following similarly situated

persons:

All current and former Tipped Employees who have worked for

Defendants within the statutory period covered by this Complaint,

and elect to opt-in to this action pursuant to the FLSA, 29 U.S.C.

216(b) (Nationwide Collective Class).

17.

In addition, Plaintiff also brings this action as a state-wide class action to recover

unpaid wages, including inappropriately withheld tips and failing to pay the applicable minimum

wage, pursuant to the PMWA, WPCL, and common law (the PA State Laws).

18.

Specifically, Plaintiff brings this suit on behalf of a class of similarly situated

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 8 of 37

persons composed of:

All current and former Tipped Employees who have worked for

Defendants in the Commonwealth of Pennsylvania during the

statutory period covered by this Complaint (the PA Class).

19.

The Nationwide Collective Class and the PA Class are hereafter collectively

referred to as the Classes.

20.

Plaintiff alleges on behalf of the Nationwide Collective Class that they are: (i)

entitled to unpaid minimum wages from Defendants for hours worked for which Defendants

failed to pay the mandatory minimum wage, as required by law; and (ii) entitled to liquidated

damages pursuant to the FLSA.

21.

Plaintiff alleges on behalf of the PA Class that Defendants violated the PA State

Laws by, inter alia: (i) failing to pay them the appropriate minimum wages for all hours worked;

and (ii) inappropriately withholding and/or deducting unlawful amounts from the gratuities of the

PA Class.

PARTIES

22.

Plaintiff is a resident of the State of New Jersey, who was employed by

Defendants as a Hostess and as a Waitress for almost fourteen (14) years at Delilahs Philly,

who Defendants failed to compensate properly for all hours worked.

23.

Pursuant to Section 216(b) of the FLSA, Plaintiff has consented in writing to be a

plaintiff in this action. Her executed Consent To Sue form is attached hereto as Exhibit A.

24.

Delilahs Philly is located at 100 Spring Garden Street, Philadelphia, PA.

Delilahs Philly operates as gentlemans club and restaurant employing Tipped Employees.

According to Delilahs Phillys filings with the Commonwealth of Pennsylvania, its corporate

headquarters is located at 100 Spring Garden Street, Philadelphia, PA. According to its liquor

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 9 of 37

license, Delilahs Phillys secretary, director, and vice president is Defendant Jennifer Shamy.

At all relevant times during the statutory period covered by this Complaint, Defendant has

transacted business within the Commonwealth of Pennsylvania, including within this district.

25.

Delilahs Pleasantville was a gentlemans club located at 201 E. Delilah Rd.,

Pleasantville, NJ. Upon information and belief, Delilahs Pleasantville has ceased operating.

When it was operating as a gentlemans club, it employed Tipped Employees. Upon information

and belief, while operational, Delilahs Pleasantville shared common ownership and/or

management with the other Defendants.

26.

Delilahs AC is located at 2405 Pacific Avenue, Atlantic City, NJ. Delilahs AC

operates as gentlemans club and restaurant, employing Tipped Employees. Upon information

and belief, Delilahs AC shares common ownership and/or management with the other

Defendants.

27.

Employees.

Zee Bar operates as an after-hours social club/night club, employing Tipped

According to Zee Bars filings with the Commonwealth of Pennsylvania, its

corporate headquarters is located at 100 Spring Garden Street, Philadelphia, PA. According to

its liquor license, Zee Bars manager/steward is Defendant Jennifer Shamy. At all relevant

times during the statutory period covered by this Complaint, Defendant has transacted business

within the Commonwealth of Pennsylvania, including within this district.

28.

Rebel is a club and restaurant, hosting local bands, and employing Tipped

Employees. It is also located at 100 Spring Garden Street, Philadelphia, PA. According to its

liquor license, Rebels president, director, and stockholder is Defendant Jennifer Shamy. At all

relevant times during the statutory period covered by this Complaint, Defendant has transacted

business within the Commonwealth of Pennsylvania, including within this district.

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 10 of 37

located at 100 Spring Garden Street, Philadelphia, PA

29.

Defendant Jennifer Shamy (Shamy) is a natural person residing in the

Commonwealth of Pennsylvania. According to the applicable liquor licenses, Ms. Shamy is the

secretary, director, and vice president of Delilahs Philly, the manager/steward for Zee Bar,

and president, director, and stockholder of Rebel. Upon information and belief, Defendant

Shamy is either the owner or general manager of each of the Clubs. Indeed, Defendant Shamys

father Joseph Shamy was the operator of Delilahs Pleasantville and Delilahs Philly. See

http://articles.philly.com/1991-07-29/news/25781806_1_casino-hosts-casino-employees-clubs

(last visited August 18, 2015), http://articles.philly.com/2006-04-16/news/25394427_1_stripclub-club-business-greta-shamy (last visited August 18, 2015).

30.

In these capacities, Defendant Shamy exercises sufficient control over the labor

policies and practices complained of herein to be considered the employer of Plaintiff and the

Classes for the purposes of the FLSA and PA State Laws.

31.

Upon information and belief, Defendants are a single and joint employer with a

high degree of interrelated and unified operations, sharing common officers with a common

address. For example, according to corporate filings with the Commonwealth of Pennsylvania,

Defendants Delilahs Philly, Zee Bar, and Rebel share a common office at 100 Spring Garden

Street, Philadelphia, PA.

32.

For instance, on January 21, 2003, Delilahs Philly filed for a U.S. federal

trademark registration, Registration No. 2852815, for the following service mark a drawing

with words in stylized form to be used in adult entertainment services in the nature of exotic

dancing:

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 11 of 37

33.

The registration filing identifies this service mark as being first used and in

commerce since February 28, 1991 (i.e., since operation of Delilahs Pleasantville).

34.

This U.S. federal trademark registration was formally registered in June of 2004

and, thereafter, renewed, with the correspondent contact for this service mark being Defendant

Shamy at the location of Delilahs Philly.

35.

Notably, however, this service mark is used by both Delilahs Philly and

Delilahs AC, as evidenced on the images below, taken from their official websites:

See http://delilahsac.com/ (last visited on August 18, 2015); http://www.delilahs.com/ (last

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 12 of 37

visited on August 18, 2015).

36.

Moreover, both Delilahs Philly and Delilahs AC also use the same service mark

interchangeably in their promotional literature, as evidenced in the images below:

37.

Further, Defendants share personnel.

For instance, the publicly-accessible

LinkedIn 2 profile of Kevin S. Mayberry (Mayberry) describes his work and experience with

Defendants as follows:

General Manager of Delilahs AC, during the period of 2012 through

2013;

Manager of Rebel, during the period of 2011 through 2013; and

An employee of Zee Bar, during the period of 2010 through 2013.

See https://www.linkedin.com/pub/kevin-mayberry/7/950/b07 (last visited on August 18, 2015).

LinkedIn.com is a social networking website on the Internet for professional occupations.

Eagle v. Morgan, et al., 2012 WL 4739436 *1 (E.D.Pa. 2012). A users profile also contains

sections for associations, honors, and awards. Eagle v. Morgan, et al., 2011 WL 6739448 * 1

(E.D.Pa. 2011).

9

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 13 of 37

38.

In fact, since approximately 2014, Mayberry has been working at and acting as

the de facto general manager of Delilahs Philly, including (but not limited to) setting employee

shifts.

39.

In addition, although Maureen J. Lafferty (Lafferty) is listed as the secretary,

director, and stockholder of Rebel on its liquor license, she is also the operations manager and

house mom of Delilahs Philly. 3

40.

Further, each of these Defendants share the common labor policies and practices

complained of herein which, upon information and belief, are all derived from and dictated and

controlled by Defendant Shamy.

41.

Plaintiff is unaware of the names and the capacities of those defendants sued as

DOES 1 through 10 but will seek leave to amend this Complaint once their identities become

known to Plaintiff. Upon information and belief, Plaintiff alleges that at all relevant times each

defendant was the officer, director, employee, agent, representative, alter ego, or co-conspirator

of each of the other defendants. In engaging in the alleged conduct herein, defendants acted in

the course, scope of, and in furtherance of the aforementioned relationship. Accordingly, unless

otherwise specified herein, Plaintiff will refer to all defendants collectively as Defendants and

each allegation pertains to each of the defendants.

JURISDICTION AND VENUE

42.

This Court has subject matter jurisdiction over this matter pursuant to 28 U.S.C.

1331 and 29 U.S.C. 201 et seq.

43.

Further, this Court also has supplemental jurisdiction over Plaintiffs state law

A house mom (or house mother) is a paid staging coordinator in the adult entertainment

industry. The house mother oversees conduct by performers in the dressing room, as well as

making sure that performers reach the stage on time, wearing the appropriate dress or costumes,

and introducing new performers to the clubs code of conduct.

See

https://en.wikipedia.org/wiki/House_mom (last visited on August 21, 2015).

10

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 14 of 37

claims pursuant to 28 U.S.C. 1367 because those claims derive from a common nucleus of

operative facts.

44.

Venue is proper in this district pursuant to 28 U.S.C. 1391(b)(ii), because a

substantial part of the acts or omissions giving rise to the claims alleged herein occurred within

this judicial district, and Defendant is subject to personal jurisdiction in this district.

45.

This Court is empowered to issue a declaratory judgment pursuant to 28 U.S.C.

2201 and 2202.

FACTUAL ALLEGATIONS

46.

The crux of the FLSA and PA State Laws is, inter alia: (i) that all employees are

entitled to be paid mandated minimum wages for all hours worked; (ii) that all employees are

entitled to premium overtime compensation for all hours worked in excess of 40 hours a week;

(iii) that all gratuities earned are the property of the employees; and (iv) it is the employers

responsibility to keep accurate records of all hours worked and wages earned by its employees.

47.

Contrary to these basic protections, Plaintiff and the members of the Classes

were: (i) deprived of the mandated minimum wage for all hours they worked; (ii) subjected to

inaccurate wage records (and corresponding wage payment) due to Defendants failure to keep

accurate records resulting from their mandate that Tipped Employees work a portion of their

time off-the-clock; (iii) forced to improperly share a percentage of their gratuities with

Defendants; and (iv) forced to reimburse Defendants for its ordinary business expenses.

Defendants Are Joint Employers

48.

Upon information and belief, each of the Clubs has had gross revenues in excess

of $500,000.00 and is an employer engaged in interstate commerce.

49.

Defendant Jennifer Shamy possesses operational control over the Clubs and/or an

ownership interest therein and, as such, controls significant functions of the other Defendants.

11

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 15 of 37

50.

According to a 2006 Philly.com article, Defendant Shamy is the owner of Zee Bar

and worked in management at Delilahs Philly.

See http://articles.philly.com/2006-04-

16/news/25394427_1_strip-club-club-business-greta-shamy (last visited August 18, 2015). Her

mother, Greta Shamy, was the owner of Delilahs Philly and the de facto landlord for Zee Bar.

Id.

51.

According to Plaintiff, since Jennifer Shamys father retired and moved to

Florida, Ms. Shamy has been acting as the owner of Delilahs Philly. Indeed, Plaintiff can recall

at least one instance where Defendant Shamy wrote Plaintiff up for a purported work infraction.

52.

Defendants are associated and joint employers, act in the interest of each other

with respect to employees, pay employees by the same method, and share control over the

employees.

53.

Indicative of the interrelatedness of Defendants, as described above, in

approximately early 2014, the manager of the Delilahs AC was transferred to the Delilahs

Philly to assume managerial responsibility of the Philadelphia location.

54.

Defendants possessed substantial control over Plaintiffs (and other Tipped

Employees) working conditions, and over the policies and practices with respect to the

employment and compensation of Plaintiff and all other Tipped Employees.

55.

Upon information and belief, the Clubs are/were operated by Defendants under

uniform policies applicable to the members of the Classes.

56.

Therefore, for the above and other reasons, Defendants jointly employed Plaintiff,

and all similarly situated individuals (e.g., all other Tipped Employees), and are Plaintiffs (and

all similarly situated individuals) employers within the meaning of 29 U.S.C. 201 et seq.

12

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 16 of 37

Plaintiffs Individual Experience

57.

Plaintiff and the members of the Classes are, or were, Tipped Employees

employed by Defendants.

58.

Plaintiff was employed at Delilahs Philly as a Hostess or Waitress from

approximately 2001 through August of 2015.

59.

For the last three years, Plaintiffs typical work schedule was Tuesday,

Wednesday, and Fridays, working from 7:00 p.m. to closing. She typically worked on average

approximately twenty (20) to twenty-four (24) hours per week.

60.

Plaintiff was paid a straight $2.83 per hour worked that was recorded in

Defendants timekeeping system. As set forth herein, Defendants timekeeping system did not

record all time worked by Plaintiff and other Tipped Employees.

Defendants Uniform Policy

61.

One of the uniform policies and procedures at issue was Defendants requirement

that its Tipped Employees be stage ready at the start of their assigned shift. Accordingly, a

Tipped Employee had to be in their Delilahs uniform, which consisted of a corset and/or

stockings. They also had to have their hair and make-up done to managements satisfaction.

62.

Defendants promoted their Club as having The World's Most Beautiful . . .

barmaids, servers, shot girls 4 through the use of the uniquely colored and detailed corset.

Indeed, Defendants directed Tipped Employees to approved locations where their unique corset

could be obtained.

63.

To ensure uniformity, a Tipped Employee was provided one corset at the start of

their employment with Defendants. Any additional corsets a Tipped Employee wished to have

See http://www.delilahs.com/about.html (last visited August 21, 2015).

13

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 17 of 37

(due, for example, to working multiple shifts in a week), had to be purchased by the Tipped

Employee.

64.

Further, Defendants regularly changed the color of the corset, requiring Tipped

Employees to purchase a new corset in the correct color. Plaintiff estimates that in the last six

years, Defendants changed the color of the corsets approximately four to five times.

65.

In addition, Defendants required Tipped Employees to purchase replacement

party corsets for the four special events Delilahs Philly held each year: the Diamond Club

event, the anniversary party, the Christmas party, and the Entertainer of the Year event. Thus,

if any damage occurred to the uniforms, Defendants made Tipped Employees bear the costs.

66.

Because of the high number of shifts, as well as due to wear and tear, in the last

three years, Plaintiff estimates that she purchased a total of 1 or 2 corsets. Notably, each corset

ranged in price between $75.00 and $85.00.

67.

Tipped Employees were required to clock out at the end of their shift before

changing out of their uniforms and leaving for the evening. Indeed, Plaintiff recalls one instance

where a manager specifically told her that the Club was not paying you to change your clothes.

68.

As such, and pursuant to Defendants uniform policies and practices, Tipped

Employees were not compensated for the time spent donning and doffing their uniforms.

Additional Off-The-Clock Work

69.

In addition to not compensating Tipped Employees for changing in and out of

their uniforms, Defendants practice was to have mandatory cleaning sessions several times a

year. At these events, Tipped Employees were required to come in and help clean the Club from

floor to ceiling. These events typically lasted two to three hours, were generally held on

Sundays, and occurred one to two times per year.

14

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 18 of 37

70.

Plaintiff and other Tipped Employees were not compensated for these cleaning

71.

In addition, Defendants had a practice whereby if a Tipped Employee did not

events.

clock out at the end of their shift (due, for example, to forgetfulness on the part of the Tipped

Employee), that Tipped Employees time records were automatically rolled back and the

employee clocked out at midnight.

72.

Plaintiff can recall several instances where she would stay until 2:30-3:00 a.m.,

forget to clock out, and was only paid for working that shift until midnight effectively working

2.5-3 hours off-the-clock for that particular shift.

73.

Plaintiff recalls seeing a memo posted in the employee-only portion of the Club

that stated employees time would be rolled back to midnight if they did not clock out.

74.

Defendants also had a policy wherein certain Tipped Employees, primarily

Hostesses and Waitresses, were required to attend promotional events.

Many of these

promotional events required Tipped Employees to work off-the-clock.

75.

Indeed, approximately one and a half years ago, Defendants altered their policy

regarding promotional events.

Now, on Thursday, Friday, and Saturday evenings, two

individuals, usually hostesses and waitresses, would be required to go out to other bars and

restaurants in an effort to entice patrons to come to the Club. Typically, management required

the employee to be out, soliciting new business, from 7:00 p.m. (the start of their shift) to 9:00

p.m., before coming in to clock in and work the remainder of their shift.

76.

Some of the locations that management encouraged Tipped Employees to attend

was the Capital Grille and Del Friscos Steakhouse. Tipped Employees had to spend their own

money at these promotional events buying their own food, drinks, and paying for

15

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 19 of 37

parking/transportation.

77.

Tipped Employees were not compensated for attending these promotional events. 5

78.

Further, management would indicate to Tipped Employees that if not enough new

patrons were brought in, the individuals who went out that night would face repercussions,

including having shifts cut/taken away.

79.

Because of the time spent donning and doffing, attending cleaning events, and

attending promotional activities, Tipped Employees were required to work off-the-clock by

Defendants.

80.

Plaintiff and members of the Classes are owed the full minimum wage for each

hour spent performing this off-the-clock work.

The Tip Credit Provision & Requirements

81.

Rather than pay their Tipped Employees the applicable minimum wage (either the

applicable state minimum wage or the federal minimum wage, whichever is higher), Defendants

chose to take a tip credit and pay these employees less than the applicable minimum wage.

82.

Under applicable law, in certain circumstances, it is permissible for an employer

to take a tip credit and pay its employees less than minimum wage provided that the employees

tips received from customers plus the tip credit paid by the employer equals at least the

applicable minimum wage. 6

Previously, Tipped Employees were paid $50.00 to attend the promotional event and given an

additional $80.00 to spend at the promotional event, buying food/drinks, during this guerilla

marketing campaign. Tipped Employees were occasionally paid to attend annual promotional

events, such as the annual Wing Bowl competition.

6

An employer is not relieved of their duty to pay an employee wages at least equal to the

minimum wage by virtue of taking a tip credit or by virtue of the employee receiving tips from

customers in an amount in excess of the applicable minimum wage. That is, an employer in the

restaurant industry must pay the employee wages at least equal to the minimum wage or equal to

16

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 20 of 37

83.

According to the Department of Labors (DOL) Fact Sheet #15: Tipped

Employees Under the Fair Labor Standards Act (FLSA) (Fact Sheet #15):

the maximum tip credit that an employer can currently claim under

the FLSA is $5.12 per hour (the minimum wage of $7.25 minus the

minimum required cash wage of $2.13).

84.

Pennsylvania mandates a higher minimum cash wage, requiring employers to pay

at least $2.83 per hour. Thus, under Pennsylvania law, the maximum tip credit is $4.45 per hour.

85.

Importantly, [t]ips are the property of the employee whether or not the employer

has taken a tip credit under section 3(m) of the FLSA. 29 C.F.R. 531.52.

86.

As the Department of Labor made clear in Fact Sheet #15A, an employer:

may use an employees tips only:

1.

as a partial credit against its minimum wage obligation to

the tipped employee, and/or

2.

in furtherance of a valid tip pool.

Even if the employer does not take a tip credit, tips remain the

property of the employee that received them and the employee

cannot be required to turn over his or her tips to the employer.

87.

As is made plain in Fact Sheet #15, in order to claim a tip credit, the employer

must satisfy five enumerated provisions. Specifically, the employer must notify its employees

of: (i) the cash wage the employer is paying the tipped employee, which must be at least $2.13

per hour; (ii) the additional amount claimed by the employer as a tip credit, which cannot exceed

$5.12 per hour; 7 (iii) that the tip credit claimed by the employer cannot exceed the amount of tips

the minimum wage less the tip credit, provided the tips claimed exceed the tip credit. Under no

circumstances is the employer relieved of paying at least the minimum wage for all hours

worked, regardless of how much an employee earns in tips.

7

Specifically, the tip credit cannot exceed the difference between the cash wage paid and the

minimum wage owed. Thus, in Pennsylvania, the tip credit amount is lower ($4.42 per hour) as

17

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 21 of 37

actually received by the tipped employee; (iv) that all tips received are to be retained by the

employee (unless subject to a valid tip pool); and (v) that the tip credit will not apply unless the

employer has notified the tipped employee of these provisions.

88.

An employer bears the burden of showing that it has satisfied the notification

requirement of informing its employees that tips are being credited against the employees

hourly wage. 8

If an employer cannot demonstrate its compliance with this notification

requirement, no credit can be taken and the employer is liable for the full minimum wage.

89.

Importantly, where a tipped employee earns less in tips than the tip credit

claimed, the employer is required to make up the difference. Stated another way, if a tipped

employee earns less than $4.42 per hour in tips (the maximum tip credit permissible where the

employer pays the employee $2.83 per hour), the employer must raise that tipped employees

hourly cash component the necessary amount above $2.83 per hour so as to ensure that the

employee earns at least $7.25 per hour the mandated minimum wage.

Defendants Failure to Notify Tipped Employees

90.

As explained above, the DOL has very specific requirements regarding what an

employer must notify his/her employee of if that employer intends to claim a tip credit.

91.

The Third Circuit and district courts across the country have held that where an

employer fails to satisfy any one of the notification requirements, that employer forfeits the tip

credit and must pay the employee the full minimum wage.

92.

Rather than comply with the notification requirements set forth in Fact Sheet #15,

Pennsylvania requires a higher cash wage component ($2.83 per hour, versus $2.12 per hour

under federal law).

8

Courts have strictly construed this notification requirement. Accordingly, some courts have

held that a generic governmental poster (which is required by the DOL) does not satisfy the tip

credit notification requirement.

18

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 22 of 37

Defendants chose to simply pay its Tipped Employees $2.83 per hour. In short, Defendants

failed to inform its Tipped Employees of (i) their intention to take the tip credit, (ii) the amount

Defendants intended to claim as a tip credit, and (iii) that all tips are to retained by the Tipped

Employee.

93.

Indeed, Plaintiff does not ever recall being notified by Defendants that they

intended to take a tip credit nor how much that amount would be. Evincing the magnitude of

Defendants abject failure to notify Tipped Employees of their intention to take a tip credit, until

recently, Plaintiff never heard the term tip credit.

94.

Defendants also failed to comply with 43 P.S. 231.34 insofar as it failed to

notify employees in writing whenever the tip credit claimed by Defendants changed. Rather,

Defendants took the maximum tip credit permissible irrespective of whether their Tipped

Employee actually earned sufficient tips to substantiate the tip credit claimed.

95.

During the course of Plaintiffs employ, there were numerous shifts worked by

Plaintiff where Plaintiff earned little to no tips. Indeed, Plaintiff can recall instances when she

earned no tips at all or as little as $20.00 in tips, despite working a full shift.

96.

Because Defendants failed to comply with the strict notification requirements of

the tip credit provision, as well as other portions of Section 203(m), Plaintiff and members of the

Classes are owed the full minimum wage for every hour worked.

Tipped Employees Did Not Keep All Tips

97.

Both the FLSA and the PMWA provide that in order to be eligible for a tip credit,

employers of tipped employees must either allow said employees to keep all gratuities received

or forgo the tip credit and pay the employee the full hourly minimum wage.

98.

Here, however, Tipped Employees have not retained all gratuities left by

19

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 23 of 37

customers.

99.

Pursuant to Defendants policies and guidelines, Plaintiff and the members of the

Classes were required to reimburse Defendants for any customer walk outs from their tips.

100.

Plaintiff knows of one instance, widely publicized by the Delilahs Phillys

management, where Defendants required the hostesses working on a particular night to cover

the cost and minimum gratuity expected when a customer took a bottle of liquor and did not pay

for it.

Notably, Defendants made the hostesses pay the full retail price for the bottle

(approximately $900.00), including gratuities, rather than the cost of the liquor Defendants paid.

101.

Further, Plaintiff herself was required to pay for customer walkouts, including one

incident where a customer walked out without paying a $300.00 tab.

102.

Upon information and belief, Defendants have a policy and practice of requiring

Tipped Employees to pay for any breakage of glassware that occurs within the Clubs. This is yet

another example of Defendants inappropriately requiring Tipped Employees to forfeit a portion

of their tips to Defendants.

103.

Because the Plaintiff and Tipped Employees have not been permitted to retain the

total proceeds of their gratuities permitted under the law, Defendants are not eligible to claim the

tip credit against the minimum wage, and thus are obligated to pay Plaintiff and Tipped

Employees the full minimum wage for every hour worked.

104.

As a result, Plaintiff and Tipped Employees have been unlawfully deprived of

their full gratuities due to Defendants policy regarding walk outs, in violation of the FLSA and

WPCL.

105.

Moreover, Defendants also engaged in a practice whereby they impermissibly

offset ordinary business expenses by making improper deductions from Tipped Employees

20

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 24 of 37

compensation. If a customer walks out of one of Defendants restaurants without paying their

bill, Tipped Employees are required to reimburse Defendants for the business loss. When cash

registers come out short at the end of the night, Tipped Employees are required to reimburse

Defendants for the loss.

106.

Due to the foregoing pay practices, including specifically requiring Tipped

Employees to cover the cost of walk outs and pay for cash shortages, Defendants are effectively

disqualified from taking the tip credit. As such, Plaintiff and members of the Classes are owed

the full minimum wage for every hour worked.

Defendants Illegal Tip Pool

107.

It is black letter law that those employers utilizing the tip credit provisions of the

FLSA must not share in the employees tips. Indeed, a tip pool (wherein employees collectively

share tips left by customers) is expressly limited to limited to employees who customarily and

regularly receive tips. See Fact Sheet #15.

108.

In order to be considered a valid tip pool, the employer must notify tipped

employees of any required tip pool contribution amount, may only take a tip credit for the

amount of tips each tipped employee ultimately receives, and may not retain any of the

employees tips for any other purpose. Id.

109.

As such, employers may not share in a tip pool. As Fact Sheet #15 explains, if a

tipped employee contributes to a tip pool that includes employees who do not customarily and

regularly receive tips, the employee is owed all tips he or she contributed to the pool and the full

$7.25 minimum wage. See Fact Sheet #15.

110.

Here, Defendants utilized a tip pool wherein managers participated in the tip pool.

111.

When Plaintiff worked as a Hostess for the Champagne Room (where private

21

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 25 of 37

dances occurred that were of longer duration typically an hour or more), Plaintiff was required

to give twenty percent (20%) of her tips that night to the managers on duty.

112.

Similarly, when Plaintiff was a waitress out in the main floor, she was required to

give ten percent (10%) of her tips to the managers and an additional ten percent (10%) to the

bartenders.

113.

Upon information and belief, Tipped Employees were required to share portions

of their tips with management personnel at Zee Bar.

114.

Further evidencing Defendants failure to conform to the requirements of Fact

Sheet #15, Defendants inappropriate took a portion of Plaintiff and members of the Classes tips

whenever they attempted to exchange Delilah Dollars.

115.

Delilah Dollars are an internal form of currency used at each of the Delilahs

clubs wherein customers can use said Delilah Dollars to purchase lap dances and tip dancers and

Tipped Employees.

116.

Although Delilah Dollars have a one for one exchange rate with U.S. Dollars

(excluding the service fee charged to customers to facilitate the purchase Delilah Dollars), when

a Tipped Employee wishes to cash in Delilah Dollars, Defendants require the Tipped Employee

to forfeit fifteen percent (15%) of the transaction amount to them. Stated another way, if a

customer gives a Tipped Employee 100 Delilah Dollars as a tip (thinking the value of the tip is

$100.00) and the Tipped Employee wishes to exchange that money for U.S. currency, the Tipped

Employee will only receive $85.00 from Defendants, as management will keep the remaining

$15.00 tip.

117.

Plaintiff and members of the Classes were subjected to this inappropriate tip

skimming tactic by Defendants.

22

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 26 of 37

118.

Because Plaintiff was required to share her tips with management, Defendants tip

pool arrangement is invalid. Accordingly, Plaintiff and members of the Classes are owed all tips

provided to management and the full minimum wage for every hour worked.

Defendants Uniform Policy Drove Tipped Employees Pay Below The Minimum Wage

119.

Tipped Employees are also required to bear the costs of such overhead expenses

as uniforms.

120.

As set forth above, Defendants required its Tipped Employees to purchase corsets

(the employer-mandated uniform).

121.

As a consequence of the foregoing, the Tipped Employees pay rate for the pay

period in which the uniform was purchased fell below the mandated minimum wage.

122.

In essence, Defendants illegally foisted their ordinary business expense, the

uniforms, onto Plaintiff and the other Tipped Employees.

123.

Due to Defendants practices Tipped Employees have been deprived of payments

to which they are entitled.

124.

Defendants have been unjustly enriched to the detriment of the Classes and

Subclasses by: (i) requiring Tipped Employees to reimburse Defendants for its business losses;

(ii) requiring Tipped Employees to reimburse Defendants for its ordinary business expenses; (iii)

paying Tipped Employees less than the mandated minimum wage while failing to comply with

the requirements for doing so; and (iv) inappropriate requiring Tipped Employees to forfeit a

portion of their tips.

125.

Evidence generally reflecting the number of uncompensated hours worked by

Tipped Employees is in the possession of Defendants.

126.

While Plaintiff is unable to state at this time the exact amount owed to the

23

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 27 of 37

Classes, Plaintiff believes that such information will become available during the course of

discovery. Irrespective of the foregoing, when an employer fails to keep complete and accurate

time records, employees may establish the hours worked solely by their testimony and the

burden of overcoming such testimony shifts to the employer. See Anderson v. Mt. Clemens

Pottery Co., 328 U.S. 680 (1946).

127.

Upon information and belief, the failure to comply with the tip notification

requirements and participation in the mandated illegal tip pool occurred at each of Defendants

Clubs.

CLASS & COLLECTIVE ACTION ALLEGATIONS

128.

Plaintiff brings this action on behalf of the Nationwide Collective Class as a

collective action pursuant to 29 U.S.C. 207 and 216(b). Plaintiff also brings this action as a

class action pursuant to Fed.R.Civ.P. 23 on behalf of themselves and the PA Class for claims

under the PA State Laws.

129.

The claims under the FLSA may be pursued by those who opt-in to this case

pursuant to 29 U.S.C. 216(b). The claims brought pursuant to the PA State Laws may be

pursued by all similarly-situated persons who do not opt out of the PA Class pursuant to

Fed.R.Civ.P. 23.

130.

Upon information and belief, the members of each of the Classes are so numerous

that joinder of all members is impracticable. While the exact number of the members of these

Classes is unknown to Plaintiff at this time, and can only be ascertained through appropriate

discovery, Plaintiff believes there are over a hundred individuals in each of the Classes.

131.

Defendants have acted or have refused to act on grounds generally applicable to

the Classes, thereby making final injunctive relief or corresponding declaratory relief with

respect to the Classes as a whole, appropriate.

24

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 28 of 37

132.

The claims of Plaintiff are typical of the claims of the Classes she seeks to

represent. Plaintiff and the members of the Classes work or have worked for Defendants and

were subject to the same compensation policies and practices, including not being compensated

for all hours worked.

133.

Common questions of law and fact exist as to the Classes that predominate over

any questions only affecting them individually and include, but are not limited to, the following:

(i)

whether Tipped Employees were required to work off-the-clock;

(ii)

whether Defendants improperly retained any portion of a Tipped

Employees tips;

(iii)

whether Defendants were precluded from claiming the tip credit during the

period encompassed by this Complaint;

(iv)

whether Defendants have failed to pay minimum wages for each hour

(v)

whether Defendants utilized an impermissible tip pool arrangement;

(vi)

whether forcing the Tipped Employees to indemnify Defendants for their

worked;

ordinary business losses due to walk outs is permissible;

(vii)

whether Plaintiff and members of the Classes are entitled to compensatory

damages, and if so, the means of measuring such damages;

(viii) whether Plaintiff and members of the Classes are entitled to restitution;

and

(ix)

134.

whether Defendants are liable for attorneys fees and costs.

Plaintiff will fairly and adequately protect the interests of the Classes as her

interests are in alignment with those of the members of the Classes. Plaintiff has no interests

25

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 29 of 37

adverse to the class she seeks to represent, and have retained competent and experienced counsel.

135.

The class action/collective action mechanism is superior to other available

methods for a fair and efficient adjudication of the controversy. The damages suffered by

individual members of the Classes may be relatively small when compared to the expense and

burden of litigation, making it virtually impossible for members of the Classes to individually

seek redress for the wrongs done to them.

136.

Plaintiff and the Classes she seeks to represent have suffered and will continue to

suffer irreparable damage from the illegal policy, practice and custom regarding Defendants pay

practices.

137.

Defendants have engaged in a continuing violation of the FLSA and PA State

Laws.

FIRST CLAIM FOR RELIEF

FAIR LABOR STANDARDS ACT MINIMUM WAGE VIOLATIONS

(On Behalf of the Nationwide Collective Class)

138.

Plaintiff, on behalf of herself and the Nationwide Collective Class, re-alleges and

incorporate by reference the paragraphs above as if they were set forth again herein.

139.

At all relevant times, Defendants have had gross revenues in excess of

$500,000.00.

140.

At all relevant times, Defendants have been and continue to be, an employer

engaged in interstate commerce, within the meaning of the FLSA, 29 U.S.C. 206(a) and

207(a).

141.

At all relevant times, Defendants have employed, and/or continue to employ,

Plaintiff and each of the Nationwide Collective Class Members within the meaning of the FLSA.

142.

Pursuant to Defendants compensation policies, rather than pay Tipped

Employees the federally-mandated minimum wage, Defendants took a tip credit and paid Tipped

26

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 30 of 37

Employees only the tip-credit wage.

143.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of requiring Tipped Employees to surrender a portion of their tips to

Defendants to cover cash shortages and walk outs.

144.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of requiring Tipped Employees to participate in an impermissible tip

pool arrangement.

145.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of failing to satisfy the notification requirements in order for

Defendants to claim the tip credit.

146.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of requiring Tipped Employees to work off-the-clock. When this

time is properly accounted for, Tipped Employees were paid less than the required cash

component of the tip credit.

147.

As a result of the Defendants willful practices, Defendants were not entitled to

pay Plaintiff and the members of the Nationwide Collective Class less than the mandated

minimum wage for all hours worked.

148.

Defendants have violated and, continue to violate, the FLSA.

149.

The foregoing conduct, as alleged, constitutes a willful violation of the FLSA

within the meaning of 29 U.S.C. 255(a).

150.

Due to Defendants FLSA violations, Plaintiff, on behalf of herself and the

members of the Nationwide Collective Class, are entitled to recover from the Defendants,

compensation for unpaid wages; an additional equal amount as liquidated damages; and

27

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 31 of 37

reasonable attorneys fees and costs and disbursements of this action, pursuant to 29 U.S.C.

216(b).

SECOND CLAIM FOR RELIEF

PENNSYLVANIA MINIMUM WAGE ACT MINIMUM WAGE VIOLATIONS

(On Behalf of the PA Class)

151.

Plaintiff, on behalf of herself and the members of the PA Class, re-alleges and

incorporate by reference the paragraphs above as if they were set forth again herein.

152.

At all relevant times, Defendants have employed, and/or continue to employ,

Plaintiff and each of the PA Class Members within the meaning of the PMWA.

153.

Pursuant to Defendants compensation policies, rather than pay Tipped

Employees the Pennsylvania mandated minimum wage, Defendants improperly took a tip credit

and paid Tipped Employees at a rate well below the Pennsylvania minimum wage.

154.

Pursuant to Defendants compensation policies, rather than pay Tipped

Employees the required minimum wage in Pennsylvania, Defendants took a tip credit and paid

Tipped Employees only the tip-credit wage.

155.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of requiring Tipped Employees to surrender a portion of their tips to

Defendants to cover cash shortages and walk outs.

156.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of failing to satisfy the notification requirements in order for

Defendants to claim the tip credit.

157.

At relevant times in the period encompassed by this Complaint, Defendants have

a willful policy and practice of requiring Tipped Employees to work off-the-clock. When this

time is properly accounted for, Tipped Employees were paid less than the required cash

28

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 32 of 37

component of the tip credit.

158.

As a result of Defendants willful practices, Defendants were not entitled to claim

the tip credit and pay Plaintiff and the members of the PA Class less than the Pennsylvania

minimum wage for all hours worked.

159.

Defendants have violated and, continue to violate, the PMWA.

160.

Due to the Defendants violations, Plaintiff, on behalf of herself and the members

of the PA Class, are entitled to recover from Defendants the amount of unpaid minimum wages,

attorneys fees, and costs.

THIRD CLAIM FOR RELIEF

PENNSYLVANIA WAGE PAYMENT COLLECTION LAW

(On Behalf of the PA Class)

161.

Plaintiff, on behalf of herself and the members of the PA Class, re-alleges and

incorporate by reference the paragraphs above as if they were set forth again herein.

162.

At all relevant times, Defendants have employed, and/or continue to employ,

Plaintiff and each of the PA Class Members within the meaning of the WPCL.

163.

Pursuant to the WPCL, Plaintiff and the members of the PA Class were entitled to

receive all compensation due and owing to them on their regular payday.

164.

As a result of Defendants unlawful policies, Plaintiff and the members of the PA

Class have been deprived of compensation due and owing.

165.

Further, due to Defendants policy of deducting amounts from the tips of Plaintiff

and the PA Class to offset business losses/expenses, Plaintiff and the PA Class were subject to

improper deductions from their compensation.

166.

Plaintiff, on behalf of herself and the members of the PA Class, are entitled to

recover from Defendants the amount of unpaid compensation, and an additional amount of 25%

29

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 33 of 37

of the unpaid compensation as liquidated damages.

FOURTH CLAIM FOR RELIEF

PENNSYLVANIA COMMON LAW UNJUST ENRICHMENT

(On Behalf of the PA Class)

167.

Plaintiff, on behalf of herself and the PA Class Members, re-alleges and

incorporate by reference the paragraphs above as if they were set forth again herein.

168.

Plaintiff and the members of the PA Class were employed by Defendants within

the meaning of the PA State Laws.

169.

At all relevant times, Defendants had a willful policy and practice of denying

Tipped Employees their full share of gratuities.

170.

During the Class Period covered by this Complaint, Plaintiff and Tipped

Employees were subjected to unlawful deductions from their gratuities.

171.

Defendants retained the benefits of its unlawful deductions from the gratuities

from Plaintiff and Tipped Employees under circumstances which rendered it inequitable and

unjust for Defendants to retain such benefits.

172.

Further, Defendants retained the benefits of inappropriately requiring Plaintiff and

Tipped Employees to purchase unique uniforms, thereby off-setting what would otherwise be an

ordinary business expense for Defendants. The purchase of these unique uniforms resulted from

the unlawful deductions from the gratuities of Plaintiff and Tipped Employees under

circumstances which rendered it inequitable and unjust for Defendants to retain such benefits.

173.

Defendants were unjustly enriched by subjecting Plaintiff and Tipped Employees

to such unlawful deductions.

174.

As direct and proximate result of Defendants unjust enrichment, Plaintiff and the

members of the PA Class have suffered injury and are entitled to reimbursement, restitution, and

disgorgement from Defendants of the benefits conferred by Plaintiff and the PA Class.

30

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 34 of 37

175.

Plaintiff, on behalf of herself and the members of the PA Class, are entitled to

reimbursement, restitution, and disgorgement of monies received by Defendants.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff, individually and/or on behalf of herself and all other similarly

situated members of the Nationwide Collective Class and members of the PA Class:

A.

Designation of this action as a collective action on behalf of the Nationwide

Collective Class, and prompt issuance of notice pursuant to 29 U.S.C. 216(b), apprising them of

the pendency of this action, and permitting them to assert timely FLSA claims in this action by

filing individual Consents to Sue pursuant to 29 U.S.C. 216(b);

B.

Designation of the action as a class action under Fed.R.Civ.P. 23 on behalf of the

PA Class;

C.

Designation of Plaintiff as representative of the Nationwide Collective Class and

the PA Class;

D.

Designation of Plaintiffs counsel as class counsel for the Nationwide Collective

Class and the PA Class;

E.

A declaratory judgment that the practices complained of herein are unlawful

under the FLSA, PMWA, and PWPCL;

F.

An injunction against Defendants and their officers, agents, successors,

employees, representatives and any and all persons acting in concert with it, as provided by law,

from engaging in each of the unlawful practices, policies and patterns set forth herein;

G.

An award of unpaid minimum wages to Plaintiff and the members of the Classes;

H.

An award of unpaid overtime wages to Plaintiff and the members of the Classes;

I.

Restitution of wages and gratuities improperly retained by Defendants;

J.

An award of liquidated damages to Plaintiff and members of the Classes;

31

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 35 of 37

K.

An award of costs and expenses of this action together with reasonable attorneys

and expert fees to Plaintiff and members of the Classes; and

L.

Such other and further relief as this Court deems just and proper.

DEMAND FOR TRIAL BY JURY

Pursuant to Rule 38(b) of the Federal Rules of Civil Procedure, Plaintiff hereby demands

a trial by jury on all questions of fact raised by the complaint.

Date: August 21, 2015

Respectfully submitted,

KALIKHMAN & RAYZ, LLC

Arkady Eric Rayz, Esquire

Demetri A. Braynin, Esquire

1051 County Line Road, Suite A

Huntingdon Valley, PA 19006

Telephone: (215) 364-5030

Facsimile: (215) 364-5029

E-mail: erayz@kalraylaw.com

E-mail: dbraynin@kalraylaw.com

CONNOLLY WELLS & GRAY, LLP

Gerald D. Wells, III, Esquire

Robert J. Gray, Esquire

2200 Renaissance Blvd., Suite 308

King of Prussia, PA 19406

Telephone: (610) 822-3700

Facsimile: (610) 822-3800

Email: gwells@cwg-law.com

Email: rgray@cwg-law.com

Counsel for Plaintiff and the Proposed Class

32

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 36 of 37

EXHIBIT A

Case 2:15-cv-04776-CDJ Document 1 Filed 08/21/15 Page 37 of 37

CONSENT TO BECOME A PARTY PLAINTIFF

1.

I, Carlee Costello, consent to sue as a Plaintiff in this action, pursuant to the Fair Labor

Standards Act of 1938, as amended, 29 U.S.C. 201 et seq.

2.

During the applicable period, I was an employee of Defendants and was not paid the

mandated minimum wage for all hours worked.

3.

By my signature below, I hereby authorize counsel to prosecute the claims in my name

and on my behalf, in this action, for Defendants' improper use of a tip credit and failure to pay minimum

wages as required under federal law.

~A'2l.8:: (Yt C,osJEU,(J

Date

ame

Você também pode gostar

- Dru CtorDocumento13 páginasDru Ctorchristoofar2190Ainda não há avaliações

- Complaint - CeramTec GMBH V C5 Medical Werks LLCDocumento13 páginasComplaint - CeramTec GMBH V C5 Medical Werks LLCDarius C. GambinoAinda não há avaliações

- Valeri v. Mystic IndustriesDocumento34 páginasValeri v. Mystic IndustriesPriorSmartAinda não há avaliações

- Lambert Appeal 2014Documento4 páginasLambert Appeal 2014Stan J. CaterboneAinda não há avaliações

- Harcum CollegeDocumento17 páginasHarcum CollegeJaredAinda não há avaliações

- LNV Corporation vs. Catherine GebhardtDocumento20 páginasLNV Corporation vs. Catherine Gebhardtbealbankfraud100% (2)

- Godinger ComplaintDocumento25 páginasGodinger ComplaintSarah BursteinAinda não há avaliações

- Phillips V NACS National Attorney Collection Services Inc FDCPA Civil Cover SheetDocumento2 páginasPhillips V NACS National Attorney Collection Services Inc FDCPA Civil Cover SheetghostgripAinda não há avaliações

- Idaho 2Documento2 páginasIdaho 2JamesMurtaghMD.comAinda não há avaliações

- Emory1 6Documento1 páginaEmory1 6JamesMurtaghMD.comAinda não há avaliações

- Riad v. LW Wireless, Inc. Et Al 2.13-Cv-02596 Doc 1 Filed 13 May 13Documento41 páginasRiad v. LW Wireless, Inc. Et Al 2.13-Cv-02596 Doc 1 Filed 13 May 13scion.scionAinda não há avaliações

- 002 - 140417 Gucci Lawsuit - Civil Cover SheetDocumento2 páginas002 - 140417 Gucci Lawsuit - Civil Cover SheetBob GinelAinda não há avaliações

- Complaint Pollick V Kimberly ClarkDocumento30 páginasComplaint Pollick V Kimberly ClarkLara PearsonAinda não há avaliações

- Jarrett v. Life Lock, Kanye West - Insane Pro Se ComplaintDocumento13 páginasJarrett v. Life Lock, Kanye West - Insane Pro Se ComplaintMark JaffeAinda não há avaliações

- 1 - ComplaintDocumento26 páginas1 - ComplaintSarah BursteinAinda não há avaliações

- Defense Distributed v. U.S. Department of State - Civil Cover SheetDocumento2 páginasDefense Distributed v. U.S. Department of State - Civil Cover SheetjoshblackmanAinda não há avaliações

- Riad V Smith Et Al 2.13-Cv-02696 Doc 1 Filed 17 May 13Documento36 páginasRiad V Smith Et Al 2.13-Cv-02696 Doc 1 Filed 17 May 13scion.scion100% (1)

- Silver State Intellectual Technologies v. Google Et. Al.Documento2 páginasSilver State Intellectual Technologies v. Google Et. Al.PriorSmartAinda não há avaliações

- Uber Fair Credit Class ActionDocumento20 páginasUber Fair Credit Class Actionjeff_roberts881Ainda não há avaliações

- Brandon Tate-Brown's Federal LawsuitDocumento43 páginasBrandon Tate-Brown's Federal LawsuitPhiladelphiaMagazineAinda não há avaliações

- Real News Project Dba WhoWhatWhy v. Dickert Complaint PDFDocumento18 páginasReal News Project Dba WhoWhatWhy v. Dickert Complaint PDFMark JaffeAinda não há avaliações