Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review For Sept 30, 2014 (Result)

Enviado por

Shyam SunderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review For Sept 30, 2014 (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

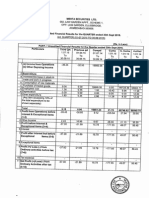

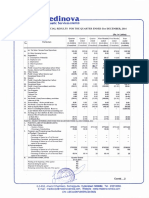

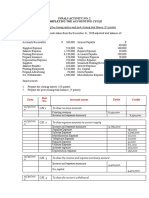

Tam~nadu

Jai Bharath Mills Umited

212, Ramasamy

ARUPPUKOTTAIStatement

- - -95.69

of Standalone

I Consolidated

Unaudited

Nagar

626159

Results

. 3 Months Ended

PARTPublic

I

21.53

21.53

2

21.53

1.53

150.60

31774746

335.59

3

376.43

240.81

1

4.00

86.64

2358.47

2358.47

440.62

381.15

879.31

308.94

148.85

953

244.87

4434.86

278.65

60.27

2717.67

21.53

535.82

Nil

8009990

20.13

Nil

8019090

34.00

15565646

93.60

187.59

Nil

8019090

8012490

20.14

374.20

8019090

Nil

20.16

778.46

20.13

297.75

193.67

820.05

30.09.2013

30.06.2014

Year

2358.47

3978.47

4915.10

79.87

100

100

66.00

404.39

58.25

266.41

1139.00

1796.55

615.58

6

452.76

2793.22

100

79.86

142.77

6.00

79.84

100

592.37

195.75

Other

41.9323.68

255.82

229.21

175.12

311.91

4.90

18.55

759.78

23.38

4659.28

2971.2

2535.72

1413.83

2306.51

1461.77

4122.95

9057.43

5627.12

Non

-encumbered

31772246

75.12

8009990

Nil

104.09

75.48

6 Months

Ended

3978.47

2358.47

21.53

15565646

31765646

500.24

295.01

79.87

114.74

100

80.71

2618.10

8297.65

1509.43

PARTICULARS

OFReserve

SHAREHOLDING

PARTICULARS

IRs.in

Lakhsl

Finance

Costs

2121.88

2121.88

30.09.2014

30:09.2013

31.03.2014

Reserve

-(279.99)

Capital

Shareholding

Exceptional

items

Pledge

/234.11

Encumbered

activities

(74.83)

(83.40)

(223.26)

ProfiU(Loss)

(Unaudited)

from

(Audited)

operations

before

other

Expenses

(391.96)

(315.75)

Profit

Tax

Expenses:Deferred

(72.74)

(318.95)

Tax

Asset

before

tax

(7+8) 2041.17

Earnings

per

share

(after

&Ended

before

extraordinary

items)

(10.65)

Unaudited)

(Unaudited)

(unaudited)

Paid-up

equity

share

capital

Income

from

(871.05)

operations

(534.74)

I/Income

(Loss)

from

ordinary

after

finance

31774746

Net

Profit

/(1.18\

(Loss)

from

ordinary

activities

after

tax

Promoters

and

Promoter

Group

Shareholding

(0.20\

(0.31)

(0.18)

(0.56)

(0.02\

A

1iii)

6(d)

13

12

(a)Rs10/

Basic

&of

Diluted

promoter

company)

Percentage

group)

income,

finance

costs

and

exceptional

Cost

of

materials

consumed

i) (of

Number

a)

each)

(not

annualised):

(Increase)

Employee

benefits

/shares

Decrease

expense

(c)

Changes

inshares

inventories

finished

goods,

costs

butof

before

exceptional

items (5+6)

items

(a)

Net

(1-2)

Sales

/Income

fromof

operations

Total income from operations

(net)

for the Quarter

and 6 Months

Ended

30.09.2014

"

For TAMlNAOO

IN BHARATH

lI.lS LTD.

61)

,~

Particulars3 month ended 30/09/2014

INVESTOR COMPLAINTS

uarter

s09.2014

unds

Pond;", " beg;"";",

of~, q~""

Nil

Nil

Nil

Rsinlakhs

-0

As at

(Un

audited)

2961.08

51.56

985.11

10.21

3978.47

239.86

202.82

1161.26

4637.34

4236.89

114.55

9860.33

4169.39

435.75

3164.92

853.58

4361.24

4371.45

3.

Provision

851.54

Deferred

Tax

will

be

considered

on 10,030.90

246.07

1420.66

3480.83

31.03.2014

33.20

14.11.2014

5623.44

5752.41

2821.17

1161.26

ASSETS

Cotton

Yarn.

4278.49

494.84

2819.23

5093.38

5083.17

As

atfor

"Company

3978.47

3434.55

1527.14

Chennai

298.29

126.65

9860.33

10030.90

130.05

EQUITY

AND

(Audited)

LIABILITIES

For

Tamilnadu

Jai

Bharath

Mills

Ltd.,

reclassified

whereever

necessary.

6.

Previous

year

figures

have

been

regrouped

5.

Provision

for

MAT

not

arise

pursuant

to

business

segment

namely

manufacturing

ofand

4.

The

in

a768.13

single

primary

4.The

Aruppukottai

Advances

from

does

Shri

not

Ramalinga

carry

interest

Mills

as14.11.2014

Ltd

per

Committee

and

approved

by

the

Board

of (3,210.34

1.

The

above

results

were

reviewed

by

the

Audit

by

the

Auditor

of

the

company.

1.74

10.21

Directors

atoperates

its

meeting

held

on

Managing

Director

235.73

296.06

(3126.93)

,,;,

Standalone

Statement

ofdoes

Assets

and

Liabilities

1 Shareholder's

funds

(a) Fixed assets

115JB

of the

I.T.Act.

Annual

Basis.

2.Sec

The

financial

results

were made "Limited Review"

mutual

agreement.

e '"

The Stock Exchange-Mumbai,

Phiroze Jeejeebhoy Towers,

Dalal Street, Fort,

MUMBAI - 400 021.

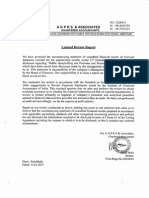

We have reviewed the accompanying statement of unaudited financial results of

TAMILNADU JAI BHARATH MILLS LIMITED, 212, Ramasamy Nagar, Aruppukottai

for the period ended

30th

September 2014 except for the disclosures regarding 'Public

Shareholding' and 'Promoter and Promoter Group Shareholding' which have been

traced from disclosures made by the management and have not been audited by us.

This statement is the responsibility of the Company's Management and has been

approved by the Board of Directors/Committee of Board of Directors. Our responsibility

is to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review

Engagement (SRE) 2400, engagement to Review Financial Statements issued by the

Institute of Chartered Accountants of India. This standard requires that we plan and

perform the review to obtain moderate assurance as to whether the financial statements

are free of material misstatement. A review is limited primarily to inquires of company

personnel and analytical procedures applied to financial data and thus provides less

assurance than and audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that

causes us to believe that the accompanying statement of unaudited financial results

prepared

in accordance

with

applicable

Accounting

Standards

and other

recognised accounting practices and policies has not disclosed the information required

to be disclosed in terms of Clause 41 of the Listing Agreement including the manner in

which it is to be disclosed, or that it contains any material misstatement.

FOR KRISHNAN & RAMAN

CHARTERED ACCOUNTANTS

Você também pode gostar

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For March 31, 2014 (Result)Documento5 páginasFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento7 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Ainda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Independent Auditor'S Report: - Ruthu Ravi 1922156 4 Bba F&A (B)Documento9 páginasIndependent Auditor'S Report: - Ruthu Ravi 1922156 4 Bba F&A (B)Kalyani JayakrishnanAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- WWW Weizmann Co inDocumento154 páginasWWW Weizmann Co inKashish PurohitAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento3 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Revised Financial Results For Sept 30, 2015 (Result)Documento3 páginasRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Equrasdec 2022Documento7 páginasEqurasdec 2022Utpal PalAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- VAT Audit Manual Maharashtra STD October 2007Documento75 páginasVAT Audit Manual Maharashtra STD October 2007Digambar ManeAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For March 31, 2014 (Audited) (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For March 31, 2014 (Audited) (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Annual Report 2016 17 NewDocumento79 páginasAnnual Report 2016 17 Newsabey22991Ainda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018No EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Ainda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocumento25 páginasPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Part 1 - Introduction To Accounting BasicsDocumento4 páginasPart 1 - Introduction To Accounting BasicsBaldrAinda não há avaliações

- Closing EntriesDocumento23 páginasClosing EntriesLeonabelle Yago DawitAinda não há avaliações

- DCW Ltd. - Annual Report - 2004-2005Documento44 páginasDCW Ltd. - Annual Report - 2004-2005kayalonthewebAinda não há avaliações

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocumento9 páginasBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverAinda não há avaliações

- QuickBooks 2014 The Missing ManualDocumento1.129 páginasQuickBooks 2014 The Missing ManualCesar Mendoza100% (3)

- SOP Arshdeep Singh, UelDocumento3 páginasSOP Arshdeep Singh, Uelcosmo worldAinda não há avaliações

- University of Kerala: Regulation, Scheme and SyllabusDocumento98 páginasUniversity of Kerala: Regulation, Scheme and SyllabusyogeshAinda não há avaliações

- Linkedin-Skill-Assessments-Quizzes - Accounting-Quiz - MD at Main Ebazhanov - Linkedin-Skill-Assessments-Quizzes GitHubDocumento15 páginasLinkedin-Skill-Assessments-Quizzes - Accounting-Quiz - MD at Main Ebazhanov - Linkedin-Skill-Assessments-Quizzes GitHubAnkit RajAinda não há avaliações

- Far Dec 11Documento12 páginasFar Dec 11Trisha Kaira RodriguezAinda não há avaliações

- Asset Recognition and Operating Assets: Fourth EditionDocumento55 páginasAsset Recognition and Operating Assets: Fourth EditionAyush JainAinda não há avaliações

- AccountingDocumento8 páginasAccountingYaredAinda não há avaliações

- CA Notes1Documento30 páginasCA Notes1jeyoon13Ainda não há avaliações

- ACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFDocumento7 páginasACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFnixn135Ainda não há avaliações

- Advanced Accounting UpdatesDocumento113 páginasAdvanced Accounting UpdatesYash KediaAinda não há avaliações

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Documento3 páginasNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- AIS Chapter 1Documento46 páginasAIS Chapter 1Ma. Elene MagdaraogAinda não há avaliações

- Bharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015Documento1 páginaBharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015L'express MauriceAinda não há avaliações

- BP - AkuntansiDocumento73 páginasBP - AkuntansiUlin HsbAinda não há avaliações

- Accounting 1 Study Guide-Review ActivityDocumento15 páginasAccounting 1 Study Guide-Review ActivityKenver RegisAinda não há avaliações

- Entrepreneurship Module-7Documento27 páginasEntrepreneurship Module-7Marianne Grace SainzAinda não há avaliações

- Maryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Documento3 páginasMaryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Hasnain BhuttoAinda não há avaliações

- Chapter 6 Lecture Slides 9eDocumento44 páginasChapter 6 Lecture Slides 9ecolinmac8892Ainda não há avaliações

- Sreedhar's CCE - Institute For Competitive and Entrance ExamsDocumento2 páginasSreedhar's CCE - Institute For Competitive and Entrance Examssaigoptri5Ainda não há avaliações

- Handbook of Frauds Scams and Swindles PDFDocumento414 páginasHandbook of Frauds Scams and Swindles PDFswathivishnuAinda não há avaliações

- PAPS-1000Ph Revised FinalDocumento11 páginasPAPS-1000Ph Revised FinalNigelT.LeeAinda não há avaliações

- Interim Financial ReportingDocumento3 páginasInterim Financial ReportingHalina ValdezAinda não há avaliações

- Job Costing System for Pisano Company TITLE Accounting Press Job Costing HomeworkDocumento2 páginasJob Costing System for Pisano Company TITLE Accounting Press Job Costing HomeworkYogie YaditraAinda não há avaliações

- JS 145 NXT With RB Kit and AC CabinDocumento1 páginaJS 145 NXT With RB Kit and AC CabinvikasAinda não há avaliações

- CH 06Documento40 páginasCH 06lalala010899Ainda não há avaliações