Escolar Documentos

Profissional Documentos

Cultura Documentos

Week 6 Tutorial Questions

Enviado por

Jess XueDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Week 6 Tutorial Questions

Enviado por

Jess XueDireitos autorais:

Formatos disponíveis

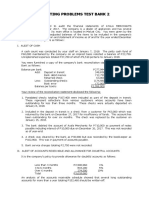

Chapter 09 - Interest Rate Risk II

Week 6 Tutorial Solutions

Chapter 9

7.

A six-year, $10,000 CD pays 6 percent interest annually and has a 6 percent yield to

maturity. What is the duration of the CD? What would be the duration if interest were paid

semiannually? What is the relationship of duration to the relative frequency of interest

payments?

12.

How is duration related to the interest elasticity of a fixed-income security? What is the

relationship between duration and the price of the fixed-income security?

13.

You have discovered that the price of a bond rose from $975 to $995 when the yield to

maturity fell from 9.75 percent to 9.25 percent. What is the duration of the bond?

14.

A 10-year, 10 percent annual coupon, $1,000 bond trades at a yield to maturity of 8 percent.

The bond has a duration of 6.994 years. What is the modified duration of this bond? What

is the practical value of calculating modified duration? Does modified duration change the

result of using the duration relationship to estimate price sensitivity?

16.

Calculate the duration of a two-year, $1,000 bond that pays an annual coupon of 10 percent

and trades at a yield of 14 percent. What is the expected change in the price of the bond if

interest rates fall by 0.50 percent (50 basis points)?

18. Suppose you purchase a six-year, 8 percent coupon bond (paid annually) that is priced to

yield 9 percent. The face value of the bond is $1,000.

a. Show that the duration of this bond is equal to five years.

b. Show that if interest rates rise to 10 percent within the next year and your investment

horizon is five years from today, you will still earn a 9 percent yield on your

investment.

c. Show that a 9 percent yield also will be earned if interest rates fall next year to 8

percent.

19.

Suppose you purchase a five-year, 15 percent coupon bond (paid annually) that is priced to

yield 9 percent. The face value of the bond is $1,000.

a. Show that the duration of this bond is equal to four years.

b. Show that if interest rates rise to 10 percent within the next year and your investment

horizon is four years from today, you will still earn a 9 percent yield on your

investment.

Chapter 09 - Interest Rate Risk II

c. Show that a 9 percent yield also will be earned if interest rates fall next year to 8

percent.

20.

Consider the case in which an investor holds a bond for a period of time longer than the

duration of the bond, that is, longer than the original investment horizon.

a. If interest rates rise, will the return that is earned exceed or fall short of the original

required rate of return? Explain.

b. What will happen to the realized return if interest rates decrease? Explain.

22.

If an FI uses only duration to immunize its portfolio, what three factors affect changes in

the net worth of the FI when interest rates change?

23.

Financial Institution XY has assets of $1 million invested in a 30-year, 10 percent

semiannual coupon Treasury bond selling at par. The duration of this bond has been

estimated at 9.94 years. The assets are financed with equity and a $900,000, two-year, 7.25

percent semiannual coupon capital note selling at par.

a. What is the leverage adjusted duration gap of Financial Institution XY?

b. What is the impact on equity value if the relative change in all market interest rates is a

decrease of 20 basis points? Note: The relative change in interest rates is R/(1+R/2) =

-0.0020.

c. Using the information calculated in parts (a) and (b), what can be said about the desired

duration gap for the financial institution if interest rates are expected to increase or

decrease.

d. Verify your answer to part (c) by calculating the change in the market value of equity

assuming that the relative change in all market interest rates is an increase of 30 basis

points.

e. What would the duration of the assets need to be to immunize the equity from changes

in market interest rates?

27.

Assume that a goal of the regulatory agencies of financial institutions is to immunize the

ratio of equity to total assets, that is, (E/A) = 0. Explain how this goal changes the desired

duration gap for the institution. Why does this differ from the duration gap necessary to

immunize the total equity?

29.

In general, what changes have occurred in the financial markets that would allow financial

institutions to restructure their balance sheets more rapidly and efficiently to meet desired

goals? Why is it critical for an FI manager who has a portfolio immunized to match a

desired investment horizon to rebalance the portfolio periodically? What is convexity?

Why is convexity a desirable feature to capture in a portfolio of assets?

Chapter 09 - Interest Rate Risk II

30.

A financial institution has an investment horizon of two years 9.33 months (or 2.777 years).

The institution has converted all assets into a portfolio of 8 percent, $1,000, three-year

bonds that are trading at a yield to maturity of 10 percent. The bonds pay interest annually.

The portfolio manager believes that the assets are immunized against interest rate changes.

a. Is the portfolio immunized at the time of bond purchase? What is the duration of the

bonds?

b. Will the portfolio be immunized one year later?

c. Assume that one-year, 8 percent zero-coupon bonds are available in one year. What

proportion of the original portfolio should be placed in these bonds to rebalance the

portfolio?

Você também pode gostar

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)No EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Nota: 4.5 de 5 estrelas4.5/5 (5)

- (Bank of America) Understanding Mortgage Dollar RollsDocumento18 páginas(Bank of America) Understanding Mortgage Dollar RollsJay Kab100% (2)

- Adapt (FM1)Documento28 páginasAdapt (FM1)SumaiyyahRoshidiAinda não há avaliações

- JadeDocumento3 páginasJadeLucky LuckyAinda não há avaliações

- Finance 100 PS 2Documento3 páginasFinance 100 PS 2AJ SacksAinda não há avaliações

- BUS288 Test Practice QuestionsDocumento9 páginasBUS288 Test Practice QuestionsJayden Vincent0% (1)

- Valuation of Bonds and SharesDocumento45 páginasValuation of Bonds and SharessmsmbaAinda não há avaliações

- 1Documento6 páginas1sufyanbutt0070% (1)

- CT1 Assignment Chapter 14Documento5 páginasCT1 Assignment Chapter 14Gaurav satraAinda não há avaliações

- Hw2 2020Documento4 páginasHw2 2020AnDy YiMAinda não há avaliações

- R55 Understanding Fixed-Income Risk and Return Q BankDocumento20 páginasR55 Understanding Fixed-Income Risk and Return Q BankAhmedAinda não há avaliações

- Investments Practice ProblemsDocumento2 páginasInvestments Practice ProblemselsaifymAinda não há avaliações

- Problem On Maturity GapDocumento4 páginasProblem On Maturity GapRoohani WadhwaAinda não há avaliações

- Understanding Fixed-Income Risk and ReturnDocumento19 páginasUnderstanding Fixed-Income Risk and ReturnHassan100% (1)

- FM212 Highlights - LSE 2013Documento18 páginasFM212 Highlights - LSE 2013xanhnonchuoi100% (1)

- Exercises On Bond Portfolio StrategiesDocumento7 páginasExercises On Bond Portfolio Strategiesmuzi jiAinda não há avaliações

- Valuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers BelowDocumento7 páginasValuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers Belowevivanco1899Ainda não há avaliações

- Week 2 ProblemsDocumento4 páginasWeek 2 Problemsbjh1234517% (6)

- Merged Seminar SheetsDocumento19 páginasMerged Seminar SheetsCharlieAinda não há avaliações

- Bond ExercisesDocumento1 páginaBond ExercisesElsa EstrellitaAinda não há avaliações

- Problem Set CouponDocumento2 páginasProblem Set CouponClaudia ChoiAinda não há avaliações

- Given Data: P TK 1075 Coupon Rate 9% Coupon Interest 9% / 2 1000 TK 45 Time To Maturity, N 10Documento4 páginasGiven Data: P TK 1075 Coupon Rate 9% Coupon Interest 9% / 2 1000 TK 45 Time To Maturity, N 10mahin rayhanAinda não há avaliações

- Tutorial 3 - Bond - QuestionDocumento3 páginasTutorial 3 - Bond - QuestionSHU WAN TEHAinda não há avaliações

- Bond PortfolioDocumento17 páginasBond PortfolioanuragAinda não há avaliações

- SampleQuestions Finance 1Documento9 páginasSampleQuestions Finance 1YiğitÖmerAltıntaşAinda não há avaliações

- AoF Tutorial02 SpotDocumento3 páginasAoF Tutorial02 SpotSeebsAinda não há avaliações

- Bond MarketDocumento4 páginasBond Marketeunice.mazigeAinda não há avaliações

- Bond ManagementDocumento4 páginasBond ManagementMarchAugustAinda não há avaliações

- R06 The Time Value of Money Q BankDocumento19 páginasR06 The Time Value of Money Q BankTeddy JainAinda não há avaliações

- Chapter 16: Fixed Income Portfolio ManagementDocumento20 páginasChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianAinda não há avaliações

- Chapter 4 - MinicaseDocumento4 páginasChapter 4 - MinicaseMuhammad Aditya TMAinda não há avaliações

- Corporate Finance Academic Year 2011-2012 TutorialsDocumento21 páginasCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- Bonds Valuation 2017 STUDocumento4 páginasBonds Valuation 2017 STUAnissa GeddesAinda não há avaliações

- FINA556 hw1Documento3 páginasFINA556 hw1RajAinda não há avaliações

- Valuation of BondsDocumento30 páginasValuation of BondsRuchi SharmaAinda não há avaliações

- Swap Derivatives: Forward Swaps and SwaptionsDocumento74 páginasSwap Derivatives: Forward Swaps and Swaptionsvineet_bmAinda não há avaliações

- Midterm Exam - Answer Key: Professor Salyer, Economics 135, Spring 2009Documento2 páginasMidterm Exam - Answer Key: Professor Salyer, Economics 135, Spring 2009kasimAinda não há avaliações

- Chapter 7. Bonds and Their Valuation: A B C D E F G H I 1 2 3 4Documento13 páginasChapter 7. Bonds and Their Valuation: A B C D E F G H I 1 2 3 4Naufal IhsanAinda não há avaliações

- Price Will Be Less Affected by A Change in Interest Rates If It Has Been Outstanding A Long TimeDocumento6 páginasPrice Will Be Less Affected by A Change in Interest Rates If It Has Been Outstanding A Long TimeghanaAinda não há avaliações

- Handout 2Documento3 páginasHandout 2Anu AmruthAinda não há avaliações

- V1 - 20140410 FRM-2 - Questions PDFDocumento30 páginasV1 - 20140410 FRM-2 - Questions PDFIon VasileAinda não há avaliações

- Bbmf2023 Principle of Investment Tutorial 1: Introduction To InvestmentDocumento9 páginasBbmf2023 Principle of Investment Tutorial 1: Introduction To InvestmentKÃLÅÏ SMÎLĒYAinda não há avaliações

- 1 What Is A Difference Between A Forward Contract and A Future ContractDocumento6 páginas1 What Is A Difference Between A Forward Contract and A Future ContractAlok SinghAinda não há avaliações

- Debt ExerciseDocumento5 páginasDebt ExerciseGiang Truong ThuyAinda não há avaliações

- Problems To Be Solved in ClassDocumento4 páginasProblems To Be Solved in ClassAlp SanAinda não há avaliações

- Bonds Test 1Documento7 páginasBonds Test 1dfvybgunimAinda não há avaliações

- FINC 620 - ScorpionsDocumento3 páginasFINC 620 - ScorpionsparaagagrawalAinda não há avaliações

- ch8 From InvestmentsDocumento32 páginasch8 From InvestmentsMitchell GriffinAinda não há avaliações

- Assignment For Internal Assesment: Fixed Income SecuritiesDocumento2 páginasAssignment For Internal Assesment: Fixed Income SecuritiesKomal ShashwatAinda não há avaliações

- Tutorial 3Documento5 páginasTutorial 3KÃLÅÏ SMÎLĒYAinda não há avaliações

- Chapter 2 TB - Long Term Liabilities StudentsDocumento7 páginasChapter 2 TB - Long Term Liabilities StudentsMohammed Al-ghamdiAinda não há avaliações

- FIN4002 LQ 2122s2Documento15 páginasFIN4002 LQ 2122s2YMC SOEHKAinda não há avaliações

- Investments Exercise 12Documento4 páginasInvestments Exercise 12Vilhelm CarlssonAinda não há avaliações

- 3 Interest Rate Risk IIDocumento64 páginas3 Interest Rate Risk IIHamza KhaliqAinda não há avaliações

- Institute of Business Management: 1 Assignment - Summer 2021Documento2 páginasInstitute of Business Management: 1 Assignment - Summer 2021Osama JawedAinda não há avaliações

- POI Tutorial 3Documento5 páginasPOI Tutorial 31 KohAinda não há avaliações

- Investments Exercise 3Documento3 páginasInvestments Exercise 3Vilhelm CarlssonAinda não há avaliações

- Chapter 5: Bond: BY: PN Azlida Binti AbdullahDocumento44 páginasChapter 5: Bond: BY: PN Azlida Binti Abdullahazlida abdullahAinda não há avaliações

- Tutorial 1 Bond ValuationDocumento2 páginasTutorial 1 Bond Valuationtai kianhongAinda não há avaliações

- Questions, Anwers Chapter 22Documento3 páginasQuestions, Anwers Chapter 22basit111Ainda não há avaliações

- ExercisesDocumento12 páginasExercisesTôn AnhAinda não há avaliações

- Chapter Seven Risks of Financial IntermediationDocumento15 páginasChapter Seven Risks of Financial IntermediationOsan JewelAinda não há avaliações

- Week 4 Tutorial QuestionsDocumento5 páginasWeek 4 Tutorial QuestionsJess XueAinda não há avaliações

- Tutorial 2 SolDocumento2 páginasTutorial 2 SolJess Xue100% (1)

- Science Show FinalDocumento17 páginasScience Show FinalJess XueAinda não há avaliações

- Chords Relative To CapoDocumento2 páginasChords Relative To CapoJess XueAinda não há avaliações

- ENT PS Unit3 Lesson3 FinalDocumento28 páginasENT PS Unit3 Lesson3 FinalVince Romyson VenturaAinda não há avaliações

- Auditing Problems Test Bank 2Documento15 páginasAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Taller Monitoria Exame FinalDocumento4 páginasTaller Monitoria Exame FinalFelipeAinda não há avaliações

- CME Group Daily Bulletin GlossaryDocumento2 páginasCME Group Daily Bulletin GlossaryavadcsAinda não há avaliações

- SDM Mergerd FileDocumento175 páginasSDM Mergerd FileAnjali BhatiaAinda não há avaliações

- AE10 - Chapter 10 ReportingDocumento30 páginasAE10 - Chapter 10 ReportingMacalandag, Angela Rose100% (1)

- Commerce Questions 1 2Documento90 páginasCommerce Questions 1 2Johnson NjasotehAinda não há avaliações

- Avinash Kapoor Branding and Sustainable Competitive Advantage Building Virtual Presence 2011Documento295 páginasAvinash Kapoor Branding and Sustainable Competitive Advantage Building Virtual Presence 2011Annamaria KozmaAinda não há avaliações

- MKT 233 - Mother MurphysDocumento12 páginasMKT 233 - Mother Murphysapi-302016339Ainda não há avaliações

- Long-Lived AssetsDocumento4 páginasLong-Lived AssetsbluemajaAinda não há avaliações

- Accounting Hawk - MADocumento21 páginasAccounting Hawk - MAClaire BarbaAinda não há avaliações

- Bad CVDocumento3 páginasBad CVTalent MuparuriAinda não há avaliações

- Day Fin309 Assignment 1Documento9 páginasDay Fin309 Assignment 1Patrick ChibabulaAinda não há avaliações

- Case Study - Coca Cola and Nike.Documento3 páginasCase Study - Coca Cola and Nike.Jayanth ReddyAinda não há avaliações

- WK 2 Audit Responsibilities and ObjectivesDocumento96 páginasWK 2 Audit Responsibilities and ObjectivesKEITH WONG KANE YOUNGAinda não há avaliações

- Chapter 6 - Designing and Managing ServicesDocumento22 páginasChapter 6 - Designing and Managing Servicesmyvo2201Ainda não há avaliações

- Sip Project NishaDocumento70 páginasSip Project Nishashinde abhijeetAinda não há avaliações

- Chapter 2Documento34 páginasChapter 2Hazel AlimAinda não há avaliações

- Investment Analysis and Stock Market OperationsDocumento45 páginasInvestment Analysis and Stock Market Operationssurabhi24jain4439100% (1)

- Examination Question and Answers, Set A (True or False), Chapter 1 - Introduction To Accounting and BusinessDocumento2 páginasExamination Question and Answers, Set A (True or False), Chapter 1 - Introduction To Accounting and BusinessJohn Carlos DoringoAinda não há avaliações

- Theories of International BusinessDocumento15 páginasTheories of International Businessmaakesh75% (4)

- Stress Testing at Major Financial Institutions:: Survey Results and PracticeDocumento46 páginasStress Testing at Major Financial Institutions:: Survey Results and Practicebing mirandaAinda não há avaliações

- Introduction To Retailing by Sumit ChangesDocumento118 páginasIntroduction To Retailing by Sumit Changesshaswat ghildiyalAinda não há avaliações

- Group10 OperationsDocumento12 páginasGroup10 OperationsKumar SaurabhAinda não há avaliações

- Liquidity Management in Janatha Credit Co-Operative Society LTDDocumento6 páginasLiquidity Management in Janatha Credit Co-Operative Society LTDInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Market Efficiency LecturesDocumento23 páginasMarket Efficiency Lecturesdev27Ainda não há avaliações

- AfsDocumento2 páginasAfsAtiq ur Rahman0% (2)

- Auto Callable TESLADocumento4 páginasAuto Callable TESLAchandkhand2Ainda não há avaliações