Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Enviado por

Shyam SunderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

suRr &

co

CHARTERED ACCOUNTANTS

Branches : Coirnbatore, Madurai, Coonoor,

Trivandrum, Kochf, Bangatore

No.4, Chevaliar Shivaji Ganesan Salai,

(South Boag Road),T Nagar,

Chennai - 600 O17

Ph : 044 24341140

I 243411so

Faxz O44 24341170

To

AW NATURAL PRODUCTS LIMITED

NO. 60, RUKMANI LAKSHMIPATHY SALAI,

EGMORE, CHENNAI 600 OO8

Limited Review Report

FOR THE SECOND qTR

& HALF YEAR

ENDED

30th

SEPTEMBER

2014

We have reviewed the accompanying statement of Un-audited Financial Resutts of AW NATURAL

PRODUCTS LIMITED ,NO. 60, RUKMANI LAKSHMIPATHY SALAI, EGMORE, CHENNAI 600 008 for the period

ended 30th September 2014 except for the disctosures regarding "Pubtic Sharehotding" and "Promoter

and Promoter Group Sharehotding" which have been traced from disctosures made by the management

and have not been audited by us. This statement is the responsibility of the Company's management

and has been approved by the Board of Directors, at their meeting hetd on 20/10/2014. Our

responsibility is to issue a report on these financial statements based on our review.

We have conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

"Engagements to review

financial statements" issued by the lnstitute of Chartered Accountants of

lndia. This standard requires that we ptan and perform the review to obtain moderate assurance as to

whether the financial statements are free of materiat misstatement. A review is timited primarity to

inquiries of company personne[ and anatytica[ procedures apptied to financial data and thus provides

less assurance than an audit. We have not performed an audit and accordingly, we do not express an

audit opinion.

Based on our review conducted as above, nothing has come

to our attention that causes us to believe

unaudited financiaI resutts prepared in accordance with

appticabte accounting standards and other recognised accounting practices and poticies has not

disclosed the information required to be disctosed in terms of clause 41 of the Listing Agreement

inctuding the manner in which it is to be disctosed, or that it contains any material misstatement

that the

a.ccompanying statement

Place: CHENNAI

Date:20/1012014

of

For SURI & CO

Chartered

AVT NATT]RAL PRODUCTS LIMITED

Regd.Office: 50,

Telefax : (+91) 44

28584142

Rukmi

Lakhmipathy Salai, Egmore Chemai - 600 008

mail : avtnpl@avtnatural.corL

Web:

wwwavtnatural.com, CIN

: L15142TN19g5pLC0127g0.

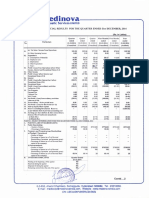

UNAUDITED FINANCIAL RESULTS FOR THE SECOND QUARTER ENDED 3O'hSEPTEMBER 2OI4

(Rs. in Lakhs

Partieulars

SI

Three Months Ended

No

30.09.2014

30.06.20t4

Six Months Ended

30.09.2013

30.09.2014

(Un-Audited)

1

Net Sales /Ilcome from Operations

505s

9026

Year Ended

30.09.2013

31

(Un-Audited)

6262

p78A

14081

C

27109

Expenditure

a. Changes in Inventories ofFinished Goods, Work-in-Progress &

Stock -in-tmde

b. Cost of Materials Consmed

(91.2:,

3034

c. Purchase of Stock in Trade

2483

Qen

1.571

(276)

(686

2535

2592

5569

5772

11625

21.

29

23

668

805

572

7473

1211

2145

e. Power and Fuel

448

340

387

788

680

1511

f. Depreciation & Arnodisation Expenses

137

128

108

265

21.6

462

g. Other Expendihre

9s1

803

113

L754

191.5

4678

433s

7lt{

4375

1T449

8918

19t2

1887

2632

3862

126

10

136

846

1922

1890

2768

3869

d. Employee Benefits Expenses

Total Expenditure

3

Profit from Operations before other income & finance cost

Ofter lncome

Profit before finance cost and Exceptional Items (3 + 4)

Finmce Cost

6'1.

ProfiU (Loss) Before Tax

785

Iax Expenses

- Cunent Tax

- Defened Tax

.03.2014

(Audited)

Net Profit i (Loss) after Taxes

720

Paid up Equity Share Capital - (Face value Re.

ll

Reserves excluding Revaluation Reserues

l2

Basic md Diluted EPS (not annualised) - Rs.

l/-

each)

19758

7357

360

7717

10

24

71.

45

1912

1866

2697

3824

7614

251.0

97

234

631.

599

865

1252

10

10

10

l0

1257

1822

2562

5103

1s23

1523

541

t0

1.523

t28t

7523

L523

1.523

1

5755

0.36

0.84

0.83

1.20

7.68

3.35

39090900

39090900

39090900

39090900

39090900

39090900

A PARTICULARS OF SHAREHOLDING

1

Public shareholding

- Number of shares

- Percentage of shareholding

25.67

25.67

25.61

25.67

25.67

Nil

Nil

Nil

Nil

Nit

Nil

Nil

Nil

Nil

Nil

Nil

Nit

Nil

Nil

Nil

Nil

Nil

Nil

113193r00

113193100

113193100

113193100

113193100

113193100

25.67

homoters and promoter goup Shareholding

a. Pledged / Encmbered

- Nmber of shues

- Percentage ot shares (as a 7o ol total shareholdng ot

promoter & promoter gloup)

- Percentage

ofshil;

(as a %

ofthe total

share capital

ofthe

company)

b. Non-encumbered

- Number of shares

- Percentage ofshares (as a

o/o

oftotal shareholding of

promoter & prornoter group)

- Percentage ofshare (as a % ofthe total share capital ofthe

company)

INVESTOR COMPLAINTS

Pending at the begiming of the quarter

100

100

100

100

r00

100

74.33

74.33

74.33

74.33

74.33

74.33

Quarter ended 30.09.2014

Nil

Received dumg the quarter

Nil

Disposed ofduring the quarter

Nil

Remaining umesolved at the end ofthe quarter

Nil

STATEMENT OF ASSETS & LIABILITIES

Particulars

(Rs. in Lakhs)

Six months

Year

ended

ended

(Unaudited)

(Audited)

30.09.2014

31.03.20r4

A EQUITY AND LIABILITIES

Shareholders Funds:

(a) Share Capital

1523

1521

(b) Reserves and Surplus

Sub-total - Shareholders' funds

t7

57i

5755

r910(

t17277

454

444

t Non-Current Liabilities

(a) Long Term Bonowings

(b) Deferred Tax Liabilities (Net)

(c) Long Term Provisions

Sub{otal - Non-Current I-iabilities

3

r06

106

56(

55(

Current Liabilities

(a) lhort Term Bonowings

348(

(b) Irade Payables

200(

(c) Jther cunent liabilities

(d) lhort Term Provisions

Sub-total - Current Liabilities

TOTAL - EQUITY AND LIABILITIES

200t

uJ

13(

3829

371(

943(

s861

2909(

23694

B ASSETS

Non-current

assets

(a) Fixed Assets

5280

501 A

(b) Non-current investments

785

754

(c) Long term Loans and Advances

130

Sub-total - Non-Current Assets

.,

Current

102

587(

6195

assets

(a) Current Investments

3616

I 51:

(b) lnventories

9721

803r

(c) Trade receivables

4856

3921

(d) Cash and bank balances

(e) Short Term Loans & Advances

(0 Other Current Assets

bJ/

15t

3l3t

4028

37

6i

Sub-total - Current Assets

22894

17821

TOTAL - ASSETS

2909(

23694

Nots

1. The Company operates pnmdly in Solvent Extracted products. Therefore, segment reporting is not applicable.

2. Previous penod's figures have been regouped wherever necessary to conform to cunent period's classification.

3. The above results were reviewed by the Audit Committee and approved at the meeting ofthe Board ofDirectors ofthe company

held on 20-' October 2014,

4. Pusuant to the Notification dated 29th August 2014 issued by MCA, the Company is in the process ofobtaining technical advice

to ascertain the useful life and calculation ofdepreciation on assets. Hence Depreciation has been charged on the basis ofthe

useful life ofthe assets which was adopted till FY 2013-14.

5. The Statutory auditors have carried out a Limited Review ofthe above Financial results

Place: Chennai

Date:2oeoctober2ol4

AJITTHOMAS

CHAIRMAN

Você também pode gostar

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Documento5 páginasAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For March 31, 2014 (Result)Documento5 páginasFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Documento4 páginasFinancial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento11 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Documento4 páginasFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Documento3 páginasFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Result)Documento13 páginasFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Ainda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- 2015 Saln FormDocumento3 páginas2015 Saln FormROSALINDA LATOAinda não há avaliações

- Restructuring of FCCBs - Global Absolute - Raj Rajinder Singh NegiDocumento9 páginasRestructuring of FCCBs - Global Absolute - Raj Rajinder Singh NegiAnkit JainAinda não há avaliações

- Five Cs of Credit: CreditworthinessDocumento3 páginasFive Cs of Credit: CreditworthinessSakshi Singh YaduvanshiAinda não há avaliações

- Week12 1 Comm MLODocumento8 páginasWeek12 1 Comm MLOVivianAinda não há avaliações

- HW1 LawsDocumento8 páginasHW1 LawsJocelyn Monceller100% (1)

- Pag-IBIG housing loan application formDocumento2 páginasPag-IBIG housing loan application formVenus Vanessa MartinezAinda não há avaliações

- Sisi's Egypt: Building Political Legitimacy Amidst Economic CrisesDocumento8 páginasSisi's Egypt: Building Political Legitimacy Amidst Economic CrisesCrown Center for Middle East StudiesAinda não há avaliações

- AssignmentDocumento8 páginasAssignmentSundas MashhoodAinda não há avaliações

- An Answered Prayer: RTP (November 2009 - IPCC)Documento19 páginasAn Answered Prayer: RTP (November 2009 - IPCC)Keshav TutejaAinda não há avaliações

- ZopaDocumento13 páginasZopaprashaant4uAinda não há avaliações

- DEDS - Office Circular - 16-17 PDFDocumento33 páginasDEDS - Office Circular - 16-17 PDFPravin NamokarAinda não há avaliações

- NABARDDocumento1 páginaNABARDNitin PatelAinda não há avaliações

- MBL Exam Schedule Dec2013Documento4 páginasMBL Exam Schedule Dec2013Sooraj SubramanianAinda não há avaliações

- UndoingProperty PDFDocumento133 páginasUndoingProperty PDFMadi Mofid100% (1)

- Hand Book On Real EstateDocumento82 páginasHand Book On Real EstateSuresh SharmaAinda não há avaliações

- IFRS and US GAAP - Key DifferencesDocumento17 páginasIFRS and US GAAP - Key DifferenceswriterlakshmivAinda não há avaliações

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocumento10 páginasMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionShawon ShanAinda não há avaliações

- Mozal ProjectDocumento12 páginasMozal ProjectKumar PrashantAinda não há avaliações

- Talking Economics Digest (Jan-June 2014)Documento31 páginasTalking Economics Digest (Jan-June 2014)IPS Sri LankaAinda não há avaliações

- Foreign Currency Deposit Act (Ayn Ruth Notes)Documento3 páginasForeign Currency Deposit Act (Ayn Ruth Notes)Ayn Ruth Zambrano Tolentino100% (1)

- Pawnshop in The PhilippinesDocumento9 páginasPawnshop in The PhilippinesPRINTDESK by Dan100% (2)

- Banking menu options documentDocumento63 páginasBanking menu options documentNCSASTRO80% (5)

- Constructive Fulfillment - Joint & Solidary ObligationsDocumento8 páginasConstructive Fulfillment - Joint & Solidary ObligationsLebene SantiagoAinda não há avaliações

- AOI and BL of XXXXXDocumento21 páginasAOI and BL of XXXXXNeil RiveraAinda não há avaliações

- Pre-Owned Vehicle Auction ListingDocumento22 páginasPre-Owned Vehicle Auction ListingNicasio AllonarAinda não há avaliações

- New Companies Act 2013 Solved With ChartsDocumento36 páginasNew Companies Act 2013 Solved With ChartsRam IyerAinda não há avaliações

- Mock Bar Examination in Land Title and DeedsDocumento9 páginasMock Bar Examination in Land Title and DeedsalbemartAinda não há avaliações

- Public Private PartnershipDocumento38 páginasPublic Private PartnershipOver_ci100% (2)

- ARIIX Enrollment PacksDocumento2 páginasARIIX Enrollment PacksSalomon DiazAinda não há avaliações

- 001 VOL 1B Pasvi 19 03 19Documento89 páginas001 VOL 1B Pasvi 19 03 19Dhaval ParmarAinda não há avaliações