Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)

Enviado por

Shyam SunderTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

VISHVPRABHA TRADING LIMITED

CIN:L51900MH1985PLC034965

R6gd, Office; Warden House, 340. J,J. Road. BycuUa, Mumbill40Q 008.

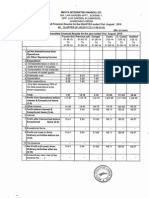

AUDITED FINANCIAL RESULTS FOR THE QUARTER AND VEAR ENDED 31ST MARCH 2015

(Rupees in Thousands)

is',

Particulars

Quarter Ended

!

1

1

2

31,12,2014

31,03,2014

31,03,2015

(Audited)

(Unaudited)

(Audited)

(Audited)

{ajNDt Salesflncome from OperatIon

(b)~!her Opc-rating_ In~ome

2S

94

Total Income

25

94

9.

99

E,II,Vl.1wJllwe

(a) (Increase)jDecresso In

(b) Other Expenditure

Year Ended

31,03,2015

$tockjn~Trade

72

40

40

(47)

54

72 ;

(ell Total

~~~:~:;;;

419

17S

419

179

39

3.

2aS

154

285

154 :

134

25

(Any Item exceeding 10% of the total

I

:

expendlwreto be shown seperatefy]

Profit from OperatlOn$ I)efore Other Income,

Interest & Exceptional Items (1-2)

Otl1er Income

Profit before Interest & ExceptionalltQms {3+4}

Interest

Profit after Interest but bcfol'O Exceptional

Itams

i 9

60

(47)

60

134

54

00

Profit (+)/Loss (-) from Ordinary Activities

147)

b&fo~~,,~~~_ ft~~J

10 Tax Expenses

after tax

54

60

11 Net Ptofit i+)/LO$$ H from Ordinary Activities

54

(56)

. _.

26

134

(5~)

Exceptlonalltems

25

147)

64

134

25

15

15

45

125

10

45

125

10

2,450

2,450

2,460

2,942

2,317 !

{9~10}

12 Extra Ordinery Items (Net of Tax Expenses)

13 Net Profit (+) I loss (.) for the period (11w12)

(56)

(Faca Value R$.1(i/ per $hare)

54

2,450

14 Paid-up equ1ty share capttal

2,450 :

.',

15 Reserves excluding Revaluation Reserves

as per Ba!ance Sheet of previous Ale year

16 Earning Per Share (EPS)

(3) Basic and diluted SPS before Extraordinary

10,23)

0,22

0,18

(0,23)

0,22

0,18

0.51

1,631150

66,59

1,63,150

1,63,150

66.59

136.59

1,83,150

88,59

0.51 !

0.04

items for the period for the year to date & for

the previous year (not to be annualized)

(h) Basic and diluted EPS after Extraordinary

0,04

items fOt the period for the year to date & for

the previous year (not to be annualfzed)

17 Public Share Holding

~

Number of Shares

Percentage of Shareholding

1,63,150

66.59

18 Promoters and promoter group Shareholdlng

a) PiedgedfEncumbered

- Number of shares

~

Percentage of shares (as a % of the total

share-holding of promoter and promoter

group)

- Percentage of shares (as a % of the total

shara capItal of Ule company)

b) Non-encumbered

~

Number of shares

Percentage of shares (ali< a % of the total

shareho!dlng of promoter and promot&r

i

81,850 '

81,850

100,00

100,00

group)

- Percentage of shares (as a % of the tolal

share capital of the company)

33.41

i

33,41 i

61,650

100,00

81,850

81,850

100,00

100.00

33.41

3:\,41

33.41

r\j\~V~

~)g) ~

.. (" $

ff

OJ

) liu\?"\

"("-J~

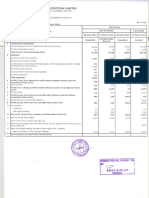

STATEMENT OF ASSETS AND LIABILITIES AS ON 31ST MARCH, 2015

(Rupees In Thousands)

SR.

PARTICULARS

NO.

AS AT

31103/2015

(Audited)

AS AT

31/0312014

(Audited)

EQUITY AND LIABILITIES

1

Share Holde,..' Fund

(a) Share Capital

2,450

2,450

(b) Reserves & Surplus

2.942

2,817 ;

Sub Total Share Holder's Fund

5,392

5,267

20

20

20

20

5,287

2 Current Liabilities

,(a) Trade Payable

Sub Total Current Liabilities

TOTAL EQUITY AND LIABILITIES

B

5.412

ASSETS

1 Non..current Assets

(a) Non-Current Investments

(b) Long Term Loans And Advances

4,112

23

1,567

3,007 .

i

Sub Total ~ Non-Current Assets

2 Current Assets

4,135

(a) Current Investments

B10

(a) Inventories

4,574

426

426

(b) Cash and Bank Balance

41

287

Sub Total- Current Assets

1,277

5,412

713

5,287

TOTAL ASSETS

Notes;

1

2

3

4

5

6

The above results were taken on record by the Board of Directors of the Company at its meeting herd on 26.05.2015

Previous period's figures have been regrouped/rearranged wherever necessary.

The company Is a single segment company in accordance with AS17 (Segment Reporting) issued by the ICAI.

Thera is no material tax effect of timing dIfference based on the estimated computation for a reasonable perIod,

hence there is no provision for deferred tax in terms of AS ~22.

The figures of last quarter are the balancing figures between audited figures in respect of the full financial year

and the published year to date figures upte the third quarter of the current financial year.

No Jnvestor complaints were received during the quarter ended 31.03.2015

For VISHVPRABHA TRADING LIMITED

Place: Mumbai

Dated: 26.05.2015

I. G. Naik & Co.

Chartered Accountants

M.COM., LLB., EC.A.

Independent Auditnr's Report on Limited Review of the Audited Financial Results of the company

for the Quarter and Year ended 31"March 2015.

To the Board ofDirectors

Vishvprabba Trading Limited

Warden House, 340, lJ. Road,

Byculla, Mumbai - 400 008

We have reviewed the accompanying statement of Audited financial results ("the Statement") of

Vishvprabha Trading Limited for the quarter and year ended 31" March, 2015, except for the

disclosures regarding "Public Sbareholding" and "Promoter and Promoter Group shareholding" which

have been traced from disclosures made by the management and have not been audited by us. This

Statement is the responsibility of the Company's Management and has been approved by the Board of

Directors/Committee of the Board of Directors. Our responsibility is to issue a report on these financial

results based on our review.

We conducted our review of the Statement in accordance with the Standard on Review Engagements

(SRE) 2410, Review of Interim Financial Infbnnation performed by the Independent Auditor of the

Entity, issued by the Institute of Chartered Accountants oflndia. This Standard requires that we plan and

perfonn the review to obtain moderate assurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of Company personnel and analytical

procedures applied to financial data and thus provide less assurance than an audit. We have not performed

an audit and accordingly we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe that

the accompanying Statement of audited financial results prepared in accordance with the applicable

accounting standards referred to in Section 211 (3C ) of the Companies Act, 1956 and other recognized

accounting practices and policies has not disclosed the infonnation required to be disclosed in terms of

Clause 41 of the Listing Agreements with stock exchanges including the manner in which it is to be

disclosed, or that it contains any material misstatement.

Place: Mumbai

Date: 26.05.2015

For I.G. Naik & Co.

Chartered Accountauts

Fir Registl'otiQnNo.106810W

r.G. NaIk

Proprietnr

Membership No. 034504

Chandrama, 2nd Floor, 21. Kalanagar, Bandra (E).. Mumbai - 400 051.

Tel.: +912226591851 Fax: +91 2226408898 Mobile: .91 9820149972

Email: ign1953@gmail.com

Você também pode gostar

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For March 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For March 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Documento3 páginasFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento15 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Documento4 páginasFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento12 páginasStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2012 (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderAinda não há avaliações

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Documento4 páginasAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Documento3 páginasAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento2 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento5 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento4 páginasStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento7 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento8 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento10 páginasStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNota: 5 de 5 estrelas5/5 (5)

- Statement of Cash Flows: Preparation, Presentation, and UseNo EverandStatement of Cash Flows: Preparation, Presentation, and UseAinda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Ainda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionAinda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Cost Control Measures and Profitability of Vitafoam Nigeria PLCDocumento8 páginasCost Control Measures and Profitability of Vitafoam Nigeria PLCInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Preparing The AIP and APPDocumento18 páginasPreparing The AIP and APPHelen Joy Grijaldo JueleAinda não há avaliações

- Imitations of Inancial Tatements 12: Balanced Scorecard Not Only Reports The Traditional Measures of Financial PerDocumento2 páginasImitations of Inancial Tatements 12: Balanced Scorecard Not Only Reports The Traditional Measures of Financial PerNicolas AliasAinda não há avaliações

- Types of Technical Writing For BusinessDocumento7 páginasTypes of Technical Writing For BusinessJane Ericka Joy MayoAinda não há avaliações

- British Land 2015Documento202 páginasBritish Land 2015lizAinda não há avaliações

- DBD Accounting ManualDocumento47 páginasDBD Accounting ManualFarrukh TouheedAinda não há avaliações

- CoVerified Pitch DeckDocumento11 páginasCoVerified Pitch Deckchetan pandeyAinda não há avaliações

- Accounting Principles and ConceptsDocumento31 páginasAccounting Principles and ConceptskunyangAinda não há avaliações

- Acc 102 - Module 3aDocumento12 páginasAcc 102 - Module 3aPatricia CarreonAinda não há avaliações

- Auditing NotesDocumento9 páginasAuditing NotesShubham Khess100% (1)

- Arthur Andersen's Fall From Grace Is A Sad Tale of Greed and Miscues - WSJDocumento7 páginasArthur Andersen's Fall From Grace Is A Sad Tale of Greed and Miscues - WSJasda asdaAinda não há avaliações

- GMP Audit ChecklistDocumento10 páginasGMP Audit Checklistmrshojaee100% (5)

- Accounting Ethics and The Professional Accountant: The Case of GhanaDocumento7 páginasAccounting Ethics and The Professional Accountant: The Case of GhanaDavid SumarauwAinda não há avaliações

- Agility in Audit Could Scrum Improve The Audit Process2018current Issues in AuditingDocumento22 páginasAgility in Audit Could Scrum Improve The Audit Process2018current Issues in AuditingMama MamamaAinda não há avaliações

- Imran ProfileDocumento1 páginaImran ProfileImran SaleemAinda não há avaliações

- Final Test - EY - Q - 3.19.2018Documento23 páginasFinal Test - EY - Q - 3.19.2018KHUÊ TRẦN ÁI100% (2)

- Drill Chapter 1: Notre Dame of Midsayap CollegeDocumento5 páginasDrill Chapter 1: Notre Dame of Midsayap CollegeMarites AmorsoloAinda não há avaliações

- CITN Study Pack - Financial and Tax AnalysisDocumento282 páginasCITN Study Pack - Financial and Tax AnalysisOguntimehin Adebisola75% (4)

- Audit Evidence and Audit Documentation Nature and Types Audit EvidenceDocumento4 páginasAudit Evidence and Audit Documentation Nature and Types Audit EvidenceCattleyaAinda não há avaliações

- Isa 706Documento12 páginasIsa 706Md. fahimAinda não há avaliações

- PICPA Audit Guide For Small and Medium-Sized Practitioners: List of ExhibitsDocumento51 páginasPICPA Audit Guide For Small and Medium-Sized Practitioners: List of ExhibitsShyrine Ejem100% (2)

- Road Safety Audit in Denmark: Lárus Ágústsson Civ. Eng., M. Sc. Danish Road Directorate Ministry of Transport - DenmarkDocumento15 páginasRoad Safety Audit in Denmark: Lárus Ágústsson Civ. Eng., M. Sc. Danish Road Directorate Ministry of Transport - DenmarkYogesh ShahAinda não há avaliações

- Kumar Mangalam Birla CommitteeDocumento24 páginasKumar Mangalam Birla CommitteeParas Gupta100% (1)

- 8e Ch3 Mini Case Client ContDocumento10 páginas8e Ch3 Mini Case Client Contaponic28100% (1)

- ACC311-Fundamental of Accounting MCQS Mega File Prepared by Brave Heart Innocent MishiiDocumento88 páginasACC311-Fundamental of Accounting MCQS Mega File Prepared by Brave Heart Innocent Mishiin_a852726Ainda não há avaliações

- OSHAD Audit en ApprovedDocumento44 páginasOSHAD Audit en ApprovedYousef OlabiAinda não há avaliações

- Payment Form: Kawanihan NG Rentas InternasDocumento2 páginasPayment Form: Kawanihan NG Rentas InternasLandsAinda não há avaliações

- Internal Auditing Role and IndependenceDocumento11 páginasInternal Auditing Role and IndependenceMhmd Habbosh100% (2)

- Managerial Accounting - Final PaperDocumento4 páginasManagerial Accounting - Final PaperMichelleHolyAinda não há avaliações