Escolar Documentos

Profissional Documentos

Cultura Documentos

Guide To Risk Benefit Charges - YoungStar Super Premium

Enviado por

manivannanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Guide To Risk Benefit Charges - YoungStar Super Premium

Enviado por

manivannanDireitos autorais:

Formatos disponíveis

HDFC SL YoungStar Super Premium

Guide to Mortality and Risk Benefit Charges

This section aims to make you understand what Mortality and Risk Benefit Charges in unit-linked products

are and how we compute them. There can be two types of risk benefit charges in our unit-linked products.

Each type is meant to charge for different types of cover you choose. They are (as defined by IRDA vide

Circular No. 032/IRDA/Actl/Dec-2005):

1.

Mortality Charge: This is the cost of life insurance cover. It is exclusive of any expense loadings

levied either by cancellation of units or by debiting the premium but not both. This charge may be

levied at the beginning of each policy month from the fund.

2.

Risk Benefit Charge: This is the cost of morbidity benefit offered to you like Extra Life Benefit. It is

exclusive of any expense loadings levied either by cancellation of units or by debiting the premium but

not both. This charge may be levied at the beginning of each policy month from the fund. This charge

will be taken in addition to the Mortality charge only in case youre covered for the benefit.

We compute the monthly charge for any benefit using the following formula:

Ch arg e amount Ch arg e Rate (attained age) *

Sum _ at _ Risk 1

*

1000

12

Here,

Charge Rate (attained age) = Charge Rate applicable for the month depending on the attained age of

the life assured on the day of calculation of charge amount

Sum at Risk = Value of the part of the risk benefit that the company is liable to pay if claim is reported.

We deduct these charges every month by de-allocating units proportionately from all funds that your

money is invested at the time of deduction of charge.

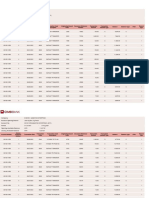

Rates (per 1000 sum at risk):

1. Charge Rate Extra Life Benefit

2. Charge Rate for Life and Health Option

Age

18

1

1.5847

2

2.6317

Age

40

1

2.5483

2

5.1493

Age

62

1

16.6597

2

33.1522

19

1.5974

2.6444

41

2.6877

5.5302

63

18.6757

36.2077

20

1.6227

2.6697

42

2.8019

5.8859

64

20.9324

39.4934

21

1.6481

2.7056

43

2.9540

6.3005

65

22.6694

42.3230

22

1.6734

2.7519

44

3.1441

6.7741

66

24.6220

23

1.7114

2.8109

45

3.3850

7.3300

67

27.5634

24

1.7369

2.8574

46

3.6513

7.9533

68

30.8345

25

1.7748

2.9163

47

3.9556

8.6356

69

34.4353

26

1.8129

2.9754

48

4.3106

9.4106

70

38.4165

27

1.8509

3.0344

49

4.7290

10.2700

71

42.7906

28

1.8762

3.0807

50

5.1855

11.2515

72

47.6212

29

1.8890

3.1355

51

5.6799

12.3129

73

52.9083

30

1.9017

3.1902

52

6.2505

13.5030

74

58.7278

31

1.9270

3.2575

53

6.8844

14.8089

75

65.1052

32

1.9524

3.3564

54

7.5691

16.2391

33

1.9904

3.4679

55

8.3425

17.8630

34

2.0411

3.6131

56

9.1920

19.6260

35

2.0919

3.7899

57

10.0287

21.4182

36

2.1552

4.0002

58

10.9416

23.3076

37

2.2312

4.2337

59

12.0447

25.4187

38

2.3200

4.5010

60

13.3506

27.7641

39

2.4215

4.8125

61

14.8847

30.3377

UIN: 101L068V02

HDFC SL YoungStar Super Premium

Notes

Mortality charge rates are guaranteed for the policy term.

Statutory Charges Service Tax & Education Cess is payable at the applicable rate on the Mortality

and the other Risk Benefit Charges.

We will be providing you information about how much we have deducted towards mortality and risk

benefit charges for your policy in the annual unit statement send to you after every policy anniversary.

It is important that you do not judge a unit linked plan solely on the basis of the risk benefit charges or any

other charge taken independently. Charges interact with each other. Thus, the key to understand the charges

of your plan and how they impact the maturity value of your policy is to look at the policy benefit

illustration.

Our certified Financial Consultant will be happy to explain the plan and the impact of charges in detail.

UIN: 101L068V02

Você também pode gostar

- Am611 InstallDocumento702 páginasAm611 InstallmanivannanAinda não há avaliações

- Claim Form IhealthcareDocumento5 páginasClaim Form IhealthcaremanivannanAinda não há avaliações

- Income Tax Calculator 2012-13Documento2 páginasIncome Tax Calculator 2012-13Cool Friend GksAinda não há avaliações

- Higher Algebra - Hall & KnightDocumento593 páginasHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- CommandDocumento1 páginaCommandmanivannanAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Taxation Law PDFDocumento295 páginasTaxation Law PDFEdu FajardoAinda não há avaliações

- Annex A.1 Checklist of Mandatory RequirementsDocumento1 páginaAnnex A.1 Checklist of Mandatory RequirementsJemila Paula DialaAinda não há avaliações

- Leases 2Documento3 páginasLeases 2John Patrick Lazaro Andres100% (1)

- Cips Fees - February 2019Documento2 páginasCips Fees - February 2019edd bazAinda não há avaliações

- Costing - M3M Atrium 57Documento2 páginasCosting - M3M Atrium 57Himanshu GodAinda não há avaliações

- Maceda v. Macaraig (1991) DigestDocumento3 páginasMaceda v. Macaraig (1991) DigestEunice IgnacioAinda não há avaliações

- Revised PF Withdrawal Form-19Documento3 páginasRevised PF Withdrawal Form-19Sukhveer SinghAinda não há avaliações

- Interim and Segment Reporting 2Documento3 páginasInterim and Segment Reporting 2JuvilynAinda não há avaliações

- Accomplishment Report 2021Documento9 páginasAccomplishment Report 2021Chacha CawiliAinda não há avaliações

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Documento12 páginas(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamAinda não há avaliações

- Account Current Question BankDocumento2 páginasAccount Current Question BankQuestionscastle Friend0% (1)

- Government Money: PaymentDocumento17 páginasGovernment Money: PaymentrickmortyAinda não há avaliações

- Chapter 10Documento17 páginasChapter 10kochanay oya-oyAinda não há avaliações

- Disbursement Voucher: Philippine Coast GuardDocumento1 páginaDisbursement Voucher: Philippine Coast GuardJona Jane VerdidaAinda não há avaliações

- W TCRL 2 Di 4 N 1 MujbzDocumento10 páginasW TCRL 2 Di 4 N 1 MujbzKiran KumarAinda não há avaliações

- Exhibition To Mango Bus Stop Jamshedpur 10032019 PDFDocumento3 páginasExhibition To Mango Bus Stop Jamshedpur 10032019 PDFvalencia mabenAinda não há avaliações

- TD WSS Units CSP的技术澄清 PDFDocumento179 páginasTD WSS Units CSP的技术澄清 PDFJindongRenAinda não há avaliações

- MKTG 361 Phase 2Documento9 páginasMKTG 361 Phase 2Sofia O'NeillAinda não há avaliações

- Payroll Workshop: Alaras, Arla Gabrielle (A0012)Documento15 páginasPayroll Workshop: Alaras, Arla Gabrielle (A0012)ellaine villafaniaAinda não há avaliações

- Company Account Opening Branch Account NoDocumento16 páginasCompany Account Opening Branch Account Nosaw hung yeatAinda não há avaliações

- 4th Year Syllabus TaxDocumento15 páginas4th Year Syllabus TaxnayhrbAinda não há avaliações

- 7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFDocumento6 páginas7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFanorith88Ainda não há avaliações

- Chapter1-Taxes and DefinitionsDocumento37 páginasChapter1-Taxes and DefinitionsSohael Adel AliAinda não há avaliações

- MG 3027 TAXATION - Week 8 Income From EmploymentDocumento44 páginasMG 3027 TAXATION - Week 8 Income From EmploymentSyed SafdarAinda não há avaliações

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocumento11 páginasABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- SPHM - Cashier HandbookDocumento14 páginasSPHM - Cashier HandbookSPHM HospitalityAinda não há avaliações

- Determination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentDocumento14 páginasDetermination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentLea ChermarnAinda não há avaliações

- Front Office CashDocumento4 páginasFront Office CashpranithAinda não há avaliações

- VAT On Down PaymentDocumento6 páginasVAT On Down Paymenthattabi2014Ainda não há avaliações

- Jeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Documento4 páginasJeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Jeremy CabilloAinda não há avaliações