Escolar Documentos

Profissional Documentos

Cultura Documentos

Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form No

Enviado por

fatmaaleahTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form No

Enviado por

fatmaaleahDireitos autorais:

Formatos disponíveis

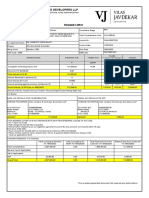

(To be filled up by the BIR)

DLN:

BCS No.

Republika ng Pilipinas

Kagawaran ng Pananalapi

PSIC:

BIR Form No.

Improperly Accumulated Earnings

Tax Return

Kawanihan ng Rentas Internas

For Corporations

1704

May 2001

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1

For the

2 Year Ended

( MM / YYYY )

Calendar

Fiscal

3 Amended Return?

Yes

Part I

TIN

Taxpayer's Name

7 0

Information

RDO Code

8 Line of Business/

Occupation

10 Registered Address

12 Date of Incorporation

(MM/DD/YYYY)

Part II

AT C

No

Background

No. of sheets attached

11 Zip Code

12A

Date of Registration with BIR

(MM/DD/YYYY)

Computation of Tax

12B

13 Taxable Income

13

14 Add: Income exempt from Tax

15

14A

14B

14C

14D

Income excluded from Gross Income

16

15A

15B

15C

15D

Income subject to Final Tax

17

16A

16B

16C

16D

Net Operating Loss Carry-over (NOLCO) deducted

17A

17B

18 Total (Sum of Item 13 and Item 17B)

19

18

Income tax paid/payable for the taxable year

19

20

Dividends actually or constructively paid/issued

20

21

Amount reserved for the reasonable needs of the business

Less:

(See Schedule I)

21A

21B

22 Improperly Accumulated Taxable Income (Item 18 less Item 21B)

22

23 Tax Rate

23

24 Improperly Accumulated Earnings Tax (Item 22 multiply by Item 23)

25

Add:

10%

24

Penalties

Surcharge

Interest

25A

Compromise

25B

25C

25D

26 Total Amount Payable (Sum of Item 24 and Item 25D)

26

We declare, under the penalties of perjury, that this return has been made in good faith, verified by us, and to the best of our knowledge and belief, is true

and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

27

28

President/Vice-President/Authorized Representative

(Signature over printed Name)

Treasurer/Asst. Treasurer/Authorized Representative

(Signature over printed Name)

Tax Agent

Tax Agent Accreditation No.

Community Tax Certificate Number

Date Issued

MM

DD

YYYY

Place of Issue

29

30

Part III

31

32

D e t a i l s of P a y m e n t

Date

Number

MM

DD

YYYY

Drawee Bank/

Particulars

Agency

33 Cash/Bank

Debit Memo.

34 Check

34A

34B

34C

35 Tax Debit

35A

Memo

36A

36B

36 Others

Amount

Amount

33

34D

35B

35C

36C

36D

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

Schedule I

Schedule of amount reserved for the reasonable needs of the business

(emanating from the covered year's taxable income)

Allowance for the increase in the accumulation of earnings

Stamp of Receiving

Office and

Date of Receipt

up to 100% of the paid-up capital

Paid-up Capital as of balance sheet date (covered year)

P

Less: Accumulated Retained Earnings as of previous year

Allowable increase considered as reasonable accumulation

Reserved for definite corporate expansion projects or programs

Reserved for building, plants or equipment acquisition

Reserved for compliance with any loan covenant or pre-existing

obligation established under a legitimate business aggreement

Earnings with legal prohibition against distribution

For subsidiaries of foreign corporations,

Earnings intended or reserved for investment within the Philippines

Total amount reserved for the reasonable needs of the business (To Item No. 21)

BIR FORM NO. 1704

Improperly Accumulated Earnings Tax (IAET) Return

Guidelines and Instructions

Você também pode gostar

- 1702q PDFDocumento2 páginas1702q PDFfloriza binadayAinda não há avaliações

- Bir-2550q 2007Documento1 páginaBir-2550q 2007Atashii Xenxi60% (5)

- 1601 CDocumento16 páginas1601 CROGELIO QUIAZON100% (1)

- Euv 1ST 2011 1701QDocumento6 páginasEuv 1ST 2011 1701QAdrian Raymnd EspirituAinda não há avaliações

- 1702-EX June 2013 Pages 1 To 2 PDFDocumento2 páginas1702-EX June 2013 Pages 1 To 2 PDFJulio Gabriel AseronAinda não há avaliações

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocumento1 páginaFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezAinda não há avaliações

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocumento26 páginasMonthly Remittance Return of Income Taxes Withheld On CompensationWinchelle Dimaapi ManalaysayAinda não há avaliações

- 1701qjuly2008 (ENCS)Documento5 páginas1701qjuly2008 (ENCS)Mary Rose AnilloAinda não há avaliações

- Bir Form 0608Documento2 páginasBir Form 0608Kram Ynothna BulahanAinda não há avaliações

- 2551QDocumento2 páginas2551QCris David Moreno79% (14)

- Kawanihan NG Rentas Internas: 27A 27B 27C 27D 28A 28B 28C 28DDocumento4 páginasKawanihan NG Rentas Internas: 27A 27B 27C 27D 28A 28B 28C 28DfatmaaleahAinda não há avaliações

- 1602Documento2 páginas1602Rhizz RamirezAinda não há avaliações

- 1702 QDocumento2 páginas1702 Qitik_usteAinda não há avaliações

- 82202BIR Form 1702-MXDocumento9 páginas82202BIR Form 1702-MXRen A EleponioAinda não há avaliações

- Bir Form 1702-RtDocumento8 páginasBir Form 1702-RtShiela PilarAinda não há avaliações

- Quarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoDocumento1 páginaQuarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoAlexis TrinidadAinda não há avaliações

- 82202BIR Form 1702-MXDocumento9 páginas82202BIR Form 1702-MXJp AlvarezAinda não há avaliações

- 2550m FormDocumento1 página2550m FormAileen Jarabe80% (5)

- 2551MDocumento3 páginas2551MButch Pogi100% (2)

- IT Return 2011 2012Documento3 páginasIT Return 2011 2012swapnil6121986Ainda não há avaliações

- 1701qjuly2008 (ENCS)Documento6 páginas1701qjuly2008 (ENCS)alvie_budAinda não há avaliações

- Bir Form 1702-ExDocumento7 páginasBir Form 1702-ExdignaAinda não há avaliações

- Monthly Value-Added Tax Declaration: 105 Specialty Store First Premium Global Dealer Co. LTDDocumento3 páginasMonthly Value-Added Tax Declaration: 105 Specialty Store First Premium Global Dealer Co. LTDAbs PangaderAinda não há avaliações

- 2551MDocumento4 páginas2551MLecel LlamedoAinda não há avaliações

- BIR Form 1702-ExDocumento7 páginasBIR Form 1702-ExShiela PilarAinda não há avaliações

- BIR FormDocumento4 páginasBIR FormfyeahAinda não há avaliações

- 1702 June 2011Documento18 páginas1702 June 2011fatmaaleahAinda não há avaliações

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Documento1 páginaMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Kristine CabalteraAinda não há avaliações

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Documento4 páginasMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Eric LeguardaAinda não há avaliações

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento4 páginasMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesAinda não há avaliações

- BIR Form 2551MDocumento4 páginasBIR Form 2551MJun Casono100% (2)

- 82276BIR Form 1702-EXDocumento7 páginas82276BIR Form 1702-EXJessicaWeinAinda não há avaliações

- 1701 Bir FormDocumento12 páginas1701 Bir Formbertlaxina0% (1)

- 1702-EX Jan 2018 ENCS Final v3 PDFDocumento3 páginas1702-EX Jan 2018 ENCS Final v3 PDFLuz SudarioAinda não há avaliações

- Assessment Year Indian Income Tax Return: I - IndividualDocumento6 páginasAssessment Year Indian Income Tax Return: I - IndividualManjunath YvAinda não há avaliações

- New Form 2550 M - Monthly VAT Return P 1-2Documento3 páginasNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- BIR Form 2551MDocumento6 páginasBIR Form 2551MDeiv PaddyAinda não há avaliações

- 1702 RTDocumento4 páginas1702 RTMaricor TambalAinda não há avaliações

- Bir Form 1601-CDocumento4 páginasBir Form 1601-Csanto tomas proper barangay100% (1)

- Annual Income Tax Return: (To Be Filled Up by The BIR)Documento10 páginasAnnual Income Tax Return: (To Be Filled Up by The BIR)Louie De La TorreAinda não há avaliações

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocumento4 páginasNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Bir Form 1701Documento12 páginasBir Form 1701miles1280Ainda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1No EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Ainda não há avaliações

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesAinda não há avaliações

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersAinda não há avaliações

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawNo EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawNota: 3.5 de 5 estrelas3.5/5 (4)

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNo EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionAinda não há avaliações

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryNo EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryAinda não há avaliações

- CTA Case No. 2740 Dated Sept 30, 1985Documento9 páginasCTA Case No. 2740 Dated Sept 30, 1985fatmaaleahAinda não há avaliações

- BOI MC No. 2022-002Documento1 páginaBOI MC No. 2022-002fatmaaleahAinda não há avaliações

- CTA Case No. 3357 Dated April 22, 1985Documento7 páginasCTA Case No. 3357 Dated April 22, 1985fatmaaleahAinda não há avaliações

- GR No. L-8506 Dated August 31, 1956Documento5 páginasGR No. L-8506 Dated August 31, 1956fatmaaleahAinda não há avaliações

- BOI MC No. 2022-003Documento1 páginaBOI MC No. 2022-003fatmaaleahAinda não há avaliações

- Rmo 72-2010Documento19 páginasRmo 72-2010Abigail JamiasAinda não há avaliações

- CTA Case No. 2799 Dated August 27, 1982Documento9 páginasCTA Case No. 2799 Dated August 27, 1982fatmaaleahAinda não há avaliações

- CTA Case No. 2433 Dated Sept 19, 1980Documento8 páginasCTA Case No. 2433 Dated Sept 19, 1980fatmaaleahAinda não há avaliações

- Bir Ruling Da 469 06Documento6 páginasBir Ruling Da 469 06juliusAinda não há avaliações

- RMC No 17-2018Documento6 páginasRMC No 17-2018fatmaaleahAinda não há avaliações

- Itad Bir Ruling No. 294-12Documento22 páginasItad Bir Ruling No. 294-12fatmaaleahAinda não há avaliações

- CA-G.R. SP No. 29838Documento8 páginasCA-G.R. SP No. 29838fatmaaleahAinda não há avaliações

- Irr Ra 9513Documento48 páginasIrr Ra 9513fatmaaleahAinda não há avaliações

- Advisory SystemsDocumento1 páginaAdvisory SystemsfatmaaleahAinda não há avaliações

- 1939 Tax CodeDocumento186 páginas1939 Tax CodefatmaaleahAinda não há avaliações

- 55153rr10 17Documento2 páginas55153rr10 17fatmaaleahAinda não há avaliações

- RMC No 54-2014Documento3 páginasRMC No 54-2014lktlawAinda não há avaliações

- 2016 Bir Tax Calendar PDFDocumento40 páginas2016 Bir Tax Calendar PDFAnonymous AcvhfPMj7PAinda não há avaliações

- RR 13-98Documento18 páginasRR 13-98fatmaaleahAinda não há avaliações

- Da 404 05Documento4 páginasDa 404 05fatmaaleahAinda não há avaliações

- Bir Ruling Da 469 06Documento6 páginasBir Ruling Da 469 06juliusAinda não há avaliações

- Cir vs. St. Luke Medical CenterDocumento23 páginasCir vs. St. Luke Medical CenterRoland ApareceAinda não há avaliações

- RMC No. 50-2007Documento6 páginasRMC No. 50-2007scribe03Ainda não há avaliações

- RMC 41-09Documento4 páginasRMC 41-09fatmaaleahAinda não há avaliações

- RMO No 17-2017Documento2 páginasRMO No 17-2017fatmaaleahAinda não há avaliações

- Section 2.57.4 of RR No. 2-98Documento2 páginasSection 2.57.4 of RR No. 2-98fatmaaleahAinda não há avaliações

- RR No. 11-2010Documento22 páginasRR No. 11-2010fatmaaleahAinda não há avaliações

- RMO No 17-2017Documento2 páginasRMO No 17-2017fatmaaleahAinda não há avaliações

- 1704 MqyDocumento1 página1704 MqyfatmaaleahAinda não há avaliações

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDocumento6 páginasImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahAinda não há avaliações

- Ah! Ventures Startup Support ServicesDocumento22 páginasAh! Ventures Startup Support ServicesabhishekAinda não há avaliações

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocumento6 páginasAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanAinda não há avaliações

- Working Capital ManagementDocumento34 páginasWorking Capital ManagementNirmal ShresthaAinda não há avaliações

- 10.digest. NG Cho Cio VS NG DiogDocumento2 páginas10.digest. NG Cho Cio VS NG DiogXing Keet LuAinda não há avaliações

- As Unnit 5 Class NotesDocumento38 páginasAs Unnit 5 Class NotesAlishan VertejeeAinda não há avaliações

- NEW Clearance Worklife 03.03.22 1Documento3 páginasNEW Clearance Worklife 03.03.22 1Ibe AstorgaAinda não há avaliações

- Trent's Mortgage & Finance BrokingDocumento10 páginasTrent's Mortgage & Finance BrokingTrent FetahAinda não há avaliações

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Documento4 páginasForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarAinda não há avaliações

- Transaction History: NicknameDocumento4 páginasTransaction History: NicknameMerle AfricaAinda não há avaliações

- Muhammad Aslam - JulyDocumento1 páginaMuhammad Aslam - JulyNajma KanwalAinda não há avaliações

- Q.P. Code:36461: Activity Preceding Activity NT (Days) CT (Days) Blenders Packers FillersDocumento3 páginasQ.P. Code:36461: Activity Preceding Activity NT (Days) CT (Days) Blenders Packers Fillersmms a19Ainda não há avaliações

- Bank Reconciliation StatementDocumento39 páginasBank Reconciliation StatementinnovativiesAinda não há avaliações

- Invoice For Portable Toilets - Nuggets ParadeDocumento1 páginaInvoice For Portable Toilets - Nuggets Parade9newsAinda não há avaliações

- Sat YamDocumento39 páginasSat YamShashank GuptaAinda não há avaliações

- Problem Set 2-EepiDocumento4 páginasProblem Set 2-EepiARBAZAinda não há avaliações

- Cancellation Acord Form - CX149661-Ramon Aguilar-Aguila Trucking PDFDocumento1 páginaCancellation Acord Form - CX149661-Ramon Aguilar-Aguila Trucking PDFBryan ArenasAinda não há avaliações

- Important Points of Our Notes/Books:: TH THDocumento42 páginasImportant Points of Our Notes/Books:: TH THpuru sharmaAinda não há avaliações

- Bank of Maharashtra History INFORMATIONDocumento3 páginasBank of Maharashtra History INFORMATIONbharatAinda não há avaliações

- Cash and Cash EquivalentsDocumento33 páginasCash and Cash EquivalentsMerry Julianne DaymielAinda não há avaliações

- TBCH 13Documento43 páginasTBCH 13Tornike JashiAinda não há avaliações

- Exchange Rate in NigeriaDocumento12 páginasExchange Rate in NigeriaJoel ChineduAinda não há avaliações

- TATA MOTORS Atif PDFDocumento9 páginasTATA MOTORS Atif PDFAtif Raza AkbarAinda não há avaliações

- Invoice - Ali Abid - 000660485Documento1 páginaInvoice - Ali Abid - 000660485AliAbidAinda não há avaliações

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Documento1 páginaVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalAinda não há avaliações

- Payment InstructionDocumento2 páginasPayment Instructionjiachendu.caAinda não há avaliações

- General Journal Date Account Titles / ExplanationDocumento22 páginasGeneral Journal Date Account Titles / ExplanationPauline Bianca70% (10)

- Advanced AccountingDocumento4 páginasAdvanced Accountinggisela gilbertaAinda não há avaliações

- Lesson 29 - General AnnuitiesDocumento67 páginasLesson 29 - General AnnuitiesAlfredo LabadorAinda não há avaliações

- Model Asset and Liability Affidavit D. VDocumento12 páginasModel Asset and Liability Affidavit D. VsavagecommentorAinda não há avaliações

- Accounting PrinciplesDocumento4 páginasAccounting PrinciplesManjulaAinda não há avaliações