Escolar Documentos

Profissional Documentos

Cultura Documentos

Oil & Gas Pakistan Overview

Enviado por

Saad AlamDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Oil & Gas Pakistan Overview

Enviado por

Saad AlamDireitos autorais:

Formatos disponíveis

Oil & Gas

February 2012

Update

Overview of the oil

and gas regime in

Pakistan

Written by James Varanese, Niazi Kabalan and

Jameel Tarmohamed

By numbers alone, Pakistan is a major world oil

and gas player. Crude oil recoverable reserves are

estimated at over 300 million barrels and current oil

production is over 65,000 barrels per day, while gas

production is at 4 billion cubic feet per day. Over 700

wells have been drilled by local and international

exploration and production companies with over

250 discoveries a success rate of slightly over 1 in 3.

US$ 810 million was spent in 2010 alone on drilling

activities with 30 new wells drilled.

In addition to the numbers, the

well developed legal regime offered

by Pakistan is another attraction.

Petroleum exploration in Pakistan is

highly structured and regulated. The

discovery of the Sui Gas Field in 1952

was the first major milestone in the

search for hydrocarbons in Pakistan

with Pakistans first oil field being

found shortly thereafter. However,

it was Pakistans independence in

1947 that prompted the need for the

new country to develop its own oil

industry and legislation governing

the sector. The oil and gas industry

was largely guided by general mineral

rights legislation enacted in 1948 and

modified by successively modern

legislative acts specifically for oil

and gas in 1969, 1976 and 1984. This

structure benefits exploration and

production companies by providing a

solid and predictable relationship with

the State.

But as with any highly regulated

regime, operators and new entrants

into Pakistan require expert guidance

to the complex legal environment

to which they are exposed. The

intricacies of that regulatory

environment must be navigated deftly

from the outset to ensure smooth

operations. Poor understanding of

legal obligations at the negotiation

stage can lead to all types of

unforeseen issues down the road.

This note addresses the current

legislation and applicable regulations

for oil and gas exploration in Pakistan,

with further detail on the fiscal regime

for production including royalties and

production bonuses and income tax

and windfall levies.

The merged firm of Clyde & Co and Barlow Lyde & Gilbert

This note does not address, as you might expect, the

procedural steps in granting exploration and production

rights, related fiscal terms and the customary licence and

lease provisions in respect of the onshore and offshore

rules. These specific areas will be covered in further

updates to follow.

This note provides a hint of the complexities that operators

and new entrants face. The sooner any exploration

company either in Pakistan or planning a new venture in

Pakistan seeks professional legal advice, the better placed

it will be to avoid the pitfalls. Clyde & Cos oil and gas team

has worked extensively in Pakistan, and is well placed to

advise from the structuring stage any company looking to

venture into this exciting emerging market.

Legislation and Regulatory Authority

Pakistan is a federal parliamentary republic comprised of

four provinces (Balochistan, Khyber Pakhtunkhwa, Punjab,

and Sindh), the federal Capital Territory of Islamabad and

the Federally Administered Tribal Areas.

The oil and gas regime in Pakistan is governed by a series of

acts, ordinances, rules and regulations enacted to amend

and supplement the Regulation of Mines and Oilfields and

Mineral Development (Government Control) Act 1948 (as

amended by the Oilfields (Regulation and Development)

Amendment Acts 1969, 1976 and 1984) (the Act).

These acts, ordinances, rules and regulations are in turn

supplemented by conditions set forth by the Government

of Pakistan (GOP) and issued in the form of a policy

which is subject to revision from time to time (the Policy).

The Directorate General of Petroleum Concessions (the

Directorate) is one of the Directorates of the Ministry

of Petroleum and Natural Resources functioning as the

regulatory authority for all upstream exploration and

production activities in Pakistan. The chart at the end of

this note sets out the organisation of the divisions of the

Ministry of Petroleum and Natural Resources.

Onshore Rules

The Act is implemented by two sets of rules: one set

applicable to onshore operations (the Onshore Rules)

and a separate set of rules applicable to offshore operations

(the Offshore Rules). These Onshore Rules and Offshore

Rules are enacted by the GOP pursuant to its powers under

s.6(1) of the Act.

The Onshore Rules provide for a licensing system on the

basis of a model Petroleum Concession Agreement (PCA).

Onshore acreage in Pakistan is divided into three zones

with different economic terms on the basis of geological

risk and investment requirements. Zone 1 comprises the

West Balochistan, Pashin and Potowar basins, Zone 2 the

Kirthar, East Balochistan, Punjab platform and Suleman

basins, and Zone 3 the Lower Indus basin. A model PCA

will apply to all new licences in these onshore areas. As

outlined below under royalty and income tax, Exploration

and Production companies profit splits with the GOP

will be on the basis of a royalty of the value of petroleum

produced plus income tax.

Offshore Rules

The Offshore Rules set out a licensing system on the

basis of a model Production Sharing Agreement (PSA).

A model PSA will apply to all offshore blocks. In the

offshore acreage, Exploration and Production companies

profit splits with the GOP will depend on the water depth

(shallow, deep or ultra-deep) and the sub-surface depth

from which oil and gas are produced. No royalty is payable

in the first four years after commencement of commercial

production, however 5% is payable in the fifth year, 10%

is payable in the sixth year and 12.5% is payable in the

following years. Income tax is also be payable at the

rate of 40%.

Exploration Right and the Production Right

Exploration and production rights are awarded by the

Directorate on the basis of the following licensing system:

1. reconnaissance permits for undertaking studies and

multi-client surveys (Permit);

2. licences for petroleum exploration (Licence) which

typically set out a work programme which the

contractor will be required to follow during the term of

the Licence; and

3. leases for petroleum development and production

(Lease) which set out a Development Plan which the

contractor will need to comply with throughout the

development and production phase.

Any eligible contractor, whether incorporated in Pakistan or

elsewhere, can apply for a Permit, Licence or Lease to carry

out onshore operations.

Oil & Gas Development Company (OGDC)

Windfall Levy

Pakistans largest upstream company, OGDC holds a

portfolio of 34 exploration licences in Pakistan with the

largest proportion of the countrys recoverable reserves,

estimated at 214 million barrels of oil and 10,660 billion

cubic feet of gas as of September 2011. Its total acreage

covering more than 61,000 square kilometres is the largest

in Pakistan and this also includes 22 operated blocks as

well as interests in another seven blocks.

The Policy also provides for a windfall levy applicable

to crude oil and condensate, in addition to a production

bonus on the basis of formulas set out in the Policy and the

relevant PCA or PSA (the Windfall Levy).

Government Holdings (Pvt) Limited (GHPL)

GHPL manages the GOPs working interest in 35

Development & Production leases and 23 Exploration

licenses with the object of optimising investment to

maximise petroleum production in Pakistan. It is among

the top 5 petroleum Exploration and Production Companies

operating in Pakistan with its production share at over

45,000 barrels of oil equivalent per day.

Royalty

The Onshore Rules and the Offshore Rules specify that

a royalty is payable on the value of petroleum produced

and saved.

The royalty under the Onshore Rules is set at 12.5%,

whereas the royalty under the Offshore Rules ranges from

5% to 12.5% based on a time-triggered sliding scale.

Income Tax

The regulations governing the calculation of profits and

gains from exploration and production are set out in the

Fifth Schedule of the Income Tax Ordinance 2001.

Tax on income will be payable at the rate of 40% of the

profit or gains derived by an offshore petroleum exploration

and production undertaking and 50% of the profits or

gains derived by an onshore petroleum exploration and

production undertaking.

The Windfall Levy on crude oil and condensate is typically

calculated on the following basis:

Windfall Levy = 0.5 x (Net Production Royalty) x

(Market Price Base Price)

The Policy will specify the Royalty, the Market Price and

the Base Price. Net Production is typically calculated with

reference to petroleum produced and saved. The Base Price

is as of 2009 USD 30 per bbl subject to an annual increase

of USD 0.25 per barrel starting from the date of first

commercial production in contract area.

Notwithstanding the formula set forth in the Policy, in

the event that the Market Price of Crude Oil/Condensate

exceeds US$100/barrel, the 100% benefit of Windfall Levy

will pass onto the GOP. The ceiling would be reviewed as

and when pricing dynamics significantly change in the

international market.

The Windfall Levy applicable to the sale of natural gas to

parties other than to the GOP will be applicable on the

difference between the applicable GOP Zone price and the

third party sale price using the following formula:

Windfall Levy = 0.5 x (Third Party Sale Price - Base Price) x

Volume Sold

The Base Price will typically be the applicable zone price

for sale to the GOP as set out in the Policy. Where the third

party sale price of gas is less or equal to the Base Price, the

Windfall Levy is zero. The Windfall Levy does not apply to

sales of natural gas made to the GOP.

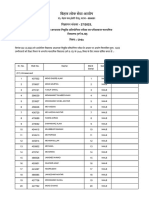

Production Bonus

Production bonuses will typically be payable to the GOP on

a contract area basis ranging from $600,000 being paid at

the start of commercial production to $7,000,000 being paid

when cumulative production reaches 100 Million Barrels of

Oil Equivalent.

The chart below provides an example of the sliding scale

used to calculate the production bonus.

Cumulative production (MMBOE)

Amount (USD)

At start of commercial production

600,000

30

1,200,000

60

2,000,000

80

5,000,000

100

7,000,000

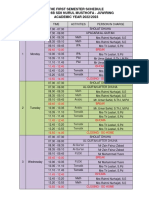

Ministry of Petroleum & Natural Resources

Minister

Dr Asim Hussain

Parliamentary Secretary

Engr. Muhammad Tariq Khattak

Secretary

Muhammad Ejaz Chaudhry

Additional Secretary

(Admn & Dev)

BS-21

Abid Saeed

JS Admn

BS-20

Hamid Asghar

JS Development

BS-20

Rashid Mazari

Deputy Secretary

(D-I)

M Shabbir Khattak

Deputy Secretary

(Personal)

Additional Secretary

(Policy)

BS-21

Mohammad Naeem Malik

DG Mineral

BS-20

Irshad Ali Khokar

Deputy Secretary

(D-II)

Afzaal Chaudhry

Deputy Secretary

(Admn)

Zafar Abbas

CF & AO

BS-20

Tahir Mehmood

DG Oil

BS-20

Mohammad Azam

Director

Refinery

M. Azam

Director

Systems

Vacant

Director

Geology & Mining

Azhar Khan

Director

Economics & Law

M. Afzal

DG Gas

BS-20

Saeed Ullah Shah

DG (PC)

BS-20

Sher Muhammad

Khan

Director

Admn

Vacant

Director

Logistics & Marketing

Abdul Hayee Baloch

Director

Gas

Vacant

Director

CNG/LPG

Vacant

Director

Database, Co ord & Acc

Gul Munir (curr charge)

DG Admn

BS-20

Dr Shahab Alam

Director

Law

Bismillah Rai

Director

Exploration

Qazi M. Saleem

(curr charge)

Director

Production

Vacant

Further information

If you would like further information on any issue raised in this update please contact:

James Varanese

E: james.varnese@clydeco.com

George Booth

E: george.booth@clydeco.com

Jason Rosychuk

E: jason.rosychuk@clydeco.com

Niazi Kabalan

E: niazi.kabalan@clydeco.com

Jameel Tarmohamed

E: jameel.tarmohamed@clydeco.com

Julia Vaynzof

E: julia.vaynzof@clydeco.com

Clyde & Co LLP

The St Botolph Building

138 Houndsditch

London EC3A 7AR

T: +44 (0)20 7876 5000

F: +44 (0)20 7876 5111

Further advice should be taken

before relying on the contents

of this summary.

Clyde & Co LLP accepts no responsibility for

loss occasioned to any person acting or refraining

from acting as a result of material contained in

this summary.

No part of this summary may be used,

reproduced, stored in a retrieval system or

transmitted in any form or by any means,

electronic, mechanical, photocopying, reading

or otherwise without the prior permission of

Clyde & Co LLP.

Clyde & Co LLP is a limited liability partnership

registered in England and Wales. Authorised and

regulated by the Solicitors Regulation Authority.

Clyde & Co LLP 2012

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- CV - Engr. Emad Abd El Kader HassanDocumento2 páginasCV - Engr. Emad Abd El Kader HassanMohanad EldarerAinda não há avaliações

- Islamization Under General ZiaDocumento3 páginasIslamization Under General ZiaSyed Wasif Hussain Bukhari100% (1)

- Target Form 2Documento3 páginasTarget Form 2Rusilawati KarimAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Distribusi Nilai R Tabel Product Moment Sig. 5% Dan 1% (WWW - Spssindonesia.com)Documento1 páginaDistribusi Nilai R Tabel Product Moment Sig. 5% Dan 1% (WWW - Spssindonesia.com)Ikhsan YusufAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- How To Pray Sholat (English Common)Documento4 páginasHow To Pray Sholat (English Common)Mr. AWAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Mughal EmperorsDocumento4 páginasMughal EmperorsJasvinder SinghAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Battle of YarmoukDocumento6 páginasBattle of YarmoukSyed Mohsin Mehdi TaqviAinda não há avaliações

- Q&a221205 Khabar Ahad - EnglishDocumento9 páginasQ&a221205 Khabar Ahad - EnglishaAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- 03 Quwwat Ul Islam MosqueDocumento24 páginas03 Quwwat Ul Islam MosqueSudhesh KumarAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- ePPGBM Purwodadi April 2021-BARUDocumento25 páginasePPGBM Purwodadi April 2021-BARUmaimunahAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Black FactsDocumento11 páginasBlack FactsBrownskiElAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- ExercitiiDocumento188 páginasExercitiiSergiu Daniel Giurgiu0% (1)

- Political Participation of Women in Afghanistan During The Last Decade (Opportunities & Challenges)Documento6 páginasPolitical Participation of Women in Afghanistan During The Last Decade (Opportunities & Challenges)International Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Meeting With SKMDocumento4 páginasMeeting With SKMAnwarAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Fiqih Islam Sulaiman Rasyid PDF Downloadgolkesl 2021Documento3 páginasFiqih Islam Sulaiman Rasyid PDF Downloadgolkesl 2021Giar Riksa Gama0% (1)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Du'as From The Quran: List Ordered by Surah Numbers (Translation by Yusuf Ali)Documento29 páginasDu'as From The Quran: List Ordered by Surah Numbers (Translation by Yusuf Ali)Muzamil Maqbool RatherAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- How To Perform Salat IstikharaDocumento2 páginasHow To Perform Salat IstikharatansamAinda não há avaliações

- FM 7Documento34 páginasFM 7Naaim AliasAinda não há avaliações

- SUKUK-Islamic BondDocumento29 páginasSUKUK-Islamic Bondwokyoh91Ainda não há avaliações

- Bachpan Ka December by HashimDocumento322 páginasBachpan Ka December by HashimAli Haider100% (4)

- The First Semester Schedule Class 6B Sdii Nurul Musthofa - Juwiring ACADEMIC YEAR 2022/2023Documento2 páginasThe First Semester Schedule Class 6B Sdii Nurul Musthofa - Juwiring ACADEMIC YEAR 2022/2023Ibrahim Al AidiAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Sources of Islamic Law For O Level IslamiatDocumento3 páginasSources of Islamic Law For O Level IslamiatIftikhar Ahmed100% (1)

- NB 2023 12 24 21Documento44 páginasNB 2023 12 24 21Mohammad mustafa AnsariAinda não há avaliações

- Muhammad at MedinaDocumento447 páginasMuhammad at MedinapriwaitAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Furniture and Wood Pakistan ImporterDocumento10 páginasFurniture and Wood Pakistan ImporterSheroz AhmedAinda não há avaliações

- 7 Hairs of Prophet Muhammad (SAW)Documento4 páginas7 Hairs of Prophet Muhammad (SAW)Uzbek TravellerAinda não há avaliações

- Sholawat and Salam To Our Prophet Muhammad SAW, Who Has Brought Us From The Darkness To TheDocumento1 páginaSholawat and Salam To Our Prophet Muhammad SAW, Who Has Brought Us From The Darkness To TheAmara TazviaAinda não há avaliações

- Ehsaas Emergency Cash Payments: Consolidated List of Campsites and Bank BranchesDocumento45 páginasEhsaas Emergency Cash Payments: Consolidated List of Campsites and Bank BranchesRaheel NaveedAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Cow Slaughter and Hindu Persecution in The Indian Subcontinent: A Short HistoryDocumento58 páginasCow Slaughter and Hindu Persecution in The Indian Subcontinent: A Short HistorynayasAinda não há avaliações

- Mlac3121 20197826 2223Documento7 páginasMlac3121 20197826 2223hattieAinda não há avaliações