Escolar Documentos

Profissional Documentos

Cultura Documentos

Form No.15g

Enviado por

Prakash GowdaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Form No.15g

Enviado por

Prakash GowdaDireitos autorais:

Formatos disponíveis

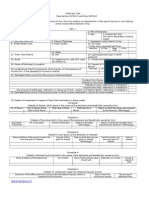

FC,R,M hIO.

15 G

{See seetion 19?A(1), 197A(lA) o,nd, rule 29C}

Oeclaration under section lS?A(l) and section 19?A(IA) of the Ineome.tax Act, 1961 to be made by an

individual or a person (not being o company or firm) claiming certain receipts without deduction of tax.

PART . I

1. Name ol'Assessee {Doclarant)

?. PAN ofthe

4. FIat / Iloor I lllock No.

ir. Name

3. Assessment Year

I tbr rvhich rlcclarstjon i* bcing nradrt

6. *Status

8. Road I Street / Lane

9. Area

Assessee

tf

Prenrises

/ Circle

AO Code{under whom

7. :lssessed in which \Yard

/ Locality

1.0.

assessed

11..

Town

CiLy

/ District

Area

12. Siate

13. PIN

1,1.

15. Ernail

last time)

AO

Range

AO

Last Assessment Year in

lvhich assessed

elcPtrurrtr

1?. Present Ward / Circle

1$. llesitlential Status {rvithin thc

19. Name of Business

meaning of Section 6 of the lncome.-Tar

Act,1961)

Occupation

20. Present A0 Code (if not snme as above)

21. Jurisdictional Chief Commissioner of lrrcome-tax or ('llommissioner of

Income-tax {if not assessed to Income-tax earlier}

22. lstimated total income from the

sour'(es mentioned below

Area

AO

Coda

Range

AO

Code

No.

(Piease tiek the relevant box)

Dirriilend from shares rctbrred to in Sehedule I

Interest on semritie$ referled to in Schedule II

Interest on Burn$ refered to in Schedule III

Income form units referred io in $chedule tV

The amount of withdmw&l rcfrrrcd to in smtion 8fi:CAr2{a) finm Natirxul Savings Schenre referrcd tn

23. Dstimated iotal income of the prrrious year

94. fJetailg nf investments

in

in whidr

incon"re mentioned

respect of rvhich the declaration is being made

SCHIIDT.ILE

in

.I

(Details of shares, which stand in the name of the declarant and treneficially orvnt:d by hirn)

Distinctive uuml:ers

Date(s) iin \vhiclt'the shar:es

0lass of ehaiea & f

of the shares

value bf ebch sh*re

SCHEDULD . II

fletails gf the *eiurities held in the name of declarant and beneficially

I)pscription

sccurities

ol'

Number of

securitics

Arr:ount of

scc

nrities

SCHEDULE

. III

{Detail.s eif the sums given b.y the declarant on interest)

anre and addrss; of the pcrson t$

the eums'are given on interest

ScheduleY

in Column 2t is to be included

owned try him)

were

n

n

n

SCHEDULE - IY

SCHEDULE - V

(Detailg of the withdrawal mado from National IJa

Sclreme)

\

--x-Declaration / Yerifrcation

*

Signature of lhe dcclarant

declare that in the hest of *my 1 our knowledge and beliefwhat is stated above is correct, complete and is truly stated. *I / 1,[e declare that

the incomes refemed to in this form are not includible in the total income of any other person u/e 60 to M of the Income-tsx Act, 1961.

*I /

We further, declare

computed

in

that the tar *on my / our estimated total income, including tincome r' incomes referred to in Column 22 above,

accordance rvith

the provisions of the Income-tax Act, 1961, for tlre previous year ending on ...................

will tre nil. *I / We also. declare thnt *my / our *ineome

....,.,.....

relevant to trhe asaessment yar

referred to

year

in

Column 22 for the previous year ending on ............."..... ..........

,....,.,.....,..

will aot

exceed the maximum amount which

......

relevant to the asses*ment

'

-Date : ___

l.

the

Name of thr; person responsible for paying the ineome

incomes

is not chargeable to income-tax.

Place l

For use

xSignature of

the declarant

PA1BT.II

to whom the declaration is fuurished

rel'errecl to in Column 22 of Part I 2. PAN of the pereon

indicated in Column

of Part

4. 'l'AN of the person indicated in Column

8. Complete Address

5. Email

6. Telephone No. (wit"h

8. Date on which Declaration is

Furnished (dd1mm/yyyy)

9. Period in regpeci ofwhieh the dividend has been

declarrd or the inmme hos b..sn paid / creditsd

$ID

LZ. Dale ol declaratron. dlstribuuon or Davment of dividend i

withdrawal under the National Savingd S<:heme (ddlmm/.vyyy)

Code) and Mobile No.

of Part

II

7. Slatus

10. Amount

of

income paid

11. Date on which the

income hns been paid/

eredited (dd/mrn/iyyy)

l3..Account-Nuqrber of N-ational Sar.ing $cheme from whicf

withdrawal has been made

Forwarded to the Chief Corxrnissioncr or Cournrissioner of Incoms-ttrx

Noter

l. 'Itc

Signature of'the pe.rson responsible for paying the

in.catne referretl to in aolunm 22 of Part I

r

dclrretioo rhould bs fornished

;frtJti,'

i.5: t56i;,;fi;;L-ii;;;.iffi';;uii

i'r'iiii*;;;#"6i;;frt".

a.

iu duolicf,E.

indivirturt under sq.rion l97A(l).tnd a jar.son iorher rhun

or s

--- o- mmpany

-"lndicslx thc crpacity in whicli tlre dcclaratioa ts furnirhed or Ueiialt ofiliijf'. ^lOi. _

,jm)

utrdcr srctiof, loTA(rA).

"t

to &v.n yeu.a arrd Bith lrrre:

coec, with rigrreur

rigrreus. imprixonnent

inptisonnleot-thich

which rhall

strall not

uot he

l* ksa

lesa thsn

thsrr 3 &onths

rtroothr but

but whith

shirh msv

oxriard to tva

rw.] yerrs

vo'ra anrl

rnrt with

uith fine.

Gnmsy extrrrrl

iir Itr

In eoy

noy othcr

--. ii)

- .-.

whic.b ruch inamo is

II

t! br inrluded excoeas tle muifrfim""mo,iiriittilJii x';;;ffi;;:6k;;il:'

TAXPRINT, 177,Pailn Narimari(Bazargate) Street,Fort,Mumbai ,400001 .lphones:43470909 /22693321 |}22695676

Você também pode gostar

- 15G FormDocumento2 páginas15G Formgrover.jatinAinda não há avaliações

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocumento2 páginas"Form No. 15H: Area Code Range Code AO No. AO Typepkw007Ainda não há avaliações

- Form 15g TaxguruDocumento3 páginasForm 15g Taxguruulhas_nakasheAinda não há avaliações

- Form No. 15G: (See Rule 29C)Documento4 páginasForm No. 15G: (See Rule 29C)MKAinda não há avaliações

- Form No 15HDocumento3 páginasForm No 15HsaymtrAinda não há avaliações

- 15g MehandiDocumento3 páginas15g MehandiAjay ParidaAinda não há avaliações

- FORM-15G: (Please Tick The Relevant Box)Documento4 páginasFORM-15G: (Please Tick The Relevant Box)Kayam BalajiAinda não há avaliações

- New Form 15H For Fixed Deposits Editable in PDFDocumento2 páginasNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Ainda não há avaliações

- PDF Editor: Form No. 15GDocumento2 páginasPDF Editor: Form No. 15GImissYouAinda não há avaliações

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocumento3 páginas"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanAinda não há avaliações

- OBC Bank Form - 15H PDFDocumento2 páginasOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocumento2 páginas"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaAinda não há avaliações

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocumento3 páginas"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanAinda não há avaliações

- Form 15g NewDocumento4 páginasForm 15g NewnazirsayyedAinda não há avaliações

- Form 15GDocumento3 páginasForm 15GRahul DattoAinda não há avaliações

- New Form No 15GDocumento4 páginasNew Form No 15GDevang PatelAinda não há avaliações

- PDFDocumento4 páginasPDFushapadminivadivelswamyAinda não há avaliações

- PAN No.Documento5 páginasPAN No.haldharkAinda não há avaliações

- Form No. 15H: Part - IDocumento2 páginasForm No. 15H: Part - Itoton33Ainda não há avaliações

- 15h Form (1) - CompressedDocumento4 páginas15h Form (1) - Compressedrekha safarirAinda não há avaliações

- Income Tax DepartmentDocumento6 páginasIncome Tax DepartmentRajasekar SivaguruvelAinda não há avaliações

- PF Form 15G PDFDocumento1 páginaPF Form 15G PDFSorabh BhargavAinda não há avaliações

- PF Form 15GDocumento1 páginaPF Form 15GSorabh BhargavAinda não há avaliações

- FD - Form 15 - G - Oct 2015Documento6 páginasFD - Form 15 - G - Oct 2015mohantamilAinda não há avaliações

- Bonds Form 15gDocumento3 páginasBonds Form 15gRishi TAinda não há avaliações

- 15G FormDocumento2 páginas15G Formsurendar147Ainda não há avaliações

- Form No. 15GDocumento2 páginasForm No. 15GGaneshAinda não há avaliações

- TAX SAVING Form 15g Revised1 SBTDocumento2 páginasTAX SAVING Form 15g Revised1 SBTrkssAinda não há avaliações

- Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)Documento6 páginasSrnoin Form 15G Srnoin Form 15H Particulars (Required Details)priyaradhiAinda não há avaliações

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocumento3 páginasFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanAinda não há avaliações

- Form 15GDocumento3 páginasForm 15Gsriramdutta9Ainda não há avaliações

- New Form 15G Form 15H PDFDocumento6 páginasNew Form 15G Form 15H PDFdevender143Ainda não há avaliações

- 15 G Form (Pre-Filled)Documento2 páginas15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocumento2 páginasArea Code AO Type Range Code AO No.: Signature of The Declarantyraju88Ainda não há avaliações

- 15 G Form (Pre-Filled)Documento2 páginas15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Form15H PDFDocumento2 páginasForm15H PDFSrinivasulu NatukulaAinda não há avaliações

- New Form 15G PDFDocumento2 páginasNew Form 15G PDFSoma Sundar50% (2)

- 103120000000007845Documento3 páginas103120000000007845arjunv_14100% (1)

- Tax Form 15H PDFDocumento4 páginasTax Form 15H PDFraviAinda não há avaliações

- Form 15GDocumento2 páginasForm 15GSrinivasa RaghavanAinda não há avaliações

- PPC 1H667511110 2018-19 12042019Documento3 páginasPPC 1H667511110 2018-19 12042019P PalAinda não há avaliações

- Acceptance&Discharge-REAL ESTATE MORTGAGE NETWORKDocumento13 páginasAcceptance&Discharge-REAL ESTATE MORTGAGE NETWORKTiyemerenaset Ma'at El86% (22)

- 272 004 Lalith KumarDocumento8 páginas272 004 Lalith Kumarreddy655Ainda não há avaliações

- Form 15H Format 1Documento4 páginasForm 15H Format 1ASHISH KINIAinda não há avaliações

- PDF 4Documento3 páginasPDF 47ola007Ainda não há avaliações

- Form 15G PDFDocumento6 páginasForm 15G PDFSmitha GowdaAinda não há avaliações

- Form No. 15H: (IT Dept. Copy)Documento9 páginasForm No. 15H: (IT Dept. Copy)jpsmu09Ainda não há avaliações

- Solid: BIR AssessmentDocumento3 páginasSolid: BIR AssessmentBusinessWorldAinda não há avaliações

- Adobe Scan Mar 25, 2022Documento2 páginasAdobe Scan Mar 25, 2022GaneshAinda não há avaliações

- Form No. 15G: Part - IDocumento2 páginasForm No. 15G: Part - Ibalaji stationersAinda não há avaliações

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerAinda não há avaliações

- Report of Al Capone for the Bureau of Internal RevenueNo EverandReport of Al Capone for the Bureau of Internal RevenueAinda não há avaliações

- Bar Review Companion: Taxation: Anvil Law Books Series, #4No EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Ainda não há avaliações

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsAinda não há avaliações

- The Continental Dollar: How the American Revolution Was Financed with Paper MoneyNo EverandThe Continental Dollar: How the American Revolution Was Financed with Paper MoneyAinda não há avaliações

- Audit of InventoriesDocumento4 páginasAudit of InventoriesVel JuneAinda não há avaliações

- Mann, Michael (1970) - The Social Cohesion of Liberal DemocracyDocumento18 páginasMann, Michael (1970) - The Social Cohesion of Liberal Democracyjoaquín arrosamenaAinda não há avaliações

- Abragan Vs ROdriguezDocumento2 páginasAbragan Vs ROdriguezAndrei Da JoseAinda não há avaliações

- Watching The Watchers - Conducting Ethnographic Research On Covert Police Investigation in The UKDocumento16 páginasWatching The Watchers - Conducting Ethnographic Research On Covert Police Investigation in The UKIleana MarcuAinda não há avaliações

- Chua v. Absolute Management Corp.Documento10 páginasChua v. Absolute Management Corp.Hv EstokAinda não há avaliações

- PIChE Code of Ethics and Code of Good Governance Alignment MatrixDocumento10 páginasPIChE Code of Ethics and Code of Good Governance Alignment MatrixBabeejay2Ainda não há avaliações

- Nationhood and Nationalities in Pakistan - Hamza AlaviDocumento9 páginasNationhood and Nationalities in Pakistan - Hamza AlaviZahid HussainAinda não há avaliações

- Motion To Compel Responses To Defendant's DiscoveryDocumento4 páginasMotion To Compel Responses To Defendant's DiscoveryMarciaQuarle100% (2)

- CORPO Case Doctrines Lex TalionisDocumento20 páginasCORPO Case Doctrines Lex TalionisJustin YañezAinda não há avaliações

- Covered California Grants: For Outreach To IndividualsDocumento2 páginasCovered California Grants: For Outreach To IndividualsKelli RobertsAinda não há avaliações

- Hagboldt Essentials of German GrammarDocumento165 páginasHagboldt Essentials of German GrammarGregory from Philadelphia100% (1)

- Diploma in Taxation: Pakistan Tax Bar AssociationDocumento6 páginasDiploma in Taxation: Pakistan Tax Bar AssociationAbdul wahabAinda não há avaliações

- IRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFDocumento3 páginasIRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFsaptarshi jashAinda não há avaliações

- Infineon TOOL Tutorial Memtool XMC1 TR v01 00 enDocumento46 páginasInfineon TOOL Tutorial Memtool XMC1 TR v01 00 enplasma411ny100% (1)

- Adarsh Comp ConsDocumento7 páginasAdarsh Comp ConsAmanAinda não há avaliações

- Collado v. Homeland Security Immigration Services - Document No. 10Documento2 páginasCollado v. Homeland Security Immigration Services - Document No. 10Justia.comAinda não há avaliações

- SampleDocumento11 páginasSampleYanyan RivalAinda não há avaliações

- Intolerance and Cultures of Reception in Imtiaz Dharker Ist DraftDocumento13 páginasIntolerance and Cultures of Reception in Imtiaz Dharker Ist Draftveera malleswariAinda não há avaliações

- IDirect Brokerage SectorUpdate Mar23Documento10 páginasIDirect Brokerage SectorUpdate Mar23akshaybendal6343Ainda não há avaliações

- The Carnatic WarsDocumento7 páginasThe Carnatic WarsMohAmmAd sAmiAinda não há avaliações

- BPI Payment ProcedureDocumento2 páginasBPI Payment ProcedureSarina Asuncion Gutierrez100% (1)

- Concept of Race 1Documento6 páginasConcept of Race 1api-384240816Ainda não há avaliações

- Kotak ReportDocumento71 páginasKotak ReportSumit PatelAinda não há avaliações

- Chartering TermsDocumento9 páginasChartering TermsNeha KannojiyaAinda não há avaliações

- Answer Key PSC FinalDocumento1 páginaAnswer Key PSC FinalPriyasajan J PillaiAinda não há avaliações

- Statement of Comprehensive IncomeDocumento1 páginaStatement of Comprehensive IncomeKent Raysil PamaongAinda não há avaliações

- Binani Industries Ltd. V. Bank of Baroda and Another - An AnalysisDocumento4 páginasBinani Industries Ltd. V. Bank of Baroda and Another - An AnalysisJeams ZiaurAinda não há avaliações

- Skema Jawapan Percubaan Math k2 2022Documento6 páginasSkema Jawapan Percubaan Math k2 2022mardhiah88Ainda não há avaliações

- Rutherford County BallotsDocumento8 páginasRutherford County BallotsUSA TODAY NetworkAinda não há avaliações

- FTP Chart1Documento1 páginaFTP Chart1api-286531621Ainda não há avaliações