Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Enviado por

Shyam SunderTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

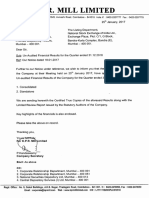

I$NCO TEA& INDUSTRIES

LIMITED

Regd.Office: 'JasmineTower',3rd Floor,31, Shakespeare

Sarani,Kolkata- 700017

Tefefax:22815217,E-Mail; contact@kancotea.in,

Website: www.kancotea.in,

CIN-L15491W81983P1C03579i

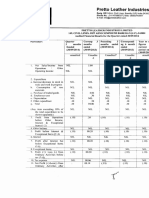

UnauditedFinancialResultsfor the Quarter& NinaMonthsended31stDecember.2014

PART I

ql

Farticulars

NO

a

a

s

10

11

12

13

14

15

16

ilncometromOperations

from operations

tNetsales/lncome

TotalIncomefromOperations

Expenses

(a) Costof materialsconsumed

tb) Changesin inventoriesof finishedgoods

{ci Employeebenefitxpense

and amorti$ationexpenses

{d} Depreciation

{e} Power&Fuel

(0 Consumplion

of $toresand $pares

Expenses

G) $elling& Distribution

{h} Otherexpenses

TotalExpenses

Profit 1 (Loss) from operationsbefore other income, finance

costsandexceptionalitems{1-2)

Otherincome

Profit/ {Loss}from ordinaryactivitiesbeforefinancecosts and

exeeptional

items{ 3+4)

Financecosts

Profit I (Loss)from srdinary activitiesafter finance costs but

beforeexceptionalitems(5- 6 )

Fxceptionallterns

ProfitI (Loss)fromordinaryactivitiesbeforetax( 7-8 )

Tax expenses

ProfitI (Loss)fromordinaryactivitiesafter tax( S - 10 )

Extraordinary

ltems(netof tax expense)

NetProfit/ (Loss)for lhe period{11-12)

Paid-upequitysharecapital(Facevalueper Sharet10/-)

ReservesexcludingRevaluationReserveas per balancesheet

of previousaccountingyeal

EamingsPerShare(before& afterextraordinaryitems)(of {

10/-each)(notannuali$eq)

a) Basic

b) Diluted

( { in Lakhs

Previous

NineMonthsEnded

QuarterEnder

31/12t2414 30tost2014 31t12t2013 e'tnznou 31t12,2013 Yearended

(Unaudited) {Unaudited)(Unaudited) (Unaudiled){Unaudited) 31/03/2014

(Audlted)

1s2A

1241

1241

1320

zo

519

312

187

(302)

367

q6

AA

117

3V

105

1233

36

lo

18

18

1 A

1302

1302

3031

303't

46

459

344

23

378

{326}

1027

105

242

3308

JJUO

370S

3709

434

(258)

'1015

450

39

1329

272

445

202

378

3207

502

b9/

s2

655

1242

100

2272

809

08

222

376

168

253

2278

1030

154

809

oz

13?

217

10?6

74

fa4

33

778

19

113

oe6

1018

116

481

778

16

760

113

93;

42

893

0

893

170.76

10'18

482

OU

958

0

9$8

17Q.76

53

4?9

52.30

52.30

56.10

56.10

4..7

bb

117

64

114

o/

ov

ooc

170.76

760

170,76

89

0

B9

174,76

0.29

0.29

44.51

44.51

5.21

5.21

JO/.

158

271

aA

95

429

174.76

1838

24,51

24.91

PART II

ot.

Particulars

4

I

Previous

Nine Months Ended

QuarterEnded

30togt2014 31112t2013 31t12t2AM 31t12t2013 Yearended

(Unaudited){Unauditedi {Unaudited) (Unaudited) (Unaudited) 31t03t2914

(Audited)

vuazau

No.

PARTICULARS

OF $HARIHOLDING

Public$hareholding

- Numberof Ehares

- Percentage

of Shareholding

Promoter

andPromoterGroup$hareholding

{a} Pledged/ Encumbered

. Numberofshares

- Percentageof shares(as a % of the total shareholdingof

promoterand promotergroup)

- Percenkgeof shares(as a o/oof the total share capitalof

the company)

tb) Non-encumbered

- Numberof shares

- Percentageof shares(as a 9oof the total sharehotdingof

promoterand promoiergroup)

- Percentage

of shares(as a % of lhe totatshare capitalot

the company)

Particulars

INVESTOR

COMPLAINTS

Pendingat lhe beginningof the quarter

Receivedduringthe quarter

Disposedof dui'inglhe quarter

Remainingunresolvedat the end of the quaner

506828

29.68Y0

506828

29.68%

506828

29.684/o

506828

29.689o

506828

29.680/a

508828

29,68%

.

,

a

1204781 1200781

100.009/0 100.00%

fi04781

100.00%

1200781

100.00%|

1200781

100.0070

1200781

100,0070

70.32o/o

70.32o/o

70.32o/o

7A.32olo

70.32%

I V.JZ-/e

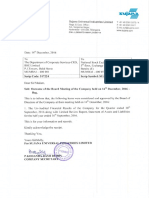

Ouarterended31I 1212014

Nil

Nir

Nil

Nil

..&

. .,'r'i:

Notes

1'

The abovere$uliswere reviewedby the Audit Commitieeand approvedby the Boardof Directorsat its meetingheld on 13thof February,lo1i and

the StatutoryAuditorsof the Companyhave canied out "LimitedRevievl'of the said results.

2'

The Companyis primarilyengagedin the businessof culiivation,manufactureand sale of tea, whiclr is seasonalin character,figuresfor

the cunent

periodcan not be takenas indicativeof likelyresultfor the yearendingll st March,201i.

The Companyhes one reportable

3'

segment,whichis tea.Accordingfy,

no disclosureunderAccountingStandard-17

dealingwith segrnentRepomng

hasbeennads.

4.

Thecostol materialsconsumedrepresentsonly greenleaf purchasedfrom thirdparties.

5'

The Provisionfor TaxesincludesCunentTax and DeferredTax. Provisionlor MalCreditFntittementwill be madeat the end of the year.

6'

Duringthe quarierended31st December.2o14,

the Companyhes reassessedtfie usefullives of itg fixed assetsas specifiedin part C of Schedulell

to the CompaniesAct,2013for all classesof assets.As a resultof the changeon acoountof depreciationfor the quarierand nine monthsendedil st

4 is higherby t37 lacs comparedto usefullivesestimatedin earlierperiods.In caseof assetswhose usefullives have ended,t21 lacs

ng value' net of residualvalue as on 1st April,2014has beenadjustedto the openingreservesas on 1st April,2014pursuantto

chedulell to theCompanies

Act, 2013.

ns representprovisionfor dirninuilon,other than iemporary,in carryingarnountof long term inveslments,

eriodfigureshave been regroupedlreaffanged,

whereevernecssary.

8y the orderof the Board

,{

Kolkata,the 13thFebruary,

2015

.o ld

-' " {Ln*'

- -^"*_-*eA^*ri_

U.Kanoria

Chairman& Director

D I N: 0 0 0 8 1 1 0 8

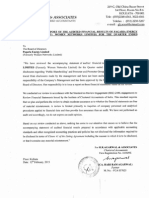

JAIN

& co,

REPORTON IIIIIITED REVIEW

we have eviewed rhe ac@hpanying datehent of unaud

ed nnanciat resu[s ol

M/l. r\ANCOTEA & |NDITSTR|ES

LtMtTDto. lhe quaderended31"rD*emher.2014,

excpl for the disclosures

regadingpublicSharehotding,

and ,promorer

and p@motef

GroupShaehotding'

whch havobeentEed iromdisclosur6madeby lhe manaqement

nd riave not been auditedby us. Ihis slalmentis lhe responsibitjty

of lhe company,.

managemenl

and has beenspprovedby the Boad ol Dneco^ / commneeof

Boardo,

Direclors.Ou. responsibililyis to issoea reporlon thee financB sErehents

basedon our

We @nducled

our reviewin .@ordance

wiihlhe StEndard

on ReviewEnqagemenl

(SRE)

24AA,Ehgagenentir Revgw Fihan tal stalorerts issued by rhe /nsliue

ol chanerd

AccounlanGof India.This siand:rd @quneslhat wo ptan and penorm

lne Eviw lo obtain

modeEtdassunce as lo whelherthe tinanciatstalements.e

re6 ot hate al

missialement

a reviewt5 timitedpnm. y lo inquines

of @mpanypeEonnetand

anaylical

pocedu@appliedto rnanciaidataandthusp@vides

tessa$u6n@ rhanan audit.we

havenot pefomed an .udit and ac@rdingly,we do norerprss an

audiroprnion.

Basenon our Evitu conducledas above,norhinghascometo ou

to believelh.l lhe accohp.nying sialefient ot unaudibn financt

esuls preparodin

accordancewilh applicabteac@unlingstandadsandolher re@gnisd

a@ounlinqpEctices

sndpolicios

hasnotdi$tosedtheinfoma|onequied io be discrosdrnrems orctause

41

ot the LislngAgementtncluding

th mannerin whichit is ro be di*tosed,or that it

conmsanymateiatmtsstatemen,

t

(RegislEtion

No.302023E)

O.redihe t3hdayofFebruary

20tb

B-d

^. r-ar

{&

p a pqd.Nn.fti=

Você também pode gostar

- Engineering Service Revenues World Summary: Market Values & Financials by CountryNo EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Cost-Based Pricing: A Guide for Government ContractorsNo EverandCost-Based Pricing: A Guide for Government ContractorsAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Chapter 14Documento25 páginasChapter 14Clarize R. Mabiog100% (1)

- Financial Results & Limited Review For March 31, 2014 (Result)Documento4 páginasFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Updates On Financial Result For Dec 31, 2015 (Company Update)Documento4 páginasUpdates On Financial Result For Dec 31, 2015 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Consolidated Statements of IncomeDocumento2 páginasConsolidated Statements of IncomePenguinAinda não há avaliações

- Easycall Communications: Q2/H1 Financial StatementDocumento44 páginasEasycall Communications: Q2/H1 Financial StatementBusinessWorldAinda não há avaliações

- Financial Results, Auditors Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Auditors Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Documento16 páginasCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Dragon SweaterDocumento34 páginasDragon Sweaterbinary786Ainda não há avaliações

- Basis For Qualified OpinionDocumento1 páginaBasis For Qualified OpinionannAinda não há avaliações

- Financial Results For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Result)Documento5 páginasFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Audited Report-2019Documento40 páginasAudited Report-2019Irfan Ul HaqAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Bharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015Documento1 páginaBharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015L'express MauriceAinda não há avaliações

- FY11 - Investor PresentationDocumento11 páginasFY11 - Investor Presentationcooladi$Ainda não há avaliações

- Result Presentation For December 31, 2015 (Result)Documento28 páginasResult Presentation For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento6 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- 2GO: H1 ResultsDocumento99 páginas2GO: H1 ResultsBusinessWorldAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- V-Guard Industries LTD 150513 RSTDocumento4 páginasV-Guard Industries LTD 150513 RSTSwamiAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento9 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Pathfinder NOV 2015 Skills LevelDocumento210 páginasPathfinder NOV 2015 Skills LevelAnonymous nqukBeAinda não há avaliações

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocumento3 páginasPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- 2015-12-31 BWPT PDFDocumento110 páginas2015-12-31 BWPT PDFAppie KoekangeAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento11 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Documento21 páginasFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results For March 31, 2016 (Result)Documento1 páginaStandalone & Consolidated Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Sept 30, 2014 (Result)Documento4 páginasFinancial Results For Sept 30, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Documento6 páginasAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Building Inspection Service Revenues World Summary: Market Values & Financials by CountryNo EverandBuilding Inspection Service Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAinda não há avaliações

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAinda não há avaliações

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAinda não há avaliações

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAinda não há avaliações

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAinda não há avaliações

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAinda não há avaliações

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAinda não há avaliações

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- BCSVDocumento8 páginasBCSVjam linganAinda não há avaliações

- Vodafone and Idea Merger: A Shareholder's Dilemma: Roshan Raju and Gita MadhuriDocumento16 páginasVodafone and Idea Merger: A Shareholder's Dilemma: Roshan Raju and Gita MadhuriSachin GAinda não há avaliações

- Case - Ragan Engines Group 9Documento9 páginasCase - Ragan Engines Group 9Ujjwal BatraAinda não há avaliações

- Shares and Dividends Class X Maths CISCEDocumento23 páginasShares and Dividends Class X Maths CISCENatasha SinghAinda não há avaliações

- Maf 620 Dutch LadyDocumento9 páginasMaf 620 Dutch LadyNur IfaAinda não há avaliações

- Reconstitution of A Partnership Firm - Retirement/Death of A PartnerDocumento55 páginasReconstitution of A Partnership Firm - Retirement/Death of A PartnerPathan KausarAinda não há avaliações

- Chapter 18 - Homework 3Documento4 páginasChapter 18 - Homework 3Khanh NguyenAinda não há avaliações

- Capital Structure and Dividend Policy Analysis of Everest IndustriesDocumento14 páginasCapital Structure and Dividend Policy Analysis of Everest IndustriesMOHAMMED SHAHIDAinda não há avaliações

- Statement of Financial Position: Fundamental of Accountancy, Business, and Management 2 ABM12Documento53 páginasStatement of Financial Position: Fundamental of Accountancy, Business, and Management 2 ABM12Mercy P. YbanezAinda não há avaliações

- 11 Accountancy English 2020 21Documento376 páginas11 Accountancy English 2020 21Tanishq Bindal100% (1)

- D. Lilly Orchids CompanyDocumento4 páginasD. Lilly Orchids CompanyDexusAinda não há avaliações

- BUS 485 .. Business Research MethodsDocumento49 páginasBUS 485 .. Business Research MethodsSYED WAFI0% (1)

- CVP Vs BEADocumento2 páginasCVP Vs BEAVaman DeshmukhAinda não há avaliações

- Ca Q&a Dec 2018 PDFDocumento392 páginasCa Q&a Dec 2018 PDFBruce GomaAinda não há avaliações

- Analyze Costs Using Marginal CostingDocumento13 páginasAnalyze Costs Using Marginal CostingmohitAinda não há avaliações

- 38-Article Text-232-3-10-20211009Documento15 páginas38-Article Text-232-3-10-20211009KeziaAinda não há avaliações

- Ch. 12 - Risk Cost of Capital Valuation M2Documento56 páginasCh. 12 - Risk Cost of Capital Valuation M2Ranggaditya Wisnu PradanaAinda não há avaliações

- CFA Level II - Equity - Equity Valuation Applications and ProcessesDocumento10 páginasCFA Level II - Equity - Equity Valuation Applications and ProcessesQuy Cuong BuiAinda não há avaliações

- Practical Questions (Sandeep Garg 2018-19)Documento10 páginasPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaAinda não há avaliações

- Far 360Documento24 páginasFar 360Kirana SofeaAinda não há avaliações

- Payment Voucher DetailsDocumento18 páginasPayment Voucher DetailsHtoo Htoo KyawAinda não há avaliações

- Now That Operations For Outdoor Clinics and Team Events AreDocumento2 páginasNow That Operations For Outdoor Clinics and Team Events AreMiroslav GegoskiAinda não há avaliações

- Financials GlossaryDocumento248 páginasFinancials GlossarySaif Al MutairiAinda não há avaliações

- Checklist For Statutory Audit of BankDocumento9 páginasChecklist For Statutory Audit of BankAayush BansalAinda não há avaliações

- CCI - Guidelines For ValuationDocumento13 páginasCCI - Guidelines For Valuationsujit0577Ainda não há avaliações

- Acctg1205 - Chapter 4 PROBLEMSDocumento6 páginasAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronAinda não há avaliações

- (ACCT2010) (2017) (F) Quiz In5mue0 72155Documento10 páginas(ACCT2010) (2017) (F) Quiz In5mue0 72155Pak HoAinda não há avaliações

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual Chapter 1 MCQDocumento190 páginasAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual Chapter 1 MCQErica Daprosa50% (2)

- Result Presentation For March 31, 2016 (Result)Documento19 páginasResult Presentation For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Shazz Corp Stock Price Under Amir's AssumptionsDocumento3 páginasShazz Corp Stock Price Under Amir's Assumptionslim hui mengAinda não há avaliações