Escolar Documentos

Profissional Documentos

Cultura Documentos

Issue of Shares

Enviado por

Khalid AzizDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Issue of Shares

Enviado por

Khalid AzizDireitos autorais:

Formatos disponíveis

Chapter # 1

Accounting for Company

Issuance of Shares & Debentures

Sameer Hussain

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

SYLLABUS ACCORDING TO UNIVERSITY OF KARACHI:

Accounting for companies.

Issuance of shares and bonds.

Appropriation of retained earnings.

Declaration and payment of dividends.

WHAT THE EXAMINER USUALLY ASK?

General Journal entries for issuance of shares.

General Journal entries for issuance of debentures/bonds.

Appropriation of retained earnings.

Sameer Hussain

Page 2

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

COMPANY

A corporate enterprise that has a legal identity separate from that of its members; it operates as

one single unit, in the success of which all the members participate. A company may have

limited liability (limited company), so that the liability of the members of the companys debt is

limited. An unlimited company is one in which the liability of the members is not limited in any

way. A company may be registered as a public limited company or a private company. The

shares of a private company may not be offered to the public for sale.

KINDS OF COMPANY

On the Basis of Incorporation:

A company incorporated under a special charter granted by the Queen

of England is called Chartered Company. The company is regulated

Chartered Company: by its charter and companies act does not apply to this kind of

company. The charter also prescribes the nature of business and the

power of the company. Example: Bank of England.

A statutory company is one which is created by a special act of

parliament or a state legislature. The nature and power of such

companies are laid down in the special act under which they are

Statutory Company:

created. Memorandum of association is not required for statutory

company. The word limited is not required after companys name.

Example: State Bank of Pakistan.

A registered company is one which is registered in accordance with

the provision of Companies Ordinance, 1984 and includes the existing

companies formed under any other law. Company comes into

Registered Company:

existence by receiving the certificate of incorporation and governed by

the Companies Ordinance, 1984. Registered company may be public

company or private company.

Private Company:

Private company must be registered under companys law.

The legal position (status) of private company is similar to that of public company.

A private company cannot invite subscription from the public.

Transfer of shares is restricted in a private company.

A private company should have at least two (2) members and maximum number cannot

exceed fifty (50).

A private company is not required to hold a statutory meeting.

Public Company:

Public company is also registered under companys law.

A public company can invite subscription from public.

A public company does not have restriction on transfer of shares.

A public company should have at least seven (7) members. There is no restriction on

upper limit of the members.

A public company has to seek certificate for commencement of business.

A public company is required to file its accounts with the registrar.

www.a4accounting.weebly.com

Page 3

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

On the Basis of Liability:

A company limited by shares is a company in which the liability of its

members is limited by its memorandum to the amount unpaid on the

Limited by Shares:

shares respectively held by them. It may either public or private

company.

A company in which the liability of its members is limited by its

memorandum to such amount as the members may respectively

Limited by Guarantee:

undertake to contribute to the assets of the company in the event of its

being wound up.

Private firm (such as a sole proprietorship or general partnership)

whose owner(s), partners, or stockholders accept personal and

unlimited liability for its debts and obligations in return for avoiding

Unlimited Company: double taxation of a limited company. Unlimited liability firms are

exempt from filing their annual accounts with a public authority (such

as Registrar of Companies) unless they are subsidiaries of limited

liability holding companies. It is also called unlimited company.

SHARE

A unit of ownership that represents an equal proportion of a companys capital is called share. It

entitles its holders (shareholders) to an equal claim on the companys profit and an equal

obligation for the companys debts and losses.

KINDS OF SHARE

There are different kinds of shares which can be raised by companies are:

Ordinary shares.

Preference shares.

1-

ORDINARY SHARES (COMMON STOCKS)

The equity shares or ordinary shares are those shares on which the dividend is paid after the

dividend on fixed rate has been paid on preference shares.

CHARACTERISTICS OF ORDINARY SHARES

2-

No fixed rate of dividend.

Dividend is paid after dividend at a fixed rate is paid on preference shares.

At the time of liquidation, capital on equity is paid after preference shares have been

paid back in full.

Non-redeemable.

Equity shareholders have voting rights & thus, control the working of the company.

Equity shareholders are the virtual owners of the company.

PREFERENCE SHARES (PREFERRED STOCKS)

Preference shares are those shares which carry with them preferential rights for their holders,

i.e. preferential right as to fixed rate of dividend and as to repayment of capital at the time of

winding up of the company.

CHARACTERISTICS OF PREFERENCE SHARES

Fixed rate of dividend.

Priority as to payment of dividend.

Preference as to repayment of capital during liquidation of the company.

Sameer Hussain

Page 4

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

Generally preference shareholders do not have voting rights.

KINDS OF PREFERENCE SHARES

On the Basis of Dividend:

Cumulative Preference They are those shares on which the dividend at a fixed rate goes on

Shares: cumulating till it is all paid.

Non Cumulative These are those shares on which the dividend does not cumulate.

Preference Shares:

On the Basis of Conversion:

Convertible Preference The owners of these shares have the option to convert their preference

Shares: shares into ordinary shares as per the terms of issue.

Non Convertible The owners of these shares do not have any right of converting their

Preference Shares: shares into ordinary shares.

On the Basis of Redemption:

Redeemable Preference These are to be purchased back by the company after a certain period

Shares: as per the terms of issue.

Irredeemable These are not to be purchased back by the company during its lifetime.

Preference Shares:

SHARE CAPITAL

Share capital is the part of the finance of a company received from its members or shareholders

in exchange for shares.

TYPES OF SHARE CAPITAL

The maximum amount of shares capital that may be issued by a

company, as detailed in the companys memorandum of association is

Authorized Share

called authorized capital or registered capital. The authorized share

Capital:

capital must be disclosed on the face of the balance sheet or

alternatively in the notes to the accounts.

Issued Share Capital:

The amount of the authorized share capital of a company for which

shareholders have subscribed is called issued share capital.

Called up capital is the part of the issued share capital of a company

payment for which has either been received (paid up share capital) or

Called Up Share requested but not yet received. Some shares are paid for in part at the

Capital: time of issue, with subsequent requests for the outstanding payment.

When all requests have been paid, the called-up share capital will

equal the paid-up share capital.

The part of the issued share capital of a company that shareholders

Paid Up Share

have paid into the company for their fully paid or partly paid shares is

Capital:

called paid up share capital.

www.a4accounting.weebly.com

Page 5

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

SHARE PREMIUM

Share premium is the amount payable for shares in a company and issued by the company itself

in excess of their nominal value. Share premium received by a company must be credited to a

share premium account, which cannot be used for paying dividends to the shareholders.

SHARE DISCOUNT

A share issued at a price below its par value. The discount is the difference between the par

value and the issue price.

PRELIMINARY EXPENSES

Expenses incurred for the registration and documentation in the setting up of a company is

called preliminary expenses. It is treated as current asset in the balance sheet.

ARTICLES OF ASSOCIATION

Article of association is the document that governs the running of a company. It sets out voting

rights of shareholders, conduct of shareholders and directors meetings, power of management,

etc.

MEMORANDUM OF ASSOCIATION

Memorandum of association is an official document setting out the detail of a companys

existence. It must be signed by the first subscribers and must contain the following information:

The name of company.

The address of the registered office.

The objects of the company.

A statement that the company is a public company.

A statement of limited liability.

Amount of the guarantee.

The amount of authorized share capital and its division.

GENERAL JOURNAL ENTRIES

ISSUE OF SHARES AT PAR

Bank

DR. (with amount received)

Ordinary shares application

CR. (with amount received)

(To record the cash received from general public at par)

----------------------------------------------------------------------------------------------------------------Ordinary shares application

DR. (with the amount of shares issued)

Ordinary shares capital

CR. (with the amount of shares issued)

(To record the shares issued to general public at par)

-----------------------------------------------------------------------------------------------------------------

ILLUSTRATION # 1:

(ISSUED AT PAR)

Paramount Co. Ltd. has an authorized capital of Rs.250,000 divided into 25,000 ordinary shares

of Rs.10 each. The company invites application for 3,000 ordinary shares at par from public

along with money. The last day, the banker of the company has informed that only 3,000

ordinary shares applications were received. The management of the company then decided to

issue the same to the public.

REQUIRED

Prepare necessary journal entries.

Sameer Hussain

Page 6

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

SOLUTION # 1:

Date

1

2

Paramount Co. Ltd.

General Journal

Particulars

P/R

Bank (3,000 x 10)

Ordinary shares applications

(To record the shares applications received at par)

Ordinary shares application

Ordinary shares capital (3,000 x 10)

(To record the shares issued to the public at par)

ILLUSTRATION # 2:

Debit

30,000

Credit

30,000

30,000

30,000

(ISSUED AT PAR)

Diamond Co. Ltd. is offering 35,000 ordinary shares of Rs.10 each to the public along with

money. The banker of the company reported that they have received 55,000 ordinary shares

application at par upto the last day. The company has decided to issue 35,000 ordinary shares

and instructed to the banker that excess amount refund to whom shares were not allotted.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 2:

Date

1

2

3

Diamond Co. Ltd.

General Journal

Particulars

P/R

Bank (55,000 x 10)

Ordinary shares applications

(To record the shares applications received at par)

Ordinary shares application

Ordinary shares capital (35,000 x 10)

(To record the shares issued to the public at par)

Ordinary shares application

Bank (20,000 x 10)

(To record the refund of excess money to the public

at par)

Debit

550,000

Credit

550,000

350,000

350,000

200,000

200,000

ISSUE OF SHARES AT PREMIUM

Bank

DR. (with amount received)

Ordinary shares application

CR. (with amount received)

(To record the cash received from general public at premium)

----------------------------------------------------------------------------------------------------------------Ordinary shares application

DR. (amount of shares issued at par plus premium)

Ordinary shares capital

CR. (with the amount of shares issued at par)

Ordinary shares premium

CR. (with the premium amount)

(To record the shares issued to the public at premium)

----------------------------------------------------------------------------------------------------------------Ordinary shares application

DR. (with the amount refund to public)

Bank

CR. (with the amount refund to public)

(To record the refund of excess money to public)

-----------------------------------------------------------------------------------------------------------------

www.a4accounting.weebly.com

Page 7

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

ILLUSTRATION # 3:

(ISSUED AT PREMIUM)

Regal Ltd. has registered capital of Rs.3,000,000 divided into 150,000 ordinary shares of Rs.20

each. The company invites applications for 28,000 ordinary shares of Rs.20 each at Rs.26 each

along with money. The banker has reported that they have received 28,000 ordinary shares

applications at premium. The company decided to issue the same number of shares to the

public.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 3:

Date

1

Regal Ltd.

General Journal

Particulars

Bank (28,000 x 26)

Ordinary shares applications

(To record the shares applications received at

premium)

Ordinary shares application

Ordinary shares capital (28,000 x 20)

Ordinary shares premium (28,000 x 6)

(To record the shares issued to the public at

premium)

ILLUSTRATION # 4:

P/R

Debit

728,000

728,000

Credit

728,000

560,000

168,000

(ISSUED AT PREMIUM)

Unilever Ltd. invites shares applications from 1 April to 10 April for 26,000 ordinary shares of

Rs.10 each with the premium of Rs.2 each. On 10 April, the banker of the company informed to

the company that they have received total 42,000 shares application along with money. On 18

April the board has decided to issue 26,000 ordinary shares at premium after balloting and

instructed to banker that they must refund the amount to whom they have not issued shares.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 4:

Date

10

April

18

April

18

April

Unilever Ltd.

General Journal

Particulars

Bank (42,000 x 12)

Ordinary shares applications

(To record the shares applications received at

premium)

Ordinary shares application

Ordinary shares capital (26,000 x 10)

Ordinary shares premium (26,000 x 2)

(To record the shares issued to the public at

premium)

Ordinary shares application

Bank (16,000 x 12)

(To record the refund of excess money to the public

at premium)

Sameer Hussain

Page 8

P/R

Debit

504,000

Credit

504,000

312,000

260,000

52,000

192,000

192,000

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

ISSUE OF SHARES AT DISCOUNT

Bank

DR. (with amount received)

Ordinary shares application

CR. (with amount received)

(To record the amount received from public at discount)

----------------------------------------------------------------------------------------------------------------Ordinary shares application

DR. (with the amount of shares issued at discount)

Ordinary shares discount

DR. (with the amount of discount)

Ordinary shares capital

CR. (with the amount of shares issued at par)

(To record the shares issued to public at discount)

----------------------------------------------------------------------------------------------------------------Bank

DR. (with the amount of shares issued at discount)

Ordinary shares discount

DR. (with the amount of discount)

Ordinary shares capital

CR. (with the amount of shares issued at par)

(To record the shares issued to underwriter as per agreement)

-----------------------------------------------------------------------------------------------------------------

ILLUSTRATION # 5:

(ISSUED AT DISCOUNT)

Pepsi Co. Ltd. has an authorized capital of Rs.2,500,000 divided into 100,000 ordinary shares of

Rs.25 each. The company invites applications for 35,000 ordinary shares of Rs.25 each at Rs.20

each for the public with the agreement by underwriter. On the last day, the banker has reported

that they have received 26,000 ordinary shares applications from public. The management then

decided to issue the 26,000 ordinary shares to the public and remaining shares will be taken up

by the underwriter as per agreement.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 5:

Date

1

Pepsi Co. Ltd.

General Journal

Particulars

Bank (26,000 x 20)

Ordinary shares applications

(To record the shares applications received at

discount)

Ordinary shares application

Ordinary shares discount (26,000 x 5)

Ordinary shares capital (26,000 x 25)

(To record the shares issued to the public at

discount)

Bank (9,000 x 20)

Ordinary shares discount (9,000 x 5)

Ordinary shares capital (9,000 x 25)

(To record the shares issued to the underwriter at

discount as per agreement)

P/R

Debit

520,000

Credit

520,000

520,000

130,000

650,000

180,000

45,000

225,000

DEBENTURES

Debentures are the most common form of long-term loan taken by a company. It is usually a

loan repayable at a fixed date, although some debentures are irredeemable securities. Most

debentures also pay a fixed rate of interest, and this interest must be paid before a dividend is

paid to shareholders.

www.a4accounting.weebly.com

Page 9

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

ISSUE OF DEBENTURES AT PAR & PAYBACK AT PAR

Bank

DR. (with the amount received)

Debentures payable

CR. (with nominal value)

(To record the debentures issued at par and payback at par)

-----------------------------------------------------------------------------------------------------------------

ILLUSTRATION # 6:

(ISSUED AT PAR & PAYBACK AT PAR)

The company has issued 15,000 7% debentures of Rs.100 each at par and agreed to payback

after 3 years at par.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 6:

Date

1

General Journal

Particulars

P/R

Bank (15,000 x 100)

7% Debentures payable (15,000 x 100)

(To record the issue of 7% debentures at par and

payback at par after 3 years)

Debit

1,500,000

Credit

1,500,000

ISSUE OF DEBENTURES AT PREMIUM & PAYBACK AT PAR

Bank

DR. (with amount received)

Debentures payable

CR. (with par value)

Premium on debenture

CR. (with amount received in premium)

(To record the debentures issued at premium and payback at par)

-----------------------------------------------------------------------------------------------------------------

ILLUSTRATION # 7:

(ISSUED AT PREMIUM & PAYBACK AT PAR)

The company has issued 23,000 10% debentures of Rs.100 each at Rs.105 and agreed to

payback after 5 years at Rs.100 each.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 7:

Date

1

General Journal

Particulars

P/R

Bank (23,000 x 105)

10% Debentures payable (23,000 x 100)

Premium on debentures (23,000 x 5)

(To record the issue of 10% debentures at premium

and payback at par after 5 years)

Debit

2,415,000

Credit

2,300,000

115,000

ISSUE OF DEBENTURES AT DISCOUNT & PAYBACK AT PAR

Bank

DR. (with amount received)

Discount on debenture

DR. (with discount amount)

Debentures payable

CR (with par value)

(To record the debentures issued at discount and payback at par)

-----------------------------------------------------------------------------------------------------------------

Sameer Hussain

Page 10

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

ILLUSTRATION # 8:

(ISSUED AT DISCOUNT & PAYBACK AT PAR)

The company has issued 30,000 8% debentures of Rs.100 each at Rs.95 and redeemable after 5

years at Rs.100 each.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 8:

Date

1

General Journal

Particulars

Bank (30,000 x 95)

Discount on debentures (30,000 x 5)

8% Debentures payable (30,000 x 100)

(To record the issue of 8% debentures at discount

and payback at par after 5 years)

P/R

Debit

2,850,000

150,000

Credit

3,000,000

ISSUE OF DEBENTURES AT PAR & PAYBACK AT PREMIUM

Bank

DR. (with amount received)

Loss on redemption

DR. (with amount of loss at the time of payback)

Debentures payable

CR. (with par value)

Premium on redemption

CR. (the amount will be paid as premium)

(To record the debentures issued at par and payback at premium)

-----------------------------------------------------------------------------------------------------------------

ILLUSTRATION # 9:

(ISSUED AT PAR & PAYBACK AT PREMIUM)

The company has issued 26,000 6% debentures of Rs.100 each at par and redeemable after 6

years at Rs.106 each.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 9:

Date

1

General Journal

Particulars

Bank (26,000 x 100)

Loss on redemption (26,000 x 6)

6% Debentures payable (26,000 x 100)

Premium on redemption (26,000 x 6)

(To record the issue of 6% debentures at par and

payback at premium after 6 years)

P/R

Debit

2,600,000

156,000

Credit

2,600,000

156,000

ISSUE OF DEBENTURES AT DISCOUNT & PAYBACK AT PREMIUM

Bank

DR. (with amount received)

Loss on redemption

DR. (with amount of loss at the time of payback)

Discount on debenture

DR. (with the discount amount)

Debentures payable

CR. (with par value)

Premium on redemption

CR. (the amount will be paid as premium)

(To record the debentures issued at discount and payback at premium)

-----------------------------------------------------------------------------------------------------------------

www.a4accounting.weebly.com

Page 11

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

ILLUSTRATION # 10:

(ISSUED AT DISCOUNT & PAYBACK AT PREMIUM)

The company has issued 35,000 9% debentures of Rs.100 each at Rs.93 and redeemable after 8

years at Rs.106 each.

REQUIRED

Prepare necessary journal entries.

SOLUTION # 10:

Date

1

General Journal

Particulars

Bank (35,000 x 93)

Loss on redemption (35,000 x 6)

Discount on debentures (35,000 x 7)

9% Debentures payable (35,000 x 100)

Premium on redemption (35,000 x 6)

(To record the issue of 9% debentures at discount

and payback at premium after 8 years)

P/R

Debit

3,255,000

210,000

245,000

Credit

3,500,000

210,000

RETAINED EARNINGS

Retained earnings are accumulated earnings that have not been distributed to shareholders but

rather reinvested in the business. A company's retained earnings are disclosed at or near the

bottom of the shareholders equity section of the balance sheet. Accountants may prepare a

separate "statement of retained earnings" that shows the change in retained earnings during the

accounting period; however, the statement of retained earnings is often combined with the

income statement.

RESERVES AND FUNDS

RESERVE

1. It is created out of retained earnings.

2. Reserve is a voluntary provision made

out of net income.

3. Reserve is part of owners equity.

4. It is shown on the credit side of the

balance sheet under owners equity.

5. It represents a portion of profits or

liability.

6. Reserve has normally credit balance.

7. It is part of retained earnings.

FUND

1. It is created out of cash.

2. A provision is a change expense and

revenue.

3. Fund is an asset.

4. It is shown on the debit side of the

balance sheet among assets.

5. It represents on assets.

6. Fund has normally debit balance.

7. It is not part of retained earnings.

CAPITAL RESERVE

Capital reserves are the reserves that may not be distributed according to Company Act 1985.

They include share capital, share premium, capital redemption reserve, certain unrealized

profits, or any other reserves that the company may not distribute according to some other act

or its own article of association.

SECRET RESERVE

Funds held in the reserve but not disclosed in the balance sheet. They arise when an asset is

deliberately either undisclosed or undervalued.

VALUATION RESERVE

Allowance, created by a charge against earnings, to provide for changes in the value of a

company's assets. Examples include accumulated depreciation and allowance for bad debts.

Sameer Hussain

Page 12

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

SURPLUS RESERVE

Amount appropriated out of earned surplus (retained earnings) for future planned or

unforeseen expenditure.

LIABILITY RESERVE

Liability reserve is used to reflect a known liability.

RESERVES

No.

Purpose

Entry to Create

Reporting on

Balance Sheet

Nature of Reserve: Contra Assets or Valuation Reserve

1. To decrease

Bad debts expense

Deduction in

accounts receivable (Dr.)

accounts

to their realizable

Allowance for bad

receivable

value

debts (Cr.)

2. To accumulate

Depreciation expense Deduction in

expired cost of

(Dr.)

related fixed

fixed assets

Allowance for

asset

depreciation (Cr.)

Nature of Reserve: Estimated Liability

3. To recognize

Income tax expense

Shown as a

estimated liability

(Dr.)

current liability

Reserve for income

tax (Cr.)

Nature of Reserve: Appropriation of Retained Earnings

4. To restrict

Retained earnings

Shown as a part

distributable profit (Dr.)

of retained

for building

Reserve for building

earnings

extension

extension (Cr.)

5. To restrict

Retained earnings

Shown as a part

distributable profit (Dr.)

of retained

for plant expansion Reserve for plant

earnings

expansion (Cr.)

6 To restrict

Retained earnings

Shown as a part

distributable profit (Dr.)

of retained

for debenture

Reserve for debenture earnings

redemption

redemption (Cr.)

7 To restrict

Retained earnings

Shown as a part

distributable profit (Dr.)

of retained

for contingencies

Reserve for

earnings

contingencies (Cr.)

Entry to Write Off

Allowance for bad

debts (Dr.)

Accounts receivable

(Cr.)

Allowance for

depreciation (Dr.)

Fixed asset (Cr.)

Reserve for income tax

(Dr.)

Bank (Cr.)

Reserve for building

extension (Dr.)

Retained earnings

(Cr.)

Reserve for plant

expansion (Dr.)

Retained earnings

(Cr.)

Reserve for debenture

redemption (Dr.)

Retained earnings

(Cr.)

Reserve for

contingencies (Dr.)

Retained earnings

(Cr.)

FUNDS

No.

Purpose

Entry to Create

Nature of Reserve: Petty Cash

1. To set aside cash

Petty cash fund (Dr.)

for petty expenses

Bank (Cr.)

Nature of Reserve: Sinking

2. To set aside cash

Sinking fund (Dr.)

for sinking fund

Bank (Cr.)

www.a4accounting.weebly.com

Page 13

Reporting on

Balance Sheet

Entry to Write Off

Shown as a part

of cash

All expenses (Dr.)

Petty cash fund (Cr.)

Shown as a part

of cash

Bonds payable (Dr.)

Sinking fund (Cr.)

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

ILLUSTRATION # 11:

(RETAINED EARNINGS)

The retained earnings account on ABC Company Ltd. showed a credit balance of Rs.400,000 on

December 31, 2010. The expense and revenue summary for the year ending on that date

showed a net income of Rs.150,000 which is transferred to retained earnings account. The

company decided on December 31, 2010 as under:

(a) To declare a cash dividend of Rs.50,000 and stock dividend of Rs.40,000.

(b) To appropriate Rs.40,000 for reserve for plant expansion.

(c) To appropriate Rs.27,000 for reserve for contingencies.

(d) To establish reserve for building extension for Rs.80,000.

(e) Cash dividend paid through bank & 4,000 shares issued in settlement of stock dividend.

REQUIRED

Give entries in General Journal to give effect to the above decisions.

SOLUTION # 11:

Date

1

2

3

4

5

6

7

8

ABC Company Ltd.

General Journal

Particulars

Expense and revenue summary

Retained earnings

(To record the transfer of net income to the retained

earnings account)

Retained earnings

Cash dividend payable

(To record the declaration of cash dividend)

Retained earnings

Stock dividend payable

(To record the declaration of stock dividend)

Retained earnings

Reserve for plant expansion

(To record the reserve for plant expansion)

Retained earnings

Reserve for contingencies

(To record the reserve for contingencies)

Retained earnings

Reserve for building extension

(To record the reserve for building extension)

Cash dividend payable

Bank

(To record the payment of cash dividend)

Stock dividend payable

Ordinary shares capital (4,000 x 10)

(To record the issue of shares against of stock dividend)

Sameer Hussain

Page 14

P/R

Debit

150,000

Credit

150,000

50,000

50,000

40,000

40,000

40,000

40,000

27,000

27,000

80,000

80,000

50,000

50,000

40,000

40,000

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

PRACTICE QUESTIONS

Question # 1:

1998 Private (Principles of Accounting B.Com I) UOK

Mind Corporation completed the following transaction for the month of January 1998.

Jan. 1 Purchased land for Rs.100,000 and in consideration issued shares of Rs.10 each. The

market price of the share was Rs.12.50.

Jan. 5 Purchased machinery and issued 12,500 shares of Rs.10 each. The market price of share

was Rs.12.00.

Jan. 10 The Corporation allotted 20,000 shares of Rs.10 each to the promoters in consideration

of services rendered.

Jan. 20 The Corporation issued 9,000 share of Rs.10 each in full settlement of bonds payable

Rs.100,000.

Jan. 25 Issued 1,000 debentures of Rs.100 each redeemable after five years at Rs.105.

Jan. 30 Issued 2,000 debentures of Rs.100 each at Rs.95 redeemable after five years.

Jan. 31 Paid preliminary expenses Rs.10,000.

REQUIRED

Give dated entries in the General Journal with narration to record the above transactions.

Question # 2:

2004 Private (Principles of Accounting B.Com I) UOK

Nishat Co. Ltd. made the following issuance of shares and debentures:

(a) The company offered 60,000 ordinary shares of Rs.10 each at Rs.12 per share to public;

applications were received for 70,000 shares. 60,000 shares were allotted and the

excess money was refunded.

(b) Land was acquired by issuing 40,000 ordinary shares of Rs.10 each. The market price

per share was Rs.15.

(c) The promoters of the company were allotted 6,000 ordinary shares of Rs.10 each in

consideration of their services rendered.

(d) Mortgage payable of Rs.60,000 was settled by the issue of ordinary shares of Rs.10 each.

The market value of the share was Rs.15.

(e) Received Rs.95,000 against the issue of 3,000 10% debentures each redeemable at par

after 5 years.

REQUIRED

Record the above transactions in the General Journal of the company.

Question # 3:

2005 Private (Principles of Accounting B.Com I)UOK

Chuhan & Co. Ltd. was registered with a capital of Rs.20,000,000 ordinary shares of Rs.10 each.

It was incorporated by acquiring the running business of Yasir, a sole trader. The balance sheet

of the business of Yasir as of January 01, 2005 was as under:

ASSETS

EQUITIES

Cash

40,000 Accounts payable

40,000

Accounts receivable

120,000 Notes payable

40,000

Merchandise inventory

160,000 Allowance for bad debts

8,000

Office supplies

8,000 Accumulated depreciation

240,000

Furniture

400,000 Yasir Capital

400,000

728,000

728,000

Chuhan & Co. Ltd. took over the business assets other than cash and assumed the liabilities. In

exchange, the company issued 30,000 shares of Rs.10 each at Rs.15 per share. The company also

made an additional issue of 10,000 shares of Rs.10 each at Rs.15 per share to the public, which

were subscribed and paid for.

REQUIRED

(i) Give the necessary entries in the General Journal of Chuhan & Company.

(ii) Prepare initial balance sheet.

www.a4accounting.weebly.com

Page 15

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

Question # 4:

1989 Regular & Private (Principles of Accounting B.Com I)UOK

Adnan & Co. Ltd. was registered with a capital of Rs.1,000,000 divided into 100,000 ordinary

shares of Rs.10 each. It started functioning by acquiring the business of Naeem, a sole trader.

The balance sheet of the business of Naeem as of the date of purchase was as under:

ASSETS

EQUITIES

Cash

10,000 Accounts payable

20,000

Accounts receivable

30,000

Naeem Capital

100,000

Less: All for bad debts

(2,000)

28,000

Merchandise inventory

40,000

Office supplies

2,000

Equipment

100,000

Less: All for depreciation

(60,000)

40,000

120,000

120,000

Adnan & Co. Ltd. takes over the business assets other than cash and assumed the liabilities. In

exchange, the company issued 9,000 shares of Rs.10 each as fully paid. The company also made

an additional issue of 15,000 shares of Rs.10 each at Rs.12 per share to the public, which were

fully subscribed and paid for. The company also paid for preliminary expenses amounting to

Rs.10,000.

REQUIRED

(i) Give entries in the General Journal of Adnan & Co. Ltd.

(ii) Prepare balance sheet of Adnan & Co. Ltd.

Question # 5:

1999 Regular & Private (Principles of Accounting B.Com I)UOK

Karim Company Ltd. completed the following transactions:

(1) The company offered 70,000 shares of Rs.10 each at Rs.12 but received applications for

80,000 shares. The company finalized the allotment and refunded the excess amount.

(2) The company purchased a running business and acquired the following assets and

liabilities:

Merchandise inventory Rs.15,000; Office equipment Rs.50,000; Machinery Rs.40,000;

Accounts payable Rs.5,000. Purchase consideration of the above business was paid by

issue of 9,000 shares of Rs.10 each fully paid-up.

(3) Purchased a machine worth Rs.200,000 and in consideration issued shares of Rs.10

each. Each share had a market value of Rs.12.50.

(4) Purchased office equipment and in consideration issued 10,000 shares of Rs.10 each.

The market value of the share was Rs.13.

(5) Issued 2,000 10% debentures of Rs.100 each at Rs.95 redeemable after five years at

Rs.105.

(6) The company declared stock dividend Rs.50,000 and issued 4,500 shares of Rs.10 each.

REQUIRED

Give journal entries in proper form of the above transactions on the books of Karim Co. Ltd.

Question # 6:

1995 Regular (Principles of Accounting B.Com I)UOK

Najeeb & Company Ltd. made the following issuance:

1) The company allotted 35,000 ordinary shares of Rs.10 each in consideration of acquiring

assets and liabilities of a running business. The agreed value of assets and liabilities

acquired is as follows:

Accounts receivable Rs.70,000; Furniture Rs.40,000; Building Rs.230,000; Machinery

Rs.100,000 and Accounts payable Rs.50,000.

2) The company allotted 8,500 ordinary shares of Rs.10 each in full settlement of

debentures payable of Rs.90,000.

Sameer Hussain

Page 16

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

3) The company allotted ordinary shares of Rs.10 each in consideration of stock dividend

of Rs.60,000. The share had a market price of Rs.12 per share.

4) The promoters of the company were allotted 15,000 ordinary shares of Rs.10 each in

consideration of the services rendered to the company.

5) Purchased equipment by issuing 6,000 ordinary shares of Rs.10 each. The market value

of share was Rs.14 per share.

6) Received cash Rs.110,000 by issue of 12,000, 10% debentures of Rs.10 each, redeemable

after 5 years at Rs.113 each.

REQUIRED

Record the above transactions in the General Journal of the company.

Question # 7:

2007 Regular (Advanced & Cost Accounting)UOK

Following are the some of the transactions completed by Asif Corporation Ltd. The corporation

has an authorized capital of Rs.5,000,000 divided into 500,000 shares of Rs.10 each.

Acquired office equipment costing Rs.500,000 and in payment issued sufficient number of

shares of Rs.10 each fully paid upto the vendor. The market price of the share is Rs.12.50 each.

Issued 2,000 6% debentures of Rs.100 each at Rs.103 redeemable at Rs.105 each.

The company issued 40,000 shares to capitalize profit of Rs.500,000.

Building extension reserve was increased by Rs.300,000.

Restriction imposed on retained earnings in the form of contingencies was removed

Rs.600,000.

REQUIRED

Give entries in the General Journal to record the above transactions.

Question # 8:

2001 Regular & Private (Principles of Accounting B.Com I)UOK

The following transactions relate to Bhutto Limited.

(a) Received applications for 100,000 ordinary shares of Rs.10 each. Issued allotment

letters for 80,000 shares and refunded the excess application money.

(b) Issued 6,000 ordinary shares of Rs.10 each at a market price of Rs.12 per share for

acquiring land.

(c) Issued ordinary shares of Rs.10 each at a premium of Rs.2 per share, in settlement of

bonds payable Rs.60,000.

(d) Declared cash dividend of Rs.30,000 and stock dividend of Rs.50,000.

(e) Appropriate Rs.150,000 for contingencies.

(f) Issued ordinary shares of Rs.10 each in payment of stock dividend of Rs.50,000.

(g) Issued dividend warrants in payment of cash dividend of Rs.30,000.

(h) Unclaimed dividend of Rs.5,000 as per bank statement.

REQUIRED

Give general journal entries for the above transactions.

Question # 9:

2002 Regular & Private (Principles of Accounting B.Com I)UOK

Al-Azam Ltd. entered into the following transactions:

(1) Issued 50,000 ordinary shares of Rs.10 par at Rs.12 each for cash.

(2) Issued 10,000 ordinary shares of Rs.10 in acquisition of machinery costing Rs.120,000.

(3) Declared cash dividend Rs.150,000 and stock dividend Rs.200,000. Retained earnings

account is having sufficient balance.

(4) Bank reported that the cash dividend in the amount of Rs.30,000 was unclaimed.

(5) Issued 17,500 ordinary shares of Rs.10 in settlement of stock dividend.

(6) Issued to directors 15,000 shares of Rs.10 each in recognition of their services rendered

to the company.

(7) Issued 1,000 debentures of Rs.100 each at Rs.110 payable after 5 years at Rs.120.

REQUIRED

Give the necessary journal entries to record the above transactions in proper form.

www.a4accounting.weebly.com

Page 17

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

Question # 10:

2003 Regular & Private (Principles of Accounting B.Com I)UOK

The shares issue transactions of Safeer Co. Ltd. for the year ended on 30th September 2003:

(a) The company issued for cash 400,000 shares of Rs.10 each at Rs.13 each.

(b) The promoters were allotted 10,000 shares of Rs.10 each for services.

(c) The company bought equipment costing Rs.100,000. Rs.10 shares were issued in

exchange. The market value per share was Rs.12.50.

(d) For land purchased worth Rs.750,000, 80,000 shares of Rs.10 each were issued.

(e) Declared dividend 25% on the shares issued above.

(f) Paid the dividend through bank.

REQUIRED

(i) Journalize the above transactions.

(ii) Prepare initial balance sheet of the company.

Question # 11:

2004 Regular (Principles of Accounting B.Com I) UOK

The following transactions related to Salman Co. Ltd.:

1. The company offered 50,000 shares of Rs.10 each at Rs.15. The company received

application for 65,000 shares. The company finalized the allotment and the excess

money was refunded.

2. The company declared stock dividend of Rs.100,000. The company issued 9,000 shares

of Rs.10 each in settlement of stock dividend.

3. The company purchased land worth Rs.500,000 and issued 45,000 shares of Rs.10 each

to vendor.

4. The company purchased machine and in consideration thereof issued 16,000 shares of

Rs.10 each. The market price of the share was Rs.12.50.

5. The company issued 2,000 debentures of Rs.100 each at par, repayable after five years

at 5% redemption premium.

6. The company issued 1,000 debentures of Rs.100 each at Rs.95 repayable after five years

at Rs.105.

REQUIRED

Record the above transactions in the General Journal of the company.

Question # 12:

2005 Regular (Principles of Accounting B.Com I) UOK

The following transactions relate to Khan & Co. Ltd.

(a) The company received application for 200,000 ordinary shares of Rs.10 each. Allotment

letters were issued for 150,000 shares and the excess subscription amount was

refunded.

(b) The promoters paid Rs.20,000 for printing of Memorandum of Association of the

company.

(c) A computer was acquired by issuing 4,000 ordinary shares of Rs.10 each fully paid up.

The market price per share was Rs.18.

(d) Declared a cash dividend of Rs.200,000 and stock dividend of Rs.300,000.

(e) Created reserve for debenture redemption in the amount of Rs.15,000

(f) Issued 5,000 debentures of Rs.100 each at Rs.90 redeemable after 7 years.

(g) The bank reported that the amount of dividend paid was Rs.150,000 and the unclaimed

dividend was Rs.50,000.

(h) The company issued 3,000 12% 5 years debentures of Rs.100 at par redeemable after 5

years at Rs.105.

REQUIRED

Give journal entries for the above transactions.

Sameer Hussain

Page 18

www.a4accounting.weebly.com

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

Question # 13:

1996 Regular (Principles of Accounting B.Com I) UOK

Siddique Company Ltd. is registered with an authorized capital of Rs.1,000,000 divided into

100,000 ordinary shares of Rs.10 each. The company issued its shares as under:

(a) The company offered to the public 50,000 shares at par. Applications for 40,000 shares

were received. As per agreement the underwriters subscribed for the balance of their

shares. The directors finalized the allotment of 40,000 shares to the public and 10,000

shares to the underwriters. The company paid 2% underwriting commission on shares

subscribed to them.

(b) The company purchased a machine costing Rs.72,000 and issued sufficient shares. The

shares had a market value of Rs.8/= each.

(c) The company allotted necessary shares in consideration of stock dividend Rs.50,000.

The shares had a market value of Rs.12.50.

(d) The company issued 1,000 shares in exchange for services rendered to the company.

The stock holders agreed that these services were worth Rs.15,000.

REQUIRED

Record the above transactions in the General Journal of the company.

Question # 14:

1992 Private (Principles of Accounting B.Com I)UOK

The equities section of Ghani Ltd. at December 31, 1991 was as under:

Authorized Capital:

200,000 shares of Rs.10 par

Rs.

2,000,000

Paid Up Capital:

100,000 shares of Rs.10 par

Rs.

1,000,000

Premium on shares

Rs.

150,000

Retained earnings

Rs.

450,000

Reserve for asset replacement

Rs.

100,000

Stock dividend to be distributed

Rs.

120,000

Cash dividend payable

Rs.

80,000

Accounts payable

Rs.

50,000

Bonds payable

Rs.

150,000

In the succeeding year, the Co. performed the following transactions, in addition to routine

business:

(1) The dividend payable was paid.

(2) 12,000 shares of Rs.10 par were allotted in settlement of the stock dividend.

(3) 10,000 shares of Rs.10 were allotted in full settlement of bonds payable of Rs.150,000.

(4) The reserve for asset replacement was disposed-off because the asset was replaced.

(5) Created a reserve for contingencies in the amount of Rs.40,000.

(6) Purchased a machinery for Rs.75,000 by allotting sufficient number of shares of Rs.10

par at a premium of Rs.5 per share.

REQUIRED

(a) Record the above transactions in the General Journal giving explanation below each

entry.

(b) Reproduce the equities section in proper form after incorporating the effects of the

above transactions.

www.a4accounting.weebly.com

Page 19

Sameer Hussain

Accounting for Company Issuance of Shares & Debentures

Chapter # 1

Question # 15:

2000 Regular & Private (Principles of Accounting B.Com I)UOK

The shareholders equity section of balance sheet of Wasim Ltd. as on June 30, 2000 was as

under:Authorized capital (2,000,000 shares of Rs.10 par)

Rs.

20,000,000

Paid up capital 90,000 shares of Rs.10 par

Rs.

900,000

Premium on shares

Rs.

180,000

Retained earnings

Rs.

520,000

Reserve for building extension

Rs.

150,000

During the quarter ended September 30, the company performed the following transactions in

addition to normal business:

(a) The company received application along with application money for 80,000 shares in

response to the issue of 100,000 shares of Rs.10 par at Rs.15/= to the public. The board

of directors finalized the allotment by allotting 80,000 shares to the public and 20,000

shares to the underwriters.

(b) Closed the reserve for building extension account as the purpose is over.

(c) A computer costing Rs.90,000 was acquired by allotting 7,000 shares of Rs.10/= par.

(d) Purchased a fax machine for Rs.75,000 by allotting shares at the price of Rs.12.50 per

share as quoted at the stock exchange.

(e) Issued 5,000 10% 5 year bonds of Rs.100 par for cash to be redeemed at Rs.110 at

maturity.

(f) Created a reserve for redemption of bonds by Rs.40,000.

(g) Declared interim stock dividend of Rs.150,000 and cash dividend of Rs.200,000.

(h) Allotted shares of Rs.10 par at a premium of Rs.5 per share in settlement of the stock

dividend.

REQUIRED

(i) Record the above transactions in General Journal.

(ii) Prepare a partial Balance Sheet reporting the above facts.

Sameer Hussain

Page 20

www.a4accounting.weebly.com

Você também pode gostar

- Ncert 12 Account 2Documento329 páginasNcert 12 Account 2soniya1karki100% (2)

- Accounting For Corporation For LMSDocumento77 páginasAccounting For Corporation For LMSRosethel Grace Gallardo100% (1)

- Acca F6 UkDocumento60 páginasAcca F6 Ukm2mlckAinda não há avaliações

- Schumpeter ModelDocumento5 páginasSchumpeter ModelKhalid Aziz100% (1)

- Corporate Formation and The Stockholders - EquityDocumento39 páginasCorporate Formation and The Stockholders - EquityChocochipAinda não há avaliações

- Company AccountsDocumento24 páginasCompany Accountsdeo omachAinda não há avaliações

- CFA Level 1 (Book-B)Documento170 páginasCFA Level 1 (Book-B)butabutt100% (1)

- Economics Mcqs Kit PDFDocumento241 páginasEconomics Mcqs Kit PDFKhalid AzizAinda não há avaliações

- Accounting For Share CapitalDocumento72 páginasAccounting For Share CapitalApollo Institute of Hospital Administration100% (5)

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocumento7 páginasUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonAinda não há avaliações

- Financial Accounting and Reporting Final Preboard Exam: A. B. C. DDocumento18 páginasFinancial Accounting and Reporting Final Preboard Exam: A. B. C. DmarinAinda não há avaliações

- C TFIN52 66-QuestionsDocumento5 páginasC TFIN52 66-QuestionsDhikra JtAinda não há avaliações

- Exercise 02 INTACC2 Cadiz Jericho E.Documento15 páginasExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonAinda não há avaliações

- QTMDocumento8 páginasQTMKhalid AzizAinda não há avaliações

- Guess Papers BY Sir Khalid Aziz: Iqra Commerce NetworkDocumento14 páginasGuess Papers BY Sir Khalid Aziz: Iqra Commerce NetworkAnonymous NKjJIpAinda não há avaliações

- Guess Papers BY Sir Khalid Aziz: Iqra Commerce NetworkDocumento14 páginasGuess Papers BY Sir Khalid Aziz: Iqra Commerce NetworkAnonymous NKjJIpAinda não há avaliações

- Ch02 Tool KitDocumento18 páginasCh02 Tool KitPopsy AkinAinda não há avaliações

- Chapter # 3: Accounting For Company - Issuance of Shares & DebenturesDocumento26 páginasChapter # 3: Accounting For Company - Issuance of Shares & DebenturesFahad BataviaAinda não há avaliações

- Company - Meaning: Voluntary Association Persons Capital Transferrable Shares Business Earn ProfitDocumento44 páginasCompany - Meaning: Voluntary Association Persons Capital Transferrable Shares Business Earn ProfitVimala Selvaraj VimalaAinda não há avaliações

- Topic 6 Accounting For CompaniesDocumento55 páginasTopic 6 Accounting For Companiestwahirwajeanpierre50Ainda não há avaliações

- Company Accounts-Updated-1Documento44 páginasCompany Accounts-Updated-1cleophacerevivalAinda não há avaliações

- Leac201 PDFDocumento73 páginasLeac201 PDFSubhamoy PradhanAinda não há avaliações

- 5 Company AccountsDocumento11 páginas5 Company Accountsdeo omachAinda não há avaliações

- Shares in Company ActDocumento5 páginasShares in Company ActMohnish ChaudhariAinda não há avaliações

- Companies NotesDocumento40 páginasCompanies NotesPetrinaAinda não há avaliações

- Edited CorporationDocumento13 páginasEdited CorporationMesele AdemeAinda não há avaliações

- COMPANIESDocumento12 páginasCOMPANIESSeth MophanAinda não há avaliações

- Far 250Documento18 páginasFar 250Aisyah SaaraniAinda não há avaliações

- Legal Aspects - Unit-2Documento33 páginasLegal Aspects - Unit-2Vikram VikasAinda não há avaliações

- Financial Accounting 1 - Acc 301: Unit One Company AccountsDocumento53 páginasFinancial Accounting 1 - Acc 301: Unit One Company AccountsTrishia ReditaAinda não há avaliações

- Prin. of Acct II - Ch-5-CorporationDocumento16 páginasPrin. of Acct II - Ch-5-CorporationfageenyakaraaAinda não há avaliações

- Issue of SharesDocumento53 páginasIssue of SharesKanishk GoyalAinda não há avaliações

- Joint Stock CompanyDocumento35 páginasJoint Stock Companymo0onshahAinda não há avaliações

- Company AccountDocumento6 páginasCompany AccountADEYANJU AKEEMAinda não há avaliações

- Chapter 6Documento13 páginasChapter 6yosef mechalAinda não há avaliações

- Company LawDocumento86 páginasCompany Lawthalapathy.7502Ainda não há avaliações

- Business LawDocumento8 páginasBusiness LawRyhanul IslamAinda não há avaliações

- Company: DefinitionDocumento6 páginasCompany: DefinitionAnthony BlackAinda não há avaliações

- Corporate Accounting-IDocumento21 páginasCorporate Accounting-IAPURVA RANJANAinda não há avaliações

- Company LawDocumento12 páginasCompany LawShellian CunninghamAinda não há avaliações

- Accounting For Issue Os Shares-1Documento77 páginasAccounting For Issue Os Shares-1fbicia218Ainda não há avaliações

- Accounting II - Chapter 5, Accounting For CorporationDocumento16 páginasAccounting II - Chapter 5, Accounting For CorporationHawultu AsresieAinda não há avaliações

- +2 Company PDFDocumento73 páginas+2 Company PDFAnonymous 3yqNzCxtTzAinda não há avaliações

- Balance Sheet PDFDocumento10 páginasBalance Sheet PDFavinash singhAinda não há avaliações

- What Is A CompanyDocumento14 páginasWhat Is A CompanySimple WaltarAinda não há avaliações

- Forms of Company and MOADocumento7 páginasForms of Company and MOAFinance UnveiledAinda não há avaliações

- The Companies Act 1956 PPT at Bec DomsDocumento55 páginasThe Companies Act 1956 PPT at Bec DomsBabasab Patil (Karrisatte)100% (1)

- A Project Report On: Factor-AnalysisDocumento53 páginasA Project Report On: Factor-Analysisswati_poddarAinda não há avaliações

- Company Law: Nature of A CompanyDocumento151 páginasCompany Law: Nature of A Companychangumangu100% (1)

- Distinguish Corporation, Partnership, and Sole Proprietorship in Terms ofDocumento6 páginasDistinguish Corporation, Partnership, and Sole Proprietorship in Terms ofMarkyle De VeraAinda não há avaliações

- Chapter 5 CorporationDocumento14 páginasChapter 5 CorporationMathewos Woldemariam BirruAinda não há avaliações

- Presentation 3Documento51 páginasPresentation 3Rapster WasorAinda não há avaliações

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Documento5 páginasFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345Ainda não há avaliações

- Chapter 10 Shareholders EquityDocumento10 páginasChapter 10 Shareholders EquityMarine De CocquéauAinda não há avaliações

- Corporations: Nature of Corporate Form of Organization Its Operation and Salient FeaturesDocumento3 páginasCorporations: Nature of Corporate Form of Organization Its Operation and Salient FeaturesIhtisham RanaAinda não há avaliações

- Company LawDocumento8 páginasCompany LawNickyAinda não há avaliações

- Introduction To Corporations: Dr. Ronnie G. Salazar, CpaDocumento105 páginasIntroduction To Corporations: Dr. Ronnie G. Salazar, CpaEllah MaeAinda não há avaliações

- Chapter 1Documento73 páginasChapter 1harbaksh moolchandaniAinda não há avaliações

- Company Share Capital 2020Documento26 páginasCompany Share Capital 2020Levin makokhaAinda não há avaliações

- Company LawDocumento56 páginasCompany Lawsiddharth devnaniAinda não há avaliações

- Equity SharesDocumento3 páginasEquity SharesKanika PasariAinda não há avaliações

- Limited Liability CompanyDocumento17 páginasLimited Liability CompanyAdrian RamsundarAinda não há avaliações

- Types & Kinds of CompaniesDocumento7 páginasTypes & Kinds of Companiesdurgesh varunAinda não há avaliações

- B Company LAW - StudentDocumento61 páginasB Company LAW - StudentSudipta SarangiAinda não há avaliações

- Shares & Share CapitalDocumento36 páginasShares & Share CapitalkritiAinda não há avaliações

- Notes Company AccountsDocumento73 páginasNotes Company AccountschetandeepakAinda não há avaliações

- BMS CL Unit 4Documento30 páginasBMS CL Unit 4RKS KRAinda não há avaliações

- ShareholdersDocumento7 páginasShareholderszhutilAinda não há avaliações

- LESSON 2 Company AccountsDocumento13 páginasLESSON 2 Company AccountsBulelwa HarrisAinda não há avaliações

- P-2 TheoryDocumento72 páginasP-2 TheoryUdayan KachchhyAinda não há avaliações

- Cir CBE March 2017Documento1 páginaCir CBE March 2017Khalid AzizAinda não há avaliações

- Date Sheet PDFDocumento1 páginaDate Sheet PDFKhalid AzizAinda não há avaliações

- Marks Question No. 2 (A) (I) Conditions Need To Fulfill To Get A Licence: 05Documento8 páginasMarks Question No. 2 (A) (I) Conditions Need To Fulfill To Get A Licence: 05Khalid AzizAinda não há avaliações

- Final Test Advanced Accounting B-COM Part 2: Sir Khalid AzizDocumento6 páginasFinal Test Advanced Accounting B-COM Part 2: Sir Khalid AzizKhalid AzizAinda não há avaliações

- B-Com GP 1 2018 FinalDocumento10 páginasB-Com GP 1 2018 FinalKhalid AzizAinda não há avaliações

- Macro Economics NotesDocumento18 páginasMacro Economics NotesKhalid AzizAinda não há avaliações

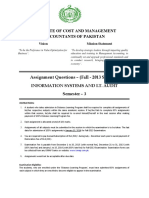

- Institute of Cost and Management Accountants of Pakistan: Assignment Questions - (Fall - 2013 Session)Documento4 páginasInstitute of Cost and Management Accountants of Pakistan: Assignment Questions - (Fall - 2013 Session)Khalid AzizAinda não há avaliações

- B-Com GP 1Documento10 páginasB-Com GP 1Khalid AzizAinda não há avaliações

- Feb 2018 AnsDocumento7 páginasFeb 2018 AnsKhalid AzizAinda não há avaliações

- Sir Khalid Aziz: According To New SyllabusDocumento1 páginaSir Khalid Aziz: According To New SyllabusKhalid AzizAinda não há avaliações

- Principles of AccountingDocumento657 páginasPrinciples of AccountingKhalid Aziz89% (106)

- Factory Overhead Idle Capacity VarianceDocumento4 páginasFactory Overhead Idle Capacity VarianceKhalid Aziz100% (1)

- q2 Half Yearly Financial Report Fifth Draft August 2015 PDFDocumento26 páginasq2 Half Yearly Financial Report Fifth Draft August 2015 PDFKhalid AzizAinda não há avaliações

- First Division Seat Nos:: University of Karachi Karachi (Examinations Department)Documento5 páginasFirst Division Seat Nos:: University of Karachi Karachi (Examinations Department)Khalid AzizAinda não há avaliações

- What Are The Main Problems of Agriculture SectorDocumento4 páginasWhat Are The Main Problems of Agriculture SectorKhalid AzizAinda não há avaliações

- M.A. (Previous) External, Annual Examination 2014.Documento2 páginasM.A. (Previous) External, Annual Examination 2014.Khalid AzizAinda não há avaliações

- LL.B. PART - I, Annual Examination 2015.Documento3 páginasLL.B. PART - I, Annual Examination 2015.Khalid AzizAinda não há avaliações

- MA Eco SyllabusDocumento27 páginasMA Eco SyllabusRana AsimAinda não há avaliações

- ClosingDocumento1 páginaClosingKhalid AzizAinda não há avaliações

- S.S.C. Part II General (Regular & Private) Group Results 2015Documento106 páginasS.S.C. Part II General (Regular & Private) Group Results 2015Khalid AzizAinda não há avaliações

- Central BankingDocumento22 páginasCentral BankingKhalid AzizAinda não há avaliações

- Amalgamation - Principles of AccountingDocumento4 páginasAmalgamation - Principles of AccountingAbdulla MaseehAinda não há avaliações

- Pathfinder NOV 2015 Skills LevelDocumento210 páginasPathfinder NOV 2015 Skills LevelAnonymous nqukBeAinda não há avaliações

- V. Financial Plan A. Major AssumptionsDocumento26 páginasV. Financial Plan A. Major AssumptionsPapi Beats-EDMAinda não há avaliações

- Credit Memo Ok Debit Memo Ok Debit MemoDocumento22 páginasCredit Memo Ok Debit Memo Ok Debit MemoVea Canlas CabertoAinda não há avaliações

- Chapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 13e, Global Edition (Gitman)Documento33 páginasChapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 13e, Global Edition (Gitman)Statistics ABMAinda não há avaliações

- Accounting Oct 21:2022Documento20 páginasAccounting Oct 21:2022SamarahAinda não há avaliações

- BR.030 B R M D: Financials-Fixed AssetsDocumento27 páginasBR.030 B R M D: Financials-Fixed Assetstyui876Ainda não há avaliações

- ACC 422 NERD Your Future OurDocumento24 páginasACC 422 NERD Your Future OurLavanya1Ainda não há avaliações

- Class Work AnshikaDocumento2 páginasClass Work AnshikaRupanshi AnandAinda não há avaliações

- 9 Set Off & Carry ForwardDocumento25 páginas9 Set Off & Carry Forward21BAM025 RENGARAJANAinda não há avaliações

- During The Current Year Blake Construction Disposed of Plant AssetsDocumento1 páginaDuring The Current Year Blake Construction Disposed of Plant Assetstrilocksp SinghAinda não há avaliações

- Example Mid TermDocumento7 páginasExample Mid TermvelusnAinda não há avaliações

- Eerest Waffers-BBA-MBA Project ReportDocumento75 páginasEerest Waffers-BBA-MBA Project ReportpRiNcE DuDhAtRaAinda não há avaliações

- Home Assignment 02: Total Sales Value Variable Costs Fixed Costs Annual Savings 1175000 1175000 1175000 1175000 1175000Documento2 páginasHome Assignment 02: Total Sales Value Variable Costs Fixed Costs Annual Savings 1175000 1175000 1175000 1175000 1175000Farzan Yahya HabibAinda não há avaliações

- Ac Far Quiz4Documento5 páginasAc Far Quiz4Kristine Joy CutillarAinda não há avaliações

- Acc05 Far Handout 7Documento5 páginasAcc05 Far Handout 7Jullia BelgicaAinda não há avaliações

- Section 44AE - TheoryDocumento44 páginasSection 44AE - Theoryuditnarayan8721663Ainda não há avaliações

- WEC Case AnalysisDocumento15 páginasWEC Case AnalysisAkanksha GuptaAinda não há avaliações

- DPR PackageDocumento29 páginasDPR PackageAbhishek SharmaAinda não há avaliações

- Engineering Economics: DevilbatDocumento10 páginasEngineering Economics: DevilbatChristian JacintoAinda não há avaliações

- Accounting For PPE Part 1Documento20 páginasAccounting For PPE Part 1Keenly ChokeAinda não há avaliações

- Kathmandu Hospital UpdatedDocumento7 páginasKathmandu Hospital Updatedone twoAinda não há avaliações

- GM 19Documento3 páginasGM 19Bhavdeep singh sidhuAinda não há avaliações