Escolar Documentos

Profissional Documentos

Cultura Documentos

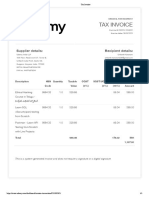

Indirect Tax

Enviado por

ding095Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Indirect Tax

Enviado por

ding095Direitos autorais:

Formatos disponíveis

Taxation

International trade involves movements of Goods (imports and exports) from one country to another

country. Every country follows either a policy of free trade or protection. In a free trade policy, there is no

restriction on movement of goods between countries. Protection involves encouragement to home industry

by providing subsidies to domestic producers or usually by providing tariffs (customs duty) on imports and

exports. Custom duties are levied with twin objectives of:

1. Generating revenue for the state and

2. Protecting interested of domestic industry by making imports costlier.

Thus, tariffs (customs) restrict international trade (particularly imports). These are used as a tool for

protection of domestic industry. Main benefits of protection are:

1. Infant industry in under-developed/developing countries requires protection from competitors

during early growth period for its proper nursing.

2. To bring about harmonious and balanced growth of all industries.

3. For expanding employment and income.

4. To correct disequilibrium in balance of payments.

5. For making terms of trade favorable to an importing country.

6. Customs have been a very productive source of state revenue.

7. For conserving scarce natural resources of a country. (E.g. minerals and other raw materials)

8. Key industries such as iron & steel, heavy chemicals have to be protected for a better and bound

industrial structure.

9. To protect market from dumping.

10. Developing countries (agrarian economies) can develop industrial potentialities rapidly by

minimizing foreign competition through high tariffs.

In a nutshell, Custom duties do affect import volume, prices, production and consumption. They also

affect terms of trade, balance of payments etc.

Custom duties include import duties, export duties and transit duties. Two types of duties also levied to

achieve specified objective under customs. These are:

1. Revenue duties

2. Protective duties/Tariffs.

Revenue Tariffs are levied to generate revenue for the state. Revenue tariffs are generally not meant to

check imports.

Window Dressing

Define window dressing. Discuss its merits and demerits.

Window dressing is much widely used concept in the corporate sector. The management of business

houses uses these techniques for the presentation of their financial statements before its users.

Window dressing is defined by different institutions & individuals in various manners.

Some have defined it as an accounting trick to make the balance sheet and income statement appear to

be better then they actually are.

To few, it is an instrument used in documents and pictures to make something to appear more attractive

than it is actually are.

Window-dressing is used popularly in business activities for advertising, selling & marketing. The Financial

statements are window-dressed to present the financial items & results and to increase the real goodwill of

the firm.

Features:

Window-dressing has the following basic features.

1. It is an instrument used in the financial statement.

2. It is used in advertising, selling & marketing.

3. It is suppression of facts.

4. It is unethical or illegal.

5. This is used to show strong financial position.

6. It is used to create goodwill for the firm.

7. It is a good practice with bad ends.

Window-dressing good practice with bad ends.

Window-dressing is mostly used for presentation of facts in the financial statements. There is manipulation

& suppression of facts. It may be used for the benefit of the firm. But it has bad ends. It is short lasting.

The actual facts and figures can’t be suppressed for a long. The true result is to come to light. Therefore, it

is said that window dressing is a good Practice with bad ends.

Advantages:

1. It is popularly used for financial reporting.

2. It is a tool used for increasing the goodwill of the firm.

3. It makes the financial statements more attractive.

4. It is very much useful for advertisement, selling & marketing for the products.

5. It helps in enhancing the image and value of the firm in the market.

Disadvantages :

However, Window-dressing has the following limitations:

1. It is suppression of facts.

2. It is unethical & illegal.

3. It is short-lasting as actual facts can’t be suppressed for long.

4. It has a bad end.

Você também pode gostar

- IBT ReportDocumento3 páginasIBT ReportMary Elaine DiasantaAinda não há avaliações

- Topic 7: International TradeDocumento4 páginasTopic 7: International TradeThành Nhơn VõAinda não há avaliações

- Benefits of International Trade & ProtectionismDocumento18 páginasBenefits of International Trade & ProtectionismEnjier CilverAinda não há avaliações

- Forms of International BusinessDocumento6 páginasForms of International BusinessMary MendezAinda não há avaliações

- 17 Big Advantages and Disadvantages of Foreign Direct InvestmentDocumento4 páginas17 Big Advantages and Disadvantages of Foreign Direct InvestmentAli HaiderAinda não há avaliações

- BBA - GGS Indraprastha University BBA-308 INTERNATIONAL Business ManagementDocumento4 páginasBBA - GGS Indraprastha University BBA-308 INTERNATIONAL Business ManagementKunal KalraAinda não há avaliações

- 30.07.2022 Balance of PaymentDocumento5 páginas30.07.2022 Balance of PaymentShanju ShanthanAinda não há avaliações

- Topic 8 - International Business OperationDocumento5 páginasTopic 8 - International Business Operationdqcbjt2t2bAinda não há avaliações

- Economics 12th Edition Michael Parkin Solutions ManualDocumento16 páginasEconomics 12th Edition Michael Parkin Solutions ManualKimCoffeyjndf100% (32)

- Ibe 1ST CahpterDocumento22 páginasIbe 1ST Cahptermanu.bAinda não há avaliações

- Portfolio Investment: S.No International Business Domestic BusinessDocumento12 páginasPortfolio Investment: S.No International Business Domestic BusinessSujith PSAinda não há avaliações

- IB NotesDocumento17 páginasIB NotesVivek KanojiyaAinda não há avaliações

- ETD Unit - 1 Notes-MergedDocumento76 páginasETD Unit - 1 Notes-MergedArunkumar DAinda não há avaliações

- Nhập mônDocumento3 páginasNhập mônDiệu QuỳnhAinda não há avaliações

- Export Promotion and Import Substitution NotesDocumento12 páginasExport Promotion and Import Substitution NotesProud IndianAinda não há avaliações

- MGT-304-reviewer - Docx 20231010 164243 0000Documento15 páginasMGT-304-reviewer - Docx 20231010 164243 0000AIAH RIZPAH SOLIVAAinda não há avaliações

- Interntionl Businessunit 3Documento6 páginasInterntionl Businessunit 3Tharun VelammalAinda não há avaliações

- Ten key business characteristicsDocumento3 páginasTen key business characteristicsTolulope DorcasAinda não há avaliações

- Discuss How Any Company Can Become A Multinational Company What Are Some TheDocumento2 páginasDiscuss How Any Company Can Become A Multinational Company What Are Some TheAmara jrrAinda não há avaliações

- Importance of International BusinessDocumento4 páginasImportance of International BusinesssandilyaAinda não há avaliações

- Ib End Term Exam: Submitted To: Dr. Akshay Joshi Submitted By: Arpit Gilra SAP Id: 80011920086 Roll No. R047Documento9 páginasIb End Term Exam: Submitted To: Dr. Akshay Joshi Submitted By: Arpit Gilra SAP Id: 80011920086 Roll No. R047akshat gilraAinda não há avaliações

- Internatoional Env ReportDocumento21 páginasInternatoional Env ReportkomaljeswaniAinda não há avaliações

- Module 1Documento23 páginasModule 1Ayan BaratAinda não há avaliações

- Modal Solution IBMDocumento13 páginasModal Solution IBMSaugat TripathiAinda não há avaliações

- Parkinmacro15 1300Documento17 páginasParkinmacro15 1300Avijit Pratap RoyAinda não há avaliações

- International trade theories and conceptsDocumento8 páginasInternational trade theories and conceptsDanae CaballeroAinda não há avaliações

- 17 Big Advantages and Disadvantages of Foreign Direct InvestmentDocumento5 páginas17 Big Advantages and Disadvantages of Foreign Direct Investmentpatil mamataAinda não há avaliações

- International Business ObjectivesDocumento18 páginasInternational Business ObjectivesAishwarya SairamAinda não há avaliações

- Elements of International BusinessDocumento7 páginasElements of International Businesstania leonelaAinda não há avaliações

- Submitted By: Shagun Vishwanath Ballb (Semester 3) 1020202148Documento23 páginasSubmitted By: Shagun Vishwanath Ballb (Semester 3) 1020202148Shagun VishwanathAinda não há avaliações

- Difference Between Domestic and International BusinessDocumento3 páginasDifference Between Domestic and International BusinessKuthubudeen T M0% (1)

- Unit - I Introduction To International BusinessDocumento53 páginasUnit - I Introduction To International BusinessChandhini RAinda não há avaliações

- Latifah Umma - 051728842 - English Trade 2Documento6 páginasLatifah Umma - 051728842 - English Trade 2Latifah UmmaAinda não há avaliações

- INTERNATIONAL BUSIness Bba Final 1 14 1Documento141 páginasINTERNATIONAL BUSIness Bba Final 1 14 1Urja ChourasiaAinda não há avaliações

- Economics 11th Edition Michael Parkin Solutions ManualDocumento18 páginasEconomics 11th Edition Michael Parkin Solutions Manualmarthalouisaq6x100% (27)

- International Business NotesDocumento7 páginasInternational Business NotesLucky parmarAinda não há avaliações

- Unit 2-The Global EconomyDocumento8 páginasUnit 2-The Global EconomyJanien MedestomasAinda não há avaliações

- Globle Markenting-2Documento11 páginasGloble Markenting-2Sonu VPersieAinda não há avaliações

- Difference Between Domestic and International BusinessDocumento3 páginasDifference Between Domestic and International Businessmanoj_mmm80% (10)

- International BusinessDocumento26 páginasInternational BusinessIshita DubeAinda não há avaliações

- Pre Test JulyDocumento4 páginasPre Test JulySai Min Thit KoAinda não há avaliações

- Basic Financial Accounting and Reporting (Reviewer)Documento7 páginasBasic Financial Accounting and Reporting (Reviewer)Keneth Joe CabungcalAinda não há avaliações

- Framework of International MarketingDocumento5 páginasFramework of International Marketingsubbu2raj3372100% (1)

- Notes of Intl - BizDocumento262 páginasNotes of Intl - BizPooja AnamAinda não há avaliações

- International Business For EconomyDocumento31 páginasInternational Business For Economycharlenealvarez59Ainda não há avaliações

- International BusinessDocumento115 páginasInternational BusinessSakshi Relan100% (1)

- CHAPTER V. INTERNATIONAL BUSINESS AND TRADE POLICIESDocumento16 páginasCHAPTER V. INTERNATIONAL BUSINESS AND TRADE POLICIESくど しにちAinda não há avaliações

- Commercial Policy: Chapter# 4Documento24 páginasCommercial Policy: Chapter# 4Alamgir KhanAinda não há avaliações

- IB Lecture 1Documento20 páginasIB Lecture 1Gaurav NavaleAinda não há avaliações

- M 5 International Entrepreneurship Opportunities: OduleDocumento35 páginasM 5 International Entrepreneurship Opportunities: OduleNageshAinda não há avaliações

- Parkinecon07 1300Documento14 páginasParkinecon07 1300Dina SamirAinda não há avaliações

- Macroeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions Manual Full Chapter PDFDocumento33 páginasMacroeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions Manual Full Chapter PDFdenmelioraqfj100% (9)

- International Business - Meaning, Importance, Nature and ScopeDocumento5 páginasInternational Business - Meaning, Importance, Nature and ScopeAdi ShahAinda não há avaliações

- International BusinessDocumento113 páginasInternational BusinessPallavi NaikAinda não há avaliações

- Business Mid - Final Sheet 2Documento27 páginasBusiness Mid - Final Sheet 2Fatima ElsahliAinda não há avaliações

- INTERNATIONAL BUSINESS MANAGEMENTDocumento7 páginasINTERNATIONAL BUSINESS MANAGEMENTHimanshiAinda não há avaliações

- Arato InternationalTradeLaw Spring 2018 UnlockedDocumento93 páginasArato InternationalTradeLaw Spring 2018 UnlockedMark Michael StrageAinda não há avaliações

- Unit: 1 International Business and Globalization: Chapter OutlinesDocumento7 páginasUnit: 1 International Business and Globalization: Chapter Outlinessubash thapaAinda não há avaliações

- Smooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1No EverandSmooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1Ainda não há avaliações

- Import Business: A Guide on Starting Up Your Own Import BusinessNo EverandImport Business: A Guide on Starting Up Your Own Import BusinessNota: 4 de 5 estrelas4/5 (1)

- Finanacial AccountingDocumento4 páginasFinanacial Accountingding095Ainda não há avaliações

- Atk 08Documento41 páginasAtk 08ding095Ainda não há avaliações

- Tax Deducted at Source: Basics Update & Practical IssuesDocumento74 páginasTax Deducted at Source: Basics Update & Practical Issuesding095Ainda não há avaliações

- Most Expected Question On Cost AccountingDocumento2 páginasMost Expected Question On Cost Accountingding095Ainda não há avaliações

- Resume of DineshDocumento2 páginasResume of Dineshding095Ainda não há avaliações

- Most Expected Question On MathDocumento5 páginasMost Expected Question On Mathding095Ainda não há avaliações

- Most Expected Question On ManagementDocumento2 páginasMost Expected Question On Managementding095Ainda não há avaliações

- Images On Mumbai AttacksDocumento41 páginasImages On Mumbai Attacksding095Ainda não há avaliações

- Incredible IndiaDocumento40 páginasIncredible Indiading095Ainda não há avaliações

- Project ReportDocumento72 páginasProject Reportding095100% (1)

- My Municipal Project ReportDocumento11 páginasMy Municipal Project Reportding095Ainda não há avaliações

- Richest Personalities of India & WorldDocumento44 páginasRichest Personalities of India & Worldding095100% (1)

- 09-PCSO2019 Part2-Observations and RecommDocumento40 páginas09-PCSO2019 Part2-Observations and RecommdemosreaAinda não há avaliações

- VC Notes - 2012Documento467 páginasVC Notes - 2012Josh C100% (6)

- VAT Fraud and Evasion PDFDocumento35 páginasVAT Fraud and Evasion PDFbastyAinda não há avaliações

- Chapter 2 - Statement of Comprehensive IncomeDocumento12 páginasChapter 2 - Statement of Comprehensive IncomeAmie Jane MirandaAinda não há avaliações

- Dividend Decisions 1 PDFDocumento29 páginasDividend Decisions 1 PDFArchana RajAinda não há avaliações

- Negative Affidavit FormDocumento3 páginasNegative Affidavit Formamenelbey80% (5)

- Spons Architects and Builders Price Book 2022 (Spons Price Books) by EACOMDocumento38 páginasSpons Architects and Builders Price Book 2022 (Spons Price Books) by EACOMtishebra33% (18)

- 9 Keland Cossia 2019 Form 1099-MISCDocumento1 página9 Keland Cossia 2019 Form 1099-MISCpeter parkinsonAinda não há avaliações

- H20124 - Ajay VermaDocumento13 páginasH20124 - Ajay VermaajayAinda não há avaliações

- BIR Form No.1601-EQ SampleDocumento2 páginasBIR Form No.1601-EQ SampleJermone MuaripAinda não há avaliações

- 04 2019 Up LMT Boc Taxation LawDocumento36 páginas04 2019 Up LMT Boc Taxation LawMikee PortesAinda não há avaliações

- 2021 Tax Return Prepared OnlineDocumento6 páginas2021 Tax Return Prepared OnlineSolomonAinda não há avaliações

- Osmeña v. Orbos, G.R. No. 99886, 31 March 1993.Documento5 páginasOsmeña v. Orbos, G.R. No. 99886, 31 March 1993.Ashley Kate PatalinjugAinda não há avaliações

- 03 CIR V La Campana Fabrica de TobacosDocumento10 páginas03 CIR V La Campana Fabrica de TobacosAna Marie LomboyAinda não há avaliações

- Cooperative Federalism Under The Constitution of IndiaDocumento19 páginasCooperative Federalism Under The Constitution of Indiaabhishek mishraAinda não há avaliações

- Personal Financial Planning and Manage EntDocumento19 páginasPersonal Financial Planning and Manage EntJoseAinda não há avaliações

- Modified UCA Cash Flow FormatDocumento48 páginasModified UCA Cash Flow FormatJohan100% (1)

- Yateen Vyas: Seeking Middle Level Career Opportunities in Logistics, Excise& Service Tax With An Organization of ReputeDocumento2 páginasYateen Vyas: Seeking Middle Level Career Opportunities in Logistics, Excise& Service Tax With An Organization of ReputeyateenvyasAinda não há avaliações

- The Sales of Goods Act, Cap.214 R.E 2002Documento37 páginasThe Sales of Goods Act, Cap.214 R.E 2002Baraka FrancisAinda não há avaliações

- Westwoods April 2023Documento2 páginasWestwoods April 2023SeshasaiAinda não há avaliações

- RKG VS Oyo 26 (2) CciDocumento11 páginasRKG VS Oyo 26 (2) CcipbAinda não há avaliações

- Udhemy CourcesDocumento1 páginaUdhemy CourcesRam Sri100% (1)

- Train 2 or Trabaho Bill: (Tax Reform For Attracting Better and High-Quality Opportunities) House Bill No. 8083Documento30 páginasTrain 2 or Trabaho Bill: (Tax Reform For Attracting Better and High-Quality Opportunities) House Bill No. 8083Azaria MatiasAinda não há avaliações

- Iloilo Bottlers Inc. V City of IloiloDocumento2 páginasIloilo Bottlers Inc. V City of IloiloTicia Co SoAinda não há avaliações

- DT Mnemonics: Sucessforsure (SFS) Direct Taxation NotesDocumento4 páginasDT Mnemonics: Sucessforsure (SFS) Direct Taxation NoteschandreshAinda não há avaliações

- Being Skeptical - Robert KiyosakiDocumento63 páginasBeing Skeptical - Robert KiyosakiMati MazzuferiAinda não há avaliações

- Pay Slip Records for Tuition Centre StaffDocumento12 páginasPay Slip Records for Tuition Centre StaffThana BalanAinda não há avaliações

- BVC 1-3 ChapterDocumento62 páginasBVC 1-3 ChapterJyothi RameshAinda não há avaliações

- Taxation in India Vs AfghanistanDocumento11 páginasTaxation in India Vs AfghanistanKomal AgrawalAinda não há avaliações

- BOQ 17 May 2012Documento85 páginasBOQ 17 May 2012abobeedoAinda não há avaliações