Escolar Documentos

Profissional Documentos

Cultura Documentos

A Broader Perspective On Corporate Social Responsibility Research in Accounting

Enviado por

alisaamTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Broader Perspective On Corporate Social Responsibility Research in Accounting

Enviado por

alisaamDireitos autorais:

Formatos disponíveis

Available online at www.sciencedirect.

com

ScienceDirect

Procedia Economics and Finance 5 (2013) 212 221

International Conference on Applied Economics (ICOAE) 2013

The influence of corporate social reporting to companys value

in a developing economy

Lina Dagilien*

Kaunas University of Technology, Laisvs al. 55-410, LT-44309, Lithuania

Abstract

The article examines the influence of corporate responsibility (CR) reporting to listed companys value. Society

encourages companies to be socially responsible and to communicate these results to stakeholders. However, company's

focus on social disclosure means additional costs. Content analysis is implemented to evaluate CR reporting. Companies

are ranked according to CR reporting results, and comparative analysis with valuation indicators is carried out.

Companies with high CR reporting level, have no higher accounting based and market based valuation indicators. The

results show that companies with a market value and book value showing the highest rates are far from socially

accountable.

2013

2013The

TheAuthors.

Authors.

Published

by Elsevier

B.V.access under CC BY-NC-ND license.

Published

by Elsevier

B.V. Open

Selection

and/or

peer-review

under

responsibility

of the Organising

Committee

ICOAE 2013.

Selection and/or peer-review under responsibility of the Organising

Committee

of ICOAEof2013

Keywords: CR reporting; social disclosure; companys value

1. Introduction

The importance of corporate responsibility (CR) reporting is growing every year. 95% of the 250 largest

companies in the world (G250 companies) now report on their corporate responsibility activities (KPMG,

2011). The G250 companies are companies in the Fortune Global 500 List and represent more than a dozen

industry sectors; 208 of the 250 are publicly traded entities. KPMG in 2011 made a comprehensive study

about CR reporting in regards to data of 34 countries. However, Lithuania and some other Eastern Europe

countries did not participate in this survey. In 2009, Partners for financial stability program initiated the

survey on reporting of corporate social responsibility by largest listed companies in 11 Central and Eastern

* Corresponding author. Tel.:+3-703-730-0566 .

E-mail address: lina.dagiliene@ktu.lt.

2212-5671 2013 The Authors. Published by Elsevier B.V. Open access under CC BY-NC-ND license.

Selection and/or peer-review under responsibility of the Organising Committee of ICOAE 2013

doi:10.1016/S2212-5671(13)00027-0

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

Europe countries, including Lithuania. It was a database containing a report on each company that indicates

whether or not the company discloses the information. However, the survey results mostly referred to

information available online in English, and not all largest publicly listed companies were included into the

survey.

Many scientists argue that it is a positive relationship between CR reporting and companys financial

performance: KPMG survey (2011), Przychodzen (2012), Gietl et al (2012), Weshah et al (2012). On the

other side the socially responsible business development means higher costs, as required greater investment in

human resources, certification standards, environmental programs and etc. In addition, CR reporting can be

seen only as a means of advertising to stakeholders (Dagiliene and Gokiene, 2011), completely does not

involve increased the company's value creation. CR information usually is not held in as high regard as

financial information because the third part assurance is still underutilized in many corporate social

responsibility reports (Ferns and Prakash, 2012). The reason for this is that the extent to which social

information disclosure is directed toward different stakeholders and how they react to this information

disclosure is not fully understood (Moser and Martin, 2012). Despite the extensive empirical studies of

corporate social responsibility information impact to companys reputation and financial performance,

different attitudes show the lack of consensus on the impact of CR reporting on companys value and

financial performance. The research question: in what way CR reporting make an influence to listed

companys value?

The objective of the paper is to investigate the influence of corporate social reporting to the listed

companys value in a developing economy.

The research methods applied in this article are the analysis of scientific literature on the subject and its

logical generalization, social reporting content analysis, the examination of separate cases, financial valuation

methods.

The paper is structured as follows. Part 2 presents the theoretical framework of interactions between

companys value and CR reporting, while part 3 describes the research methodology employed. Part 4

presents the analysis of the data and discussion and part 5 offers the concluding remarks.

2. Literature review

Changes in the role of the organization only for-profit company to company, which aims for sustainable

development with the environment, encourages exploration of social accounting and reporting trends in the

conceptual and instrumental levels.

The social contract theory is the key theory explaining the necessity of business entity to act in a

responsible manner not only because it is in its commercial interest to do so, but because it is a part of how

society implicitly expects business to operate. At the same time corporate social disclosure behavior is being

explained by legitimacy theory, stakeholder theory and voluntary disclosure theory. And despite the extensive

empirical studies of social information impact to companys value and financial performance, the analyses

have produced conflicting results: acknowledging positive, negative or mixed/neutral impact of social

reporting information to companys reputation and financial performance.

Studies stating a positive relationship usually focus on management decisions, environmental impact or on

investors point of view. Wang and Choi (2010) more recently find a significant positive influence of CR

reporting on a companys financial performance, which is caused not only by the level of corporate social

performance, but also by its consistency.

According to KPMG (2011) report, financial value overwhelmingly comes from two sources: direct cost

savings and enhanced reputation in the market. Thus, companies are increasingly demonstrating that CR

reporting provides financial value and drives innovation. 47% of the G250 companies reported gaining

213

214

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

financial value. These companies were most likely to cite either increased revenues or improved cost savings,

with market share close behind. At the same time the ownership structure of a company has a direct impact on

their CR reporting activity. Publicly listed companies tend to be more advanced in CR reporting in

comparison to other types of ownership structures, because 69% of listed companies around the world now

reporting on CR (KPMG, 2011). Companies are also increasingly using multiple forms of media to

communicate results. Only 20% of G250 rely solely on stand-alone CR reports, and barely 10% restrict their

report either to web-only formats or annual reports alone. Companies that continue to utilize only one channel

of communication (such as an annual report) for their CR reporting will quickly find that they are losing

ground to competitors.

Przychodzen (2012) analyzed possibilities and consequences on implementing sustainability into corporate

strategy, whether it can lead to higher than average market valuation. Firms with balanced financial, social

and environmental activities had lower revenues growth, lower growth volatility, and lower stock price

volatility. These results are consistent with the idea that firms benefit from investing in corporate

sustainability and that these practices are reflected in their stock prices. The empirical evidence of this paper

is particularly pronounced for public firms that consider implementing sustainability into core business

strategy. Ferns and Prakash (2012) analyzed trends in CR reporting by western European and North American

corporations. Their findings suggest that European companies have a higher rate of publishing social reports

comparing with companies from North America. The quality of social reports varied from country to country

within Western Europe, but compared to their North American counterparts, as a group Western European

companies provided greater detail about issues in their social reports.

Gietl et al (2012) investigated the impact of sustainability reporting under the global reporting initiative

(GRI) on the companys value of non-financial EUROSTOXX 600 firms. The findings show that the highest

level of GRI-aligned reporting has a negative and significant influence on the firm value of smaller or less

profitable firms. However, no significant impact is detected for larger and more profitable firms. These results

may reflect the high costs of implementing GRI A+-level reporting for smaller or less profitable firms.

Mahadeo et al (2011) investigated whether the extent and variety of corporate social disclosure themes are

influenced by size, leverage and industry affiliation in a developing economy. The results show that size does

explain variations in overall social disclosures, whilst leverage is positively related to changes in

environmental and health and safety disclosures. Profitability relationship and the effects of industry

affiliation on social disclosure are non-significant.

Weshah et al (2012) suggested that there is a significant positive relationship between corporate social

responsibility, bank size, the level of risk in the bank and advertising intensity both from the perspective of

corporate financial performance and the Jordian banking companies.

Hammann et al (2009) analyzed issues of socially responsible business effect to companies performance

in small-and- medium sized companies, as the focus has almost exclusively been on large corporations. It was

found that socially responsible management practices towards employees, customers and to a lesser extent

society have a positive impact on the firm and its performance.

Fiori et al (2007) investigated if CSR affects companys stock market prices or not. Empirical results

showed that in Italy firms stock prices are not affected by CSR reports even if firms show a greater attention

to these issues because Italian financial market is not enough efficient and transparent.

Cho et al (2009) determine whether the presentation medium of corporate social and environmental web

site disclosure has an impact on user trust in such disclosure. Their research provides evidence that

corporations could use enhanced web-based technology as it is positively associated with user perception of

corporate social and environmental responsibility.

Lithuania scientists just at the primary level investigate issues of CR reporting. The first studies in this

field analyzed only the disclosure of additional information, its quality, quantity and presentation of financial

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

statements (Vaskeliene and Selepen, 2008, Legenzova, 2008; Dagiliene, 2009; Dagiliene and Bruneckiene,

2010). Legenzova (2008) investigated voluntary financial information disclosure of Lithuanian listed

companies and its interactions with companys ownership structure in the period 2002-2005. The

investigation results showed that high ownership concentration explains low voluntary financial disclosure of

Lithuanian companies. Dagiliene (2010) conducted the research of social responsibility disclosure in annual

reports. Dagiliene and Bruneckiene (2010) analyzed the role of the voluntary disclosure aspect of CSR.

Dagiliene and Gokiene (2011) carried out the valuation of social responsibility reports of Lithuanian

companies. Dagiliene (2011) investigated the social disclosure in social media and websites of Lithuanian

dairy industry. The results of investigation showed that dairy industrys participation in social media is mainly

focused on brand advertising. In 2012 Leitoniene and Sapkauskiene, Dagiliene and Leitoniene also

investigated issues of corporate social reporting. These studies distinguished that the basic problem of social

accounting in Lithuania is the limitations of corporate social accounting regulation.

However, there are no investigations about influences of CR reporting to companys value or financial

performance in Lithuania.

3. Research methodology

The aim of the research is to calculate ROA and MVA for listed companies and to compare to the CR

reporting level of the publicly listed company.

For measuring companys value, some authors differ on whether to use accounting based or market-based

indicators (Surroca and Trib, 2008; Berrone et al., 2007; Weshah et al., 2012, Galan and Melo, 2011).

According to our line of reasoning and considering the integrative nature of companys value as the

independent value, we are using both variables. Return on assets (ROA) represents accounting-based research

and market value added (MVA) is calculated as the market evaluation of the company minus the capital

invested in it (Berrone et al., 2007), being the market-based measure.

ROA is the ratio of net income before tax to total asset value. Whereas it has been investigated publicly

listed company, the market value was set equal to the market capitalization of the last day of the year 2011.

Market capitalization was calculated as the number of shares and shares multiplied by the market price.

Invested capital was set equal to the amount of authorized capital of the company and net cash flow from

investing activities of current year. Data of financial reports are used for calculations.

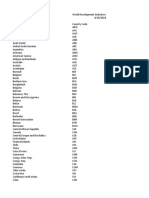

All thirteen companies listed in Vilnius stock market exchange for 2012-12-31 were included into the

investigation. Three banks listed in the stock market exchange were not included because valuation indicators

are different in comparison with business entities. In the research these reports that were accessible in Internet

are valued:

x Annual reports;

x Social information on websites.

Content analysis is used to investigate CR reporting level in the annual reports and websites. Units of

social disclosure in content analysis may be various: words, phrases, characters, lines, sentences, pages,

mentions. This empirical study uses two units for disclosure: 1) a number of sentences (Mahadeo et al., 2011,

Dagiliene, 2010) for evaluating CR reporting since sentences provide complete, meaningful and reliable date

about companys social disclosure level; 2) also mentions that focuses on the semantic content of social

information (Leitoniene and Sapkauskiene, 2012).

Usually social reporting contains various issues that raise interest of stakeholders: human rights and human

resources, product design and development, environmental protection, bribery and community. In this article

CR reporting content analysis is carried out by major Global Compact principles on human and labour rights,

environmental protection, relations to society. The activity of products and services is not valued as previous

215

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

216

empirical researches has showed that usually companies are focused on products and services advertising in

different media means and it is complicated to attribute to social responsible activity.

4. Results and discussion

4.1. Social reporting research results

CR reporting research results of publicly listed companies are presented in Table 1. As can be seen from

the results, level of CR disclosure ranges from a minimum of information about the employees in annual

report and detailed information on human resources, environment and communication with the public through

different communication channels, i.e. annual reports, websites, and separate social reports.

Table 1. CR disclosure research results of publicly listed companies.

Company/activity

Social info in

annual

reports,

sentences

Human

resources,

sentences %

Environment,

sentences %

Community,

sentences %

Social info

on websites,

sentences

Social

reports

CR

rating

Retail sale of clothing

14

35,7%

14,3%

0%

no

Facilities management

and integrated utilities

70

38,6%

10,0%

44,3%

yes

Paper and corrugated

paperboard production

10

60,0%

40,0%

0%

22

yes

Electricity service

113

29,2%

17,7%

45,1%

126

yes

Gas service

62

40,3%

24,2%

24,2%

27

no

Electricity production

135

43,7%

40,7%

13,3%

46

yes

Agro production

36

36,1%

16,7%

36,1%

no

Diary

13

15,4%

84,6%

0%

no

Diary

72

43,1%

56,9%

0%

34

no

Pharmacy

43

58,1%

41,9%

0%

no

Telecommunications

51

94,1%

5,9%

0%

47

yes

Knitwear and textile

production

37,5%

62,5%

0%

no

Diary

100%

0%

0%

30

no

The highest CR disclosure rating (1) is given to companies that reveal the most information in the annual

reports and websites, and prepare social reports. These conditions corresponded to five companies from the

following industries: paper and corrugated paperboard production, integrated facilities management and

utilities, electricity service, electricity production and telecommunications. Three of these companies provide

the basic necessities to customers, and a higher level of social disclosure is one way for these companies to

look more attractive to its users. So it can be said that CR disclosure level depends on the industries, since all

companies reveal the extent required by law.

The medium CR disclosure rating (2) is given to companies that reveal the social information in the annual

reports and websites. The two listed companies belonging to the dairy industry, gas company, reveal the

average information both in annual reports and websites. Company belonging to knitwear and textile

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

217

production industry, dairy company, agro company, pharmacy company, retail sale of clothing company

provide minimum social information, i.e. compulsory information about employees number, average salary,

education and etc. It is given the least level (3) of CR disclosure.

Also, the results show that the majority of companies (eight), most of the information reveals about human

resources. All companies disclose the number and education of employees, average wage. Companies ranked

highest CR reveal additional information about a system of motivation, training opportunities, human

resources policy. Information on environmental activities is a less frequently because the law also requires a

minimum of this disclosure. This area is most relevant for manufacturing companies - dairy, knitwear and

textile production, pharmacy, electricity production. The focus on the environmental information provided

can be explained by the theory of legitimacy. Manufacturing companies, i.e., polluting companies are under

pressure from stakeholders on environmental pollution and justify this activity by revealing more

environmental-related information.

Information on community activities is not a total (eight companies). Other companies disclose much

information about the projects, organized promotional activities.

The main limitation of the research is composition of CR reporting group limits. Most of the companies,

such as electricity or telecommunication companies actively participate in social information revealed both

qualitative analysis of meaning and sense of communication with stakeholders. However, there are

companies, which are difficult to assign to one or another group, for example, gas service company discloses

a relatively large amount of information about corporate responsibility activities in the annual report, but do

not separate social reports.

4.2. Financial performance and social reporting interaction research results

Calculated ROA and MVA indicators and their comparison with the social responsibility performance

evaluation are presented in Tables 2 and 3.

Table 2. Rating of CR reporting downwards and comparing with value indicators.

Company/industry

Sector

CR rating

ROA

MVA, EUR

Telecommunications

services

13,9%

191.198.557

Facilities management and

integrated utilities

services

9%

53.667.753

Paper and corrugated paperboard

production

manufacturing

9%

3.425.035

Electricity production

manufacturing

0,3%

12.076.870

Electricity service

services

-0,9%

77.836.611

Diary

manufacturing

4,8%

28.518.809

Gas service

services

3,5%

111.702.646

Diary

manufacturing

11%

7.306.250

Agro production

manufacturing

20,7%

46.345.358

Retail sale of clothing

sale

15,4%

59.240.523

Diary

manufacturing

7,7%

69.288.609

Pharmacy

manufacturing

1,6%

266.502.770

Knitwear and textile production

manufacturing

-15,5%

-1.308.816

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

218

Companies that actively revealing social information to stakeholders depends largely on service sector.

Services companies disclose social information mostly. Lithuanian manufacturing companies despite issues of

legitimacy theory are less active in CR reporting.

A market-based higher MVA indicator shows a higher value added. The highest MVA indicator with

pharmaceutical company has a low level of CR reporting. The companys social information dissemination

takes place through only one communication channel annual report which contains the required regulatory

information about the staff and the environment. Accordingly, the following three companies sorted by MVA

indicator are far more active in CR reporting. However, even the two companies (paper production and

electricity production) with a high level of social disclosure, MVA have low rates. This suggests that higher

level of social information disclosure for stakeholders does not increase the market value added of the Vilnius

Stock listed companies.

The highest level of ROA indicators with agro production and retail sale of clothing company, again are

characterized by a low level of social disclosure.

Table 3. Accounting based and market based ratios downwards comparing with CR rating.

Company/activity

MVA, EUR

CR rating

Company/activity

ROA

CR rating

Pharmacy

266.502.770

Agro production

20,7%

Telecommunications

191.198.557

Retail sale of clothing

15,4%

Gas service

111.702.646

Telecommunications

13,9%

Electricity service

77.836.611

Diary

11%

Diary

69.288.609

Facilities management

and integrated utilities

9%

Retail sale of clothing

59.240.253

Paper and corrugated

paperboard production

9%

Facilities management and

integrated utilities

53.667.753

Diary

7,7%

Agro production

46.345.358

Diary

4,8%

Diary

28.518.809

Gas service

3,5%

Electricity production

12.076.870

Pharmacy

1,6%

Diary

7.306.250

Electricity production

0,3%

Paper and corrugated paperboard

production

3.425.035

Electricity service

-0,9%

Knitwear and textile production

-1.308.816

Knitwear and textile

production

-15,5%

Analyzing the impact of CR disclosure by sectors it should be noticed that only telecommunication

company have high both ROA and MVA indicators and high level of CR reporting. Telecommunication

company have a greater emphasis on staff training and professional development and the main focus in this

area is focused on the good internal relationships. This leads to a special new technology and knowledge

workers the importance of communications sector.

Analyzing the impact of CR disclosure to valuation several significant observations can be made.

Companies with high CR rate of disclosure, have no higher ROA indicators or higher MVA indicator. The

results show that companies with a market value and book value showing the highest rates are far from

socially accountable. Accordingly, investors and other stakeholders, valuing the company, are not paying

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

much for social information. Higher levels of social disclosure do not affect larger or smaller MVA and ROA

figures. Since a large part of theoretical research, puree the links between financial activity characterizing the

MVA and ROA indicators established a positive impact on the social responsibility of financial activities, it is

necessary to take into account the fact that the need for social information depends on the countrys

development and the society, i.e. stakeholder perceptions and needs.

4.3. Discussion

Research results show that CR reporting activity has no important influence for listed companys value in

Lithuania. This situation can be explained by several factors. In Lithuania, like in many developing countries

the promotion of business disclosure about its social activities started in state institutions and professional

organizations in the initiative. Laws and regulations were adopted that encourage companies to submit

compulsory financial information in the financial statements and annual reports. All laws establish a

mandatory rule only on financial disclosure, and companies that must prepare an annual report from the

financial and non-financial performance analysis should also present the environmental and employee

matters related information. Usually listed companies disclose quantitative information about number and

education of employees, average salary. Worldwide the legal and social processes governing financial

markets transparency are focused on increasing the organization's responsibility towards society. Thus,

Lithuanian laws simply determine what information should be disclosed at the minimum level. Thats why

most of even listed companies present only obligatory social information.

Also, listed companies on the Vilnius Stock Exchange must comply with the Code of Corporate

Governance, which encourages companies to disclose information adequately for the market. This document

recommends that listed companies comply with certain standards of transparency and ensure the quality of

management, to improve disclosure to stakeholders, in order to increase confidence of investors and other

stakeholder groups. The Code does not recommend specifically how and how much the company should

provide information about social and environmental business risks. Although provisions of the Code of

Corporate Governance for listed companies are much more specific than the mentioned above legal

requirements, but these requirements are summarized in the form and may be treated differently.

Finally, the attitude of the public, social information need, interest in the activities of companies lead to

business seeks to develop socially responsible business. Therefore, Lithuania's corporate social disclosure can

basically be explained by the theory of stakeholder groups as social information, in particular, is presented in

order to meet the needs of investors. The conception of voluntary information disclosure is not spread among

Lithuanian listed companies.

5. Conclusions

Analyzing theoretical issues and influence of corporate social reporting to value of Lithuanian publicly

listed companies, these main conclusions were made. Growing number of companies that participates in

social disclosure confirms the phenomenon of CR reporting. Theoretical studies have produced conflicting

results: acknowledging positive, negative or mixed/neutral impact of CR reporting to companys value and

financial performance. Most theoretical and empirical studies usually focus on one country or one region case,

so different results of CR reporting to companys value may be explained by the different levels of

development, regional differences and behavioral characteristics of the largest (publicly listed) companies in

the country.

Lithuania listed companies reveal the extent of social information required by law. The majority of

companies most of the information reveals about human resources. All companies disclose the number and

219

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

220

education of employees, average wage. 38% of companies provide complete information about corporate

responsibility activities in human and labor rights, environmental protection, relations to society using

different channels of communication with their stakeholders. CR disclosure level of publicly listed companies

can be explained by stakeholder theory, as voluntary disclosure theory is not very common.

Companies with high CR rate of disclosure, have no higher ROA indicators or higher MVA indicators. The

results show that companies with a market value and book value showing the highest rates are far from

socially accountable.

References

Berrone, P., Surroca, J., Trib, J.A., 2007. Corporal Ethical Identity as a Determinant of Firm Performance: a Test of Mediating Role of

Stakeholder Satisfaction, Journal of Business Ethics, 76, p.35-53.

Cho, Ch.H., Phillips J.R., Hageman A.M., Patten D.M., 2009. Media Richness, User Trust, and Perceptions of Corporate Social

Responsibility. An experimental investigation of visual web site disclosures, Accounting, Auditing & Accountability Journal,

vol.22, No.6, p. 933-952.

Corporate Governance Code for the Companies Listed on NASDAQ OMX Vilnius, 2006. Vilnius, available at:

http://www.nasdaqomxbaltic.com/files/vilnius/teisesaktai/The%20Corporate%20Governance%20Code%20for%20the%20Companie

s%20Listed%20on%20NASDAQ%20OMX%20Vilnius.pdf.

Dagiliene, L., Leitoniene, S., 2012. Corporate social reporting development in Lithuania, Economics and management -2012. p. 17.

Dagiliene, L., Gokiene, R., 2011. Valuation of corporate social responsibility reports, Economics and management -2011, p. 21-27.

Dagiliene, L., 2011. Disclosure of social information in social media and websites: a case study of Lithuanian dairy industry,

Knowledge for market use 2011: new generation of workers (Generation Y), Olomouc, p. 72-78.

Dagiliene, L., Bruneckiene, J., 2010. The role of voluntary disclosure information in the context of social responsibility, Economics

and Management -2010, p. 451-456.

Dagiliene, L., 2010. The Research of Corporate Social Responsibility Disclosures in Annual Reports, Engineering Economics (2),

p.197-204.

Dagiliene, L., 2009. The role of voluntary disclosed information in financial valuation, Social Research, 17(3).

Ferns, B., Prakash S, S., 2012. Emerging trends in corporate social responsibility (CSR) reporting by large corporations: a comparative

analysis of corporate CSR reports by Western European and North American corporations, The Fifth ISBEE World Congress.

Warsaw, Poland.

Fiori G., Donato, F., Izzo, M.F., 2007. Corporate Social Responsibility and Firms Performance. An Analysis on Italian Listed Companies,

available at: http://ssrn.com/abstract=1032851.

Galan, J.I., Melo, T., 2011. Effects of corporate social responsibility on brand value, The Journal of Brand Management, vol.18, issue

6, p. 423-437.

Gietl, S., Gttsche, M., Habisch, A., Roloff, M., Schauer, M, 2012. Does CSR reporting destroy firm value? Empirical evidence on GRIAligned European firms, The Fifth ISBEE World Congress. Warsaw, Poland.

Hammann, E., Habisch, A., Pechlaner, H., 2009. Values That Create Value: Socially Responsible Business Practices in SMEs

Empirical Evidence from German Companies, Business Ethics: A European Review, Vol .18, No. 1, p. 37-51.

KPMG, 2011. KPMG international survey of corporate responsibility reporting, Amsterdam: KPMG International.

Leitoniene, S., Sapkauskiene, A., 2012. Analysis of social information as measure of ethical behavior of Lithuanian firms, Economics

and Management -2012, No.17(3).

Legenzova, R., 2008. Valuation of Lithuanian companies ownership structure relationship with the financial information presentation,

Economics and Management -2008, p. 48-54.

Mahadeo, J.D., Oogarah-hanuman, V., Soobaroyen, T., 2011. A longitudinal study of corporate social disclosures in a developing

economy, Journal of Business Ethics, 104(4), p. 545-558.

McGuire, J. B., Sundgren, A., T. Schneeweis., 1988. Corporate social responsibility and firm financial performance, Academy of

Management Journal, Vol. 31, No. 4, p. 85472.

McWilliams, A., Siegel, D., 2000. Corporate social responsibility and financial performance: correlation or misspecification, Strategic

Management Journal, Vol. 21, No. 5, p. 603-609.

Moser, D.V., Martin, P.R., 2012. A broader perspective on corporate social responsibility research in accounting, The Accounting

Review, 87(3), p. 797-806.

PFS, 2008. Survey of reporting on corporate social responsibility (CSR) by the largest listed companies in 11 Central and Eastern

European (CEE) countries.

Lina Dagiliene / Procedia Economics and Finance 5 (2013) 212 221

Przychodzen, J., 2012. Corporate sustainability and shareholder wealth evidence from American companies, The Fifth ISBEE World

Congress. Warsaw, Poland.

Republic of Lithuania Law of Financial Statement Entities, available at: http://www3.lrs.lt/psl/inter3/dokpaieska.showdoc.

Scholtens, B., Zhou, Y., 2008. Stakeholder relations and financial performance. Sustainable Development, Vol. 16, No. 3, p. 313-232.

Surroca, J., Trib, J.A., 2008. Managerial Entrenchment and Corporate Social Performance, Journal of Business Finance &

Accounting, vol.35, issue 5-6, p.748-789.

Vaskeliene, L., Selepen, J., 2008. Information about intellectual capital disclosure in Lithuanian joint stock companies, Economics and

management 2008, p. 88-96.

Wang, H., Choi, J., 2010. A new look at the corporate socialfinancial performance relationship: The moderating roles of temporal and

interdomain consistency in corporate social performance, Journal of Management, doi: 10.1177/0149206310375850.

Weshah, S.R., Dahiyat, A.A., Abu Awwad, M.R., Hajjat, E.S., 2012. The impact of adopting corporate social responsibility on corporate

financial performance: evidence from Jordanian, Interdisciplinary Journal of Contemporary Research in Business, 4(5), p. 34-45.

Website of Vilnius Stock Exchange: www.baltic.omxnordicexchange.com.

221

Você também pode gostar

- CSR Strategy For Sustainable Business Samy Odemilin and BamptonDocumento16 páginasCSR Strategy For Sustainable Business Samy Odemilin and BamptonabbakaAinda não há avaliações

- Customer Relation ManagementDocumento13 páginasCustomer Relation ManagementSaurav SharanAinda não há avaliações

- McDonald's Strategic AnalysisDocumento44 páginasMcDonald's Strategic AnalysisMadeleine AritonangAinda não há avaliações

- Development Economics Unit 1 and 2Documento64 páginasDevelopment Economics Unit 1 and 2ibsa100% (1)

- Alusaf Case PDFDocumento31 páginasAlusaf Case PDFLuis AguirreAinda não há avaliações

- Factors Influencing The Development of CSR Reporting Practices: Experts' Versus Preparers' Points of ViewDocumento11 páginasFactors Influencing The Development of CSR Reporting Practices: Experts' Versus Preparers' Points of ViewLương Linh GiangAinda não há avaliações

- IJCA0905-0604LOW 69875 OfflineDocumento28 páginasIJCA0905-0604LOW 69875 OfflineKhaled BarakatAinda não há avaliações

- Corporate Governance and Financial Characteristic Effects On The Extent of Corporate Social Responsibility DisclosureDocumento23 páginasCorporate Governance and Financial Characteristic Effects On The Extent of Corporate Social Responsibility DisclosurePrahesti Ayu WulandariAinda não há avaliações

- The Effect of Financial Crisis in Corporate Social Responsibility PerformanceDocumento9 páginasThe Effect of Financial Crisis in Corporate Social Responsibility PerformanceSaad MasudAinda não há avaliações

- Research On Corporate Social Responsibility Reporting: Camelia I. Lungu, Chiraţa Caraiani and Cornelia DascăluDocumento15 páginasResearch On Corporate Social Responsibility Reporting: Camelia I. Lungu, Chiraţa Caraiani and Cornelia DascăluMasudur RahmanAinda não há avaliações

- Rameez Shakaib MSA 3123Documento7 páginasRameez Shakaib MSA 3123OsamaMazhariAinda não há avaliações

- The Determinants Influencing The Extent of CSR DisclosureDocumento25 páginasThe Determinants Influencing The Extent of CSR DisclosurePrahesti Ayu WulandariAinda não há avaliações

- Benchmarking Corporate Social ResponsibilityDocumento36 páginasBenchmarking Corporate Social ResponsibilityAAinda não há avaliações

- Sustainability 12 08536 v2Documento31 páginasSustainability 12 08536 v2sita deliyana FirmialyAinda não há avaliações

- Financial Performance, Sustainability Disclosure, and Firm ValueDocumento6 páginasFinancial Performance, Sustainability Disclosure, and Firm ValuealfianaAinda não há avaliações

- New Perspectives On Corporate Reporting: Social-Economic and Environmental InformationDocumento6 páginasNew Perspectives On Corporate Reporting: Social-Economic and Environmental InformationManiruzzaman ShesherAinda não há avaliações

- Concept PaperDocumento7 páginasConcept PaperArrianne DimaapiAinda não há avaliações

- Sustainability 12 05670 PDFDocumento16 páginasSustainability 12 05670 PDFAllalannAinda não há avaliações

- J Ribaf 2017 07 151Documento33 páginasJ Ribaf 2017 07 151Nur Alfiyatuz ZahroAinda não há avaliações

- A Study of The Relationship Between Corporate Social Responsibility Report and TheDocumento18 páginasA Study of The Relationship Between Corporate Social Responsibility Report and TheunibooksAinda não há avaliações

- The Research of Corporate Social Responsibility Disclosures in Annual ReportsDocumento8 páginasThe Research of Corporate Social Responsibility Disclosures in Annual ReportsalisaamAinda não há avaliações

- Research ProposalDocumento8 páginasResearch ProposalZahraAinda não há avaliações

- Corporate Governance, Social Responsibility and Business EthicsDocumento12 páginasCorporate Governance, Social Responsibility and Business EthicsAshish KumarAinda não há avaliações

- The Integrated Reporting Initiative From An Institutional Perspective: Emergent FactorsDocumento5 páginasThe Integrated Reporting Initiative From An Institutional Perspective: Emergent FactorsUssy FitriyaAinda não há avaliações

- Maximizing Profits vs Ensuring SustainabilityDocumento3 páginasMaximizing Profits vs Ensuring SustainabilityAdzan 45Ainda não há avaliações

- Sustainability 09 02112 PDFDocumento12 páginasSustainability 09 02112 PDFTawsif HasanAinda não há avaliações

- Understanding CSR Reporting QualityDocumento13 páginasUnderstanding CSR Reporting QualityJoseph JboyAinda não há avaliações

- The Impact of Sustainability Reporting On Company PerformanceDocumento16 páginasThe Impact of Sustainability Reporting On Company PerformanceroristuaAinda não há avaliações

- Sustain Abiliy Reporting Versus Integrated ReportingDocumento11 páginasSustain Abiliy Reporting Versus Integrated ReportingMohammed BeyanAinda não há avaliações

- 1CSR 2010 SMJ CharityDocumento19 páginas1CSR 2010 SMJ CharityJasonAinda não há avaliações

- Bidhari 2013Documento10 páginasBidhari 2013Ervin ChaiAinda não há avaliações

- 2021 - Olena Et Al - Impact of Corporate Social Responsibility On The Financial Performance of CompaniesDocumento16 páginas2021 - Olena Et Al - Impact of Corporate Social Responsibility On The Financial Performance of CompaniesAnand Yamani YupitrikaAinda não há avaliações

- Voluntary Nonfinancial Disclosure and The Cost of Equity Capital PDFDocumento43 páginasVoluntary Nonfinancial Disclosure and The Cost of Equity Capital PDFMark NarcisoAinda não há avaliações

- Artikel InternationalDocumento10 páginasArtikel InternationalDikin ZikinAinda não há avaliações

- It Is Not Only What You Say, But How You Say It - ESG, Corporate News, and The Impact On CDS SpreadsDocumento14 páginasIt Is Not Only What You Say, But How You Say It - ESG, Corporate News, and The Impact On CDS SpreadsEdna AparecidaAinda não há avaliações

- Corporate Social Performance and Stock Returns: UK Evidence From Disaggregate MeasuresDocumento20 páginasCorporate Social Performance and Stock Returns: UK Evidence From Disaggregate MeasuresLavneet SinghAinda não há avaliações

- CAC-10+(138)-ok-(1429-1437)Documento9 páginasCAC-10+(138)-ok-(1429-1437)Fagbile TomiwaAinda não há avaliações

- Corporate Social ResponsibilityDocumento10 páginasCorporate Social ResponsibilityGermanicous21Ainda não há avaliações

- Social Disclosure and Profitability: Study in Indonesian Companies Fida Muthia, IsnurhadiDocumento14 páginasSocial Disclosure and Profitability: Study in Indonesian Companies Fida Muthia, IsnurhadiMoudruy AnastaAinda não há avaliações

- Social Responsibility and Financial Performance - The Role of Good Corporate GovernanceDocumento15 páginasSocial Responsibility and Financial Performance - The Role of Good Corporate GovernanceRiyan Ramadhan100% (1)

- Final Paper FinanceDocumento9 páginasFinal Paper FinanceKaruna TuladharAinda não há avaliações

- 2.1 Materi SRDocumento12 páginas2.1 Materi SRfadhlyjheAinda não há avaliações

- V11i1 Social Responsibility and Financial PerformanceDocumento6 páginasV11i1 Social Responsibility and Financial PerformanceneppoliyanAinda não há avaliações

- SSRN Id3537535Documento58 páginasSSRN Id3537535Yanto LieAinda não há avaliações

- Journal Critique AssignmentDocumento6 páginasJournal Critique AssignmentJesy Joaquin AmableAinda não há avaliações

- projet_sanaa_dea_elsDocumento27 páginasprojet_sanaa_dea_elspowersplyAinda não há avaliações

- Research Proposal1Documento60 páginasResearch Proposal1Bura ManAinda não há avaliações

- An Empirical Analysis of Triple Bottom-Line Reporting and Its Determinants: Evidence From The United States and JapanDocumento28 páginasAn Empirical Analysis of Triple Bottom-Line Reporting and Its Determinants: Evidence From The United States and JapanCeline JohanaAinda não há avaliações

- Determinants of Corporate Social Responsibility Reporting in IndiaDocumento10 páginasDeterminants of Corporate Social Responsibility Reporting in IndiadessyAinda não há avaliações

- ESG Practices and The Cost of Debt Evidence From EU CountriesDocumento48 páginasESG Practices and The Cost of Debt Evidence From EU CountriesVenket RamanaAinda não há avaliações

- Corporate social performance inter-industry and international differencesDocumento29 páginasCorporate social performance inter-industry and international differencesdessyAinda não há avaliações

- Business Research Quarterly: Social Responsibility and Financial Performance: The Role of Good Corporate GovernanceDocumento15 páginasBusiness Research Quarterly: Social Responsibility and Financial Performance: The Role of Good Corporate GovernanceKuKur NiaAinda não há avaliações

- The Impact of ESG Factor Materiality On Stock Performance of Firms HeijningenDocumento50 páginasThe Impact of ESG Factor Materiality On Stock Performance of Firms HeijningenKinga Katona-KunglerAinda não há avaliações

- Balance ScorecardDocumento21 páginasBalance ScorecardEdha LiaAinda não há avaliações

- Background of Study: Wood, (2010) - Adams and Frost (2006) Gulyás (2009) Young and Thyil (2009)Documento16 páginasBackground of Study: Wood, (2010) - Adams and Frost (2006) Gulyás (2009) Young and Thyil (2009)bhupi5Ainda não há avaliações

- 10.1108@sampj 01 2014 0003 PDFDocumento19 páginas10.1108@sampj 01 2014 0003 PDFParsika ProjectAinda não há avaliações

- Econometrics Thesis Related Article reading-CSRDocumento12 páginasEconometrics Thesis Related Article reading-CSRAdnan KamalAinda não há avaliações

- Sustainability 11 00343Documento26 páginasSustainability 11 00343Vishesh GuptaAinda não há avaliações

- Cheng Wan - Article 3Documento13 páginasCheng Wan - Article 3Miss BakiaAinda não há avaliações

- s10997-021-09582-wDocumento65 páginass10997-021-09582-wluisAinda não há avaliações

- Does Corporate Social Responsibility Influence Corporate Tax Avoidance of Chinese Listed Companies?Documento12 páginasDoes Corporate Social Responsibility Influence Corporate Tax Avoidance of Chinese Listed Companies?Dorina Elena ComanAinda não há avaliações

- Which country characteristics support corporate socialperformanceDocumento15 páginasWhich country characteristics support corporate socialperformancedessyAinda não há avaliações

- 10.2478 - Sbe 2022 0034Documento11 páginas10.2478 - Sbe 2022 0034disertasi.fbpAinda não há avaliações

- Disclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersNo EverandDisclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersAinda não há avaliações

- Corporate Voluntary Disclosure Practices of Banks in BangladeshDocumento6 páginasCorporate Voluntary Disclosure Practices of Banks in BangladeshalisaamAinda não há avaliações

- Current Context of Disclosure of Corporate Social Responsibility in Sri LankaDocumento8 páginasCurrent Context of Disclosure of Corporate Social Responsibility in Sri LankaalisaamAinda não há avaliações

- 1 s2.0 S1045235414001051 MainDocumento20 páginas1 s2.0 S1045235414001051 MainalisaamAinda não há avaliações

- Corporate Social Responsibility Disclosure and Financial PerformaDocumento402 páginasCorporate Social Responsibility Disclosure and Financial PerformaalisaamAinda não há avaliações

- Analysis Sustainable Development Corporate Social Bmptsu Al KautsarDocumento14 páginasAnalysis Sustainable Development Corporate Social Bmptsu Al KautsaralisaamAinda não há avaliações

- GRIG4 Part1 Reporting Principles and Standard DisclosuresDocumento97 páginasGRIG4 Part1 Reporting Principles and Standard DisclosuresalisaamAinda não há avaliações

- Buat Hutan DeforestasiDocumento1 páginaBuat Hutan DeforestasialisaamAinda não há avaliações

- SawhnyKEPRRA AwardDocumento43 páginasSawhnyKEPRRA AwardalisaamAinda não há avaliações

- Guidance On The Strategic ReportDocumento60 páginasGuidance On The Strategic ReportalisaamAinda não há avaliações

- For BAB I Corporate Social Responsibility and Firm Performance - Evidence FDocumento76 páginasFor BAB I Corporate Social Responsibility and Firm Performance - Evidence FalisaamAinda não há avaliações

- Persepsi Auditor Mengenai Metode Pendeteksian Dan Pencegahan Tindakan Kecurangan Pada Industri PerbankanDocumento11 páginasPersepsi Auditor Mengenai Metode Pendeteksian Dan Pencegahan Tindakan Kecurangan Pada Industri PerbankanalisaamAinda não há avaliações

- Accounting and Control For Sustainability Call1Documento1 páginaAccounting and Control For Sustainability Call1alisaamAinda não há avaliações

- A Broader Perspective On Corporate Social Responsibility Research in AccountingDocumento10 páginasA Broader Perspective On Corporate Social Responsibility Research in AccountingalisaamAinda não há avaliações

- The Research of Corporate Social Responsibility Disclosures in Annual ReportsDocumento8 páginasThe Research of Corporate Social Responsibility Disclosures in Annual ReportsalisaamAinda não há avaliações

- Emy Iryanie-Teori StakeholderDocumento118 páginasEmy Iryanie-Teori StakeholderDwi Suhartini0% (1)

- Sistem Informasi Akuntansi untuk Toko Makanan JepangDocumento4 páginasSistem Informasi Akuntansi untuk Toko Makanan JepangalisaamAinda não há avaliações

- What Are The Scope and Conceptual Foundation of Economic Geography?Documento5 páginasWhat Are The Scope and Conceptual Foundation of Economic Geography?MiaAinda não há avaliações

- Explain Briefly Non-Tariff Measures and Give Three Examples?Documento8 páginasExplain Briefly Non-Tariff Measures and Give Three Examples?Meysam KhamehchiAinda não há avaliações

- Raising Capital PDFDocumento10 páginasRaising Capital PDFSaurav SinghAinda não há avaliações

- Module 1 - Risk ManagementDocumento4 páginasModule 1 - Risk ManagementWenli FuAinda não há avaliações

- ECONOMIC ADMINISTRATION AND FINANCIAL MANAGEMENT First Paper: Business EconomicsDocumento4 páginasECONOMIC ADMINISTRATION AND FINANCIAL MANAGEMENT First Paper: Business EconomicsGuruKPOAinda não há avaliações

- AC Resume (English - March 2017)Documento2 páginasAC Resume (English - March 2017)Angelo CaraballoAinda não há avaliações

- Versace. FinalDocumento31 páginasVersace. FinalShivangi RaiAinda não há avaliações

- ISK Eturn: University of LethbridgeDocumento20 páginasISK Eturn: University of LethbridgeDavid ZhangAinda não há avaliações

- Guide to Forecasting Methods for BusinessesDocumento3 páginasGuide to Forecasting Methods for BusinesseskhalilAinda não há avaliações

- Entrepreneur DevelopmentDocumento16 páginasEntrepreneur DevelopmentRADHA JAYALAKSHMI TAinda não há avaliações

- Case Body LineDocumento4 páginasCase Body LinepcmantilAinda não há avaliações

- Answers Toa Extra Questions Management AnDocumento77 páginasAnswers Toa Extra Questions Management AnNhan ThaiAinda não há avaliações

- API SI - POV.NAHC DS2 en Excel v2 10081287Documento37 páginasAPI SI - POV.NAHC DS2 en Excel v2 10081287mommysharkAinda não há avaliações

- PDF Merger 2019 05 28 20 48 43926Documento44 páginasPDF Merger 2019 05 28 20 48 43926BoomZaTvZAinda não há avaliações

- Agricultural Commercialization - Impacts On Income and Nutrition and Implications For Policy BraunDocumento16 páginasAgricultural Commercialization - Impacts On Income and Nutrition and Implications For Policy BraunFara WulanAinda não há avaliações

- Feasibility of Briquetting Municipal Solid Waste in RwandaDocumento59 páginasFeasibility of Briquetting Municipal Solid Waste in Rwandarhtrhtrohit100% (3)

- What Is A RecessionDocumento3 páginasWhat Is A Recessionsamina123Ainda não há avaliações

- Macro5 Lecppt ch02Documento75 páginasMacro5 Lecppt ch02meuang68Ainda não há avaliações

- Public Expenditure ClassifiedDocumento10 páginasPublic Expenditure ClassifiedIshaan JoshiAinda não há avaliações

- Economics – GDP, Prices, and Economic GrowthDocumento22 páginasEconomics – GDP, Prices, and Economic GrowthArun BabuAinda não há avaliações

- Eco QP 1 CSSC WDocumento8 páginasEco QP 1 CSSC Wdianaprince2006Ainda não há avaliações

- 【摩根士丹利】美股策略 : 策略数据包Documento53 páginas【摩根士丹利】美股策略 : 策略数据包void8234Ainda não há avaliações

- Routine Mba 13 Old 2009Documento1 páginaRoutine Mba 13 Old 2009siddhartha rayAinda não há avaliações

- Test Bank For Social Welfare A History of The American Response To Need 8 e 8th Edition Mark J Stern June J AxinnDocumento36 páginasTest Bank For Social Welfare A History of The American Response To Need 8 e 8th Edition Mark J Stern June J Axinnhelixloot5noyc2100% (26)

- Public Capital Stock and State ProductivDocumento9 páginasPublic Capital Stock and State ProductivPili MesaAinda não há avaliações

- Presentation Chapter 1 - 4Documento95 páginasPresentation Chapter 1 - 4ElearnAinda não há avaliações