Escolar Documentos

Profissional Documentos

Cultura Documentos

Republic of The Philippines v. Leonor de La Rama (1966)

Enviado por

easyisthedescentTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Republic of The Philippines v. Leonor de La Rama (1966)

Enviado por

easyisthedescentDireitos autorais:

Formatos disponíveis

2/14/2015

ELibraryInformationAtYourFingertips:PrinterFriendly

124Phil.1493

[G.R.No.21108,November29,1966]

REPUBLICOFTHEPHILIPPINES,PLAINTIFFAPPELLANT,VS.

LEONORDELARAMA,ETAL.,RESPONDENTSAPPELLEES.

DECISION

ZALDIVAR.J.:

ThisisanappealfromthedecisionoftheCourtofFirstInstanceofManila,datedDecember

23, 1961, in its Civil Case No. 46494, dismissing the complaint of the Republic of the

PhilippinesagainsttheheirsofthelateEstebandelaRamaforthecollectionof956,032.50

asdeficiencyincometax,inclusiveof50%surcharge,fortheyear1950.

TheestateofthelateEstebandelaRamawasthesubjectofSpecialProceedingsNo.401of

the Court of First Instance of Iloilo. The executoradministrator, Eliseo Hervas, filed on

March12,1951,incometaxreturnsoftheestatecorrespondingtothetaxableyear1950,

declaringanetincomeof922,796.59,onthebasisofwhichtheamountofP3,919.00 was

assessedandwaspaidbytheestateasincometax.TheBureauofInternalRevenuelater

claimedthatithadfoundoutthattherehadbeenreceivedbytheestatein1950fromthe

De la Rama Steamship Company, Inc. cash dividends amounting to 966,800.00, which

amount was not declared in the income tax return of the estate for the year 1950. The

Bureau of Internal Revenue then, on March 7, 1956, made an assessment as deficiency

incometaxagainsttheestateinthesumof956,032.50,ofwhichamount937,355.00was

thedeficiencyand918,677.50wasthe50%surcharge.

TheCollectorofInternalRevenuewrotealetter,datedFebruary29,1956,toMrs.Lourdes

delaRamaOsmeainformingherofthedeficiencyincometaxandaskingpaymentthereof.

OnMarch13,1956theletter'scounselwrotetotheCollectoracknowledgingreceiptofthe

assessment,butcontendedthatLourdesdelaRamaOsmeahadnoauthoritytorepresent

theestate,andthattheassessmentshouldbesenttoLeonordelaRamawhowaspointed

tobysaidcounselastheadministratrixoftheestateofherlatefather.Onthebasisofthis

informationtheDeputyCollectorofInternalRevenue,onNovember22,1956,sentaletter

toLeonordelaRamaasadministratrixoftheestate,askingpayment.Thetax,asassessed,

not having been paid, the Deputy Commissioner of Internal Revenue, on September 7,

1959,wrote another letter to Mrs. Lourdes de la RamaOsmea demanding, through her,

upon the heirs, the payment of the deficiency income tax within the period of thirty days

from receipt thereof. The counsel of Lourdes de la RamaOsmea, in a letter dated

September 25, 1959, insisted that the letter should be sent to Leonor de la Rama. The

DeputyCommissionerofInternalRevenuewrotetoLeonordelaRamaanotherletter,dated

February11,1960,demanding,throughherasadministratrix,upontheheirsofEstebande

laRama,thepaymentofthesumofP56,032.50,asdeficiencyincometaxincludingthe50%

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/17392

1/6

2/14/2015

ELibraryInformationAtYourFingertips:PrinterFriendly

surcharge,totheCityTreasurerofPasayCitywithinthirtydaysfromreceiptthereof.

The deficiency income tax not having been paid, the Republic of the Philippines filed on

March 6, 1961 with the Court of First Instance of Manila a complaint against the heirs of

Esteban de la Rama, Making to collect from each heir his/her proportionate share in the

income tax liability of the estate. An amended complaint dated August 31, 1961, was

admittedbythecourt.

Thedefendantsappellees,LourdesdelaRamaOsmea,LeonordelaRama,Estefanla de

laRamaPirovano,DoloresdelaRamaLopez,CharlesMiller,andAnicetadelaRamaSian,

thru counsel, filed their respective answers, the gist of their allegations and/or defenses

being(1)thatnocashdividendsof966,800.00hadbeenpaidtotheestate(2)thatthe

administration of the estate had been extended by the probate court precisely for the

purpose of collecting said dividends (3) that Leonor de la Rama had never been

administratrixoftheestate(4)thattheexecutoroftheestate,EliseoHervas, had never

beengivennoticeoftheassessment,andconsequentlytheassessmenthadneverbecome

finaland(5)thatthecollectionoftheallegeddeficiencyincometaxhadprescribed.Fausto

F.Gonzales,Jr.,oneofthedefendants,nothavingfiledananswer,wasdeclaredindefault.

Fromtheevidenceintroducedatthetrial,bothoralanddocumentary,thelowercourtfound

thatthedividendof966,800.00declaredbytheDelaRamaSteamshipCo.infavorofthe

late Esteban de la Rama was applied to the obligation of the estate to the company

declaringthedividendsthatLeonordelaRamawasnottheadministratrixoftheestate,but

itwasthelateEliseoHervaswhowastheexecutoradministratorthattheadministrationof

theestatewasextendedforthepurposeofrecoveringfortheestatesaiddividendsfromthe

DelaRamaSteamshipCo.,IncandthatthequestionofwhetherthedeceasedEstebande

laRamawasadebtortotheentity known as the Hijos de I. de la Rama, which was also

indebtedtotheDelaRamaSteamshipCo.,Inc.,wasnotasettledone.

Aftertrial,thelowercourtrendereditsdecision,datedDecember23,1961,dismissing the

complaint. The Republic of the Philippines appealed from said decision to the Court of

Appeals,buttheappealwaslatercertifiedtothisCourtbecauseonlyquestionsoflaware

involved.

Plaintiffappellantcontendsthatthetrialcourterred(1)inholdingthattherewasnobasis

fortheassessmentuponthegroundthatitwaanotprovedthattheincomeinquestionwas

received by the estate of Esteban de la Rama or by his heirs (2) in not holding that the

incomewasconstructivelyreceivedbytheestateofthelateEstebandelaRama(3)innot

holding that the heirs and legatees of the late Esteban de la Rama were liable for the

paymentofthedeficiencyincometax(4)innotholdingthattheassessmentinvolvedinthe

casehadlongbecomefinal(5)innotholdingthattheserviceofthenoticeofassessment

onLourdesdelaRamaOsmeaandLeonordelaRamawasproperandvalidand(6)innot

holdingthatsaidcourthadnojurisdictiontotakecognizanceofappellees1defensethatthe

assessmentinquestionwaserroneous.

Plaintiffappellant argues that the deficiency income tax in this case was assessed in the

sum of 986,800. 00 representing cash dividends declared in 1950 by the De la Rama

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/17392

2/6

2/14/2015

ELibraryInformationAtYourFingertips:PrinterFriendly

SteamshipCo.,Inc.infavorofthelateEstebandelaRamaandwasappliedaspaymentof

thelatter'saccountwiththeformer.Theapplicationofpaymentappearsinthebooksofsaid

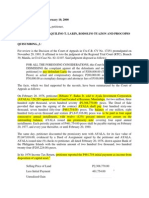

creditorcompanyasfollows:

"Againstaccountsreceivableduefrom

P25,255.24

EstebandelaRama..........

"AgainsttheaccountduefromHijosdeI.de

laRama,Inc.,ofwhichDonEstebandela

P61,544.76

Ramawastheprincipalowner..........

...........

Total.........P86,800.00"

Theplaintiffappellantmaintainsthatthiscreditingofaccountsinthebooksofthecompany

constitutedaconstructivereceiptbytheestateortheheirsofEstebandelaRamaofthe

dividends,andthisdividendwasanincomeoftheestateandwastherefore,taxable.

Itisnotdisputedthatthedividendsinquestionwerenotactuallypaideithertotheestate,

ortotheheirs,ofthelateEstebandelaRama.Thequestiontoberesolvediswhetheror

notthesaidapplicationofthedividendstothepersonalaccountsofthedeceasedEsteban

delaRamaconstitutedconstructivepaymentto,andhence,constructivelyreceivedby,the

estateortheheirs.Ifthedebtstowhichthedividendswereappliedreallyexisted,andwere

legallydemandableandchargeableagainstthedeceased,therewasconstructivereceiptof

thedividendsiftherewerenosuchdebts,thentherewasnoconstructivereceipt.

Thefirstdebt,asaboveIndicated,hadbeencontestedbytheexecutoradministratorofthe

estate.ItdoesnotevenappearthattheDelaRamaSteamshipCo.,Inc.hadeverfileda

claimagainsttheestateinconnectionwiththatindebtedness.Theexistenceandthevalidity

ofthedebtis,therefore,indispute,andtherewasnoproofadducedtoshowtheexistence

andvalidityofthedebt.

Theseconddebttowhichthedividendswerepartlyappliedwereaccounts"duefromHijos

deI.delaRama,Inc."Theallegeddebtorherewasanentityseparateanddistinctfromthe

deceased.Ifthatwasso,itsdebtscouldnotbechargedagainstthedeceased,evenifthe

deceasedwastheprincipalownerthereof,intheabsenceofproofofsubstitutionofdebtor.

ThereisnoevidenceintheinstantcasethatthelateEstebandelaRama substituted the

"HijosdeI.delaRama"asdebtortotheDelaRamaSteamshipCo.,Inc.norwasthere

evidencethattheestateofthelateEstebandelaRamaownedthe"HijosdeI.delaRama,

Inc.,"thisfactbeing,asfoundbythelowercourt,notasettledquestionbecausethesame

wasdeniedbytheadministrator.

UndertheNationalInternalRevenueCode,incometaxisassessedonincomethathasbeen

received. Thus, Section 21 of the Code requires that the income must be received by an

individualbeforeataxcanbeleviedthereon.

"Sec.21.Ratesoftaxoncitizensorresidents.Thereshallbelevied,collected,

andpaidannuallyupontheentireincomereceivedintheprecedingtaxableyear

fromallsourcesbyeveryindividual,orcitizenorresidentofthePhilippines,xx

x."

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/17392

3/6

2/14/2015

ELibraryInformationAtYourFingertips:PrinterFriendly

Section 56 also requires receipt of income by an estate before an Income tax can be

assessedthereon.Itprovides:

"Sec.56.Impositionoftax(a)Applicationoftax.Thetaxesimposedbythis

Title upon individuals shall apply to the income of estates or of any kind of

propertyheldintrustincluding

(3) Income received by estate of deceased persons during the period of

administrationorsettlementoftheestatexxx."

Hence,ifincomehasnotbeenreceived,noincometaxcanbeassessedthereon.Inasmuch

astheincomewasnotreceivedeitherbytheestate,orbytheheirs,neithertheestatenor

theheirscanbeliableforthepaymentofincometaxtherefor.

Thetrialcourt,therefore,didnoterrwhenitheldinitsdecisionthat:

"Afterastudyoftheproofs,theCourtisconstrainedtosustainthepositionof

thedefendantsonthefundamentalissuethattherecouldhavebeennocorrect

andrealbasisfortheassessmentorthatthereisnoproofthattheincomein

questionhadbeenreceiveditwasnotactuallydelivereduntotheEstatesince

it was retained by the De la Rama Steamship Co., Inc. which applied said

dividendstocertainaccountsreceivableduefromthedeceasedallegedly,Exh.

Al now if truly there had been such indebtedness owing from the deceased

untosaidDelaRamaSteamshipCo.,Inc.,theCourtwillagreewithplaintiffthat

the offsetting of the dividends against such indebtedness amounted to

constructivedeliverybutherehasnotbeenpresentedanyprooftothateffect,

i.e.,thattherewassuchanindebtednessduefromdeceasedonthecontrary

what the evidence shows is that the former administrator of the Estate had

challenged the validity of said indebtedness,Exh. D, motion of 4 June, 1951

thisbeingthecase,thereisnoclearshowingthatincomeintheformofsaid

dividendshadreallybeenreceived,whichistheverbusedinSection21ofthe

Internal Revenue Code, by the Estate whether actually or constructively and

the income tax being collected by the Government on income received, the

Government's position is here without a clear basis the position becomes

worsewhenitbeconsideredthatitisnoteventheEstatethatisbeingsuedbut

the heirs themselves, who admittedly had not received any of said dividends

themselvesthefictionoftransferofownershipbysuccessionfromthedeathof

thedecedantwillhavetogivewayto.acttualfactthatthedividendshavenot

beenadjudicatedatalltotheheirsuptonowatleastsofarastheevidence

shows.ThisbeingtheconclusionoftheCourt,therewillbenoneedtodiscuss

thequestionofwhethertheactionhasorhasnotprescribed."

Thefactualfindingsofthetrialcourt,asstatedintheabovequotedportionofthedecision,

isdecisiveinthedeterminationofthelegalissuesinthiscase.

AppellantcitesthecaseofHerbertv.ConmisslonerofInternalRevenue81F(2d)912 as

authority that the crediting of dividends against accounts constitutes payment and

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/17392

4/6

2/14/2015

ELibraryInformationAtYourFingertips:PrinterFriendly

constructivereceiptofthedividends.Thecitationofauthoritymissesthepointinissue.In

that case the existence of the indebtedness of Leon S. Herbert to the corporation that

declared the dividends and against which indebtedness the dividends were applied, was

neverputinissue,andwasadmitted.Intheinstantcase,theexistenceoftheobligations

hasbeendisputedand,asthetrialcourtfound,hasnotbeenproved.Ithavingbeenshown

in the instant case that there was no basis for the assessment of the income tax, the

assessmentitselfandthesendingofnoticesregardingtheassessmentwouldneitherhave

basis,andsotheassessmentandthenoticesproducednolegaleffectthatwouldwarrant

thecollectionofthetax.

Theappellantalsocontendsthattheassessmenthadbecomefinal,becausethedecisionof

the Collector of Internal Revenue was sent in a letter dated February 11, 1960 and

addressed to the heirs of the late Esteban de la Rama, through Leonor de la Rama as

administratrixoftheestate,andwasnotdisputedorcontestedbywayofappealwithinthirty

days from receipt thereof to the Court of Tax Appeals. This contention is untenable. The

lowercourtfoundthatLeonordelaRamawasnottheadministratrixoftheestateofEsteban

delaRama.Theallegeddeficiencyincometaxfor1950waschargeableagainsttheestate

ofthedeceasedEstebandelaRama.OnDecember5,1955,whentheletterofnoticefor

theassessmentofthedeficiencyincometaxwasfirstsenttoLeonordelaRama(SeeAnnex

"A"ofAnswerofdefendantLourdesdelaRamaOsmea,pp.1617,RecordonAppeal),the

administrationproceedings,inSpecialProceedingsNo.401oftheCourtofFirstInstanceof

Iloilo,werestillopenwithrespecttothecontrovertedmatterregardingthecashdividends

uponwhichthedeficiencyassessmentwaslevied.ThisisclearfromtheorderdatedJune

21,1951(Exhibit"E")oftheCourtofFirstInstanceofIloilowhichinpartprovides:

"El albaceaadministrador hace constar, sin embargo, que quedan por cobrar

ciertosdividendosdeclaradosydevengadosporlasaccionesdelfinadoEsteban

delaRama en The De la Rama Steamship Co., Inc., que los funcionarios de

dichacorporationxxxnonanpagadoaunxxxyqueportalesmotivoshabria

necesidad de prolongar la administracion, solamente para que esta contine

atendiendo,conautorizacion,atalesmenesteres.

"Se ordena el cierre de la Administracin pero se provee, sin embargo, la

extensindelamisma,solamenteparaelpropositodeiniciaryproseguirhasta

euterminacionunaaccioncontraTheDelaRamaSteamshipCo.,Inc.para el

cobro de dividendos declarados por dicha corporacin en Diciembre 31, 1950

sobrelas869accionesdelfinadoEstebandelaRamaenlamismaxxx.

"Y finalmente, queda relevado al Administrador Sr. Eliseo Hervas de toda

responsibilidadenrelaci&nconsuadministracin,exceptoenloquerespecta

alcobrodedividendosxxx."

The estate was still under the administrationofEliseo Hervas as regards the collection of

saiddividends.Theadministratorwastherepresentativeoftheestate,whosedutyitwasto

payanddischargealldebtsandchargesontheestateandtoperformallordersofthecourt

byhimtobeperformed(Rule81,Section1),andtopaythetaxesandassessmentsdueto

the Government or any branch or subdivision thereof (Section 7, Rule 89, Old Rules of

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/17392

5/6

2/14/2015

ELibraryInformationAtYourFingertips:PrinterFriendly

Court). The tax must be collected from the estate of the deceased, md it is the

administrator who is under obligation to pay such claim (Estate of Claude E. Haygood,

Collector of Internal Revenue v. Haygood, 65 Phil., 520). The notice of assessment,

therefore,shouldhavebeensenttotheadministrator.Inthiscase,noticewasfirstsentto

Lourdes de la RamaOsmea on February 29, 1956, and later to Leonor de la Rama on

November 27, 1956, neither of whom had authority to representtheestate.As the lower

courtsaidinitsdecision:"LeonordelaRamawasnottheadministratrixoftheestateofthe

lateEstebandelaRamaandassuchthedemanduntoher,Exh.Def.8,p.112,wasnota

correct demand before November 27, 1956, because the real administrator was the late

EliseoHervasxxx."(p.45,RecordonAppeal)Thenoticewasnotsenttothetaxpayerfor

the purpose of giving effect to the assessment, and said notice could not produce any

effect.InthecaseofBautistaandCorralesTanv.CollectorofInternalRevenue,L12259,

May27,1959,thisCourthadoccasiontostatethat"theassessmentisdeemedmadewhen

thenoticetothiseffectisreleased,mailedorsenttothetaxpayerforthepurposeofgiving

effecttosaidassessment."Itappearingthatthepersonliableforthepaymentofthetaxdid

notreceivetheassessment,theassessmentcouldnotbecomefinalandexecutory (R. A.

1125,Section11).

Plaintiffappellant also contends that the lower court could not take cognizance of the

defensethattheassessmentwaserroneous,thisbeingamatterthatiswithintheexclusive

jurisdictionoftheCourtofTaxAppeals.Thiscontentionhasnomerit.AccordingtoRepublic

Act1125,theCourtofTaxAppealshasexclusivejurisdictiontoreviewbyappealdecisionsof

theCollectorofInternalRevenueincasesinvolvingdisputedassessments,andthedisputed

assessmentmustbeappealedbythepersonadverselyaffectedbythedecisionwithinthirty

days after the receipt of the decision. In the instant case, the person adversely affected

shouldhavebeentheadministratoroftheestate,andthenoticeoftheassessmentshould

havebeensenttohim.Theadministratorhadnotreceivedthenoticeofassessment,and

hecouldnotappealtheassessmenttotheCourtofTaxAppealswithin30daysfromnotice.

Hence the assessment did not fall within the exclusive jurisdiction of the Court of Tax

Appeals.

IN VIEW OF THE FOREGOING, the decision appealed from should be, as it is hereby,

affirmed,withoutcosts.

Concepcion,C.J.,Reyes,J.B.L.,Barrera,Dizon,Regala,Makalintal,Bengzon,J.P.,Sanchez

andRuizCastro,JJ.,concur.

Source:SupremeCourtELibrary

Thispagewasdynamicallygenerated

bytheELibraryContentManagementSystem(ELibCMS)

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/17392

6/6

Você também pode gostar

- The Philippine Islands, 1493-1898 — Volume 11 of 55 1599-1602 Explorations by Early Navigators, Descriptions of the Islands and Their Peoples, Their History and Records of the Catholic Missions, as Related in Contemporaneous Books and Manuscripts, Showing the Political, Economic, Commercial and Religious Conditions of Those Islands from Their Earliest Relations with European Nations to the Close of the Nineteenth CenturyNo EverandThe Philippine Islands, 1493-1898 — Volume 11 of 55 1599-1602 Explorations by Early Navigators, Descriptions of the Islands and Their Peoples, Their History and Records of the Catholic Missions, as Related in Contemporaneous Books and Manuscripts, Showing the Political, Economic, Commercial and Religious Conditions of Those Islands from Their Earliest Relations with European Nations to the Close of the Nineteenth CenturyAinda não há avaliações

- 4 People Vs Dela Rama, G.R. No. L-21108 November 29, 1966Documento5 páginas4 People Vs Dela Rama, G.R. No. L-21108 November 29, 1966Thely GeollegueAinda não há avaliações

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Ainda não há avaliações

- Plaintiff-Appellant vs. vs. Respondents-Appellees Solicitor General Meer, Meer & MeerDocumento7 páginasPlaintiff-Appellant vs. vs. Respondents-Appellees Solicitor General Meer, Meer & MeerVMAinda não há avaliações

- Post Capitulation Trinidad (1797–1947): Aspects of the Laws, the Judicial System, and the GovernmentNo EverandPost Capitulation Trinidad (1797–1947): Aspects of the Laws, the Judicial System, and the GovernmentAinda não há avaliações

- Republic Vs de La RamaDocumento8 páginasRepublic Vs de La RamaJeff GomezAinda não há avaliações

- Republic Vs Dela RamaDocumento5 páginasRepublic Vs Dela RamaaldinAinda não há avaliações

- Case 5.3Documento4 páginasCase 5.3regine rose bantilanAinda não há avaliações

- Crime Against PropertyDocumento26 páginasCrime Against PropertySharmaine SantiagoAinda não há avaliações

- Government of Philippine Islands Vs PamintuanDocumento3 páginasGovernment of Philippine Islands Vs PamintuanGoodyAinda não há avaliações

- Heirs of Pedro Escanlar Vs CADocumento8 páginasHeirs of Pedro Escanlar Vs CAReth GuevarraAinda não há avaliações

- Republic vs. Sandiganbayan - Full TextDocumento77 páginasRepublic vs. Sandiganbayan - Full TextJOHN KENNETH CONTRERASAinda não há avaliações

- OCA Circular No. 92 2004Documento10 páginasOCA Circular No. 92 2004Stephanie Faye OlivaAinda não há avaliações

- LAW 1100 - Constitutional Law I - JD 1. 407 SCRA 10 2003 - Republic vs. Sandiganbayan - Full TextDocumento72 páginasLAW 1100 - Constitutional Law I - JD 1. 407 SCRA 10 2003 - Republic vs. Sandiganbayan - Full TextJOHN KENNETH CONTRERASAinda não há avaliações

- People vs. CastanedaDocumento7 páginasPeople vs. CastanedaWreath An GuevarraAinda não há avaliações

- Rallos Vs YangchoDocumento12 páginasRallos Vs YangchoskyeconfessionsAinda não há avaliações

- Art 315 Par 2Documento72 páginasArt 315 Par 2Feisty LionessAinda não há avaliações

- Usurpation of Real RightsDocumento7 páginasUsurpation of Real RightsTukneAinda não há avaliações

- Ting-Dumali v. Atty. TorresDocumento5 páginasTing-Dumali v. Atty. TorresGil ValdezAinda não há avaliações

- Conchita Quinao, Petitioner, vs. The People of The Philippines, Rep. by The Office of The Solicitor General, and Francisco DEL MONTE, RespondentsDocumento7 páginasConchita Quinao, Petitioner, vs. The People of The Philippines, Rep. by The Office of The Solicitor General, and Francisco DEL MONTE, RespondentslyrrehcAinda não há avaliações

- Producer's Bank vs. CADocumento7 páginasProducer's Bank vs. CAAyra CadigalAinda não há avaliações

- 38.holgado v. CADocumento15 páginas38.holgado v. CAGedan Tan0% (1)

- Publication March 13, 2024Documento12 páginasPublication March 13, 2024Katrina PerezAinda não há avaliações

- Republic vs. de La RamaDocumento4 páginasRepublic vs. de La RamaMj BrionesAinda não há avaliações

- 37 1 Catalan Vs BasaDocumento5 páginas37 1 Catalan Vs BasaKing BautistaAinda não há avaliações

- Reinstatement of TorresDocumento7 páginasReinstatement of TorresAJ PaladAinda não há avaliações

- CA Draft Decision - Espina-AbellanaDocumento20 páginasCA Draft Decision - Espina-Abellanaangeli abellanaAinda não há avaliações

- Articles 315 To 318 Criminal Law CasesDocumento91 páginasArticles 315 To 318 Criminal Law CasesNiñoMaurinAinda não há avaliações

- Femc Vs Heirs of LlanesDocumento12 páginasFemc Vs Heirs of LlanesRuby TorresAinda não há avaliações

- Sec9 2consigna V PeopleDocumento11 páginasSec9 2consigna V Peoplejeanette4hijadaAinda não há avaliações

- Eusebio V PeopleDocumento7 páginasEusebio V PeopleArgel Joseph CosmeAinda não há avaliações

- Art 13 10 Legrama Vs SBDocumento6 páginasArt 13 10 Legrama Vs SBAAMCAinda não há avaliações

- Art 13 10 Legrama Vs SBDocumento6 páginasArt 13 10 Legrama Vs SBAAMCAinda não há avaliações

- G.R. No. 71523-25 PDFDocumento17 páginasG.R. No. 71523-25 PDFKang DanielAinda não há avaliações

- G.R. No. 184053, Estafa - ConvictionDocumento7 páginasG.R. No. 184053, Estafa - Convictionlr dagaangAinda não há avaliações

- Additional Cases For Right Against Unreasonable Searches and SeizuresDocumento88 páginasAdditional Cases For Right Against Unreasonable Searches and SeizuresAnna Katrina QuanicoAinda não há avaliações

- Canon 10 To Rule 10.03Documento93 páginasCanon 10 To Rule 10.03SM BArAinda não há avaliações

- JUDGE LOLITA O. GAL-LANG and CLERK OF COURT NENITA R. GRIJALDO, Branch 44, Regional Trial Court, Manila, Respondents.Documento130 páginasJUDGE LOLITA O. GAL-LANG and CLERK OF COURT NENITA R. GRIJALDO, Branch 44, Regional Trial Court, Manila, Respondents.Elma MalagionaAinda não há avaliações

- FIRST DIVISION, Respondent.Documento130 páginasFIRST DIVISION, Respondent.Elma MalagionaAinda não há avaliações

- JUDGE LOLITA O. GAL-LANG and CLERK OF COURT NENITA R. GRIJALDO, Branch 44, Regional Trial Court, Manila, RespondentsDocumento130 páginasJUDGE LOLITA O. GAL-LANG and CLERK OF COURT NENITA R. GRIJALDO, Branch 44, Regional Trial Court, Manila, RespondentsElma MalagionaAinda não há avaliações

- Criminal Law SubjectDocumento130 páginasCriminal Law SubjectElma MalagionaAinda não há avaliações

- 3 CRIM LAW 2 CASES TO BE DIGESTED Gambling Malfeasance Misfeasance Bribery Graft Corruption and MalversationDocumento130 páginas3 CRIM LAW 2 CASES TO BE DIGESTED Gambling Malfeasance Misfeasance Bribery Graft Corruption and MalversationElma MalagionaAinda não há avaliações

- Crim LawDocumento130 páginasCrim LawElma MalagionaAinda não há avaliações

- Heirs of Pedro Escanlar vs. CaDocumento11 páginasHeirs of Pedro Escanlar vs. CanomercykillingAinda não há avaliações

- RP vs. SandiganbayanDocumento96 páginasRP vs. SandiganbayanMichelle Joy ItableAinda não há avaliações

- Javier vs. SandiganbayanDocumento8 páginasJavier vs. SandiganbayanTats YumulAinda não há avaliações

- 13quirino v. GrospeDocumento9 páginas13quirino v. GrospeShairaCamilleGarciaAinda não há avaliações

- Canon 10 - Canon 13 CasesDocumento65 páginasCanon 10 - Canon 13 CasesLoUisSaNcholesAinda não há avaliações

- Credit Trans SupplementalDocumento61 páginasCredit Trans Supplementalmuton20Ainda não há avaliações

- People v. FallerDocumento1 páginaPeople v. FallerSansa's SmirkAinda não há avaliações

- Amended Pre Trial Brief Re Saranquin V Saranquin Civil Case 9293Documento6 páginasAmended Pre Trial Brief Re Saranquin V Saranquin Civil Case 9293Jaime GonzalesAinda não há avaliações

- Producers Bank of The Philippines V CADocumento5 páginasProducers Bank of The Philippines V CAcmv mendozaAinda não há avaliações

- 16.05 Manuel Vs SandiganbayanDocumento11 páginas16.05 Manuel Vs SandiganbayannazhAinda não há avaliações

- CasesDocumento27 páginasCasesBritney Alison BersabalAinda não há avaliações

- G.R. No. 115324Documento7 páginasG.R. No. 115324BGodAinda não há avaliações

- Ting-Dumali - v. - TorresDocumento8 páginasTing-Dumali - v. - TorresAnonymous CxlJHHrAinda não há avaliações

- Property 4th Wave CasesDocumento108 páginasProperty 4th Wave Caseskaizen shinichiAinda não há avaliações

- Republic of The PhilippinesDocumento5 páginasRepublic of The PhilippinesMeshellee Cruz PaquibotAinda não há avaliações

- RP V SandinganbayanDocumento58 páginasRP V SandinganbayanNathalie Jean YapAinda não há avaliações

- GR 104768Documento18 páginasGR 104768Brent Owen PastorAinda não há avaliações

- US vs. PabloDocumento6 páginasUS vs. PabloeasyisthedescentAinda não há avaliações

- Urbano v. IACDocumento2 páginasUrbano v. IACeasyisthedescentAinda não há avaliações

- Heirs of Manlapat V CA (2005)Documento20 páginasHeirs of Manlapat V CA (2005)easyisthedescentAinda não há avaliações

- People v. Medina (1933)Documento7 páginasPeople v. Medina (1933)easyisthedescent67% (3)

- Estandarte V People PDFDocumento14 páginasEstandarte V People PDFeasyisthedescentAinda não há avaliações

- City Government of Makati V OrdenaDocumento31 páginasCity Government of Makati V OrdenaeasyisthedescentAinda não há avaliações

- La Chemise Lacoste V FernandezDocumento22 páginasLa Chemise Lacoste V FernandezeasyisthedescentAinda não há avaliações

- Hutson v. Rankin (1922)Documento6 páginasHutson v. Rankin (1922)easyisthedescent50% (2)

- People v. CahindoDocumento4 páginasPeople v. CahindoeasyisthedescentAinda não há avaliações

- SEC Opinion To Romulo, MabantaDocumento1 páginaSEC Opinion To Romulo, MabantaeasyisthedescentAinda não há avaliações

- Lamb V CamdenDocumento17 páginasLamb V CamdeneasyisthedescentAinda não há avaliações

- SEC OpDocumento11 páginasSEC OpeasyisthedescentAinda não há avaliações

- Najim V de MesaDocumento6 páginasNajim V de MesaeasyisthedescentAinda não há avaliações

- Latin Phrases - LDocumento7 páginasLatin Phrases - LeasyisthedescentAinda não há avaliações

- Lon Fuller: Legal TheoryDocumento1 páginaLon Fuller: Legal TheoryeasyisthedescentAinda não há avaliações

- Ronald Dworkin: Legal TheoryDocumento1 páginaRonald Dworkin: Legal TheoryeasyisthedescentAinda não há avaliações

- Lawrence v. TexasDocumento1 páginaLawrence v. TexaseasyisthedescentAinda não há avaliações

- Latin PhrasesDocumento12 páginasLatin PhraseseasyisthedescentAinda não há avaliações

- The American Federal GovernmentDocumento2 páginasThe American Federal GovernmenteasyisthedescentAinda não há avaliações

- Province of Zamboanga v. City of ZamboangaDocumento4 páginasProvince of Zamboanga v. City of Zamboangajrvyee100% (1)

- Second Division: Please Take Notice That The Court, Second Division, Issued A Resolution DatedDocumento9 páginasSecond Division: Please Take Notice That The Court, Second Division, Issued A Resolution DatedSalman JohayrAinda não há avaliações

- TORTS - BPI vs. Allied BankDocumento3 páginasTORTS - BPI vs. Allied BankLotus KingAinda não há avaliações

- Appellate Brief For Defendant/Appellee, Agosta v. FAST Systems Corp.Documento25 páginasAppellate Brief For Defendant/Appellee, Agosta v. FAST Systems Corp.KennethRyesky100% (1)

- WolverineDocumento2 páginasWolverineApril SaligumbaAinda não há avaliações

- Accounting PrincipalsDocumento13 páginasAccounting PrincipalsMasood Ahmad AadamAinda não há avaliações

- Balatbat v. Arias y SanchezDocumento6 páginasBalatbat v. Arias y Sanchezcarla_cariaga_2Ainda não há avaliações

- Minor's Position in ContractDocumento40 páginasMinor's Position in ContractJiji Cleetus100% (2)

- The Victorian Court HierarchyDocumento18 páginasThe Victorian Court HierarchyLencesiAinda não há avaliações

- ADR - Chapter 1 IntroductionDocumento4 páginasADR - Chapter 1 IntroductionJoseph AbadianoAinda não há avaliações

- Windows8 Hardware Cert Requirements DeviceDocumento943 páginasWindows8 Hardware Cert Requirements DeviceSushubhAinda não há avaliações

- Republic V CabantugDocumento2 páginasRepublic V Cabantugmelaniem_10% (1)

- ABITRIA - Duero V. CA 373 SCRA 11 (Digest)Documento2 páginasABITRIA - Duero V. CA 373 SCRA 11 (Digest)Joshua Langit CustodioAinda não há avaliações

- PCTDocumento12 páginasPCTamarbirsalarAinda não há avaliações

- LegalForce RAPC v. TrademarkEngine, Inc. Filed Complaint December26 2017Documento52 páginasLegalForce RAPC v. TrademarkEngine, Inc. Filed Complaint December26 2017LegalForce - Presentations & ReleasesAinda não há avaliações

- Re-Application For Survivorship Benefits Full TextDocumento12 páginasRe-Application For Survivorship Benefits Full TextSyElfredGAinda não há avaliações

- Texas AG Amazon RulingDocumento4 páginasTexas AG Amazon RulingTexas WatchdogAinda não há avaliações

- Angeles City v. Angeles City Electric Corp.Documento6 páginasAngeles City v. Angeles City Electric Corp.Paul Joshua SubaAinda não há avaliações

- MUNICIPALITY OF HAGONOY vs. DUMDUM, JRDocumento1 páginaMUNICIPALITY OF HAGONOY vs. DUMDUM, JRfred_barillo09100% (1)

- 05) Garcia Vs COADocumento3 páginas05) Garcia Vs COAAlexandraSoledadAinda não há avaliações

- Amended Complaint Against SEIU Local 1000Documento25 páginasAmended Complaint Against SEIU Local 1000jon_ortizAinda não há avaliações

- 28-Tax-Capitol Wireless Inc vs. Provincial Treas. of BatangasDocumento2 páginas28-Tax-Capitol Wireless Inc vs. Provincial Treas. of BatangasJoesil Dianne SempronAinda não há avaliações

- Amaro v. SumanguitDocumento2 páginasAmaro v. SumanguitJazem AnsamaAinda não há avaliações

- Involuntary BankruptcyDocumento2 páginasInvoluntary BankruptcyRinku Kokiri80% (5)

- Remedial LawDocumento11 páginasRemedial LawKayzer SabaAinda não há avaliações

- Gallanosa Vs Arcangel - DoctrineDocumento1 páginaGallanosa Vs Arcangel - DoctrineRenz AmonAinda não há avaliações

- Republic v. Vega G. R. No. 177790, Jan. 17, 2011Documento15 páginasRepublic v. Vega G. R. No. 177790, Jan. 17, 2011Mp CasAinda não há avaliações

- Sumilao Case Opinion and ResolutionDocumento6 páginasSumilao Case Opinion and ResolutionAreeAinda não há avaliações

- Digest Tupaz V CADocumento2 páginasDigest Tupaz V CACarlos Poblador100% (2)

- Francisco V NMMPDocumento2 páginasFrancisco V NMMPatoydequitAinda não há avaliações

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyAinda não há avaliações

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNo EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNota: 4.5 de 5 estrelas4.5/5 (97)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooNo EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooNota: 5 de 5 estrelas5/5 (2)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorNo EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorNota: 4.5 de 5 estrelas4.5/5 (132)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesNo EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesNota: 4 de 5 estrelas4/5 (9)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNo EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNota: 4.5 de 5 estrelas4.5/5 (43)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsAinda não há avaliações

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorNo EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorNota: 4.5 de 5 estrelas4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseNo EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseAinda não há avaliações

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsAinda não há avaliações

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNo EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNota: 4 de 5 estrelas4/5 (52)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- Public Finance: Legal Aspects: Collective monographNo EverandPublic Finance: Legal Aspects: Collective monographAinda não há avaliações

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersAinda não há avaliações

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNo EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNota: 5 de 5 estrelas5/5 (5)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationAinda não há avaliações

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipAinda não há avaliações

- The Streetwise Guide to Going Broke without Losing your ShirtNo EverandThe Streetwise Guide to Going Broke without Losing your ShirtAinda não há avaliações

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNo EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNota: 5 de 5 estrelas5/5 (27)