Escolar Documentos

Profissional Documentos

Cultura Documentos

JLL - Baltimore DC Q3 2015 Office Insight PDF

Enviado por

Anonymous Feglbx5Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

JLL - Baltimore DC Q3 2015 Office Insight PDF

Enviado por

Anonymous Feglbx5Direitos autorais:

Formatos disponíveis

Office Insight

Baltimore | Q3 2015

Limited leasing and absorption in third quarter

Office conversions make big impact on CBD vacancy

Overall inventory in the Central Business District has shrunk the past two years

by over 1 million square feet as obsolete buildings are converted to apartments.

The conversions have helped to offset weak office demand as tenants who have

remained in the CBD focus on space efficiency and Class A product along Pratt

Street, where vacancy has dropped to just 6.3 percent. Without the reduction in

inventory, vacancy in the CBD would have reached 23.6 percent as cumulative

negative net absorption since 2007 has climbed to 1.7 million square feet.

Drop in inventory offsets negative absorption in CBD

25%

Change in inventory

Net absorption

Vacancy

500000

20%

0

15%

10%

-500000

5%

0%

-1000000

2007 2008 2009 2010 2011 2012 2013 2014 2015

Source: JLL Research, BLS

Howard County vacancy dips below ten percent

Vacancy dropped below 10.0 percent during the quarter in Howard County as

market fundamentals have continued to swing in favor of landlords across much

of Columbia, especially in Columbia Town Center. Asking rental rates have

jumped 11.2 percent year-over-year in Columbia Town Center, while leasing

concessions have dropped considerably as tenants have placed a premium on

buildings with walkable amenities. Additional development will likely break

ground shortly as the pipeline of tenants in the market is active with extremely

limited available large blocks of space.

Overall vacancy by submarket cluster

Baltimore County East

Howard County

I-83 Corridor

BWI

Baltimore City

I-97/Annapolis

NW Baltimore County

Harford County

Source: JLL Research 0%

Leasing volume limited in the third quarter

While improved from the beginning of the year, leasing volume during the quarter

fell 33.9 percent short of 2014. The majority of transactions came from tenants

between 10,000 to 20,000 square feet, primarily in Class A inventory across

Howard County. Tenants in the market, however, remained robust with 2.1

million square feet of active requirements, which should drive strong leasing

activity in the coming quarters and additional construction starts. Demand has

come from the traditional drivers of growth in Baltimore: education, healthcare

and government tenants.

5%

10% 15% 20% 25% 30% 35%

Leasing volume for transactions >10,000 s.f.

600,000

400,000

200,000

0

Q4 2014

Source: JLL Research

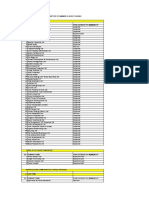

2,257

Q1 2015

Q2 2015

Q3 2015

71,153,930

-26,484

$22.42

1,040,900

Total inventory (s.f.)

Q3 2015 net absorption (s.f.)

Direct average asking rent

Total under construction (s.f.)

13.4%

145,894

2.4%

65.4%

Total vacancy

YTD net absorption (s.f.)

12-month rent growth

Total preleased

Current conditions submarket

Historical leasing activity (s.f.)

Peaking

market

Howard County

Rising

market

Falling

market

Harford County

Bottoming

market

Baltimore County,

Anne Arundel County

Tenant leverage

Landlord leverage

8,000,000

6,000,000

5,822,534

5,501,184

4,237,180

4,000,000

3,168,547

1,614,410

2,000,000

0

2011

Baltimore CBD

Source: JLL Research

2012

2013

2014

YTD 2015

Source: JLL Research

Total net absorption (s.f.)

2,500,000

2,005,144

2,000,000

1,609,131

1,500,000

1,149,911

961,133

862,193

1,000,000

338,870

500,000

946,858

930,411

234,205

145,894

0

2006

2007

2008

2009

2010

2011

2012

2013

2014

YTD 2015

13.8%

13.4%

2014

YTD 2015

Source: JLL Research

Total vacancy rate (%)

20.0%

15.0%

10.0%

16.5%

12.8%

13.7%

16.9%

15.6%

14.7%

15.3%

15.4%

5.0%

2006

2007

2008

2009

2010

2011

2012

2013

Source: JLL Research

Direct average asking rent ($ p.s.f.)

$23.50

$22.90

$23.00

$22.50

$23.04

$22.64

$22.47

$22.50

$22.45

$22.42

$22.22

$22.18

$21.84

$22.00

$21.50

$21.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

YTD 2015

Source: JLL Research

For more information, contact: Patrick Latimer | +1 443 451 2609| Patrick.Latimer@am.jll.com

2015 Jones Lang LaSalle IP, Inc. All rights reserved.

Você também pode gostar

- CIO Bulletin - DiliVer LLC (Final)Documento2 páginasCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5Ainda não há avaliações

- Progress Ventures Newsletter 3Q2018Documento18 páginasProgress Ventures Newsletter 3Q2018Anonymous Feglbx5Ainda não há avaliações

- 4Q18 South Florida Local Apartment ReportDocumento8 páginas4Q18 South Florida Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 North Carolina Local Apartment ReportDocumento8 páginas4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocumento6 páginasHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Atlanta Local Apartment ReportDocumento4 páginas4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- The Woodlands Office Submarket SnapshotDocumento4 páginasThe Woodlands Office Submarket SnapshotAnonymous Feglbx5Ainda não há avaliações

- ValeportDocumento3 páginasValeportAnonymous Feglbx5Ainda não há avaliações

- Houston's Office Market Is Finally On The MendDocumento9 páginasHouston's Office Market Is Finally On The MendAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Washington, D.C. Local Apartment ReportDocumento4 páginas4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Philadelphia Local Apartment ReportDocumento4 páginas4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- THRealEstate THINK-US Multifamily ResearchDocumento10 páginasTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Houston Local Apartment ReportDocumento4 páginas4Q18 Houston Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 New York City Local Apartment ReportDocumento8 páginas4Q18 New York City Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Dallas Fort Worth Local Apartment ReportDocumento4 páginas4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- Asl Marine Holdings LTDDocumento28 páginasAsl Marine Holdings LTDAnonymous Feglbx5Ainda não há avaliações

- Wilmington Office MarketDocumento5 páginasWilmington Office MarketWilliam HarrisAinda não há avaliações

- 4Q18 Boston Local Apartment ReportDocumento4 páginas4Q18 Boston Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 3Q18 Philadelphia Office MarketDocumento7 páginas3Q18 Philadelphia Office MarketAnonymous Feglbx5Ainda não há avaliações

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDocumento9 páginas2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5Ainda não há avaliações

- Fredericksburg Americas Alliance MarketBeat Office Q32018Documento1 páginaFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Ainda não há avaliações

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocumento9 páginasMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5Ainda não há avaliações

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDocumento1 páginaRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5Ainda não há avaliações

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocumento7 páginasUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5Ainda não há avaliações

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Documento1 páginaFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Ainda não há avaliações

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Documento2 páginasHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Ainda não há avaliações

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Documento1 páginaFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5Ainda não há avaliações

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocumento1 páginaRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Ainda não há avaliações

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocumento1 páginaRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Ainda não há avaliações

- Hampton Roads Americas Alliance MarketBeat Office Q32018Documento2 páginasHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Old Questions 6th Sem Remaining - 1617594602Documento23 páginasOld Questions 6th Sem Remaining - 1617594602Monica DhitalAinda não há avaliações

- Additional bottom reinforcement RC flat slabDocumento7 páginasAdditional bottom reinforcement RC flat slabbarsathAinda não há avaliações

- Echeverria Vs Bank of America Et Al Judicial Notice Doc.55 Exhibit ADocumento71 páginasEcheverria Vs Bank of America Et Al Judicial Notice Doc.55 Exhibit AIsabel SantamariaAinda não há avaliações

- One Way Slab DesignDocumento19 páginasOne Way Slab DesignWinston Advincula100% (1)

- 5000 Lakewood RD, Stanwood, WA Lease Contract FormDocumento8 páginas5000 Lakewood RD, Stanwood, WA Lease Contract Formjason walterAinda não há avaliações

- Real Estate MortgageDocumento2 páginasReal Estate MortgageAprille S. AlviarneAinda não há avaliações

- Types of Joints in Rigid PavementDocumento14 páginasTypes of Joints in Rigid PavementNIDHI JARIWALAAinda não há avaliações

- Landlord Remedies - Chicago Residential Landlord Tenant OrdinanceDocumento2 páginasLandlord Remedies - Chicago Residential Landlord Tenant OrdinanceDarylRBerryAinda não há avaliações

- Notice To Vacate To Tenants of Rented PremisesDocumento12 páginasNotice To Vacate To Tenants of Rented PremisesAndrewMihelakisAinda não há avaliações

- Mock Bar Examination in Land Title and DeedsDocumento9 páginasMock Bar Examination in Land Title and DeedsalbemartAinda não há avaliações

- How To Building Construction Process Step by StepDocumento18 páginasHow To Building Construction Process Step by StepKrishna KanhaiyaAinda não há avaliações

- Building ID-NCRTC-RRTS-BCS PKG-8MB - 563Documento17 páginasBuilding ID-NCRTC-RRTS-BCS PKG-8MB - 563mayank dixitAinda não há avaliações

- The Estate Makati Project Cp03: General Construction Works Eei Corporation Guaranteed Maximum QuantitiesDocumento1 páginaThe Estate Makati Project Cp03: General Construction Works Eei Corporation Guaranteed Maximum QuantitiesRentz OzAinda não há avaliações

- 13744843Documento10 páginas13744843veercasanovaAinda não há avaliações

- Updated Training Calendar 2021-22Documento1 páginaUpdated Training Calendar 2021-22supriya kumariAinda não há avaliações

- Commercial MortgageDocumento6 páginasCommercial MortgagemirmoinulAinda não há avaliações

- Real Estate Exam 4 Practice QuestionsDocumento3 páginasReal Estate Exam 4 Practice QuestionsJuan Carlos NocedalAinda não há avaliações

- Residential Building EstimateDocumento2 páginasResidential Building EstimateKUNCHALA SRINADHAinda não há avaliações

- KPDA Directory of Members in Good Standing, 27th October 2021Documento3 páginasKPDA Directory of Members in Good Standing, 27th October 2021BobAinda não há avaliações

- Petition For Extra Judicial Foreclosure of Real Estate Mortgage Under Act 3135 As AmendedDocumento2 páginasPetition For Extra Judicial Foreclosure of Real Estate Mortgage Under Act 3135 As AmendedaL_2k100% (7)

- Monthly Internship Report 3 (Biniyam Assefa and Tensae Degu)Documento7 páginasMonthly Internship Report 3 (Biniyam Assefa and Tensae Degu)biniyam assefaAinda não há avaliações

- Design coefficients for seismic force-resisting systemsDocumento3 páginasDesign coefficients for seismic force-resisting systemsLuis HidalgoAinda não há avaliações

- Living Bedroom 1 Floor PlanDocumento1 páginaLiving Bedroom 1 Floor PlanKenneth VirtudesAinda não há avaliações

- Roommate Lease Agreement SummaryDocumento2 páginasRoommate Lease Agreement SummaryChristine PerezAinda não há avaliações

- Doctrine of Priority in Property LawDocumento7 páginasDoctrine of Priority in Property LawRamesh KumarAinda não há avaliações

- Unconventional Technology For Medium Rise HousingDocumento1 páginaUnconventional Technology For Medium Rise HousingEleazer JabatAinda não há avaliações

- Type 42Documento5 páginasType 42Muhamad Aris HabibiAinda não há avaliações

- Land Titles and Deeds-Case Digests-Espina-M6Documento20 páginasLand Titles and Deeds-Case Digests-Espina-M6NiellaAinda não há avaliações

- Civil EngineeringDocumento16 páginasCivil EngineeringAgus Sholehudin AnzieAinda não há avaliações

- Certificate Program Details - Fundamentals of Concrete ConstructionDocumento1 páginaCertificate Program Details - Fundamentals of Concrete ConstructionOscar MataAinda não há avaliações